Q4 Outlook: Cancun Upgrade, RWA, and Gaming Investment Logic Explained

TechFlow Selected TechFlow Selected

Q4 Outlook: Cancun Upgrade, RWA, and Gaming Investment Logic Explained

This article will analyze potential investment-worthy crypto assets from three aspects: the Cancun upgrade, RWA, and gaming.

Let's talk about the tokens I'm currently watching and positioning in.

Cancun Upgrade

The Cancun upgrade is the most important narrative recently. Major narratives often bring significant emotional sentiment and traffic concentration (not driven by technical changes leading to price movements). However, since no specific timeline has been announced for Cancun yet, there hasn't been a coordinated market reaction. Based on current progress, devnet9 could very well be the final testnet, after which comes the public testnet phase. Alternatively, devnet9 might just be a short-term testnet, with devnet10 potentially being the last one.

During the public testnet phase, the likelihood increases that a concrete date (block height) for the official Cancun upgrade will be announced. However, such an announcement likely won’t come until mid-October or November.

The primary beneficiaries of the Cancun upgrade are Layer2 projects: Arbitrum, Optimism, and Metis—which recently announced potential positive developments (Metis plans to become Ethereum’s first decentralized L2 this year, enabling its community to take over key centralized components)—along with other Layer2 solutions. Mantle is also pushing network growth, though $MNT has shown lackluster performance so far. The Cancun upgrade could also benefit Coinbase's stock price.

Beyond direct Layer2 tokens, sentiment may spill over into protocols built on these Layer2s. On Arbitrum, my top pick is $GMX. On Optimism, $VELO seems unlikely to deliver, mainly due to high inflation and a weak ecosystem; $SNX might be a better alternative. But if I had to choose only one asset across these ecosystems, I’d go with $GMX.

Why?

Two main reasons:

First, optimism about the future development of the Arbitrum ecosystem and GMX’s continued growth as a leading protocol (GMX even appears in tasks within the Odyssey campaign);

Second, bullish outlook on future volatility (slowing pace of liquidity contraction).

Let me elaborate on the first point.

Recently, Arbitrum passed a proposal allocating 50 million $ARB as a grant fund for ecosystem protocols. GMX will surely receive a portion of this. The key question is whether GMX will use $ARB incentives to accelerate the adoption of v2. With additional incentives from GMX itself, and decreasing airdrop expectations/incentives from other protocols, there’s real potential for a comeback.

Also, personally, I don’t see the 50M $ARB distribution as a concern—in fact, it lightens the load and could actually be beneficial for $ARB (depends on how deep you want to go in analysis).

GMX v2 has clear pros and cons. The drawbacks include being less friendly to large capital, fragmented liquidity, and incomplete support for long-tail assets. On the flip side, v2 offers lower fees, better composability, and higher capital efficiency. Overall, while market expectations for GMX v2 remain muted, the upgrades directly address prior issues—so it’s still a net positive.

In short, choosing $GMX is a bet on an upcoming reversal of sentiment.

A few extra thoughts on Arbitrum. I’m quite positive about what they’ve been doing lately—for example, collaborating with Espresso Systems to explore shared sequencer solutions; launching XAI (a Layer3) to boost gaming sector development (gaming may experience a small breakout not too far ahead, as mentioned later); Offchain Labs’ co-founder also stated gaming is one of Arbitrum’s growth areas. Arbitrum introduced Stylus, allowing developers to build applications on Arbitrum Nitro using traditional EVM tools and WASM-compatible languages like Rust, C, and C++. Also, Arbitrum has restarted the Odyssey campaign—though honestly, it doesn’t offer real rewards or airdrops, only badges, so it might need to be paired with the 50M $ARB incentive program for full effect.

That said, all these are technical improvements—their impact on price remains subject to market response.

RWA

FXS

$FXS is a token with strong market expectations, but also a difficult one to trade. Although it previously attracted widespread attention through its Lend module mechanism, today its price has fallen back to levels seen during the Curve incident.

In my view, $FXS won’t sustain a continuous uptrend—its price movement this cycle will rely solely on short-term expectations from new products. Future catalysts include: frxETH v2 (lending model for node operators), Frax v3, FPI (Coinbase CEO believes "Flatcoins"—stablecoins pegged to inflation rates—will be the next generation of stablecoins), sFRAX (and FXB, RWA), Fraxchain, frxBTC (? questionable, harder to implement, but appears on the team roadmap), among others.

From the perspective of fundamental transformation, perhaps only sFRAX (if FraxDAO proves more organized than MakerDAO in governance) could reverse $FXS’s downward trend and drive growth in its stablecoin supply and positive revenue streams. I’ll be closely monitoring this development.

Overall, Frax has too many overlapping product lines and complex dependencies, making sustainable price appreciation unlikely—especially given FRAX supply contraction, declining FraxBP TVL, and sluggish frxETH growth.

In the RWA space, I’m also watching $MKR and $CFG. I believe $MKR has potential to test $1,600 (pre-split, it might even temporarily surpass ETH in price). From a DeFi blue-chip perspective, I’d also consider $AAVE. Currently, $AAVE is actively working to resolve $GHO depegging issues (though depegging doesn’t directly affect $AAVE’s token price).

Gaming

Web3 gaming will be my primary focus area in Q4. Let’s discuss a few gaming-related tokens.

Gas Hero

I’m paying attention to Gas Hero largely because of its developer, Stepn, who have invested effort in marketing and generating early hype—making it worth watching.

Judging from the whitepaper, Gas Hero doesn’t show clear advantages over other Web3 games, nor does its gameplay introduce much novelty—idle game + Ponzi mechanics. Since details on earning mechanisms for players haven’t been released yet, I can’t determine whether the game can sustain interest via a Ponzi model. Additionally, $GMT’s secondary market dynamics are already complicated. Building a trading strategy purely around Gas Hero’s $GMT consumption doesn’t seem solid.

Prime

Parallel is one of my favorite blockchain games. Despite some imbalance in game design, the overall production quality (evident from budget and team size) is solid. It’s a card battle game similar to Hearthstone, with card collection mechanics akin to Magic: The Gathering.

Most importantly, $PRIME is deeply embedded into the game economy. For instance, each NFT card gains reputation through gameplay, and once enough reputation is accumulated, players can spend PRIME to mint Echo (phantom) cards. The amount of PRIME required scales dynamically based on demand (e.g., popular NFT cards require more PRIME to clone). This allows players to avoid buying expensive original cards and instead obtain replicas via PRIME/ETH. As more players join, demand for $PRIME grows, creating a flywheel effect.

However, investing in $PRIME requires a long time horizon, so entry timing is crucial.

MC

Merit Circle’s major move is rebranding $MC to $BEAM and executing a 1:100 split. Beam is built on an Avalanche subnet. Merit Circle claims Beam has “a robust network of over 60 partner games, dozens of contributors, developers, tools, and investors.”

GHST

The Aavegotchi chain launch is imminent. While the team claimed a testnet release in September, we’re nearly at month-end with no update. That said, judging from interactions between the team and Polygon, they’re actively pushing forward (including launching the Game Center). The main issue remains slow execution speed.

Others

LINK

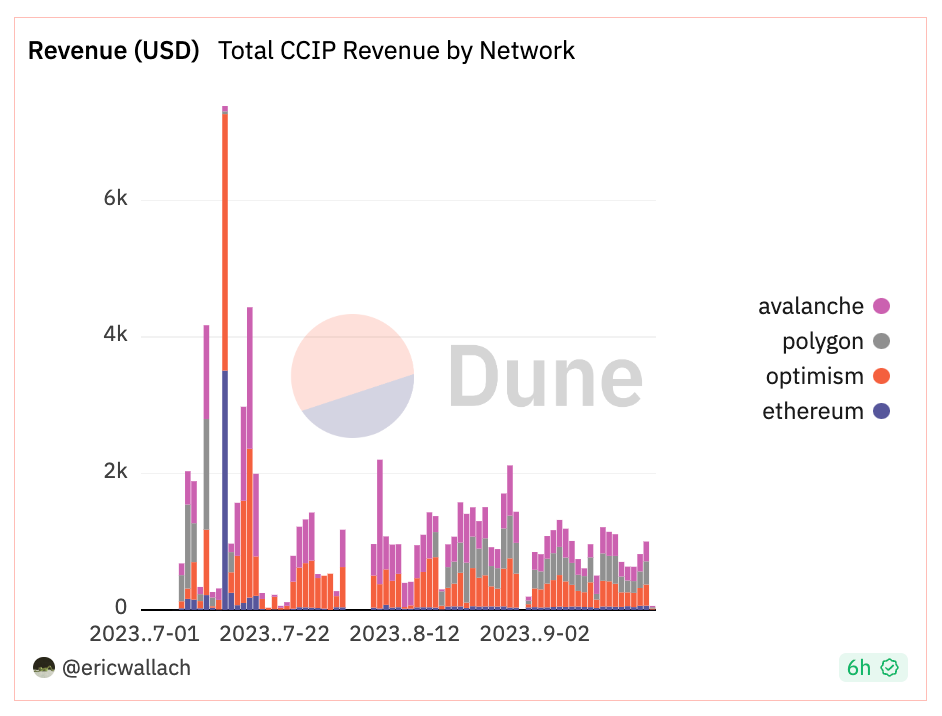

My view on $LINK draws heavily from current price trends and insights from @jyosamson. Xiu believes Chainlink holds Smartcon annually on October 2nd, where major announcements may occur. Secondly, $LINK’s price is closely tied to CCIP revenue, which currently shows no standout performance (partly due to overall low on-chain activity).

SOL

I’m watching $SOL because Solana has been active in hackathons lately, and many Western KOLs and media outlets are vocal about it. Judging from their generous hackathon funding, the Solana Foundation appears well-capitalized. However, this doesn’t directly correlate with $SOL’s price. More impactful is FTX’s potential sell-off. It’s confirmed that FTX’s $SOL holdings are mostly investment shares rather than fully liquid tokens, so their market impact is less severe than feared.

One last note: In this article, the logic behind each token varies in strength—be sure to read carefully.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News