Bitget Wallet Research Institute: Ondo knocks on a new door—stock tokenization, old wine in a new bottle or the next revolution in financial markets?

TechFlow Selected TechFlow Selected

Bitget Wallet Research Institute: Ondo knocks on a new door—stock tokenization, old wine in a new bottle or the next revolution in financial markets?

When Wall Street's century-old trading rules collide with blockchain's trustless technology, a profound transformation around efficiency, liquidity, and compliance is brewing.

Author: Lacie Zhang, Researcher at Bitget Wallet

On September 3, 2025, Ondo Finance officially launched its stock tokenization platform "Ondo Global Markets," listing over 100 tokenized stocks initially and planning to expand to 1,000 by year-end. This move not only marks a solid step in Ondo's strategic development but is also widely seen by the industry as a critical validation of stock tokenization transitioning from theory to large-scale practice.

As Wall Street’s century-old trading rules collide with blockchain’s trustless technology, a profound transformation around efficiency, liquidity, and compliance is brewing. In this article, Bitget Wallet Research returns to fundamentals, offering a systematic review and presentation of today’s stock tokenization market across three core dimensions: value logic, implementation pathways, and compliance frameworks.

The Imagination of a Multi-Trillion Dollar Market: Analyzing the Value Logic Behind Stock Tokenization

Stock tokenization is not a new concept, yet the potential it holds is sufficient to reshape the existing financial landscape. The total market capitalization of all tokenized stocks today is less than $400 million—dwarfed by NVIDIA’s single stock valuation exceeding $4 trillion. This stark contrast highlights both the early-stage challenges of the sector and its unparalleled growth potential. Its core value manifests in three primary aspects.

First, it aims to disruptively optimize traditional trading settlement systems. The current mainstream “T+N” delayed settlement mechanism represents a major bottleneck in capital market efficiency. It means investors’ funds remain frozen for one to two days after a trade, an inefficient use that limits reinvestment capacity and introduces counterparty risk during settlement. Stock tokenization enables “atomic settlement,” synchronizing asset ownership transfer with fund payment. This model not only supports a 24/7 global trading market but also liberates vast amounts of capital previously tied up in clearing processes, significantly enhancing overall market efficiency.

Second, stock tokenization helps dismantle the complex barriers of traditional cross-border investment. Under conventional models, international securities investments must navigate a multi-layered intermediary network comprising custodian banks, clearinghouses, and brokers—each layer adding time and cost. Tokenization offers a new approach by embedding compliance protocols such as Know-Your-Customer (KYC) and Anti-Money Laundering (AML) directly into the asset’s protocol layer. This gives assets an inherent “compliance self-check” capability, drastically reducing reliance on trust intermediaries and manual reviews, paving the way for a flatter, more efficient, and lower-cost global capital market.

Finally, from a broader perspective, its ultimate value lies in serving as a key bridge connecting the two parallel worlds of traditional finance (TradFi) and decentralized finance (DeFi). On one hand, it provides a low-barrier “on-chain” pathway for massive traditional capital accustomed to existing investment instruments, allowing them to benefit from blockchain’s efficiency gains without diving into unfamiliar DeFi protocols. On the other hand, it injects much-needed stability and value backing into the native crypto ecosystem. Blue-chip assets with real earnings power and strong fundamentals can effectively hedge against crypto’s inherent volatility while supplying new, stable collateral for on-chain DeFi applications. This bidirectional value creation positions stock tokenization as a potential cornerstone of future financial systems.

Three Paths, One Destination: Decoding the Implementation Routes of Stock Tokenization

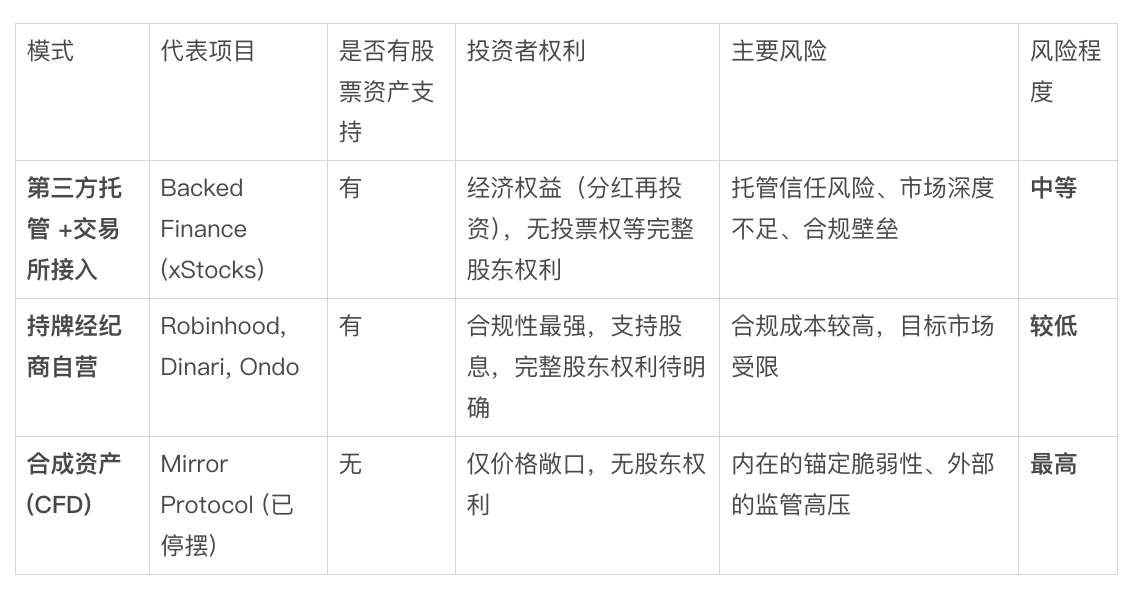

Despite its promising outlook, securely and compliantly mapping real-world stock rights onto blockchains remains a central challenge. Currently, the market’s dominant issuance models fall into three categories, differing significantly in asset backing, investor rights, and risk levels.

Overview of Three Issuance Models

The first is the “Third-party Custody & External Channels” model. Exemplified by Backed Finance’s xStocks series, this model operates by establishing an independent legal entity (SPV) to hold actual stocks, with third-party institutions managing off-chain custody and audits before distribution via mainstream exchanges. Trust in this model hinges on the custodian’s credibility and asset transparency. However, investors typically receive only economic exposure linked to the underlying asset, not full legal shareholder status.

The second is the “Licensed Institution-Owned” model, considered the most rigorous path in terms of compliance. Its essence lies in licensed entities building vertically integrated systems covering asset issuance, trading matching, and settlement. Institutions like Robinhood, Ondo Finance, and Dinari are pursuing this route. While legally and technically demanding, this model offers investors the highest level of legal protection.

The third is the “Synthetic Derivatives” model, which carries the greatest risk exposure. Mirror Protocol, once active but now dormant, serves as a case in point. What it issued were not tokenized stocks per se, but financial derivatives mimicking stock price movements, lacking 1:1 backing by real shares. Users gain only price-based returns and possess no shareholder rights. Without physical asset anchoring, such platforms face dual pressures of de-pegging risks and regulatory scrutiny.

Notably, these models are not rigidly distinct in practice but show signs of dynamic evolution. Licensed issuers often incorporate third-party custody and exchange access to boost liquidity, while unlicensed projects actively pursue licensing to align with compliant, self-operated models. This reflects a clear industry consensus: compliance is the only ticket to the future.

Ondo’s “Winning Hand”: Why Compliance Is the Ultimate Moat?

Among these paths, Ondo Finance’s approach stands out. As a leading player in the tokenization space, its core strategy targets the industry’s highest barrier: building a fully compliant tokenized stock system within the stringent U.S. regulatory framework. Achieving this requires holding three key financial licenses—and Ondo is among the few players in the market that have already cleared this hurdle.

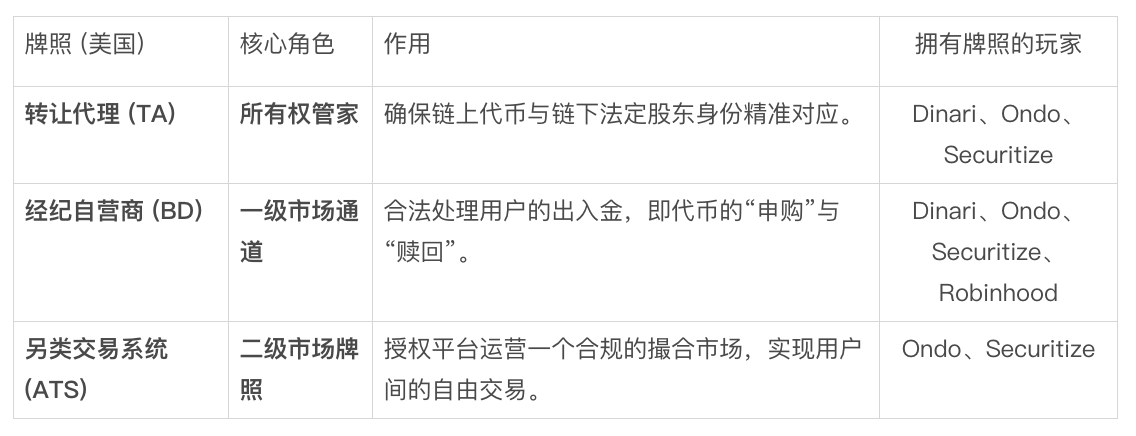

Overview of Three Key U.S. Compliance Licenses

The first license is Transfer Agent (TA). Its primary role is to serve as the official “shareholder registry manager” for issuers, accurately recording securities ownership. In tokenization, TA ensures precise alignment between on-chain digital tokens and off-chain legal rights, forming the foundational trust layer of the entire compliance system.

The second is Broker-Dealer (BD) license—the essential permit for conducting any securities business. In tokenization, whether users purchase tokens with fiat (minting) or sell tokens for cash (redemption), the underlying stock transactions must be executed by a BD-licensed entity. It acts as the core compliance hub linking investors to the primary market.

The third, and most difficult to obtain, is the Alternative Trading System (ATS) license. It authorizes the operation of a regulated secondary market trading platform. Without ATS, a platform can only handle issuance and redemption, preventing peer-to-peer legal trading between users. Thus, ATS is the key to unlocking true liquidity for tokenized stocks and represents the ultimate solution to the industry’s long-standing liquidity challenges.

Through forward-looking strategy, Ondo has secured all three licenses, creating a powerful operational closed loop. This differentiates it from competitors relying on European regulations or holding only a single license, enabling it to potentially offer U.S.-based investors a fully compliant end-to-end service—from primary market subscription to secondary market trading. This moat built on licenses constitutes Ondo’s most fundamental competitive advantage.

Conclusion: Revolution, or Just “Old Wine in New Bottles”?

Stock tokenization paints a vision of deep integration between traditional finance and the digital world—a global value network transcending time zones, enabling instant settlement, and unlocking infinite possibilities. It could catalyze the digital migration of trillions in traditional assets and fundamentally reshape global capital structures. Yet, the collision of these two ecosystems brings not only sparks of efficiency revolution but also intense friction with regulatory frameworks and investment cultures.

Ondo Finance’s compliance-first entry resembles a directional exploration at this uncertain intersection. Can it leverage its strong licensing advantage to forge a viable path within strict regulations and attract incremental capital from both worlds? Will this grand financial innovation ultimately give rise to a new, highly efficient market—or will it fail to adapt and become just another case of “old wine in new bottles”? The answer depends on ongoing efforts by market pioneers and the final verdict of time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News