Maple Finance, the Future of On-Chain Institutional Asset Management?

TechFlow Selected TechFlow Selected

Maple Finance, the Future of On-Chain Institutional Asset Management?

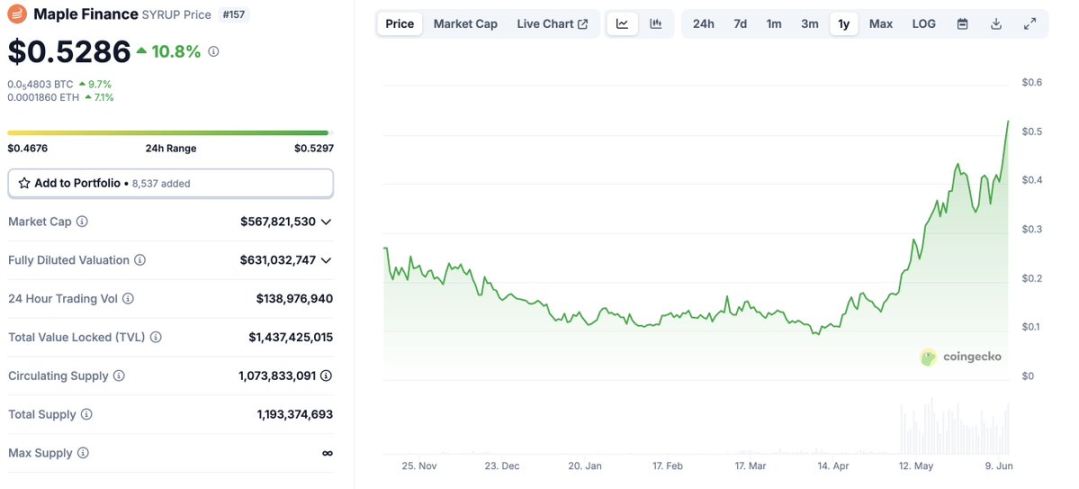

Since its listing on Binance Spot in May, SYRUP has risen more than 100% against the market trend.

Author: @defi_gaz, Castle Labs

Translation: Alex Liu, Foresight News

This cycle has been challenging for many. If one word could describe it, "extraction" would likely be the choice.

Native crypto capital is rotating at an unprecedented pace—fast enough to dizzy even the most seasoned "gamblers." Protocols are pulling out all stops with incentives, striving to attract limited liquidity into their products, even if those funds only stay for a few days before the next hype cycle.

Meanwhile, Bitcoin's dominance has been steadily rising since its November 2022 lows, driven primarily by what appears to be an endless wave of institutional buying.

Bitcoin market share, data: TradingView

The implications are clear.

Undoubtedly, the crypto market is maturing. We're finally seeing the regulatory clarity needed to propel the industry forward, and many protocols are shifting their target users toward different types of participants.

The giants have arrived—and they’re bringing serious capital.

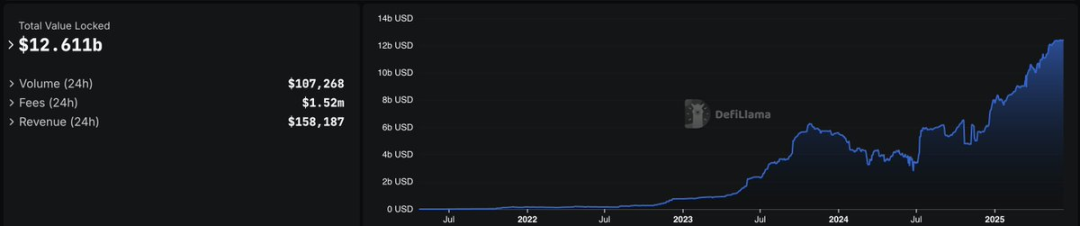

We’ve already witnessed the impact of these large institutions. The real-world assets (RWA) sector is growing steadily, with total value locked (TVL) now reaching approximately $12.6 billion.

Many leaders in this space are building products tailored for institutional capital participation—some even developed directly by institutions themselves.

Among emerging projects, Maple Finance stands out due to the rapid growth in its revenue and assets under management (AUM). This surge is clearly reflected in the price action of the SYRUP token, showing no signs of slowing down.

What Is Maple Finance?

In short, Maple Finance aims to bring asset management on-chain by offering a suite of financial products tailored specifically for institutions—with a strong focus on lending.

Founded in 2019, the team brings deep traditional finance expertise and understands exactly what it takes for large institutions to enter the crypto space at scale.

Maple takes a minimalist approach to collateral types used on its platform, focusing exclusively on top-tier blue-chip tokens and stablecoins—the very assets that large institutions want exposure to.

The numbers speak for themselves.

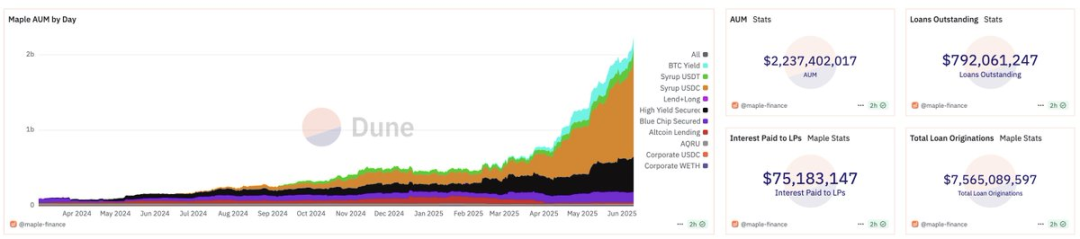

Source: Maple Finance Dune Dashboard

According to the latest data from the Maple Finance Dune dashboard, its total AUM is around $2.2 billion—up over $1 billion since early May. This represents a staggering fivefold increase compared to January 1, 2025.

Similarly, active outstanding loans on the platform have surged, increasing by about 30% in May alone.

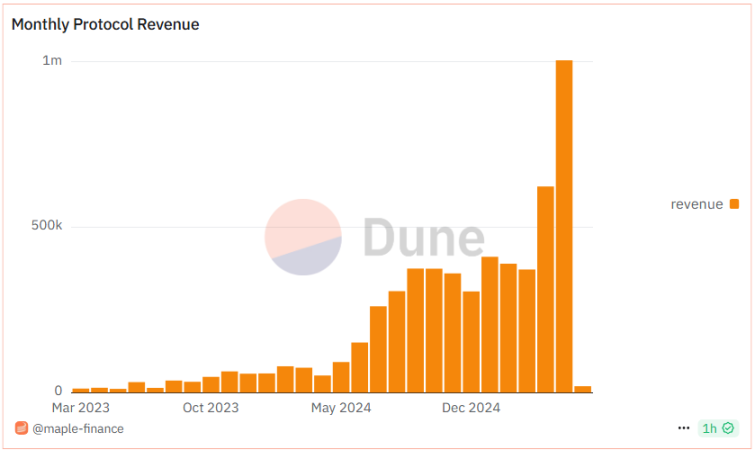

Revenue performance is equally strong, with monthly revenue recently surpassing $1 million—a 61.21% month-over-month increase from April. Since March 2023, its average monthly revenue growth has remained around 28%, indicating a clear upward trend.

This revenue primarily comes from interest-sharing with borrowers and yield generated by deploying collateral into DeFi protocols.

Source: Maple Finance Dune Dashboard

Three unique lending products have powered Maple’s impressive results:

-

High-Yield Product: 9% net APY, using BTC, ETH, and a curated set of top altcoins as collateral.

-

Blue-Chip Lending: 6.9% net APY, accepting only BTC and ETH as collateral.

-

Bitcoin Yield: Allows large institutional Bitcoin holders to earn 4–6% net APY on their BTC holdings.

Notably, higher-yielding products require higher over-collateralization ratios to offset the increased volatility of the underlying collateral assets.

Diving Deeper Into Maple

Maple is rapidly becoming the go-to platform for large institutional borrowers. Its rigorous borrower vetting process—ensuring they can meet financial obligations—is a key differentiator from other lending protocols.

These permissioned borrowers must undergo a thorough underwriting process that evaluates balance sheet strength and confirms operational capacity to meet margin calls during market downturns.

The underlying collateral is held via institutional-grade custody solutions, while Maple provides on-chain verifiability, allowing lenders to view detailed collateral information for each outstanding loan.

Leveraging liquid blue-chip tokens as collateral and active, institution-level collateral management, Maple consistently delivers above-market yields in a secure manner.

Thanks to its robust screening of top-tier borrowers and highest-quality collateral, combined with a focus on short-term loan durations, liquidation events within the Maple ecosystem are extremely rare.

The SYRUP Token

SYRUP is Maple’s native token.

It is used for platform governance, incentivizes participation through staking, and enables holders to benefit from the growth of the Maple ecosystem.

Currently, about 42.7% of the 1.07 billion circulating SYRUP tokens are staked on the platform.

Stakers receive rewards from protocol-driven token buybacks (funded by revenue), earning a 2.7% annual percentage yield (APY) with no lock-up period.

The SYRUP emission schedule is approximately 5% per year, continuing for three years from inception. This means all SYRUP tokens will be fully circulated by September 2026.

syrupUSDC/USDT & Drips Rewards

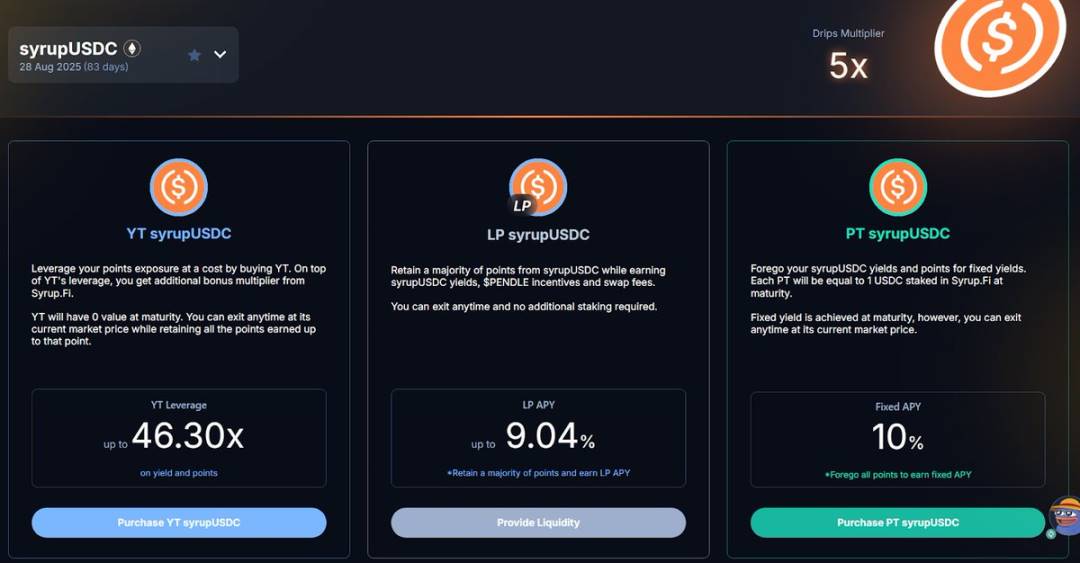

Users who lend USDC or USDT on the Maple platform receive corresponding liquidity provider (LP) tokens: syrupUSDC or syrupUSDT. Upon receiving syrupUSDT, users immediately begin accruing a 6.6% APY and can use these tokens across various DeFi platforms.

syrupUSDC offers an APY of approximately 10.6%, outperforming protocols like AAVE, Ethena, and Compound. Combined with its strong emphasis on security, Maple has become the preferred destination for users seeking to maximize stablecoin returns.

Beyond earning yield and enabling DeFi utility through USDC or USDT deposits, lenders also earn Drip rewards. These can be converted into additional staked SYRUP tokens at the end of each "Season," allowing users to compound their SYRUP holdings over time.

Drips themselves compound every 4 hours, further boosting the effective APY for SYRUP stakers.

Partnerships & Integrations

In recent months, Maple has secured several notable partnerships and plans to continue expanding its network across both crypto and traditional finance.

April 2025: Announced a major partnership with Spark, including a $50 million USDC investment into syrupUSDC.

March 2025:

-

Bitwise joined and began allocating capital to the Maple ecosystem, further solidifying Maple’s position as a preferred destination for institutional capital.

-

Maple announced its integration into the Convergence ecosystem—an initiative led by Ethena that unites protocols such as Pendle and Morpho to accelerate institutional-grade RWA onboarding onto blockchains.

February 2025: The Core Foundation partnered with Maple to launch lstBTC, a liquid, yield-bearing Bitcoin token designed for institutions to generate yield from their BTC holdings.

May 2025 (most recent): Maple completed its first Bitcoin-collateralized financing deal with global investment bank Cantor. This opened an initial $2 billion financing channel, enabling institutional Bitcoin holders to leverage their BTC via the Maple ecosystem.

Additionally, for users looking to enhance returns on syrupUSDC while earning up to 5x boosted Drip rewards, the integration between syrupUSDC and Pendle is ideal.

Competitive Landscape

Maple Finance serves a client base primarily composed of large funds, family offices, and high-net-worth individuals.

By underwriting its loans and requiring all borrowers to complete KYC (Know Your Customer) procedures to verify creditworthiness, Maple occupies a unique niche bridging DeFi and centralized finance (CeFi).

This model addresses two major pain points present in past DeFi and CeFi frameworks:

-

Risks associated with large institutional players deploying capital on-chain via decentralized providers.

-

Slow, costly, and restrictive processes involved in obtaining credit through traditional financial methods or centralized finance providers.

Maple aims to solve both issues through a hybrid approach: combining the over-collateralization typical of DeFi lending protocols with the strict compliance, credit assessment, and borrower underwriting standards common in traditional finance.

Compared to other platforms in the space, we are beginning to see Maple’s underappreciated potential.

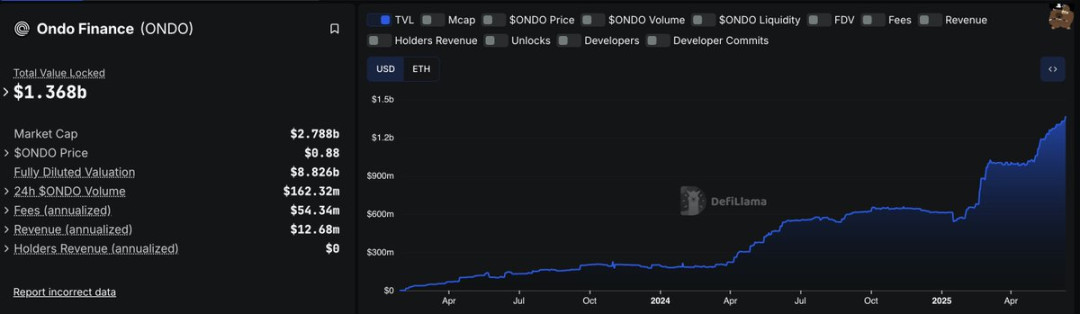

For example, Ondo Finance has a TVL of about $1.3 billion, a market cap (MC) of $2.6 billion, and a fully diluted valuation (FDV) of approximately $8.36 billion.

BlackRock’s Buidl holds about $2.9 billion in TVL, with a market cap also at $2.9 billion (on a fully diluted basis).

In contrast, Maple currently has a TVL of $2.2 billion but a market cap of just $567.8 million. Even on a fully diluted basis, its valuation stands at only about $631 million.

Based on the TVL-to-market-cap ratio, Maple’s potential upside relative to competitors appears strikingly evident.

Of course, this is a very basic method of valuation and numerous factors should be considered when assessing a protocol’s future potential. However, it quickly highlights the current valuation gap in the institutional lending space.

As the entire sector continues to grow, Maple’s recent growth trajectory positions it well to outperform competitors—if it maintains its current momentum without near-term slowdowns.

Conclusion

As a relatively new player in the decentralized institutional lending space, Maple is exceptionally well-positioned to capture significant market share in the coming months and years.

Their goal is to reach $4 billion in TVL by year-end, broken down as follows:

-

syrupUSDC/USDT: $1 billion

-

Bitcoin Yield Product: $1.5 billion

-

Other Maple Institutional Product Suite: $1.5 billion

Whether they achieve these targets remains to be seen, but so far, the outlook is positive.

As the broader crypto market matures, projects with strong fundamentals are more likely to gain market share amid the shift from retail to institutional investors.

These institutional participants will likely seek the same types of metrics they rely on in traditional finance: Price-to-earnings ratios (PE), revenue generation capability, and competitive moats will be top of mind as they enter this space.

Therefore, following their lead, extending our investment time horizons, and identifying protocols with real fundamentals—rather than the once-dominant "pumpamentals"—will likely prove rewarding.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News