Behind Zelenskyy's Outfit: Prediction Markets Are Becoming Manipulation Markets

TechFlow Selected TechFlow Selected

Behind Zelenskyy's Outfit: Prediction Markets Are Becoming Manipulation Markets

When the cost of corruption is lower than the return, the truth becomes a commodity sold to the highest bidder.

Author: Omer Goldberg, Founder of Chaos Labs

Translation: TechFlow

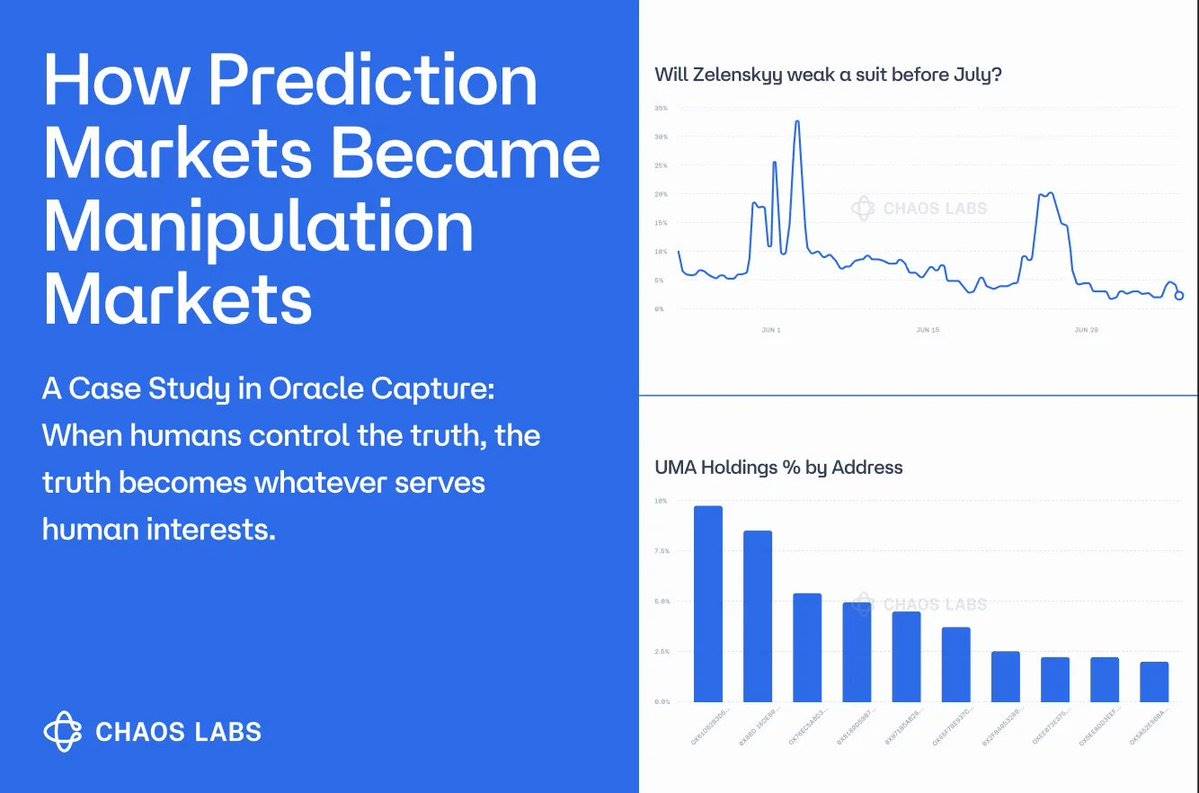

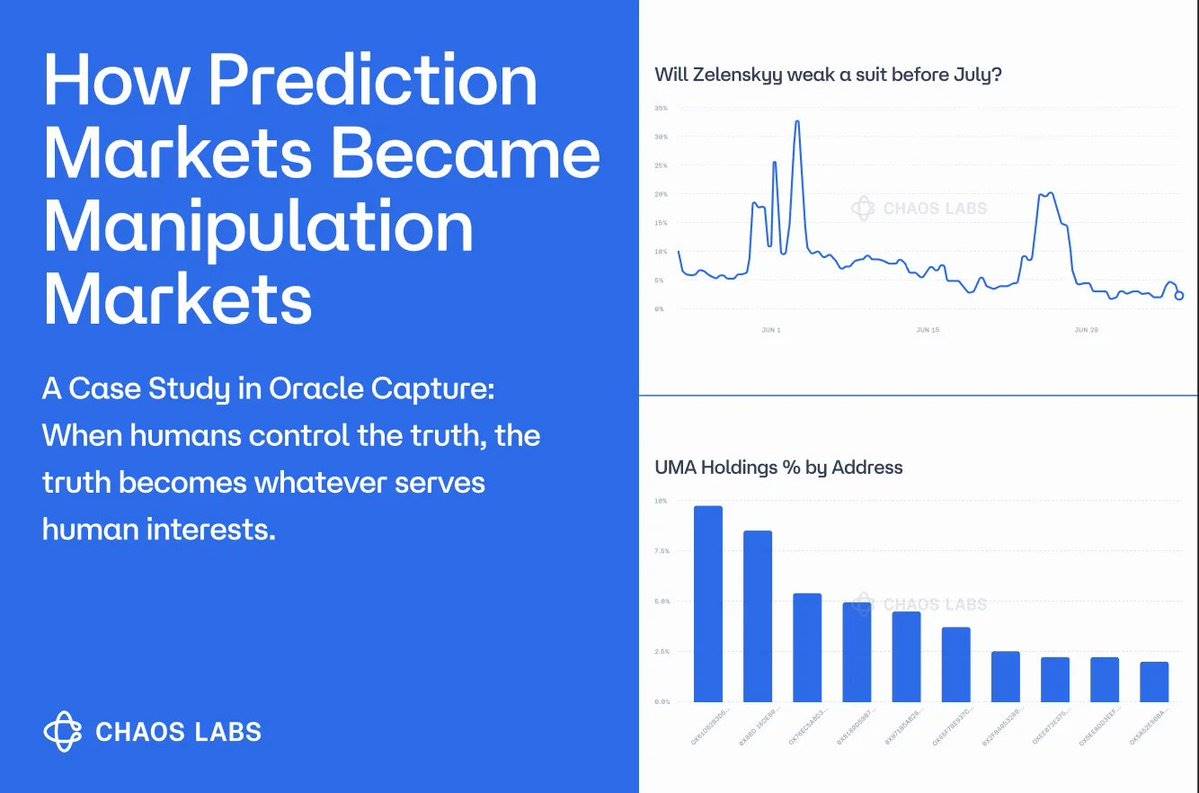

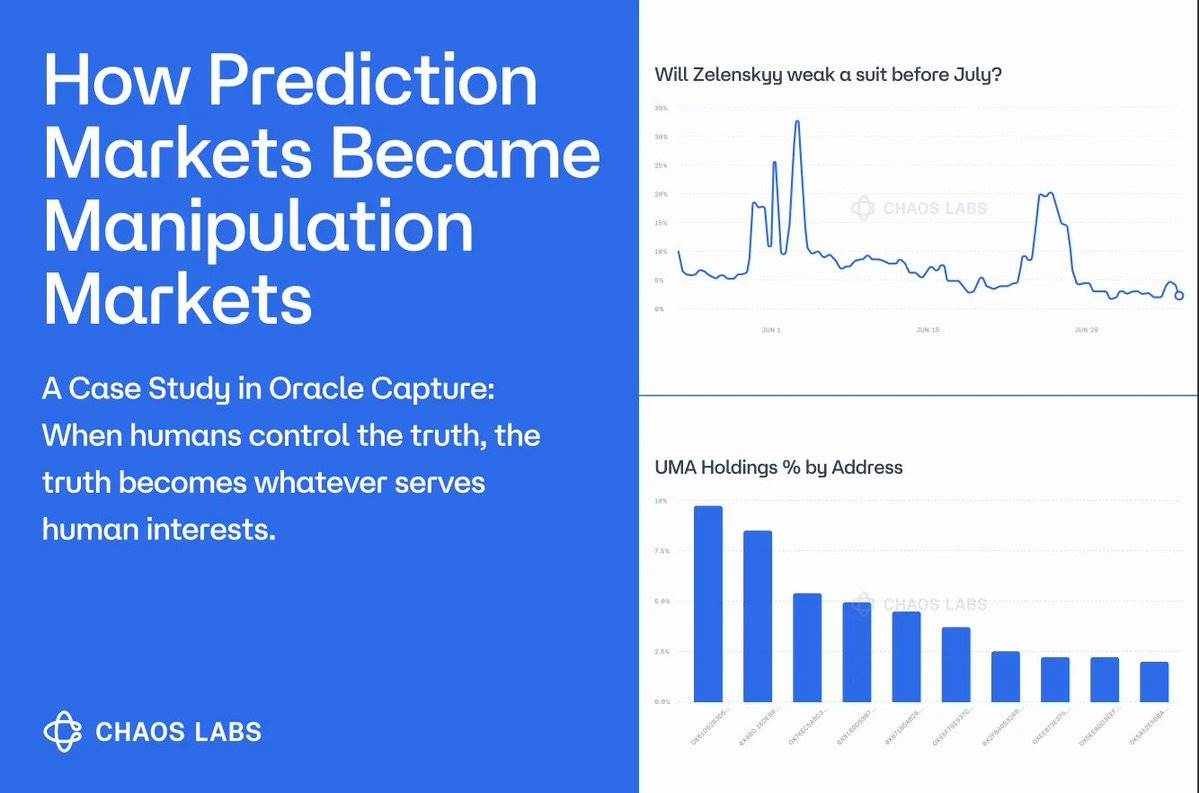

The controversy surrounding Polymarket's Zelensky lawsuit is not a minor glitch. It's a fatal flaw in a $200 million human-controlled oracle system: when the cost of corruption is lower than the reward, truth becomes a commodity sold to the highest bidder.

Zelensky’s $200 Million Fashion Show

Imagine: Zelensky walks into the NATO summit wearing what every major news outlet calls a suit. The market has $200 million in volume. The outcome seems obvious. Then, UMA’s oracle votes “No.”

Not because Zelensky wasn’t wearing a suit. Not because the evidence was unclear. But because the people controlling the oracle had millions of dollars bet on “No,” and they only needed to use their voting power to rewrite reality—without bearing any actual risk.

(TechFlow note: UMA is an open-source protocol, short for Universal Market Access. It relies on economic incentives and dispute resolution to ensure the accuracy of price data.)

Oracle Manipulation 101

The unsettling truth about human-controlled oracles is this: humans are biased.

-

Some of the largest UMA holders were heavily invested in the "No" outcome.

-

When the “Yes” outcome appeared correct, they didn’t accept defeat—they flipped the result.

-

Over 23 million UMA tokens, worth approximately $25 million, were voted to challenge the outcome.

This isn't decentralization. This is whales protecting their own interests. With enough UMA and coordination, truth doesn’t matter—only the outcome does.

The Broader Oracle Crisis

This problem extends far beyond Polymarket and UMA. Human-controlled oracles are vulnerable to manipulation and incentive design failures.

While we use the Zelensky Suit Market as a case study, we should note that we’ve observed this issue before—the Ukrainian mineral rights market in March 2025.

Every major prediction market faces the same fundamental challenge.

When humans control truth, truth bends to human interests. Move beyond human-controlled oracles: replace intent with intelligence.

The only real solution to human oracles is to remove humans.

AI-driven oracles change everything:

-

No economic incentives: models don’t hold positions or care who wins.

-

Bias-resistant decision rules: same training weights, same prompt, same temperature = model evaluates evidence against identical baseline standards. AI has no emotions, no skin in the game, no backroom coordination.

-

Reasoning pipeline: every intermediate step can be logged, audited, and replayed.

-

Machine-scale throughput: parallel ingestion of thousands of sources, no fatigue or side deals.

Residual noise remains, but it’s random statistical noise—much harder for traders to exploit. With clear resolution criteria and verified data feeds, state-of-the-art models already deliver production-grade accuracy, and the improvement curve is steep.

Random Noise Beats Calculated Lies

The future of prediction markets requires completely removing humans from truth determination.

This architecture looks like:

-

Predefined source hierarchy: Reuters > BBC > local news > blogs

-

Cryptographic proof of data sources: verify information hasn’t been tampered with

-

Multi-agent consensus: multiple AI systems reach independent conclusions

-

Transparent reasoning: full audit trail for every decision

-

Immutable evidence: proofs stored on blockchain, unmodifiable and undeletable

Truth Discovery in a Post-Truth World

Prediction markets are a microcosm of a larger challenge. When Wikipedia can be edited, news can be revised, and “facts” negotiated, we need systems capable of establishing ground-truth reality.

This spans domains including:

-

Election integrity and verification

-

Scientific consensus and research validation

-

News authenticity in the age of deepfakes

-

Historical record preservation and tamper-proofing

-

Corporate transparency and accountability

Final Thoughts

The choice facing prediction markets is stark: continue pretending that incentivized humans can be neutral arbiters of truth, or build systems that fully eliminate human bias from truth determination.

The market has already answered. When $200 million flows in, an obvious outcome exists, and that obvious outcome still fails—the system reveals its true nature.

Truth discovery is too important to be auctioned off to the highest bidder.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News