Turning Point in the Cycle: Buy the Dip, Sell, or Wait? Hotcoin Research | November 10-14, 2025

TechFlow Selected TechFlow Selected

Turning Point in the Cycle: Buy the Dip, Sell, or Wait? Hotcoin Research | November 10-14, 2025

The probability of a Fed rate cut in December has fallen below 50%, and subsequent market focus should be on economic data releases following the reopening of the U.S. government.

Crypto Market Performance

The current total market capitalization of cryptocurrencies is $3.26 trillion, with BTC accounting for 58.7% at $1.91 trillion.The market cap of stablecoins is $304.2 billion, down 0.41% over the past 7 days. Notably, stablecoin supply has seen negative growth for three consecutive weeks, with USDT making up 60.44%.

CoinMarketCap’s top 200 projects show most declined while a few rose: STRK surged 72.26% over 7 days, DRC rose 65.91%, ZEC gained 26.84%, B increased 26.63%, and MET climbed 19.58%.

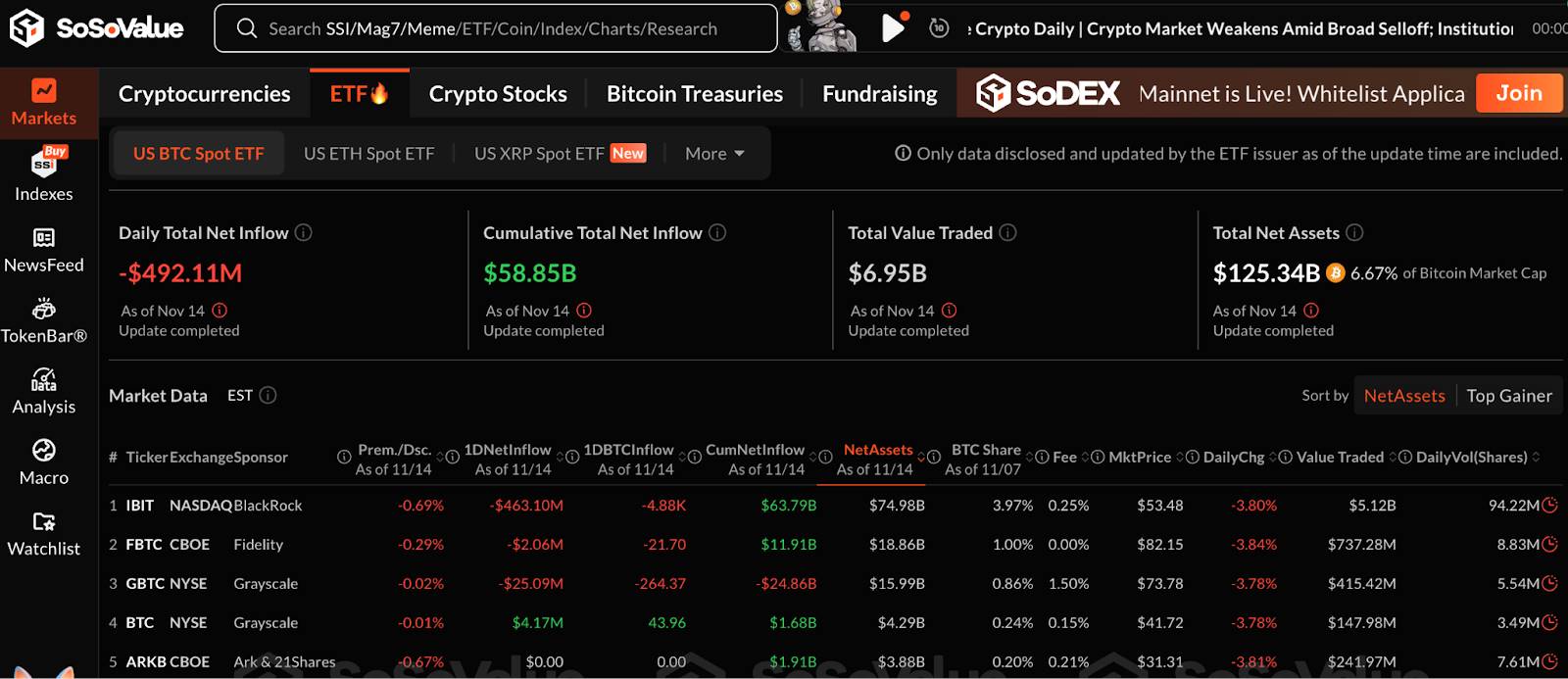

This week, U.S. Bitcoin spot ETFs saw net outflows of $1.111 billion; U.S. Ethereum spot ETFs recorded net outflows of $729 million.

Market Outlook (Nov 17 - Nov 21):

The current RSI stands at 43.52 (neutral zone), fear & greed index is at 9 (down from last week, in extreme fear territory), and altseason index is at 39 (lower than last week).

BTC core range: $97,000–110,000

ETH core range: $3,000–4,000

SOL core range: $140–175

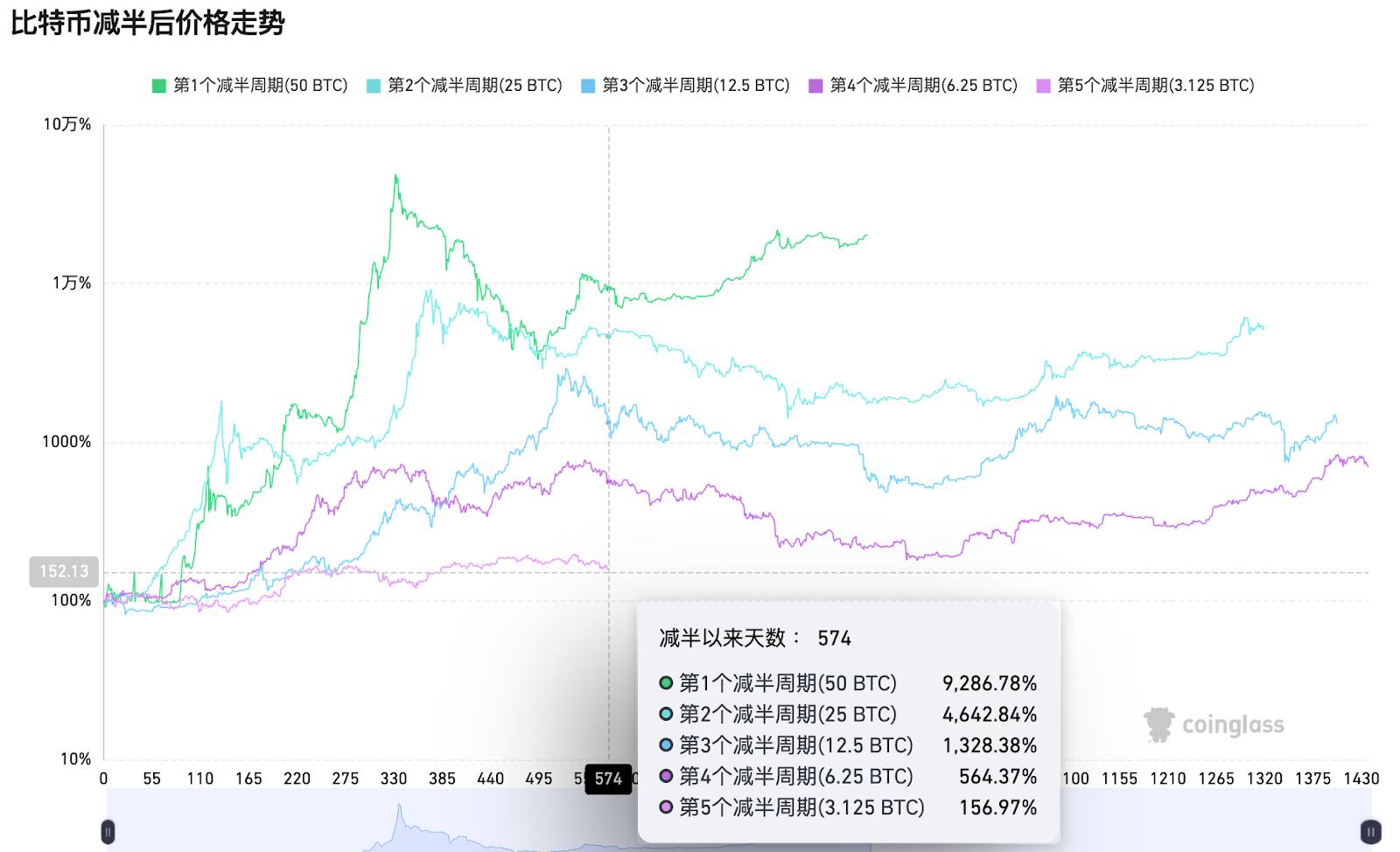

Market sentiment: Over the past year, there have been only 11 days categorized as "extreme fear." Looking back at price charts, these 11 days were all "golden pits," raising the question—does the investment principle of "buying in fear, selling in greed" still hold? After all, we may now be at the end of the traditional four-year crypto cycle! On-chain data indicates BTC remains in a mildly bearish phase, with a dense supply zone between $106,000 and $118,000 where many investors are inclined to sell, creating strong resistance. The $100,000 level below is a key psychological support, while $97,000 marks the bottom of the range.

The probability of a Fed rate cut in December has dropped below 50%. Investors should closely monitor U.S. economic data releases following the reopening of the government.

For conservative investors: Consider accumulating positions gradually on dips or maintaining ample cash reserves—avoid going “all in”!

For active traders: Within this clearly defined consolidation range, consider taking small long positions near support levels and reducing exposure or shorting near resistance levels. Always set proper stop-losses.

Understanding the Present

Weekly Recap

1. On November 10, U.S. media reported that the U.S. Senate had reached an agreement to end the federal government shutdown;

2. On November 11, Federal Reserve Governor Michelle Bowman stated that given softening labor markets and declining inflation, the Fed should cut rates by 50 basis points in December. She believes a 25-basis-point cut would be the "bare minimum" appropriate move;

3. On November 10, Coinbase announced via social media that the public sale of Monad tokens will launch on November 17;

4. On November 12, Upexi, a Solana-based digital asset reserve and consumer goods brand company, reported record-breaking quarterly results, with digital asset revenue surpassing $6 million driving overall gross profit to $8.3 million—an 183% year-on-year increase;

5. On November 12, Coinbase terminated its $2 billion acquisition deal with BVNK, a stablecoin infrastructure startup. Had it closed, this would have been one of the largest M&A deals in crypto history, significantly expanding Coinbase’s institutional-grade stablecoin operations;

6. On November 12, SEC Chair Paul Atkins outlined his plan for a crypto “token taxonomy” to clarify which cryptocurrencies qualify as securities, as the SEC advances digital asset regulation through new approaches;

7. On November 14, the crypto market suffered another blow—Bitcoin dipped to $98,000 early morning, currently trading at $100,294; Ethereum fell below $3,200, now at $3,252. Total crypto market cap dropped 2.0% in the past 24 hours, now at $3.45 trillion. U.S. equities closed sharply lower across all three major indices—Nasdaq plunged 2.3%, Dow down 1.6%, S&P 500 down 1.6%, with all crypto-related stocks declining;

8. On November 14, Musk announced, “X just launched a full suite of new communication features including encrypted messaging, audio/video calls, and file transfers. X Money is coming soon”;

9. On November 14, Coinglass data showed that total liquidations across the network surged to $748 million in the past 24 hours, including $596 million in longs and $152 million in shorts.

Macroeconomic Overview

1. On November 14, hawkish signals from Fed officials dashed market hopes for a December rate cut in the U.S., compounded by a messy data calendar and concerns about an AI bubble, leading to heavy losses in global equities and precious metals on Friday;

2. On November 15, according to the Fed Funds Rate Monitor, the probability of a 25-basis-point rate cut in December stands at 39.8%.

ETFs

Data shows that between November 10 and 14, U.S. Bitcoin spot ETFs saw net outflows of $1.111 billion. As of November 14, GBTC (Grayscale) has seen cumulative outflows of $24.638 billion, currently holding $16.091 billion; IBIT (BlackRock) holds $75.162 billion. Total market cap of U.S. Bitcoin spot ETFs: $126.787 billion.

U.S. Ethereum spot ETFs net outflows: $7.29 million.

Anticipating the Future

Upcoming Events

1. Devconnect will take place in Buenos Aires, Argentina, from November 17 to 22, 2025. This major technical event will bring together core participants from the Ethereum ecosystem. Throughout the event, Ethereum builders, educators, and protocol teams will drive innovation and advancement in blockchain technology through hands-on sessions, deep-dive technical talks, and community-led workshops;

2. Bitcoin MENA will be held at ADNEC (Abu Dhabi National Exhibition Centre) on December 8–9;

3. Solana Breakpoint 2025 will take place in Abu Dhabi from December 11 to 13.

Project Updates

1. Berachain plans to launch a claims portal for Balancer v2 / BEX exploit victims before November 16, along with a fork to unlock BEX contracts at the VM level;

2. ALT5 Sigma, a publicly traded financial strategy firm behind WLFI, will release its latest financial report on November 18;

3. The airdrop claim window for AI agent project Capx AI will close at 7:59 AM on November 20.

Key Events

1. At 8:30 AM on November 18, the Reserve Bank of Australia will release minutes from its November monetary policy meeting;

2. At 9:30 PM on November 20, the U.S. will release initial jobless claims (in thousands) for the week ending November 15;

3. At 3:00 AM on November 20, the Federal Reserve will release minutes from its monetary policy meeting;

4. At 11:00 PM on November 21, the University of Michigan will release the final U.S. consumer sentiment index for November.

Token Unlocks

1. Melania Meme (MELANIA) will unlock 26.25 million tokens on November 18, worth approximately $3.74 million, representing 5.04% of circulating supply;

2. LayerZero (ZRO) will unlock 26.72 million tokens on November 20, worth approximately $38.05 million, representing 7.29% of circulating supply;

3. KAITO (KAITO) will unlock 8.35 million tokens on November 20, worth approximately $6.46 million, representing 2.97% of circulating supply;

4. SOON (SOON) will unlock 15.21 million tokens on November 23, worth approximately $29.51 million, representing 4.33% of circulating supply.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is dedicated to turning professional analysis into practical tools for your trading success. Through our “Weekly Insights” and “Deep Dive Reports,” we help you understand market trends. Our exclusive column “Top Picks” (powered by AI + expert screening) identifies high-potential assets and reduces trial-and-error costs. Each week, our analysts engage with you live to explain hot topics and forecast trends. We believe that informed guidance combined with personal engagement empowers more investors to navigate market cycles and capture value opportunities in Web3.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and operate within a strict risk management framework to safeguard their capital.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News