Hotcoin Research | Large Outflows from ETFs This Week, Crypto Assets Tested Amid Macroeconomic Pressure

TechFlow Selected TechFlow Selected

Hotcoin Research | Large Outflows from ETFs This Week, Crypto Assets Tested Amid Macroeconomic Pressure

Still看好 Q4 as the peak of this cycle, with another market upswing expected—just wait and see.

Cryptocurrency Market Performance

The current total market capitalization of cryptocurrencies is $4.02 trillion, with BTC accounting for 57.7% at $2.32 trillion.The stablecoin market cap is $276.3 billion, up 0.45% over the past 7 days, with USDT representing 60.39%.

CoinMarketCap shows most of the top 200 projects are up while a few are down, including: OKB up 123.59% over 7 days, MORPHO up 35.13%, BIO up 131.53%, QTUM up 29.34%, and ZEC up 18.29%.

This week, U.S. Bitcoin spot ETFs saw net outflows of $1.178 billion; U.S. Ethereum spot ETFs saw net outflows of $233 million.

Market Outlook (August 25 - August 29):

This week saw stablecoin issuance increase, while U.S. Bitcoin and Ethereum spot ETFs experienced large net outflows. Platform tokens such as $OKB posted significant gains. The RSI index stands at 58.39, indicating neutral-to-bullish momentum. The Fear & Greed Index is at 59 (unchanged from last week).

BTC core trading range: $112,000 - $117,000

ETH core trading range: $4,200 - $4,700

On August 22, Federal Reserve Chair Powell stated at the Jackson Hole symposium that "the balance of risks to employment has shifted," signaling that he may be preparing for a rate cut in September. Following his remarks, the probability of a Fed rate cut in September increased to 91.2%. With less than one month until the September rate decision, key inflation data during this period will influence the final outcome. Q4 remains bullish for this cycle, and another upward move is expected—just wait.

Understanding the Present

Review of Weekly Major Events

1. On August 18, Ark Invest Daily disclosed that within Cathie Wood's ARKK fund portfolio, Coinbase accounted for 6.28%, Robinhood 3.84%, Bitmine 3.22%, and Circle 3.17%;

2. On August 18, according to Jupiter data, in the Solana token launch platform market share ranking over the past 24 hours, pump.fun ranked first with 79.4%, Letsbonk second with 12.9%, and BAGS third with 3.08%;

3. On August 19, Bloomberg reported that blockchain lending company Figure Technology Solutions Inc. has publicly filed an IPO application with the U.S. Securities and Exchange Commission (SEC), planning to trade on Nasdaq under the ticker FIGR;

4. On August 20, ALT5 Sigma stated that Jon Isaac is not, and has never been, the president or advisor of ALT5 Sigma. The company is unaware of any investigation by the U.S. Securities and Exchange Commission (SEC) into its activities;

5. On August 21, initial jobless claims in the U.S. for the week ending August 16 were 235,000, higher than the expected 225,000 and prior 224,000.

Macroeconomics

1. On August 29, the Reserve Bank of New Zealand announced a 25 basis point rate cut, bringing the interest rate to 3%;

2. On August 22, Federal Reserve Chair Powell said at the Jackson Hole symposium that a shift in risk balance may require policy adjustments, noting rising downside risks to employment. Markets interpreted this as Powell preparing for a September rate cut;

3. On August 22, according to CME's "Fed Watch" data, the probability of a Fed rate cut in September rose to 91.2% following Powell’s speech.

ETF

According to statistics, between August 18 and August 22,U.S. Bitcoin spot ETFs had net outflows of $1.178 billion. As of August 22, GBTC (Grayscale) has seen cumulative outflows of $23.876 billion and currently holds $20.869 billion, while IBIT (BlackRock) holds $87.209 billion. The total market cap of U.S. Bitcoin spot ETFs is $152.474 billion.

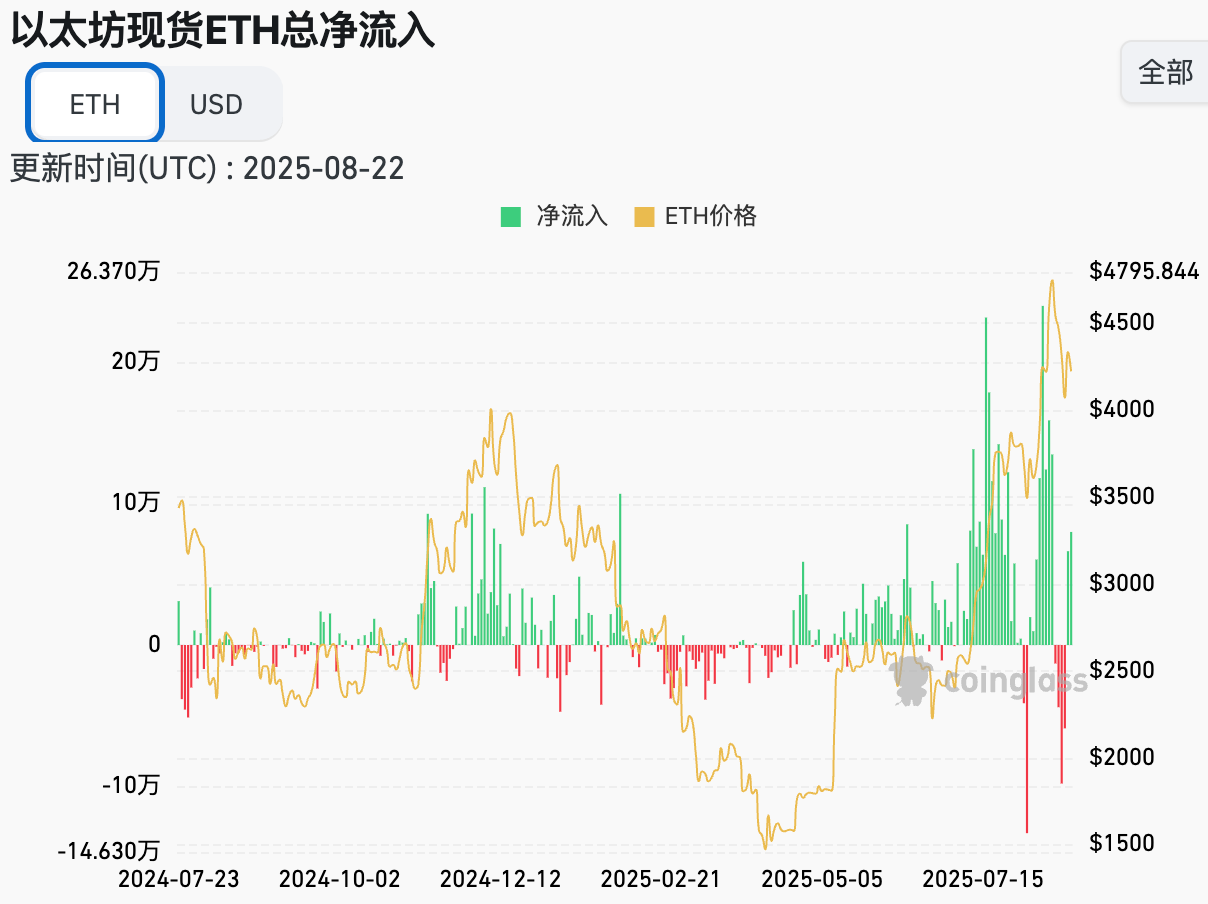

U.S. Ethereum spot ETFs had net outflows of $233 million.

Anticipating the Future

Event Preview

1. WebX Asia 2025 will take place in Tokyo, Japan from August 25 to 26;

2. Bitcoin Asia 2025 will be held at the Hong Kong Convention and Exhibition Center from August 28 to 29;

3. Taipei Blockchain Week 2025 will take place in Taipei from September 4 to 6;

4. EDCON 2025 will be held in Osaka, Japan from September 16 to 19, gathering global Ethereum community members to discuss protocol upgrades, ecosystem development, and the future of Web3;

5. Korea Blockchain Week 2025 will take place in South Korea from September 22 to 28.

Project Updates

1. Gryphon shareholders will vote on August 27 regarding a merger listing with American Bitcoin;

2. CUDIS airdrop claim is open until 20:00 on August 31; users must connect their verified Solana wallet and claim the S1 airdrop before then.

Key Events

1. On August 26 at 9:30, the Reserve Bank of Australia will release minutes from its August monetary policy meeting;

2. On August 28 at 20:30, the U.S. will release initial jobless claims (in thousands) for the week ending August 23;

3. On August 29 at 20:30, the U.S. will release the year-over-year core PCE price index for July.

Token Unlocks

1. Velo (VELO) will unlock 182 million tokens on August 25, worth approximately $2.88 million, representing 0.83% of circulating supply;

2. Venom (VENOM) will unlock 59.26 million tokens on August 25, worth approximately $9.55 million, representing 2.28% of circulating supply;

3. Artificial Superintelligence Alliance (FET) will unlock 3 million tokens on August 28, worth approximately $2.04 million, representing 0.14% of circulating supply;

4. Jupiter (JUP) will unlock 53.49 million tokens on August 28, worth approximately $27.55 million, representing 1.78% of circulating supply;

5. Optimism (OP) will unlock 31.24 million tokens on August 31, worth approximately $24.11 million, representing 1.9% of circulating supply.

About Us

Hotcoin Research, the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for investors. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends. With our exclusive column "Top Picks" (powered by AI and expert screening), we help you identify high-potential assets and reduce trial-and-error costs. Each week, our analysts also host live streams to interpret hot topics and forecast trends. We believe that warm, personalized support combined with professional guidance can help more investors navigate market cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News