A lesson from Polymarket: swinging back and forth between loss and profit

TechFlow Selected TechFlow Selected

A lesson from Polymarket: swinging back and forth between loss and profit

Every bet is an adventure of cognition and belief.

Author: 1912212.eth, Foresight News

Luck always favors the brave. Today's prediction markets teach us how to think about future outcomes in probabilistic terms. Driven by interest in betting mechanics and Polymarket airdrops, I’ve been actively trading prediction markets over recent months.

Polymarket is a decentralized prediction market platform where users make predictions by purchasing “shares” representing event outcomes. Share prices reflect the market’s expected probability of an outcome. A correct prediction yields profit; if incorrect when the event resolves, the investment drops to zero. Traders may also exit early by buying low and selling high before the resolution date.

Prediction markets resemble a wild west gold rush—rewarding speed, information asymmetry, research capability, and execution. Every bet is a leap of cognition and conviction. There are arbitrage opportunities, but also many pitfalls.

In June this year, Paradigm partner Matt Huang, after leading Kalshi’s funding round, said, “Prediction markets remind me of cryptocurrency a decade ago: an emerging asset class on track to become worth trillions.” Just three months later, Polymarket and Kalshi were reportedly considering new funding rounds at $9 billion and $5 billion valuations, respectively—Kalshi’s valuation more than doubling from its previous $2 billion. The surge in interest around prediction markets is evident.

I will omit specific unrealized profit/loss figures and instead review lessons learned through actual successful and failed trades.

Markets Reward Research: AI-Assisted Search and Analysis

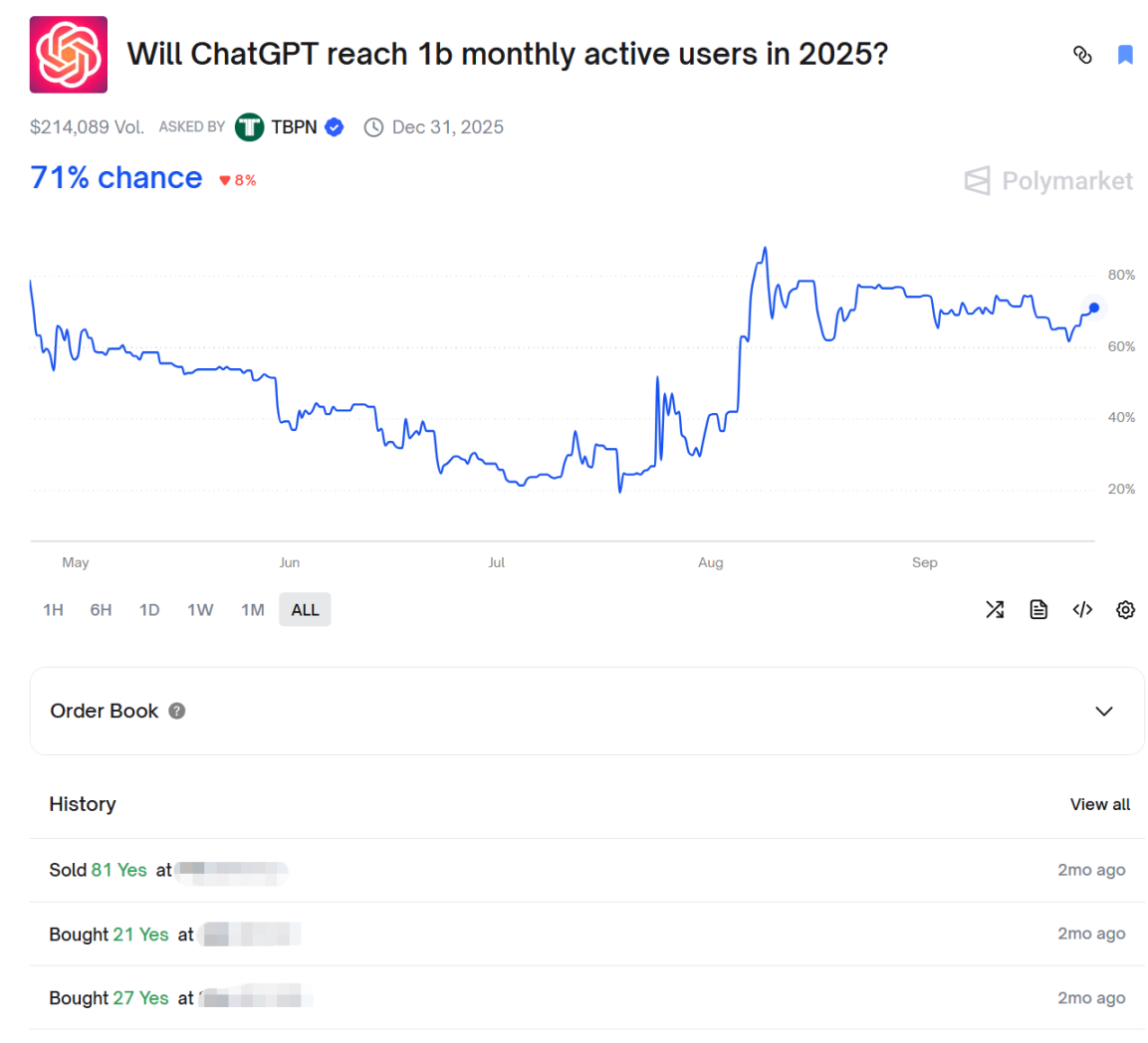

I personally focus on three or four verticals on Polymarket—Crypto, technology, Trump, and Fed rate cuts—some of which require daily monitoring. For example, on July 29, I spotted an intriguing market in the tech category: “Will ChatGPT reach 1 billion monthly active users by 2025?”

At the time, the probability was only 30%. I wondered why it was so low and broke the question into two parts: First, what had OpenAI’s monthly active user count been this year, and how far was it from 1 billion? Second, what upcoming catalysts could boost user growth, such as a major product launch?

With the anticipated ChatGPT-5 release just over a week away and market expectations high, the second factor seemed promising. The key uncertainty was current user numbers. Neither ChatGPT nor Grok provided accurate figures, but Perplexity returned a relatively reliable data point: a court disclosure revealed OpenAI had already reached 600 million monthly active users in one month this year.

On July 31, while browsing news, I saw a Wall Street Horizon report citing The Information stating OpenAI’s annualized revenue had reached $12 billion and its weekly active users exceeded 700 million. This made the first key point seem solid.

I decided to increase my position and eventually took profits when the probability rose to 81%.

It’s worth noting that AI models like Grok-4 and ChatGPT-5 are now highly capable at gathering and analyzing information. For uncertain questions, inputting precise queries can yield helpful answers. However, AI can occasionally err, so cross-verification across sources remains essential.

For instance, AI-based research suggests a high probability of 7+ magnitude earthquakes occurring globally each month—and indeed, the past two months have seen exactly that. On July 17, a 7.3-magnitude quake hit off Alaska; on July 30, a 7.9-magnitude quake struck off Russia’s Kamchatka Peninsula; on August 22, a 7.4-magnitude quake occurred in the Rat Islands; and on September 13, another 7.1-magnitude quake hit near Kamchatka.

Observationally, when the market probability for such events drops below 60%, the odds tend to become more favorable.

Speed and Patience Are Key: Aim for Roughly Right

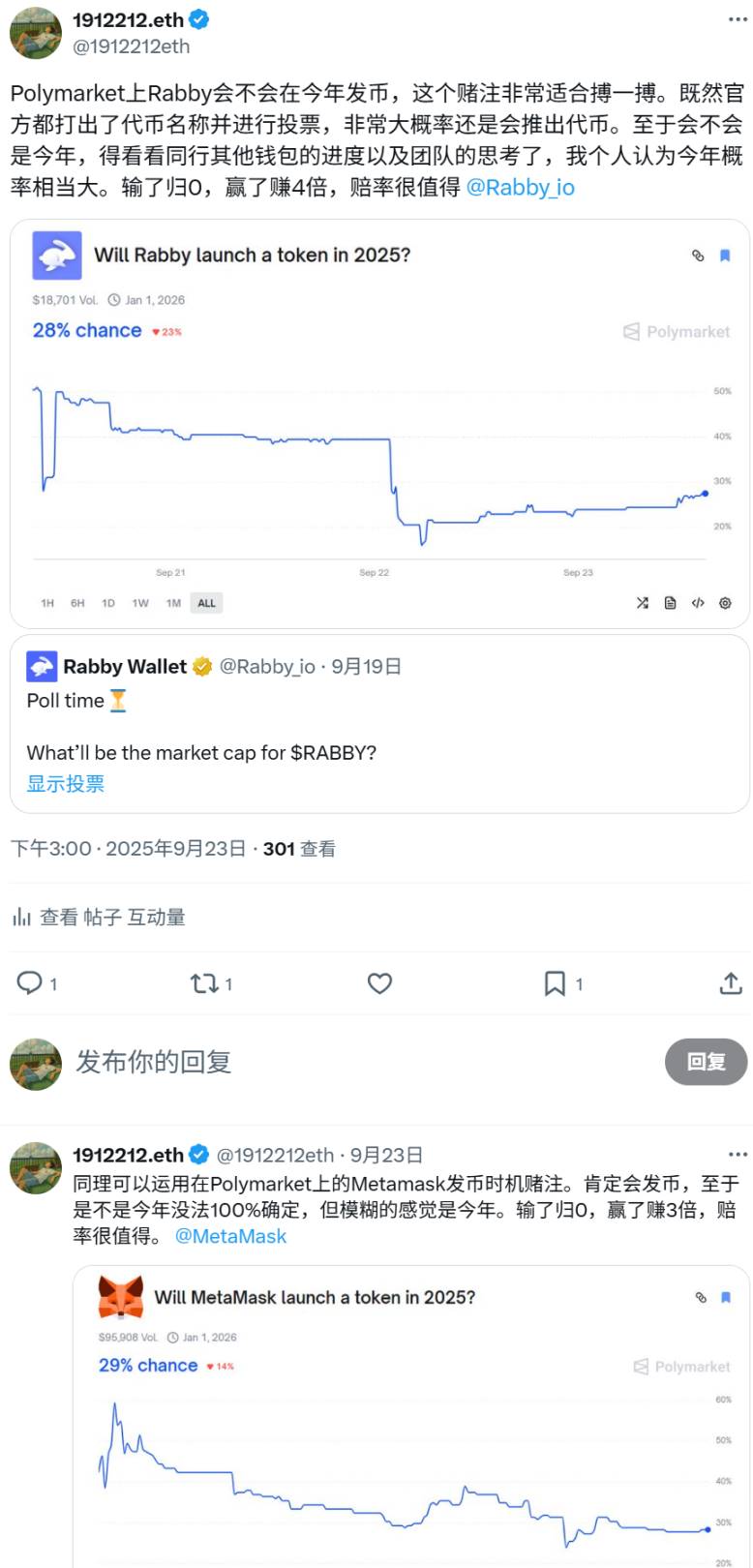

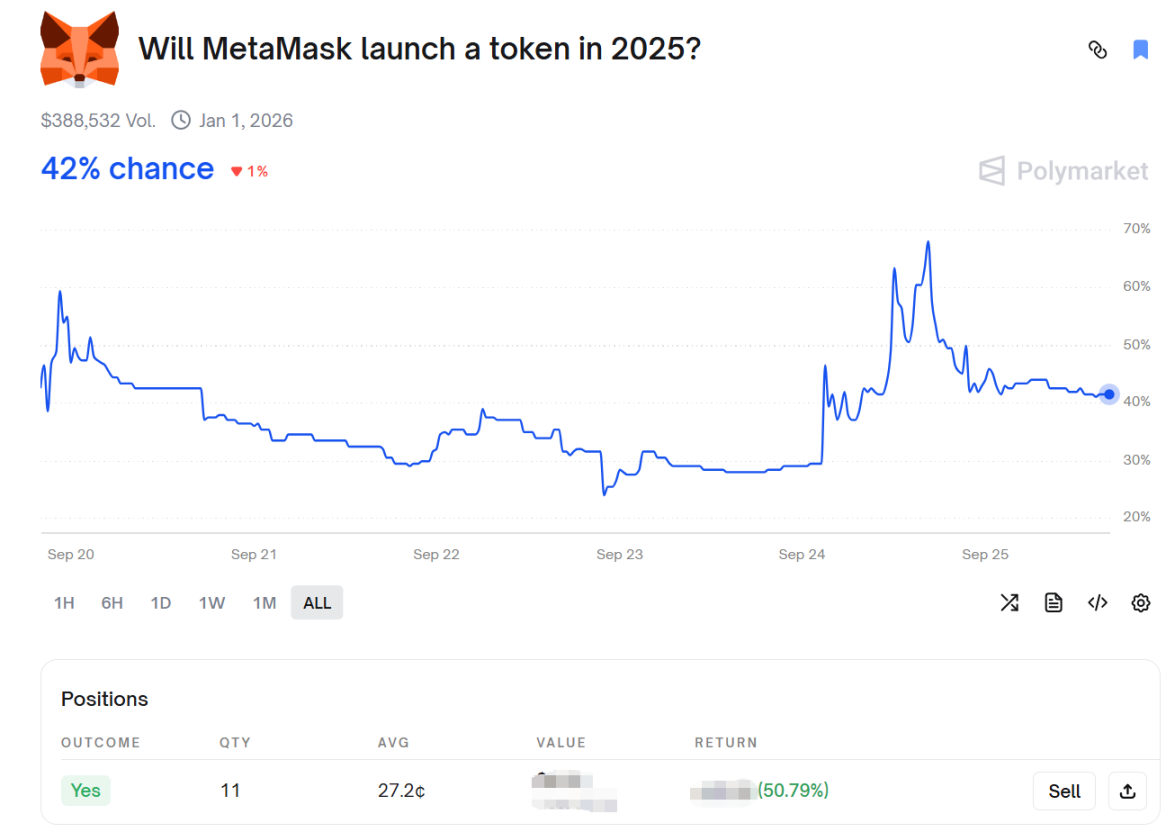

On September 23, while scanning crypto-related markets on Polymarket, I偶然 discovered prediction markets for token launch dates of Rabby and MetaMask.

Can we be certain these wallets will launch tokens this year? Probably not—even their founding teams might not claim 100% certainty. But aiming for a roughly right assessment suffices. Based on official tweets and public news, the likelihood of a 2024 launch appears reasonably high.

The compelling factor here was high implied win probability combined with attractive odds—losing meant losing everything, but winning offered 3–4x returns.

On September 24, market-implied probability for Rabby launching a token this year briefly surged to 44%.

The probability for MetaMask launching a token this year even spiked to 68%.

Yet in uncertain markets, for every profitable highlight, there’s an equally painful loss lesson.

“Surprises” Taught Me a Lesson

Probabilities on Polymarket reflect market sentiment expressed through bets. Even high probabilities don’t guarantee outcomes.

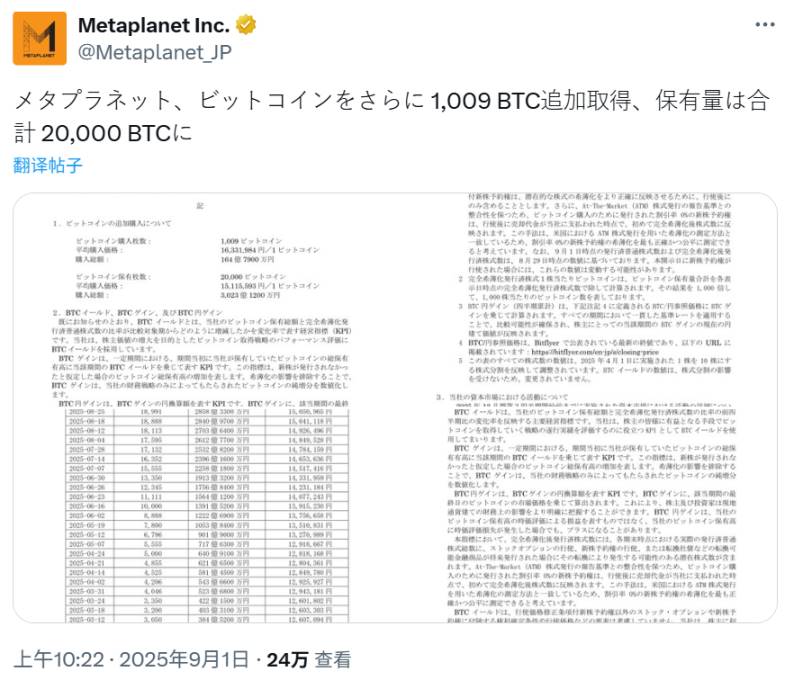

On the evening of August 30, I noticed a market asking whether Japanese-listed company Metaplanet would hold 20,000 BTC by 11:59 PM ET on August 31. At the time, the “NO” side had surged to 98%. Recall that on August 25, they announced purchasing 103 additional BTC, bringing their total to 18,991 BTC—over 1,000 short of 20,000.

The market resolution time converted to 11:59 AM Beijing time on September 1. Just as I thought a safe arbitrage was locked in, surprise struck.

At 10:22 AM on September 1—less than 90 minutes before settlement—the company tweeted they had acquired BTC, precisely reaching 20,000 BTC. My entire stake dropped to zero.

Failing to Take Profits Led to Another Loss

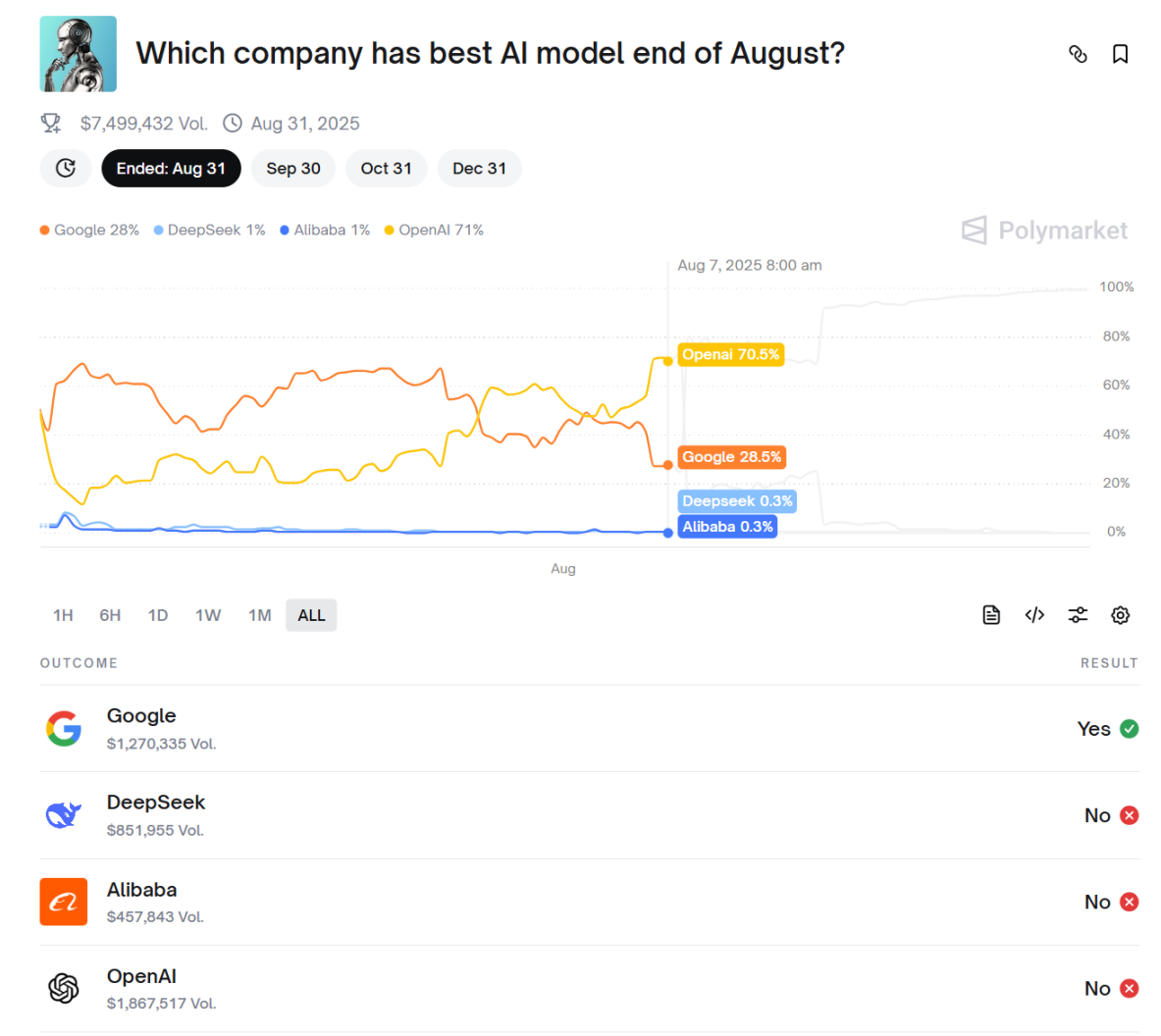

In early August, I found a market titled “Which will be the top AI model by September 1?” At the time, Google was leading and OpenAI lagging. I believed OpenAI had strong potential given the upcoming ChatGPT-5 release.

I placed a sizable bet on OpenAI. As the release neared, OpenAI’s implied probability rose above 70%, and my position was significantly in the green. Feeling confident, I ignored shifting market sentiment. Many users expressed disappointment over minor feature improvements. I dismissed this as temporary noise. But the market quickly punished that complacency—OpenAI’s probability plummeted, erasing all gains.

Post-launch market reactions heavily influence probability trends. Ignoring sentiment and failing to lock in profits can lead to complete reversal.

Additionally, for markets with distant settlement dates, taking profits early reduces opportunity costs.

Beware Market Order Liquidity

For convenience, I often use market orders on Polymarket. However, in markets with low trading volume or shallow order books, clicking “buy” can instantly result in 5–10% slippage—or even as high as 20% loss.

Generally, markets with trading volumes exceeding hundreds of thousands of dollars tend to have healthy liquidity. But for niche markets with low betting volume or thin order books, it’s crucial to check the order book before trading to avoid immediate losses upon entry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News