Top Perpetual Contract DEXs in 2026: The CEX Winter Is Coming

TechFlow Selected TechFlow Selected

Top Perpetual Contract DEXs in 2026: The CEX Winter Is Coming

Perpetual contracts are a test of execution capability: including trade execution, funding rates, and liquidations.

Author: Coinmonks

Translation: Baihua Blockchain

At the start of this year, a clear public signal indicated a shift in focus.

In early October, Hyperliquid launched permissionless listings (HIP-3). Builders can now launch perpetual markets by staking 500,000 HYPE, subject to safeguards such as validator penalties and open interest caps. This move coincided with decentralized perpetuals reaching new highs in market share against CEXs, further fueling the narrative that "on-chain is winning."

Meanwhile, CZ (Binance founder) responded on X to rumors about Hyperliquid, even engaging a widely discussed post about "shorting $1 billion on Hyperliquid." Whether interpreted as concern or simple rumor control, the fact that Binance's founder publicly mentioned a DEX signals where attention has shifted.

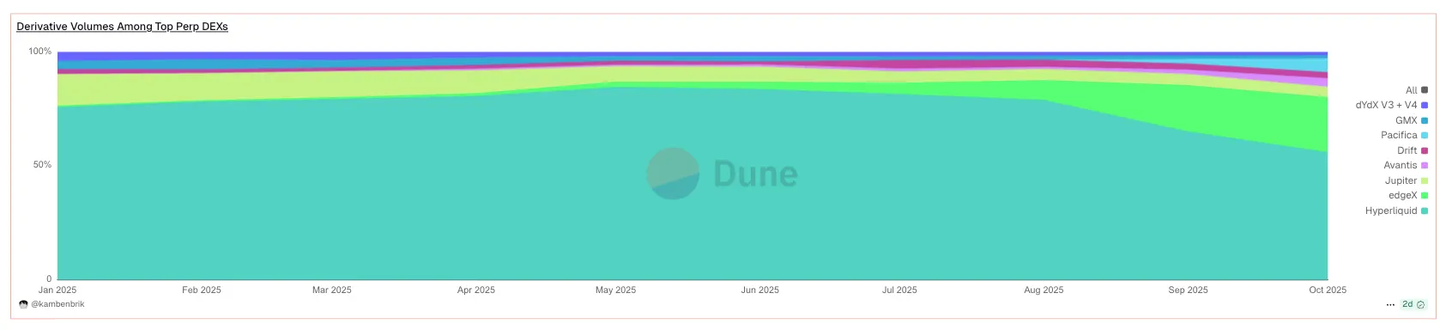

Zooming out to market structure: by mid-2025, DEX perpetuals accounted for approximately 20–26% of global perpetual trading volume, up from single digits two years prior. The DEX-to-CEX futures volume ratio hit a record of around 0.23 in Q2 2025—a clear directional signal that liquidity and users are migrating on-chain.

Execution determines your edge

Three levers drive PnL:

-

Execution and slippage (latency, depth, queuing)

-

Liquidation design (mark price vs index price; ADL vs insurance fund)

-

Fee surface (classic maker/taker vs zero fees/profit-sharing)

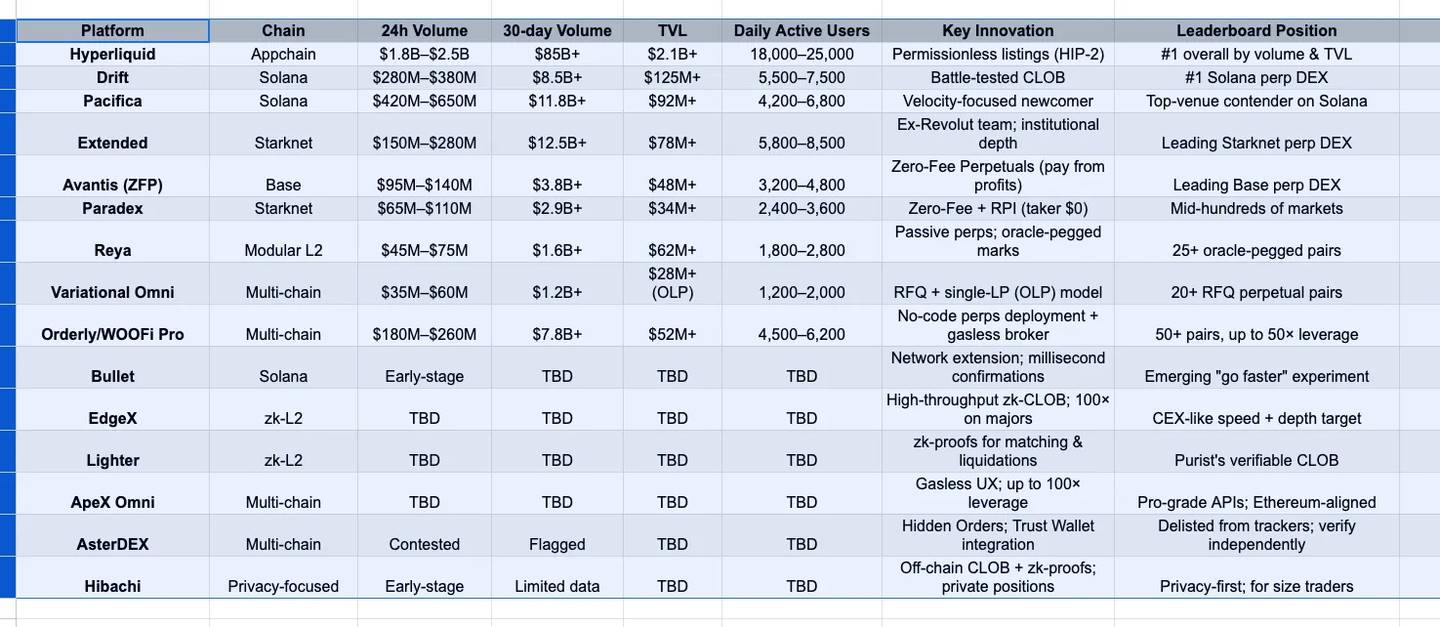

The following analysis is organized around how platforms apply these levers, interwoven with metrics to explain behavior rather than simply listing tables.

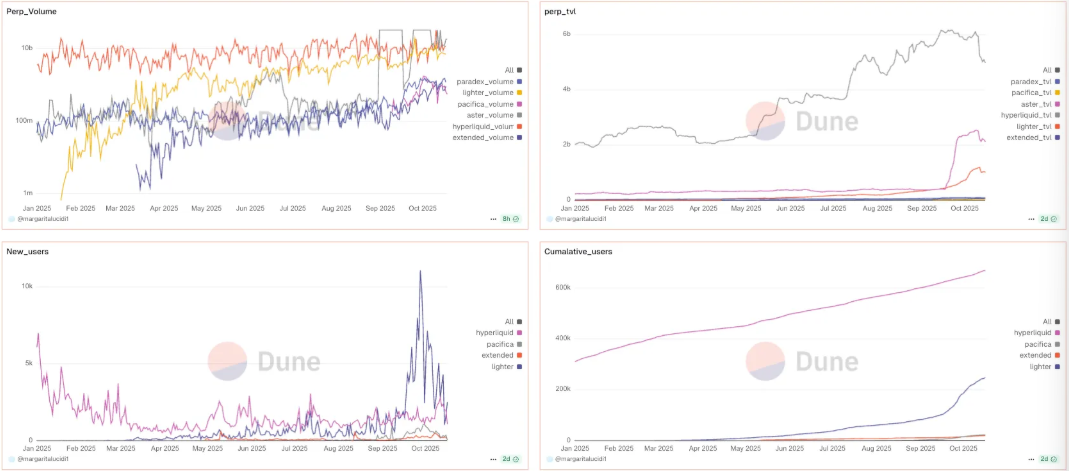

Appchain CLOBs: When latency becomes a feature (and shows up in PnL)

Hyperliquid’s HIP-3 changed the supply side of liquidity. With listings becoming permissionless (requiring only a 500,000 HYPE bond), long-tail markets are no longer fleeting. You can now see open interest persist beyond the first funding cycle without evaporating, with Day 3 and Day 7 liquidity still sufficient to absorb large trades. This stickiness, combined with consistently top-tier daily volumes, explains why traders now assume depth on Hyperliquid for “niche” pairs when planning execution—because it often holds true.

On Solana, Bullet emphasizes speed. During volatile two-minute bursts, its “network scaling” design keeps confirmation times in low milliseconds (Celestia DA, app-specific optimizations). The real-world effect is tighter slippage during fast moves: when SOL jumps fractions of a percent in seconds, execution prices stay closer to intent than on slower stacks. This isn’t marketing fluff—it’s basis points saved on every trade.

EdgeX implements the same philosophy with zk tech. During macro data releases, takers pay just single-digit basis points to cross the spread because the matching engine actually preserves queue position. Over a month of news-driven trading, this gap accumulates into meaningful advantage—partly why trading desks keep it as a “fast lane” backup option.

A Solana story ties this together. When Drift hit a billion-dollar daily volume, market makers compared execution prices across platforms within the same minute; Pacifica, despite still being invite-only, showed comparable impact on BTC/SOL during those windows. Conclusion: Solana’s throughput is now shared across multiple platforms, not unique to one—execution routing can be based on strategy, not loyalty.

zk-L2 order books: Verifying not just outcomes, but engines

Lighter turns “don’t trust, verify” into infrastructure. Matching and liquidations are both covered by ZK proofs, so price-time priority and ADL paths become auditable state transitions, not policy documents. You feel this during market dumps: liquidations unfold exactly as documented, and insurance fund usage aligns with stress paths. That’s why backtests here hold up better in live conditions.

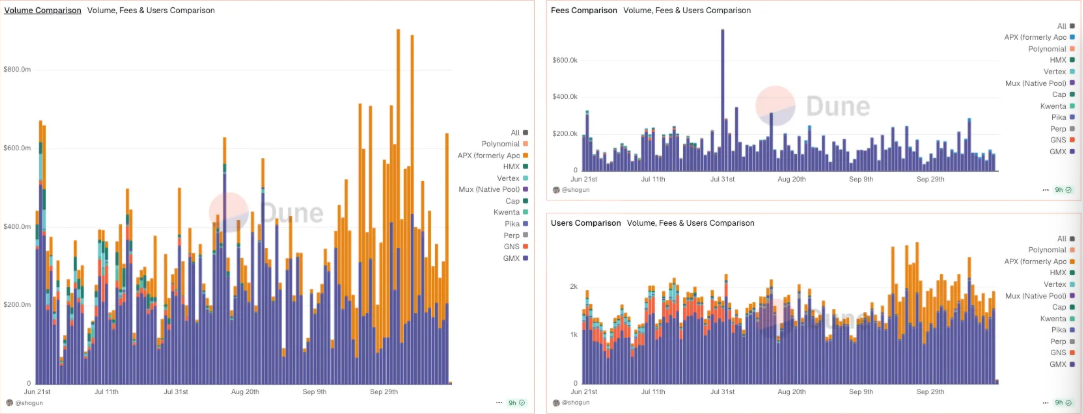

ApeX (Omni) prioritizes user experience without sacrificing custody: gas-free frontends, up to 100x leverage on major pairs, and CEX-grade APIs—all backed by consistently strong daily volume in the hundreds of millions, ensuring agile cancel/replace latency when funding rates flip. If you're a high-frequency trader, the key metric isn't nominal value, but whether sub-second cancels remain effective when the order book churns.

Fee alchemy: “Zero” really means “different”

Two designs force you to update your spreadsheets:

-

Avantis (Base) removes opening/closing/borrowing fees, charging only on profitable closes (ZFP: zero fee/profit-sharing). In a month of high-leverage, high-frequency trading, you’ll see PnL variance tighten because fee drag stops bleeding you during choppy conditions. Analysts note ZFP differs significantly from “discounts”: it alters optimal holding time, especially for short-term flows.

-

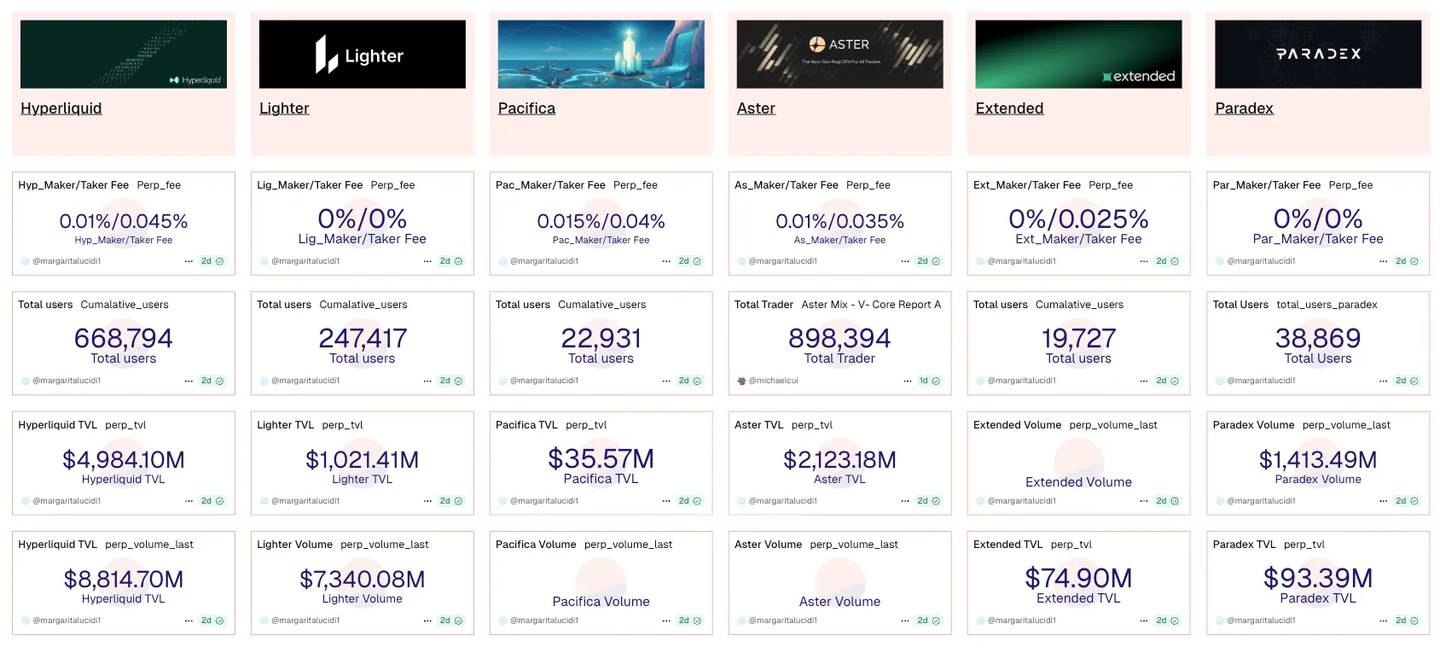

Paradex (Starknet) keeps taker fees at $0 via Retail Price Improvement (RPI). Whether it’s cheaper depends on the spread. In calm periods, $0 taker fee + RPI usually beats classic maker/taker models; during headline news, spreads widen and the math reverses. Paradex’s own RPI post is a great primer—you need to track effective cost per trade (spread ± improvement), not banner ads.

A notable dynamic on X worth citing: after Paradex explained RPI, quant traders posted costs adjusted for trade size and spread. For volumes under five-figure USD amounts, RPI typically wins; above that, depth dominates the fee label. Hence, execution routing must adapt in real time.

Anchored mark prices and passive liquidity (fewer “why was I liquidated?” moments)

Reya optimizes for clean mark pricing over raw speed. By anchoring unrealized PnL to a hybrid oracle basket, the gap between mark and index prices narrows during price spikes. In choppy conditions, this gives you a few extra ticks before liquidation—potentially the difference between getting wiped out and surviving to catch the next candle.

RFQ: When certainty beats time priority

Variational’s Omni replaces public order book trading with Request-for-Quote (RFQ), where an Omni LP provides quotes, hedges across CEX/DEX/OTC, and shares market maker PnL with depositors. The important number isn’t notional value, but the fill rate at quoted size when order books thin. During two-minute BTC volatility spikes, takers report higher completion rates than on sparse CLOBs—precisely when certainty is worth more than a single basis point.

Market share shift (and why it’s sticky)

Three data points form the structural case:

-

By mid-2025, DEX perpetual market share climbed into the low-to-mid 20s—up from roughly 4–6% in 2024. This isn’t seasonal—it’s a growth curve.

-

The DEX-to-CEX futures volume ratio hit a record of ~0.23 in Q2 2025, corroborated by multiple market data sources.

-

Hyperliquid’s permissionless listing and the public CZ discussion amplified this narrative precisely as those ratios reached new highs. The timing is unambiguous: DEXs are no longer peripheral—they’re central to the conversation.

Solana’s three-track ecosystem (how to route flow)

Drift is the endurance player—maintaining stable depth, cross-margin, and low slippage on major pairs at around $300M daily volume. When it hits over $1B in 24-hour volume, traders use identical order sizes to compare execution across platforms, treating Drift as the benchmark.

Pacifica is the speedster—even in invite-only beta, it achieved over $600M daily volume, with execution prices competitive with Drift within the same hour, making it a real alternative, not just “paper volume.”

Bullet is raw speed—the millisecond lane for event trading, where basis-point slippage defines the entire profit of a trade. You route here when it matters.

Starknet’s CLOB cluster (no longer science projects)

Extended and Paradex regularly reach hundreds of millions in daily volume and tens of billions over 30-day windows. Crucially, their characteristics matter: Extended shows shallower slippage curves on majors than expected for a “young” platform, while Paradex’s $0 taker fee truly costs less during off-peak hours—until spreads widen near news events. Execution routing requires real-time adjustment.

AsterDEX: Features vs depth

Hidden orders are live. Trust Wallet integration broadens the user funnel. In the same window, third-party trackers flagged suspicious volume patterns and delisted perpetual data sources. A mature approach is simple: enjoy its rapid feature iteration, but only commit large capital once depth / OI / fees pass your order size tests.

Privacy without sacrificing execution

Hibachi combines an off-chain CLOB with Succinct-style ZK proofs and encrypted data availability on Celestia, so balances/positions remain private yet provable. The key performance indicator (KPI) isn’t TVL; it’s execution quality under privacy—when you don’t broadcast inventory, do your fills and slippage meet expectations?

Extreme leverage is a slogan, not a strategy

“Up to 1000x” looks flashy; at that leverage, a 0.10% adverse move triggers automatic liquidation. If you’re testing it, keep positions extremely small and set hard stop-losses. In practice, clean 25–50x leverage on gas-free CLOBs (like WOOFi Pro on Orderly) is sufficient—and far easier to manage risk-wise.

How to choose—practical, metrics-driven

-

Execution first. During CPI/FOMC/ETF meeting minutes, measure realized slippage and cancel/replace latency. If milliseconds and queue position matter, appchain/zk CLOBs—Hyperliquid, EdgeX, Bullet, Lighter, ApeX—typically win.

-

Fees second. Backtest ZFP (pay from profit) vs RPI ($0 taker fee) based on your order size and volatility regime; the “cheapest” platform changes hourly, not monthly.

-

Liquidation third. When depth thins, favor small mark-index gaps (Reya), proven liquidation paths (Lighter), or RFQ hedging (Variational).

-

Always verify liquidity. Use 24h/7d/30d volume and open interest (OI) for sanity checks—then send real test orders for your pairs (not just BTC/ETH).

2026 setup, in one sentence

Run a speed-focused platform (Hyperliquid / EdgeX / Bullet), a fee-model hedge platform (Avantis ZFP or Paradex RPI), and a chain-native option you trust (Drift/Pacifica on Solana; Extended/Paradex on Starknet). Then let latency, proofs, effective fees, and liquidation logic—measured against your order size—decide where you click to open.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News