Hotcoin Research | Unlocking Trillion-Dollar Potential: U.S. 401(k) Retirement Plans Could Become New Driver of Long-Term Bull Market

TechFlow Selected TechFlow Selected

Hotcoin Research | Unlocking Trillion-Dollar Potential: U.S. 401(k) Retirement Plans Could Become New Driver of Long-Term Bull Market

Trump signed an executive order allowing U.S. 401(k) retirement plans to invest in cryptocurrency, coupled with expectations of a potential Fed rate cut in September, opening the door for 401(k) plans—managing around $8.7 trillion in assets—to enter the crypto market. This policy shift marks a step toward institutional adoption of crypto assets and could bring long-term incremental capital support to the market.

1. Introduction

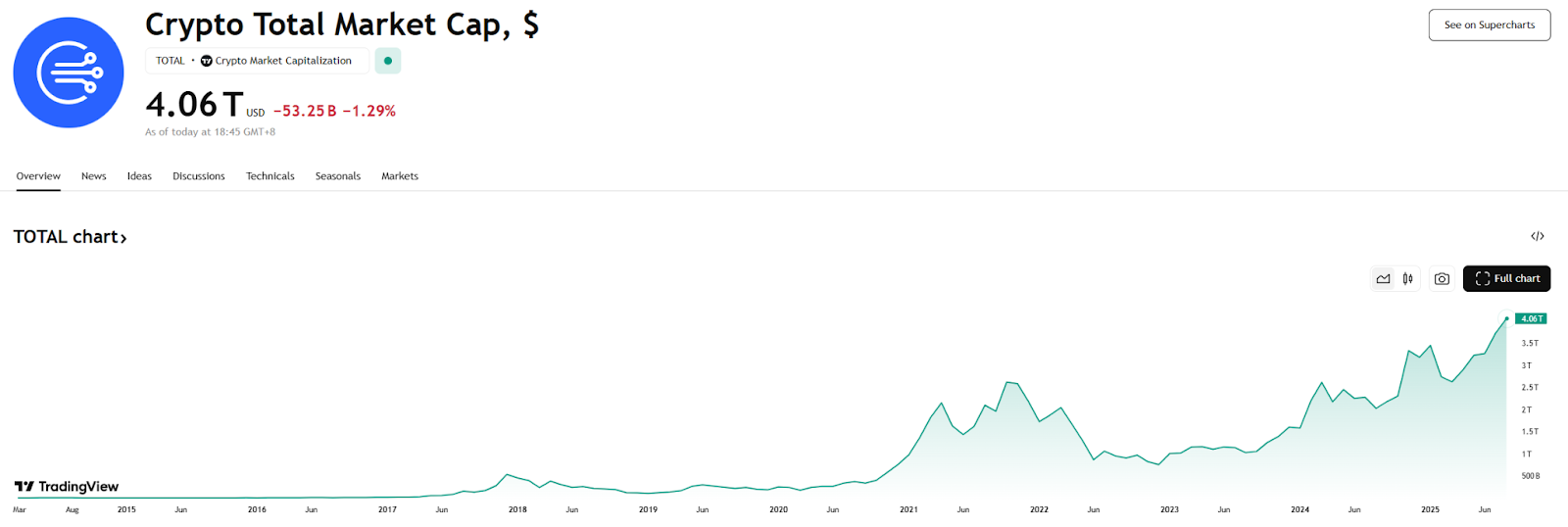

On August 7, 2025, Trump signed an executive order allowing 401(k) retirement savings plans to invest in alternative assets including private equity, real estate, and cryptocurrencies. This move breaks the long-standing U.S. pension investment convention of being limited solely to stocks and bonds, opening the door for massive pension funds to enter the crypto market. The 401(k) plan is the primary corporate retirement system in the United States, covering nearly 90 million American workers and managing trillions of dollars in assets. It is foreseeable that even a small portion of 401(k) funds flowing into the crypto market—relative to the current total market capitalization of approximately $4 trillion—could have a significant impact. Upon this news, combined with expectations that the Federal Reserve may begin a rate-cutting cycle in September, major cryptocurrencies such as Bitcoin and Ethereum surged, further fueling the bull market.

This article provides a comprehensive analysis of this major policy shift from multiple angles: first reviewing the current state and investment landscape of the U.S. pension system and the 401(k) plan, interpreting the background and potential implications of the new policy; then comparing international experiences with pension investments in crypto to assess the global relevance of the U.S. model; followed by analyzing how this policy could boost the crypto market; finally, incorporating the Federal Reserve’s monetary policy shift, we will examine evolving market dynamics and explore the changing role of crypto assets in future retirement wealth allocation.

2. Understanding the U.S. 401(k) Pension Plan

1. The Three Pillars of the U.S. Pension System

The U.S. pension system consists of three main components:

- Federal Social Security: Managed by the federal government, it provides basic retirement income security and covers almost all employed individuals, aiming to ensure a basic standard of living after retirement.

- Employer-sponsored pension plans: Represented by the 401(k), primarily serving private-sector employees, these are the most common employer-supported retirement savings vehicles in the U.S.

- Individual Retirement Accounts and Annuities (IRAs & Private Annuities): Established and funded entirely by individuals, serving as supplementary retirement savings tools.

2. Size and Investment Composition of 401(k)

The 401(k) plan is an employer-sponsored, tax-advantaged retirement savings program, mainly participated in by private-sector employees. Contributions are primarily made by employees through pre-tax salary deductions into their 401(k) accounts, while employers typically offer matching contributions at varying rates and rules set by the employer. Since its inception in 1981, the 401(k) has evolved from a supplementary savings tool into a core pillar of the U.S. pension system and the largest corporate pension plan in scale.

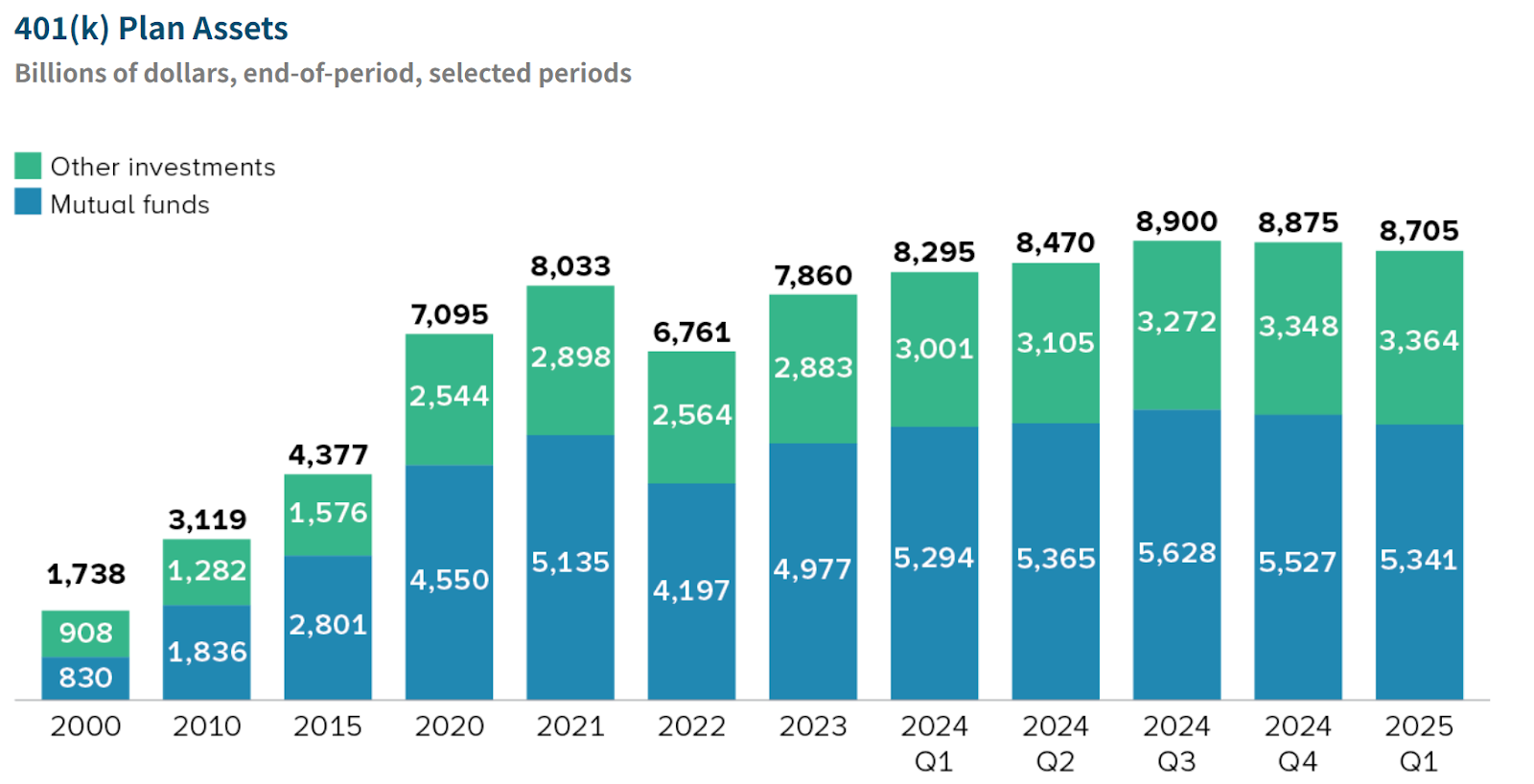

According to a report released in June by the Investment Company Institute (ICI), total U.S. retirement assets reached $43.4 trillion as of Q1 2025, accounting for about 34% of household financial assets. Among them, U.S. 401(k) plans held $8.7 trillion in assets, representing approximately 20% of total retirement assets and covering over 90 million participants. Within 401(k) plans, mutual funds managed $5.3 trillion in assets, or 61% of the total, with equity funds holding $3.2 trillion and hybrid funds around $1.4 trillion.

Source: https://www.ici.org/statistical-report/ret_25_q1

In terms of investment composition, 401(k) assets are primarily invested via mutual funds, which account for as much as 61%. These funds are mainly allocated to traditional financial assets, with equities dominating:

- Equity Funds: Approximately $3.2 trillion, or 37% of total 401(k) assets—the largest single category;

- Hybrid Funds: Around $1.4 trillion, including target-date funds and other balanced products that automatically adjust asset allocations;

- The remainder is distributed across bond funds, stable value funds, money market funds, and company stock.

Overall, the core of 401(k) portfolios consists of publicly traded equities, with minimal exposure to alternative assets such as private equity, commodities, and real estate, and no direct allocation to cryptocurrencies like Bitcoin. This traditional configuration may undergo a historic transformation under Trump’s new policy.

3. The 401(k) Investment Landscape Enters the Era of "Alternative Assets"

On August 7, Trump signed an executive order enabling ordinary retirement investors to access alternative assets. The order directs the Department of Labor to reassess regulatory guidance on 401(k) investments in alternative assets within the existing framework of the Employee Retirement Income Security Act (ERISA), and to collaborate with the Treasury Department and the Securities and Exchange Commission on whether related regulations need to be amended. The executive order explicitly defines “alternative assets” as private market investments, direct or indirect real estate interests, commodities and infrastructure projects, and digital assets (i.e., cryptocurrencies) held through actively managed vehicles. In other words, assets such as private equity funds, unlisted company equities, and Bitcoin are now included in the permitted scope.

However, it should be noted that the executive order does not immediately lift investment restrictions but initiates a regulatory revision process, with full implementation expected by 2026. Nevertheless, the policy shift itself sends a clear signal: the U.S. government is willing to endorse retirement funds entering emerging areas such as cryptocurrency.

3. Global Experiences with Pension Investments in Crypto Markets

The U.S. move to open pension investments to crypto carries symbolic significance globally. Overall, large pension funds worldwide remain highly cautious toward crypto assets, though there have been some exploratory cases and lessons learned in recent years.

- In Canada, the Ontario Teachers' Pension Plan (OTPP), with about $190 billion in assets, invested approximately $95 million in the crypto exchange FTX through venture funds between 2021 and 2022. However, FTX's subsequent collapse wiped out the investment, which accounted for less than 0.05% of the fund’s net assets. Although the amount was small, the incident caused significant backlash: OTPP not only suffered losses but also faced class-action lawsuits from retirees accusing it of inadequate due diligence. As a result, OTPP stated it would avoid crypto-related investments in the near term. This negative precedent makes institutions more conservative and serves as a warning to regulators.

- Within the U.S., a few public pension funds have experimented with crypto. For example, the Houston Firefighters’ Relief and Retirement Fund invested $25 million in Bitcoin and Ethereum in October 2021, about 0.5% of its assets. The fund’s management stated they view cryptocurrencies as a new hedge and potential growth source, unwilling to “ignore” this emerging asset class. Due to the small allocation, the investment had little impact on overall portfolio volatility. Similarly, two county retirement systems in Fairfax County, Virginia, have gradually made small allocations (about 3–5% of their portfolios) to blockchain since 2018, including blockchain venture funds and crypto yield farming.

- In contrast, mainstream pension plans in most European and Asian countries still do not include cryptocurrencies in their eligible investment categories. On one hand, many national pension systems prioritize government-led or fixed-income assets and have lower risk appetites than U.S. or U.K. corporate pensions. On the other hand, regulators impose strict limits on pension investment scopes, emphasizing “responsible investing,” and exclude crypto due to concerns over money laundering, volatility, and uncertainty. However, some privately managed pension accounts with autonomous investment rights have begun exploring crypto. For instance, in Australia, high-net-worth individuals have used self-managed superannuation funds (SMSFs) to allocate to Bitcoin as part of diversified portfolios. This model allows greater flexibility through individual decision-making but risks insufficient expertise and regulatory blind spots. In the U.K., Self-Invested Personal Pensions (SIPPs) have seen cases of purchasing crypto derivatives, though financial regulators have imposed tight restrictions on retail investors buying crypto assets.

Clearly, global pension investments in crypto assets are still in the early exploratory phase. The U.S. opening of 401(k) plans to crypto will undoubtedly attract attention and discussion from regulators and industry players worldwide. If the U.S. experience proves successful, other countries may gradually relax their policies to allow pensions to benefit from the crypto economy. In the short term, however, only forward-looking institutions are likely to experiment on a small scale, with widespread adoption still far off.

4. Opportunities and Challenges Brought by 401(k) Fund Entry

Opening the 401(k) pension plan to alternative assets such as cryptocurrencies will significantly enhance portfolio returns and diversification for retirement savers. Supporters argue that historically, average workers’ 401(k)s were limited to mutual funds, while only large institutions and wealthy investors could access high-return areas like private equity and hedge funds—an “unfair” disparity. Expanding 401(k) investment options could put ordinary investors “on equal footing with institutions,” allowing them to share in the appreciation potential of private markets and crypto assets.

For the cryptocurrency market, the entry of 401(k) pension funds represents not just an increase in capital inflow but also a qualitative transformation.

- Increased Capital Inflows: Once implemented, this policy will open a channel for U.S. retirement savings to flow into crypto assets. Given that 401(k) plans manage nearly $9 trillion in assets, compared to the current crypto market cap of $4 trillion, even a 10% allocation would bring in nearly $900 billion in potential new capital—equivalent to 22% of the current crypto market value—providing strong price support. Such a shift in funding dynamics is undoubtedly a major long-term positive for the crypto market.

Source: https://www.tradingview.com/symbols/TOTAL

- Enhanced Institutional Recognition: 401(k) plans are overseen by company trustees and professional advisors who exercise extreme caution in asset selection. Formal inclusion of crypto assets in mainstream pension offerings would greatly elevate the status of Bitcoin and other cryptos as legitimate investment instruments, encouraging more观望 institutions to follow suit and creating a virtuous cycle. Fidelity Investments announced in 2022 its intention to offer Bitcoin investment options within 401(k) plans (later paused due to regulatory concerns); with policy barriers now lifting, such products are expected to rapidly enter the market. Specialized crypto investment vehicles tailored for retirement plans—such as Bitcoin trusts, crypto index funds, or target-date funds with minor crypto exposure—are likely to emerge.

- Improved Investor Structure: Pension funds are inherently long-term and stable, potentially improving the investor structure of the crypto market and reducing extreme volatility. Unlike retail traders chasing short-term gains, pension allocations emphasize long-term, steady growth and risk diversification, avoiding frequent large-scale entries and exits. If a portion of 401(k) assets are allocated to Bitcoin, they would act as “long-term holders,” reducing circulating supply and enhancing market stability. While this effect requires time and sufficient scale to materialize, the direction is positive.

- Accelerated Integration of Traditional and Crypto Finance: As retirement advisors, custodian banks, and fund managers begin developing crypto products for 401(k) plans, the crypto industry’s infrastructure in compliance, custody, and security will also mature. For instance, to meet 401(k) requirements, custodians must address private key custody, theft risks, and liquidity arrangements. The involvement of traditional financial institutions will accelerate the development of industry standards and best practices—including valuation models, performance reporting formats, and fee structures—making crypto assets more accessible and trustworthy for mainstream capital.

Nonetheless, policy liberalization also brings challenges:

- Costs and Liquidity Issues: Over decades, 401(k) plans have trended toward lowering costs, widely adopting low-fee index mutual funds, with average management fees now down to 0.26%. In contrast, private equity funds commonly charge “2% management fee + 20% performance fee,” and crypto investment products generally carry higher fees, requiring careful design when integrating such assets into 401(k) plans.

- Risk and Information Transparency: Traditional public market investments benefit from relatively robust disclosure and regulation, whereas private markets and crypto assets suffer from greater information asymmetry and higher volatility.

- Legal Liability and Litigation Risk: Employees might file collective lawsuits if investments perform poorly. Without clear legal protections, plan fiduciaries and asset managers may hesitate to enter volatile domains.

- Investor Education Challenges: Educating ordinary participants about the risk-return profiles of assets like Bitcoin, appropriate allocation levels, and alignment with retirement goals requires sustained effort. Otherwise,盲目 following trends or taking on excessive risk beyond their capacity could occur.

For the crypto industry, attracting traditional pension capital represents both a massive opportunity and a serious test. Whether it can deliver investment products that satisfy regulators and investors, and whether it can prove its value under strict fiduciary frameworks, will determine how far and fast this long-term capital flows. But regardless, once the door has cracked open, it is unlikely to close again. Looking ahead over the next decade, as Millennials and Gen Z become the primary participants in pension systems—with their higher acceptance of digital assets—and with technological and regulatory progress, crypto assets are likely to gradually increase their share in pension portfolios. This will further expand the crypto market’s scale and ecosystem maturity, and one day, crypto assets may become as integral to retirement wealth as gold or real estate.

5. Conclusion and Outlook: Is the Wind Finally at Crypto’s Back?

The market widely expects the Federal Reserve to announce its first rate cut of the year at its September meeting. According to trading data, the probability of a 25-basis-point cut is nearly 100%, with a small chance of a 50-basis-point cut. The turning point toward monetary easing is evident, and the tone is shifting from “hawkish” to “dovish.” Since this rate cut is seen as the beginning of a long-term trend reversal and a series of accommodative policies, its medium- to long-term support for risk assets could be substantial. If the Fed continues cutting rates and restarting balance sheet expansion to provide liquidity, the crypto market may not just experience “a gust of wind,” but rather an extended “period of nourishing rain.”

The favorable news of 401(k) plans gaining access to crypto markets coincides temporally with the macroeconomic tailwind of anticipated Fed rate cuts. The former brings structural incremental capital and long-term buying pressure, while the latter creates a supportive overall funding environment and improved risk appetite. These two forces complement each other and could shape a new upward cycle for the crypto market. The potential entry of pension funds suggests cryptocurrencies may transition from fringe assets to mainstream portfolio components; meanwhile, the shift in interest rate conditions provides fertile ground for a new bull market. At this juncture in 2025, we may be witnessing a pivotal step toward maturity for the crypto industry—from speculative instruments for a niche group of tech enthusiasts and institutions to becoming part of the retirement savings of billions.

For investors, it is essential to maintain confidence in long-term trends while remaining vigilant against short-term volatility and uncertainty. Pension fund entry remains on the eve of policy implementation, with possible twists and turns along the way; although the Fed’s policy is turning dovish, macroeconomic trajectories still hold variables. As the market hopes, perhaps the crypto spring has already arrived—but we must learn to sow in spring and reap in autumn.

About Us

TechFlow Research, the core research arm of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical investment edge. Through our "Weekly Insights" and "Deep Dive Reports," we unravel market dynamics; with our exclusive column "Top Picks" (AI + expert dual screening), we identify high-potential assets and reduce trial-and-error costs. Each week, our analysts engage with you live, decoding hot topics and forecasting trends. We believe that warm, consistent support paired with expert guidance empowers more investors to navigate market cycles and capture value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and conduct investments within a rigorous risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News