Hotcoin Research | Focus on Short-Term Rebound Momentum and Potential "Golden Pit" in First Half of Year

TechFlow Selected TechFlow Selected

Hotcoin Research | Focus on Short-Term Rebound Momentum and Potential "Golden Pit" in First Half of Year

A significant "risk liquidation event" may occur in the first half of 2026, leading to a sharp correction in asset prices.

Cryptocurrency Market Performance

Currently, the total cryptocurrency market capitalization stands at $3.22 trillion, with BTC accounting for 59% ($1.9 trillion). The stablecoin market cap is $310.6 billion, up 1.01% over the past seven days—marking significant growth—of which USDT accounts for 60.07%.

Among the top 200 projects on CoinMarketCap, most have seen gains while a minority declined: BTC rose 5.5% over 7 days, ETH increased by 6.6%, SOL gained 3.1%, DASH surged 141.5%, and XMR climbed 54.9%.

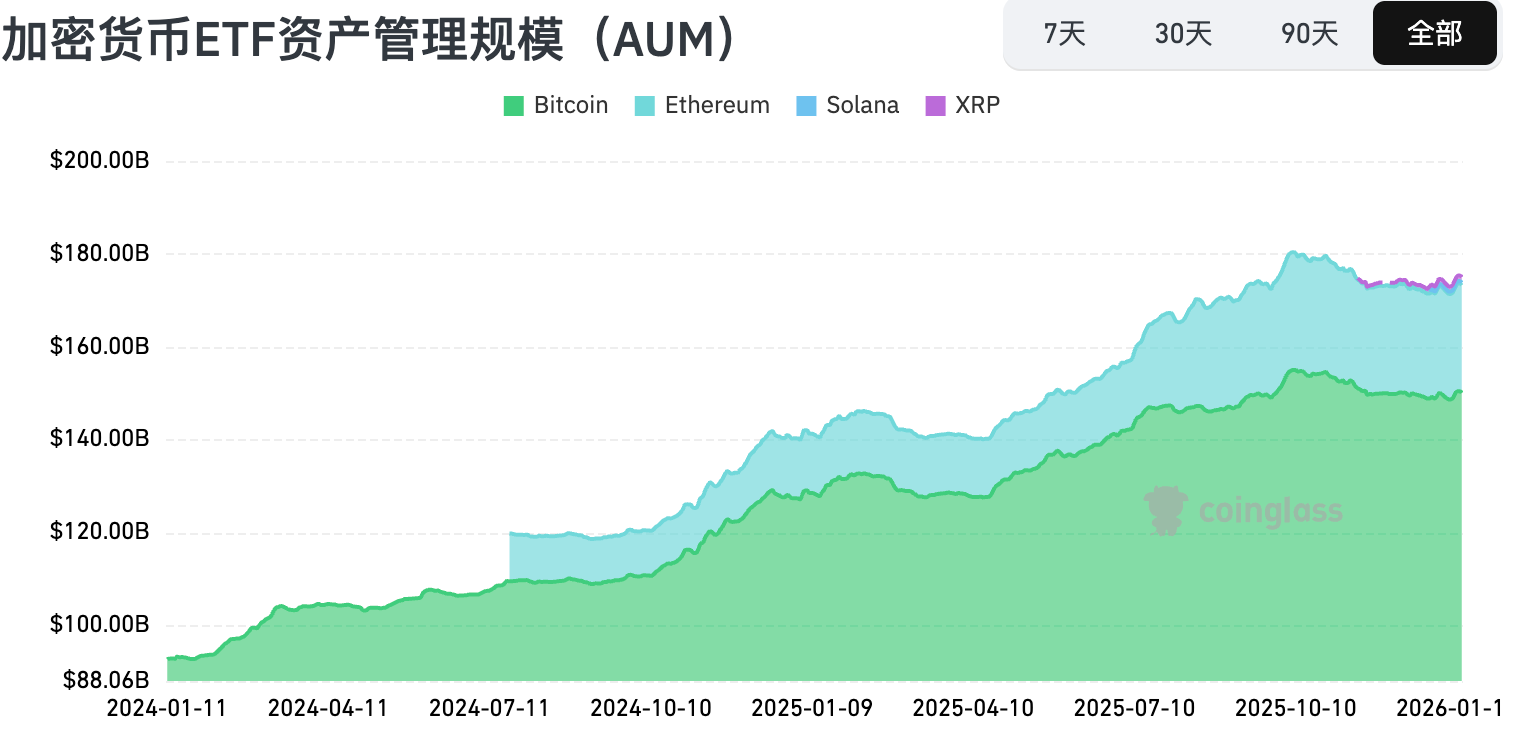

This week, net inflows into U.S. spot Bitcoin ETFs amounted to $1.417 billion; net inflows into U.S. spot Ethereum ETFs reached $478 million.

Market Outlook (January 19–25):

The current RSI index is at 47.38 (neutral range), the Fear & Greed Index is at 50 (returning to neutral levels for the first time in months), and the Altcoin Season Index is at 33 (neutral, down from last week).

BTC core range: $94,800–100,000

ETH core range: $3,250–3,400

SOL core range: $138–155

On-chain data shows reduced profit-taking pressure, institutions are returning to net buying via spot ETFs, and bullish bets in the options market are increasing—risk appetite is recovering. However, significant historical resistance exists between $97,000 and $117,400 for BTC, creating strong selling pressure. A "cautiously positive" stance is held toward the first half of 2026. Recently, Chinese-language meme coins have gained traction on-chain. While monitoring short-term opportunities, investors must remain highly vigilant against a consensus risk emerging from major institutions: a significant "risk liquidation event" could occur in early 2026 (possibly after January 26), potentially triggering a sharp correction in asset prices.

Understanding the Present

Weekly Major Events Recap

- On January 12, escalating geopolitical tensions drove upward movements across gold, silver, and crude oil markets, with gold futures surpassing $4,600 per ounce for the first time;

- On January 12, according to The New York Times, U.S. federal prosecutors have launched a criminal investigation into Federal Reserve Chair Jerome Powell, focusing on renovation work at the Fed’s Washington headquarters—an escalation in the long-standing conflict between President Trump and the Fed chair;

- On January 11, CNBC reported that Walmart and Google announced a new partnership enabling shoppers to discover and purchase items directly from Walmart and Sam’s Club through Gemini, allowing customers to complete purchases without leaving the AI chatbot interface;

- On January 13, former New York City Mayor Eric Adams launched the "NYC Token," which spiked sharply upon opening before quickly retracing;

- On January 14, the Senate Agriculture Committee announced plans to release the draft text of its proposed crypto market structure bill—the Clarity Act—on January 21, followed by a key hearing on January 27;

- On January 14, Glassnode data showed that recent market rebound triggered $684 million in total liquidations over the past 24 hours, including $577 million in short positions, marking the largest short squeeze among the Top 500 cryptocurrencies since the October 11 crash;

- On January 15, multiple Fed officials publicly emphasized the importance of central bank independence in policymaking. Officials broadly signaled a pause in rate cuts during this month’s meeting due to resilient economic performance and elevated inflation, indicating monetary policy should remain restrictive;

- On January 15, X product lead and Solana ecosystem advisor Nikita Bier stated, “We’re revising our developer API policy: apps that reward users for posting on X (so-called 'InfoFi') will no longer be permitted. These mechanisms have generated large volumes of low-quality AI content and spam replies on the platform”;

- On January 16, BeInCrypto reported, citing multiple sources, that Polygon conducted a major internal layoff, dismissing approximately 30% of employees this week. This marks not the first such action—back in 2024, the company cut nearly 20% of its workforce.

Macroeconomic Overview

- On January 13, the U.S. December unadjusted core CPI year-on-year rate was 2.6%, below expectations of 2.70% and unchanged from the prior 2.60%;

- On January 15, the U.S. weekly initial jobless claims for the week ending January 10 came in at 198,000, lower than the expected 215,000, with the previous figure revised from 208,000 to 207,000;

- On January 15, CME's "FedWatch" data indicated a 3.4% probability of a 25-basis-point rate cut by the Fed in January, with a 96.6% chance of rates being held steady.

ETF Developments

Data indicates that between January 12 and January 16, net inflows into U.S. spot Bitcoin ETFs totaled $1.417 billion. As of January 16, GBTC (Grayscale) has seen cumulative outflows of $25.367 billion and currently holds $15.634 billion in assets, while IBIT (BlackRock) holds $74.697 billion. The total market value of U.S. spot Bitcoin ETFs stands at $129.177 billion.

Net inflows into U.S. spot Ethereum ETFs reached $478 million.

Looking Ahead

Industry Conferences

- Consensus Hong Kong 2026 will take place in Hong Kong, China, on February 11–12;

- ETHDenver 2026 will be held in Denver, USA, from February 17 to 21;

- EthCC 9 will run from March 30 to April 2, 2026, in Cannes, France. EthCC is one of Europe’s largest and longest-running annual Ethereum events, focused on technology and community development.

Project Updates

- Caroline Ellison, former partner of SBF, may be released on January 21, 2026. She previously testified as a key witness in SBF’s 2023 criminal trial, receiving judicial recognition for her “substantial cooperation,” though still sentenced to prison;

- Immunefi, the crypto bug bounty platform, will launch its IMU token on January 22;

- Meteora’s MET airdrop claim period ends on January 23, after which unclaimed tokens will be added to the circulating community reserve for future rewards;

- Sequel, an on-chain film development and funding project, announced that its Base-funded film *THE MUSICAL* has been selected for the U.S. Dramatic Competition at the Sundance Film Festival. The film will premiere in this category on January 25.

Key Events

- January 22 at 21:30: U.S. weekly initial jobless claims (in thousands) for the week ending January 17;

- January 23 at 23:00: Final reading of the University of Michigan Consumer Sentiment Index for January.

Token Unlocks

- Official Trump (TRUMP) will unlock 50 million tokens on January 18, valued at approximately $271 million, representing 11.95% of circulating supply;

- Ondo (ONDO) will unlock 1.94 billion tokens on January 18, worth about $772 million, or 57.23% of circulating supply;

- LayerZero (ZRO) will unlock 25.71 million tokens on January 20, valued at around $42.68 million, or 6.36% of circulating supply;

- River (RIVER) will unlock 1.5 million tokens on January 22, worth approximately $29.84 million, or 4.32% of circulating supply;

- Soon (SOON) will unlock 21.88 million tokens on January 23, valued at about $7.55 million, or 5.63% of circulating supply;

- Humanity (H) will unlock 105 million tokens on January 25, worth roughly $19.6 million, or 4.57% of circulating supply.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for investors. Through our flagship publications *Weekly Insights* and *Deep Dive Reports*, we help you understand market dynamics. Our exclusive column *Top Picks* (powered by AI + expert screening) identifies high-potential assets and reduces trial-and-error costs. Each week, our analysts engage directly with you via live streams to explain hot topics and forecast trends. We believe informed guidance and human-centered support empower more investors to navigate market cycles and capture value opportunities in Web3.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and operate within a strict risk management framework to safeguard their capital.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News