Puffer Finance: Based Rollups will empower Ethereum unification

TechFlow Selected TechFlow Selected

Puffer Finance: Based Rollups will empower Ethereum unification

Through UniFi's rollup-based stack, Puffer Finance transforms Ethereum fragmentation into a positive-sum ecosystem.

Author: Roland Roventa

Trump's victory has sparked a resurgence in DeFi, giving Ethereum—responsible for 63% of global DeFi TVL—the opportunity to ride this momentum toward breakthrough growth. Since the U.S. presidential election results were announced, the Ethereum ecosystem has consistently outperformed expectations.

However, despite being critical for scalability, Ethereum’s rollup-based scaling roadmap faces a significant challenge: fragmentation.

The current rollup ecosystem operates under a winner-takes-all dynamic, causing liquidity, user attention, and communities to scatter across isolated Layer 2 chains.

To fully unlock the potential of DeFi’s renewed rise, Ethereum must address these fragmented dynamics and build a more unified and open network.

Bridging the Gap: Solving Ethereum’s Fragmentation and Liquidity Challenges

Puffer Finance’s innovative solution—UniFi—directly tackles Ethereum’s fragmentation problem. We believe that once the market recognizes Puffer not just as another liquid restaking token (LRT) but as an infrastructure innovation, its performance will exceed expectations.

Puffer’s Past: Puffer began as a leading LRT protocol focused on delivering decentralized staking solutions.

Puffer’s Present: Puffer has now evolved into an Ethereum-centric unification solution. It has expanded from the first native liquid restaking protocol into a comprehensive Ethereum-integrated scaling ecosystem composed of three core components:

-

Decentralized Liquid Restaking Protocol (LRT)

Puffer’s flagship product, slash-resistant and designed for high yield and security, enabling decentralized restaking within the Ethereum ecosystem.

-

UniFi-Based Rollup Stack

A Layer-2-based sequencing solution enabling seamless L2<>L2 and L2<>L1 interactions with atomic composability for efficient cross-chain operations.

-

UniFi Preconfirmation AVS

The industry’s first preconfirmation AVS, delivering near-instant transaction finality for both L1 and L2 transactions, significantly enhancing speed and reliability across the Ethereum network.

Through the UniFi-based rollup stack, Puffer Finance transforms Ethereum’s fragmentation into a positive-sum ecosystem.

Part 1: Puffer UniFi-Based Rollup Stack – What Is It? How Does It Work?

What Are Based Rollups?

Based rollups are an advanced scaling approach that integrates directly with Ethereum’s shared sequencer, eliminating reliance on the centralized sequencers used by most other L2s (e.g., optimistic or zero-knowledge rollups). The concept was first introduced by Justin Drake in a research paper from March 2023:

“A based rollup, or L1-sequenced rollup, is one whose sequencing is driven by the base L1. Specifically, a based rollup allows the next L1 proposer to collaborate with L1 searchers and builders to permissionlessly include the next rollup block in the next L1 block.” – Justin Drake

For non-technical readers, this may sound complex. Simply put, L1-based rollups validate transactions directly on L1, leveraging Ethereum’s existing mechanisms efficiently. In contrast, common rollup models (like optimistic and ZK) typically process transactions on L2 before submitting them to L1.

By using based sequencing (leveraging Ethereum L1 validators for ordering), several advantages emerge:

-

Inherit Ethereum’s activity and decentralization: Ensures reliability without single points of failure.

-

Simplified infrastructure: No need to run independent sequencers.

-

Faster execution: Achieves quicker finality via preconfirmations (explained later).

-

Aligned economic incentives with L1: Creates new non-extractive MEV (Maximal Extractable Value) revenue opportunities for existing validators.

-

Lower operational costs: Transaction sequencing is handled by L1.

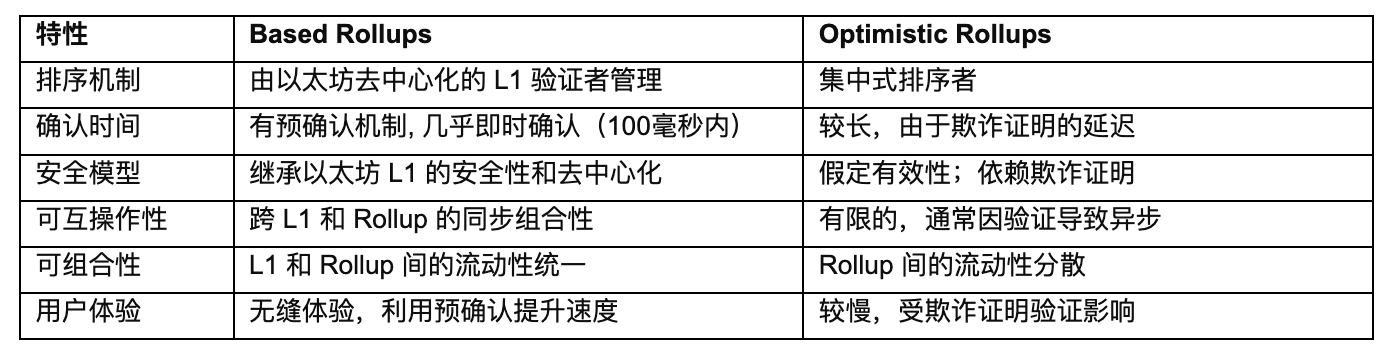

Based Rollups > Optimistic Rollups

tl;dr:

By optimizing the underlying transaction sequencing process, costs are reduced and speeds increased—all while preserving Ethereum’s inherent security and decentralization.

Puffer Is Based

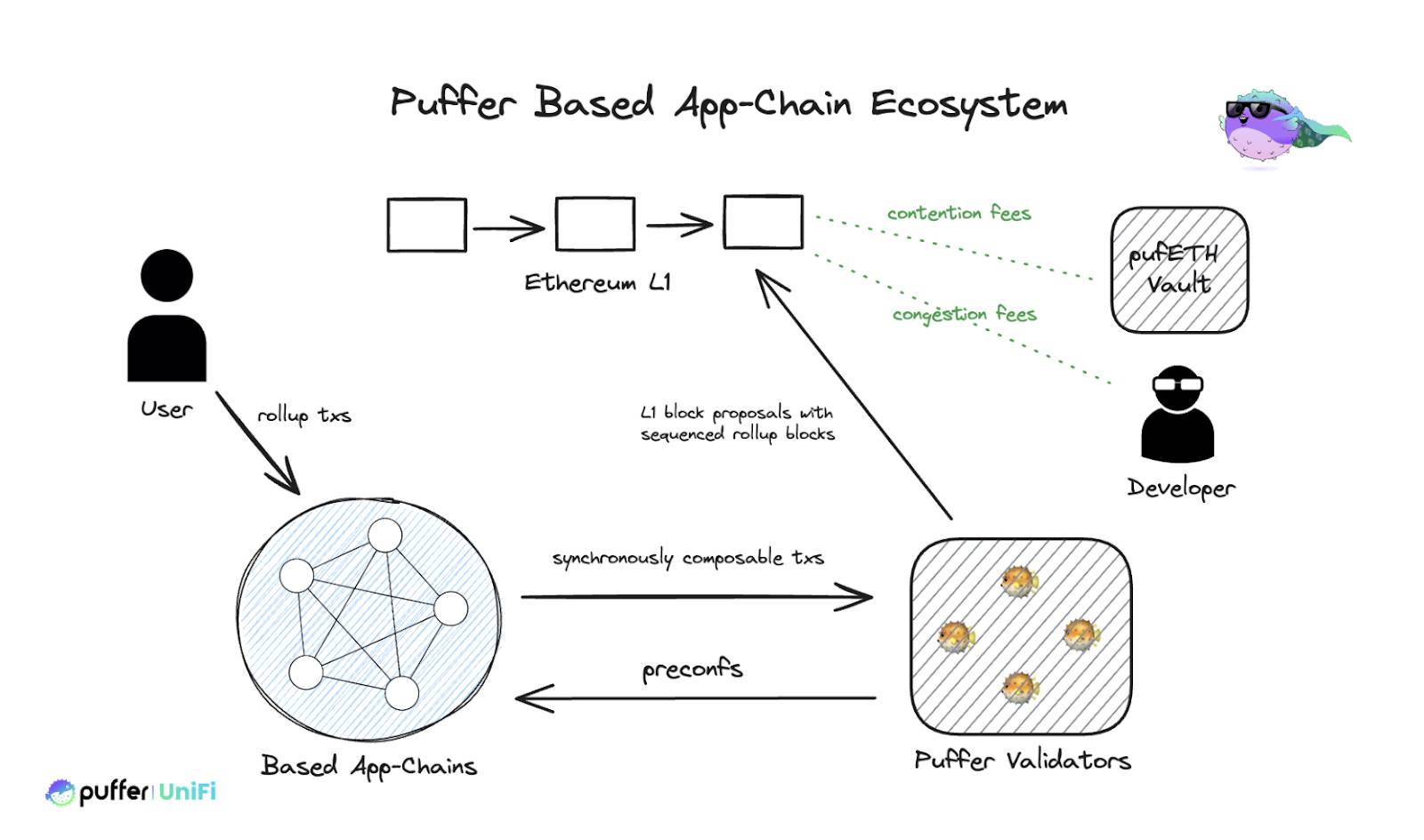

Puffer UniFi is an Ethereum-based rollup that enables application-specific chain creation through its technology stack.

It solves Ethereum’s liquidity fragmentation by enabling synchronous composability. Transactions on UniFi can interact directly with other based rollups without bridges, creating unified liquidity and application layers. Developers can easily launch their own app-chains, capture fee revenue, and leverage shared liquidity.

UniFi aims to bring atomic composability to Ethereum—redefining what’s possible for on-chain interaction. With atomic composability, UniFi will allow Layer 1 and Layer 2 to interact smoothly and integrally within a single Ethereum block. For example, a user or protocol could deposit assets from L1 into UniFi, perform complex actions (such as swaps or liquidity mining), and withdraw back to L1—all within the same 12-second Ethereum block. This is not only fast but also a major leap forward in blockchain interoperability.

Puffer does not compete with L1; it collaborates with L1, extending functionality in an integrated way.

How Does It Work?

Inspired by collaborative research with Justin Drake, Puffer UniFi employs Trusted Execution Environments (TEEs) within its processing stack. To achieve real-time proofs, Puffer plans to use TEEs as a temporary auxiliary tool. Real-time proofing greatly enhances interoperability. Once zero-knowledge proof (ZK-proof) technology reaches sufficient speed, provers can transition from trusted hardware dependence to fully ZK-based systems.

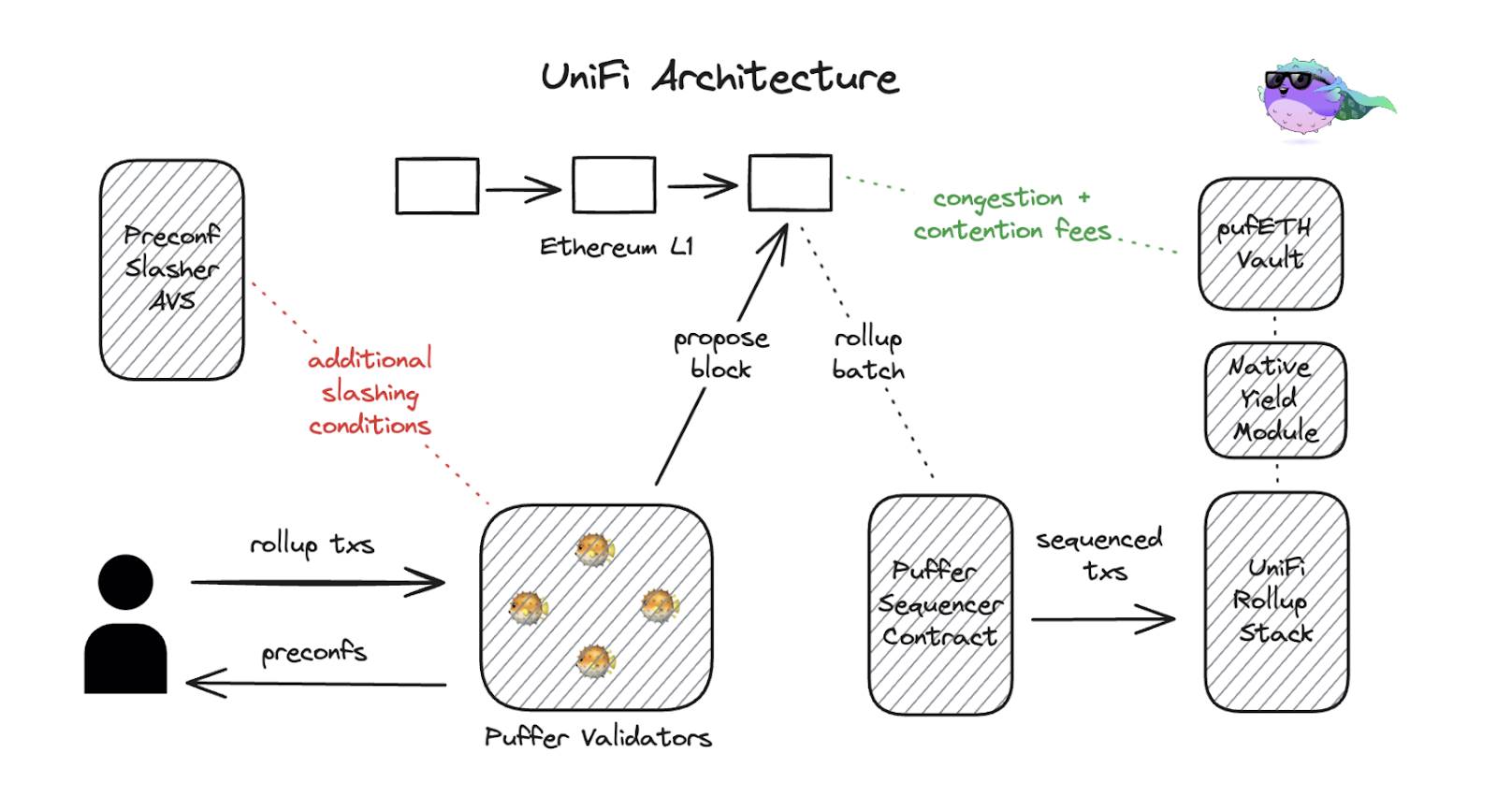

Architecture Breakdown of Puffer UniFi

Overview – Puffer’s UniFi Preconfirmation AVS provides users with L2 execution confirmation services. Interactions via UniFi deliver sub-second transaction speeds. Within the UniFi General Rollup, native yield-bearing tokens serve as gas tokens.

The consensus layer, data availability layer, and settlement layer are all managed by the base layer (Layer 1, i.e., Ethereum). The rollup itself focuses solely on execution.

This is precisely what makes Puffer’s app-chains unique.

Why This Matters

Puffer is building its own app-chains using based rollups, enabling seamless integration across EVM protocols. This creates opportunities for everyone in the ecosystem—individual validators and large dApps alike—to benefit from a faster, more efficient, and increasingly decentralized Ethereum. Ethereum’s fragmentation has persisted too long; it’s time for change.

Ecosystem Overview

Growth will unfold in stages:

Phase One: Puffer introduces based rollups to users and developers. Protocols not yet ready to run their own app-chains can deploy directly onto UniFi.

Phase Two: UniFi will release an SDK, enabling any dApp developer to quickly build and deploy their own app-chain in a simplified manner.

Part 2: UniFi Preconfirmation AVS

UniFi delivers near-instant execution confirmations via preconfirmation (preconf) technology. This isn’t merely a speed upgrade—it’s a new paradigm in Ethereum scalability. Preconfirmation addresses Ethereum’s fragmentation while offering ultra-fast transaction confirmation.

How is this achieved? Because Ethereum’s 12-second block time limits rapid transaction finality, preconfirmations become crucial for improving user experience. To solve this, Puffer developed a proprietary preconfirmation AVS technology that offers nearly instantaneous (~100ms) assurance that a transaction will be included in the next block. This innovation dramatically boosts the speed and reliability of the based rollup ecosystem.

How Does It Work?

Preconfirmations come in two types: execution preconfs and inclusion preconfs. Both enable faster transaction confirmation for users on L1 or L2. Execution preconfs provide users with final, guaranteed commitments including post-execution state confirmation—for instance, guaranteeing the price at which a trade executes—greatly enhancing user experience.

Implementing execution preconfirmation on L1 is challenging; however, L2 execution preconfirmation effectively resolves this issue. Puffer UniFi AVS leverages this capability to deliver an optimized user experience.

Security Mechanism of Preconfirmations: A preconfirmation represents a commitment from a proposer (validator or authorized entity) to the user. Failure to honor this commitment should result in penalties such as slashing. Restaking protocols like EigenLayer play a key role in providing slashing protection for preconfirmations. Notably, Puffer UniFi Preconfirmation AVS is the first service of its kind to operate on EigenLayer.

Puffer UniFi: Catalyst for Ethereum’s Next Chapter – Unification

UniFi’s synchronous composability is a disruptive innovation. Cross-rollup interactions feel like operating on a single unified chain, eliminating the need for L2 bridges (which no one likes), reducing costs, and mitigating security risks associated with asset transfers. UniFi’s approach unifies liquidity, allowing developers and users to seamlessly interact across chains, elevating Ethereum’s liquidity and user experience to unprecedented levels.

Implications for Developers: UniFi offers developers a unique opportunity to scale applications within a unified, low-friction environment. By removing centralized sequencers, UniFi drastically reduces operational costs, allowing developers to focus on their products rather than the complexities of isolated L2s. Moreover, UniFi’s architecture makes deploying a based rollup almost as simple as deploying a smart contract, lowering entry barriers and encouraging innovation.

Revenue Growth: How Puffer’s Based Rollups and Preconfirmations Drive Value Across Ethereum

All revenue streams flow into a treasury governed by the $PUFFER token.

Puffer’s upgraded revenue model (note: not just an LRT) fully leverages based rollups and preconfirmation technology to generate sustainable value within the Ethereum ecosystem. Through based rollups, Puffer generates sequencing fees by enabling Ethereum validators to manage transaction ordering. UniFi enables seamless interoperability—not only between Ethereum L1 and L2 but also among L2s—unifying liquidity and composability. By integrating sequencing fees into Ethereum’s validator network, Puffer captures transaction-based revenue while reinforcing the value of Ethereum’s native economy.

Users can also pay preconfirmation tips to prioritize their transactions. This provides Puffer with an additional revenue stream, combining with transaction inclusion fees to create diversified income. These fees and tips are reinjected into Puffer’s ecosystem, further enriching the value of its native tokens pufETH and unifiETH, while delivering additional yield to token holders.

As explained by Puffer core contributor Amir:

“If every user pays a small extra fee for these preconfirmations to ensure faster, more reliable transactions on Ethereum, then the AVS becomes tightly coupled with every Ethereum transaction. This builds a very strong, efficient revenue-generating AVS capable of consistently producing organic yield.”

About vePuffer

One of the key factors enabling sustainable long-term price growth for a protocol is tokenomics. A strong protocol requires a well-designed token model focused on creating value for long-term holders. At Mechanism Capital, we prioritize tokenomics design and support teams that innovate to maximize value capture.

Puffer Finance is launching vePuffer as an update to its tokenomics. Its goal is to return value to token holders and align incentives across the ecosystem. To achieve this, they’ve introduced several innovations:

Decentralized Governance:

vePUFFER enables the community to vote on the distribution of PUFFER points, aligning with Puffer’s decentralization goals.

Tradable Points:

Season 2 ERC20 PUFFER points are tradable, allowing users to earn early yields or make additional purchases, increasing flexibility and arbitrage potential.

Flexible Strategies:

Tradable points empower users to hold, sell, or buy based on personal strategies and market sentiment, enhancing risk management.

Bribery Markets:

Protocols can incentivize vePUFFER holders to boost votes for their pools, increasing APR and liquidity.

Competitive Protocols:

The bribery mechanism allows protocols to attract votes and increase APR, driving user engagement and aligned incentives.

Community-Driven Reward System:

The vePUFFER model supports governance, speculation, and diverse strategies, empowering users to shape incentive structures across the ecosystem.

Why Puffer’s UniFi Stands Apart: Reshaping Ethereum’s Rollup Landscape

With the launch of UniFi, Puffer creates an opportunity for Ethereum to evolve from a fragmented rollup environment into a unified, positive-sum ecosystem—one that brings together developers, users, and liquidity in unprecedented ways. The end result? A stronger, more resilient Ethereum capable of serving billions of users.

Disclaimer: This article does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News