2025 CEX Token Listing Landscape: 2,147 Projects Listed, Trading Volume Plummets 55%; Who’s Reaping Profits, and Who’s Just Along for the Ride?

TechFlow Selected TechFlow Selected

2025 CEX Token Listing Landscape: 2,147 Projects Listed, Trading Volume Plummets 55%; Who’s Reaping Profits, and Who’s Just Along for the Ride?

Decoding the 2025 CEX Token Listing Strategy: Insights into Valuation Distribution, Listing Timing, and Sector Rotation Logic

Author: OpenWorld

Compiled by: TechFlow

TechFlow Introduction: 2025 was a year of profound upheaval for the crypto market. This annual report by OpenWorld provides an in-depth retrospective of listing activities across major centralized exchanges (CEXs) throughout the year, backed by comprehensive data. Among 2,147 listings, which sectors were most favored? And how did market liquidity shift dramatically after Bitcoin (BTC) fell below $100,000 in October?

How do the listing strategies of top-tier exchanges—collectively referred to as “BCOBB” (Binance, Coinbase, OKX, Bybit, Bitget)—compare and contrast? This article decodes the CEX listing playbook for 2025, revealing insights into valuation distribution, optimal listing timing, and sector rotation logic—a must-read guide to understanding current secondary-market listing barriers.

Full Text Below:

Key CEX Listing Insights

- A total of 2,147 listings were recorded in 2025: Across the major exchanges we monitored, primary listings accounted for 65%.

- Most CEXs experienced negative growth in 2025: Kucoin was the only exchange showing positive growth.

- Trading volume contracted alongside falling BTC prices: Since BTC dropped below $100,000 in October 2025, market trading activity and investor sentiment were both dampened, leading to declining volumes.

- The top-tier “BCOBB” exchanges collectively listed 678 tokens: Of these, 71% were primary listings; Bitget alone accounted for roughly half.

- High-quality AAA-tier Token Generation Events (TGEs) achieved notable success: 150 tokens launched simultaneously on two or more of the “Big 5” exchanges.

- FDV (Fully Diluted Valuation) distribution: Most tokens launched with FDVs concentrated between $101 million and $500 million.

Listing Updates: Monthly YoY Overview

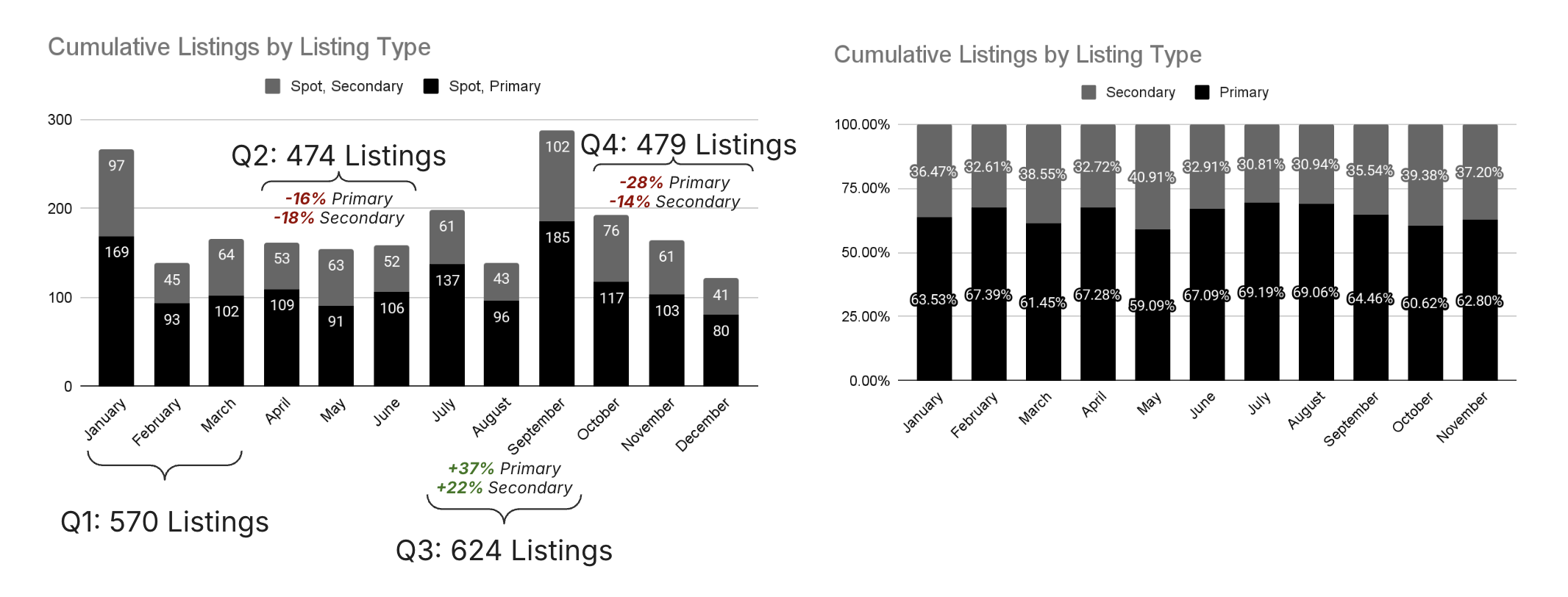

In 2025, our monitored major exchanges recorded a total of 2,147 listings. The fourth quarter saw 479 listings, representing a ~23% decline from Q3, a slight ~1% increase from Q2, and a ~16% drop from Q1.

Graded Snapshot: Comprehensive Overview

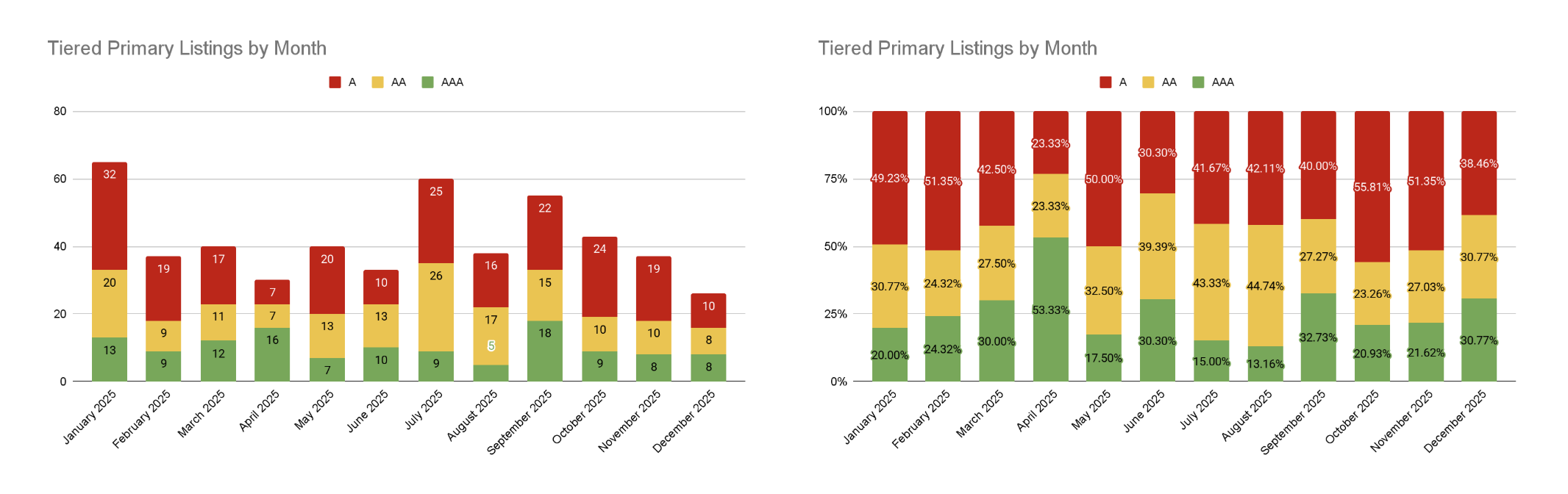

AAA-tier token listings rose in Q1 and Q4, while quality fluctuated sharply—and varied significantly—during Q2 and Q3.

Note: AAA-tier tokens are those listed on two or more BCOBB exchanges; AA-tier tokens are listed on exactly one BCOBB exchange; A-tier tokens refer to all others not listed on any BCOBB exchange.

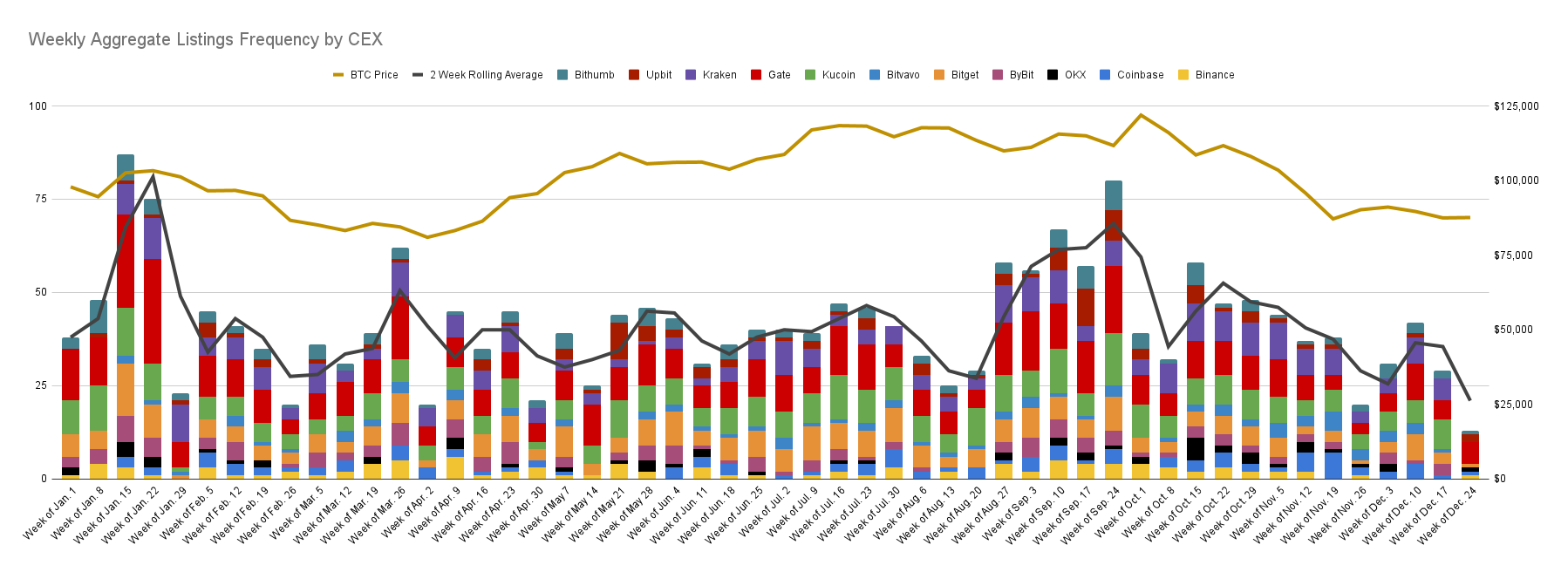

Listing Updates: Year-to-Date (YTD) Weekly YoY Overview

Weekly listing counts remained relatively stable until early October. However, the altcoin crash on October 10 materially altered the frequency of new token launches.

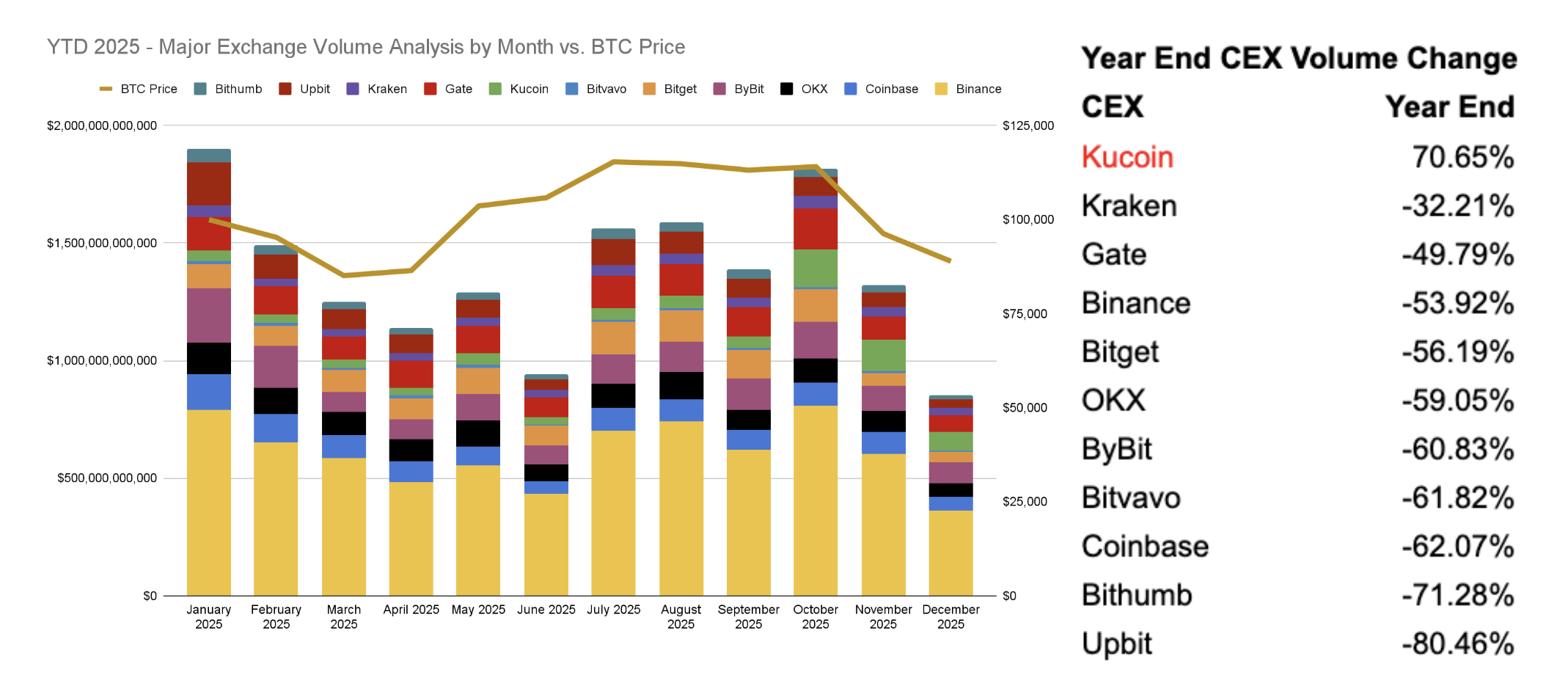

Exchange Trading Volume Snapshot: Monthly YoY Analysis

Following the liquidation event on October 10, 2025, trading volumes across major mainstream CEXs plunged sharply in Q4. By year-end, global cryptocurrency trading volume had declined by ~55%, while BTC’s price remained relatively stable over the full 12-month period.

BCOBB Snapshot (Binance, Coinbase, OKX, Bybit, Bitget): Summary

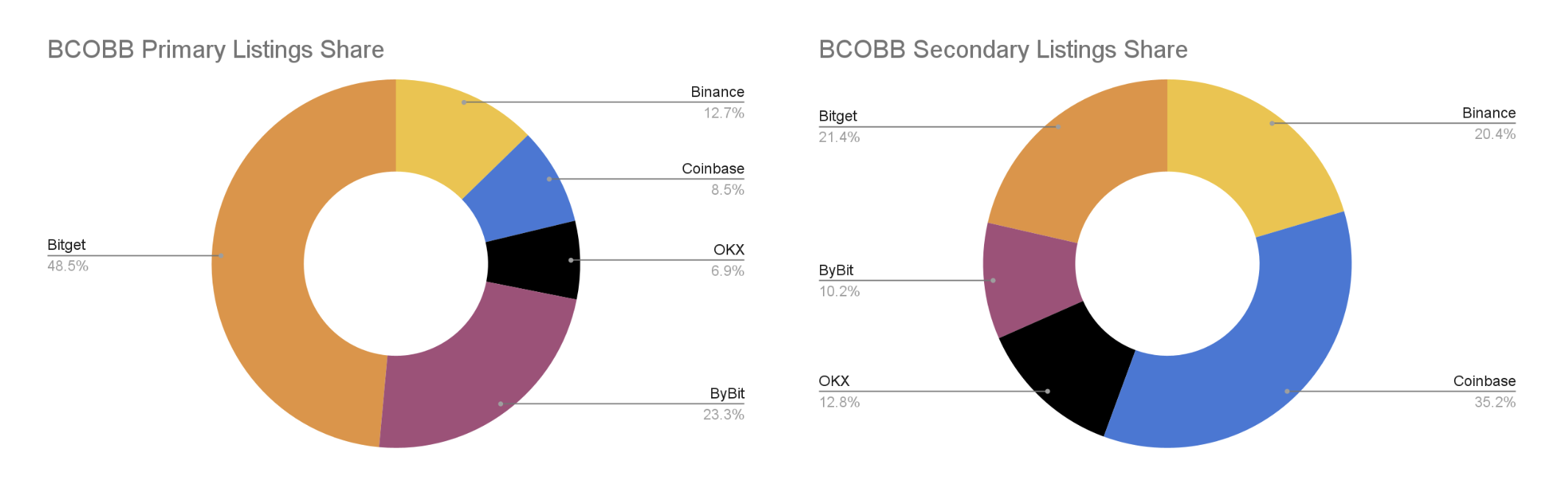

Across the “Big 5” (BCOBB) exchanges, there were 678 listings in 2025. Of these, 479 were primary spot listings—meaning ~71% were primary. A total of 150 tokens were cross-listed on two or more of the Big 5 exchanges.

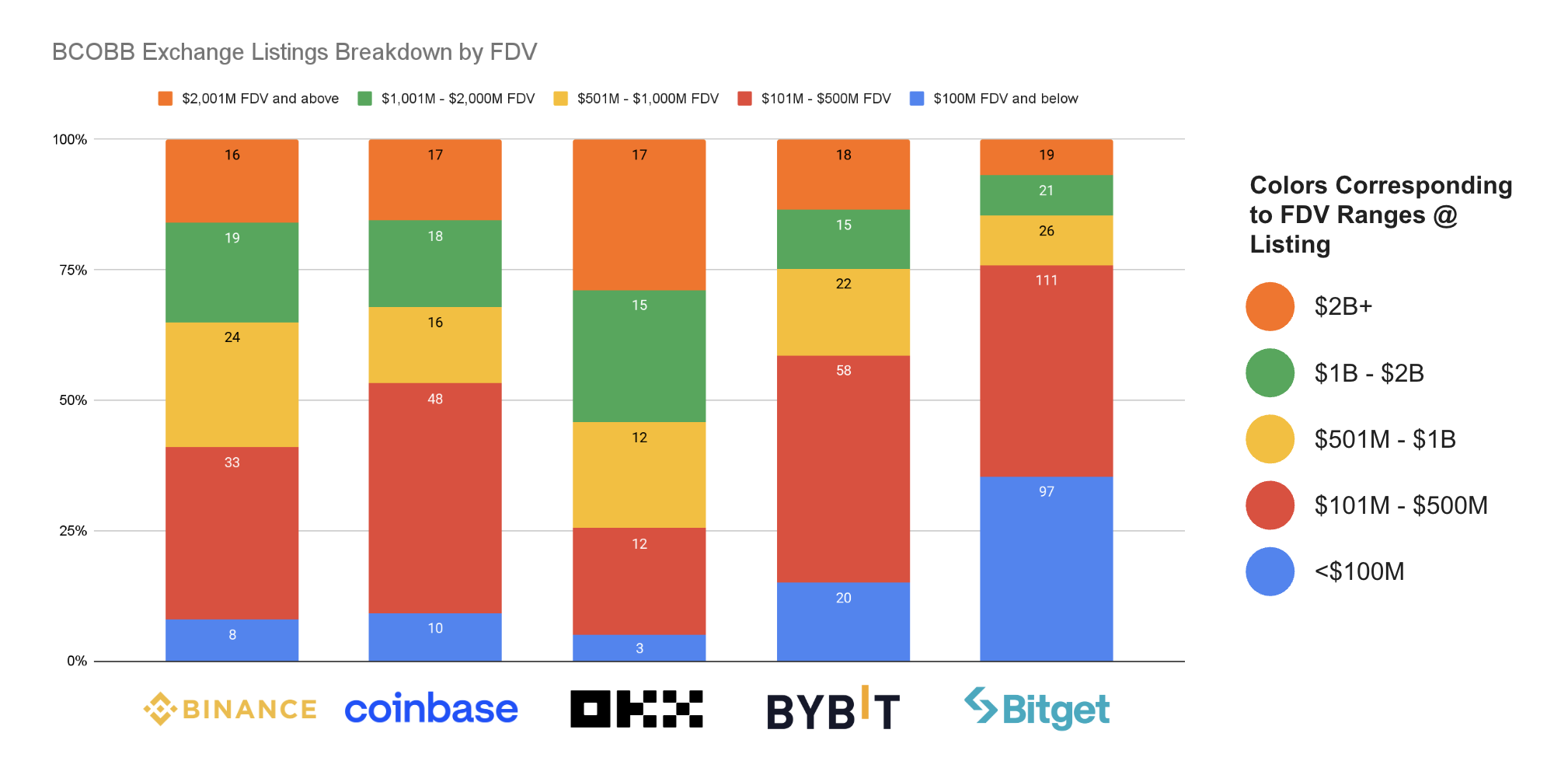

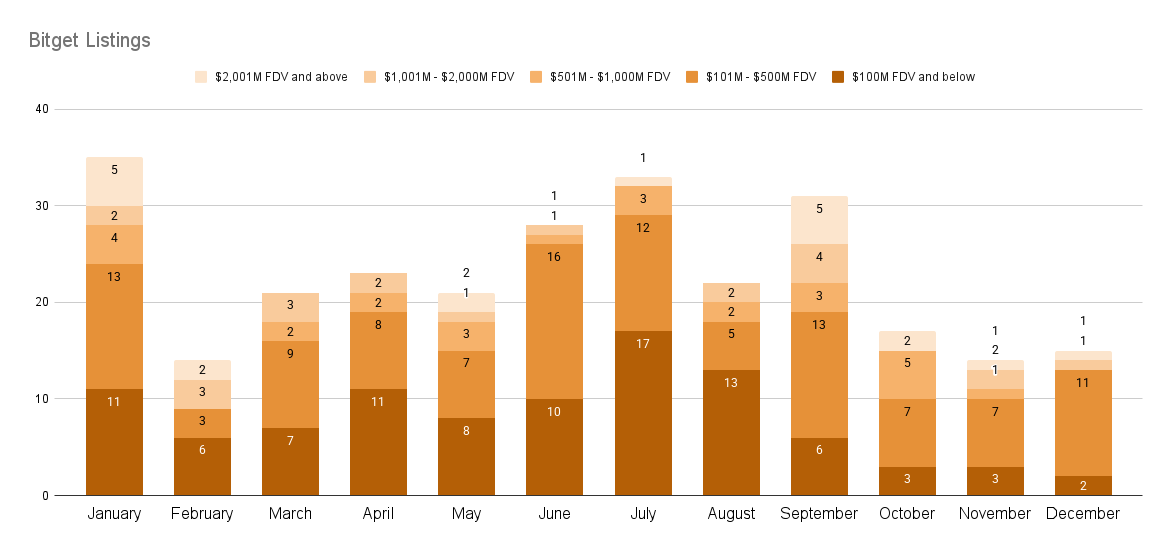

BCOBB Snapshot: FDV Distribution at Listing

In 2025, tokens listed on all major CEXs spanned all five FDV bands. The densest concentration fell within the $101 million–$500 million range, highlighting strong market interest in lower-valuation projects.

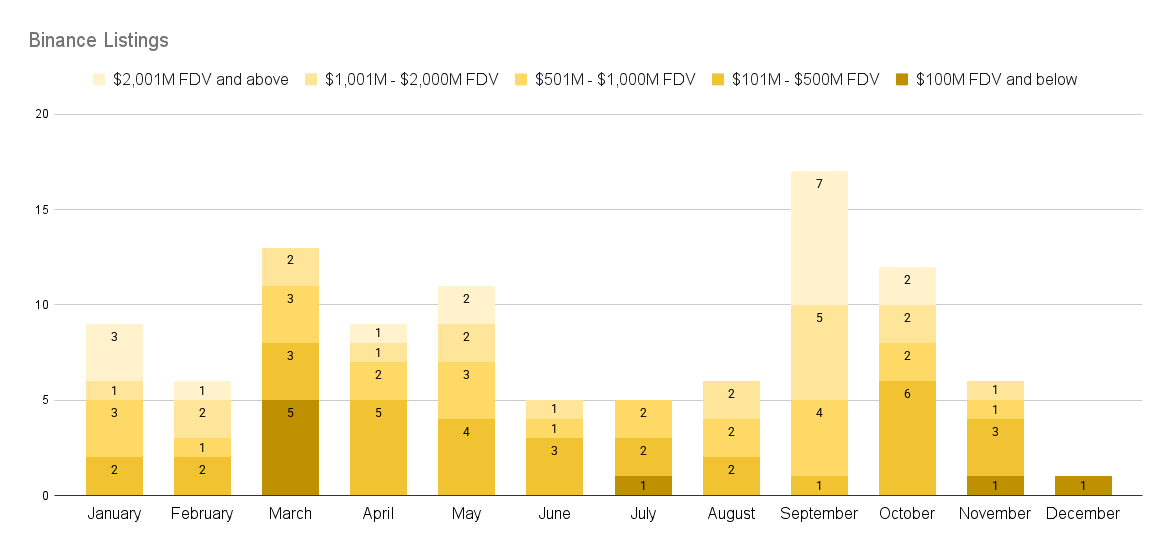

BCOBB Snapshot: Binance

Binance listed tokens spanning all five FDV bands in 2025.

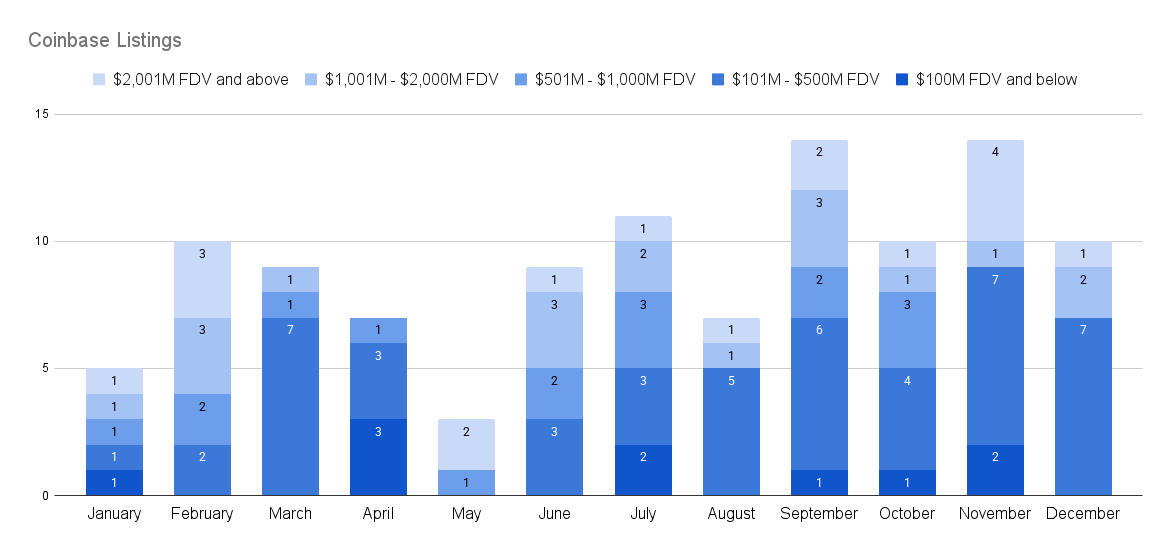

BCOBB Snapshot: Coinbase

Coinbase also listed tokens across all five FDV bands in 2025.

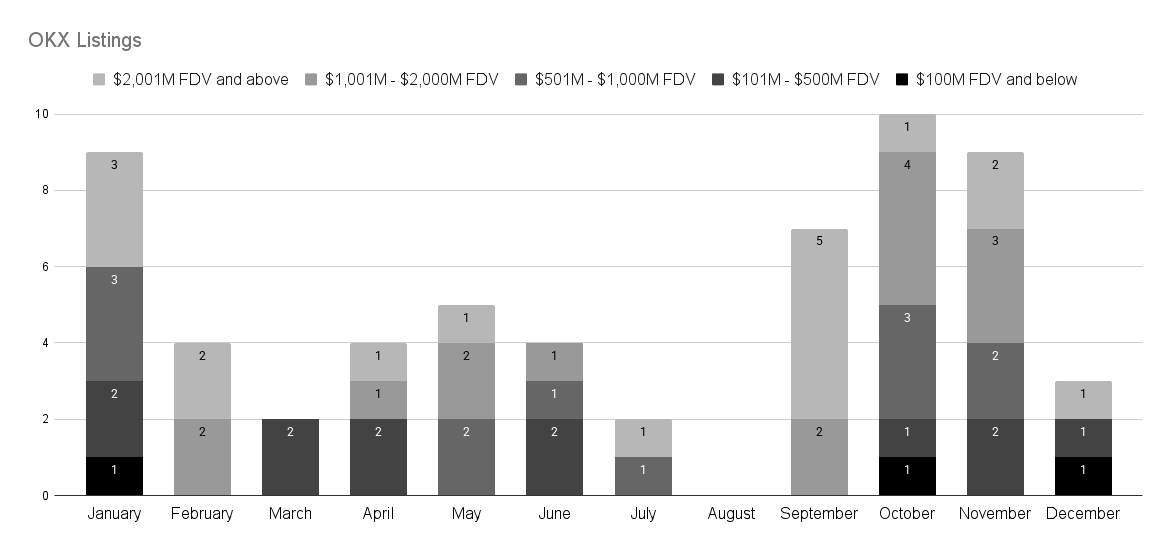

BCOBB Snapshot: OKX

OKX listed tokens across all five FDV bands in 2025, though it launched no new tokens in August 2025.

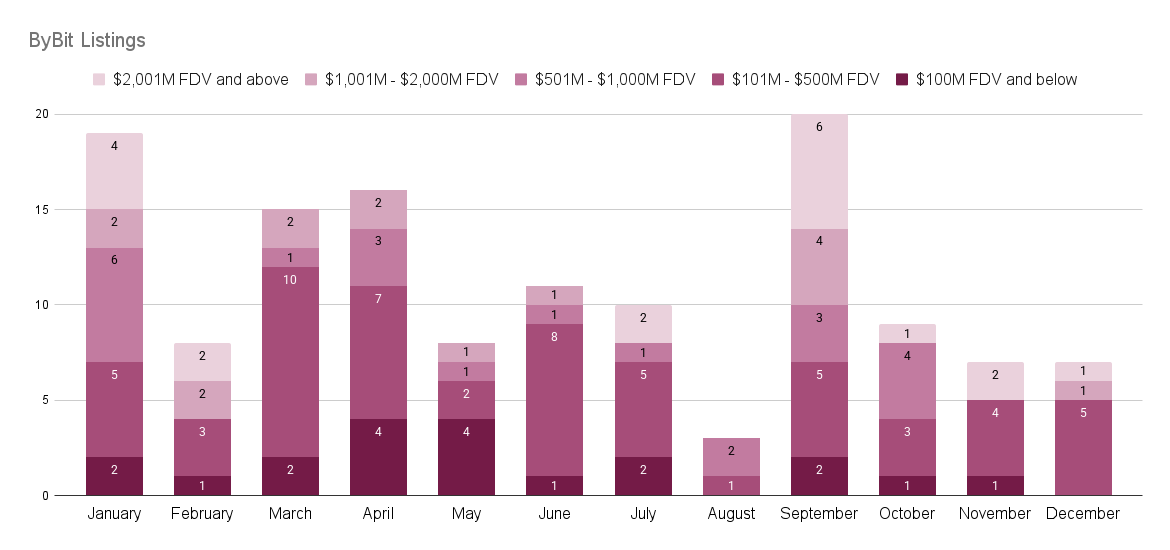

BCOBB Snapshot: Bybit

Bybit listed tokens across all five FDV bands in 2025.

BCOBB Snapshot: Bitget

Bitget listed tokens across all five FDV bands in 2025.

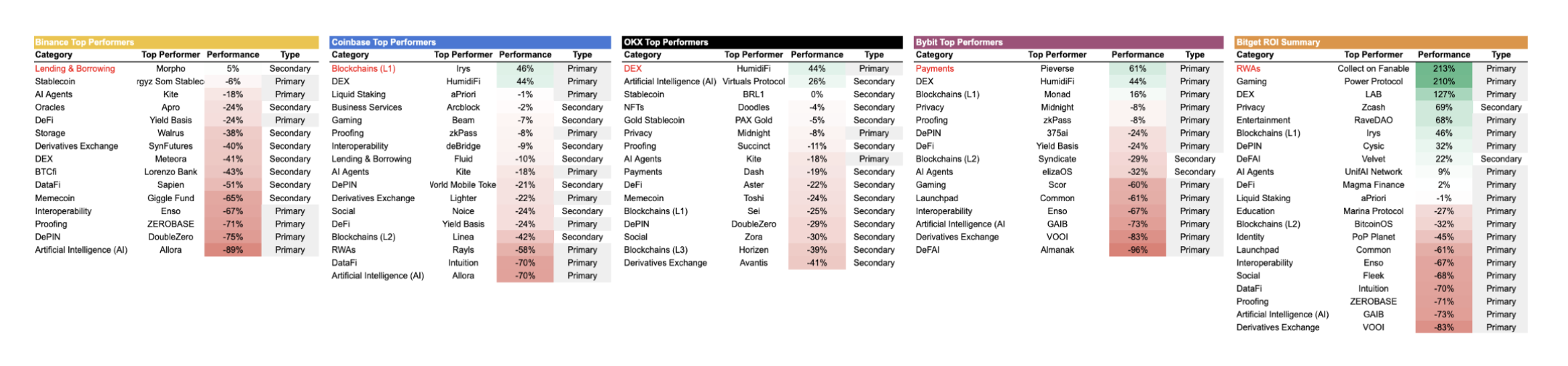

BCOBB Snapshot: Top Performers

Token performance varied significantly across exchanges, but in Q4 2025, ~23% of tokens posted positive returns.

Note: Performance is measured from each exchange’s listing date. For tokens cross-listed on different dates across platforms, performance metrics differ accordingly per platform.

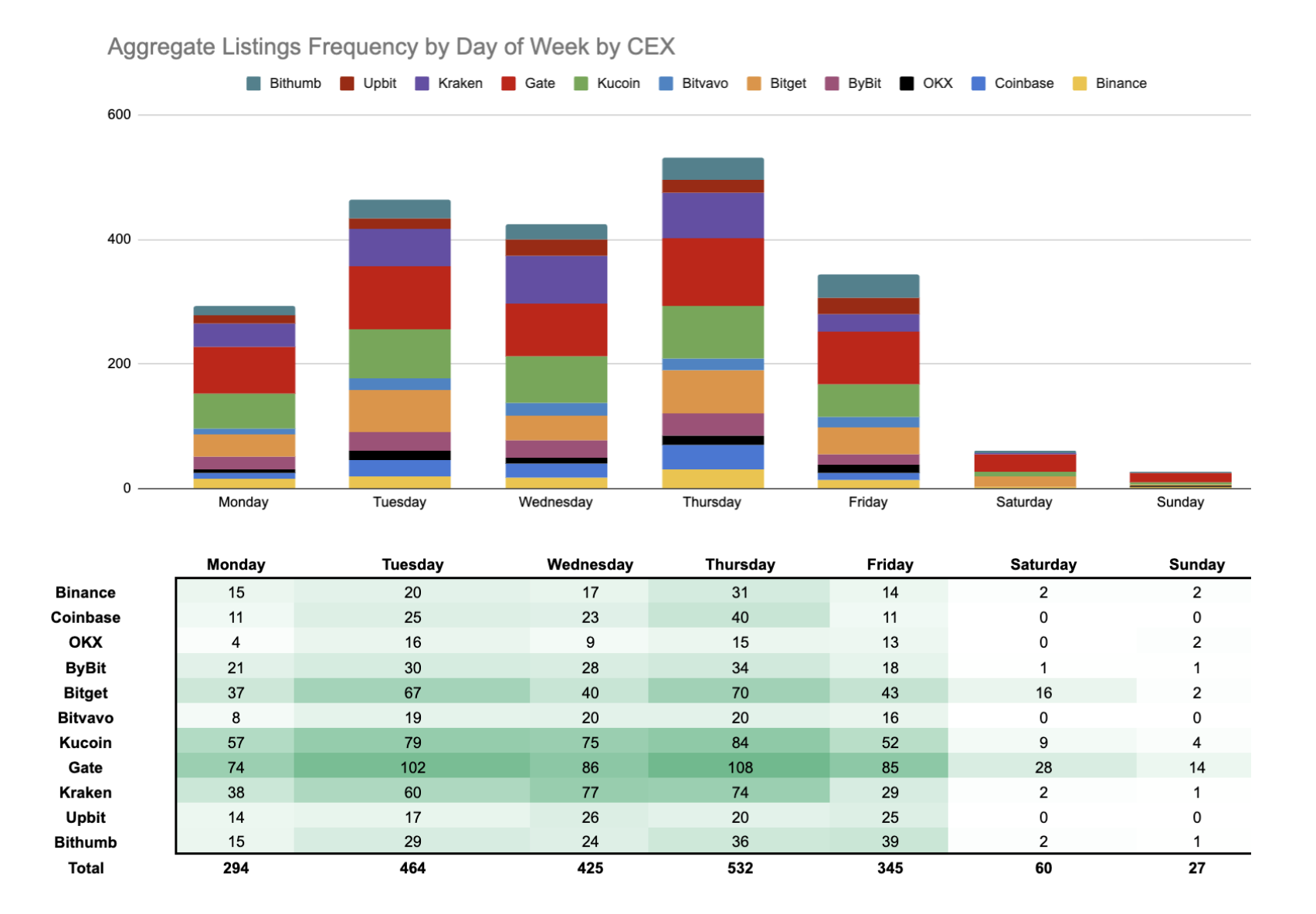

Listing Updates: Distribution of Listing Days Within a Week

Only 4% of projects chose weekend listings; weekdays remained dominant. In 2025, Thursday was the most popular listing day of the week.

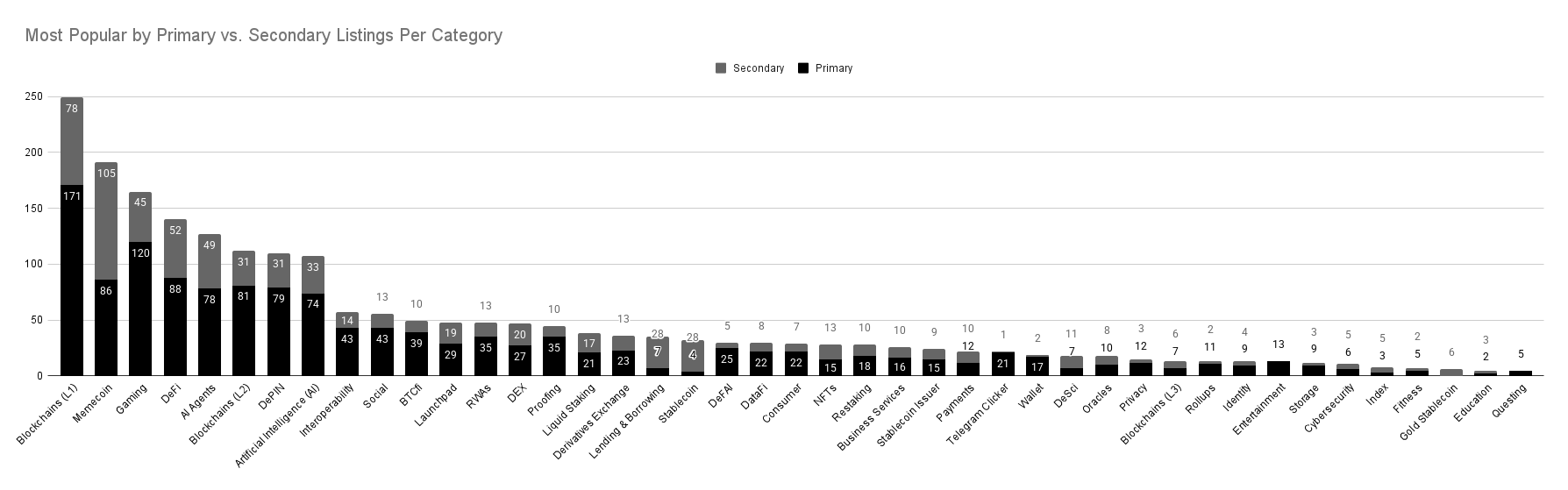

Listing Updates: Popular Sectors

In 2025, the most frequently listed sub-sectors—by count—were: L1 blockchains (249), memecoins (191), and gaming (165).

The above constitutes our deep-dive analysis of CEX listings in 2025. Stay tuned—we’ll soon release our 2025 Token Generation Event and Valuation Insights Report.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News