Grayscale, which once stood firm against the SEC, is about to list on the NYSE

TechFlow Selected TechFlow Selected

Grayscale, which once stood firm against the SEC, is about to list on the NYSE

From the launch of GBTC in 2013 to date, Grayscale's assets under management have exceeded $35 billion.

By Eric, Foresight News

On the evening of November 13, Beijing time, Grayscale submitted an IPO application to the New York Stock Exchange, planning to enter the U.S. stock market through Grayscale Investment, Inc. The IPO is being led by Morgan Stanley, BofA Securities, Jefferies, and Cantor as joint bookrunners.

Notably, Grayscale is adopting an Up-C (umbrella partnership corporation) structure for this listing. This means that Grayscale's operating and controlling entity, Grayscale Operating, LLC, will not be the listed entity. Instead, a newly formed public entity, Grayscale Investment, Inc., will conduct the IPO and achieve public trading by acquiring certain interests in the LLC. Founders and early investors can convert their LLC interests into shares of the listed entity, enjoying favorable capital gains tax treatment—only subject to individual income tax. IPO investors, however, will be required to pay corporate taxes on profits as well as individual income tax on dividends.

Besides offering tax advantages to company insiders, this structure also allows continued absolute control post-IPO through dual-class shares. According to the S-1 filing, Grayscale is wholly owned by its parent company DCG, which explicitly stated that after the IPO, DCG will retain decision-making power over major matters at Grayscale by holding 100% of the voting rights through Class B shares with superior voting power. All proceeds raised from the IPO will be used to acquire equity interests from the LLC.

Grayscale needs no introduction—it was the first to launch Bitcoin and Ethereum investment products and achieved conversion of Bitcoin and Ethereum trusts into spot ETFs after a long and arduous battle with the SEC. Its Digital Large Cap Fund has earned a reputation as something akin to an "S&P 500 for crypto." During the previous bull cycle, each rebalancing of the fund caused significant short-term price fluctuations in both removed and newly added tokens.

The S-1 filing shows that as of September 30 this year (local time), Grayscale’s total assets under management (AUM) reached $35 billion, making it the largest digital asset manager globally. It offers more than 40 digital asset investment products covering over 45 cryptocurrencies. Of the $35 billion, $33.9 billion is in ETPs and ETFs (primarily Bitcoin, Ethereum, and SOL-related products), while $1.1 billion is in private funds (mainly altcoin investment products).

In terms of revenue alone, Grayscale's main investment products outperform key competitors—largely due to AUM accumulated from previously non-redeemable trusts and management fees above the industry average.

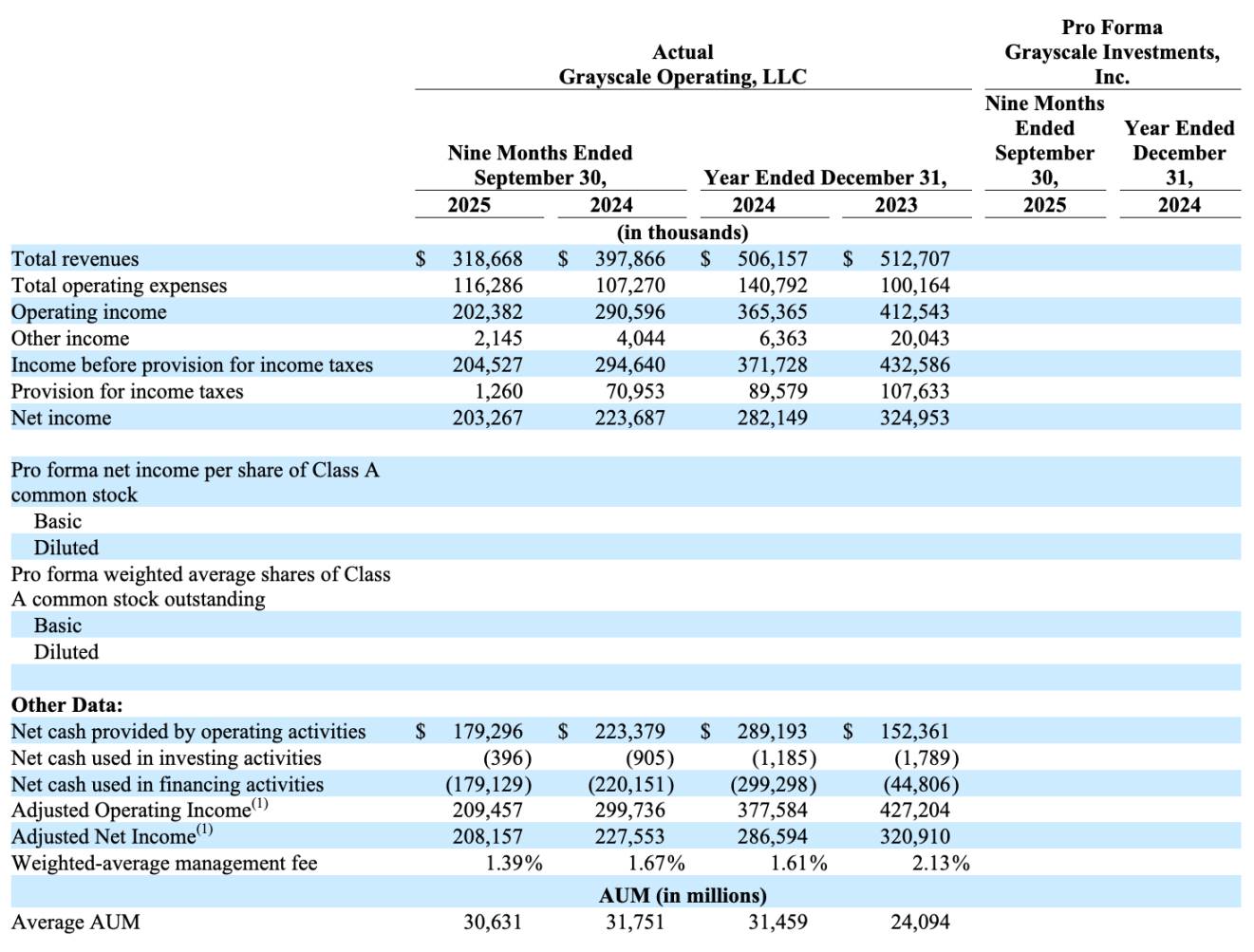

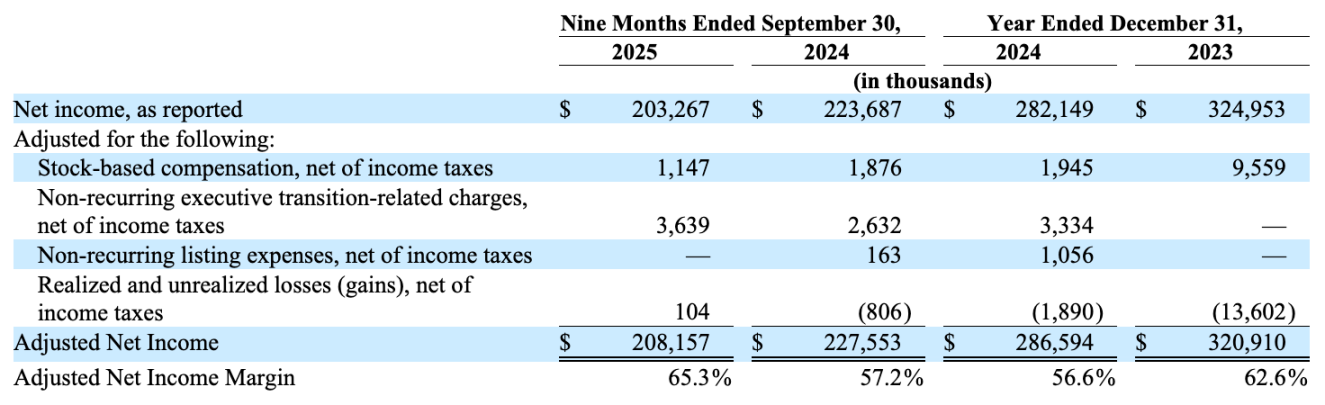

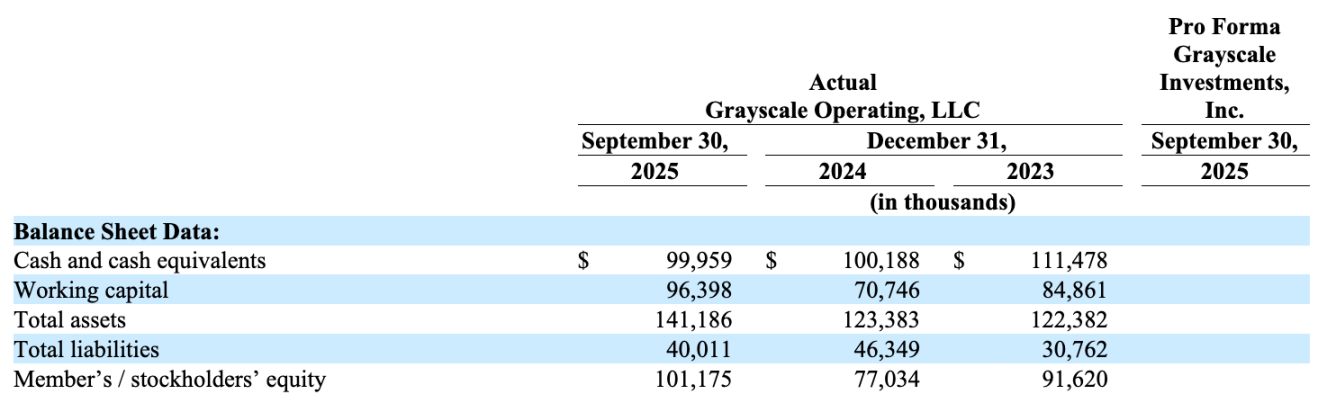

Financially, for the nine months ended September 30, 2025, Grayscale reported approximately $319 million in operating revenue, down 20% year-over-year; operating expenses were about $116 million, up 8.4%; operating profit came in at roughly $202 million, down 30.4%. After adding other income and deducting income tax provisions, net profit was approximately $203 million, down 9.1%. Additionally, average AUM data indicates that this year’s AUM may have declined compared to last year.

Excluding non-recurring items, adjusted net profit during the reporting period was approximately $208 million, with a net profit margin of 65.3%. While the former declined 8.5% year-over-year, the net profit margin increased from 57.2% in the same period last year.

Currently, Grayscale maintains a healthy debt ratio. Although revenues and profits have declined, the company's operational condition continues to improve, evidenced by rising asset value, declining liabilities, and increasing profit margins.

The S-1 filing also revealed Grayscale’s future development plans, including expanding private fund offerings (launching more altcoin-focused private investment products); introducing actively managed products to complement passive investment products (ETFs, ETPs); and engaging in active investments, including its own investment products, cryptocurrencies, or other assets.

Regarding distribution channel expansion, Grayscale disclosed that it has completed due diligence with three broker-dealers whose combined AUM totals $14.2 trillion. This month, it launched Bitcoin and Ethereum mini ETFs on a major independent brokerage platform serving over 17,500 financial advisors, with advisory and brokerage assets exceeding $1 trillion. In August, Grayscale partnered with iCapital Network, a network comprising 6,700 advisory firms. Under the agreement, Grayscale will provide digital asset investment opportunities to firms within the network through its actively managed strategies in the future.

Overall, the information disclosed by Grayscale portrays it as a relatively stable asset management firm whose primary revenue comes from management fees on investment products, leaving little room for speculation. However, given precedents among traditional asset managers going public, estimates for Grayscale’s market valuation and P/E ratio are reasonably predictable, making it a relatively transparent and foreseeable investment option.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News