Hotcoin Research | The Era of Zero-Barrier DeFi Has Arrived: Observations and Analysis of the Abstraction and Intent-Based Track

TechFlow Selected TechFlow Selected

Hotcoin Research | The Era of Zero-Barrier DeFi Has Arrived: Observations and Analysis of the Abstraction and Intent-Based Track

Emerging “abstraction” and “intent” technologies in the blockchain space—by simplifying cross-chain interactions and redefining user transaction logic—are striving to eliminate Web3’s usability barriers and may become a key driver for blockchain’s mass adoption. However, they still face multiple challenges, including technical implementation, ecosystem collaboration, economic governance, and regulatory compliance.

Introduction

One of the hottest topics in the recent crypto market has been the announcement that River—a chain-abstraction stablecoin protocol—has secured strategic investment from TRON. On January 21, 2026, TRON founder Justin Sun announced an $8 million investment in River to support its deployment of cross-chain stablecoin abstraction technology within the TRON ecosystem. Following the news, River’s native token RIVER surged dramatically: up nearly 1,900% over the past 30 days—from around $5 at the start of January to a recent peak of $86—and its market capitalization surpassed $1.6 billion, placing it among the top 70 cryptocurrencies by market cap. Industry heavyweights including Arthur Hayes have publicly endorsed River, while major exchanges have listed RIVER, sparking widespread discussion about the concept of “abstraction.”

This article takes “abstraction” and “intents” as its central themes, offering a comprehensive overview of this emerging sector—including its evolution, current state, representative projects, underlying risks and opportunities, and future outlook. Part I explains what “abstraction” and “intents” are, and the pain points they aim to solve in blockchain. Part II traces the development trajectory and current status of related technical concepts—from the early conceptualization of Ethereum account abstraction, to the rise of chain abstraction driven by multi-chain ecosystem fragmentation, and finally to the emergence of intent-based architectures. Part III focuses on representative projects across the abstraction and intent sectors, dissecting their models and performance. Part IV discusses potential risks and challenges; Part V explores opportunities and future prospects. Through this holistic analysis, we aim to deliver actionable insights for investors and practitioners: how to seize opportunities and mitigate risks amid the abstraction and intent wave—and whether these innovative sectors can become the next engine of industry growth.

I. Understanding Abstraction and Intents: Concepts and Context

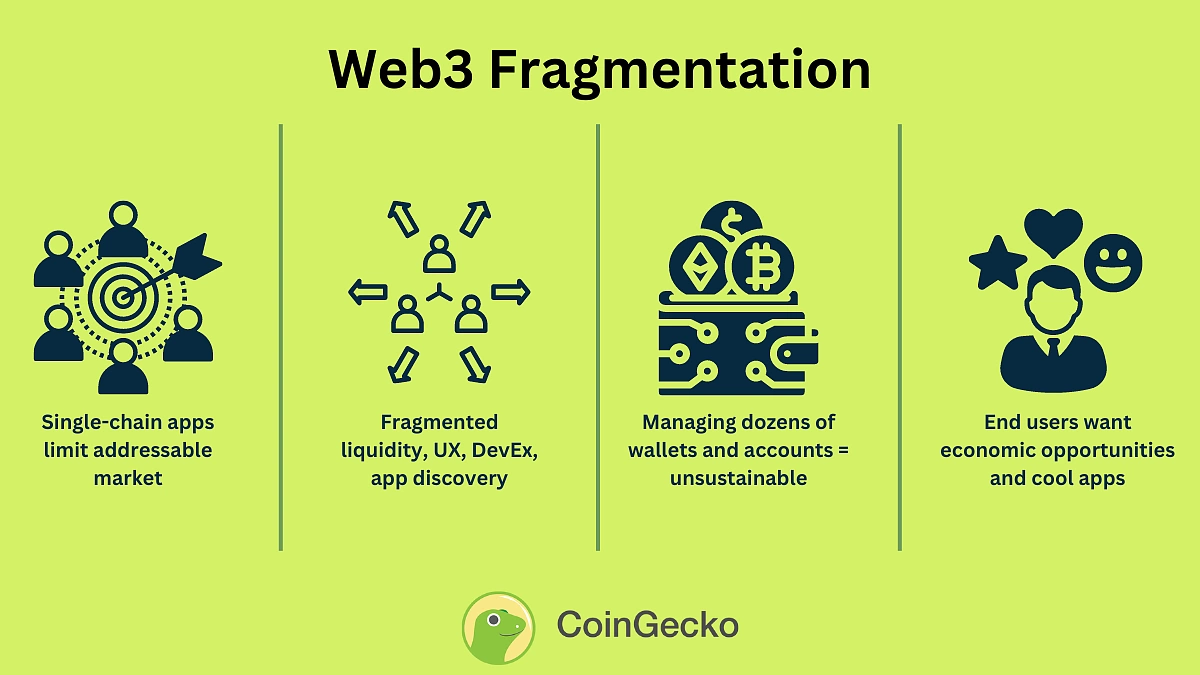

To grasp “abstraction” and “intents,” it’s essential first to understand the user experience (UX) pain points currently plaguing blockchain. For ordinary users to interact with on-chain applications, the barrier remains high: they must hold cryptocurrency, pre-fund the target chain with requisite assets, possess the native gas token for network fees, and navigate complex steps such as transaction signing, bridge transfers, and slippage management. These sequential hurdles act like gatekeepers—excluding most potential users from Web3 entirely. Improving blockchain usability and lowering entry barriers has thus become a shared industry priority. “Abstraction” and “intents” emerged precisely against this backdrop, promising transformative improvements to UX.

Abstraction

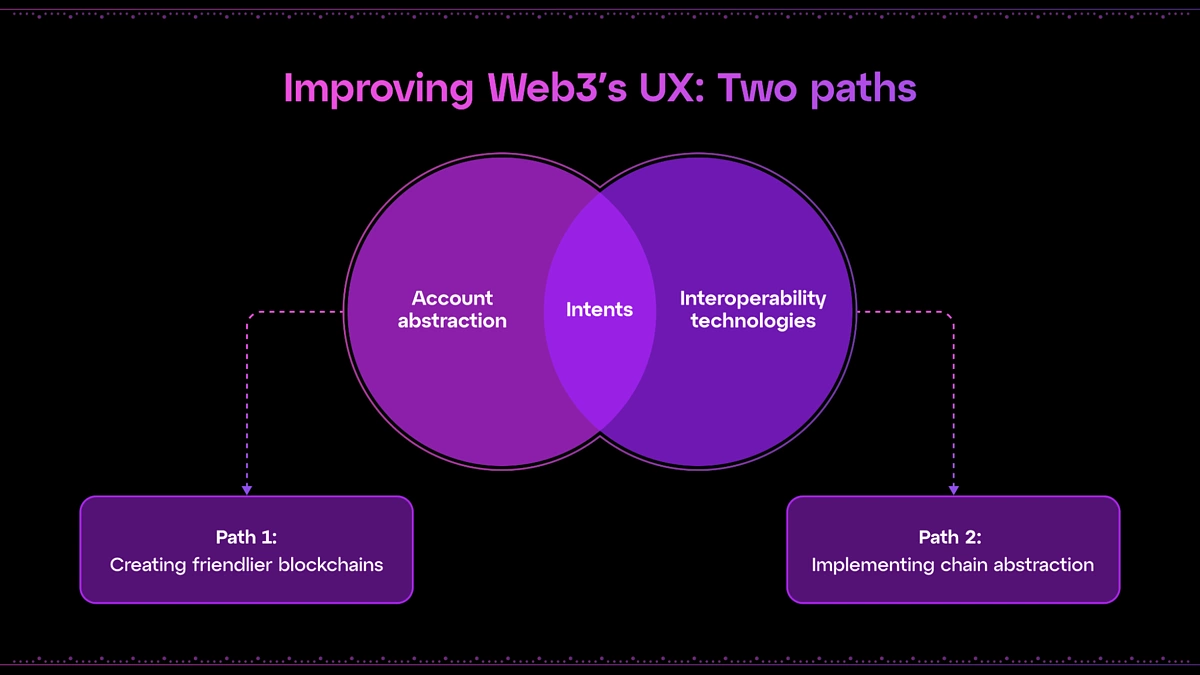

In blockchain, “abstraction” generally refers to a suite of technical solutions designed to hide underlying complexity and simplify users’ interactions across multiple chains. Depending on the layer of application, abstraction can be categorized into types such as “account abstraction” and “chain abstraction.” Today’s abstraction landscape is dominated by two main directions:

- Account abstraction is fundamentally an active technical upgrade enabling programmable accounts—supporting features like social recovery, sponsored gas payments, and batched transactions—to enhance operational flexibility.

- Chain abstraction represents more of a UX-level paradigm shift—an organic response by the Web3 ecosystem to the challenge of multi-chain fragmentation. Its goal is to eliminate the friction associated with cross-chain operations.

Intents

Complementing abstraction’s mission of hiding complexity, the “intents” sector seeks to redefine interaction logic itself. In traditional models, users must manually design and execute each step of a transaction—for example, converting USDC on Ethereum Mainnet into SOL on Solana requires researching bridges, identifying optimal swap paths, and executing each leg manually.

- In an intent-driven architecture, users simply declare their desired outcome—e.g., “I want to exchange 1,000 USDC on Ethereum Mainnet for SOL on Solana”—and solvers automatically identify the optimal route, coordinating bridges and DEXs to fulfill the request end-to-end.

- Rather than submitting explicit transactions, users submit an “intent.” The system then executes the operation on their behalf based on that intent. This “declare outcome → automatic fulfillment” paradigm is widely seen as a powerful way to lower usability barriers and make blockchain interactions more intuitive.

Although abstraction and intents emphasize different aspects, they share a common mission: reducing the barrier to using blockchain. Account abstraction enhances wallet intelligence and security by upgrading the account model; chain abstraction streamlines multi-chain operations by unifying cross-chain liquidity; intent-driven systems go further—redefining the transaction paradigm so users focus solely on *what* they want, not *how* to achieve it. As Web3 enters an era defined by multi-chain coexistence and increasingly sophisticated applications, these concepts directly address core pain points for everyday users. Consequently, abstraction- and intent-focused projects have attracted strong investor interest and community attention over the past two years—emerging as a new frontier. Some even refer to this phase as the “Abstraction Era”: a new infrastructure epoch centered on user experience.

II. Evolution and Current State of the Abstraction & Intent Sector

1. The Genesis and Implementation of Account Abstraction

- As early as 2016–2017, the Ethereum community began discussing ways to make user accounts more flexible. Vitalik Buterin proposed the initial concept of Account Abstraction (AA), envisioning EOAs that behave like smart contracts—fully programmable.

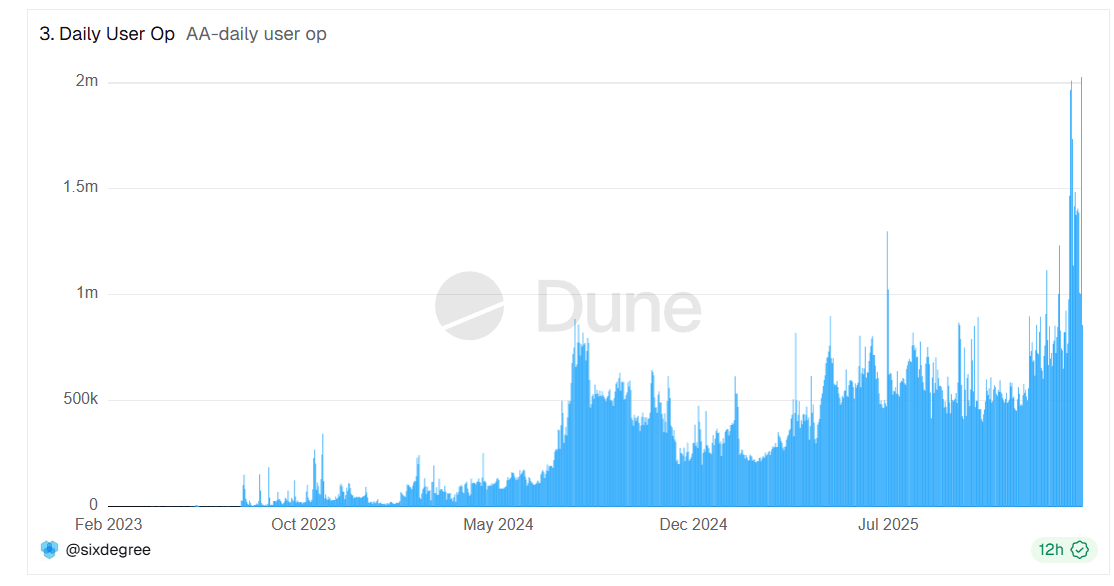

- In March 2023, Ethereum achieved account abstraction without modifying its core protocol: EIP-4337 was formally introduced, establishing a smart account framework outside consensus layers. This allowed users to replace traditional EOA wallets with “contract accounts.” With ERC-4337, users gained access to social recovery wallets, third-party gas sponsorship, pre-configured automated trades, and batch execution of complex operations. Wallet projects rushed to integrate AA functionality, while on-chain applications—including games and social dApps—adopted gas sponsor mechanisms to simplify onboarding. Giants like Coinbase launched AA-based wallets, and institutions such as Visa built proof-of-concept auto-debit payment demos atop AA. As of late January 2026, AA account users exceeded 40 million, with over 2 million daily operations.

Source: https://dune.com/sixdegree/account-abstraction-overview

- Ethereum clients are also exploring enhancements like EIP-7702, which would allow external accounts to directly invoke certain smart account functionalities—further lowering AA adoption barriers.

2. Multi-Chain Ecosystem Growth and the Rise of Chain Abstraction

- Beginning in 2020–2021, soaring Ethereum gas fees catalyzed the proliferation of new public blockchains and Layer 2s—spreading users and assets across disparate chains. Yet this multi-chain boom came with fragmentation: liquidity became siloed, and user onboarding grew exponentially harder. Assets couldn’t flow freely between chains, and users had to master multiple bridges and wallets—an unwieldy experience. To address this, the industry gradually embraced “chain abstraction”: protocol-layer innovations that conceal cross-chain complexity. Examples include smart contracts capable of cross-chain calls, or tokens pegged to assets across multiple chains—enabling users to transact freely without needing to know where their assets physically reside.

- In the stablecoin space, this philosophy gave rise to “chain-abstraction stablecoins”: users deposit mainstream stablecoins on any supported chain and mint a globally usable stablecoin 1:1, freely transferable and spendable across chains, redeemable later for the original chain’s assets. River pioneered this model: it accepts USDT (on Ethereum, TRON, etc.), TRON’s native USDD, and even regulated USD-pegged stablecoin USD1 as collateral to mint satUSD—a universal stablecoin usable across multiple networks. This eliminates the need for manual cross-chain bridging. Holding satUSD effectively grants users simultaneous dollar liquidity across all supported chains—no more frequent bridging required.

- Numerous other prominent projects have entered the chain-abstraction/cross-chain arena: cross-chain communication protocols LayerZero and Axelar focus on message-passing bridges, enabling direct contract-to-contract cross-chain calls. As Ethereum scaling and multi-chain coexistence become standard, abstraction-layer infrastructure will assume ever-greater importance.

3. The Emergence and Development of Intents

- 2023–2024: Projects like Anoma explicitly proposed intent-based architectures for asynchronous cross-chain transaction execution, emphasizing that users should only need to declare their *goal*, not the execution path. Account abstraction served as foundational infrastructure for the intent space—enhancing wallet and transaction workflow flexibility.

- 2024–2025: More DeFi protocols, DEXs, and aggregators integrated intent mechanisms into product design to improve UX. For instance, solvers compete to fulfill user intents—optimizing routing across trading venues, bridges, and asset management tools to reduce operational complexity.

- Intent mechanisms remain in early stages but show clear growth: primary use cases include trade aggregation and automated investment execution tools. By letting users focus solely on *purpose*, intent mechanisms could significantly lower onboarding barriers—driving mass user adoption.

Source: https://blog.particle.network/chain-abstraction-vs-intents/

III. Representative Projects in the Abstraction & Intent Sector

3.1 Account Abstraction: Smart Wallets and Seamless Payments

- Safe ($SAFE): A pioneer in programmable accounts, Safe offered multi-signature smart contract wallets long before ERC-4337—featuring social recovery, pre-signed transaction batching, and other advanced capabilities. It now hosts the largest smart account ecosystem in Web3. The Safe team actively contributes to AA standards development and plans to integrate proposals like EIP-7702. Today, virtually every top DAO holds treasury funds in Safe wallets, and DeFi protocols are exploring native support for Safe login and interaction. Given Safe’s leadership in AA, $SAFE is widely viewed as a potential cornerstone asset in the account abstraction segment.

- Biconomy ($BICO): Biconomy began by offering gas sponsorship and cross-chain relay services, evolving into a full-stack developer solution combining account abstraction and chain abstraction. Its SDK enables dApps to embed “one-click transactions”: users sign once to execute multi-step workflows (e.g., “swap and stake”), with gas fees covered by the dApp or third parties—delivering near-Web2 smoothness. Biconomy also launched “Smart Account Nexus,” a module helping projects rapidly deploy large-scale ERC-4337 accounts. As its Modular Execution Layer expands across more chains—and supports increasingly sophisticated “super-transactions” (e.g., cross-chain composability)—Biconomy stands to boost user retention and token utility.

- Particle Network ($PARTI): Particle targets Web2-native UX, offering passwordless login + integrated smart wallets. Users log in via phone number or email; Particle creates and manages ERC-4337 smart accounts behind the scenes—sharding private keys to enable frictionless blockchain usage. Its defining innovation is the “Universal Account”: users see a single unified identity, while Particle internally orchestrates separate smart contract wallet instances across multiple chains via its proprietary base chain. This achieves both account and chain abstraction simultaneously: users see one account and one balance—freely interacting with dApps across all supported chains, oblivious to asset location or gas sourcing. Particle monetizes via B2B service fees and ecosystem token incentives for network nodes. However, its custodial model faces scrutiny over decentralization and security—requiring technical upgrades and open-source transparency to earn user trust.

3.2 Chain Abstraction: Cross-Chain Liquidity and Unified Assets

- River ($RIVER): River enables users to deposit stablecoins from various chains to mint satUSD—a unified, cross-chain stablecoin—allowing seamless fund movement across ecosystems. River’s flagship product, satUSD, is an over-collateralized stablecoin. Its protocol TVL stands at ~$159 million, down from a peak of $605 million in October 2025. While RIVER’s recent price surge was triggered by Justin Sun’s investment announcement, it also reflects limited circulating supply and market speculation—warranting caution against short-term volatility. Long-term viability hinges on three pillars: security (mitigating smart contract vulnerabilities and collateral risk in cross-chain minting); network effects (expanding chain support and real-world adoption of satUSD); and regulatory compliance (navigating diverse jurisdictional frameworks governing cross-chain stablecoins).

For now, integration with TRON provides River rapid expansion leverage. If it attracts broader adoption beyond TRON—including Ethereum, BSC, and others—it could evolve into a cross-chain stablecoin “hub,” significantly expanding $RIVER’s value proposition. Conversely, stalled growth or security incidents could trigger swift valuation corrections—investors must closely monitor project developments.

- ZetaChain ($ZETA): ZetaChain is a purpose-built omnichain public blockchain, dubbed “the first truly global blockchain.” Its core innovation is native cross-chain messaging and asset control—e.g., smart contracts deployed on ZetaChain can natively manage Bitcoin, Ethereum, and Solana assets. Developers leverage this to build omnichain dApps: deploying a contract on ZetaChain enables reading/writing states across major chains, delivering truly native cross-chain experiences. For example, a user initiating a DeFi action on ZetaChain can automatically trigger swaps on Ethereum DEXs and lending on BSC—all orchestrated natively through ZetaChain, without user intervention or third-party bridges. To avoid centralization, ZetaChain employs DPoS multi-node validation for external chain assets—functionally mirroring Ethereum’s approach but for cross-chain interoperability. $ZETA serves as the native token for gas payments and cross-chain consensus maintenance. ZetaChain represents an alternative chain abstraction pathway: building cross-chain abstraction into a new L1’s foundational architecture.

- LayerZero / Axelar: These projects represent critical cross-chain communication infrastructure—and key enablers of chain abstraction. LayerZero delivers a unified cross-chain message-passing protocol, simplifying cross-chain dApp development. Axelar ($AXL) is another leading cross-chain network, enabling decentralized asset and message transfers via a decentralized gateway—and launching its own cross-chain stablecoin (axlUSD), similar to satUSD. $AXL is used for cross-chain fee payments and node staking. LayerZero and Axelar advance chain abstraction from complementary angles: LayerZero focuses on the message layer; Axelar spans both asset and message layers. As cross-chain interoperability becomes table stakes for applications, the importance of such protocols continues rising. Notably, cross-chain bridges remain high-risk attack surfaces—LayerZero and Axelar have repeatedly emphasized security measures. Still, investors must recognize that security breaches in cross-chain infrastructure carry systemic impact, disproportionately affecting associated token valuations. Thus, while benefiting from LayerZero and Axelar’s chain abstraction advantages, due diligence on technical robustness and audit history remains essential.

3.3 Intents: From User Needs to Automated Fulfillment

- Anoma ($XAN): A Layer 1 blockchain architected entirely around “intents.” Anoma aims to function as a “decentralized operating system,” where users broadcast any on-chain request, and the network automatically matches and executes it—without requiring users to define implementation steps. Simply put, on Anoma users don’t send transactions—they publish “intents” (e.g., “I want to swap 50 tokens A for token B at a minimum rate of 1:100”). The Anoma network handles matching and execution. Architecturally, Anoma comprises three components: an intent pool (collecting user intents), solvers (competing to match intents and generate execution plans), and a settlement layer (executing finalized plans on-chain). Its parallel project Namada adds zero-knowledge privacy, encrypting intent contents—only revealing final outcomes on-chain. Risks include Anoma’s extreme technical difficulty: achieving general-purpose intent matching requires solving open problems like solver game theory and composability of complex intents—making timelines and outcomes highly uncertain.

- CowSwap ($COW): CowSwap brilliantly adapts intent principles to existing Ethereum DEX trading—emerging as a standout success case. Built atop Gnosis Protocol, CowSwap lets users submit “request-for-quote” (RFQ)-style intents—not traditional swap transactions. For example, a user declares “I want to swap 100 DAI for ≥0.05 WBTC.” This intent is broadcast to professional market makers and algorithmic solvers. Solvers search DEX pools and order books for optimal routes—or match against counterparty orders—then submit execution proposals. If a proposal satisfies the intent (≥0.05 WBTC), CowSwap settles the trade; otherwise, no execution occurs and no gas is paid. Key advantages: ① Batch matching: CowSwap aggregates orders over time, finding optimal collective execution paths—reducing slippage and gas costs; ② MEV resistance: Since intent matching occurs off-chain (outside the public mempool), MEV bots cannot front-run, promoting fair pricing; ③ Minimal UX: Users only sign once; gas is paid only upon successful settlement—if no match is found, users incur zero cost.

IV. Risks and Challenges Facing the Abstraction & Intent Sector

While promising, the abstraction and intent sectors face substantial hurdles. Most projects launched to date have underperformed—reflecting the inherent difficulty of maturing novel paradigms. A rational assessment of risks and challenges is essential.

- High Technical Complexity: Though account abstraction standards exist, integrating them into diverse dApps remains challenging—many apps still lack smart account login support, and implementing ERC-4337 demands significant engineering effort. Chain abstraction poses even greater security and complexity tests: achieving seamless interoperability across heterogeneous chains is extraordinarily difficult. Security and reliability are therefore existential concerns. For instance, River must guarantee satUSD’s strict 1:1 backing and mitigate smart contract risks—if satUSD de-pegs, confidence collapses. Intent networks must guard against solver collusion, intent misuse, and balancing decentralization with efficiency. These technical challenges lack ready-made solutions, demanding continuous iteration.

- Ecosystem Coordination and Standardization: The abstraction/intent space is currently fragmented, with competing projects advancing divergent approaches. Short-term innovation is vibrant—but long-term fragmentation looms. Beyond ERC-4337, non-EVM chains like Aptos implement their own AA models; chain abstraction varies from bridge-centric to novel-chain-centric designs—interoperability remains uncertain. Similarly, intent projects may adopt incompatible intent syntaxes and protocols, undermining network effects. To prevent balkanization, community-led open collaboration and standardization—such as universal intent formats or cross-chain abstraction APIs—are vital. Research groups like Paradigm advocate for open intent pools and permissionless solver networks. We may eventually see W3C-style standards bodies emerge in blockchain to harmonize abstraction and intent technologies.

- Economic and Governance Risks: Abstraction and intent projects often introduce novel incentive structures and tokenomics. Poor token distribution or governance design risks price manipulation and governance attacks. In intent networks, solvers might prioritize personal profit over user benefit—e.g., capturing MEV without sharing gains. Designing incentive mechanisms aligned with user interests remains a fundamental economic challenge. Additionally, decentralization levels warrant scrutiny: many AA wallets rely on project-hosted services; chain abstraction bridges often use multisig controls; early intent solvers may operate as centralized entities. Such centralization points pose critical risks—if compromised or abused, user assets face direct exposure.

- Regulatory and Compliance Risks: Cross-chain stablecoins and intent networks obscuring transaction details attract regulatory scrutiny. Stablecoins remain a high-priority regulatory focus—River’s satUSD operations across jurisdictions require adherence to local AML and payment regulations. Some chain abstraction projects aim to bypass traditional financial and cross-border restrictions, potentially triggering policy backlash. Intent networks involving private transaction matching also risk abuse for money laundering or sanctions evasion. Projects must therefore build compliance mechanisms—KYT monitoring, blacklisted address detection—and proactively engage regulators.

V. Opportunities and Outlook: Unlocking a New Web3 Paradigm

Despite challenges, abstraction and intents embody the key catalysts for blockchain’s mass adoption. As technology matures and ecosystems evolve, cautious optimism is warranted—and the long-term horizon remains expansive:

- From a UX perspective, abstraction and intents could jointly elevate Web3 usability to unprecedented heights. Account abstraction solves wallet usability and security—preventing “overnight zeroing” from lost private keys and eliminating constant gas calculations. Chain abstraction breaks down ecosystem silos, freeing users from worrying “where my tokens live” or “which L2 hosts this dApp”—making assets and applications universally accessible. Intent-driven interaction represents a true paradigm shift: users express goals, and services materialize automatically. Envisioning mature convergence, future blockchain usage could rival—even surpass—traditional internet products: register one account, select desired services, and seamlessly interact across any underlying blockchain. This would finally remove Web3’s mass-adoption barriers—making the next billion users a tangible reality.

- From an innovation standpoint, abstraction and intents unlock vast new application frontiers. When cross-chain operations and complex interactions become simple and efficient, developers gain unprecedented creative freedom. For example, via chain abstraction, a DeFi app could aggregate liquidity across all chains to offer users best-in-class yields—while users remain oblivious to asset origins. Combined with intents, a wealth management protocol could let users declare “automatically rotate funds across the three highest-yielding pools,” with intelligent agents optimizing execution. Strategies previously requiring expert manual intervention—or impossible altogether—will become trivial thanks to abstraction/intent infrastructure. Further, NFTs, gaming, and social applications hold immense promise: NFT marketplaces could accept purchase intents, auto-sourcing quotes; play-to-earn games could let users declare complex actions (“defeat Boss X and claim rewards”), with game contracts orchestrating multi-party execution. Abstraction and intents will inevitably spawn entirely new dApp paradigms—teeming with opportunity.

- From an industry trend perspective, abstraction and intents align perfectly with today’s multi-chain reality and user-centric ethos—positioning them as likely central themes of the next cycle. The Ethereum Foundation and major L2 teams prioritize UX enhancement; AA standards undergo active refinement; L2s explore deeper AA/intent integrations. Non-EVM chains like Sui and Aptos also pursue abstraction/intent capabilities—enabling Move-language customization of account authentication logic. Meanwhile, Web2 tech giants and traditional finance institutions monitor developments closely: Visa and Mastercard research AA for auto-payments; decentralized social apps spark anticipation for breakthroughs in social finance. Abstraction and intents stand on the cusp of explosive growth: when accumulated technical foundations and conceptual clarity converge, they may ignite sudden, massive user growth and application proliferation.

Conclusion

The blockchain world never stops innovating. The rise of abstraction and intent reflects the industry’s urgent demand for improved user experience and seamless application connectivity. From River’s chain-abstraction stablecoin to Anoma’s intent-native L1, these projects boldly reimagine foundational logic and interaction paradigms. In this article, we’ve dissected both their exciting innovations and sobering risks. Looking ahead, abstraction and intent concepts will undoubtedly intensify—and gradually permeate mainstream blockchain applications. When cross-chain operations feel invisible and transactions respond intuitively to user intent, blockchain’s value will reach far wider audiences.

About Us

Hotcoin Research, the core investment research arm of Hotcoin Exchange, transforms professional analysis into your practical edge. Our weekly “Insights” and in-depth “Research Reports” decode market dynamics; our exclusive “Hotcoin Select” program—powered by AI and expert curation—helps you identify high-potential assets and minimize trial-and-error costs. Each week, our researchers host live sessions on Hotcoin Live to unpack trending topics and forecast market shifts. We believe that empathetic guidance and expert insight empower more investors to navigate cycles—and capture Web3’s value opportunities.

Risk Disclaimer

Cryptocurrency markets are highly volatile, and investing carries inherent risk. We strongly advise investors to fully understand these risks and invest strictly within a robust risk management framework to safeguard capital.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News