100x in Two Months: What Is the Prediction Trading Bot Flipr?

TechFlow Selected TechFlow Selected

100x in Two Months: What Is the Prediction Trading Bot Flipr?

Socialized prediction trading with leverage.

Author: ChandlerZ, Foresight News

From late June to late August this year, Flipr's price performance was nothing short of a dark horse. Two months ago, its market cap was less than $2 million, largely ignored. As of August 27, the project’s market cap had surged to a peak of $21 million—over a hundredfold increase—with a 16x rise just in August alone.

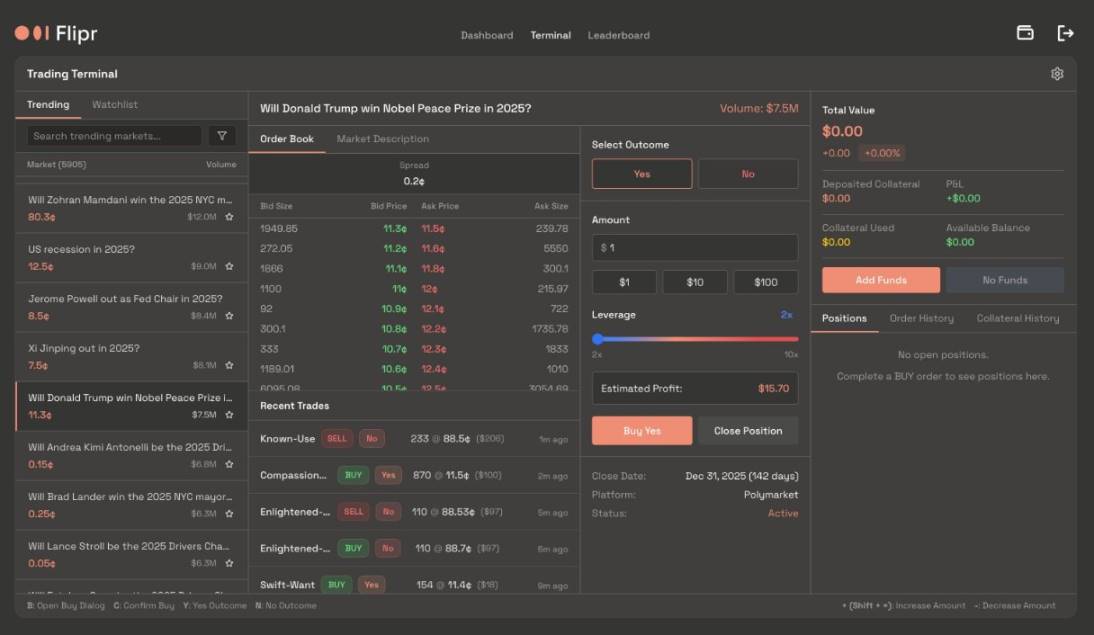

So what exactly is Flipr? Simply put, it is not a new prediction market, but a social gateway to prediction markets. Unlike Polymarket or Kalshi, which require standalone platforms and interfaces, Flipr has chosen a lighter approach: direct integration into the social platform X.

What is Flipr: The "Social Layer" of Prediction Markets

Launched in July 2025, Flipr's core entry point is Fliprbot, a trading bot operating on X. Unlike traditional prediction markets that require users to navigate to a separate website, browse market listings, connect wallets, and then place bets, Flipr compresses the entire process into social conversations.

Users simply tag @fliprbot on X or send a natural language command via direct message—such as "Will Donald Trump win Nobel Peace Prize in 2025?"—along with their bet direction and amount, and the trade is executed instantly. The bet information then appears on the timeline as content, becoming a social event that others can copy, share, or challenge. Flipr essentially merges trading with posting, making every bet inherently public and visible.

To lower barriers, Flipr integrates Privy's account system at the base layer and introduces derivative features such as leveraged trading, take-profit, and stop-loss. Betting is no longer an isolated action after redirection, but a natural extension within conversational contexts. Flipr even supports group chats and community embedding, allowing group admins to instantly create markets within conversations so users can discuss and bet simultaneously—turning prediction functionality into a seamless part of social interaction, much like chat stickers.

The logic behind this design is clear. Traditional prediction markets are tools for professional speculators, while Flipr aims to make trading part of social engagement. Rather than competing head-on with Polymarket or Kalshi, Flipr focuses on the user-facing front end. Polymarket and Kalshi offer trading depth and regulatory compliance, while Flipr delivers visibility and shareability. For prediction markets, this is a complementary relationship. Flipr acts as an amplifier, bringing specialized trading behaviors into mainstream social settings.

This product philosophy defines its distribution advantage. A bet becomes a dynamic post that can be shared, commented on, and counter-bet. Expression of opinions and financial stakes are layered within the same space, amplifying transaction visibility across the entire social network. Flipr transforms prediction markets from a tool into content—and the inherent shareability of content is precisely why it gained popularity so quickly.

On July 7, Flipr launched its Mindshare Mining campaign, lasting six weeks and distributing a total of 10 million FLIPR tokens as rewards.

Unlike typical trading mining programs that solely reward trading volume, Flipr designed a more complex scoring system aiming to integrate betting with social activity. The scoring mechanism covers five dimensions: larger trading volumes yield higher scores—the most straightforward component; posting time is also factored in, with earlier weekly posts carrying greater weight to encourage immediate participation; consecutive posting receives bonus rewards; meanwhile, the system includes anti-spam controls—excessively frequent posting incurs penalties to prevent meaningless information from flooding the community; and user post engagement (likes, comments, shares) directly impacts final scores.

The Landscape of Prediction Markets and Flipr’s Future

Flipr’s rapid rise makes sense when viewed within the broader development trajectory of the prediction market sector. Over the past year, Polymarket and Kalshi have demonstrated the scale and potential of prediction markets, yet neither has issued a token—leaving capital without a direct vehicle to latch onto narratives. As a result, speculative capital naturally flows toward smaller-cap projects like Flipr that carry the prediction market label.

At the same time, interest in prediction markets continues to build. Polymarket recorded over $9 billion in trading volume in 2024, peaking at $2.6 billion in a single month during the U.S. election, firmly securing its position as the leading crypto-native prediction platform. Kalshi, backed by CFTC approval, has rapidly expanded in the compliant space, achieving nearly $2 billion in annual trading volume in 2024 and reaching a $2 billion valuation following its 2025 funding round. Over the past two years, prediction markets have evolved from niche experiments into a high-growth vertical.

According to official information, Flipr has already integrated with Polymarket and will soon connect with Kalshi. Flipr does not aim to compete with giants on liquidity or compliance, but instead focuses on front-end user experience. With 150 million daily active users, the X platform is inherently immersed in event-driven discussions and emotional expression. By embedding prediction markets into this environment, Flipr overlaps betting with posting, significantly lowering the entry barrier. For Polymarket and Kalshi, this “social layer” may well be the missing piece in their current offerings.

More importantly, Ethereum co-founder Vitalik Buterin has publicly expressed support for prediction markets on multiple occasions. Over the past two years, Vitalik has become prediction markets’ most prominent advocate, repeatedly emphasizing their role in enhancing “information accuracy” and “cognitive correction.” He points out that in token-based voting systems, there is little penalty for choosing incorrectly, whereas in prediction markets, flawed judgments result in real financial losses—this mechanism forces participants to act more rationally, enabling market prices to often reflect probabilities more accurately than media sentiment. On a personal level, prediction markets help him stay calm, preventing social media emotions from inflating the perceived importance of events, while also serving as early warning signals during genuinely significant developments. Thus, Vitalik views prediction markets as a social technology capable of enhancing rationality at a collective level—one that aligns closely with blockchain’s open governance objectives.

At the same time, he frequently discusses the application potential and improvement directions for prediction markets. Vitalik notes that most current prediction markets lack interest compensation, limiting their appeal as hedging tools. However, if this issue is resolved in the future, these markets could spawn numerous hedging applications and see substantial trading volume growth. He also envisions combining prediction markets with artificial intelligence, suggesting AI-powered prediction markets could open new pathways in community fact-checking, DAO dispute resolution, and even automated market-making. For instance, he imagines integrating prediction markets into X’s “Community Notes” feature, using AI and small-stake incentives to accelerate truth verification. Vitalik even ranks prediction markets alongside Community Notes as the two flagship social cognition technologies of the 2020s—systems built on open participation rather than elite control, serving as key instruments for decentralized social governance.

The key question going forward is whether Flipr can transform this short-term surge into sustained long-term growth. After the Mindshare Mining incentive program ends, user activity may decline without new mechanisms to maintain momentum. If the collaboration with Kalshi materializes further, Flipr could become the social front end for compliant prediction trading in the U.S. market—opening up significant new growth opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News