Life's candlestick charts cannot save you from anxiety, predicting the market cannot calculate the outcome.

TechFlow Selected TechFlow Selected

Life's candlestick charts cannot save you from anxiety, predicting the market cannot calculate the outcome.

Real life often happens beyond the candlestick charts.

Author: Yanz, TechFlow

At the beginning of 2026, a sudden geopolitical event shocked the world: On January 3rd, the United States launched a military operation codenamed "Operation Absolute Resolve," successfully capturing President Nicolás Maduro and his wife Cilia Flores. They were swiftly transported to New York to face criminal charges including narcoterrorism conspiracy, cocaine importation conspiracy, and weapons offenses at the Manhattan Federal Courthouse.

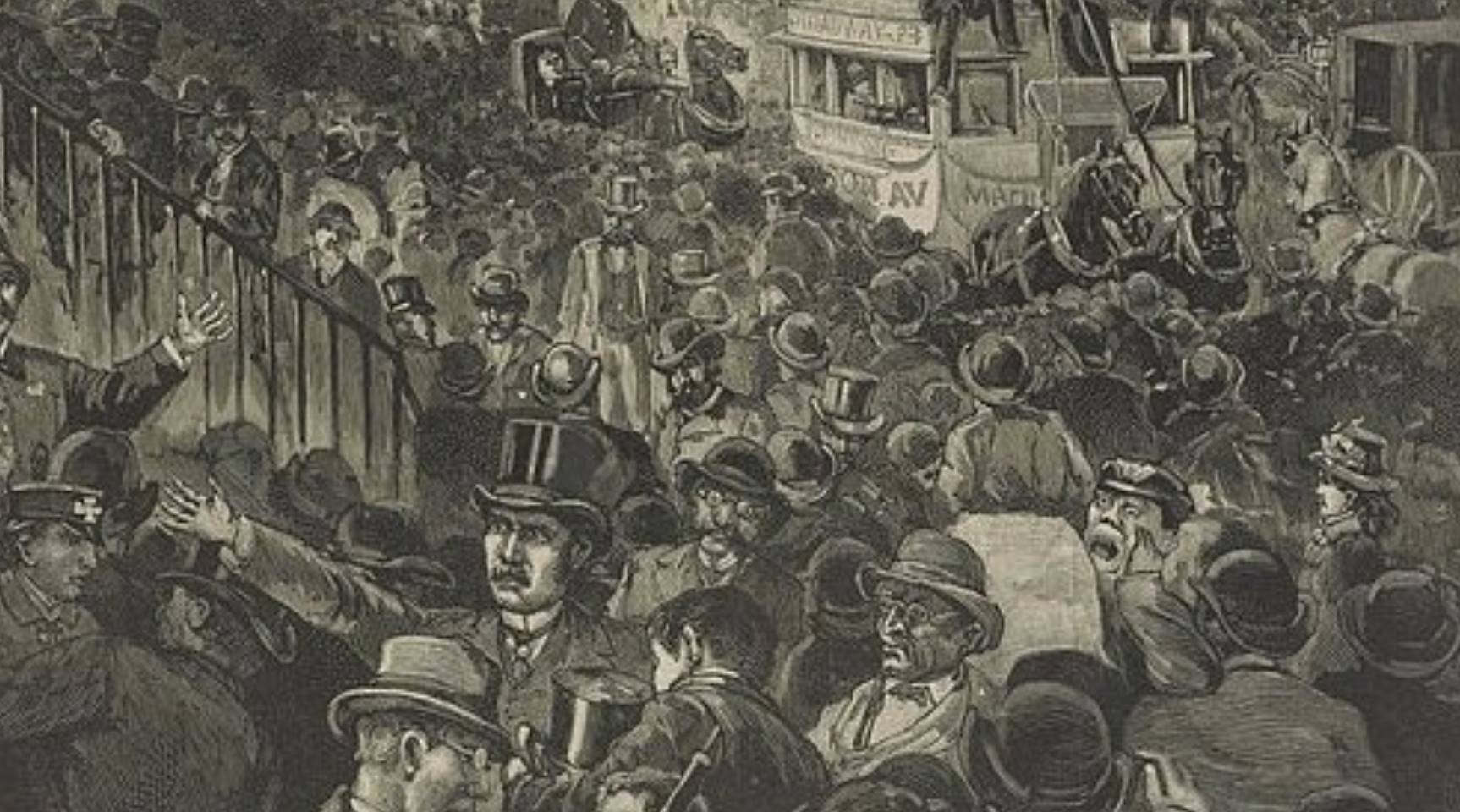

Although the U.S.-Venezuela confrontation had been ongoing for a long time, the secrecy and explosive force of this operation completely defied conventional logic. Just 24 hours before the action, Caracas seemed completely normal, with no public signals of diplomatic mediation breaking down. This event quickly made global headlines, not only for its political significance but also because it revealed a stark reality: true historical turning points often occur in moments without any warning.

Just before the raid, the trading price of contracts on Polymarket betting on whether Maduro would step down was only around 5 to 7 cents, meaning the market widely considered him extremely secure in the short term. No one anticipated his arrest, which brought massive profits to traders who entered the bets shortly before the operation became public.

Despite the world being so unpredictable, humanity's desire to "spoil" the future has never been as urgent as it is today. At the end of 2025, two tools unexpectedly formed a kind of intertextuality: one is the "Life K-line" that visualizes Eight Characters (Bazi) fortune-telling, and the other is prediction markets that odds-ify global events.

We try to use the former to calculate an individual's fate, and the latter to calculate the world's fortune. What they jointly promise is a quantifiable future.

The Life K-line provides a sense of certainty through symbolic visual output, while prediction markets offer probabilistic certainty through price signals. It seems that by reading these signals early enough, we can prepare in advance and hedge against uncertainty, as if gaining an advantage. But is reality truly like that?

The viral popularity of the Life K-line reflects more of a psychological demand for a sense of certainty. Users input their birth information, AI automatically generates the chart, calculates major life cycles (Da Yun), and outputs a K-line graph. The fluctuations of the graph provide a readable life curve. Under the dual pressures of employment stress and emotional turbulence, it acts like a coordinate axis, offering a framework for narrating the self and venting emotions. This K-line sells not science, but meaning and comfort—undeniable emotional value.

Prediction markets, on the other hand, promise testable predictions in the language of finance. In 2025, Polymarket and Kalshi dominated the prediction market arena. Sports, political, and economic events... all became subjects for prediction and betting, with trading volume extending from election cycle peaks to daily activities. Platforms allow users to bet with real money, and prices form a probabilistic consensus through liquidity and disagreement.

Under the triple anxieties of economic volatility, geopolitical tensions, and AI disruption, what young people need is not precise prophecy, but an illusion that fate can be grasped and is entirely within their control. These two types of tools provide precisely two heterogeneous forms of "sense of control." It seems that by simulating life and event trajectories in advance, one can hedge against macro risks and get a head start in an uncertain world.

But such preparation inevitably has limitations and even harbors significant risks. Cultural biases from model training, algorithmic black boxes, and "black swan" events like Maduro's arrest all prove that the true accuracy of predicting the future is questionable.

But such preparation inevitably has limitations and harbors significant risks. Cultural and algorithmic biases from model training, and the risk of black swan events, all indicate that the true accuracy of predicting the future is questionable. The risk of over-focusing on prediction also cannot be ignored. Although the Life K-line is labeled as entertainment, it may influence an individual's key choices; manipulation cases in prediction markets occur frequently, with suspicions of insider trading and large players influencing prices being verified realities.

But this is not the most dangerous aspect. The deeper crisis lies in the fact that the act of observation itself interferes with the system, a metaphor long established by Heisenberg's uncertainty principle. The more users superstitiously trust the probabilities output by tools, the more likely they are to lose their sharp intuition for sudden risks. We stare at the dashboard for too long, forgetting to look up at the road.

Prediction tools can identify trends but can never foresee true turning points. They are rearview mirrors, capable of reflecting current anxieties and consensus, but unable to become searchlights illuminating the fog.

Ultimately, uncertainty is the underlying code of the world. After a 2025 filled with frequent black swans, the best preparation is not staring at K-lines or odds on a screen, but acknowledging the limitations of algorithms.

After all, real life often happens outside the K-line. Going with the flow and building individual anti-fragility within immense uncertainty might be the only real trajectory we can grasp.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News