Deep Dive into Puffer: The LSDfi Protocol Lowering the Barrier to Entry for Independent Validators

TechFlow Selected TechFlow Selected

Deep Dive into Puffer: The LSDfi Protocol Lowering the Barrier to Entry for Independent Validators

As an emerging project, Puffer stands out with its unique technological advantages.

Author: Elma Ruan, Senior Research Analyst at TechFlow

Project Overview

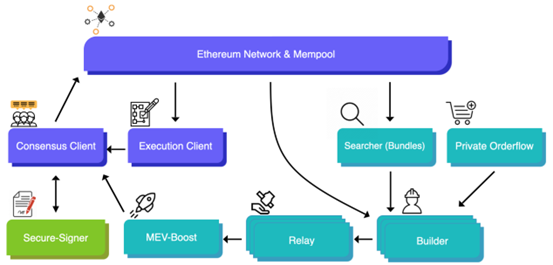

Puffer is an innovative, technology-driven project focused on achieving low barriers to entry, high returns, and decentralization within the LSD (Liquid Staking Derivatives) sector of the cryptocurrency space. As an emerging project, Puffer stands out due to its unique technical advantages. It operates as a liquid staking protocol built on EigenLayer, with its nodes simultaneously serving as AVS (Actively Validated Services) node operators on EigenLayer.

Puffer's staking mechanism enables participants to earn dual staking rewards—one portion from the Ethereum network and another from the EigenLayer network. Additionally, by leveraging its proprietary Secure-Signer (a remote signing tool) and RAV technology, Puffer addresses slashing risks in both the Ethereum and EigenLayer networks, thereby offering participants low-risk, dual-source returns.

1. Research Highlights

1.1 Core Investment Thesis

Since Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) in September 2022, increasing attention has been paid to staking methods. After the Shanghai upgrade enabled withdrawals from the Beacon Chain, ETH staking rates surged significantly.

Staking refers to locking up a certain amount of Ether on the Ethereum network to gain the right to validate transactions and receive corresponding rewards. Currently, becoming a validator node under Ethereum’s PoS system requires 32 ETH.

As a result, a large portion of ETH is staked through centralized exchanges, major mining pools, and leading LSD protocols such as Lido. According to Dune Analytics data, Lido controls 23.01% of all staked ETH—significantly exceeding Vitalik Buterin’s proposed cap of 15%. This concentration indicates a growing market monopoly. The high technical and financial barriers to staking have led to increased centralization of validators, undermining the network’s decentralization and security.

Puffer offers a new staking solution designed to enhance Ethereum’s decentralization and security. At the same time, it integrates deeply with EigenLayer to boost yields and sustain staker participation.

Puffer is an early-stage project that has already attracted support from notable investors, including the founder of EigenLayer, Coinbase’s head of staking, and Ethereum core researcher Justin.

Moreover, the Ethereum Foundation has funded the development of Puffer’s Secure-Signer technology to reduce slashing risks and maximize the number of independent node operators, furthering network decentralization.

Puffer represents an advanced staking solution aimed at improving Ethereum’s decentralization and security. It employs various technological innovations—including anti-slashing mechanisms, restaking services, and remote signing—to minimize slashing incidents and highlight the benefits of individual stakers.

In simple terms, participating in Puffer allows users to earn dual rewards from both ETH and EigenLayer, while leveraging original technologies like Secure-Signer and RAV to mitigate slashing risks on both networks. This provides stakers with dual returns at minimal risk. Through Puffer’s innovative design, participants can achieve stable returns from two networks using smaller capital investments, maximizing overall yield.

The core logic of Puffer lies in enhancing staking safety and yield through technological innovation, thus encouraging more individuals to run validator nodes. Puffer Finance is built atop the EigenLayer protocol. As a Puffer node, it functions not only as an Ethereum validator but also as a native node on EigenLayer, running AVS (Validator Node Services). Puffer’s first partnered AVS is EigenDA. Therefore, these nodes can earn rewards from both Ethereum and EigenLayer’s restaking program, without needing additional collateral. Node private key security and resistance to slashing are jointly ensured by Secure-Signer, RAV software, and TEE hardware—similar to a cold wallet setup. Hardware efficiency improves because the same node hardware performs double validation duties—Ethereum PoS and EigenLayer AVS—increasing utilization. Both Ethereum and EigenLayer enforce penalty mechanisms, with EigenLayer’s being programmable; Secure-Signer effectively reduces this type of slashing risk. By enabling dual verification and utilizing Secure-Signer, Puffer lowers risks associated with LSD and LSDFi assets. Compared to existing LSD tokens or liquidity restaking tokens, this approach offers greater security and reliability.

To elaborate: First, Puffer adopts anti-slashing techniques—spreading staked ETH across multiple addresses during staking to reduce exposure to attacks. Second, it implements a restaking mechanism, where staked ETH is further restaked into other validating nodes to increase yield and reduce risk. Third, Puffer uses remote signing technology, transferring the signing process from local nodes to remote servers to improve security and lower risk.

Furthermore, as a technology-driven startup, Puffer innovatively tackles several core challenges in Ethereum staking. On lowering entry barriers, Puffer reduces the required ETH amount for staking, enabling broader participation. Simplifying operations is another critical challenge. In Ethereum’s consensus mechanism, block proposers are randomly selected, and committees must attest to block validity. Ordinary stakers must avoid duplicate signatures to prevent slashing—a complex task requiring significant effort. To address this, Puffer lowers entry thresholds and provides automated tools to prevent slashing, making it easier for average users to set up validator nodes. The Ethereum Foundation strongly supports such initiatives. Secure-Signer is one such solution—by performing final signature operations in a secure, isolated environment, it minimizes slashing risks. Thus, Secure-Signer proves effective in mitigating slashing caused by poor key management.

Since the rise of the LSD sector, numerous projects have emerged, focusing on three main goals: lowering entry barriers, increasing yields, and enhancing decentralization. Lowering thresholds and boosting returns are tangible benefits for users, prompting many projects to push yields beyond Ethereum’s base APR. Puffer aligns perfectly with current LSD trends. Beyond reducing staking requirements, Puffer leverages Ethereum Foundation-funded secure signing technology to increase the number of independent operators, strengthening network decentralization. Simultaneously, through reduced protocol fees and deep integration with EigenLayer, Puffer enables restaking and MEV-smoothing, enhancing returns. These improvements aim to deliver better user experiences and higher system security, attracting more individual stakers. Only when the network is sufficiently decentralized and secure can it attract more users and applications, supporting Ethereum’s long-term growth and value maximization.

In summary, Puffer is an emerging staking solution aiming to strengthen Ethereum’s decentralization and security. Its emergence holds significant importance for Ethereum, helping achieve higher levels of decentralization and network resilience, laying a solid foundation for long-term development. However, Puffer also faces challenges and risks, including technical complexity and intense market competition. Nevertheless, as Ethereum continues to grow, Puffer has the potential to become a key player in the staking ecosystem, contributing meaningfully to the network’s future.

Currently, Puffer’s testnet has not launched, so it remains uncertain whether it could emerge as a dark horse in the LSD space, break Lido’s dominance, or further advance Ethereum’s decentralization. Finally, it should be noted that Puffer is an early-stage project. Investors should closely monitor its technical implementation and post-launch performance before making investment decisions. For now, Puffer can be considered a mid-term observation opportunity, with developments warranting close attention.

1.2 Valuation

As the project’s testnet has not yet launched and its seed round valuation has not been publicly disclosed, accurate valuation is currently impossible.

2. Project Fundamentals

2.1 Business Scope

Puffer.fi focuses on providing a trust-minimized liquid staking protocol, optimizing staker reward mechanisms, and improving accessibility by lowering collateral requirements and implementing slashing-resistant environments. These measures aim to promote Ethereum network decentralization and offer competitive liquidity solutions. Collectively, they make home-based staking a viable option.

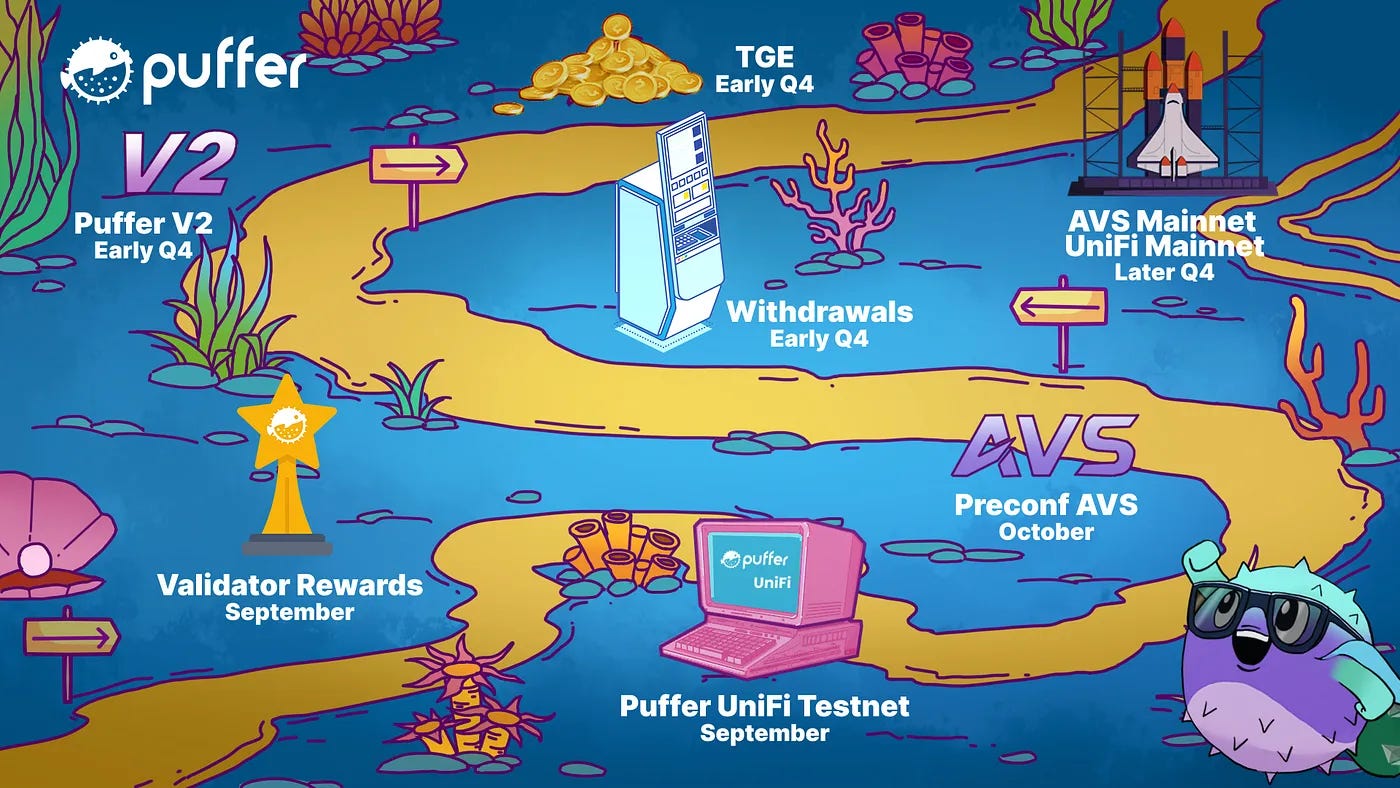

2.2 Development History and Roadmap

Future Roadmap:

Puffer is currently in its early development phase, planning to launch on testnet in late 2023 and roll out its mainnet in 2024. Additionally, according to its official Discord community, Puffer Fi is exploring technical optimizations for LSD protocols, such as pDVT and privacy-enhancing ZK-2FA.

2.3 Team Overview

2.3.1 General Overview

According to LinkedIn, the team consists of five core members skilled in Python, C, Java, SolidWorks, JavaScript, blockchain, and related fields. Their backgrounds span computer science, electrical engineering, and marketing. With diverse expertise, the team is well-equipped to provide comprehensive support and solutions. The company is currently hiring experienced Solidity smart contract developers.

2.3.2 Founders

Amir Forouzani Co-Founder & CEO

Amir Forouzani is Puffer’s co-founder and CEO. He graduated from the University of Southern California with a background in data science and NASA research. He holds a Master’s degree in Electrical and Electronic Engineering from USC and previously worked as a research assistant.

Jason Vranek Co-Founder & CTO

Jason Vranek holds a Master’s degree in Computer Science and Engineering, with experience in market design and blockchain front-running. He builds hardware accelerators using Chisel and has research interests in teaching, automated theorem provers, and deep reinforcement learning. He is currently pursuing a PhD in verifiable computing.

2.3.3 Key Members

Christina Chen Marketing & Operations

Christina is a seasoned professional with extensive experience in marketing, PR, branding, and business development in Silicon Valley’s tech industry. She has deep expertise in Web3 and blockchain, particularly in DeFi, NFTs, metaverse, P2E, DAOs, and DAO funds.

Jeff Zhao Developer & Software Engineer

He holds a Bachelor’s degree in Computer Science from the University of Toronto and has served as a full-time software engineer at Puffer, Alder Labs, Alice, and Circle, working on crypto exchange products, smart contracts, and L2 MATIC integration. During his internship at IBM, he developed and maintained components of the Java Virtual Machine.

2.4 Funding Status

1) Initial Funding:

A. Initial team expansion funding came from a Pre-Seed round led by Jump Crypto, raising $650,000.

B. The Ethereum Foundation granted a total of $138,000 to fund the initial development of Secure-Signer technology.

2) Seed Round:

Raised $5.5 million in a round co-led by Lemniscap and Lightspeed Faction. Other participants include Brevan Howard Digital, Bankless Ventures, Animoca Ventures, DACM, 33DAO, WAGMI33, and other community funds. Additional support came from institutions and individuals such as Eigenlayer, Curve, Coinbase Institutional, Canonical Ventures, and Obol Labs.

3. Business Analysis

3.1 Target Users

The project primarily serves the following groups:

1) Individual Users: Individuals can use the liquid staking protocol to deposit their tokens into a staking pool and earn rewards. By participating, users contribute to Ethereum’s liquidity while earning yield.

2) Validators: The project targets individuals who want to become Ethereum validators. Using Puffer.fi’s services, validators can lower entry barriers and stake their tokens via the staking pool, allowing them to participate in Ethereum’s validation process and earn rewards.

3.2 Business Categories

1) Staking Services: The project provides a staking pool (Puffer Pool), allowing users to deposit tokens and participate in Ethereum validation.

2) Technological Innovation: The project employs unique technologies and strategies—such as lowering collateral requirements and offering restaking services—to improve capital efficiency, economic potential, hardware performance, and risk management.

3) Decentralization Promotion: By increasing the feasibility and participation of home-based validators, the project aims to enhance Ethereum’s decentralization, increasing node count and distribution to improve overall network security and stability.

In summary, the project’s business model includes staking services, technological innovation, and decentralization promotion.

3.3 Business Details

1. Puffer Protocol

Built on EigenLayer, Puffer Protocol operates under rules known as Active Validation Services (AVS) or middleware. AVS refers to optional services or middleware that validators opt into, which can programmatically slash their 32 ETH deposits. For example, if fraud occurs during an Optimistic Rollup restaking process, the validator’s 32 ETH can be automatically slashed. If a validator violates Puffer Protocol’s AVS rules, their ETH will be programmatically slashed and returned to the pool.

1) To protect Puffers’ ETH from inactivity penalties, each validator’s balance must remain above a threshold set by the Puffer DAO. This threshold must be low enough to allow reasonable downtime but high enough to incentivize good performance—in essence, a balanced compromise between performance incentives and operational flexibility.

2) MEV-Smoothing is crucial for preventing internal centralization. It enables home-based nodes to earn higher returns than solo operators and reduces economies of scale enjoyed by centralized staking providers. Block proposers must share execution rewards with the pool. Validators proven to steal rewards on-chain will be penalized.

Puffers (Stakers)

Puffers refer to individuals who stake ETH on the Puffer Protocol to receive pufETH, a liquid staking token. When a Puffer stakes 0.01 ETH or more, it is added to an ETH pool. Part of this pool supplies nodes with the required 32 ETH to activate Ethereum validators, while the remainder ensures liquidity for Puffers redeeming pufETH back to ETH.

Nodes

Protecting staked ETH is a top priority in the Puffer Protocol, essential for maintaining protocol stability. To achieve this, all nodes must undergo economic bonding to ensure proper incentives. In case of violations, penalties are first deducted from the node’s bonded stake. To minimize slashing risks, Puffer Protocol employs a "shielded zone" strategy supported by Guardians, reducing the likelihood of penalties and effectively managing node inactivity. This creates a safer, more stable environment that protects users’ staked assets from potential risks.

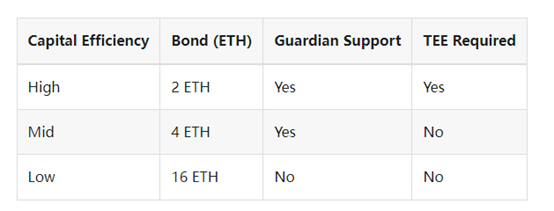

To accommodate varying risk appetites and ETH needs, nodes can choose among three different operating modes, each offering different capital efficiencies and requirements. Nodes using Secure-Signer enjoy higher capital efficiency and access to a dedicated set of shielded-zone validators. Currently, nodes with less than 16 ETH require Guardian support to prevent slashing until EIP-7002 removes this requirement. Until then, nodes with 16 ETH or more can join without Guardian support.

Rewards

pufETH is a reward-bearing token similar to Compound’s cToken, offering strong compatibility within DeFi. As the protocol generates rewards, the underlying ETH backing pufETH increases, raising the exchange rate between ETH and pufETH. This allows pufETH holders to gradually accumulate staking and restaking rewards while remaining active in DeFi.

Puffer Rewards

When Puffers deposit ETH into the PufferPool contract to mint pufETH, the initial exchange rate is 1:1. However, if the protocol performs well—accumulating more rewards than penalties—the exchange rate will cause pufETH to appreciate in value relative to ETH. Thus, pufETH holders can expect their holdings to increase in value over time.

Node Rewards

After registering a validator key, a Puffer node mints pufETH equal to its stake and locks it until exiting the protocol. Since nodes generate consensus, execution, and restaking rewards, they receive liquid ETH as rewards based on a commission rate set by the Puffer DAO. The remainder goes to the PufferPool and treasury accounts. Because nodes hold locked pufETH, they also share in rewards generated by other nodes in the protocol. This helps optimize MEV and maintains consistent node incentives.

Slashing Mechanism

A consensus mechanism is a rule system that supports a given blockchain’s operation, determining how it functions. It governs operational rules, user interactions, and safeguards against network manipulation—which could be catastrophic. This is typically achieved by ensuring network nodes have “skin in the game.” In other words, to achieve optimal personal outcomes, nodes must also act in the network’s best interest, aligning incentives. Slashing is part of the Proof-of-Stake consensus mechanism, used to penalize malicious or negligent validators. In many PoS networks, validator nodes must initially lock up a certain amount of tokens on-chain—a process known as crypto staking. Simply put, by making a personal investment in the blockchain, the consensus mechanism can deter bad or inefficient behavior through penalties—this is slashing.

Generally, slashing penalizes the following key behaviors:

1. Downtime

Downtime occurs when a validator node is offline for any period, unable to participate in consensus. This unreliability harms network functionality and is typically subject to penalties.

2. Double-Signing

To avoid downtime, many validators deploy backup systems. However, this introduces its own slashing risk: if the network detects the same validator key running on two different servers, it may view this as a threat (since such behavior deviates from expectations and could lead to conflicting information). Hence, this too may trigger slashing penalties.

3. Network Manipulation

Finally, any attempt to manipulate the consensus process—such as signing two different blocks for the same slot—will also face slashing.

The slashing mechanism ensures that PoS validators not only actively participate in consensus but also actively avoid any actions that harm or delay the network’s consensus process.

Guardians

Guardians are a group of permissioned nodes responsible for ensuring smooth protocol operations. They currently have two responsibilities, which will eventually be replaced by EIP-4788 and EIP-7002 after future hard forks:

1. Reporting the amount of ETH backing pufETH: To calculate the conversion ratio between ETH and pufETH, the main contract must know the total ETH supporting the protocol. This involves summing all active validators’ balances on-chain and on the Beacon Chain. Currently, Guardians perform this calculation, but after EIP-4788, trustless zero-knowledge proofs will replace Guardian computations.

2. Exiting nodes violating Puffer Protocol AVS: The first rule of Puffer Protocol AVS aims to protect offline nodes. However, since EIP-7002 hasn’t been implemented, validators cannot exit on-chain and must sign an exit message using their validator key. To maintain decentralization before EIP-7002, Puffer requires nodes with less than 16 ETH to shard-encrypt their validator keys into Guardians’ secure execution environments. These environments are designed to only allow the validator key shards to sign exit messages. Once EIP-7002 is live, Guardians will no longer be needed.

To reduce counterparty risk, Guardians implement multiple safeguards. They consist of public community members who strongly align with Ethereum’s philosophy and reputation. Guardians must use secure execution environments to enhance operational security, and a high threshold (e.g., 8 out of 9 signatures) is required to approve any action.

Withdrawals

Puffer Withdrawals

Puffer offers withdrawal functionality. When sufficient liquidity exists in the withdrawal pool, pufETH holders can burn their tokens to redeem their original ETH and accumulated rewards. To ensure withdrawal liquidity, portions of all Puffer deposits, rewards, and node withdrawals are directed into the withdrawal pool.

Node Withdrawals

After joining the Puffer protocol, nodes can fully exit by proving they’ve exited the Beacon Chain. Upon complete exit, the node’s locked pufETH is burned and redeemed for liquid ETH equal to their initial stake plus accumulated rewards minus penalties. For example, a node with a 2 ETH stake exits with a validator balance of 32 ETH. If the pufETH:ETH ratio has doubled since registration, the validator receives 4 ETH, while 28 ETH return to the withdrawal pool.

Governance

Puffer aims to build an unstoppable, decentralized protocol capable of sustained growth and operation without reliance on its core team. To achieve this, Puffer works to minimize governance roles within the protocol. PUFI tokens are primarily used for: pausing and upgrading contracts in response to vulnerabilities or Ethereum hard forks; voting on protocol parameters such as commission rates; managing the Puffer protocol treasury, including grants; and whitelisting AVS providers aligned with Ethereum’s values.

Restaking

Built on EigenLayer, all Puffer nodes can become native restakers, increasing their rewards. Restaking spans a wide range of services, including critical middleware such as bridges and oracles, as well as data availability layers and L2 sequencers. Additionally, nodes with secure execution environments can participate in Puffer-specific AVS activities, such as privacy-preserving L2s and ZK-2FA. Puffer is committed to supporting AVS that do not negatively impact Ethereum.

DVT (Distributed Validator Technology) in Puffer

Puffer Protocol is compatible with DVT. When combined with the Secure-Signer component, this pairing offers optimal decentralized validation protection. Furthermore, Puffer introduces a scaling mechanism called DVT fractalization, which can only be realized within secure execution environments. Through DVT fractalization, DVT cluster sizes can exceed standard limits, enabling larger-scale decentralized operations and lowering collateral requirements. This scalability allows Puffer to flexibly adapt to varying validation demands while maintaining high security and reliability, delivering a superior user experience.

Burst Threshold

The burst threshold ensures the Puffer pool remains within a reasonable size to preserve Ethereum’s decentralization. It is set at 22% of maximum capacity. Once the Puffer pool reaches 22% of the validator set, minting of pufETH and new node registrations will pause. This prevents the Puffer pool from ever exceeding the dangerous consensus threshold of 33%, safeguarding Ethereum’s stability.

2. Secure-Signer (Remote Signing Tool)

•Definition and Principles

Puffer’s Secure-Signer is a remote signing tool funded by the Ethereum Foundation, designed to prevent slashing attacks targeting Intel SGX.

Secure-Signer is a remote signing tool developed by Puffer using Trusted Execution Environment (TEE) technology, currently implemented via Intel SGX enclaves. To reduce single points of failure, Puffer plans to implement Secure-Signer across devices from different vendors, including AMD’s SEV TEE and future hardware platforms.

Using TEE provides guarantees of confidentiality and integrity. Within the SGX environment, an enclave is a protected memory region storing code and data, ensuring the code runs unmodified and data remains encrypted and secure. Hardware characteristics help preserve these properties. By combining these technologies, Secure-Signer delivers secure and reliable remote signing capabilities.

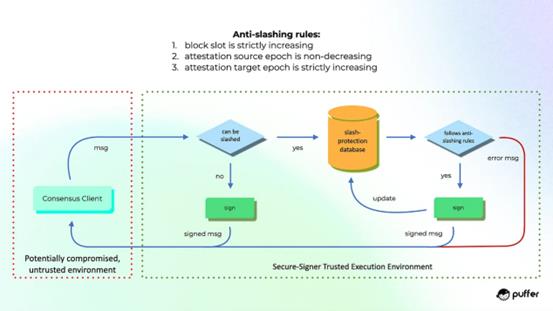

•Operational Workflow

Secure-Signer is a remote signing tool that manages validator keys on behalf of consensus clients. It can run locally with the consensus client or remotely on a server. From an operator’s perspective, setting up a validator remains largely unchanged. If they possess SGX-capable hardware, they can install and run Secure-Signer and configure their chosen consensus client to use it as a remote signer.

How It Prevents Slashing

To prevent potential double-signing attacks, Secure-Signer generates and protects all BLS validator keys within its encrypted, tamper-proof memory. These keys are only accessible at runtime and remain encrypted at rest, except when signing non-duplicatable block proposals or attestations.

This binding and encryption method ensures keys cannot be used across multiple consensus clients, protecting nodes from accidental slashing due to double-signing. Moreover, even if the system is compromised, the keys remain effectively protected.

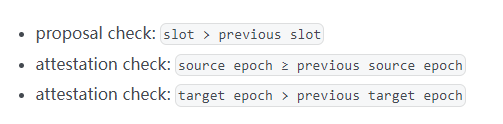

In addition to protecting validator keys, the secure signer maintains an integrity-protected database compliant with EIP-3076, storing previous signatures. This database prevents double-signing attacks. When a consensus client sends a block or attestation to Secure-Signer, all validator key signatures must meet specific requirements and assertions.

By eliminating slashing risks caused by accidents or consensus client bugs, Secure-Signer significantly reduces node risk and enables Puffer Pool to safely lower staking requirements. This ensures nodes can continue operating even if the OS is compromised and protects against catastrophic consensus client failures, as Secure-Signer runs in an isolated environment with its own integrity-protected slashing defense database.

Significance

Secure-Signer is a public good that uses Trusted Execution Environments (TEE) to protect validators and reduce individual validators’ financial losses from slashing. Compared to Distributed Validator Technology (DVT), Secure-Signer offers a cheaper alternative to enhance slashing resistance. Secure-Signer and DVT are complementary technologies—Secure-Signer protects keys at rest and provides stronger slashing protection during execution, akin to the security of a cold wallet.

By using TEE to protect validators, Secure-Signer ensures individual key security and reduces systemic slashing risks across the entire validator set. Thus, Secure-Signer provides a secure and reliable way for the entire validator network to benefit.

3. RAVe (Remote Attestation Verification)

RAVe is the second component of Puffer’s Ethereum Foundation grant, standing for Remote Attestation Verification. This important suite of smart contracts enables secure interaction between protected environments and the blockchain, helping Puffer Pool achieve permissionless operation. RAVe unlocks entirely new use cases previously unattainable.

Remote Attestation

Remote Attestation is a process allowing an untrusted party to prove they are running a specific SGX (Software Guard Extensions) isolated execution environment. An SGX enclave only allows execution of pre-initialized code, so remote attestation lets someone prove they are running only a specific program. In communication apps like Signal, remote attestation allows these apps to prove to user devices that they are running privacy-preserving software.

RAVe (Remote Attestation Verification) enables anyone to prove to a smart contract that they are running an isolated execution environment. This is highly valuable in blockchain contexts, enabling highly trusted, off-chain confidential computation. RAVe allows smart contracts to verify participants’ runtime environments, ensuring they meet specific security criteria, thereby strengthening blockchain protection and computational privacy.

RAVe v1

RAVe v1 uses EPID (Enhanced Privacy ID)-based remote attestation, interacting with Intel Attestation Service (IAS). At a high level, the isolated execution environment submits 64 bytes of user data within its remote attestation report. The report also includes device security details and MRENCLAVE and MRSIGNER fields. MRENCLAVE is a measurement of the enclave, uniquely identifying the program to be run, while MRSIGNER identifies the entity that built the enclave.

Upon successful remote attestation, IAS returns attestation evidence to the requesting SGX device. This evidence includes the attestation report, IAS-signed attestation report, IAS root CA certificate, and the x.509 signing certificate used. The RAVe smart contract verifies the source and validity of these reports, then extracts the 64-byte payload.

RAVe in Puffer Pool

RAVe in Puffer Pool is used to verify whether nodes are running Secure-Signer. The RAVe smart contract validates attestation evidence to allow nodes into the pool. When generating a validator key, the Secure-Signer enclave commits its validator public key in the USERDATA field of the attestation report. RAVe verifies the node’s attestation evidence, extracts its validator public key, and registers it on-chain. This allows the node to prove to the pool that it is running the Secure-Signer enclave and generating a new validator key inside it. Anyone can verify by reviewing the source code that the Secure-Signer program never leaks keys.

RAVe in Restaking

In restaking, zero-knowledge proofs (ZKP) can be used to prove correct program execution. However, isolated execution environments prevent users from running anything other than correctly executed programs. This is especially attractive for middleware on EigenLayer, particularly considering the lower overhead of isolated execution environments compared to ZKPs. By combining isolated execution environments with RAVe, the problem of “potential restaking” can be addressed.

3.4 Market Potential and Industry Outlook

3.4.1 Background and Classification

The LSD (Liquid Staking) sector refers to the practice of staking PoS tokens into staking pools and receiving liquid proof-of-stake tokens representing those staked assets. On Ethereum, Liquid Staking has evolved into a full ecosystem centered around three core narratives.

The first narrative is LSD protocols and LSTs (Liquid Staking Tokens). They provide liquid staking services and create liquidity and yield for staked assets through LSTs. Major current protocols include Lido’s stETH/wstETH, Frax’s sfrxETH, Rocket’s rETH, and Swell’s swETH.

The second narrative is LSDFi (LSD in DeFi). LSTs are high-consensus yield-bearing assets with programmable, composable, and freely transferable features. They can be deployed across various DeFi applications to meet investor demands for liquidity, capital efficiency, yield strategies, and risk management, forming diverse LSDFi business models. For instance, in Pendle, depositing stETH yields PT (Principal Token) and YT (Yield Token), enabling differentiated risk-return strategies.

The third narrative is decentralization solutions. Two mainstream approaches exist to ensure blockchain network security and decentralization. One is DVT technology, implemented by projects like SSV.Network and Obol Labs. The other is restaking, exemplified by EigenLayer. These solutions mainly respond to the centralization trend and risks arising from rapid LSD protocol growth.

The LSD sector has established an initial landscape. In tiered classification, DVT service providers like SSV Network and Obol Labs are considered Layer 0. LST issuers like Lido, Ankr, and Coinbase are Layer 1. These L1 projects distribute PoS rewards via commission models and dominate most of the market share—Lido alone holds 74.45% of liquid staking volume. Other LST issuers exist but hold relatively small shares.

Additionally, Ethereum’s PoS mechanism requires 32 ETH to become a validator, raising the barrier to entry compared to the previous PoW model. This reduces the likelihood of centralized entities controlling over two-thirds of the validator set and helps lower Ethereum’s energy footprint.

The PoS mechanism incentivizes validator participation through consensus and execution rewards and implements penalties to ensure honest, diligent performance. These mechanisms will play a crucial role in the continued development of the LSD sector.

Moreover, updates and upgrades to Ethereum’s PoS mechanism, such as the Shanghai/Capella upgrade, will further enhance validator liquidity and improve user experience. Validators can now fully withdraw their ETH when needed, and consensus rewards exceeding 32 ETH are no longer paid in one lump sum but disbursed weekly to execution layer addresses. This increases liquidity, making liquid staking more flexible and efficient.

Based on the above classification, Ethereum’s LSD sector can be divided into the following categories, each detailed below:

1) Liquid Staking: This category refers to issuing liquid proof-of-stake tokens after staking Ethereum tokens, enabling trading and liquidity provision. The main advantage of liquid staking is that stakers retain liquidity while earning staking rewards, allowing them to invest elsewhere or trade.

2) Unidentified: This category includes stakers not clearly defined or classified, possibly due to lack of data or inability to fit into other clear categories.

3) Centalized Exchanges (CEX): This category refers to users staking via centralized exchanges. These exchanges typically offer staking services, allowing users to stake ETH directly from exchange wallets without managing the process themselves.

4) Staking Pools: This category includes staking pools where multiple stakers pool resources to stake collectively, increasing their chances of earning staking rewards.

5) Independent Stakers: This category refers to individuals or entities choosing to stake independently. Independent stakers manage and operate their own staked tokens and directly participate in Ethereum’s consensus process.

6) Others: This category includes stakers that don’t fit into the above classifications, possibly due to special circumstances or uncommon staking methods.

3.4.2 Market Size

Overall Situation

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News