Hotcoin Research | In-depth Analysis of Whether SOL Can Take Off Again: Reviewing the Reasons and Outlook on Price Trends

TechFlow Selected TechFlow Selected

Hotcoin Research | In-depth Analysis of Whether SOL Can Take Off Again: Reviewing the Reasons and Outlook on Price Trends

This article will analyze the overall performance of Solana's on-chain data and ecosystem to break down the core reasons behind SOL's underperformance relative to ETH, and examine the strengths and weaknesses of SOL's potential for another surge.

I. Introduction

In mid-August, ETH surged past $4,700, reaching a four-year high, while SOL mostly fluctuated between $180–200 during the same period, significantly underperforming BTC and ETH in price. Recalling Solana's meme coin frenzy in 2024 on platforms like Pump.fun, which was once seen as a potential "ETH killer," SOL hit a historical peak near $293 on January 19, 2025, followed by pullbacks, consolidation, and volatile sentiment—diverging from ETH’s steadily strengthening trend. Behind these surface-level dynamics lie systemic differences in capital inflow channels, value anchors, and network narratives. What drives these disparities? Can Solana’s ecosystem shine again, and can SOL token take off once more?

This article analyzes Solana’s on-chain data and overall ecosystem performance to unpack the core reasons behind SOL’s underperformance relative to ETH, and evaluates the strengths and weaknesses of a potential SOL rebound. Based on this analysis, we will project Solana’s likely trajectory in Q3–Q4 2025, offering readers a systematic reference.

II. Comprehensive Analysis of Solana’s Ecosystem Performance in 2025

Solana’s growth path clearly differs from Ethereum’s: instead of capturing value through “high gas fees + deflation,” it relies on single-chain high throughput and ultra-low fees to support massive long-tail and high-frequency transactions.

1. Core On-Chain Metrics

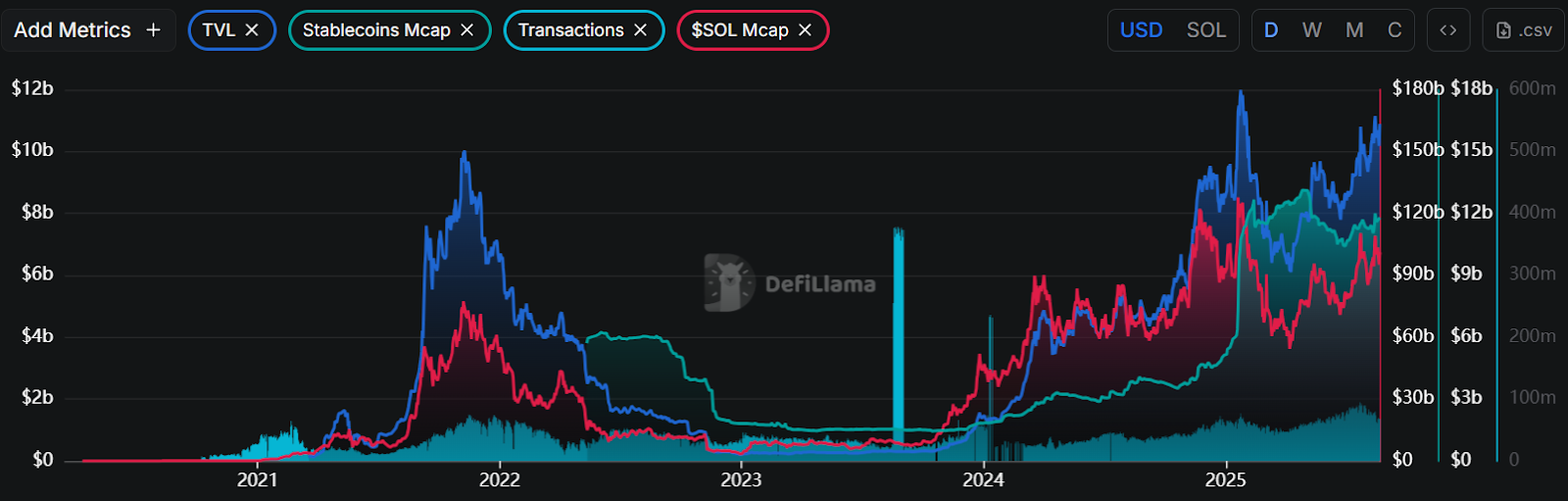

Since the beginning of the year, Solana’s ecosystem has shown a pattern of “pullback from highs followed by oscillating recovery.” TVL and stablecoin supply have risen in steps, with current TVL at approximately $10.42 billion and stablecoin market cap around $11.62 billion, indicating that the on-chain “base dollar liquidity pool” has returned and stabilized above the $10 billion threshold. On-chain transaction volume remains high, maintaining an active state of “high-frequency/long-tail” trading. The total market cap of $SOL dropped sharply in Q1 but began a wave-like upward oscillation starting in Q2. Structurally, renewed meme coin enthusiasm has marginally improved DEX activity and chain fees, though levels have not yet reached their annual peaks.

Source: https://defillama.com/chain/solana

2. Meme Coin Sector

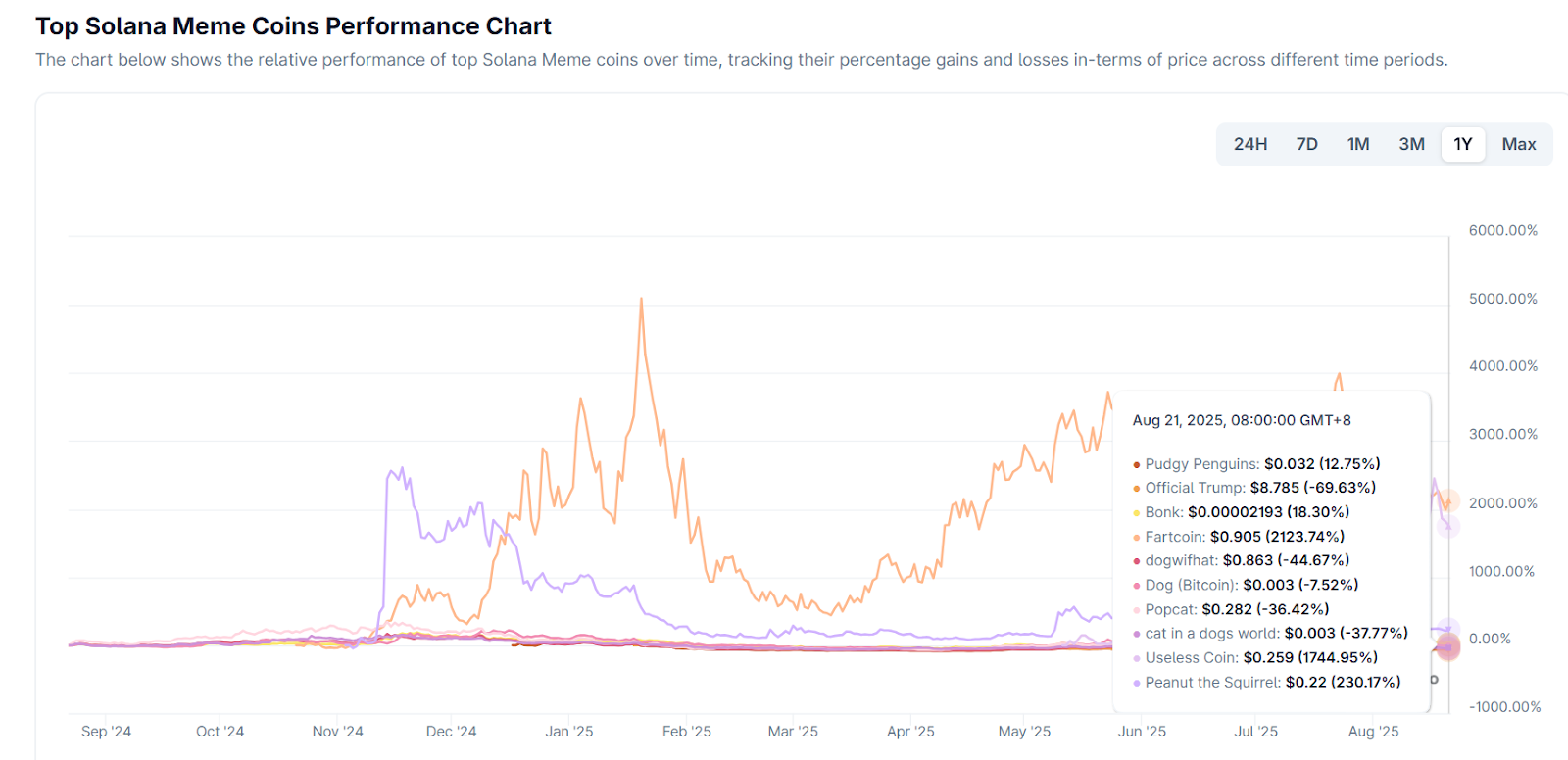

As the leading meme coin network, Solana has launched star tokens such as BONK, WIF, POPCAT, MOODENG, PNUT, TRUMP, PENGU, FARTCOIN, and USELESS. Common characteristics of Solana memes include “high volatility, strong rotation, and event-driven momentum.” The total market cap of Solana’s meme sector is currently around $11.7 billion. The top five most popular meme coins since the beginning of the year are:

- PENGU: A “brand token” tightly linked to a popular NFT IP, with over $10 million in physical toy sales across more than 3,100 stores. Canary Capital has filed a PENGU ETF application with the SEC. It has strengthened significantly throughout the year and ranks among the top meme coins on Solana by market cap.

- BONK: A veteran dog-themed token and community traffic gateway; experienced notable growth following the breakout of LetsBonk.fun, but has since pulled back significantly.

- TRUMP: A political-themed sentiment-driven token; showed overall downward volatility since its January launch, briefly rebounded after Trump’s crypto dinner in May, and remains sensitive to event catalysts.

- FARTCOIN: Gained popularity due to its humorous theme and viral spread: users earn tokens by submitting fart jokes or memes, each trade generates a digital fart sound, and combined with AI narrative (created by AI Truth Terminal), it became an AI-meme hybrid, easily triggering FOMO.

- USELESS: Emphasizes “uselessness” as its selling point, satirizing empty promises of other tokens, earning the title of “most honest meme coin.” The higher its price, the more useless it becomes, paradoxically attracting more speculation.

Source: https://www.coingecko.com/en/categories/solana-meme-coins

3. Launchpad Sector

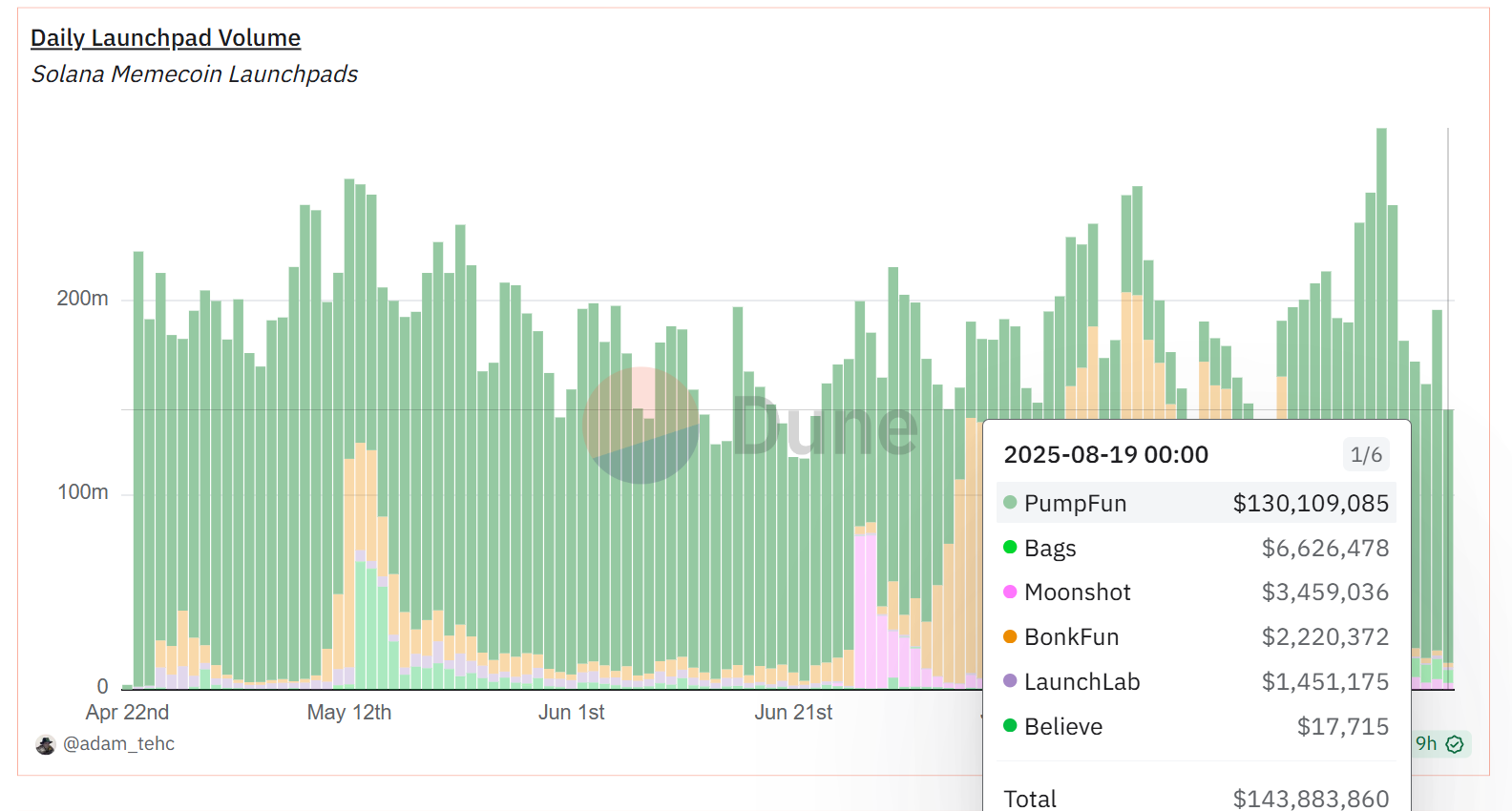

The competition among Solana launchpads has evolved beyond “who is cheaper or faster to list” into a contest centered on creator economy, token buybacks, and community governance.

- Pump.fun: Revived the entire chain’s meme scene with its 1% fee and “foolproof issuance” model. In mid-August 2025, weekly revenue reached ~$13.48 million, returning to a phase high; cumulative revenue has surpassed $800 million. Its dramatic recovery—market share rising from 5% to ~90% within two weeks—has drawn widespread attention.

- LetsBonk.fun: Rapidly rose after launching in April 2025, capturing over 78% of issuance share in July before declining. Its “community mobilization + low-barrier issuance” approach remains one of Pump.fun’s main competitors.

- Bags: Focuses on “creator revenue sharing/royalties,” emphasizing ongoing payouts to creators and targeting influencers and content creators. Its 30-day trading volume recently exceeded $1 billion.

- Moonshot: A fiat-onramp app supporting Apple Pay top-ups and direct fiat deposits. Once topped the U.S. App Store’s “Free Finance Apps” chart, greatly lowering entry barriers for new users.

- Believe: A social-media-style launchpad where “replying posts mints tokens.” Faced controversy in June over pausing certain on-chain payouts and shifting to offline payments, later switching from automatic to “manual review” listing.

Source: https://dune.com/adam_tehc/memecoin-wars

4. DeFi Sector

Solana’s DeFi resembles a “high-frequency/long-tail transaction infrastructure.” Raydium and Orca handle DEX trading and liquidity; Jupiter and Drift manage derivatives and aggregate fragmented liquidity; Kamino enhances capital efficiency; Jito and Marinade provide foundational assets with “stable yield + liquidity.”

- Raydium (AMM + Ecosystem Launch Pool): A veteran Solana DEX/AMM, handling most long-tail spot liquidity and launch pool functions. Fees and revenue rank among the highest in its category, creating a positive feedback loop between “platform cash flow” and “token value.”

- Jupiter (Aggregator + Trading Gateway): The default-level router on Solana, aggregating liquidity from Raydium and other DEXs. The JPL pool concentrates significant liquidity and has announced plans to launch a lending module.

- Kamino (Unified Liquidity/Lending/Market Making Management): Known for its “active market-making vaults + lending,” consistently ranks among the top in Solana TVL, serving as a hub for LPs and capital.

- Jito (LST + MEV Infrastructure): Makes MEV explicit via Jito client/block engine/bundles, distributing part of MEV rewards to stakers through jitoSOL. Jito tips now account for a significant portion of on-chain “realized economic value (REV).”

III. Why SOL Underperformed ETH: Root Cause Analysis

ETH leveraged spot ETFs to establish a complete closed loop of “compliant capital → secondary liquidity → market making/derivatives,” further amplified by larger corporate treasury holdings and its narrative as the “on-chain financial hub,” resulting in stronger capital attraction and valuation anchoring. Solana, focused on a transactional ecosystem for “high-frequency/long-tail applications,” has greater price elasticity tied to thematic trends (memes, launchpads, etc.), making it more vulnerable to “anchor loss” when risk appetite declines or themes rotate.

1. Gap in ETF Capital Inflows

- SOL: There is already a staking-yield-bearing Solana ETF (SSK) listed on U.S. exchanges, but it is complex in structure and not an SEC-registered spot ETF. Since launch, net inflows have totaled only about $150 million—far below ETH ETFs’ capital-raising power. Market attention now centers on VanEck and Grayscale’s pending SOL spot ETF applications; approval around October could open similar compliant models and passive funding channels.

- ETH: Spot ETFs have surpassed $22 billion in scale, becoming the primary institutional gateway. Leading firms like BlackRock are pursuing “stakable ETH ETFs,” which, if approved, would combine “staking yield” and “compliant access,” further solidifying long-term institutional allocation.

2. Corporate Holding Scale Gap

- SOL: Upexi, dubbed the “SOL MicroStrategy,” currently has a NAV of ~$365 million and holds 1.8 million SOL, inviting Arthur Hayes to its advisory board to strengthen strategy and visibility. Other public companies (e.g., DFDV, BTCM) are slowly accumulating, but overall scale still lags far behind ETH treasury strategies.

- ETH: BitMine Immersion (BMNR), branding itself as the “ETH MicroStrategy,” plans to raise up to $20 billion, with current NAV at ~$5.3 billion—second only to Bitcoin’s MicroStrategy in scale. Combined with endorsements from globally influential figures like Tom Lee, this significantly strengthens market narrative and capital appeal.

3. Differences in Network Narrative Positioning

- Solana: Leans toward “single-chain high throughput + ultra-low fees” for consumer-grade apps and speculative trends (memes, launchpads). Despite multiple attempts to enter RWA this year, most efforts fizzled. The August issuance of a dollar money market fund token (CMBMINT) on Solana by CMBI × DigiFT stands out as a rare positive case of compliant RWA, pushing SOL above $200 that day—seen by the market as a potential narrative shift.

- Ethereum: Is building a compliant, sustainable on-chain financial infrastructure and clearing layer, earning “structural buying” from institutions. Over half of all stablecoin issuance and about 30% of gas usage occur on Ethereum. Additionally, Robinhood is launching stock tokens on Ethereum L2, and Coinbase is heavily investing in Base.

4. Different Value Capture Mechanisms

- Solana: Achieves ultra-high interaction density through low fees and high throughput, relying on transaction volume and application-layer fees/MEV for value capture. When meme/long-tail activity fades, both chain and app fees decline, weakening the valuation anchor.

- Ethereum: EIP-1559 burns base fees directly, leading to net deflation or low inflation during busy periods. Combined with staking yields, this creates a valuation anchor based on “supply contraction + cash flow.”

5. Historical Risk Memory and “Credibility Discount”

- Solana: The ~5-hour downtime on February 6, 2024, and subsequent temporary drops in consensus node count, though resolved, remain risk factors in institutional pricing models.

- Ethereum: Its “never stops” reliability and broader developer/compliance ecosystem result in lower credibility discount—this gap widens during macro volatility.

IV. Can SOL Take Off Again? Strengths and Weaknesses Analysis

SOL has a solid foundation of “high activity, low fees, MEV sharing, and application-level cash flows.” With catalysts like spot ETF approvals and RWA compliance, it certainly has room for another upward trend. However, without confirmed ETF inflows, smaller treasury scale, weaker narrative strength compared to ETH, and lingering concerns over historical stability, its price remains highly “event-driven.”

1. SOL’s Advantages and Bull Case

- High Throughput + Low Fees = Natural Ground for Active and Long-Tail Assets

Solana supports tens of millions of daily interactions, fostering naturally active trading and market making at extremely low costs, ideal for continuous experimentation and spread of memes, long-tail assets, and high-frequency DeFi. - Compliant RWA Is Setting Precedents

CMBI × DigiFT tokenized a U.S. dollar money market fund and deployed it across multiple chains including Solana and Ethereum, claiming it as the first public compliant MMF on Solana—bringing “institutionally explainable cash-like assets” and fiat/stablecoin gateways. This opens a potential “long-term capital narrative.” - Inflation Curve Is Predictable

Solana’s set inflation model: starts at 8%, decreases 15% annually (~180 epochs), converging to 1.5% long-term. In 2025, actual annual inflation is expected around 4.3%–4.6%, with community discussions on proposals to accelerate disinflation. Predictable declining inflation supports medium-to-long-term valuation anchoring. - If Spot ETF Approved = “Capital Gate Opens”

Multiple institutions including VanEck have submitted or updated S-1 filings for SOL spot ETFs with the SEC. If approved, it would replicate ETH’s path of “compliant capital → passive allocation → market making/derivatives,” attracting more corporate treasuries.

2. SOL’s Disadvantages and Bear Case

- Real ETF Inflows Still Pending

ETH’s spot ETFs exceed $22B, forming an institutional capital loop; SOL remains in application/communication phase. Current U.S.-listed “staking-included” products are not standard SEC spot ETFs and have weak capital attraction. Realized vs. expected directly impacts relative returns. - Treasury Strategy Scale and “Spokesperson” Gap

ETH-aligned “treasury firms” (e.g., BMNR) are significantly larger than SOL counterparts (e.g., Upexi), backed by top-tier influencers like Tom Lee. SOL’s treasury efforts are still in “catch-up mode,” meaning less firepower during turbulence. - Narrative Divide: “Financial Hub vs. Consumer/Speculation Chain”

ETH dominates the narrative around stablecoins, clearing, and compliant finance; Solana relies more on memes, launchpads, and long-tail activity to drive fees and engagement. Theme rotation directly affects on-chain fees and cash flows, making its price anchor more “floating.” - Fee Competition from Ethereum Itself

Lower fees on Ethereum’s mainnet, along with competition from BSC, Base, Sui, and others, erode Solana’s “low fee” as a unique selling point, diverting new developers and capital.

V. Q3–Q4 SOL Trend Outlook and Summary

Solana remains fundamentally a consumer-grade, high-frequency chain built on “high activity, low fees, and application monetization.” Whether it can “take off again” in Q3–Q4 hinges on whether ETFs bring compliant inflows, whether RWA can achieve scalable closure, and whether network stability continues improving.

- Base Case: Q3 enters a “transaction recovery + narrative wait” phase of oscillating recovery. On-chain activity and DEX/perpetual trading remain high, with memes cycling through pulses of activity → drawdown → reactivation. Price-wise, SOL will likely oscillate between “valuation center uplift from fundamentals” and “risk premium compression from event expectations,” trending upward with volatility.

- Bull Case: If spot ETFs are approved or enter a clear effective window around Q4, combined with formalized RWA issuance (beyond isolated MMFs, including more treasury bills, notes, funds), then SOL’s “capital gate, sustainable cash flow, and network resilience” would be simultaneously strengthened, potentially driving a sustained uptrend and breaking previous highs.

- Bear Case: If ETFs are delayed or rejected, meme/launchpad activity visibly cools, or competing L1s introduce innovative features or hot topics, it may trigger valuation anchor loosening and transaction beta collapse. Combined with macro tightening or significant fee reductions on Ethereum mainnet/L2s, SOL could enter a “high-volatility downtrend with weak rebounds” phase.

Conclusion

In 2025, Solana experienced rollercoaster-like shifts in popularity. From shining brightly amid early-year meme mania to appearing relatively dim under ETH’s aggressive pressure mid-year, market perception of Solana has repeatedly swung. Yet one thing is clear: Solana’s unique value as a high-performance public chain remains prominent, and its ecosystem hasn’t stagnated despite temporary cooling. In the long run, whether Solana can lead again depends on transforming its network speed advantage into sustained user value: retaining users after speculative waves fade, expanding application boundaries, and gaining mainstream capital trust to claim a share in the compliance race. Fortunately, signs are emerging: whether through institutional moves, tech upgrades, or narrative transformation, Solana is gathering strength. Perhaps the current pullback is merely a buildup—waiting for the right moment to take off again.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is dedicated to turning professional analysis into your practical edge. Through our “Weekly Insights” and “Deep Dive Reports,” we unpack market trends. Our exclusive “Top Picks” column (AI + expert dual screening) helps you identify promising assets and reduce trial-and-error costs. Each week, our analysts host live streams to discuss hot topics and forecast trends. We believe that warm, consistent support combined with expert guidance can help more investors navigate market cycles and seize Web3 value opportunities.

Risk Warning

Cryptocurrency markets are highly volatile, and investing inherently carries risks. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News