After compiling 300 cryptocurrency predictions for 2025, we’ve identified these trends

TechFlow Selected TechFlow Selected

After compiling 300 cryptocurrency predictions for 2025, we’ve identified these trends

By 2025, the number of AI agents is expected to exceed one million.

Author: insights4.vc

Translation: TechFlow

To help you save time and focus on market highlights, we have curated over 300 forward-looking predictions for 2025. Every year, top institutions and industry leaders share insights with profound implications for the future of crypto. This report compiles perspectives from ETF issuers, investment funds, research firms, and market pioneers, offering not only a comprehensive overview of market sentiment but also practical advice and actionable insights into emerging opportunities.

The five most watched themes for 2025 include:

-

Stablecoin Growth and Adoption

-

Tokenization of Real-World Assets (RWAs)

-

Expansion of Bitcoin and Ethereum ETFs

-

Integration of Artificial Intelligence and Blockchain

-

Decentralized Physical Infrastructure Networks (DePINs)

1. Stablecoin Growth and Adoption

Predictions from Blockworks Founder Jason Yanowitz and Inversion Capital Founder Santiago R Santos

-

By 2025, stablecoins are expected to account for 10% of total cryptocurrency market capitalization. This growth may be driven by at least one major bank, tech company, or fintech firm launching its own stablecoin—potential entrants include BlackRock, Robinhood, and Meta. Tether is expected to maintain its market leadership through strategic political relationships, while USDC’s market share could decline from the current 20% to around 15% due to new competitors like PayPal. These developments may accelerate U.S. regulatory progress, positioning stablecoins as key drivers in payments and e-commerce.

Prediction from 21shares

-

Stablecoin market capitalization has already surpassed $170 billion and is making significant strides in global remittances, particularly in countries like the Philippines and Turkey. As tokenization of private credit gains traction, this trend is expected to further enhance capital liquidity and financial transparency. Platforms such as Maple Finance, which use smart contracts to streamline operations and reduce costs, are emerging as industry leaders. With institutions like Moody's beginning to offer ratings for tokenized credit, this sector is poised to become a mainstream asset class by 2025.

2. Tokenization of Real-World Assets (RWAs)

Prediction from Coinbase

-

The market for tokenized real-world assets (RWA) is growing rapidly. It is projected to increase 60% by 2024, reaching $13.5 billion, and could soar to $30 trillion by 2030. Currently, global financial leaders such as BlackRock and Franklin Templeton are actively advancing the tokenization of government securities. Tokenized assets are becoming crucial collateral within DeFi ecosystems.

Prediction from Pantera Capital Managing Partner Paul Veradittakit

-

RWAs grew 60% this year to $13.7 billion, with 70% being private credit and the remainder treasury bills and commodities. Capital inflows are accelerating, and more sophisticated types of tokenized assets are expected by 2025.

-

Private Credit: With infrastructure improvements, Figure added $4 billion in tokenized credit in 2024. An increasing number of companies are channeling capital into crypto via private credit.

-

Treasuries and Commodities: On-chain treasuries currently stand at $2.67 billion, while trillions remain off-chain and untokenized. Treasuries offer better yields than stablecoins. BlackRock’s BUIDL fund holds $500 million on-chain versus hundreds of billions off-chain. DeFi pools are now integrating treasuries, reducing barriers to user adoption.

-

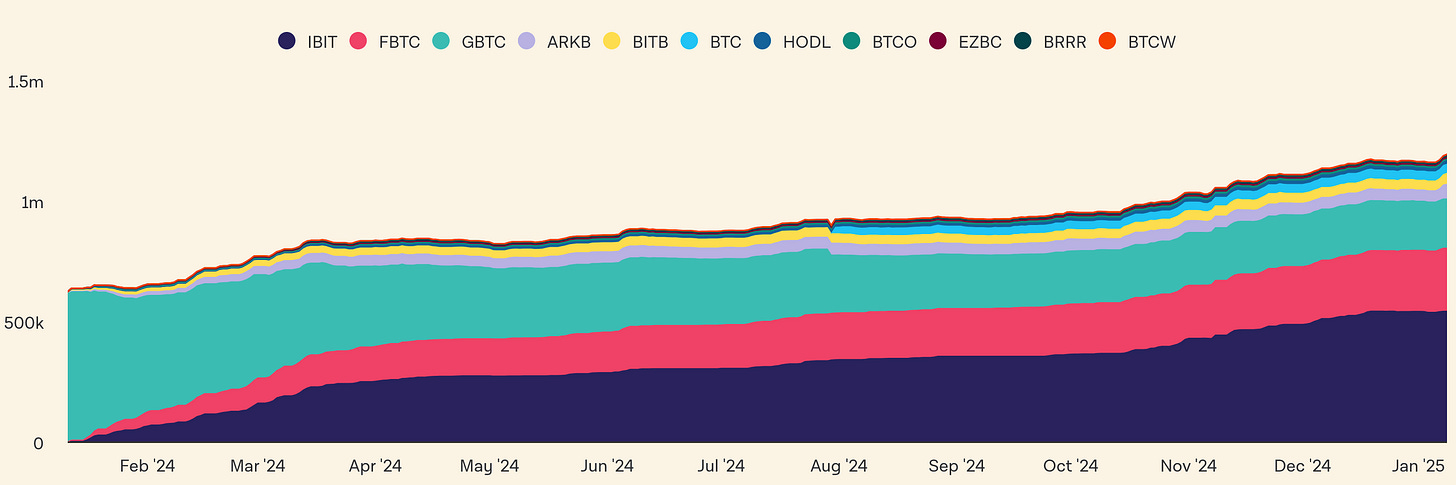

3. Expansion of Bitcoin and Ethereum ETFs

Predictions from Bloomberg ETF Experts Eric Balchunas and James Seyffart

-

The U.S. Securities and Exchange Commission (SEC) approved the first 11 spot Bitcoin ETFs on January 10, 2024, followed by spot Ethereum ETFs on July 23, 2024. These approvals signal a gradually loosening regulatory environment and lay the groundwork for altcoin ETFs. The emergence of altcoin ETFs could further boost market liquidity and lower the barrier to entry for crypto investments.

-

Bitcoin ETF assets are projected to surpass those of gold ETFs by 2025. Currently, Bitcoin ETFs hold $110 billion compared to $128 billion for gold ETFs. The rapid growth of Bitcoin ETFs suggests this milestone may arrive sooner than expected.

-

If the SEC leadership becomes more pro-innovation, it may approve ETFs for altcoins such as XRP, Solana (SOL), and Hedera (HBAR), further diversifying the range of available crypto investment products.

-

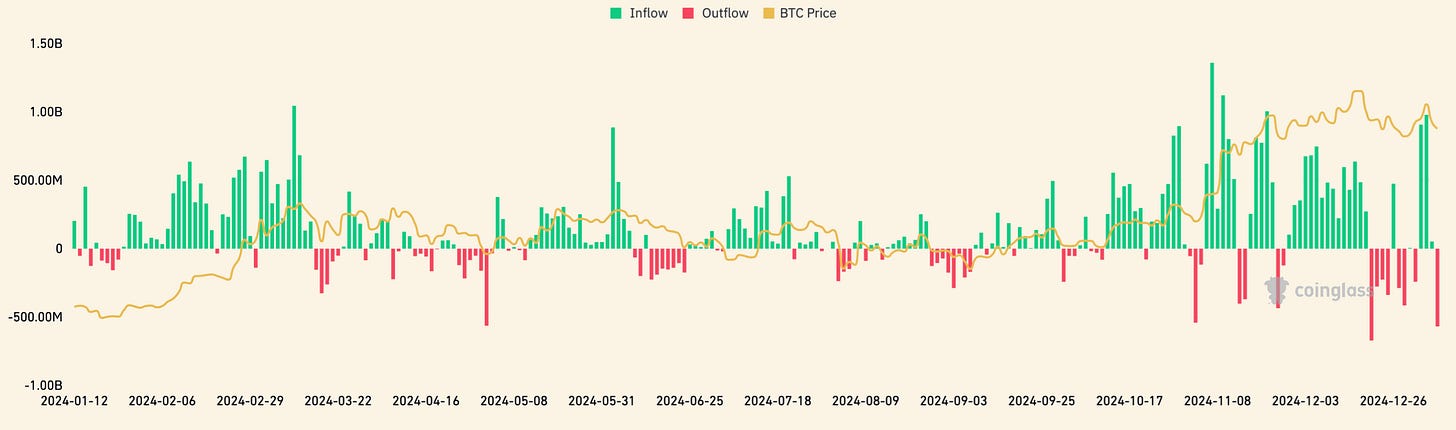

If you'd like a deeper dive into spot Bitcoin ETFs, we recommend our article published last month: here. Below are ETF metrics as of January 8, 2025:

On-chain holdings of spot Bitcoin ETFs (Source: The Block)

Bitcoin ETF flows

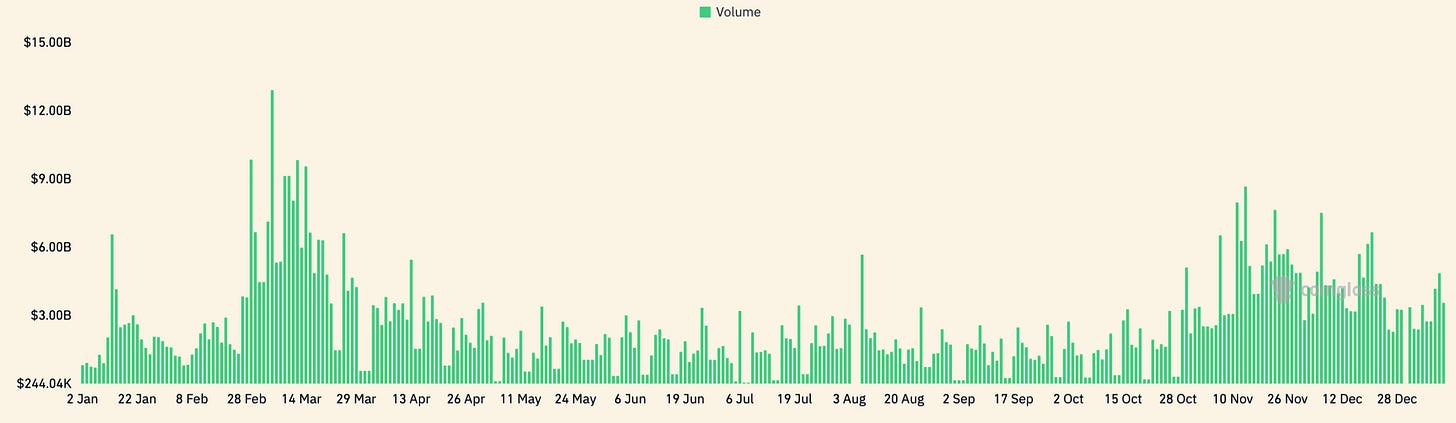

Bitcoin ETF trading volume

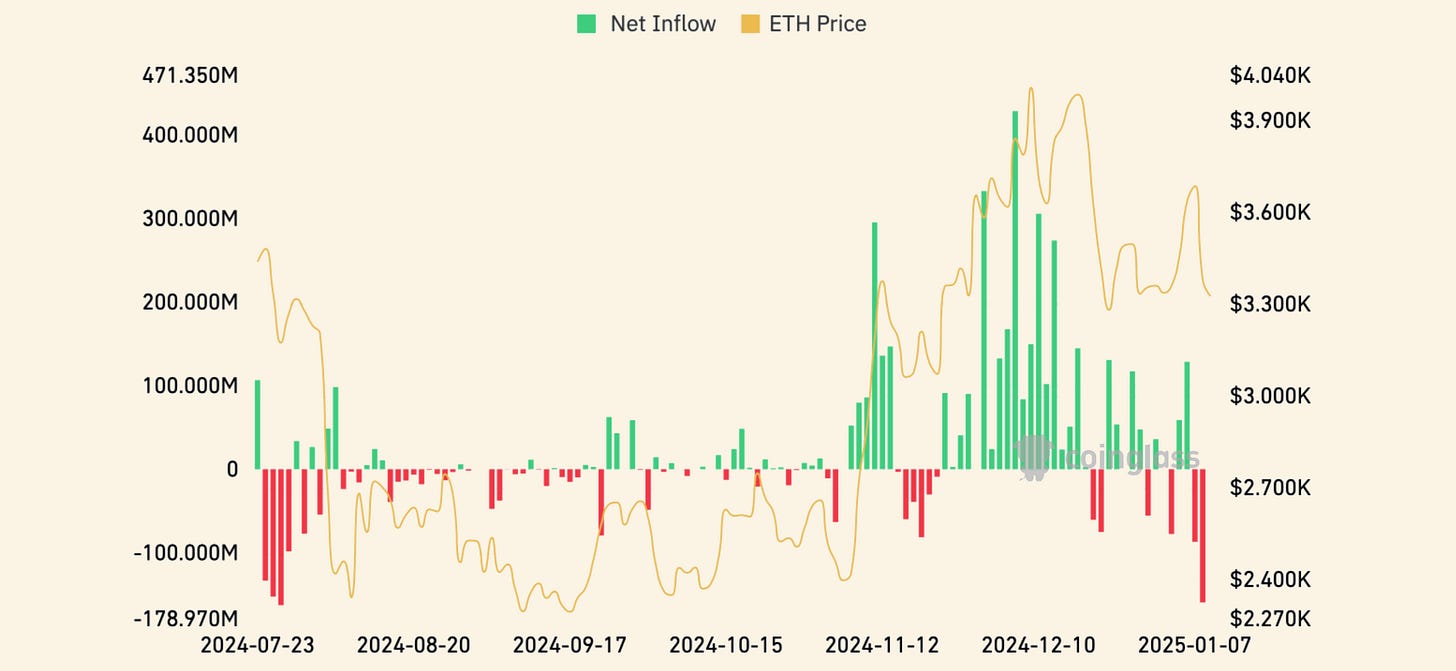

Ethereum ETF flows

Prediction from Bitwise

Bitcoin ETF inflows in 2025 are expected to exceed the record $33.6 billion set in 2024. This growth will be driven largely by major brokerages such as Morgan Stanley and Bank of America, which are expanding access to crypto products for their clients. As investor confidence strengthens and Bitcoin becomes increasingly mainstream in investment portfolios, ETF inflows are expected to accelerate—a trajectory similar to that of gold ETFs over the past few decades.

4. Integration of Artificial Intelligence and Blockchain

Prediction from Vaneck

-

By 2025, the number of AI agents is expected to exceed one million. These agents will significantly drive on-chain activity, optimizing DeFi yields, automating tasks, and enabling interactions in gaming and social media. Platforms like Virtuals Protocol are pushing the development of AI technology, expanding agent applications from finance to gaming and marketing, generating substantial revenue and enhancing user engagement.

Prediction from Dragonfly Capital Managing Partner Haseeb Qureshi

-

AI agents will widely adopt stablecoins for peer-to-peer transactions, especially as stablecoin regulation becomes clearer. This trend will extend to large enterprises, which will use stablecoins to replace traditional banking systems for greater flexibility and efficiency.

-

Decentralized AI training and inference will see rapid development, led by projects such as ExoLabs, NousResearch, and PrimeIntellect, offering alternatives to today’s centralized AI models. NEAR Protocol is working to build a fully permissionless AI tech stack, making development and deployment more open.

-

AI-powered wallets will transform the user experience by automating complex operations such as cross-chain bridging, transaction optimization, fee reduction, and fraud prevention. This will enable seamless cross-chain experiences. By 2026, this automation trend may diminish the importance of blockchain network effects, as users no longer need to directly interact with blockchains.

5. Decentralized Physical Infrastructure Networks (DePINs)

Prediction from Multicoin Capital

-

The Trump administration is expected to introduce a national standard for autonomous driving (AD), creating new growth opportunities for decentralized physical infrastructure networks (DePINs) based on autonomous vehicles and robotics. With GPU clusters exceeding 100,000 H100 units, autonomous driving technology will become practically viable. Some startups backed by traditional venture capital firms may adopt the DePIN model to distribute operational risks and reduce costs. Early adopters will gain access to critical robotic operation data. For example, startup Frodobots has already begun exploring this direction, and more similar companies are expected to follow. Additionally, Hivemapper is experimenting with similar innovative concepts.

Prediction from Framework Ventures Co-founder Vence Spencer

-

DePIN projects focused on energy (such as Glow and Daylight) are expected to reach transaction fee levels comparable to top DeFi platforms. This indicates that blockchain applications in energy distribution management and monetization are becoming increasingly widespread. For instance, these projects use smart contracts to optimize energy efficiency while providing users with transparent transaction records and revenue-sharing mechanisms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News