Hotcoin Research | Restructuring the Global Crypto Regulatory Landscape: 2025 Policy Trends and Compliance Outlook

TechFlow Selected TechFlow Selected

Hotcoin Research | Restructuring the Global Crypto Regulatory Landscape: 2025 Policy Trends and Compliance Outlook

The global cryptocurrency regulatory landscape is undergoing a major shift in 2025, as major economies led by the United States move from ambiguous观望 to actively building clear regulatory frameworks, driving the crypto industry through legislation and policy to leave behind unregulated growth and enter a new phase of standardization and institutionalization.

1. Introduction

In 2025, global cryptocurrency regulation is reaching a historic turning point. The crypto asset domain, once seen as a gray area, is now being reshaped by governments' "visible hand." From the proposal and review of landmark U.S. crypto legislation to Hong Kong's formal implementation of its Stablecoin Ordinance, major economies worldwide are shifting almost simultaneously from vague,观望, or even suppressive stances toward actively building clear regulatory frameworks. This global policy transformation marks the industry’s departure from its wild, unregulated past into a new phase defined by compliance and accelerated integration with traditional finance.

This article comprehensively reviews and deeply analyzes significant global crypto policy developments since 2025, and outlines their far-reaching implications for future market structures. We begin by focusing on the United States, dissecting its legislative, executive, and regulatory actions. Then, we broaden our scope to examine policy dynamics across key jurisdictions including the EU, Hong Kong, Singapore, and the UAE. Next, we reveal the interplay between policy and markets through analysis of price movements, institutional trends, and on-chain data. Finally, we identify core trends shaping the future of global crypto policy, offering forward-looking insights for investors navigating this transformative era of opportunity and risk.

2. Policy-Market Interplay in Crypto

The 2025 crypto market has demonstrated a clear policy-driven pattern, repeatedly exhibiting the classic “buy the rumor, sell the news” dynamic. Regulatory intervention is not only bringing structure and guidance to the industry but also reshaping market logic itself.

1. Correlation Between Crypto Policy and Market Prices

At the start of 2025, Bitcoin continued its late-2024 rally, briefly surpassing $100,000 in early January—a surge largely reflecting expectations around Trump’s election victory and his pledged pro-crypto policies. However, sentiment fluctuated: due to the lack of concrete policy details by mid-January, Bitcoin sharply corrected in February, falling from an early peak of ~$105,000 to around $70,000, a monthly drop exceeding 17%. This volatility highlights investor sensitivity to policy realization—expectations drive gains, delays trigger pullbacks. In early March, when Trump hinted via social media at establishing a national strategic crypto reserve, markets surged again: Bitcoin spiked 20% over the weekend, while altcoins like XRP jumped 25% within two days. However, the subsequent official executive order lacked plans for direct government Bitcoin purchases, leading markets to interpret it as “sell the news,” causing Bitcoin to retreat about 6% after its initial spike.

In July, as U.S. “Crypto Week” approached and legislative momentum built, the market experienced a short-squeeze rally. Mid-month, Bitcoin broke past prior highs, setting new records and surpassing $120,000 on July 14. During this phase, multiple catalysts converged: House passage of key bills (GENIUS, CLARITY, etc.) was viewed as foundational for the industry, prompting preemptive investment; concurrently, the SEC shifted stance, accelerating approvals for spot Bitcoin and Ethereum ETFs, driving sustained and robust capital inflows into Bitcoin ETFs, pushing prices to new highs. Related equities also rose, with U.S.-listed miners and large crypto-holding firms seeing strong share performance. Digital asset investment funds recorded a weekly net inflow of up to $3.7 billion, lifting total industry assets under management to a record $211 billion. Bitcoin-related products alone attracted $2.7 billion, dominating inflows, while Ethereum and others also saw significant capital increases. In essence, policy tailwinds drove capital to “rush in,” directly fueling substantial market gains.

2. Exchange Liquidity and Institutional Moves

Improved regulatory conditions in 2025 were also reflected in exchange market structure. First, liquidity on U.S. compliant exchanges clearly rebounded. As U.S. regulations became clearer and institutions entered, major licensed U.S. exchanges (e.g., Coinbase) saw significantly deeper Bitcoin order books, restoring U.S. dominance in global Bitcoin 1% depth liquidity. Clearer rules and professional execution created a positive feedback loop: deeper liquidity attracted more capital, further enhancing market depth. Additionally, institutional investor behavior shifted markedly—not only did ETF inflows accelerate, but enthusiasm among U.S. public companies and traditional financial institutions for investing in Bitcoin returned. Strategy added to its holdings multiple times in 2025, reaching 628,791 BTC by July, representing 2.994% of total supply. Similarly, several Wall Street asset managers launched new crypto trusts and funds during favorable policy windows, offering clients compliant exposure. According to CoinShares, digital asset investment products recorded over $100 billion in net inflows during the first seven months of 2025—surpassing full-year 2024 levels. Even within traditional hedge funds, crypto assets are increasingly seen as legitimate portfolio components.

Source: https://bitbo.io/treasuries/microstrategy

3. On-Chain Data and Liquidity

Long-term holders have become the dominant force in Bitcoin supply. A Coinbase Research report indicates that by August 2025, approximately 85% of Bitcoin supply was held in long-term wallets, with circulating, tradeable supply hitting historic lows. After early price surges, vast amounts of Bitcoin did not return to exchanges but instead settled into cold storage. Correspondingly, Bitcoin balances on exchanges showed a continuous downward trend, indicating investor preference for long-term holding over frequent trading.

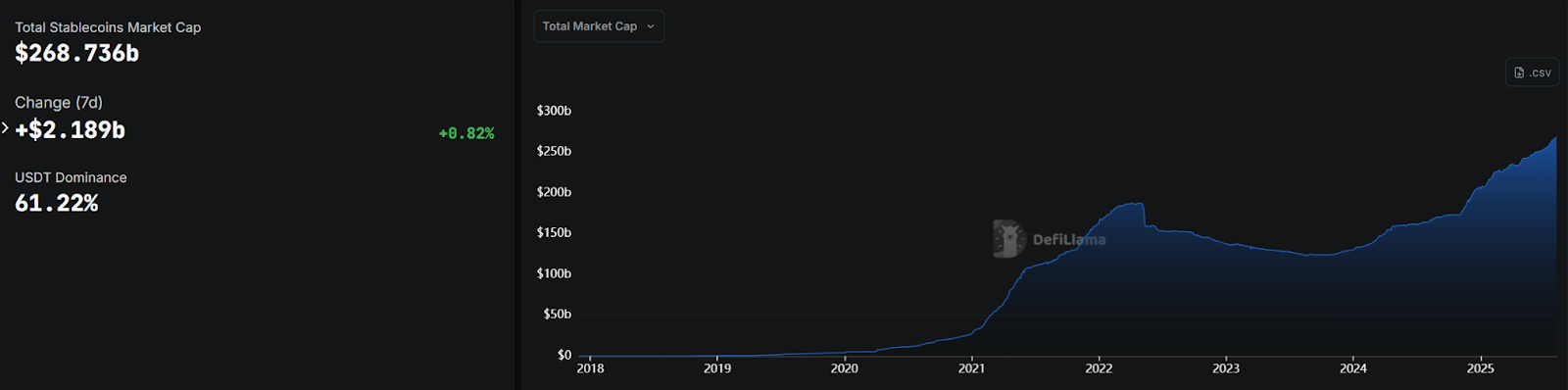

Stablecoin supply and on-chain activity rebounded significantly. After stagnation in 2022–2023, regulated stablecoins resumed growth in 2025, signaling capital seeking entry points. Rising stablecoin issuance is seen as a leading indicator of recovering risk appetite. Especially under U.S. regulatory clarity supporting dollar-backed stablecoins, compliant stablecoins like USDC halted declines and began recovering, with single-month issuances reaching tens of billions of dollars. These stablecoins injected fresh liquidity into the market. On-chain data shows daily transaction volumes for USD stablecoins grew 28% year-on-year mid-2025, with annual on-chain payment volumes even surpassing combined Visa and Mastercard totals. This underscores stablecoins’ growing role in global capital flows and reflects regulators pushing them from gray zones into mainstream payment networks.

Source: https://defillama.com/stablecoins

In summary, 2025’s market response can be distilled as: regulatory clarity boosted both new capital inflows and holding intentions. Bitcoin, leveraging trust and liquidity, emerged as the biggest beneficiary, achieving repeated price highs and climbing to multi-year peaks in market dominance. Ethereum followed closely, solidifying its status as “digital silver.” Most competing coins lagged or were marginalized due to regulatory pressure or lack of compelling narratives. On-chain, mainstream assets increasingly concentrated in long-term hands, with trading behavior becoming more rational. All signs indicate the crypto market is gradually leaving its lawless past behind, entering a mature and stable era.

3. U.S. Crypto Policy Developments

1. Legislative Breakthroughs

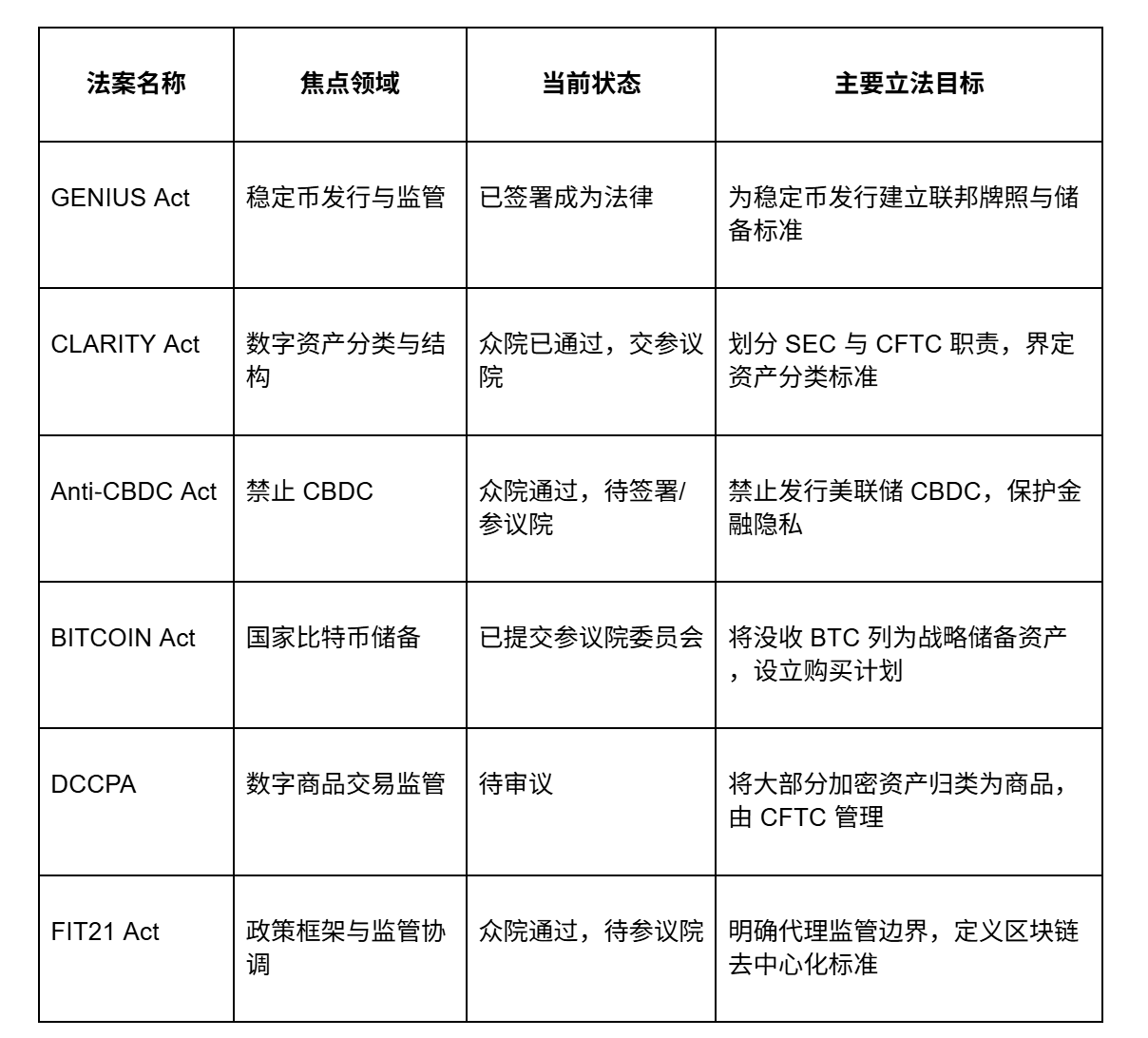

2025 marked a landmark year for U.S. crypto legislation. Beyond the recently passed GENIUS and CLARITY Acts, multiple other significant crypto-related bills are advancing, covering areas such as CBDC prohibition, Bitcoin strategic reserves, consumer protection, mining, and taxation.

- GENIUS Act: On July 18, Trump signed the GENIUS Act—the first comprehensive crypto legislation passed by Congress—focusing on stablecoin regulation and prohibiting interest payments on stablecoins. This marks a pivotal step in U.S. digital asset policy. The Act stipulates that only federally insured financial institutions (banks, credit unions, and specially approved compliant entities) may issue payment stablecoins; issuers must maintain 1:1 backing in fiat currency or high-quality reserve assets, undergo monthly reserve disclosures and regular audits; all stablecoin issuers must also comply with the Bank Secrecy Act, implementing anti-money laundering and counter-terrorism financing measures. The bill aims to provide clear regulatory guardrails for the stablecoin sector, effectively creating a “bank charter” system for stablecoins.

- CLARITY Act: Shortly after, the U.S. House advanced another major bill, the CLARITY Act, designed to clarify whether digital assets qualify as securities or commodities, defining regulatory jurisdiction between the SEC and CFTC. The CLARITY Act would grant the Commodity Futures Trading Commission (CFTC) broader authority over non-security crypto assets and establish a transition path for certain decentralized, functionally complete tokens to be reclassified from securities to commodities, ending the prior “regulatory gray zone.” The bill has passed the House and awaits Senate review.

- CBDC Ban Bill: Concurrently advanced with GENIUS and CLARITY, this bill imposes a federal ban on issuing a U.S. central bank digital currency (CBDC), having passed the House and awaiting presidential signature or Senate coordination. It aims to protect financial privacy and limit Federal Reserve expansion into digital currency domains.

- BITCOIN Act: Introduced on March 11, 2025, by Senator Cynthia Lummis with bipartisan co-sponsors, this bill proposes consolidating federally seized Bitcoin into a “Strategic Bitcoin Reserve” and mandates purchase plans, such as acquiring one million BTC over five years. It has been submitted to the Senate Banking Committee for review, not yet reaching vote stage.

- DCCPA: Jointly sponsored by multiple senators, this bill seeks to classify most crypto assets as “commodities” under CFTC oversight, while strengthening consumer protections. Initiated in 2022, it remains under ongoing review.

- FIT21 Act: Passed by the House in May 2024, not yet voted on in the Senate. Similar in goal to CLARITY, it clarifies SEC-CFTC jurisdiction, defines decentralization standards, provides exemptions for small issuers, brings stablecoins into the regulatory framework, and specifies anti-fraud enforcement powers.

Additionally, states like Texas passed state-level “Bitcoin Strategic Reserve” legislation in June 2025, allowing government investment in digital assets with market caps above $500 billion (e.g., Bitcoin). The White House Digital Assets Task Force released a 160-page comprehensive report recommending faster tax code updates (e.g., redefining income from mining and staking), building regulatory sandboxes, and streamlining banking access—all aligning with draft bills (CLARITY, GENIUS, Anti-CBDC).

2. Executive Actions and Regulatory Shifts

Alongside legislative progress, the executive branch and regulators took major steps to reverse years of uncertainty toward the crypto industry, beginning top-down coordination to craft a unified digital asset strategy.

In January 2025, the newly installed Trump administration issued a presidential executive order titled “Strengthening American Leadership in Digital Financial Technology,” explicitly banning the development or use of any U.S. central bank digital currency (CBDC). This order reversed prior administrations’ exploration of CBDCs, halting potential digital dollar issuance by the Fed on grounds of financial privacy and monetary independence, while emphasizing support for dollar-backed stablecoins to preserve the dollar’s digital-era dominance. The order also emphasized protecting citizens’ rights to participate in blockchain networks (including mining, node validation, self-custody), requiring no laws or policies unduly restrict these activities. More critically, it revoked Biden’s 2022 crypto executive order and Treasury framework, establishing a White House Digital Asset Markets Working Group led by newly appointed “crypto czar” David Sacks, former PayPal executive. This group, comprising senior officials from Treasury, SEC, CFTC, and DOJ, was tasked with delivering a unified digital asset regulatory framework report within 120 days to eliminate regulatory overlap and gaps. On August 7, Trump signed an executive order permitting alternative assets like private equity, real estate, and cryptocurrencies to enter 401(k) retirement savings plans, potentially unlocking around $12.5 trillion in retirement accounts.

At the SEC, a significant policy shift occurred in 2025 following the change in administration. Paul Atkins, Trump-nominated SEC Chair, made establishing a digital asset regulatory framework the SEC’s top priority. He adopted a relatively relaxed regulatory posture, actively pushing for crypto deregulation through ETF approvals, regulatory guidance, and litigation settlements. On July 31, Atkins launched “Project Crypto,” aiming to comprehensively update U.S. securities regulations for blockchain and digital asset markets. He directed SEC staff to develop clear criteria for determining which crypto tokens qualify as securities, and to draft disclosure and exemption frameworks to lower compliance barriers. He also instructed the SEC to collaborate with firms wishing to issue tokenized securities, promoting pilot programs for on-chain traditional financial assets.

3. Financial and Accounting Policies

In financial and accounting standards, the U.S. introduced complementary measures in 2025 to integrate crypto assets with traditional finance. In January 2025, the SEC issued SAB 122, revoking the controversial 2022 crypto custody accounting guidance SAB 121. SAB 121 previously required banks and custodians to record client-held crypto assets as both liabilities and equivalent assets on balance sheets—a rule criticized by the banking sector as excessively capital-intensive and a barrier to offering crypto custody services. Congress had passed a resolution in 2023 to overturn SAB 121, but it was vetoed by Biden.

Now, the SEC has withdrawn this requirement, freeing banks and custodians from making high-value provisions simply for holding client crypto assets. The American Bankers Association (ABA) welcomed the move, calling it a step enabling banks to “more confidently serve as digital asset custodians.” Clearly, the U.S. is removing accounting-level obstacles for traditional finance to engage with crypto, facilitating compliant capital inflows.

4. Strategic Reserves and Macroeconomic Policy

The Trump administration elevated digital assets like Bitcoin to strategic national importance. In March 2025, the White House issued an executive order establishing a “Strategic Bitcoin Reserve” and “Digital Asset Reserve Account.” Under this order, the federal government will consolidate seized Bitcoin into the strategic reserve instead of selling it off, and authorize Treasury and Commerce Departments to study budget-neutral methods to increase holdings without burdening taxpayers. All government agencies must report their crypto holdings to Treasury and the President’s Digital Assets Task Force for centralized management of national crypto assets.

The administration emphasized this move positions the U.S. as one of the “first nations to establish an official Bitcoin reserve,” leveraging Bitcoin’s strategic value as “digital gold.” Officials estimate prior scattered disposal of seized Bitcoin cost taxpayers over $17 billion in unrealized value. The new policy aims to correct this by “locking up” these assets for national needs. The U.S. officially holding crypto reserves is unprecedented globally, signaling a major shift from past suppression toward viewing crypto as a strategic resource.

In sum, since 2025 the U.S. has rolled out密集 initiatives across legislative, executive, and regulatory fronts, dubbed an “era of regulatory spring” by the industry. Under Trump’s leadership, the U.S. is positioning itself as a “global crypto capital,” reversing prior ambiguity and hostility through stablecoin legislation, market clarity acts, and executive orders. These moves have had immediate market impact: investor sentiment improved dramatically, and new capital began flowing into U.S. compliant markets.

4. Global Crypto Policy Developments

Beyond the U.S., many countries and regions in 2025 accelerated efforts to refine their crypto regulatory frameworks, focusing primarily on stablecoins, anti-money laundering, and market standardization.

- European Union: The EU’s Markets in Crypto-Assets Regulation (MiCA) fully came into force at the end of 2024, providing member states with a unified regulatory blueprint. MiCA brings crypto asset issuance and services under EU financial supervision, imposing strict rules on stablecoins: only entities with e-money institution licenses or credit institution status may issue single-fiat-denominated stablecoins (EMT), while issuers of asset-basket-backed tokens (ART) must be established in the EU and obtain regulatory authorization. Stablecoin issuers must meet capital requirements, hold high-quality, liquid reserves, and regularly disclose reserve composition and audit reports to regulators. MiCA’s implementation makes the EU the first major economy with comprehensive crypto legislation. In the first half of 2025, national regulators (e.g., ESMA, EBA) focused on drafting MiCA technical standards, while exchanges and custodians began applying for EU-wide operating licenses. This harmonized framework enhances the EU’s appeal, with a wave of European-native compliant platforms and stablecoin issuers expected by year-end.

- UK and Australia: The UK passed the Financial Services and Markets Act in 2023, incorporating stablecoins and other crypto assets into its regulatory regime. This law empowers the Treasury and Financial Conduct Authority (FCA) to designate crypto issuance and services as regulated financial activities. From 2024 to 2025, the UK government conducted consultations on detailed rules, aiming to finalize stablecoin issuance and exchange operation guidelines by end-2025, aligning them with traditional financial regulation. The UK’s stance is broadly positive, hoping legal improvements will attract crypto businesses back to London. Australia also moved in 2025: following its 2022 “token mapping” report, the government announced plans to propose draft regulations for crypto custody and exchange licensing, along with updated tax guidance for digital assets.

- Hong Kong: Hong Kong is actively exploring a model for China’s crypto policy, testing open exchange operations and public blockchain R&D within a tech-regulated sandbox to inform mainland policy. It aims to become Asia’s compliant crypto hub. The Securities and Futures Commission (SFC) implemented a licensing regime for virtual asset trading platforms back in June 2023. In 2025, Hong Kong regulators further signaled support for compliant stablecoins and tokenized securities. The Stablecoin Ordinance, effective August 1, requires any issuer of HKD-pegged stablecoins to obtain a local license, making unlicensed issuance illegal. Reserves must consist of high-liquidity, high-quality assets equal in value to outstanding stablecoins, subject to HKMA supervision and audits. These moves reflect Hong Kong’s effort to balance investor protection with innovation, attracting global compliant crypto businesses. Several major exchanges and crypto funds have already set up offices or sought licenses in Hong Kong, with market liquidity showing signs of recovery.

- Singapore: Initially open to the crypto industry, Singapore attracted numerous firms and talents. However, the 2022 collapse of FTX, significant losses by sovereign funds like Temasek, and failures of firms like Three Arrows Capital and Terraform Labs damaged its reputation as a financial hub. Since 2023, the Monetary Authority of Singapore (MAS) gradually tightened regulations, requiring recognized stablecoins to meet standards in price stability, reserve custody, and capital adequacy, with issuers needing proper licenses. This prevented Binance, Bybit, and Huobi from obtaining licenses, leading them to exit Singapore by end-2023. In 2025, MAS further tightened crypto trading rules: after June 30, digital token service providers serving overseas clients must obtain licenses to operate in Singapore, or else shut down, curbing crypto-related money laundering. In innovation, Singapore launched sandbox initiatives like “Project Guardian” to explore institutional DeFi. Overall, Singapore’s approach is “encourage innovation, cautious regulation.”

- United Arab Emirates: The UAE has actively positioned itself as a crypto-friendly jurisdiction. Its central bank introduced the “Regulation on Payment Token Services” at the end of 2024, defining fiat-pegged stablecoins as “payment tokens” and adopting a tiered access policy: locally issued AED-pegged stablecoins can apply to become qualified payment tokens for domestic use, while foreign-issued stablecoins (e.g., USDT, USDC) cannot be used for payments domestically, only for investment and trading. The UAE encourages local banks or institutions to issue AED stablecoins and explores government-supported multi-asset-reserve stablecoins (e.g., pegged to government bonds or gold). Regulators ban algorithmic stablecoins and anonymous privacy coins to prevent systemic risks and money laundering. Additionally, Dubai’s Virtual Assets Regulatory Authority (VARA) issued rules from 2023 to 2025 on token offerings and marketing, requiring crypto firms in Dubai to be licensed and comply with advertising disclosures and investor protections. Overall, the UAE is building a multi-layered crypto regulatory system, aiming to become one of the most attractive crypto hubs in the Middle East while ensuring financial safety.

- Thailand: Thailand took a dual approach of support and regulation in 2025. On one hand, the government announced a five-year exemption from capital gains tax on digital asset trading profits via licensed platforms, effective January 1, 2025, to encourage compliant trading. This offers investors tax incentives within a regulated environment, potentially boosting market appeal. On the other hand, Thailand’s SEC revised regulations in April 2025, requiring foreign crypto service providers (exchanges, brokers) serving Thai citizens to register and obtain local licenses, otherwise deemed illegal. The SEC also strengthened oversight on crypto advertising and investor suitability.

- Pakistan: Pakistan shifted from past ambiguity or outright bans on crypto, embracing virtual assets to advance financial modernization. In July, the government formally approved the 2025 Virtual Assets Act, establishing the Pakistan Virtual Assets Regulatory Authority (PVARA) as an independent regulator to license and supervise crypto and virtual asset service providers nationwide. This framework mirrors Dubai’s VARA model, aiming to introduce licensing and risk controls for the domestic industry. Pakistan’s central bank governor Jameel Ahmad stated a digital rupee (CBDC) pilot is imminent, and the legislation lays the foundation for virtual asset licensing and regulation. Pakistan also formed a Crypto Council (PCC) to promote blockchain and Bitcoin mining projects, invited Changpeng Zhao, founder of the world’s largest exchange, as advisor, and plans to establish a national Bitcoin reserve. Overall, Pakistan is attempting a shift from harsh crackdowns to proactive regulation, aiming to capture opportunities in emerging digital finance.

- Turkey: As an emerging market with a large crypto user base, Turkey implemented strict new rules in 2025 to combat illegal activities and safeguard financial stability. The Financial Crimes Investigation Board under the Ministry of Treasury began enforcing a series of crypto AML rules: all crypto transactions require mandatory real-name verification, transactions exceeding 15,000 lira must be reported and reviewed; all transactions include delayed settlement—standard transfers take 48 hours, first withdrawals require 72 hours. Additionally, new rules impose limits on stablecoin circulation: individuals cannot transact more than $3,000 equivalent in stablecoins per day, or $50,000 monthly. Finance Minister Mehmet Şimşek stated the goal is to “prevent illegal gambling and fraud proceeds from being laundered via crypto.” With an estimated one-fifth of Turkey’s population having engaged in crypto investments and ranking third globally in trading volume, the new regulations have broad market impact. While they may reduce short-term exchange liquidity, in the long run they help cleanse illicit fund flows and enhance the legitimacy and transparency of Turkey’s crypto ecosystem.

- India: India’s government remains cautious and conservative toward crypto, though some softening signals have emerged. Since 2022, India has imposed a 30% tax on crypto trading gains and a 1% source withholding tax (TDS), drastically reducing domestic trading volume. However, during its 2023 G20 presidency, India pushed the IMF and FSB to develop a joint global crypto regulatory framework, indicating a preference for coordinated international action. As of 2025, India lacks dedicated crypto legislation, and domestic exchanges operate under strain. Yet officials have repeatedly stated they won’t “ban everything,” preferring to await international consensus. On CBDC, the Reserve Bank of India is gradually expanding its digital rupee pilot. India may adjust its policy only after global standards become clearer.

- Russia: Russia employs a “dual-track” crypto regulatory strategy. Domestically, using crypto as payment remains strictly banned, while the rollout of the digital ruble (CBDC) accelerates to strengthen state control over the monetary system. Internationally, however, to circumvent Western financial sanctions, Russia has adopted a notably open stance toward crypto. In early 2025, the “Law on the Use of Digital Financial Assets in International Settlements” took effect, providing a legal framework for Russian importers and exporters to use crypto for trade settlements with friendly nations. The law authorizes specific enterprises to use major cryptos like Bitcoin, Ethereum, and stablecoins in overseas transactions, bypassing SWIFT. Additionally, the Russian government is actively pushing for standardized management and taxation of crypto mining, aiming to convert its abundant energy resources into fiscal revenue and foreign reserves—realizing a “nationalized crypto mining” strategic goal.

Beyond major economies, smaller nations are also exploring crypto pathways. Bhutan, a South Asian nation, continues deepening its “green mining” strategy in 2025, linking Bitcoin mining with its rich hydropower resources to support national revenue and economic development. In April 2025, Bhutan’s government announced partnerships with international firms to build multiple sustainable mining centers, aiming to become Asia’s “green crypto mining hub.” Meanwhile, El Salvador continues and expands its national Bitcoin strategy: after making Bitcoin legal tender in 2021, it announced in 2025 the creation of a “Bitcoin National Wealth Fund” to grow its Bitcoin reserves. The government also launched a dedicated Bitcoin bond program to fund the construction of “Bitcoin City,” further strengthening Bitcoin’s strategic role in the national economy.

Overall, 2025 saw diverse policy rollouts, reflecting both convergence and divergence: developed economies emphasize comprehensive legal frameworks, while emerging markets focus on preventing financial crime and seizing crypto opportunities. Stablecoin regulation is a shared priority, with the U.S., EU, Hong Kong, and others enacting rules to ensure sufficient reserves and controlled issuance. Exchange oversight and AML are also common themes, as nations apply KYC/AML standards similar to traditional finance to crypto trading. It is foreseeable that legal status and regulatory requirements for crypto will gradually become clearer across major jurisdictions.

5. Global Crypto Policy Trends and Outlook

Looking ahead to the remainder of 2025 and beyond, crypto policy may follow these trends, profoundly impacting the global market landscape:

1. Accelerated Global Regulatory Convergence: U.S. policy direction may push major economies toward similar regulatory frameworks. On one hand, the GENIUS Act sets a benchmark for stablecoin regulation—its requirements on compliant reserves and licensing may become reference models for other nations. For instance, regulators in Japan and South Korea are reportedly assessing how U.S. rules could inform their own stablecoin policies, while the EU observes U.S. implementation to fine-tune its own rules. On the other hand, the CLARITY Act’s attempt to resolve the securities-commodities classification challenge is a universal issue. If the U.S. successfully reclassifies tokens above certain market cap and decentralization thresholds as non-securities, it could offer regulatory blueprints for jurisdictions like the UK and Singapore aiming to develop crypto finance, reducing “no legal basis” vacuums. Simultaneously, cross-border regulatory cooperation will strengthen. Under the G20, the IMF and Financial Stability Board (FSB) proposed high-level crypto regulatory principles in 2023, and by end-2025, nations are expected to finalize domestic rules based on these and enhance information sharing.

2. Increasingly Institutionalized and Commoditized Market Structure: The U.S. regulatory shift pulling traditional finance into crypto is likely to continue. By end-2025, the CFTC may introduce a regulatory framework for on-chain commodity trading, guiding more commodities and indices to be tokenized and traded under compliance. This will further commoditize and financialize the crypto market, deeply integrating it with traditional commodity markets. Additionally, more types of crypto ETFs and investment products will emerge. Following Bitcoin and Ethereum ETFs, regulators may approve basket crypto index ETFs, options ETFs, etc., easing institutional allocation. Major Wall Street firms are preparing to launch actively managed crypto funds and pension-linked crypto portfolios when permitted. Bitcoin may increasingly exhibit macro sensitivities akin to gold or the Nasdaq, becoming a recognized “alternative asset” in institutional portfolios.

3. Competition and Specialization Among Regional Compliance Hubs: In Asia and the Middle East, Hong Kong, Singapore, and Dubai are vying to become regional crypto hubs. Hong Kong, backed by mainland China and robust financial infrastructure, has attracted prominent platforms and projects through dense 2023–2025 regulations on exchanges and stablecoins. Singapore, with its solid legal system, tax advantages, and business-friendly climate, remains a breeding ground for blockchain startups. Together, they may cement Asia’s significance in the global crypto map. The UAE (Dubai) and Saudi Arabia in the Middle East are also catching up, using low taxes and open rules to attract crypto firms pressured in the West. In coming years, a multi-hub structure may emerge: North America with Miami and New York as crypto finance centers, Europe with Switzerland and Paris embracing regulation, Asia led by Hong Kong and Singapore, and the Middle East anchored by Dubai. These compliant hubs will dominate the flow of regulated capital and projects.

4. New Opportunities at the Intersection of Technology and Compliance: Regulatory clarity will unlock new innovation potential. Once prohibited activities are defined, enterprises can boldly invest in permitted areas. For example, the U.S. ban on CBDC but support for private stablecoins may spark a boom in bank-issued dollar stablecoins, with traditional banks and fintech firms collaborating to launch compliant stablecoins to fill payment gaps—a market with huge potential. Security token offerings may gain traction, with tokenized stocks and bonds listed on compliant exchanges. Blockchain technology will see broader application in supply chain finance and trade settlement. Even Web3 technologies like decentralized identity (DID) and zero-knowledge proofs may find roles in privacy-compliant digital identity verification, driving regtech innovation.

5. Evolution of Investor Behavior: Policy evolution will also reshape investor psychology. After enduring the 2022–2023 regulatory crackdowns, global investors in 2025’s rebound have shown stronger compliance awareness and risk management. In the near future, U.S. retirement plans may formally allow Bitcoin ETF allocations, and some sovereign wealth funds may publicly announce digital asset holdings as long-term strategies. These moves will further solidify the market’s foundation and reduce excessive speculation. Of course, new policy environments may bring novel volatility patterns—e.g., with institutional algorithmic trading participation, short-term swings may closely track macro news and liquidity shifts, requiring investors to adapt to institutional market rhythms, distinct from the emotional retail-driven swings of the past.

Conclusion

The crypto world in 2025 is undergoing a profound transformation—from disorder to order. Compliance is now the dominant theme, as major global economies extend their “visible hand” to this emerging field from various angles, enacting laws and issuing guidance to bring crypto assets into the formal financial system. Long-term, this policy evolution will deeply shape the industry’s infrastructure and investment environment. Clearer rules will drive out bad actors and retain quality participants, moving the industry beyond its wild adolescence into a compliant, orderly new phase. For ordinary investors, this means crypto investing is no longer a risky venture in a gray zone, but is increasingly becoming a legally protected, transparent, and sustainable asset allocation option.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is committed to transforming professional analysis into your practical advantage. Through our “Weekly Insights” and “In-Depth Reports,” we decode market trends. Our exclusive “Top Picks” column (AI + expert dual screening) helps you identify promising assets and reduce trial-and-error costs. Weekly live streams let our analysts engage directly, explaining hot topics and forecasting trends. We believe thoughtful guidance and consistent support empower more investors to navigate cycles and seize value opportunities in Web3.

Risk Warning

Cryptocurrency markets are highly volatile, and investing inherently carries risk. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News