Can DEX replace CEX?

TechFlow Selected TechFlow Selected

Can DEX replace CEX?

DEXs have evolved from "experimental alternatives" to "credible competitors" and are expected to capture the majority market share within the next 2-3 years.

Author: A1 Research

Translation: Saoirse, Foresight News

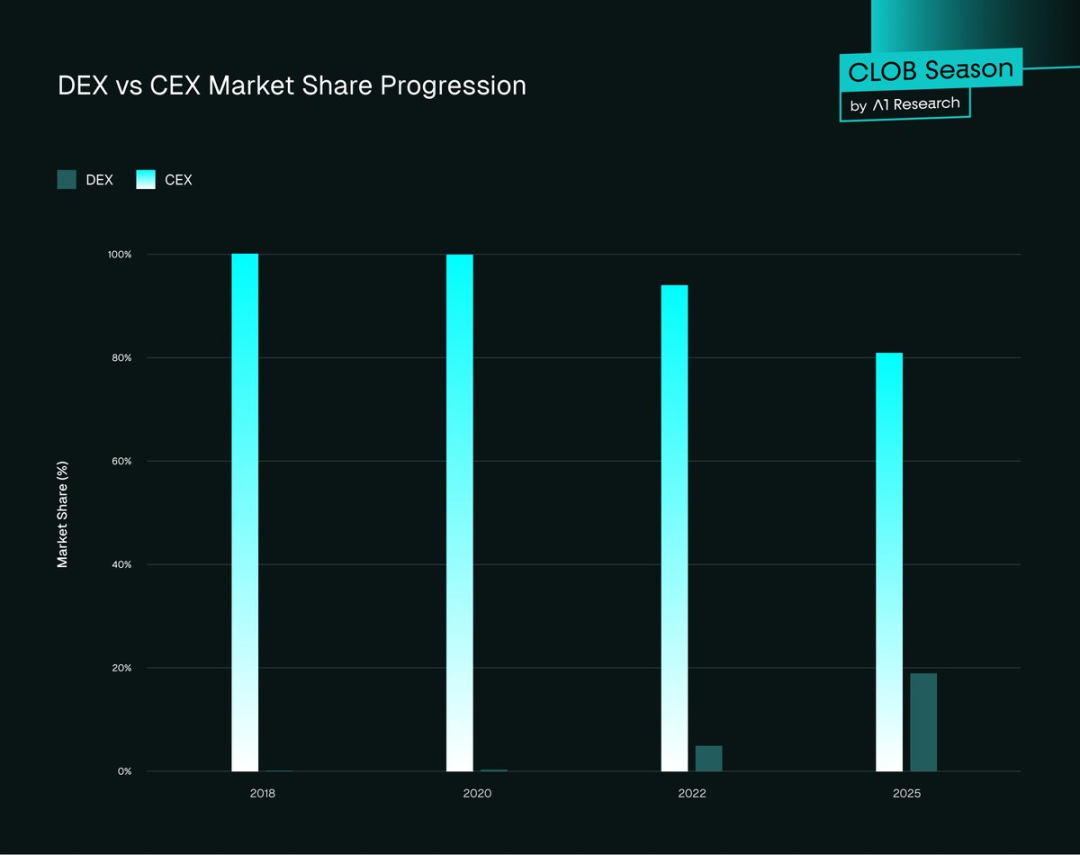

Decentralized finance (DeFi) has undergone significant structural evolution across market cycles. While centralized exchanges (CEX) have consistently led in trading volume, decentralized exchanges (DEX) have steadily captured market share from CEX in each cycle—and this time, the competitive gap between them has narrowed to an unprecedented level.

This persistent shift in market share stems from a clear root cause: decentralization itself imposes fundamental infrastructure limitations. For much of the past decade, blockchain as a new financial infrastructure could not match CEX in speed, liquidity, or user experience.

However, with each cycle, DEXs have made visible progress in closing this gap. By 2025, we are justified in asking: will decentralized exchanges (DEX) ultimately replace centralized exchanges (CEX)?

Cyclical Challenges: Why Haven’t DEXs Surpassed CEX Yet?

Analysis across multiple market cycles shows that DEX infrastructure is maturing progressively, with each cycle laying the foundation for today’s landscape.

2017–2018: Experimental Phase

Early DEXs like EtherDelta ran directly on Ethereum Layer 1, requiring minutes for settlement, offering poor user interfaces, and suffering from severe liquidity shortages. In contrast, Binance scaled rapidly like a Web2 application—fast, liquid, and user-friendly—quickly attracting both retail and institutional users.

-

DEX market share: ~0%

-

CEX market share: ~100%

This early phase confirmed a key insight: decentralization is feasible, but performance and usability remain critical barriers.

2020: Breakthrough During DeFi Summer

Uniswap's introduction of the Automated Market Maker (AMM) model was revolutionary. Without order books, anyone could provide liquidity "permissionlessly"—a major architectural innovation in DEX design. However, AMMs primarily served "long-tail tokens" (less actively traded niche tokens), unable to support mainstream tokens with deep liquidity.

As Ethereum network congestion worsened, gas fees surged from under 20 gwei to over 400 gwei, significantly increasing transaction costs. Severe interface delays persisted, leading professional traders to stick with CEXs like Bybit and Binance.

-

DEX market share: 0.33%

-

CEX market share: 99.67%

To address liquidity issues, Uniswap V3 launched "concentrated liquidity pools" in 2021—a complex architecture allowing liquidity providers (LPs) to allocate funds within custom price ranges. Although the issue of impermanent loss (IL) remained unresolved (discouraging many from providing liquidity for small-cap tokens), this was a major leap: DEXs evolved from "experimental protocols" into viable trading venues for specific markets and certain traders.

2022: Trust Crisis After the FTX Collapse

In November 2022, the collapse of FTX sent shockwaves through the industry: billions of dollars in user funds vanished overnight, shattering trust in centralized custodians. In the following weeks, "Not your keys, not your coins" became a trending topic on Twitter (now X), and traders flocked to self-custody.

As a result, trading volumes surged on DEXs like Uniswap and dYdX: Uniswap exceeded $5 billion in volume, while dYdX saw a 400% spike. Many users migrated from CEX to DEX. Yet despite this momentum, core problems remained: poor wallet UX, fragmented cross-chain liquidity, and lack of fiat on/off ramps. As short-term panic subsided, behavior normalized, and many returned to CEX.

-

DEX market share: ~5%

-

CEX market share: ~95%

In response, the DeFi ecosystem innovated further: introducing cross-chain Uniswap routing and improving UX via wallets like Rabby Wallet and Phantom.

Nonetheless, DEXs still couldn't achieve CEX-level low latency. Each cycle brought incremental improvements, but the performance gap remained significant: blockchains still couldn't support professional-grade trading, and the ultra-low-latency "order book architecture" fundamentally conflicted with AMM design constraints.

2025: The Turning Point

The 2025 market environment has undergone a qualitative shift—the infrastructure has matured enough for DEX and CEX to engage in "true competition." High-performance blockchains, on-chain central limit order books (CLOB), direct fiat integration, and near-CEX latency are now fully integrated into on-chain protocols. Perpetual contract DEXs (Perp DEXs) like Hyperliquid, Paradex, and Lighter now offer on-chain trading experiences approaching CEX functionality.

Liquidity aggregation, faster block confirmation times, and unified margin systems now allow traders to execute strategies across spot and derivatives directly on-chain, without the previous friction of on-chain trading.

-

DEX market share: ~19% (peaked at 23% in Q2 2025)

-

CEX market share: ~81%

While full functional parity hasn't been achieved, DEXs are no longer just "alternatives," but direct competitors to CEXs.

Figure 1. DEX vs CEX Market Share Trend

2025 Data Snapshot: CEX Still Dominant, But DEX Gaining Rapidly

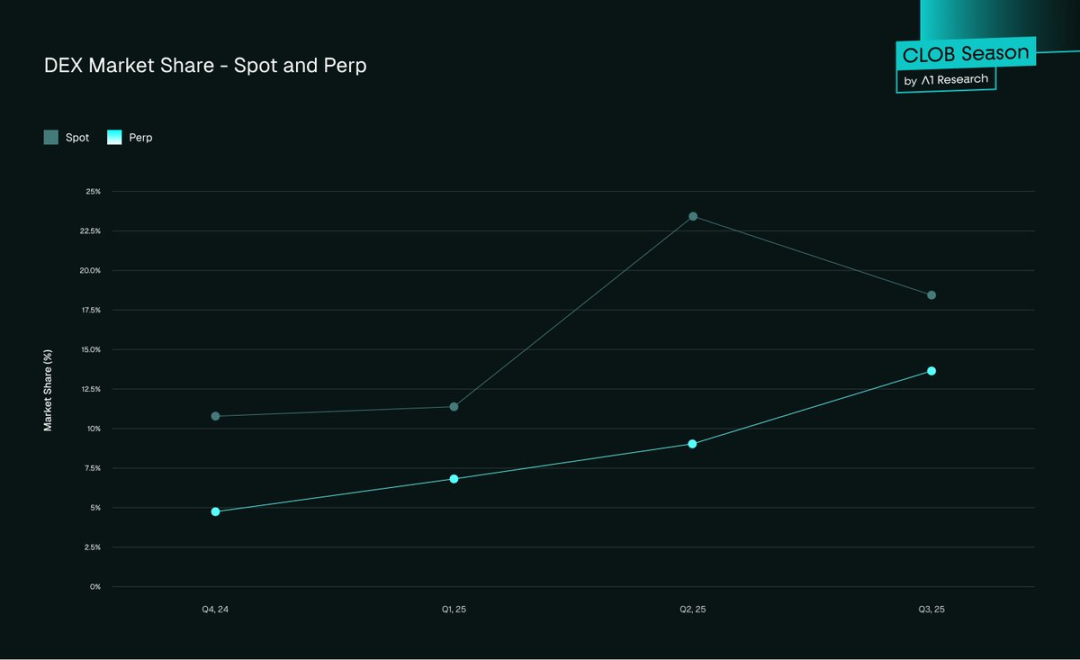

Data clearly shows that while CEX still dominates global liquidity, DEX is narrowing the gap cycle by cycle, quarter by quarter. Across both spot and derivatives, signs point to a shift of trading activity on-chain.

-

Spot market: DEX market share rose from 10.5% in Q4 2024 to 19% by end of Q3 2025.

-

Futures market: By end of Q3 2025, DEX share reached ~13%, up sharply from 4.9% in Q4 2024.

Figure 2. DEX Market Share—Spot & Perpetual Contracts

-

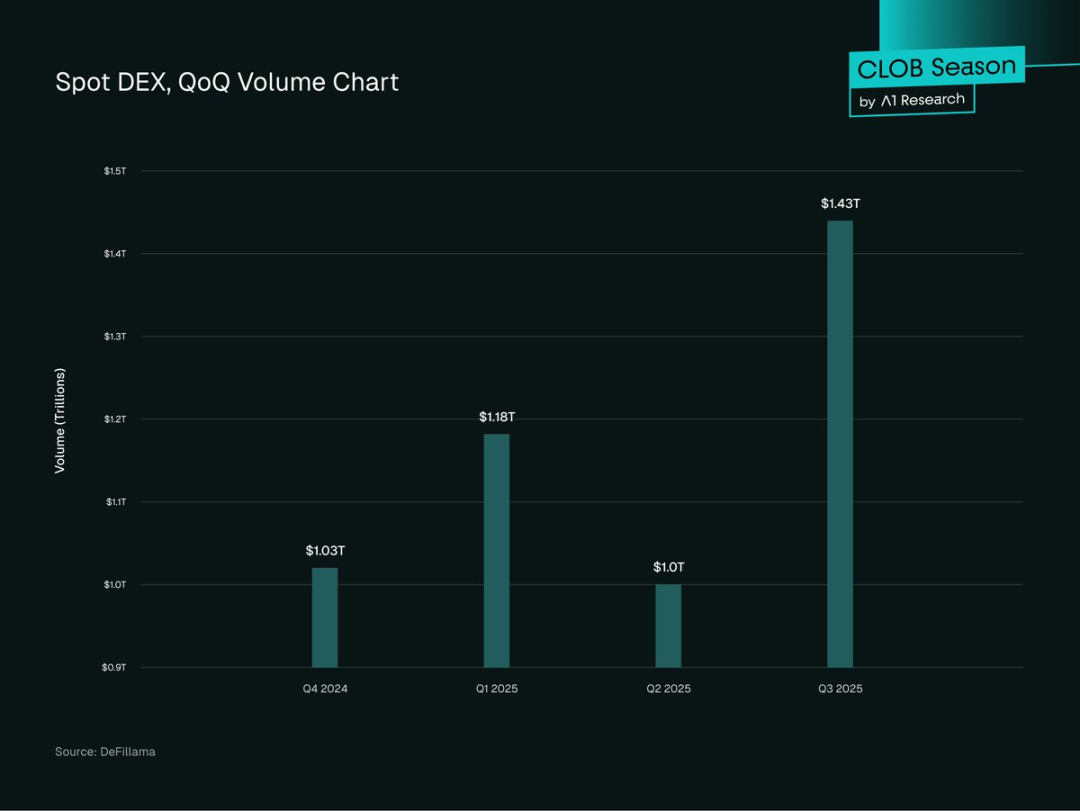

Spot trading volume: In Q3 2025, DEX spot volume hit $1.43 trillion, a record high—up 43.6% from $1 trillion in Q2 2025 and surpassing the previous peak of $1.2 trillion in Q1 2025.

Figure 3. Spot DEX Quarterly Sequential Trading Volume Chart

-

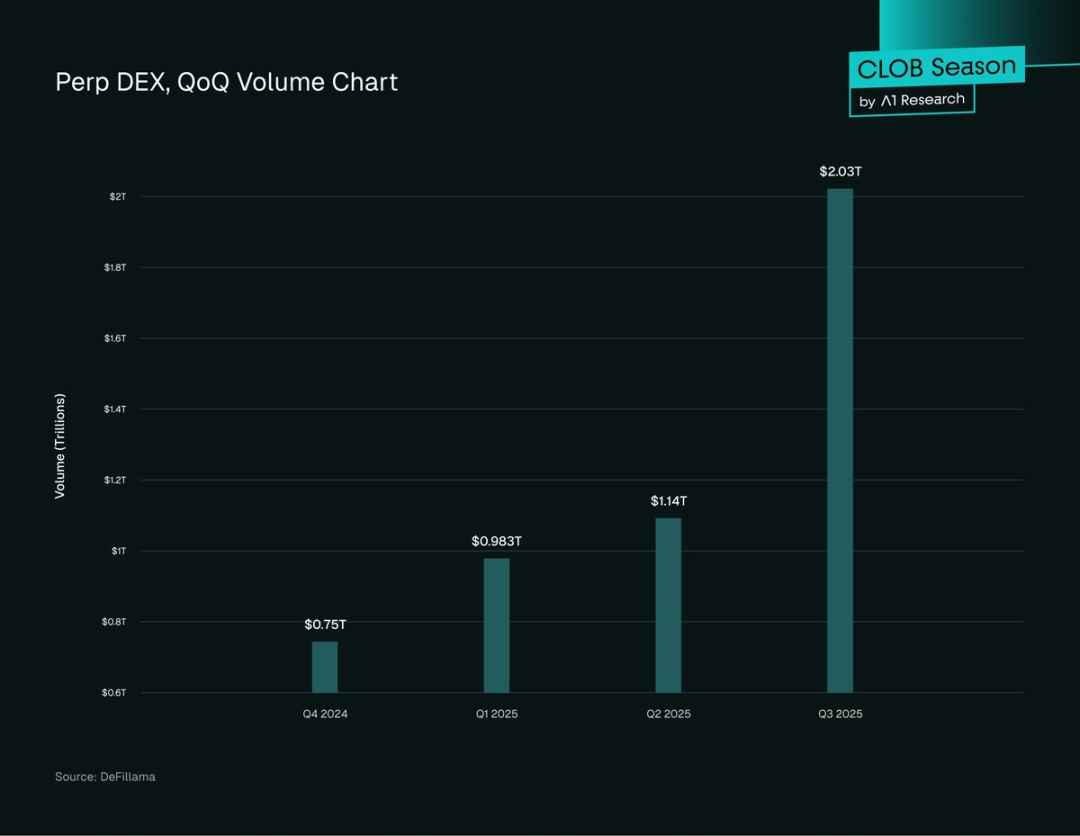

Perpetual contract volume: DEX perpetual trading volume expanded dramatically in 2025, reaching $2.1 trillion cumulatively on-chain by Q3—up 107% from Q2 2025 and exceeding DEX spot volume.

Figure 4. Perp DEX Quarterly Sequential Trading Volume Chart

-

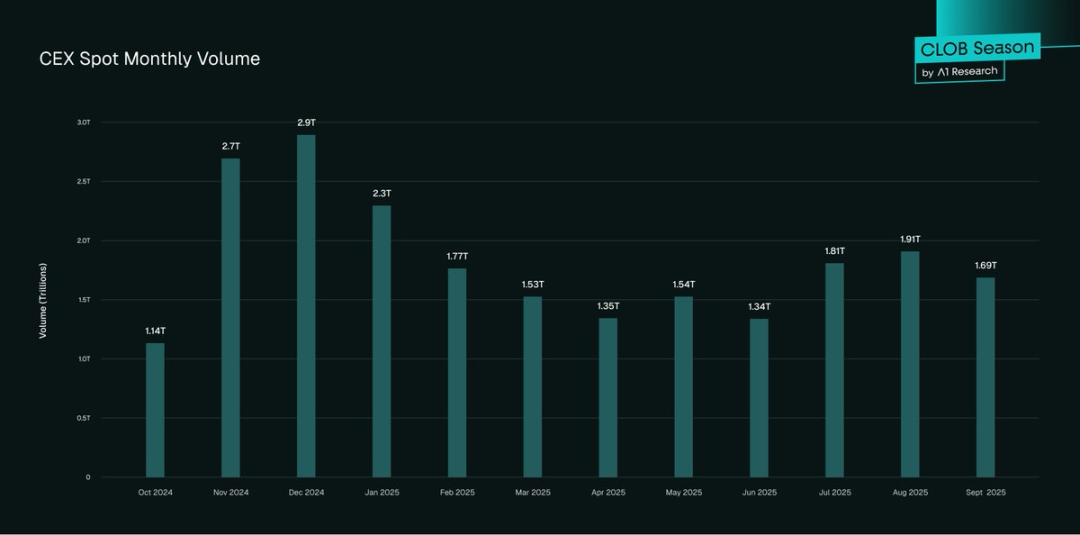

CEX performance: In Q3 2025, CEX spot trading volume exceeded $5.4 trillion, maintaining dominance and growing 25% from Q2 2025.

Figure 5. CEX Spot Monthly Trading Volume

-

Trend direction is clear and accelerating: DEX spot volume grew 43.6% sequentially and 33% year-over-year; perpetual contract volume surged over 5x in the past 12 months, increasing its share of total futures volume from 3.45% to 16.7%. If current trends continue, 2025 will mark the "inflection point" for DEX market positioning.

Adoption Patterns

Although DeFi adoption is rising steadily, growth remains uneven across regions and user groups. Different markets, user characteristics, and institutional behaviors are shaping the global evolution of DeFi. The following patterns reveal hotspots of DeFi growth, differences in participation between professionals and retail users, and what these trends mean for the next phase of expansion.

-

Uneven global distribution: The Asia-Pacific region is the fastest-growing area, with on-chain activity up 69% year-over-year, followed by Latin America and Sub-Saharan Africa; North America and Europe still dominate in absolute trading volume but show lower growth rates (~42%-49%). Growth momentum in Asia and Africa is strong, particularly in small transactions on low-fee chains—reflecting a "retail-driven organic growth" pattern.

-

Institutional participation: Institutional adoption of DeFi follows a unique pattern. Major trading firms increasingly use "cross-platform routing"—integrating CEX and DEX liquidity to optimize execution and hedge positions. This "hybrid model" indicates that professional traders no longer see DEX as a "high-risk alternative," but as a "complementary trading venue."

-

Token launch preference: Most new projects now choose to "launch first on DEX"—using DEXs for initial price discovery before seeking CEX listings. This is because DEX token launches are permissionless and fee-free; however, well-funded projects often opt for CEX listings to achieve broader token distribution.

-

DeFi Total Value Locked (TVL): In Q3 2025, DeFi protocol TVL reached $157 billion, a record high—with over 50% of TVL related to DEX protocols and liquidity pools. Ethereum dominates DeFi TVL with approximately 63% share.

-

Active trader base: CEX still leads in user numbers, with over 300 million registered users globally (Binance alone has 290 million); in contrast, DEX has about 10–15 million monthly active users—fewer in number, but more "DeFi-native" and experienced in trading.

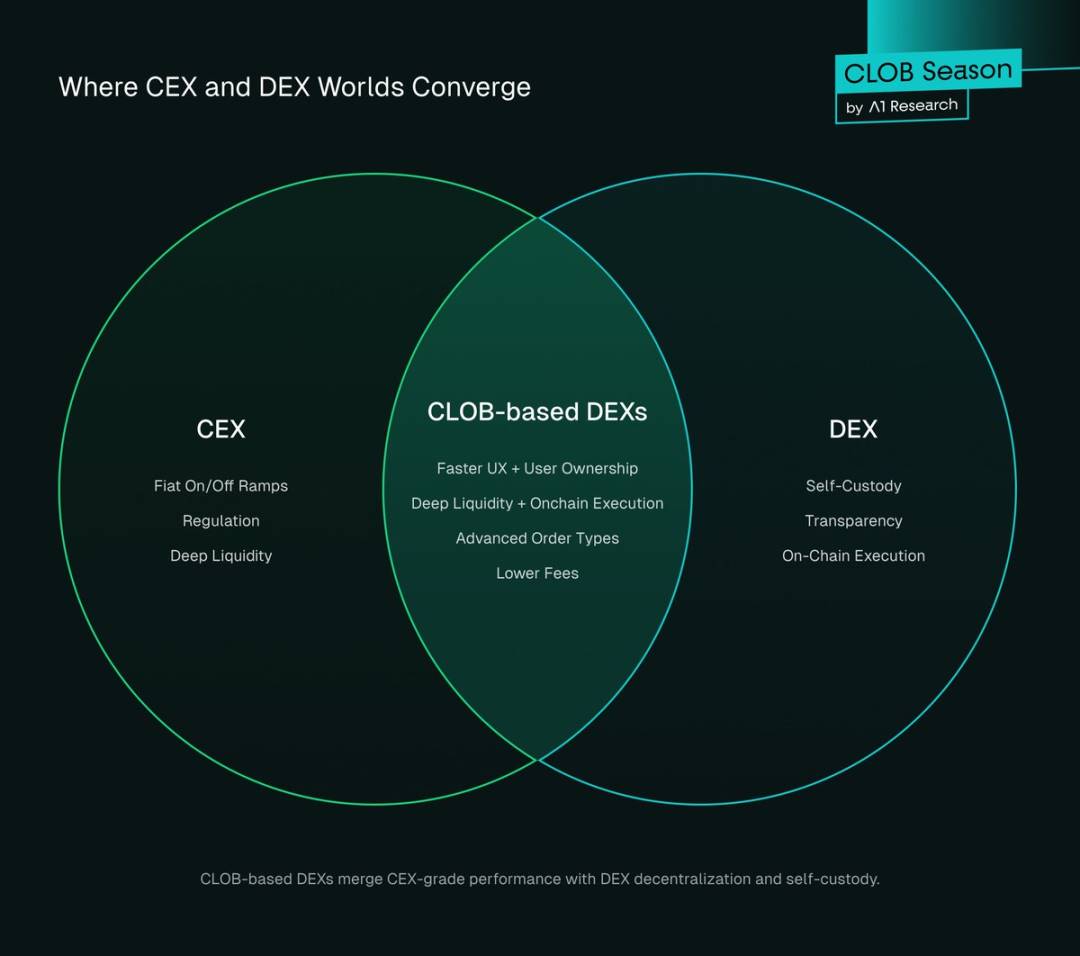

In summary, DEX continues to narrow the competitive gap with CEX, but the real driver bringing DEX close to CEX performance levels is the evolution of its core trading architecture. The next breakthrough will be driven by the "on-chain order book (CLOB)" model—a structure combining the advantages of decentralization with the efficiency of CEX and traditional finance (TradFi).

Breaking the AMM Barrier: The Era of High-Performance CLOB DEX

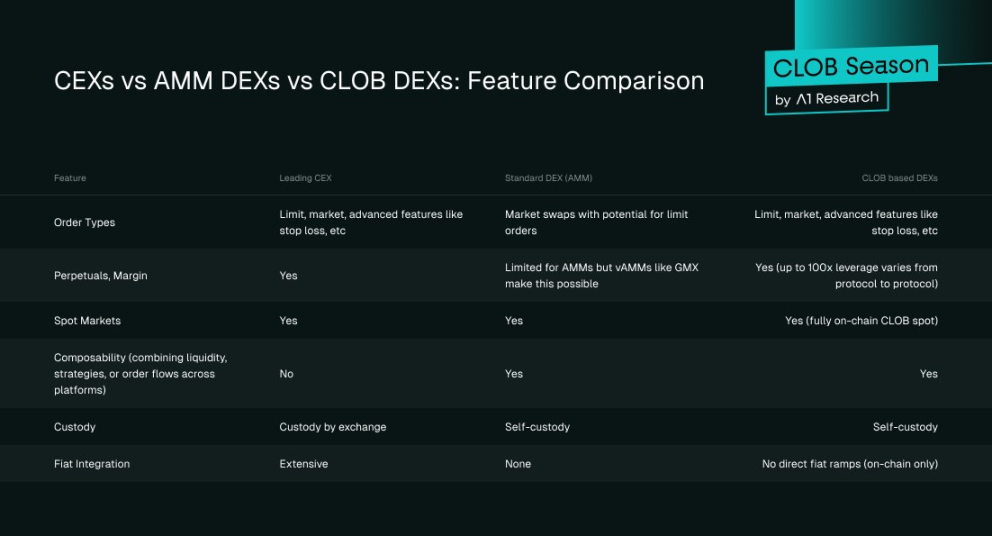

Automated Market Makers (AMMs) powered the first wave of DeFi, enabling "permissionless trading," but they suffer from clear shortcomings in efficiency, price discovery, and capital utilization. The new generation of "on-chain Central Limit Order Book (CLOB) DEXs" marks a structural leap in DEX architecture.

Take Hyperliquid as an example: it demonstrates the possibility of combining "CEX-level performance with on-chain transparency." By reintroducing order book mechanisms into decentralized systems, it addresses core pain points that keep traders dependent on CEX—latency, execution precision, and capital efficiency, especially for limit orders and derivatives trading.

-

Latency: Average confirmation time [as low as 0.07 seconds] (achieved via HyperBFT consensus)—comparable to major CEXs and far faster than AMM DEXs (2–30 seconds).

-

Liquidity depth: On-chain CLOBs like Hyperliquid set a new benchmark for decentralized liquidity—capable of processing up to 200,000 orders per second, with open interest reaching [$6.5 billion]. Deep order books can handle large trades with minimal price impact. For major pairs like Bitcoin (BTC) and Ethereum (ETH), slippage (deviation between actual and expected price) is below 0.1%, rivaling CEX performance. This contrasts sharply with AMMs: even with architectural optimizations like ve(3,3), slippage and impermanent loss remain unresolved. However, less-traded "niche pairs" on Hyperliquid still face wider spreads, indicating varying liquidity depths across markets.

-

Trading fees: Hyperliquid’s CLOB design drastically reduces trading costs—average taker fees for futures are around 0.035%–0.045%, and 0.07% for spot, with makers receiving small rebates. These rates are comparable to top-tier CEXs and far below typical AMM swap fees (0.3%–0.5%). Unlike AMMs, traders do not bear impermanent loss or inefficient routing costs, making CLOBs more capital-efficient for active and institutional traders.

Figure 6. CEX vs AMM DEX vs Order Book DEX: Feature Comparison

CLOB-based DEXs represent the "convergence" of CEX and DEX—offering both high performance and deep liquidity like CEX, while retaining DEX advantages such as self-custody, transparency, and on-chain execution.

Figure 7. Convergence Point of CEX and DEX Ecosystems

Why Are Traders Switching to DEX?

Traders may choose decentralized platforms over custodial ones for ideological reasons, but the real driver of migration is tangible improvement in security, cost efficiency, or operational convenience. CEX dominated historically due to smoother UX and deeper liquidity.

Now, DEX is catching up—by 2025, DEX not only approaches "functional parity with CEX" but also establishes competitive advantages in specific areas. Today’s DEX offers three structural advantages: decentralization with CEX-level UX, extremely low (or zero) fees, security, and access to a "fair market."

1. Decentralization + CEX-Level User Experience

DEXs have two inherent advantages:

-

Transparency: On-chain settlement makes transactions traceable and liquidity verifiable, typically providing "proof of reserves," allowing users to audit protocol activity independently;

-

Self-custody: Traders retain full control of assets, completely avoiding risks of CEX hacks—by mid-2025, total losses from CEX hacks had exceeded [$2.17 billion].

Historically, DEX "execution infrastructure" was weak: poor UI, highly fragmented liquidity (leading to high slippage), slow settlement, and high fees. Traders tolerated CEX risks solely for speed and ease of use. With the launch of dYdX, infrastructure weaknesses began improving; Hyperliquid’s emergence brought "exponential enhancement" to DEX experience.

In 2025, CLOB DEXs like Lighter, Paradex, and Bullet emerged—matching CEX in speed and efficiency (sometimes outperforming), while preserving core decentralization benefits.

Modern DEX experience upgrades include:

-

User experience / UI innovation: Trading dashboards on Hyperliquid, Paradex, and Lighter rival Binance in design and responsiveness;

-

Liquidity transformation: AMMs are gradually being replaced by on-chain CLOBs, enabling deep order books, tight spreads, and low slippage;

-

Seamless onboarding: Wallet integration, one-click trading, fiat on-ramps, and guided tutorials make DEX account setup sometimes faster than CEX KYC processes.

For example, Hyperliquid achieved $655.5 billion in trading volume in Q2 2025—the reason such massive volume is possible lies in delivering CEX-level UX and usability without sacrificing asset custody or transparency.

2. Zero-Fee Model

The biggest difference between DEX and CEX business models lies in fee structure. CEXs have long relied on "taker/maker commissions, rebates, and affiliate marketing" for revenue, while DEXs are restructuring this economic framework.

Take perpetual contracts as an example: Binance charges 0.020% for makers and 0.040% for takers, while emerging DEXs like Paradex and Lighter have eliminated trading fees entirely. They adopt Robinhood’s model (the U.S. zero-commission broker)—charging users no direct trading fees, instead monetizing by selling "order flow access and execution priority" to market makers.

Paradex, for instance, pioneered structured models like "Retail Price Improvement (RPI)" and "Payment for Order Flow (PFOF)": enhancing trade execution quality while ensuring sustainable protocol revenue. This replicates Robinhood’s revolution in retail stock trading—but fully on-chain and more transparent.

The impact of zero-fee DEXs is profound:

-

Disrupting CEX affiliate economy: Zero fees disrupt traditional CEX pricing—while traders pay no taker/maker fees, protocols still generate revenue via PFOF, RPI, premium features, reducing reliance on affiliate commissions and reshaping incentive structures in the trading ecosystem;

-

Lowering market entry barriers: Professional/VIP traders on CEX can earn rebates through high volume, but most users pay standard rates and are highly sensitive to "fee discounts" or "zero fees"—zero-fee DEXs perfectly meet this demand;

-

Restructuring incentives: DEXs offer on-chain referral programs, governance rewards, token airdrops, and liquidity incentives—less stable than CEX affiliate payouts, but more closely tied to actual user activity.

Although trading fees seem small, they add up significantly at scale: for active users, even minor rate differences compound into substantial costs over time (especially in perpetual markets). The rise of zero-fee or ultra-low-fee DEXs may force CEXs to reevaluate pricing—mirroring Robinhood’s impact on stock brokerage fees. Long-term, "fee compression" will shift competition from "pricing" to "liquidity depth, execution quality, and comprehensive financial services."

Notably, major CEXs are strategically investing in decentralized infrastructure, which may ultimately affect their dominance: for example, Binance co-founder CZ advises Aster, a DEX built on BNB Chain, and publicly states Binance is increasing investment in "non-custodial and on-chain businesses."

Other large CEXs like Bybit are also taking action: either integrating on-chain trading or directly investing in emerging DEX infrastructure. For these institutions, this is both "risk hedging" and recognition that the next phase of exchange industry growth may revolve around "on-chain operations, interoperability, and community alignment."

3. Security, Accessibility, and Market Fairness

DEXs possess core traits of "trustlessness" and "resilience": users always control their assets, funds cannot be seized, and protocol rules are immutable; audit records are permanently stored on-chain, so even if the team disappears, markets continue operating normally, and users don’t fear arbitrary rule changes or discriminatory treatment.

Additionally, DEXs offer "permissionless global access": traders can operate 24/7 without KYC, listing applications, or geographical restrictions; any token can be listed instantly, free of charge, without centralized approval; DEXs also seamlessly integrate with other DeFi protocols and smart contract applications, forming a "highly composable ecosystem."

DEX market mechanisms are also transparent: open-source code, verifiable liquidity, and on-chain order books greatly reduce the likelihood of "selective market manipulation"; their architecture minimizes "operational errors during volatile periods," giving traders confidence that DEXs will function reliably when market stability is most needed.

On October 9–10, 2025 (author's timezone), the crypto market faced the "largest liquidation event in history": triggered by President Trump announcing "100% tariffs on Chinese imports," over $19 billion in leveraged positions were liquidated, affecting 1.6 million traders. During this period, CEXs like Binance experienced system instability, while decentralized protocols like Aave protected $4.5 billion in assets using "resilient oracles," and Hyperliquid maintained transparent and stable operations throughout.

This event highlighted a stark contrast in "trust and stability": CEX credibility suffered, while on-chain platforms maintained operational continuity. It demonstrated the "operational advantage of transparent settlement during market shocks" and accelerated the trend of trading migration to DEX.

These traits further confirm DEX's "structural advantages," complementing the "performance and cost benefits" brought by modern CLOBs and improved AMMs, collectively enhancing DEX competitiveness.

Outlook Ahead

CEX remains essential in areas like "fiat on/off ramps, compliant products, insurance services, and trusted onboarding for new users/institutions"; DEX excels in "core decentralized value scenarios"—such as on-chain transparency, user self-custody, innovative financial product launches, and privacy features.

Today, more traders—especially experienced traders and institutions—are adopting "cross-ecosystem strategies": using CEX liquidity for "fiat-to-crypto conversion" (on/off ramps) while relying on DEX for trading execution, DeFi strategies, and asset self-custody. This "dual-platform model" is rapidly shifting from "exception" to "norm." But if technological progress and DEX adoption maintain current momentum, DEX could eventually achieve "market dominance."

Key Catalysts to Watch

Technological advances have greatly strengthened DEX capabilities; further breakthroughs in "liquidity depth, capital efficiency, seamless fiat integration, and regulatory clarity" would accelerate DEX adoption and shrink the gap with CEX. Key catalysts include:

-

On-chain CLOB scalability: Existing networks like Hyperliquid or future "app-specific chains" already deliver "deep liquidity + sub-second latency"; achieving similar liquidity depth for less-active niche pairs would drastically narrow the remaining "execution gap," attracting more sophisticated day traders to DEX.

-

Composability and new product categories: Perpetual contracts have become a "differentiating strength" for DEX; currently, "on-chain options trading" remains largely unfeasible—if this barrier is overcome, it could attract massive retail and institutional TVL to DEX.

-

Regulatory clarity and convergence: As CEXs like Binance face restrictions in multiple jurisdictions, regulators are beginning to explore frameworks for recognizing non-custodial platforms as legitimate market venues. Singapore and Japan have launched or studied "compliant DeFi sandboxes," with others expected to follow. Such clarity would "mainstream DEX"—enabling user and institutional participation without regulatory uncertainty, thereby strengthening trust in the DeFi ecosystem.

-

On-chain dark pools and privacy: On-chain dark pools offer DEX a "confidential trading venue," enabling large trades executed without disclosing public order books. This privacy prevents front-running and liquidation sniping, attracting institutional participants seeking efficient, manipulation-resistant trading. By enhancing confidentiality and reducing manipulation risks, dark pools will accelerate institutional DEX adoption.

-

Branding and fiat innovation: Emerging "decentralized fintech" startups like PayPal and Stripe may combine "bank-grade support" with "seamless fiat channels"—further weakening CEX's advantage in fiat on/off ramps.

Conclusion: The Inevitable Rise of DEX

Data clearly shows the DEX market share expansion trend: in Q4 2024, DEX accounted for 10.5% of spot and 4.9% of perpetuals; by Q3 2025, these figures surged to 19% and 13.3% respectively—representing average quarterly growth of ~25%-40% across segments. Based on current trajectories, we project:

-

By mid-2027, DEX spot trading volume share may exceed 50%;

-

By early 2027, DEX perpetual contract trading volume share may exceed 50%.

Even under "conservative growth scenarios," DEX will surpass the 50% market share threshold within two years, completing the transition from "niche alternative" to "dominant platform."

Governments are increasingly involved in DeFi framework development: Singapore and Japan have initiated DeFi sandbox testing, and agencies like SEC and MiCA are expected to roll out similar frameworks. This will drive "legalization of non-custodial platforms," enabling individuals and institutions to participate in DEX without legal concerns.

Black swan events like those on October 9–10 have proven that DEX holds a structural advantage over CEX in "transparent liquidation handling"—when CEXs suffer system failures, DEXs like Hyperliquid remain fully operational. This shows that DEXs are not only superior ideologically, but also more reliable in practical operation.

Looking ahead, on-chain dark pools and more composable liquidity layers are imminent, further attracting experienced traders and institutions; CLOB-based DEXs are nearing CEX-level execution efficiency, and with added privacy features, they will form a value proposition unmatched by CEX.

The competitive trajectory is clear: 2025 is the "tipping point" for DEX development—it has evolved from an "experimental alternative" into a "credible competitor," and is poised to capture the majority of market share within the next 2–3 years.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News