Hotcoin Research | When AI Learns to Trade: How the OlaXBT Project is Using AI to Redefine the Trading Experience?

TechFlow Selected TechFlow Selected

Hotcoin Research | When AI Learns to Trade: How the OlaXBT Project is Using AI to Redefine the Trading Experience?

OlaXBT boldly and ingeniously integrates artificial intelligence with blockchain quantitative trading, presenting a highly futuristic trading landscape.

1. Introduction

AI is rewriting the paradigm of crypto trading. From quant funds to on-chain strategy bots, AI is no longer just an analytical aid but is gradually becoming an independent decision-making entity. As algorithmic learning, sentiment analysis, and reinforcement learning models mature, automated trading is evolving from "passive execution" to "active insight." The recently emerged OlaXBT is not simply "AI-enhanced trading," but aims to build an AI-driven trading ecosystem capable of thinking, learning, and self-evolving. To support this experience, OlaXBT has established the AIO Nexus data infrastructure to unify and factorize multi-source on-chain and off-chain data, continuously validate and trace data through PLAP, and integrate with the MCP tool layer. On the settlement side, it introduces the x402 micro-payment layer to enable near-zero Gas proxy calls, closing the loop of "data → execution → settlement," aiming to give every investor their own AI trader.

This article provides a systematic analysis of OlaXBT from multiple dimensions—team background, token performance, core technology and functionality, tokenomics, business model, and risk assessment—exploring how it builds an open, scalable intelligent trading ecosystem at the intersection of AI and blockchain, and discussing potential directions for future decentralized smart trading. Through in-depth research on OlaXBT, we aim to offer readers a window into the evolution of AI trading and understand how AI is redefining market behavior and investment logic.

2. OlaXBT Project Background and Token Performance

OlaXBT is an AI-powered Web3 market intelligence platform. At its core is an AI agent system driven by Reinforcement Learning (RL) technology, combined with its proprietary MCP market infrastructure, providing users with tools for automated trading and strategy customization to create their own "AI traders."

Team Background: OlaXBT was launched in 2025. Its CEO, Jason, previously worked in Binance Earn’s strategy operations team. The team brings together experienced data scientists, strategists, engineers, and quantitative traders from top-tier institutions such as Binance, KuCoin, and JPMorgan Chase, along with AI researchers and blockchain architects who have driven innovation at IBM and Goldman Sachs. Their vision is to use AI + blockchain to eliminate information asymmetry, allowing ordinary investors to “sleep soundly” even amid extreme market volatility.

Funding and Partnerships: In July 2025, OlaXBT announced a $3.38 million seed round led by Amber Group, with participation from notable institutions including DWF Ventures, Mindfulness Capital, Web3Labs.club, and Credit Scend. The funds will be primarily used to accelerate AI model development, expand the MCP server marketplace, and enhance user engagement through features like "chat-to-earn" trading terminals. Additionally, OlaXBT actively embraces community collaboration, establishing strategic partnerships with communities such as AB DAO to attract top developers and users, continuously expanding its influence in DeFi and quantitative trading.

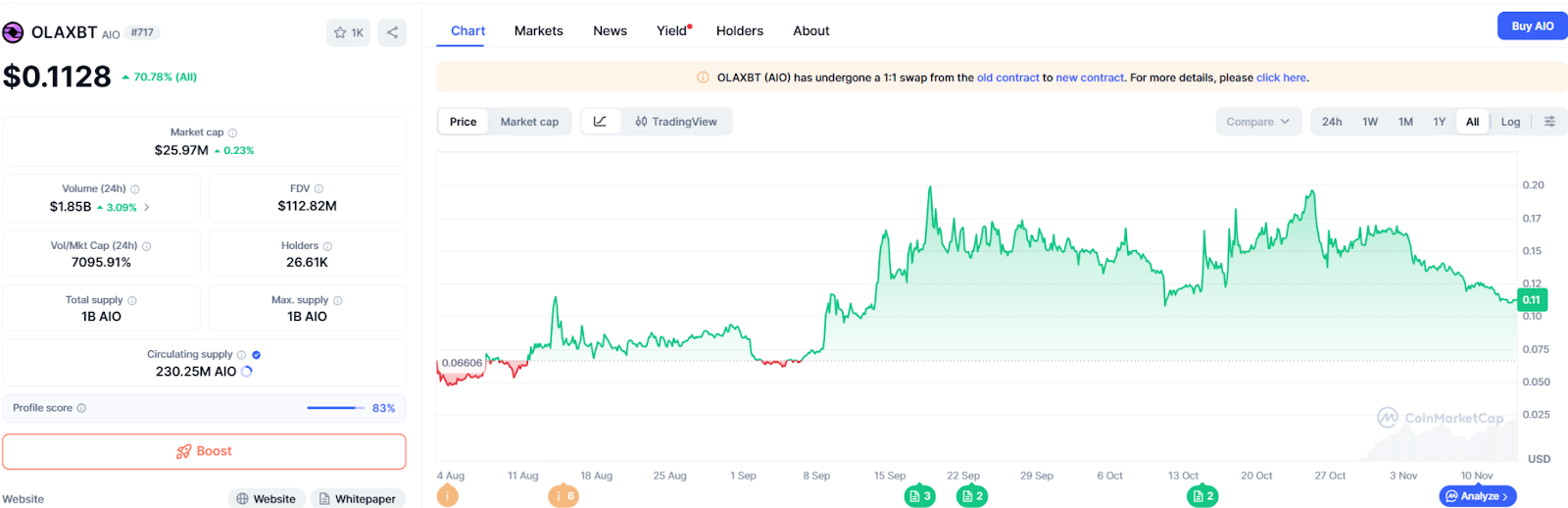

AIO Token Performance: OlaXBT launched in early August 2025. The AIO token has been listed on major exchanges including Binance Alpha, Hotcoin, Gate, Bitget, and MEXC. Although the AIO token theft incident on September 1 caused some FUD within the community, the OlaXBT team responded swiftly by replacing the token contract, minimizing the negative impact. Market cap has shown a steady upward trend. As of November 13, AIO's circulating market cap was approximately $26 million, ranking #717 on CoinMarketCap.

Source: https://coinmarketcap.com/currencies/olaxbt/

3. OlaXBT Core Technology and Features

This chapter focuses on OlaXBT’s three-layer architecture—"data–execution–settlement"—and its derived functionalities. AIO Nexus unifies and factors multi-source data, delivering verifiable and reusable "factor streams"; MCP standardizes external tools and cross-chain calls, giving Agents low-friction execution power; x402 enables per-use settlement and gasless experiences for data/calls, forming a billable machine economy loop.

Core Technology Overview

AIO Nexus: OlaXBT uses AIO Nexus to parallel ingest multi-source data—including on-chain ledgers, CEX/market feeds, macroeconomic indicators, and social sentiment—and applies normalization → factorization to generate atomic, pattern-locked Factor Libraries. These are directly accessible by Agents via low-latency, standardized interfaces. Each factor includes timestamps, source chains, variance/uncertainty metrics, and cryptographic provenance, enabling easy composition, reuse, and auditing. To ensure data credibility, Nexus implements PLAP (Proctor-LLM Attestation Protocol): using multi-agent probing, LLM-based semantic anomaly detection, and RL scheduling to continuously score and provide on-chain proofs (including ZK proofs and auditable trails) for data and signal quality. This ensures that inputs to "strategies/protocols/Agents" are verifiable and Sybil-resistant, reducing risks from noise or manipulation.

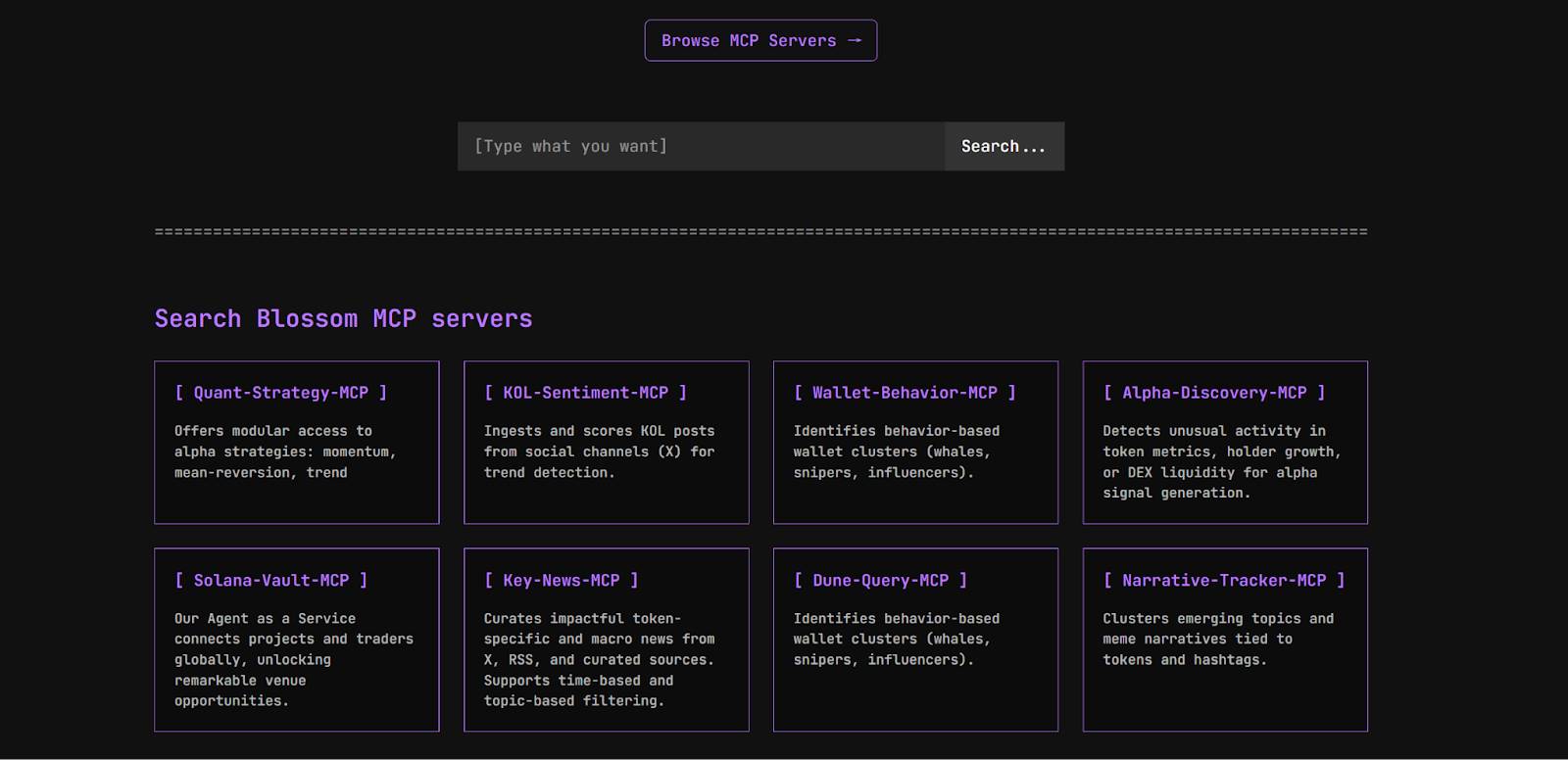

MCP Technology: MCP stands for Model Context Protocol, serving as a standardized interface between AI agents and blockchain environments or external tools—akin to a "universal plugin" in AI. Based on MCP, OlaXBT has developed a series of modules and servers enabling AI agents to easily invoke various tools and data. For example, the Dune Query MCP seamlessly delivers query results from the popular on-chain analytics platform Dune Analytics to AI agents, allowing natural language queries for on-chain metrics; the KOL Sentiment MCP leverages Masa AI’s semantic retrieval API to scrape and analyze social content from key crypto influencers, extracting trending topics and quantifying sentiment trends; the Solana Vault MCP allows AI to securely interact with Solana wallets via protocol-level interfaces without exposing private keys.

Source:https://olaxbt.xyz/

x402 Micro-Payment / Settlement Layer: OlaXBT introduces x402 as a micro-payment/settlement layer. Each data endpoint can implement "microtransaction gating," where developers or Agents pay per use for accessing factors/APIs—ideal for high-frequency, fine-grained data consumption. AIO Nexus has integrated x402 on BNB Chain and leveraged EIP-2612 to achieve "Gasless" operations (one-time signature, subsequent proxy calls without Gas), nearly eliminating friction for Agent data reads and strategy executions. This enables automatic backend settlement of the "Agent ↔ data" economic loop, unlocking the full potential of Agent-to-Agent and Agent-to-API machine economies.

Main Features and Use Cases

Chat Interaction & "Chat to Earn": OlaXBT offers users an intuitive conversational trading terminal. Users interact with OlaXBT’s AI assistant via a chatbot-like interface to request analyses or issue trading commands. For instance, entering "$BTC trend analysis" or asking "Is now a good time to buy $SOL?" triggers instant technical analysis, price trend insights, and market sentiment interpretation from the AI, complete with generated charts and signals. The platform synthesizes multidimensional factors—price movements, on-chain data, liquidity, social rumors—into a "Trend Score" (ranging from "extremely bullish" to "extremely bearish") to help users quickly assess market direction.

OlaXBT also introduces "Chat to Earn" to incentivize usage. Users earn platform credits during chat interactions, and upgrading to paid Core Pro or Core Ultra memberships unlocks additional benefits. Credits can be redeemed for premium AI trading tools such as deep market analysis, whale tracking, and professional quantitative signals.

Source: https://olaxbt.xyz/

Agent System & Customization:OlaXBT provides a no-code intelligent agent builder. With modular components such as MCP tools (e.g., market data APIs, KOL sentiment analyzers, Solana wallet operators) and strategy blocks, users can customize logic without coding. For example, you could create an agent that scans Twitter daily for sentiment shifts from specific KOLs and monitors large on-chain transfers of a token, automatically executing a buy order from your vault when positive sentiment coincides with whale accumulation. OlaXBT encapsulates these complex workflows into simple interfaces, enabling non-technical users to build sophisticated quant systems.

MCP Space & Agent Marketplace: OlaXBT plans to launch MCP Space (Model Protocol Space) and Agent Space, creating a decentralized AI agent marketplace. Developers and quant teams can publish new MCP modules or servers (e.g., integrating more data sources or blockchains) for universal access by all AI agents, enabling plug-and-play extensibility. Agent Space will serve as a marketplace for trading and monetizing agent strategies: skilled AI strategy developers can list their agents, while others can subscribe, copy, or rent them for automated trading, with creators earning revenue shares in tokens. This mechanism aims to stimulate continuous community innovation, forming an "App Store for AI agents." The official states that the MCP Marketplace will promote agent transactions and revenue monetization, introducing healthy competition and shared-profit models to the ecosystem.

Automated Vaults: Another key upcoming feature is on-chain Automated Trading Vaults. Users can deposit funds into AI-managed vaults for custodial quant trading. Strategies cover market-making, arbitrage, and risk management. For example, some Vaults use AI to place two-sided orders and earn fees and spreads; others dynamically adjust positions to chase trends or conduct cross-platform arbitrage. In the future, users may simply select a preferred AI vault strategy and deposit funds to enjoy "hands-off" quant returns, with AI automatically monitoring markets, placing orders, and managing take-profits and stop-losses—enabling truly intelligent wealth management. However, this also demands higher standards for the stability and security of the platform’s AI strategies.

Overall, OlaXBT uses AIO Nexus to ensure data quality and composability, MCP to connect tools and on-chain execution, and x402 to transform "data/calls" into sustainable micro-payment revenue, culminating in a complete user experience across chat terminals, no-code agents, agent/tool markets, and automated vaults. It advances AI trading from merely "usable" to a verifiable, scalable, and monetizable system.

4. OlaXBT Tokenomics and Business Model

As a platform serving both users and developers, OlaXBT’s tokenomics and business model are designed to balance ecosystem growth, user incentives, and long-term sustainability:

Source:https://olaxbt-docs.gitbook.io/

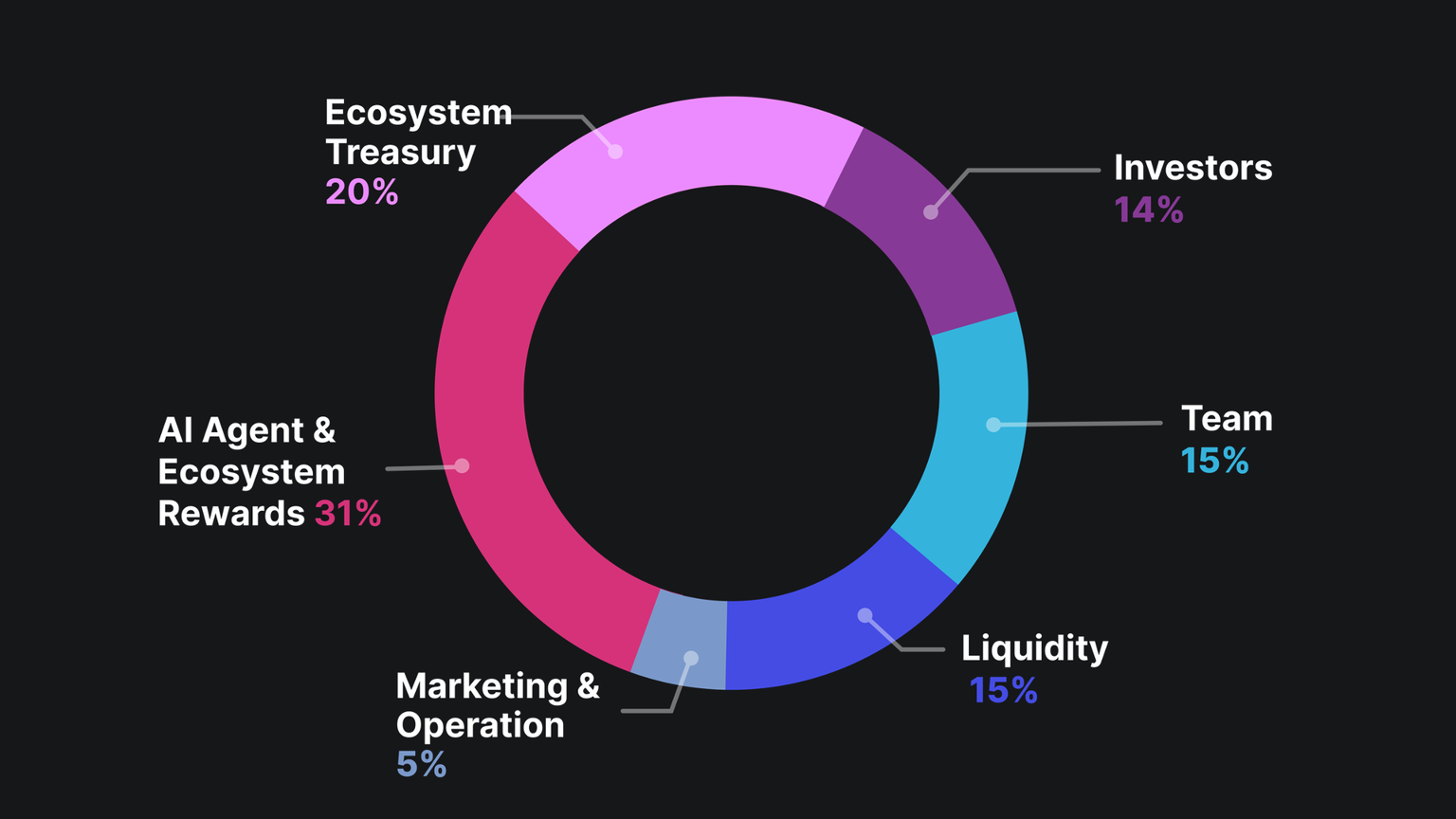

1. Token Distribution: OlaXBT’s native token AIO has a total supply of 1 billion. The distribution heavily emphasizes community and ecosystem development, allocating 71% to ecosystem and user incentives, with the remaining 29% to initial contributors and investors. Specifically:

- Ecosystem & Community (71%): 31% allocated to AI agent and ecosystem rewards for daily user incentives (e.g., chat mining, strategy rewards); 15% for liquidity, fully released at launch to support trading pairs; 20% reserved for ecosystem treasury to fund future expansion and strategic opportunities; 5% for marketing and operations, including partnership promotions and event rewards.

- Team & Investors (29%):Team allocation accounts for 15%, investors 14%. These tokens have a 12-month cliff followed by 24-month linear vesting, aligning long-term interests of the team and early investors while avoiding premature sell-offs.

Overall, the token distribution balances strong community focus with incentives for core contributors, encouraging user participation and retention. Strict vesting schedules also signal the team’s commitment to long-term development.

2. Unlock Schedule & Inflation: According to the release plan, aside from the one-time liquidity release, most tokens will unlock gradually over the next 2–3 years. Of the 31% allocated to ecosystem rewards, 21.85% were released at TGE for early airdrops and incentives, with the remainder distributed linearly over 36 months. If user growth and demand keep pace, inflationary pressure from increased supply can be offset; otherwise, price depreciation risks arise. Thus, the project must sustain operations and growth to support token value.

3. Token Utility & Value Capture: AIO serves as the platform’s utility token, with value captured through multiple practical uses:

- Payment Medium:AIO is the payment token for using MCP servers, AI tools, and agent services. Users pay fees in AIO for advanced functions, and receive discounts (e.g., reduced API call fees), encouraging frequent usage.

- Access Credential:Holding a certain amount of AIO grants access to premium features. For example, only users who hold/stake sufficient AIO can use the Agent Vault smart vault function or unlock advanced liquidity management and quant strategy libraries. Similarly, becoming a Core Pro/Ultra member requires purchasing or staking AIO to gain faster data access and airdrop rights.

- Rewards & Incentives:The platform distributes AIO rewards for various user interactions. Data contributions and chat activities earn token incentives. Additionally, events like Binance Alpha trading competitions and platform staking mining encourage AIO airdrops, creating a positive feedback loop between users and the platform.

- Unlock Advanced Features:AIO holders can unlock premium trading signals and analytical tools. Accessing more accurate alpha signals or exclusive strategy reports on the OlaXBT terminal may require holding a minimum token balance. Publishing new AI agents or customizing private agents on the marketplace may require burning AIO as deployment fees or collateral.

- Governance & Voting:The team plans to introduce DAO governance, where AIO may be used for community voting on matters such as new token listings and strategy approvals, giving token holders decision-making power.

4. Revenue Streams: The platform’s main potential income sources include:

- Tool & Data Service Fees: OlaXBT offers free basic access to MCP servers, AI toolkits, and basic strategy signals, but deeper usage incurs fees or token payments. For example, calling certain advanced MCP interfaces or real-time high-speed data queries may be charged per request based on volume and latency. Professional users needing faster, customized data services can upgrade permissions by staking AIO or purchasing premium packages. This SaaS-like model enables monetization through tiered access and real-time pricing.

- Vault & Trading Revenue Sharing: For Automated Vaults, the platform may charge a performance fee or management fee based on returns. When user funds generate profits in vaults, the platform and strategy providers share revenue according to predefined mechanisms. This incentivizes better strategies and creates value for token holders.

- Agent Marketplace Revenue: In the Agent Marketplace, the platform earns commissions when users purchase/rent top-performing AI agent strategies or delegate copy trades. Additionally, community developers monetizing their strategies may share revenues with the platform or token holders per protocol terms.

- Token Issuance & Ecosystem Fund: The AIO token itself provides funding and operational capital. The reserved 20% ecosystem treasury tokens will be used for future partnerships and ecosystem investments. As the project grows, appreciation of the ecosystem fund supports long-term operations.

Through these mechanisms, the AIO token becomes a nexus linking users, developers, and the platform, enabling a "use → earn → use" cycle. Reports indicate that the OlaXBT team also plans to distribute profits from protocol enhancements and collaborative optimizations back to the ecosystem, further enhancing token value.

5. OlaXBT Project Risk Assessment

As an innovative AI quant project, OlaXBT rides the wave of AI + Crypto but faces multiple challenges including security, market dynamics, competition, and regulation.

1. Security & Trust Risks: On September 1, 2025, OlaXBT suffered a major security incident: approximately 32 million AIO tokens were abnormally withdrawn from the project’s multisig wallet and dumped for over $2 million, shaking the community and causing a sharp drop in token price. The team responded urgently by coordinating with Binance Alpha, Bitget, Hotcoin, and other major platforms to suspend AIO trading and issuing a 1:1 token swap under a new contract to neutralize the stolen supply. While technically resolved and protecting legitimate holders, the incident severely tested the team’s security management and credibility. Community skepticism arose, questioning whether the multisig breach stemmed from internal mismanagement. Moving forward, the team must strengthen smart contract audits, private key management, and risk monitoring to establish transparent and trustworthy security protocols to regain and solidify investor confidence.

2. Market Risk & Strategy Effectiveness: The crypto market is highly complex and volatile. AI models face challenges such as historical overfitting and difficulty predicting black swan events. OlaXBT’s AI signals and automated trading strategies do not guarantee profitability. Additionally, beware of the "automation trap": homogeneous models leading to herd behavior, or overreliance on bots potentially triggering collective panic during extreme conditions. For retail investors, blindly trusting AI without considering personal risk tolerance may lead to consecutive losses and negative public sentiment.

3. Industry Competition & Substitution Risk: AI + crypto trading is becoming a hot sector. Traditional quant funds and exchanges are rapidly developing their own smart trading tools—for example, major exchanges launching built-in AI advisors, or established quant firms rolling out open strategy platforms. Moreover, players like Numerai, ChainGPT, and even ChatGPT plugins are entering crypto trading. OlaXBT must maintain technological iteration and user growth momentum to avoid being overshadowed. Building brand moats and network effects will be critical for long-term success.

4. Compliance & Regulatory Risk: Although OlaXBT is fundamentally a decentralized platform, its offerings—such as automated trading and asset management—may resemble regulated financial advisory or asset management services in certain jurisdictions. This could trigger licensing requirements or regulatory scrutiny. The U.S. SEC has not yet clarified whether quant bots offering investment advice qualify as regulated investment advisors. Should regulations tighten, the project will need to establish legal compliance teams and proactively engage regulators.

5. Ecosystem Growth Risk: OlaXBT’s design heavily depends on a thriving ecosystem: sufficient user chats to train models, developer contributions to enrich the MCP marketplace, and capital inflows to validate automated vault performance. Low participation could trap the project in a "cold start" dilemma. Currently, community热度is moderate, but sustained retention and activation require long-term efforts. If market volatility or project progress falls short of expectations, the AIO token may face significant downside pressure.

6. Conclusion and Outlook

As global AI momentum continues, AI applications in crypto trading are only beginning. In the coming years, AI-driven quant trading is poised to become one of the fastest-growing sectors in crypto, with demand for intelligent trading assistants multiplying. As an early mover in this space, if OlaXBT can successfully validate its model and build user trust, it has the potential to emerge as a leading pioneer in AI-powered crypto trading.

According to the official product roadmap, OlaXBT has clear version milestones in the coming quarters: near-term launches include practical token utilities such as prompt-based trading signals and personalized chat with wallet binding; mid-term focuses on deepening user stickiness with multimedia market insights, KOL Echo functionality, and VIP tiers; plans to expand data monetization include behavioral coaching, airdrop matching, and market sentiment exposure metrics for user portfolios. In 2026, it aims to roll out Quant Vaults, De-Voting, and multi-agent collaborative teams. Long-term ambitions target enterprise services: integrating real-world economic data to enrich AI training, launching an Airdrop Amplifier for precise project marketing, a GTM Agent to help new projects quickly gain liquidity and users, and a Risk Sentinel to provide portfolio risk alerts for institutions. This demonstrates a long-term vision and continuous expansion into new application scenarios.

In summary, OlaXBT boldly and ingeniously integrates artificial intelligence with blockchain-based quant trading, presenting a futuristic vision of trading. With a robust technical foundation and rich product innovation, it has the potential to redefine how ordinary investors participate in crypto markets: the future may no longer involve humans staring at screens, but rather everyone having an AI trading assistant fluent in on-chain data, market sentiment, and automated execution. For retail investors, OlaXBT is worth approaching with an open mind for experimentation and observation.

About Us

TechFlow Research, as the core research arm of TechFlow Exchange, is dedicated to transforming professional analysis into your practical edge. Through our "Weekly Insights" and "Deep Research Reports," we dissect market trends. Leveraging our exclusive column "Top Picks" (AI + expert dual screening), we identify high-potential assets and reduce your trial-and-error costs. Every week, our analysts host live sessions to explain hot topics and forecast trends. We believe that warm, guided support paired with professional insights can help more investors navigate market cycles and capture Web3’s value opportunities.

Risk Disclaimer

Cryptocurrency markets are highly volatile, and investing inherently carries risk. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to safeguard capital.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News