Sexy Casino, Online Real Estate Speculation

TechFlow Selected TechFlow Selected

Sexy Casino, Online Real Estate Speculation

Using Polymarket to predict U.S. housing prices feels like catching a whiff of the 2008 subprime mortgage crisis.

Written by: Curry, TechFlow

Polymarket gained widespread attention in 2024 by betting on the US presidential election, with record-breaking trading volume on the night Trump won. In November 2025, they signed a deal with UFC, entering the sports betting arena. On January 5, 2026, they officially announced a new game:

Betting on house prices.

Previously, Polymarket had offered markets on mortgage rates, but those were derivatives betting on Federal Reserve policy. This time it's different—directly betting on whether a city's housing price index will rise or fall.

The partner is Parcl, a real estate data protocol project on the Solana blockchain. The gameplay is simple: choose a city and predict whether its housing price index will go up or down next month.

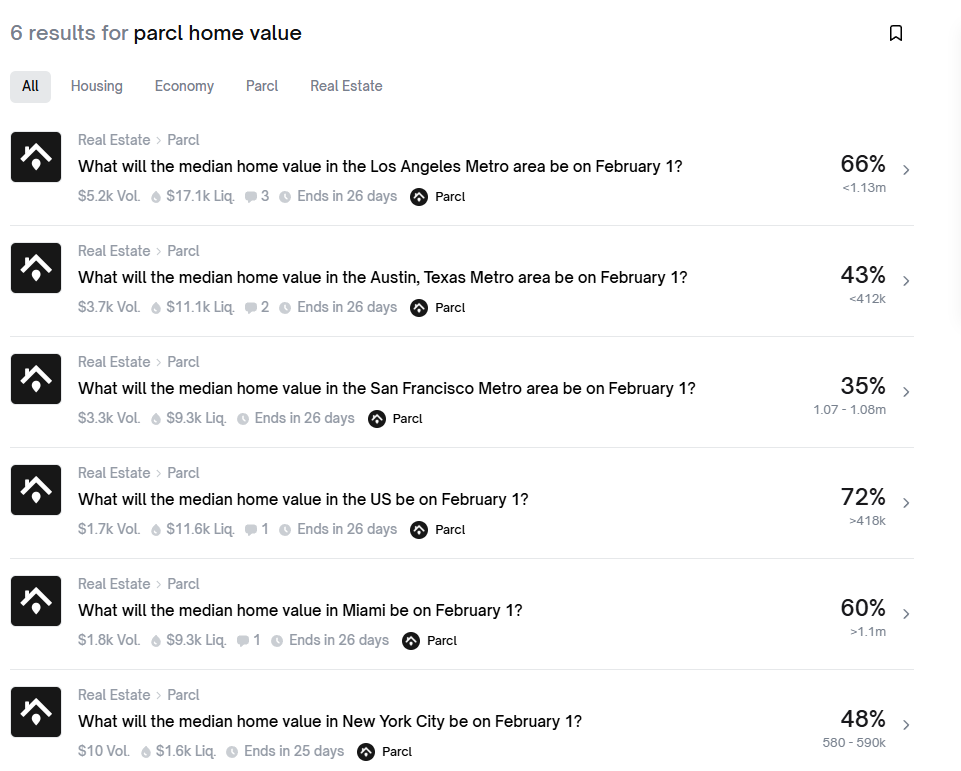

Currently available markets include Austin, San Francisco, Miami, New York, plus a national average index.

No down payment required, no loan applications, no haggling with agents. Put down $100, double your money if you guess right, lose it all if you're wrong.

Polymarket's CMO stated that real estate is the world's largest asset class, valued at $400 trillion, and deserves to be a "first-class citizen" in prediction markets.

The entry fee for this $400 trillion casino is now:

The price of a cup of coffee.

However, this isn't a new invention.

In 2008, the UK betting exchange Betfair opened markets on housing market crashes. What happened in the world that year goes without saying. Wall Street was playing with CDS, MBS, CDO—a bunch of acronyms ordinary people couldn't understand, yet everyone paid the price for the subprime mortgage crisis.

Now, Polymarket has translated it into plain language: Will Miami's housing prices rise or fall before February 1st? Pick one.

According to the partnership announcement, settlement data is provided by Parcl, updated daily, faster than traditional housing price indices. Each market has a dedicated settlement page clearly stating the final value, historical trends, and calculation methods.

Transparent, open, verifiable on-chain.

It sounds great. But we took a look at the current market data: the Los Angeles market with the highest liquidity only has about $17,000, while New York has a mere $1,600. Trading volume is even more dismal—New York saw only $10 in total trades over two days since launch.

People are enthusiastic about betting on presidents, but when it comes to betting on house prices, they don't seem to have figured out how to play yet.

This looks more like a playground for early adopters, or rather:

A hunting ground for whales.

Parcl, the company, secured two rounds of funding in 2022 from investors including Dragonfly, Coinbase Ventures, and Solana Ventures, totaling over $11 million.

Their previous product was more aggressive: long or short real estate indices with up to 10x leverage, perpetual contracts.

You read that right—you can now use leverage to speculate on real estate.

After partnering with Polymarket, the gameplay has become milder. No leverage, no perpetual contracts, just simple binary options: up or down, settled at expiration.

Polymarket itself has been on a sprint these past two years. Valued at $1.2 billion in 2024, by the end of 2025, ICE, the parent company of the NYSE, announced plans to invest $2 billion, bringing its valuation close to $9 billion.

From betting on presidents to boxing to house prices, the categories keep expanding. What's next? Who knows. Betting on divorce rates? Birth rates? How long a bubble tea shop under an American residential building can survive?

As long as there's a data source, anything can become a market.

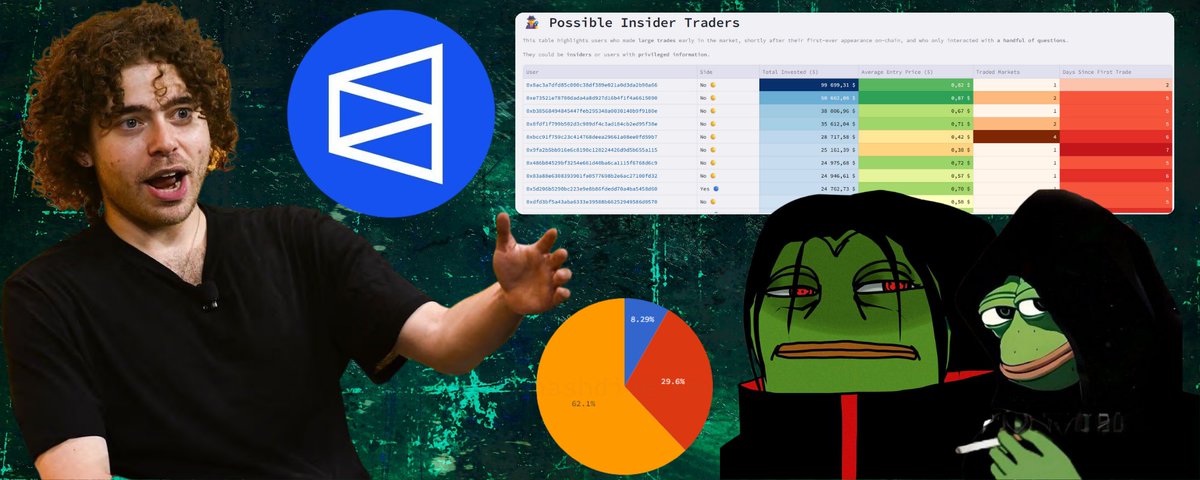

Previously, we also saw another on-chain analysis showing that nearly 70% of users on Polymarket lose money, with profits concentrated in a very few wallets.

This ratio is similar to crypto trading and stock trading.

The difference is that election results are deterministic events—right or wrong is clear. Housing price data is different; it has lags, noise, seasonal fluctuations, and methodological disputes. You think you're making a judgment, but you're actually gaming the statistical methodology.

The logic of proper home buying is: 30% down payment, a 30-year loan, monthly payments possibly higher than your salary, but at least the house is yours.

The logic of "buying a house" on Polymarket is: put down $100, wait a month, either double or lose it all. The house isn't yours, never was.

Which one sounds more like gambling?

The last round of real estate financialization in 2008 blew up in the subprime crisis. This round, retail investors can also sit at the table.

What progress.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News