Data Analysis: In-depth Comparison of New Coins and Contracts Data Across Ten Major Exchanges

TechFlow Selected TechFlow Selected

Data Analysis: In-depth Comparison of New Coins and Contracts Data Across Ten Major Exchanges

This article attempts to quantitatively compare the top ten mainstream exchanges on new token listing performance and derivatives trading, from both spot and futures dimensions.

In Q3 2025, after a phase of market recovery, newly launched tokens once again became the focus of speculative capital. Recently, numerous projects have distributed airdrops via TGE (Token Generation Event) and listed on exchanges simultaneously—such as World Liberty Financial (WLFI), associated with the Trump family—sparking widespread debate over whether new tokens are still worth participating in. Under current conditions, investors are clearly divided on whether to maintain a short-term "sell at listing" mindset toward newly listed tokens or adopt a more long-term strategy. To address this controversy, this article attempts to provide a comprehensive analytical framework for investors by quantitatively comparing the performance of ten major exchanges across spot and derivatives markets regarding new token listings and derivative trading.

We selected the following ten major exchanges—Binance, Upbit, OKX, Bybit, KuCoin, Gate, LBank, Bitget, MEXC, and HTX (formerly Huobi)—for data collection, analyzing their new token listing activities and performance from August to mid-September 2025. By comparing each platform’s listing pace, price changes across different timeframes post-listing, and trends in futures trading volume, we aim to evaluate:

-

Listing rhythm vs. token performance: Which exchanges list the most tokens and do so most frequently? How do gains and drawdowns differ across platforms, and where is the “profit effect” most concentrated?

-

Derivatives trading activity: Which exchanges see the fastest growth in derivatives volume and market share gains? What differences exist in strategies for new token contracts (e.g., speed of contract launch, breadth of contract coverage)?

-

Spot-derivatives synergy: Is there a closed loop between listing frequency and concurrent contract support? How do spot price movements interact with derivatives trading?

-

Future trends: Against the backdrop of exchanges launching their own chains (e.g., Binance’s BNB Chain, Bybit’s Mantle), how will the integration of “new tokens–derivatives–on-chain ecosystems” create closed-loop effects?

Through these analyses, we aim to clarify the differences in current exchange strategies for new token listings and uncover the underlying reasons behind them.

Comparison of New Token Listings on Spot Markets

Overview of Listing Pace and Volume

Different exchanges showed significant divergence in the number and frequency of new token listings during the August 2025 surge. Based on statistics covering the past six weeks (early August to mid-September), the number of newly listed tokens per platform was as follows:

-

Binance — Global leader focused on quality and compliance, relatively conservative in new listings. Since August, Binance has listed around 13–14 new tokens, maintaining a cautious approach by prioritizing projects through mechanisms like Launchpad or Seed Tag before opening trading.

-

OKX — Prioritizes quality over quantity, lowest listing count. From August to mid-September, OKX listed only about six new tokens. The platform maintains its prudent stance, selecting only a few high-quality projects to preserve market order.

-

Bybit — Strict project screening, moderate volume with steady rhythm. Bybit launched approximately 14 new tokens over two months, averaging about two per week, continuing its stable output pattern of one token every 2–3 days established in H1. Bybit favors high-attention categories such as Memes and new public chain ecosystems, which account for roughly 70% of listings.

-

Upbit — Focused on the Korean market, selectively lists well-known tokens. During the period, Upbit added around 18 trading pairs, mostly globally recognized or locally popular tokens in Korea (e.g., WLD, API3, CYBER, already traded on other platforms). Upbit rarely conducts initial listings and instead adopts a “recognition-based” listing model.

-

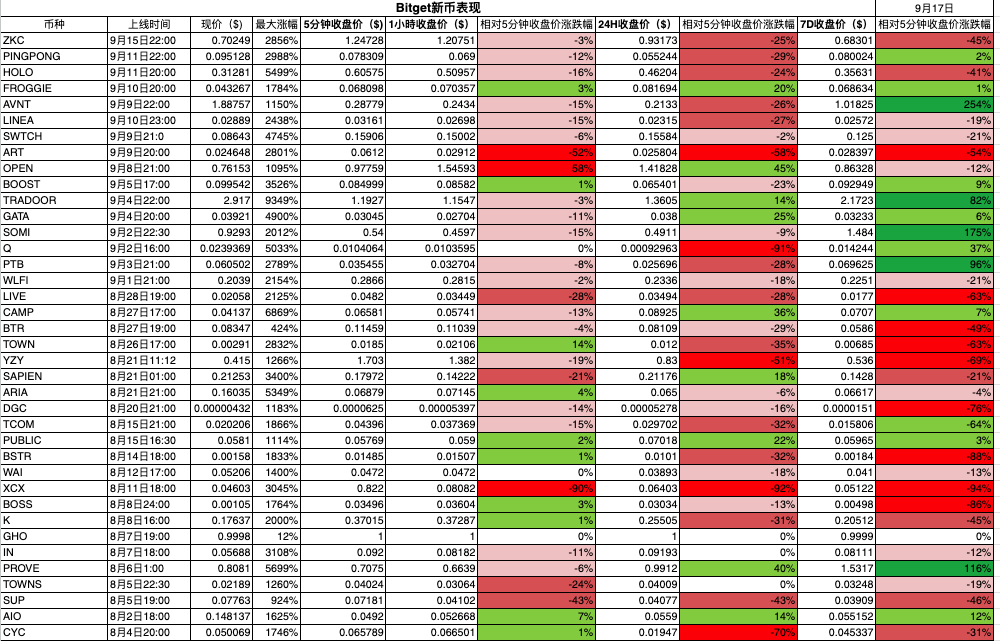

Bitget — Dual engine of spot and derivatives, medium-to-high listing volume. Bitget launched an estimated 20–30 new tokens during this period (exact data pending), approaching a frequency of four to five listings per week.

-

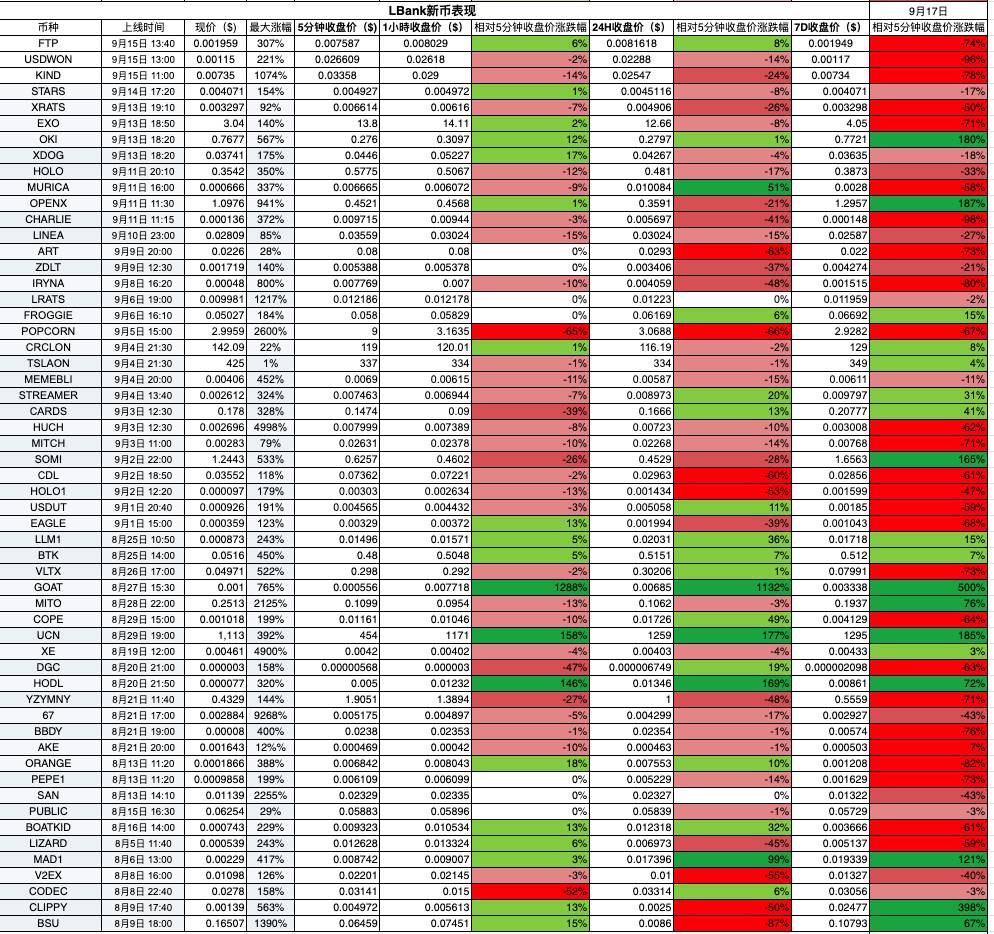

LBank — Highest volume, listing at machine-gun speed. According to incomplete statistics, LBank listed dozens, even hundreds, of new tokens during this period, maintaining the intense pace of “2–3 new tokens daily” seen in H1. This high-density listing offers many trial opportunities but results in mixed project quality, with sharp seven-day price divergences prominent (in samples from May–June, 90% of projects experienced significant volatility within a week).

-

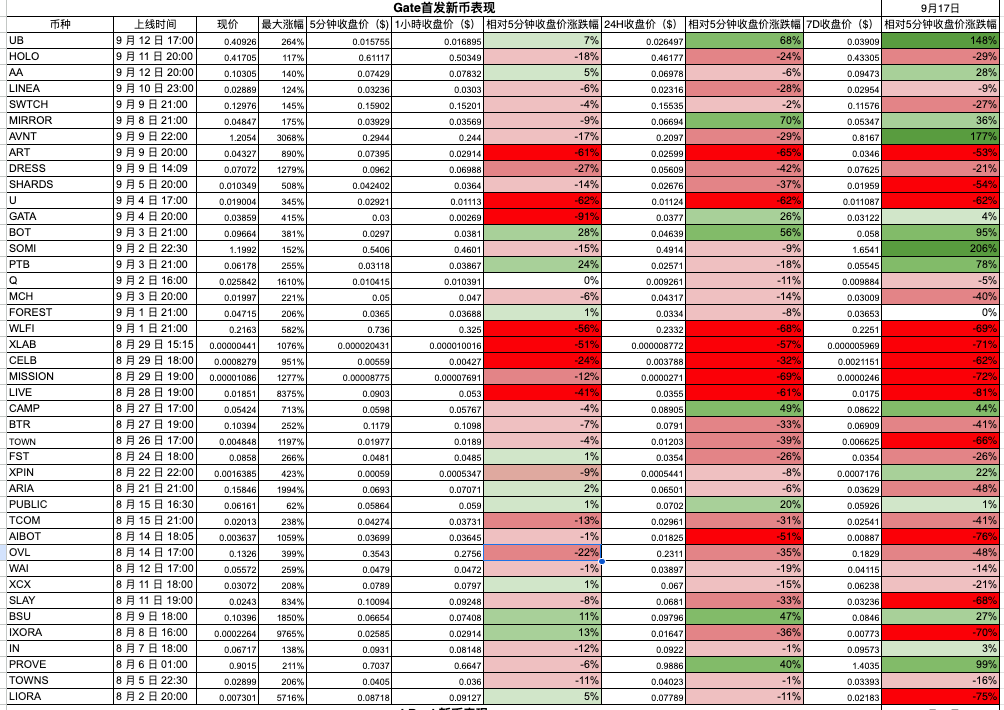

Gate — High-frequency listing second only to LBank, nearly daily new listings, ranking among top platforms. Since August, about 40+ new tokens were listed on Gate, either simultaneously or initially, exceeding the expansion pace of first-tier platforms targeting Western markets. Gate maintains a “one token per day” rhythm, providing ample opportunities for short-term traders. However, due to large numbers and limited market-making depth, some tokens experience sharp volatility and deep drawdowns after listing.

-

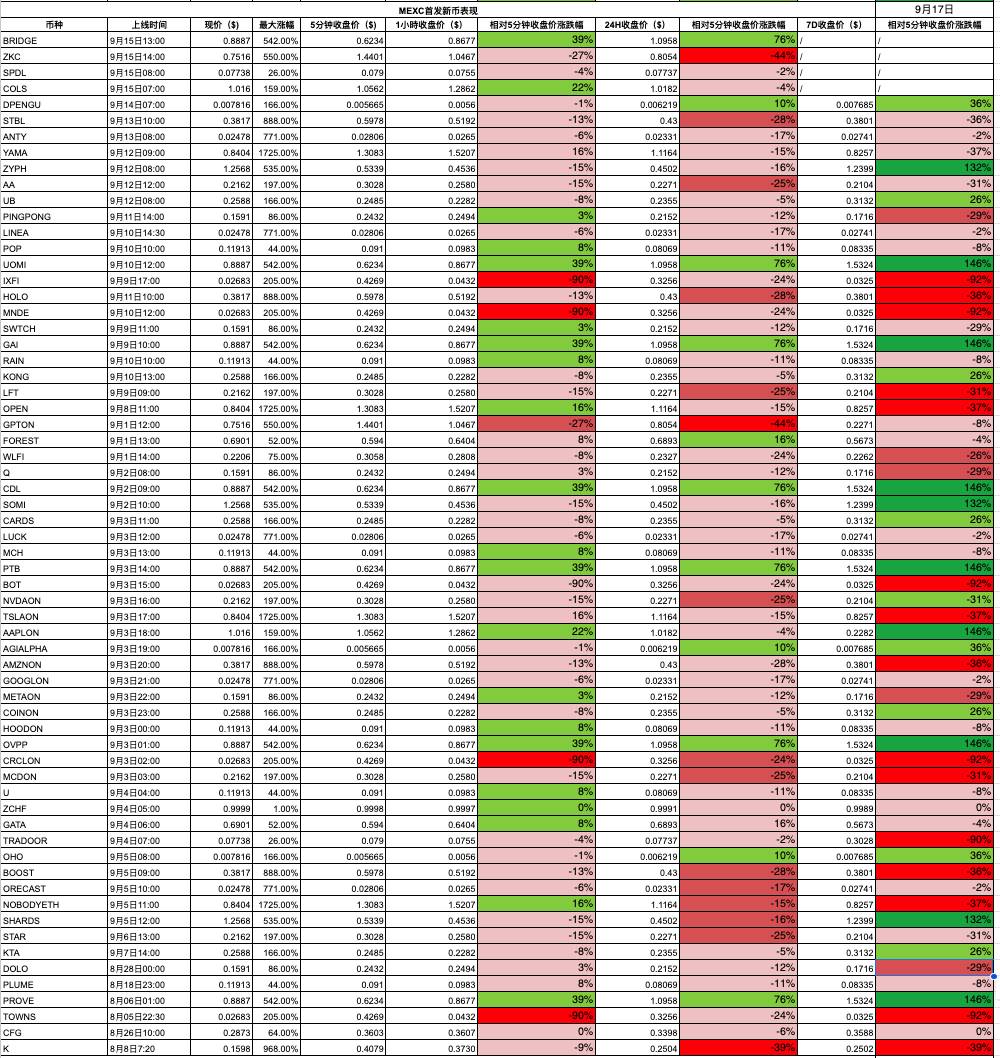

MEXC — Extremely fast listing pace with broad coverage. During the period, MEXC listed over 60 new tokens, surpassing even Gate and ranking among the highest. MEXC eagerly lists small-cap trending tokens, almost ensuring “any trend gets listed.” While this aggressive strategy creates breakout opportunities, it also means variable listing quality and severe polarization in short-term price movements.

-

KuCoin — Actively follows market trends, significantly increased new listings. KuCoin listed about 44 new tokens recently, averaging one new project daily. Compared to its previously restrained approach, KuCoin has notably accelerated, covering hot public chain ecosystem tokens, GameFi/Meme coins. High-frequency listings allow users to stay current with trends but require quick market capture skills.

-

HTX (Huobi) — Attempting to revive listing business, moderate volume. HTX listed about 11 new tokens in August, showing improvement compared to its sluggish start earlier in the year, though still far below high-frequency platforms like LBank and Gate. As an established exchange, HTX now emphasizes compliance and quality, strategically preferring to follow rather than lead trends.

In summary, new token listing patterns show a “polarized” landscape: Platforms like LBank, Gate, MEXC, and KuCoin aggressively compete for attention through frequent listings, casting a wide net to generate short-term opportunities. In contrast, Binance, OKX, and Upbit strictly control listing volume to ensure ecosystem stability. Bitget and Bybit fall in between, maintaining certain listing volumes while amplifying market participation via derivatives tools. These differences reflect distinct development strategies: some platforms attract speculative traffic with abundant new tokens, while others build reputations through curated, high-quality projects.

Performance Comparison of Newly Listed Tokens

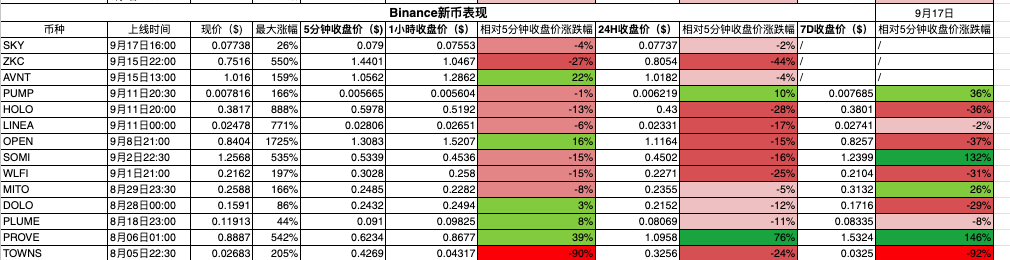

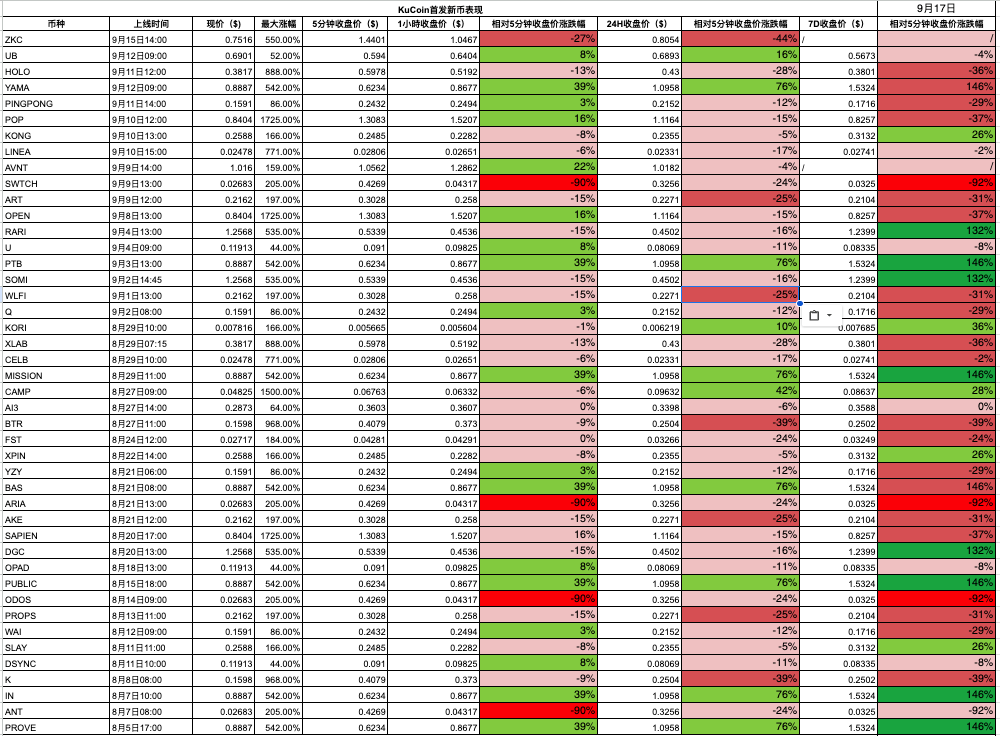

Beyond listing volume, post-listing price performance is the core metric for evaluating each exchange's “listing effect.” We compare price changes across different timeframes (5 minutes, 1 hour, 24 hours, 7 days) to identify which exchanges deliver concentrated gains and which suffer higher rates of post-listing declines.

Based on available data, the distribution of new token performances across exchanges within one week after listing is roughly as follows:

Binance: Overall stable, few up, most down

As the market leader, Binance lists highly anticipated projects with relatively rational speculation. Weekly data shows that about 36% of Binance’s new tokens rose in price, while 64% declined—similar to KuCoin. Extreme drawdowns (>50% decline) accounted for less than 10%, indicating Binance’s quality control reduces blow-up risks.

Most tokens fluctuated within +/-30% over seven days, showing relatively contained volatility.

-

WLFI surged nearly 2x on Binance before retreating, ending the week down ~30%;

-

Linea spiked on Day 1 but quickly corrected, nearly returning to issue price by week’s end (~2% drop).

-

Overall, no extreme rags-to-riches stories, nor frequent crash disasters.

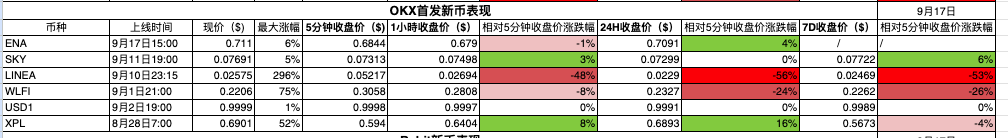

OKX: Controlled volatility, profit concentration high

Due to low listing volume, sample size is small. Among six new tokens, only one rose in price over the week, while others fell, including one dropping over 90%, dragging average returns negative.

-

On a 24-hour view, OKX new tokens showed mild price swings, median close to flat;

-

Seven-day data reveals divergence: A few high-quality projects continued steady gains, e.g., RESOLV rose ~49% in 24h during May–June, but most projects gave back all gains within a week;

-

OKX’s overall token volatility is lower than peers, rarely seeing wild spikes or crashes, but profit potential is highly concentrated: Missing a few strong performers means little gain elsewhere.

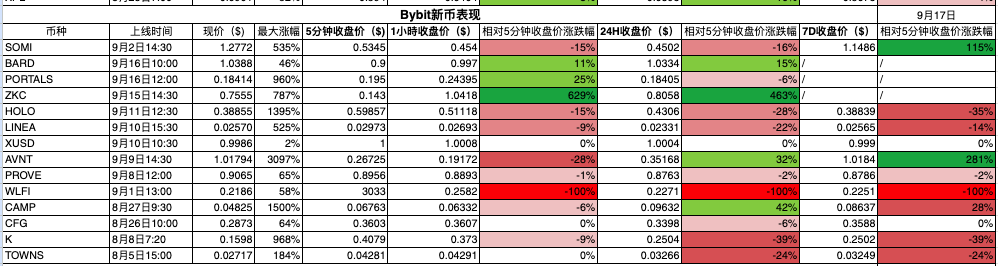

Bybit: "Stopwatch行情" evident, profits and losses polarized

Bybit tokens often spike sharply on Day 1, then weaken overall. Data shows only ~27% remained above listing price after seven days, nearly 30% dropped >50% in the first week, and over 70% turned negative. Most tokens peak within minutes of opening, then step down gradually. For example, Homecoin rebounded ~30% from 5-minute price within 24h but failed to hold; BDXN dropped from 0.1404 USDT to 0.0441 USDT in a week, down 68.6%.

However, Bybit occasionally sees standout “dark horses”: Avantis (AVNT) in this cycle surged over 30x on Day 1, becoming a rare positive outlier. Overall, Bybit’s returns heavily rely on a few star projects; most tokens turn negative within seven days. Investors who miss the initial surge struggle to achieve positive returns later.

Upbit: More down than up, stability-focused

Since Upbit mostly follows existing listings, its new tokens often miss the most volatile phase elsewhere, resulting in relatively muted performance. Data shows only ~15% of Upbit’s new tokens rose over the week, with over 80% closing lower. About 23% lost over half their value within seven days, suggesting catch-up sell-offs for overseas-hyped tokens entering Korea. For instance, Worldcoin (WLD) spiked and collapsed on listing day, down over 20% by week’s end; Linea opened near fair market value and stayed flat with slight gain. Both average and median weekly returns are negative (median ~-25%), indicating most tokens lack upward momentum. While unexciting, this suits conservative Korean investors seeking controlled risk.

Bitget: Common same-day pullback, few strong ones lift average

Sample covers 38 new tokens.

-

About 34% rose over 7 days relative to 5-minute price, 24% dropped ≥50%; deep-drawdown rate significantly lower than LBank, but overall elasticity limited.

-

7-day average change ~-6.7%, median -19%; 24-hour average -16%, median -20.5%, indicating common path: “opening spike → intraday pullback → weekly weakening.”

-

Projects doubling (≥+100%) over 7 days: 7.9%; none gained ≥+300%.

Notable gainers: AVNT (+254%), SOMI (+175%), PROVE (+116%); notable losers: XCX (-94%), BSTR (-88%), BOSS (-86%). Overall, Bitget shows deeper median 24h drawdown and more concentrated negative 7-day medians—a distribution where “few stars lift average, most assets fade.” Traders missing top performers face difficulty achieving positive returns later.

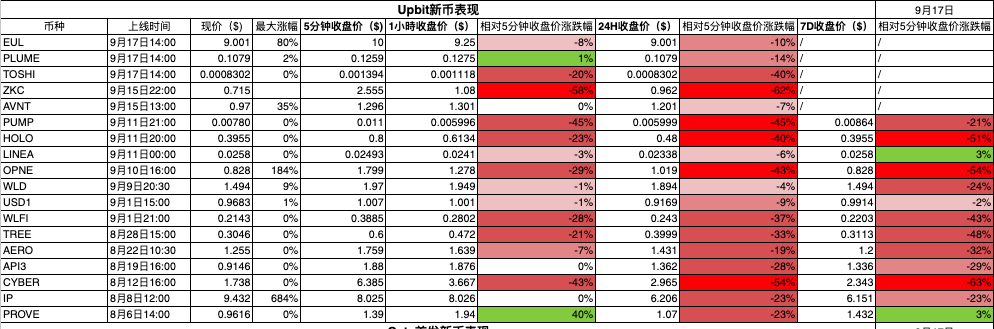

LBank: High-frequency listing = higher discovery rate, "dark horse density" leads industry

Sample includes 56 new tokens. LBank leverages “machine-gun-style” listings and ample initial liquidity to achieve efficient early price discovery:

-

About 34% rose over 7 days, with 12.5% doubling (≥+100%) and 3.6% gaining ≥+300%—leading peer platforms in dark horse density;

-

7-day average return ~+1.5%, 24-hour average ~+16%, indicating attractive short-term profit windows.

Standout cases: GOAT (+500%), CLIPPY (+398%), OPENX (+187%), showcasing platform strength in spotting new themes and small-cap trends. However, broad coverage also means a long-tail distribution: 7-day median ~-36.5%, ~43% dropped ≥50%. Thus, optimal trader approach treats LBank as a “discovery engine”: select candidates, capture first wave, disciplined take-profit—using strict position and risk management to amplify dark horse wins and mitigate tail losses, turning high hit rate into strategic edge.

Gate: Explosive rallies coexist with deep-drawdown risks

With the most listings, Gate has the largest sample. Data shows ~30% of Gate-listed tokens remained above listing price after 7 days, but over 70% turned negative, including ~30% halving within a week—the highest deep-drawdown rate among platforms. This relates to Gate’s thinner market depth, making prices prone to single-point manipulation.

Yet Gate delivered the market’s most extreme rally: Avantis (AVNT) surged over 30x on Day 1, creating a short-term myth, then rapidly faded. Overall, Gate tokens show highest volatility—often huge opening spikes, but most fail to sustain and eventually crash.

MEXC: Right-skewed return distribution, standout peak gains

Another high-frequency lister, MEXC resembles Gate: ~30% of projects rose after a week, 70% fell. About 10% suffered halving-level drawdowns. MEXC stands out with frequent extreme gain cases: IXORA, an MEXC-exclusive launch, peaked ~98x above issue price—absurdly high. This reflects MEXC’s concentration of high-risk-speculative capital willing to pump microcaps. But most projects cool down rapidly post-hype, retracing or breaking down. MEXC’s 7-day average slightly positive (pulled by outliers), but median negative, indicating most tokens underperform.

KuCoin: Generally stable, moderate breakout power

KuCoin’s new tokens saw ~36% close up, ~64% down over a week—slightly better than Gate/MEXC. Less than 10% suffered >50% drawdown, relatively fewer deep drops. On average, KuCoin tokens showed slight positive 7-day return (~+15%) vs. listing price, median ~-8%, meaning a few big gainers lifted averages while most dipped slightly. KuCoin lacks tens-of-thousands-fold surges; peak gains typically range 5–20x, mostly handpicked hot projects (e.g., SocialFi, gaming). Overall, KuCoin shows a “mildly bullish” distribution: neither extreme rags-to-riches myths nor continuous crashes—investors can achieve steady returns with proper timing.

Horizontally, among high-frequency listers like LBank, Gate, and MEXC, 7-day return distributions are right-skewed with “boom-bust” patterns: a few tokens deliver tens-of-thousands-fold gains, but most break down quickly, leading to clear profit-loss polarization. Conversely, top-tier exchanges like Binance and OKX, with strict listing filters, show milder, tighter distributions: rare explosive rallies, fewer crashes, most tokens moving within controllable ranges. Bybit and Bitget combine both traits—featuring multi-thousand-fold daily stars alongside many quietly declining tokens, yielding “long-tail” returns where outliers lift averages while median returns are low or negative—indicating traders need strong case-selection skills on these platforms.

Analysis of New Token Performance Distribution Characteristics

Combining the above data, we summarize key performance distribution traits across platforms:

-

Gain concentration: Degree to which profits concentrate in a few tokens. Bybit and Bitget show highest concentration—one or two big gainers drive most aggregate returns, while majority show limited or negative gains. OKX, with few projects, also shows high concentration as any single token swing heavily impacts totals. In contrast, LBank and Gate show more “evenly spread” gains—though absolute high-gain cases exist, contributions are diluted across many tokens. Binance and KuCoin sit in the middle: not dominated by one or two tokens, nor fully averaged, with strong performers contributing meaningfully but not decisively.

-

Green ratio (proportion closing up on Day 1 or Week 1): Reflects new token “breakdown rate.” Upbit has the lowest green ratio, under 20%, showing most new tokens fail to close up in KRW market. OKX and Bybit also low, ~20–30%. Gate, MEXC, Binance, KuCoin hover at 30–40%. LBank lacks precise data but historically likely ~30%. This means breakdown (weekly drop) is normal across most platforms; green closes are rare. Only locking in early profits ensures gains.

-

Deep drawdown ratio: Define >50% drop from 5-minute price within 7 days as “deep drawdown” (halving). Gate had ~31% of new tokens suffer deep drawdown—highest. Confirms liquidity gaps amid high-frequency listing, leading to frequent next-day waterfall events. Upbit follows with ~23% weekly halvings, possibly due to overseas-hyped tokens correcting upon Korean listing. Bybit ~9%, Binance/KuCoin <10%, MEXC ~10%, LBank/Bitget estimated 10–20%. OKX unclear but extreme cases occurred. Overall, Gate and Upbit carry higher risk, with nearly one in four new tokens halving quickly; Binance and KuCoin are milder, with deep drawdowns around 10%.

The analysis clarifies performance trade-offs across exchanges: high-frequency platforms offer both opportunity and risk, with overall returns depending on catching rare rockets; low-frequency, curated platforms offer fewer riches but smaller average drawdowns, with returns clustered mid-range. For ordinary investors, participating in new projects on high-frequency platforms demands greater caution with stop-loss/take-profit discipline, while joining hot listings on top-tier platforms carries lower risk—but don’t expect outsized returns.

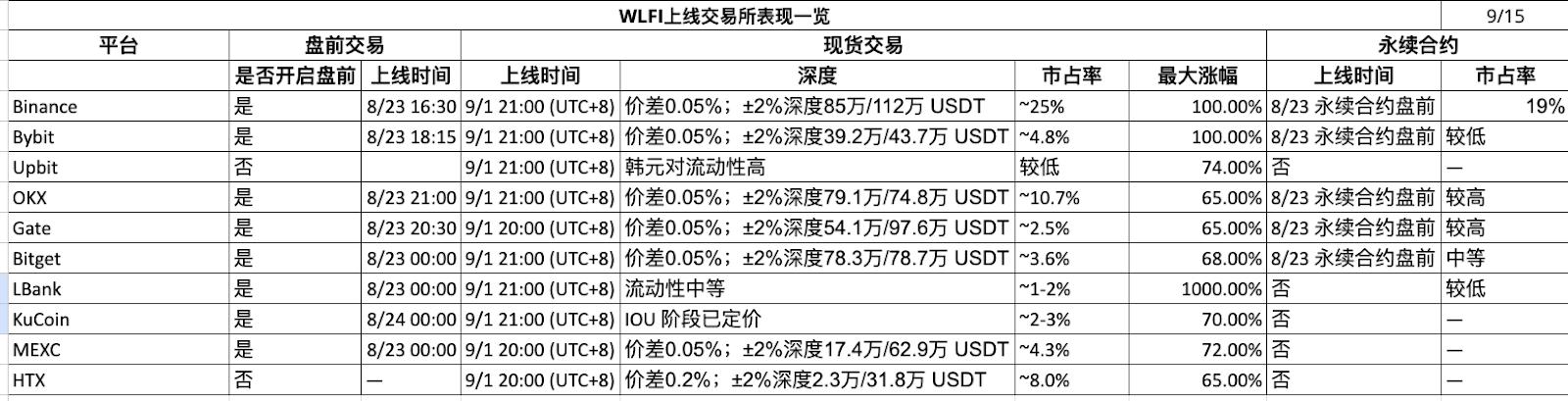

WLFI: Multi-platform performance of a Trump-themed token

Project overview: WLFI (World Liberty Financial), rumored to be backed by former U.S. President Donald Trump’s family, attracted significant attention, nicknamed “Trump coin.” Around September 1, multiple exchanges—including Binance, HTX, KuCoin, Bybit, LBank—announced WLFI listings, nearly achieving global simultaneous launch. Binance even tagged it with the rare “Seed Tag” to signal high risk. Bybit launched an exclusive “Token Splash” airdrop event; LBank offered transaction-loss compensation. Such coordinated multi-platform listing is rare in recent years, making WLFI an ideal case to test user base and rollout strategy differences across exchanges.

Day 1 price trajectory: WLFI showed clear inter-exchange differences in opening pricing and subsequent volatility. Overall, it followed a “high-open, immediate drop” path—spiking early then falling fast—but peak magnitudes varied:

-

On KuCoin, HTX, and Binance, WLFI opened relatively low, buyers pushed price nearly double, peaking ~+97% (1.97x). E.g., on Binance, WLFI rose from ~0.15 USDT to ~0.30 USDT within minutes of September 1 opening, then met resistance. One hour later, gains narrowed; 24h close was only +34% from open; by week’s end, it broke issue price by ~30%. KuCoin and HTX mirrored Binance—both saw ~double spikes but failed to hold, closing near open levels.

-

On OKX and MEXC, WLFI opened at relatively high prices, saw no clear rally, and opening price became daily high (“plunge” pattern). This resulted in max gain only ~+0.75x (i.e., 25% below open price) [30†Col1]—meaning WLFI had no upside on these platforms, peaked at open, then steadily declined. Day 1 close down >20% from open, week-end down ~26%, weak performance [30†Col1]. Suggests more aggressive bids on OKX/MEXC may have inflated opening prices, leaving no room for further upside.

-

On Bybit, WLFI’s Day 1 behavior was unique. Due to concurrent airdrop, many users received free WLFI, creating instant sell pressure. Price shot high at open (gap up), but max gain only +0.58x, then plunged sharply [30†WLFI-Bybit]. Data suggests 5-minute close ~0.3033 USDT, falling to 0.2582 after one hour, 24h close 0.2271 USDT—all below open, down ~30% by week’s end [30†WLFI-Bybit]. Bybit’s airdrop boosted volume but caused heavy opening sell-off, weakening Day 1 performance.

-

On Upbit (Korean market), WLFI performed poorly. Local users showed limited interest in this foreign political theme; opening price became high point (“max gain” recorded as 0% [30†WLFI-Upbit]). Price then steadily declined, down ~37% in 24h, over 43% below open by week’s end [30†WLFI-Upbit]. Shows Korean market lacks chase momentum—possibly due to regulatory environment or investor preference favoring caution over frenzy. Also possible that when WLFI reached Upbit, global prices had already peaked and fallen, leaving KRW pair without independent momentum.

Liquidity and trading volume: WLFI’s inter-exchange liquidity and volume distribution also reflected user base differences. As the world’s largest exchange, Binance led in WLFI/USDT daily volume, with deep order books enabling stable price discovery. KuCoin and MEXC, hosting many speculators, saw high short-term activity, with volatile tick-level charts, though shallower depth than Binance, making them prone to whale pumps/dumps. Bybit, due to airdrop, saw massive sell orders flood in at open, straining buy-side absorption, but later attracted bargain hunters, sustaining high volume. Upbit’s KRW pair volume, while below USD markets, ranked among top local trades, showing residual interest. Overall, WLFI liquidity was more centralized and orderly on large exchanges, while smaller platforms saw active but chaotic trading.

Launch strategy and user base analysis: The WLFI case highlights how differing exchange strategies impact price paths:

-

Binance applied a “seed tag” without extra promotion, attracting its rational user base. Price movement was relatively mild and orderly. Its global professional investor base approaches political-hype tokens cautiously, so WLFI rallied briefly before reverting to sanity.

-

Bybit chose airdrop-driven volume stimulation, catering to derivatives and airdrop enthusiasts. Flood of free tokens, combined with Bybit’s short-term trading culture, led to inflated opening prices and heavy selling pressure, causing gap-up, gap-down action. Indicates high speculative ratio in Bybit’s user base, reinforced by platform strategy.

-

Upbit’s users are primarily Korean retail, investment style conservative, less emotionally attached to non-Korean products. Despite global hype, Korean investors remained restrained, avoiding mania. Reflects regional preference: Koreans favor local concepts or global blue-chips, showing limited interest in U.S. political tokens. Also, lacking futures market, Upbit users cannot short-sell; once global prices fell, KRW pair followed without support.

-

LBank, to reduce first-minute mispricing and abnormal matching risks, often deploys pre-market price protection and platform-level loss compensation for new listings: setting thresholds for quote ranges, order sizes, and matching anomalies, triggering rollback and compensation if breached. This combo helps suppress extreme slippage and improve predictability in early price discovery for emotional tokens like WLFI, boosting retail confidence in primary participation; meanwhile, somewhat curbing “blitz” space for more controlled opening curves and stable user experience.

-

KuCoin, MEXC, HTX host many international retail and speculative funds, highly sensitive to novel concepts. Especially KuCoin’s community excels at short-term trend chasing, eager to pile in at low prices to push prices up—thus WLFI on KuCoin first surged nearly 2x. But because such capital is “fast in, fast out,” profits are quickly taken, leading to pullbacks. These platforms’ strategies broadly cast wide nets to迎合market sentiment, lacking additional risk controls, letting market emotion fully drive price swings—hence volatile moves.

In sum, WLFI faced “same question, different answers” across exchanges: identical project, but divergent outcomes due to differing user bases (rational vs. speculative, local vs. global) and supporting strategies (airdrop, risk warnings). Some platforms staged 100% rallies; others saw flat, downtrend action. This fully demonstrates how exchange ecology shapes a new token’s trading fate—exchanges are not just launch venues but price discoverers, and different “audiences” dictate the show’s direction.

Summary: Cross-platform insights into new token launches

From the WLFI case, we derive general rules for cross-platform new token performance:

-

User base determines hype intensity: Speculation-prone platforms (e.g., LBank, MEXC, Gate) easily generate exaggerated rallies on emotional tokens, but may dump harder on fundamental ones. Conservative, rational groups (e.g., Upbit, parts of Binance) react mildly to theme tokens, showing slight preference for value plays.

-

Synchronized listing narrows price gaps: When most exchanges list a token simultaneously, price discovery is rapid, arbitrage quickly eliminates inter-exchange spreads. Differences then manifest in volatility and details, not trend deviations.

-

Platform strategy affects short-term moves: Exchange tactics (airdrops, trading contests, loss guarantees) influence early supply-demand balance. Airdrops increase sell pressure, contests amplify volume and volatility, loss guarantees may dampen blind FOMO. All reflect on Day 1 candlesticks.

-

Derivatives accelerate mean reversion: Exchanges offering new token futures/perpetuals often see spot prices revert faster to rational levels. Short-selling mechanisms burst bubbles quicker—especially after surges, the ability to short may cap tops earlier.

-

Regional markets have unique rhythms: Local exchanges (e.g., Upbit) exhibit distinct investor reactions even when listing global tokens. Globally hyped tokens may not resonate locally, and vice versa. Reminds us to consider market context’s impact on new token performance.

In short, differences in new token performance across exchanges stem from dual forces: investor composition and platform policy. The same new token may face entirely different scripts depending on where it’s traded. For projects, multi-platform listing is now standard, but coordinating rollout timing and leveraging platform strengths is an art. For investors, understanding these differences aids strategic timing and venue selection—where to buy, where to sell—potentially impacting final returns. This is precisely the value of our cross-platform deep comparison.

Derivatives Data Comparison

While new token spot performance draws attention, derivatives competition better reflects exchange strategic focus. In August 2025, with market recovery, major exchanges diverged noticeably in derivatives volume. Using metrics from the “Exchange Data Comparison” table, we analyze derivatives performance across ten platforms in volume scale, growth trends, and asset coverage to reveal shifting dynamics.

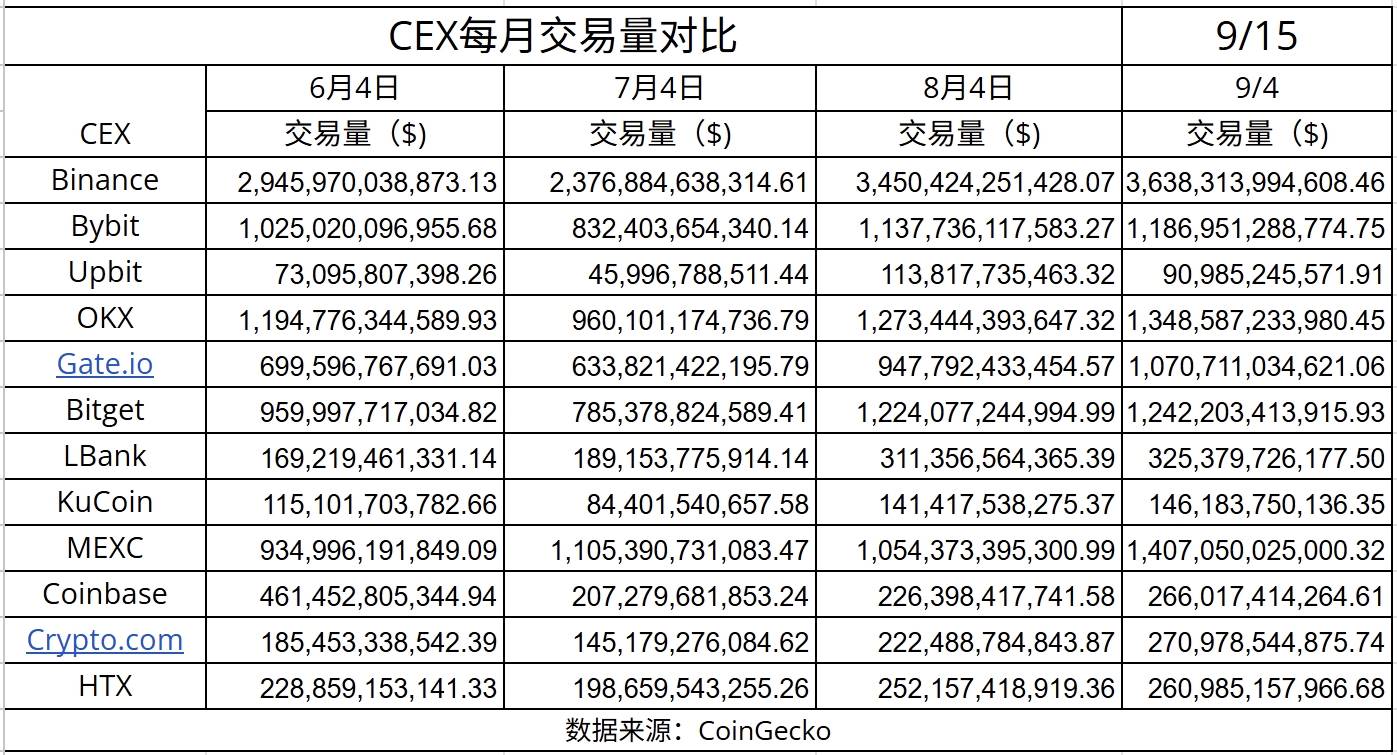

Total Volume and Derivatives Share

First, overall volume and derivatives share. Based on CoinGecko’s September 2025 24-hour volume data, spot vs. derivatives comparison per platform (figures in parentheses indicate derivatives share of total):

-

Binance: Spot ~$735.6B, USD derivatives ~$2.90T, total ~$3.64T/24h, derivatives share ~80%. As industry leader, Binance futures volume leads by far, about 4x spot.

-

Bybit: Spot ~$126.9B, derivatives ~$1.06T, total ~$1.187T, derivatives share ~89%. Born as a derivatives specialist, Bybit’s futures volume approaches nearly 9x its spot.

-

OKX: Spot ~$114.0B, derivatives ~$1.234T, total ~$1.348T, derivatives share ~92%.

-

Gate: Spot ~$129.2B, derivatives ~$941.5B, total ~$1.0708T, derivatives share ~88%.

-

Bitget: Spot ~$131.6B, derivatives ~$1.1106T, total ~$1.2422T, derivatives share ~89%.

-

MEXC: Spot ~$128.5B, derivatives ~$1.2785T, total ~$1.4070T, derivatives share ~90.8%.

-

LBank: Spot ~$108.4B, derivatives ~$216.9B, total ~$325.3B, derivatives share ~66.7%. LBank’s derivatives share is low among peers, only about 2/3.

-

HTX (Huobi): Spot ~$107.3B, derivatives ~$153.6B, total ~$260.9B, derivatives share ~58.8%. HTX has the lowest derivatives share in this comparison, under 60%.

-

KuCoin: Spot ~$53.7B, derivatives ~$92.4B, total ~$146.2B, derivatives share only ~63%. KuCoin’s derivatives share lags far behind peers, indicating its user base remains spot-focused, with derivatives lagging. Though KuCoin offers perpetuals, product depth and variety may trail leaders, limiting user stickiness in derivatives.

-

Upbit: Spot ~$9.1B, no derivatives trading.

The above shows: Except for a few (KuCoin, LBank, Upbit), most exchanges now dominate in derivatives volume. Especially OKX, Bybit, Bitget, Gate, MEXC—emerging or tier-two platforms—have futures/perpetual shares consistently 85–90% or higher, demonstrating success in scaling via derivatives. This aligns with user preferences and platform strategy—younger traders favor high-leverage, high-volatility products, and these platforms gladly supply diverse contract offerings. Even Binance, despite massive spot base, sees derivatives volume nearly 4x spot, share 80%, proving even leaders rely on derivatives.

KuCoin, LBank, HTX show transitional states: Their derivatives still trail spot significantly, shares around 60%. This may reflect late derivatives entry (e.g., LBank only recently launched futures), conservative user bases (e.g., HTX’s traditional spot-oriented users), or weaker contract competitiveness (e.g., KuCoin’s limited futures depth and variety). As the industry evolves, these platforms will likely boost derivatives share to grow total volume.

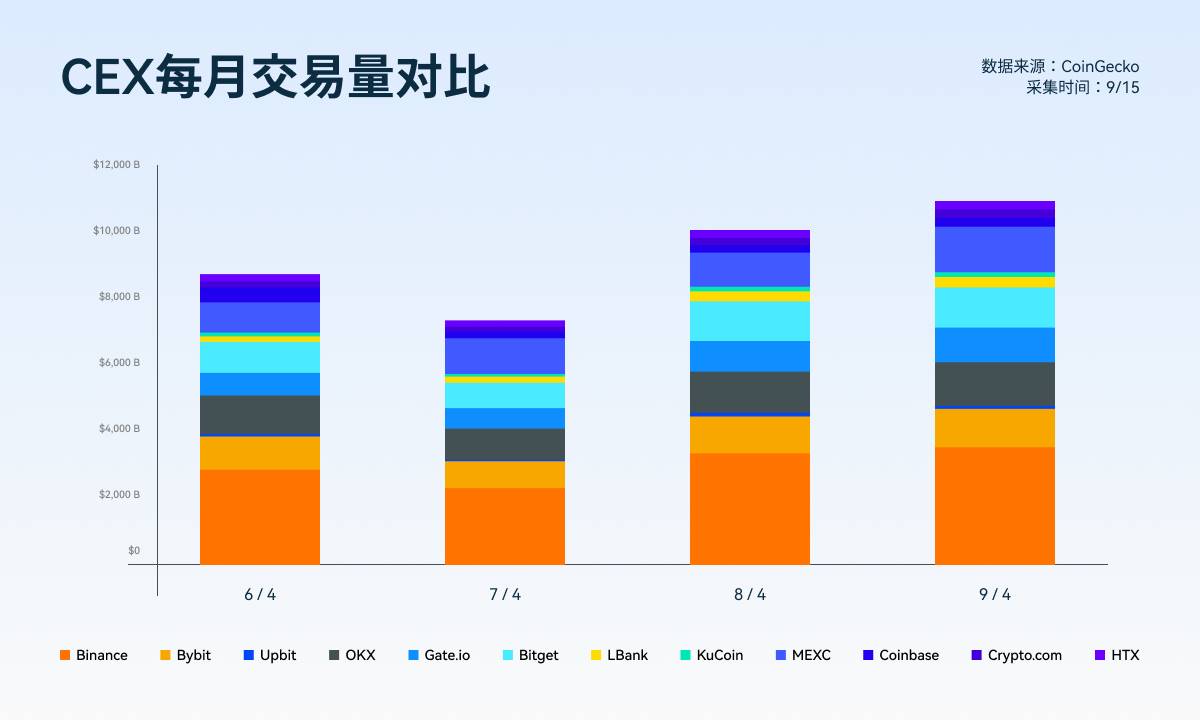

Trends in Derivatives Volume and Market Share Changes

Observing volume trends, we compare early June and early September 2025 data to calculate quarterly volume changes, revealing which platforms grew fast and which stagnated:

-

LBank: Quarterly volume growth +92.3%, fastest in sample. Such explosive growth suggests aggressive Q3 expansion in derivatives, possibly via launching popular token contracts and incentive campaigns. Also, many small-cap tokens surged in Q3, and LBank’s leading listing volume amplified total trading.

-

Gate: Quarterly total growth ~+53.0%. Gate, a veteran altcoin exchange, reached new highs in Q3, driven mainly by derivatives (+62% MoM). Linked to timely listing of many new token perpetuals.

-

MEXC: Quarterly growth ~+50.5%. MEXC maintained rapid growth in Q3, solidifying its “dark horse” status. Notably strong derivatives growth brought it close to OKX’s derivatives scale.

-

Bitget: Quarterly growth ~+29.4%. Bitget maintained steady growth.

-

KuCoin: Quarterly growth ~+27.0%. KuCoin’s growth came mainly from spot (Q3 new listings boosted spot trading). Derivatives improved moderately.

-

Upbit: Quarterly growth ~+24.5% (spot only). Upbit benefited from overall Q3 market recovery and Korean capital inflow, naturally lifting volume by nearly a quarter. Growth rate similar to Binance, indicating passive alignment with market, no outperformance.

-

Binance: Quarterly growth ~+23.5%. For the largest base, 23% sequential growth is notable. Driven by improved Q3 market sentiment, with volume increases in both major and some small-cap tokens. No major strategic shifts—perhaps even scaled back some high-risk products under U.S. regulatory pressure—so growth represents market average. Market share slightly declined (due to faster growth of mid-sized players), but leadership remains firm.

-

Bybit: Quarterly growth ~+15.8%. Bybit lags, below industry average. Possible reasons: Binance captured some users (e.g., regional bans pushing users to Binance); Bybit’s Q3 campaigns were modest, and despite many new listings, trading impact was limited; derivatives market share eroded by newcomers like Bitget and MEXC. 15.8% growth risks being overtaken by Bitget, signaling slight share decline. A warning for the former #2 in derivatives, needing renewed product and marketing efforts to regain momentum.

-

HTX: Quarterly growth ~+14.0%. HTX also grew slowly. Amid internal and external challenges, Huobi’s user base struggles to expand; volume gains came from slightly increased activity among existing users. 14% growth further marginalizes HTX, with continued share erosion.

-

OKX: Quarterly growth only ~+12.9%. Slowest among peers, nearly stagnant. Surprising given OKX’s recent overseas expansion and new product launches. Data shows volume growth far behind competitors. Possibly due to high base making incremental gains hard; or slowing user growth, especially missing opportunities in altcoins and derivatives trends.

This trend indicates: Q3’s biggest winners were mid-tier platforms—LBank, Gate, MEXC, Bitget—expanding at >50%, even nearing doubling, capturing larger trading shares. Traditional giants—Binance, OKX, Huobi, Bybit—lagged, losing relative share. Likely because Q3’s heat centered on small-cap speculation and derivatives—precisely the sweet spot of tier-two platforms. Giants, constrained by compliance and strategy, couldn’t dive deep into high-risk, high-reward areas, limiting growth. Long-term sustainability depends on full bull market performance, but in choppy markets, agile, smaller platforms show stronger traction.

Differences in Trading Structure and Asset Coverage

Beyond spot/derivatives split, we compare internal derivatives structure: perpetual vs. delivery contracts, major vs. altcoin contracts, number of contract assets. These reveal focus and depth in derivatives trading.

-

Perpetual vs. Delivery: Almost all mentioned platforms prioritize perpetuals, dominating volume. Delivery contracts (fixed-term) are offered by only a few full-service platforms like Binance and OKX, with shrinking relevance. Thus, focus stays on perpetuals.

-

Major vs. Altcoins: Top-tier exchanges like Binance and OKX concentrate volume on BTC, ETH, etc. For example, BTC/USDT and ETH/USDT perpetuals may account for >50% of Binance futures volume. Small-cap contracts, though numerous, have limited individual volume. In contrast, platforms like MEXC and Gate, attracting small-cap speculators, disperse trading across many altcoin contracts. A new token’s perpetual might hit $100M daily volume on MEXC, while never listed on Binance. On Gate, PEPE—a low-cap token—once ranked among top perpetuals. This shows: Leaders win via “depth in majors,” mid-tiers via “breadth in minors.”

-

Number of Contract Assets: Binance offers ~150+ USDT-margined perpetuals, dozens of coin-margined. OKX offers ~200 contracts, including many DeFi and trending projects. Bybit has over 150. MEXC claims >250 perpetuals, covering nearly all its spot-listed alts. Gate has ~200. KuCoin offers ~100+. LBank has very limited variety, perhaps dozens of majors and some popular minors. Upbit has none. These differences show: MEXC and Gate aggressively add minor-token contracts to attract speculators; Binance remains cautious, controlling counts. Bitget and Bybit strike middle ground—offering many new-token contracts but selectively (e.g., Bitget picks based on热度, unlike MEXC’s “list all” approach).

-

Trading Tools and Features: Beyond quantity, functional details differ. Leverage: Binance and OKX offer up to 125x on majors, 20–50x capped on minors. MEXC sometimes offers high leverage on minors to attract gamblers. Liquidity: Binance has vast market maker networks ensuring depth and low slippage; smaller platforms may suffer thin depth, prone to liquidation spikes. Funding rates, insurance fund strength—also points of difference. Overall, top platforms offer superior professionalism and stability; emerging ones win via aggression and flexibility, sometimes sacrificing stability.

-

Hotspot Tracking: Strategically, some exchanges chase trends. MEXC and Gate rush to list perpetuals when new tokens explode, enabling two-way trading. When Friend.tech trended, related tokens like BLUR got futures on these platforms, drawing massive volume. Bitget and Bybit also chase trends, but more cautiously—typically waiting for spot listing and basic liquidity before adding contracts. Others focus on mainstream, avoiding obscure listings. Coinbase (BTC/ETH futures only, outside scope) and OKX exemplify restraint. Binance sits between: selectively joins trends—e.g., listed PEPE perpetual during peak hype—but avoids most alts.

These differences result in distinct user stickiness across exchanges. Minor-token speculators often rotate among Gate, MEXC, Bitget—going wherever new contracts appear. Large-scale BTC/ETH traders prefer Binance and OKX for reliable depth and low slippage. In the short term, minor-token booms boost mid-tier platforms’ derivatives volume; when markets normalize and big money focuses on BTC, leaders regain prominence. These models aren’t mutually exclusive—many aim for “dual-track”: pushing minor contracts while maintaining major-depth. Bybit and Bitget follow this path—offering many alt-perpetuals while competing with Binance on major-depth. This full-stack approach demands resources and tech. Currently, Binance remains the undisputed king of full-category contracts, but others are gaining ground in niche areas through differentiation.

Summary of New Token and Derivatives Performance Comparison

Through comprehensive comparison of spot and derivatives, we reach several key conclusions:

(1) Platforms with strongest new token breakout power: If judged by “explosiveness,” LBank, Gate, MEXC lead—provided investors pick the right “rocket.” However, emphasize: high returns come with high breakdown and deep-drawdown rates, far exceeding top-tier exchanges.

(2) Platforms with best overall new token performance: Judging by majority of projects delivering relatively stable returns, Binance and KuCoin stand out. Binance’s breakdown rate is below average, few catastrophic crashes—investors less likely to get burned. KuCoin sees ~1/3 of projects close up after a week, with mean and median returns ranking high among peers (mean +15%, median -8%). OKX, despite few listings, avoids extreme drops except in one or two cases—fairly stable. Upbit, mostly listing mainstream-follow tokens, offers modest gains but controlled risk. Overall, for stable profits, Binance and KuCoin slightly edge out; Bitget/Bybit rank second (means pulled up by outliers, medians low); Gate/MEXC most challenging (extreme profit-loss polarization). Note: “overall best” here assumes risk control; aggressive investors may prefer the “explosiveness ranking” above.

(3) Platforms with fastest-growing derivatives share: From quarterly growth, LBank, MEXC, and Gate lead in derivatives share and scale expansion. LBank’s derivatives volume nearly doubled, share rising from ~55% to ~67%, successfully converting spot users to derivatives. MEXC and Gate, already high-share, each grew ~5 percentage points, cementing high-leverage trading dominance. Bitget and KuCoin each gained ~4 points, showing derivatives’ growing importance. Conversely, OKX and Bybit saw flat shares; Binance rose slightly but minimally (large base). HTX barely changed, stuck around 60%. Overall, mid-tier platforms boosted derivatives share faster, clearly focusing on derivatives to drive Q3 growth; leaders, due to base and positioning, saw minimal share changes but absolute volume gains. Expected: As these rising challengers grow, derivatives landscape will diversify beyond a few dominant players.

(4) Closed-loop effect of listing volume and contract support: Our analysis shows some exchanges have formed a “new token spot +配套contracts” closed-loop, while others haven’t. Clear examples: Bitget, LBank, Gate, MEXC lead in listing volume and nearly offer contracts for every hot token. This spot-derivatives synergy forms a closed loop: Users can complete both spot and leveraged trading on one platform, increasing retention and volume. For example, a user spotting strong momentum in token X on LBank can go long spot, then immediately open a leveraged long on the same platform, then exit—all within LBank. For the exchange, new tokens bring spot traffic, derivatives amplify volume—mutually reinforcing. In contrast, Binance and OKX form loops slower: they list fewer or slower, so many new tokens lack spot, let alone contracts (or only add contracts after price stabilizes). This forces users to other platforms for small-cap derivatives. Binance tried syncing Launchpad projects with contracts (e.g., ARB airdrop followed by futures), but overall pace remains conservative. KuCoin and HTX list new tokens but often delay corresponding contracts, forcing leveraged traders to migrate, causing capital outflow. Overall, platforms achieving listing-contract linkage thrived in Q3, benefiting in volume and user retention; those failing missed trading potential.

(5) Investor returns match platform strategy: Cross-platform comparisons show investor return prospects align with platform strategy: high-risk/high-return platforms (e.g., LBank, MEXC) may offer huge short-term gains but unsustainable for most, suiting fast-in/fast-out players. Stable platforms (Binance, OKX) offer fewer but steadier opportunities, fitting low-volatility investors. Similarly, in derivatives, aggressive platforms offer more minor-token contracts and higher leverage—potential for 2x, 10x gains, but also overnight blow-ups; stable platforms focus on major-token contracts with manageable swings. This risk-return alignment reflects established “ecosystem personalities”: users self-select based on risk appetite, reinforcing platform strategies. For example, those betting on new token riches flock to LBank/Gate, prompting these platforms to list even more, forming a cycle. For investors, when trading new tokens or derivatives, consider platform attributes as part of portfolio strategy: make quick gains on one platform, allocate conservatively on another, balancing return and risk.

Extension: Trend of exchange-owned chains and ecosystem integration

Beyond new tokens and derivatives, a broader trend deserves attention: exchanges building their own blockchains or Layer 2 networks, and the integration potential with new token and derivatives businesses. Currently, major exchanges are rolling out proprietary chains: Binance’s BNB Chain, Bybit-backed Mantle, Coinbase’s Base (an Ethereum L2). Though not exchange-built, emerging L2s like ZKSync (integrated with Bitget Wallet) are also relevant. Comparing these strategies, we explore how future “new token–derivatives–on-chain ecosystem” closed loops might form.

Current exchange chain strategies:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News