Maple Finance: On-Chain Asset Management in the Era of Institutional Capital

TechFlow Selected TechFlow Selected

Maple Finance: On-Chain Asset Management in the Era of Institutional Capital

Analyze Maple Finance's positioning as an on-chain asset management platform and its strategic opportunities in the evolving institutional crypto market.

By: Tiger Research

Key Takeaways

As institutional investors increasingly enter the cryptocurrency market, demand is rising for asset management solutions that meet traditional financial standards. Maple Finance emerged to fill this gap, establishing itself as an on-chain asset management platform.

Maple does more than simply connect lenders and borrowers. It conducts structured borrower evaluations and strategically manages collateral, operating more like a traditional asset management firm. Recently, Maple has also expanded its product line by launching a Bitcoin yield product that transforms Bitcoin from a passive holding into a yield-generating asset.

As institutions deepen their presence in crypto, well-prepared asset management platforms like Maple Finance are positioned to establish early institutional relationships—a first-mover advantage that could translate into long-term market leadership.

1. Demand for Asset Management in Crypto

In traditional finance, investors holding large asset positions typically rely on brokerages for professional asset management—a widely adopted strategy. But consider another scenario: suppose you are Michael Saylor, CEO of Strategy, who has accumulated a substantial Bitcoin position. How do you manage these assets effectively?

Initially, options such as staking or direct lending may seem viable. Yet in practice, managing large-scale crypto assets is complex and error-prone, often requiring specialized personnel and robust operational controls. One might then turn to professional asset management, similar to traditional finance. However, a new challenge arises: structured and reliable asset managers are extremely scarce in the crypto market.

This gap presents a clear opportunity for crypto-based asset management. Applying proven models from traditional finance to digital assets could unlock significant market potential. As institutional participation in crypto deepens, the need for professional, structured asset management becomes critical.

Source: bitcointreasuries, Tiger Research

The urgency of this demand grows with accelerating institutional adoption. A key example is Strategy’s large-scale Bitcoin purchases starting in 2020. This momentum intensified further after spot Bitcoin ETFs were approved in the U.S. and Hong Kong in 2024.

Thus, a market once dominated by retail investors is approaching its limits. The current environment calls for professional asset management solutions tailored specifically to institutional needs.

Maple Finance was created precisely to meet this demand. Founded in 2019, Maple combines traditional financial expertise with blockchain infrastructure, steadily establishing itself as a leading on-chain asset management provider.

2. On-Chain Asset Management: Maple Finance

Maple Finance’s structure is simple and clear. It facilitates credit-based on-chain lending by connecting liquidity providers (LPs) with institutional borrowers.

This raises a key question: In traditional finance, asset management typically involves diversifying clients’ portfolios across stocks, bonds, real estate, and other instruments to manage risk and achieve long-term value growth.

Given this context, can a platform focused on lending intermediation be considered a true asset manager?

Source: Maple Finance

A closer look at Maple Finance’s actual operations clarifies the answer. The platform employs professional asset management practices that go beyond simple loan matching. It conducts thorough credit assessments of institutional borrowers and makes strategic decisions regarding capital allocation and loan terms.

Throughout the lending process, Maple also actively manages funds using mechanisms such as collateral pledging and re-lending. This operational model clearly transcends basic lending intermediation and aligns more closely with the functions of a modern asset management firm.

3. Core Participants and Operational Mechanisms of Maple Finance

Maple Finance operates as an on-chain asset manager—not merely a lending intermediary—thanks to its well-defined participant structure and systematic operational framework. Its products are built around three core roles:

Maple Finance’s role as an on-chain asset manager (rather than just a lending intermediary) stems from its clear participant structure and systematic operational framework. Its product model is built around three core participant roles:

Source: Tiger Research

This structure mirrors established safeguards in traditional finance. In bank corporate lending, depositors supply capital, companies apply for loans, and internal credit teams assess financial health. Shareholders participate in governance decisions that influence institutional direction.

Maple Finance operates similarly. When a borrower applies for a loan, Maple’s credit team sets terms based on collateral ratios and asset quality. Lenders provide funds, functioning much like depositors, while $SYRUP holders take on shareholder-like governance roles, participating in protocol-level decisions.

A key difference is that $SYRUP holders also receive staking rewards funded by protocol revenue. Notably, 20% of revenue is allocated to buybacks supporting these rewards.

Source: Tiger Research

Consider a concrete example: major market maker TIGER 77 requires $10 million in operating capital to expand trading positions during periods of heightened market volatility. However, traditional banks deny the request due to limited trust in the crypto sector—leaving TIGER 77 unable to access needed funds.

Maple Direct, Maple Finance’s internal lending and advisory division, bridges this gap through its High-Yield Corporate Product. Qualified investors, confident in Maple Direct’s track record, deposit $10 million in USDC into the lending pool.

When TIGER 77 applies for a loan, Maple Direct conducts a comprehensive credit assessment, reviewing the company’s financial condition, operational history, and risk profile. Upon approval, a $10 million USDC loan is issued, secured by Ethereum collateral at a 12.5% interest rate.

After loan execution, revenue distribution begins. TIGER 77 pays monthly interest, of which Maple Direct retains 12% as a management fee. The remaining interest is distributed to qualified investors.

Here, Maple’s differentiation becomes evident. It goes beyond basic lending intermediation by actively managing collateral—including secondary lending and collateral pledging—to enhance capital efficiency. In some cases, Maple structures loans based on corporate guarantees from parent companies rather than traditional collateral.

In effect, Maple offers services comparable to traditional financial institutions. It actively manages capital rather than merely connecting lenders and borrowers. This approach reinforces Maple’s positioning as a trusted institutional-grade asset manager—not just another DeFi lending platform.

4. Core Products of Maple Finance

4.1. Maple Institutional

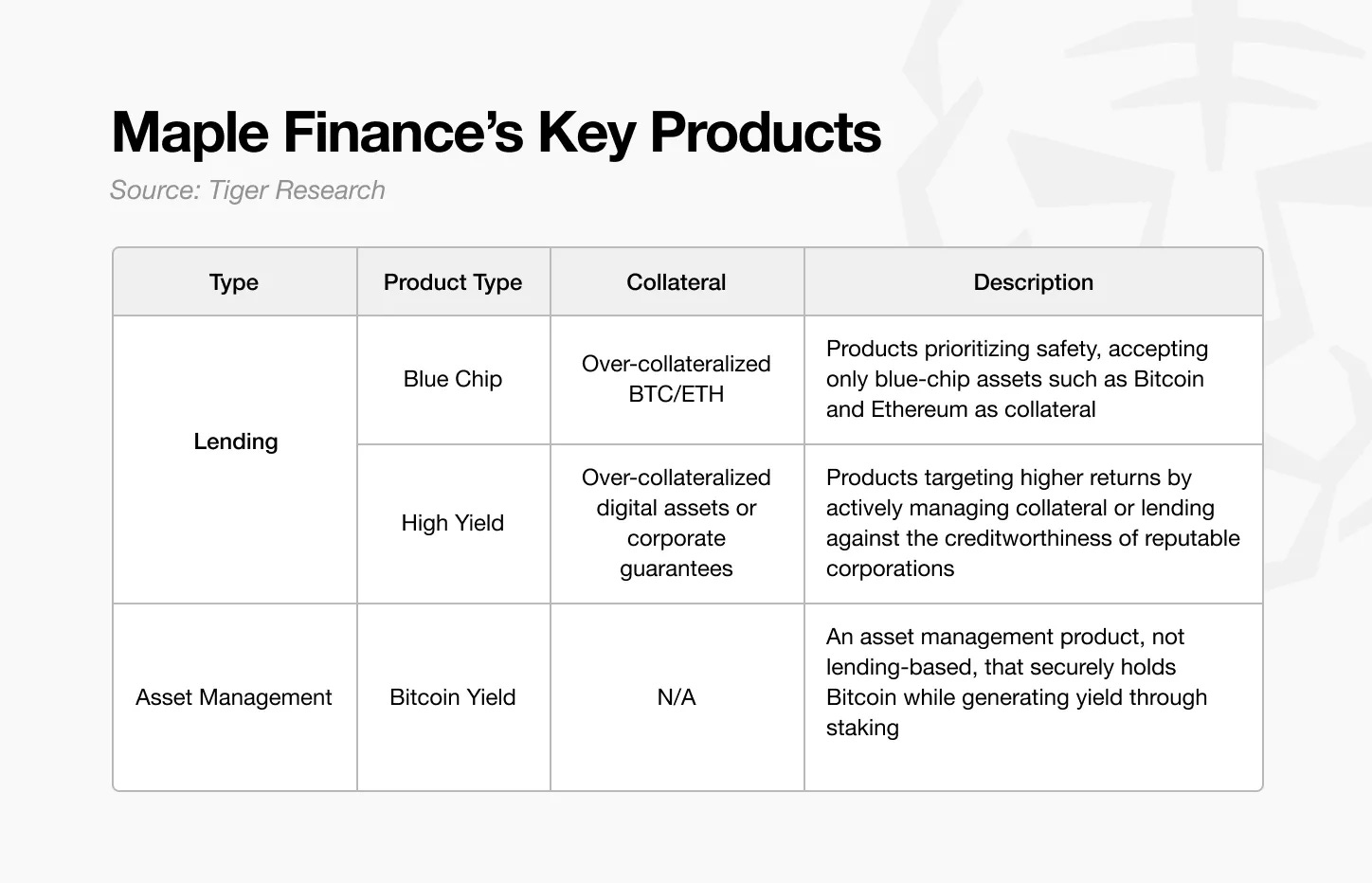

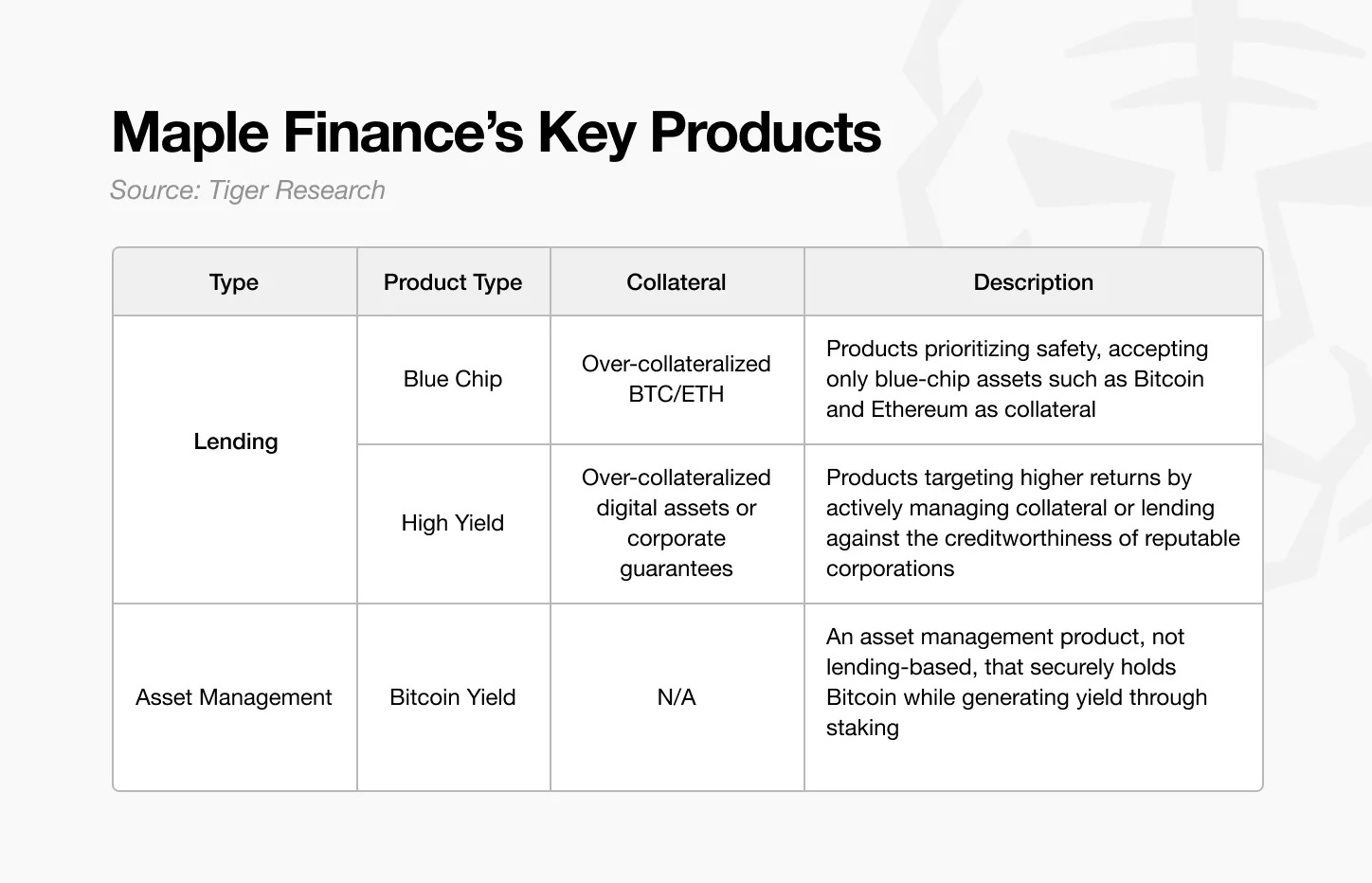

Maple Finance establishes itself as a legitimate on-chain asset manager by offering diversified, structured products. Its offerings fall into two main categories: lending products and asset management products, each designed to match investors’ varying risk tolerances and return objectives.

Source: Tiger Research

The first category—lending products—included Maple’s Blue Chip and High Yield offerings. The Blue Chip product line is designed for conservative investors focused on capital preservation. It accepts only mature assets like Bitcoin and Ethereum as collateral and follows strict risk management practices.

In contrast, the High Yield product targets investors seeking higher returns and willing to accept greater risk. Its core strategy involves actively managing over-collateralized assets—through staking or re-lending—to generate additional yield rather than simply holding collateral idle.

Source: Maple Finance

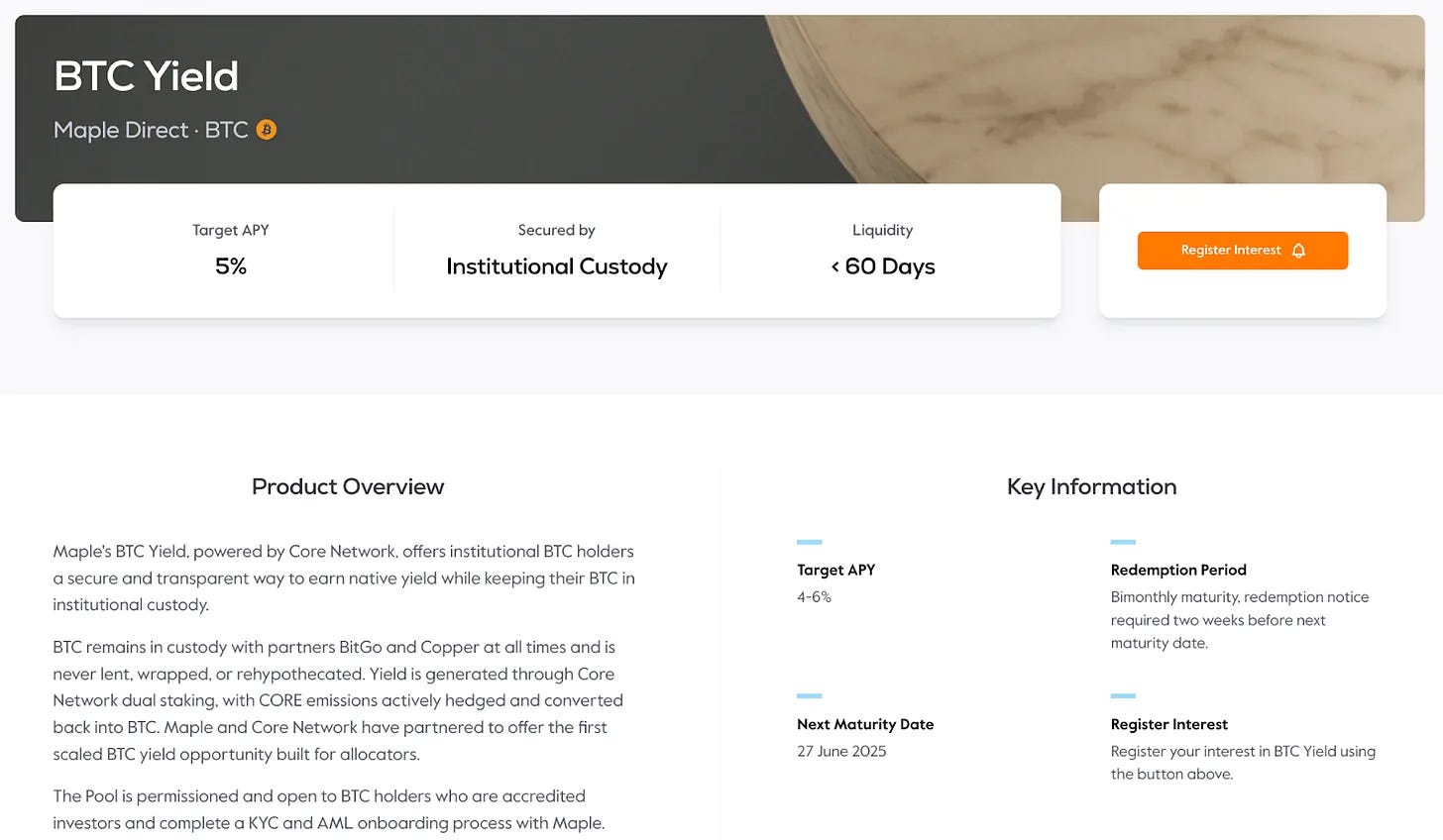

Maple Finance’s second product category—asset management—begins with its BTC Yield product. Launched earlier this year, it responds to growing institutional demand for Bitcoin. Its value proposition is straightforward: instead of passively holding Bitcoin, institutions can deposit BTC to earn interest, generating yield from existing holdings.

This naturally raises a question: if institutions can directly buy and hold Bitcoin, why not manage it themselves? The answer lies in practical constraints—primarily the lack of secure technical infrastructure or operational expertise required to generate yield.

Maple Finance’s Bitcoin yield product leverages dual staking provided by Core DAO. Under this model, institutions securely store their Bitcoin with institutional custodians like BitGo or Copper and earn staking rewards by committing to lock their assets for a predetermined period. In short, institutions safely lock up their assets and earn yield.

However, the actual execution process is more complex than it appears. Behind the simple idea of “earning yield on Bitcoin” lies a series of technical and operational steps—contract arrangements with custodians, participation in Core DAO staking, conversion of $CORE staking rewards into cash. Each step requires specialized knowledge most institutions lack internally.

This reflects a familiar pattern in traditional finance. While companies could manage assets directly, they typically rely on professional asset managers to perform the task efficiently and securely. In crypto, the need for such expertise is even greater—due to added layers of technical complexity, regulatory oversight, security, and risk management.

Starting with the Bitcoin yield product, Maple Finance plans to expand into broader asset management offerings. This strategy is crucial for bridging the gap between institutional investors and the crypto market, addressing a long-standing unmet need.

By providing comprehensive, professionally managed services, Maple enables institutions to pursue stable returns from digital assets—without diverting focus from their core business.

4.2 syrupUSDC

Source: Maple Finance

The products discussed so far primarily target qualified investors, limiting access for general retail participants. To address this, Maple Finance launched syrupUSDC and syrupUSDT—retail-facing liquidity pools built atop Maple’s existing lending infrastructure and borrower network.

Funds raised through syrupUSDC are lent to institutional borrowers from Maple’s Blue Chip and High Yield pools, who undergo the same credit evaluation process as other Maple products. Interest generated from these loans is directly distributed to syrupUSDC depositors.

Although structurally similar to Maple’s institutional products, syrup pools are independently managed. This design maintains the operational rigor of institutional products while lowering barriers for retail users—enhancing accessibility without compromising structural stability.

Source: Dune

While yields are slightly lower than those offered to institutional participants, Maple introduced the "Drips" reward system to boost long-term engagement. Drips provide additional token incentives, compounded every four hours as points. At the end of each season, points can be converted into SYRUP tokens. Through this incentive mechanism and active fundraising, Maple Finance has attracted approximately $1.9 billion in USDC and USDT.

In summary, syrupUSDC/USDT extends institutional-grade products to retail investors, combining accessibility with a structured reward mechanism. By integrating Drips, Maple demonstrates a deep understanding of Web3 engagement dynamics, delivering a model that encourages sustained participation while maintaining financial discipline.

5. Key Differentiators of Maple Finance

Maple Finance’s core competitive advantage lies in its fully on-chain implementation of an institutional-grade system. Rather than relying solely on algorithmic lending protocols, Maple combines on-chain infrastructure with human expertise to create an environment that meets institutional standards.

5.1. Services Developed by Traditional Finance Experts

This distinction starts with Maple’s team composition. Many on-chain financial platforms lack professionals with traditional finance backgrounds. While such experience isn’t strictly necessary, a deep understanding of institutional investor needs and risk expectations is essential for delivering truly institutional-grade services.

This is where Maple stands out. Its team includes professionals with decades of experience in traditional finance and credit assessment. Their expertise in rigorous credit evaluation and sound risk management forms the foundation of trust required by institutional clients.

Source: Tiger Research

The background of Maple’s leadership helps explain why it has earned institutional trust.

CEO Sidney Powell brings asset management experience from the National Australia Bank and Angle Finance. Co-founder Joe Flanagan was a PwC consultant specializing in corporate financial analysis before serving as CFO of Axsesstoday.

On the technical side, CTO Matt Collum was a senior engineer at Wave HQ and founder of fintech startup Every. COO Ryan O'Shea led strategic initiatives at Kraken, gaining direct experience in crypto.

The broader team includes professionals with combined financial and technical expertise. Sid Sheth, Director of Capital Markets, previously handled institutional sales at Deutsche Bank. Product lead Steven Liu held product management roles at Amazon and led fintech projects at Anchorage Digital.

Maple’s core strength lies in this fusion of traditional finance and blockchain expertise. This dual-domain knowledge enables the team to meet institutional expectations while delivering on-chain solutions with operational credibility and technical precision.

5.2. Differentiated Risk Management Framework

Maple Finance’s approach to risk management reflects the expertise of its professional team and distinguishes it from most DeFi protocols. While most protocols heavily rely on automated, decentralized mechanisms, Maple directly applies proven methodologies from traditional finance to on-chain environments.

The first key component is the loan evaluation process. In most DeFi protocols, loans are automatically issued once collateral is deposited, with little to no credit assessment.

In contrast, Maple Finance implements a more prudent underwriting model. As noted, borrower screening is conducted by its investment advisory arm, Maple Direct. This credit-first approach, combined with a preference for over-collateralized structures, allows Maple to manage risk from the outset.

In the event of liquidation, most protocols trigger immediate asset sales once collateral falls below a threshold. Maple takes a different approach—issuing a 24-hour notice, giving borrowers time to replenish collateral. This mirrors traditional banking practices, where margin calls precede liquidation. If the borrower fails to respond within the window, liquidation proceeds.

Even the liquidation process itself is designed to minimize market impact. While common DeFi protocols conduct public liquidations on exchanges—risking slippage and price disruption—Maple executes liquidations via pre-arranged OTC deals with market makers, ensuring controlled execution and reduced volatility.

Maple’s withdrawal system is also notable. In traditional DeFi, users can instantly withdraw funds if liquidity is available—but face uncertainty when liquidity is insufficient. Maple processes withdrawals sequentially or in timed batches, giving users clear expectations about fund availability. This structured approach enables investors to plan effectively, adding predictability and confidence to Maple’s risk management framework.

5.3. Integrated Ecosystem Structure

Source: Tiger Research

Maple Finance pursues a disciplined growth strategy—prioritizing internal risk management and strategic alignment over rapid expansion. Before engaging in external partnerships, the team established a robust risk framework. Rather than blindly scaling, Maple focuses on collaborating with core partners capable of meaningful value creation.

This strategy is clearly reflected in the expansion of the syrupUSDC ecosystem. To increase its footprint in DeFi, Maple partnered with leading platforms like Spark and Pendle, enabling diversified yield structures and multiple user access points.

The collaboration with Spark delivered tangible results: Spark allocated $300 million to syrupUSDC, using it as collateral backing for USDS. This is not a symbolic partnership—it resulted in real capital deployment.

The integration with Pendle further enhances flexibility. syrupUSDC holders can now use Pendle’s Principal Token (PT) and Yield Token (YT) mechanisms to customize their yield exposure. This model—leveraging each partner’s core strengths—has become a consistent strategy across Maple’s product lines.

The BTC yield product exemplifies the same approach. Its goal is to transform Bitcoin from a passive asset into a yield-generating one. Achieving this requires two core components: secure custody and effective deployment. Maple addresses both by partnering with BitGo and Copper for institutional-grade custody, while generating yield through Core DAO’s dual staking model. The result is an integrated system where custody and yield coexist without trade-offs.

6. Maple Finance in 2025 and Beyond

In December 2024, Maple Finance released its strategic roadmap in a founder’s letter outlining 2025 priorities. Approximately six months later, many of these goals have already been achieved:

-

Maple’s total value locked (TVL) exceeds $4 billion;

-

The first traditional finance (TradFi) partner has borrowed over $100 million via Maple Institutional;

-

Syrup.fi achieved its first DeFi integration exceeding $100 million;

-

Protocol revenue surpassed $25 million.

Maple’s long-term vision is ambitious. By 2030, the platform aims to manage $100 billion in annual loan volume—nearly 45 times its current portfolio size of $2.2 billion. Achieving this scale will require more than just expanding existing lending operations. Maple must broaden its asset management product suite, deepen partnerships with traditional financial institutions, and attract institutional investors globally.

The first strategic priority is expanding adoption of the BTC yield product. Institutional interest in Bitcoin is surging, along with demand for return-generating solutions beyond simple custody. Capturing a significant share of this market is critical.

The second strategy involves broadening Maple’s range of asset products. Currently focused primarily on Bitcoin, Maple plans to extend yield-generating products to various digital assets. Recently, institutional investors have begun including Ethereum in their portfolios, and this trend toward diversified digital asset holdings is expected to accelerate. If Maple can deliver effective asset management services that generate incremental yield from these assets, significant growth opportunities will emerge.

7. Maple Finance: Moving Toward Greater Prominence

The cryptocurrency market has historically been retail-driven. With a current market cap of approximately $3.29 trillion (CoinMarketCap), it remains small compared to the $51 trillion U.S. Treasury market and $18–27 trillion gold market. These comparisons highlight the immense growth potential should crypto fully integrate into traditional asset classes.

Institutional investors will play a central role in driving this growth. Unlike retail participants, institutions manage asset bases in the tens or hundreds of billions of dollars, meaning even minor allocations can significantly expand the crypto market. However, institutional entry comes with higher expectations—including regulatory compliance, sophisticated risk management, and secure custody solutions.

Maple Finance is positioned precisely to serve this institutional segment. Rather than offering basic lending tools, Maple is building a comprehensive suite of financial services designed to meet institutional standards. Its strategy now includes expanding partnerships and contractual relationships with traditional financial institutions to further strengthen credibility.

A recent milestone underscores its positioning: Maple announced an inaugural Bitcoin-backed financing arrangement with Cantor Fitzgerald. Cantor’s Bitcoin financing division plans to provide up to $2 billion in initial funding, with Maple selected as the first borrower. This highlights Maple’s institutional credibility and leadership in the crypto credit market.

Winning high-profile clients—such as Strategy, which has adopted Bitcoin as treasury assets—will further accelerate adoption of Maple’s BTC yield product. Timing is especially critical: institutional clients are sticky. Unlike retail users, institutions rarely switch service providers once relationships are established, preferring long-term partnerships for risk and operational continuity.

Maple is not the only company pursuing this market, but its proven institutional track record gives it a strong advantage. Ultimately, the next two to three years will be decisive in determining which platforms emerge as category leaders in institutional crypto finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News