Polymarket Blocked Again, Can Crypto Projects Innovate Amid Enduring Regulatory Challenges?

TechFlow Selected TechFlow Selected

Polymarket Blocked Again, Can Crypto Projects Innovate Amid Enduring Regulatory Challenges?

Currently, many countries or regions have differing views on the legality of prediction markets.

By 1912212.eth, Foresight News

Polymarket, the prediction market platform, has entered a turbulent period following its moment in the spotlight during the U.S. presidential election.

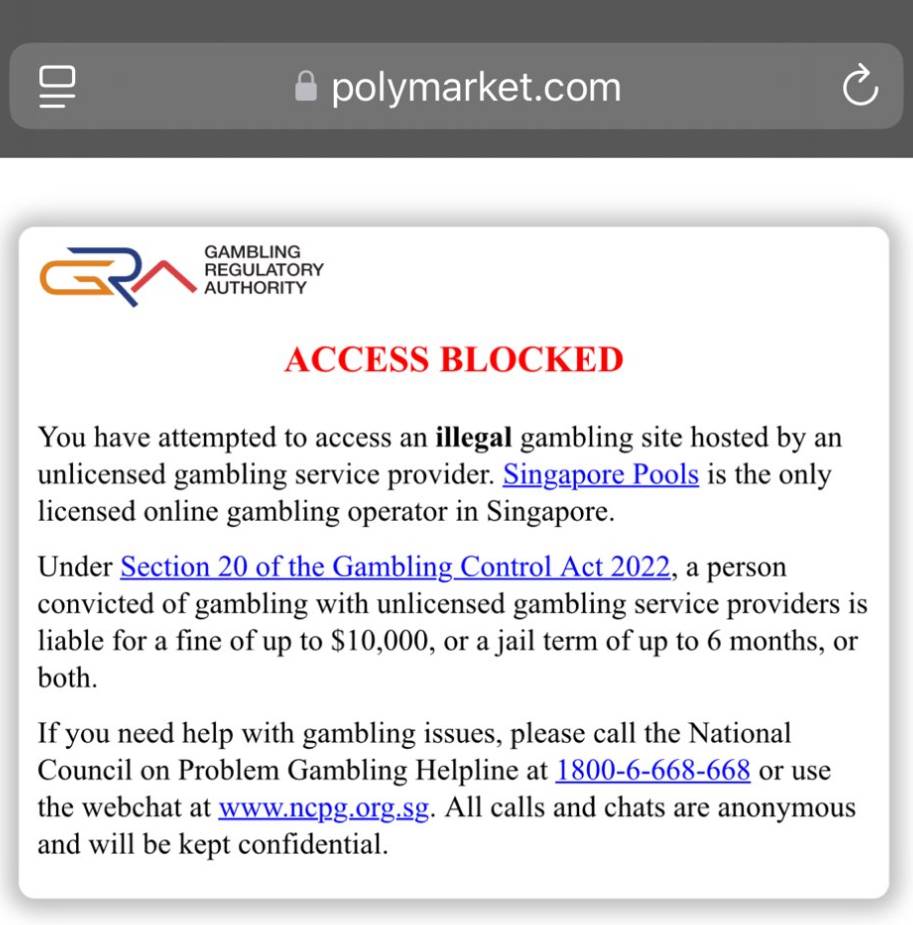

On January 12, Polymarket was officially classified as a gambling website in Singapore and subsequently blocked. Users attempting to access the site from Singapore receive a notice stating: "This website is an illegal gambling site hosted by an unlicensed gambling service provider. Users may face fines of up to USD 10,000 or imprisonment for up to six months."

This is not the first time Polymarket has faced restrictions. In November last year, widespread attention emerged after news broke that a French whale had accumulated over $40 million in unrealized profits by betting on Trump’s victory. The French National Gaming Authority (ANJ) promptly launched a compliance investigation into the platform and suspended access for users within France.

According to government regulations, any new gambling market must obtain prior authorization from the French National Gaming Authority.

Frequent Regulatory Challenges: A Blurry Line

Polymarket is a blockchain-based prediction market platform that leverages decentralized technology to allow users to bet on various events and outcomes. It stands as one of the few applications in the crypto space with significant mainstream reach. The platform reached its peak moment in 2024, with the U.S. presidential election significantly boosting its visibility and influence.

In October 2024, Polymarket recorded trading volume of $2.28 billion, rising further to $2.577 billion in November. Although volume declined substantially in December, it still reached $1.7 billion. Additionally, Polymarket saw 309,228 active trading users in December 2024—a record high—with 231,556 new accounts created.

For comparison, in January 2024, Polymarket's monthly trading volume was just over $51 million, with only 8,261 new accounts registered.

Polymarket offers a transparent and public platform for market predictions. Its forecasting accuracy often surpasses traditional media and so-called experts, earning strong favor among data-driven markets. Some media outlets and data platforms frequently cite its prediction data.

Despite strong performance metrics, regulatory crackdowns have quickly followed.

Prediction markets share similarities with traditional gambling, primarily relying on users wagering on future event outcomes and distributing rewards based on betting rules. However, the innovation lies in their independence from physical operators, instead leveraging blockchain technology for automated management.

Currently, many countries hold differing views on the legality of prediction markets. Some regions treat them as legitimate innovations, while others argue they blur the line between gambling and compliant investing.

As early as 2022, Polymarket reached a settlement with the U.S. Commodity Futures Trading Commission (CFTC), agreeing to pay $1.4 million and shut down non-compliant markets by January 24.

Singapore’s blocking of Polymarket makes it another jurisdiction—joining the U.S., France, and Taiwan—to restrict access to the platform.

To date, Polymarket has not issued any official response.

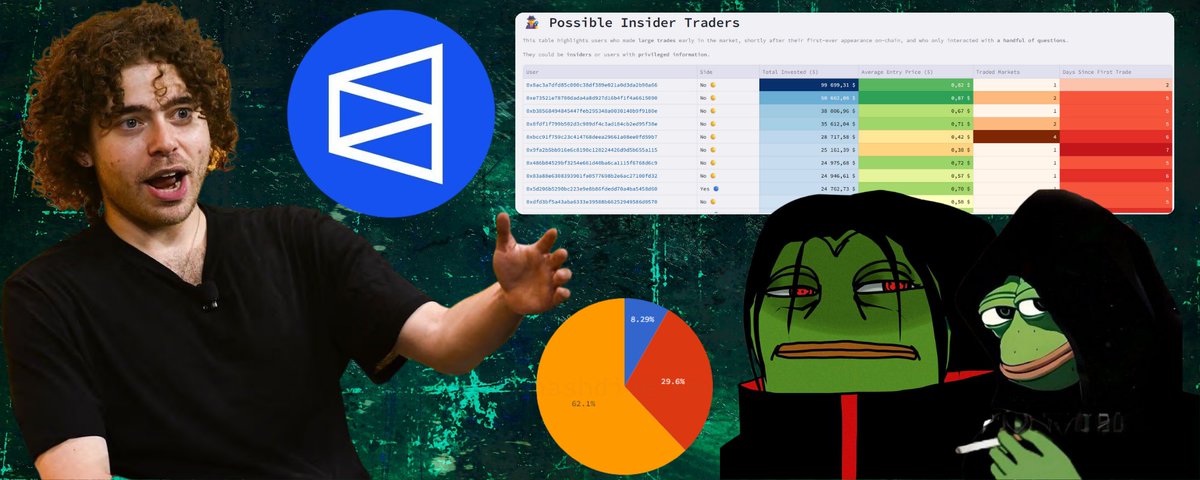

Ongoing Controversies

Recently, Polymarket sparked controversy over user speculation related to wildfires in California.

Amid a devastating fire season that claimed lives and forced evacuations of hundreds of thousands, users coldly placed bets on the progression of the disaster, with some prediction pools reaching as high as $100,000. This act of turning public tragedies into gambling opportunities triggered intense moral backlash. Many users criticized the platform for promoting unethical, even pathological, gambling behavior without boundaries. In response, Polymarket added a brief disclaimer stating that it uses crowd wisdom to generate accurate and objective event forecasts. Yet, if you’re actually facing a natural disaster, the credibility of such prediction markets becomes highly questionable.

Experts suggest this incident may prompt stricter regulatory requirements for prediction markets, necessitating clearer definitions from platforms about the boundaries of permissible betting content.

Prior to this, Polymarket’s founder, Shayne Coplan, was subjected to an FBI raid amid suspicions of market manipulation. The incident stemmed from an ongoing investigation by the U.S. Department of Justice (DOJ) into whether Polymarket violated its 2022 agreement with the CFTC—which required blocking access to U.S. users—by continuing to accept trades from American users.

Conclusion

While Polymarket has grown rapidly, it continues to face significant legal and compliance challenges. Questions surrounding the legitimacy of betting on sensitive events, potential market manipulation, and regulatory adherence remain urgent issues that must be addressed. Perhaps, by slowing down and focusing on more refined, responsible operations, Polymarket can achieve longer-term sustainability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News