Decoding Puffer UniFi: From Native Restaking to the Narrative Expansion of Based Rollups

TechFlow Selected TechFlow Selected

Decoding Puffer UniFi: From Native Restaking to the Narrative Expansion of Based Rollups

From nLRT to UniFi, it is not a simple linear expansion, but rather aims to extend and build a decentralized infrastructure for Ethereum.

Author: Puffer Finance

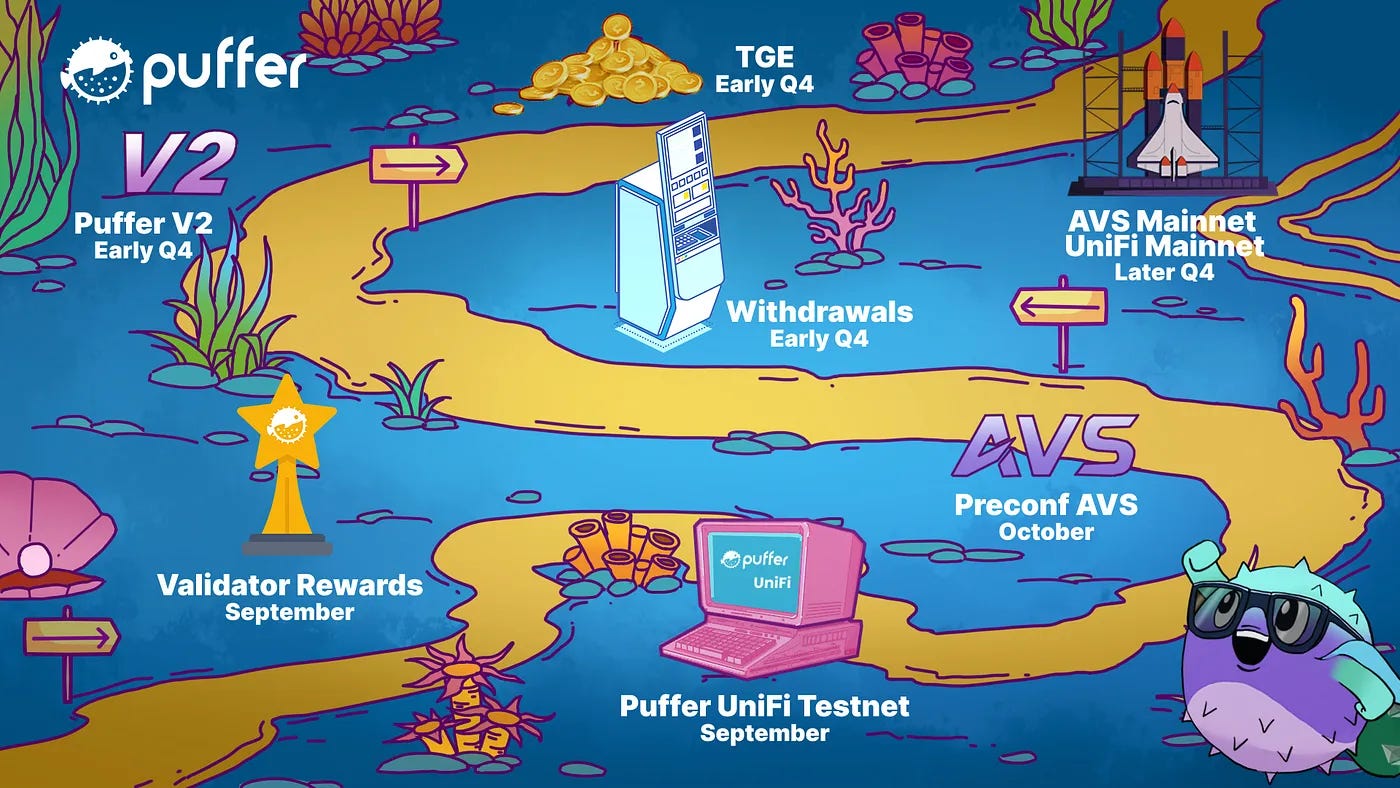

In August, Puffer officially announced its evolution from a native Liquid Restaking Protocol (nLRP) into a decentralized infrastructure provider for Ethereum. Its product architecture now consists of three core components: the Based Rollup solution Puffer UniFi, the pre-confirmation (Preconf) technology solution UniFi AVS, and the restaking product Puffer LRT.

This article will begin by exploring Puffer’s native liquid restaking protocol (nLRP), revealing the internal logic behind Puffer’s expansion into the Based Rollup direction. It will examine the unique mechanisms Puffer has developed in resource integration, market demand fulfillment, and technological innovation, demonstrating the completeness and coherence of Puffer’s developmental path from Restaking to Based Rollup.

Puffer LRT: A Decentralized Architecture Rooted in Ethereum's Roadmap

Before introducing Puffer UniFi, it is essential to first understand the architecture and characteristics of Puffer nLRT—the native liquid restaking product. Here, "native restaking" refers to Puffer enabling direct restaking of native ETH, providing it to node operators for PoS validation and AVS validation—offering a more native and lower-risk approach.

The Puffer nLRT service involves three main participant groups: Node Operators (NoOps), Restaking Operators (ReOps), and regular ETH stakers:

-

Stakers can deposit ETH, stETH, wstETH, or other assets into Puffer to stake and receive pufETH—a liquid restaking token. This allows them to earn staking/restaking rewards while using pufETH’s liquidity in other DeFi protocols to further boost yields;

-

NoOps are core participants in the Puffer ecosystem, responsible for running Ethereum PoS validator nodes and participating in consensus processes such as block proposal and transaction validation. Notably, Puffer ensures that NoOps who perform their duties diligently receive 100% of PoS rewards through an innovative mechanism called “Validator Tickets”;

-

ReOps handle both PoS validation and AVS operations, maximizing returns by restaking staked assets. ReOps also serve as NoOps for PoS validation;

Currently, the system is in a transitional phase where NoOps focus solely on PoS validation (but still earn restaking rewards), primarily due to user asset security concerns—AVSs are still in early stages with high uncertainty and risk, so this responsibility is temporarily assigned to professional node operators.

In the future, as technology and mechanisms mature, NoOps will expand beyond their current scope and share AVS validation responsibilities alongside ReOps.

Throughout this process, Puffer employs various innovative mechanisms to lower participation barriers, incentivizing more users and node operators to join and further decentralize Ethereum’s staking ecosystem.

For example, Puffer’s pioneering “Validator Tickets” (VT) model establishes a permissionless economic incentive alignment between Stakers and NoOps—Stakers can withdraw a discounted portion of future PoS rewards upfront, while NoOps are guaranteed 100% of PoS rewards during the same period as long as they fulfill their duties.

This enables both parties to cooperate under optimized incentive structures, improving capital efficiency for validator operations:

-

For Stakers, there is no longer concern about negligent node operation (“monks hitting the bell without devotion”). By pre-withdrawing PoS rewards, they transfer the risk of potential laziness or even rug pulls by NoOps, protecting their staking returns;

-

For aspiring NoOps, purchasing VTs (minimum 28 VTs currently) and depositing at least 1 ETH (or 2 ETH if not using anti-slashing technology) as collateral allows permissionless entry into Puffer’s node module—offering higher capital efficiency than traditional liquid staking protocols;

This significantly lowers the barrier to becoming a NoOp, enabling more中小型, non-institutional operators to participate in node operations. Not only does this allow ordinary individuals to run validators with less capital, but it also allows the same amount of capital to support more validators, thereby enhancing capital efficiency and strengthening Ethereum’s decentralization.

UniFi’s Narrative Expansion: One Fish, Multiple Meals

This is a natural advantage of Puffer LRT over other liquid staking or restaking products. With this foundation, we can see how it perfectly aligns with Vitalik Buterin’s repeatedly emphasized vision for Based Rollups:

In the Based Rollup architecture, the core idea is to shift transaction sequencing responsibility to L1—leveraging Ethereum’s decentralized set of validator nodes to propose blocks and bundle transactions, thus inheriting L1 security while promoting Ethereum’s decentralization.

In essence, Based Rollups require a large-scale, decentralized validator set (decentralized sequencer set) to promote Ethereum’s decentralization. Puffer LRT, by lowering entry barriers and offering strong decentralized support, naturally provides exactly this kind of extensive validator network.

Technically, Puffer UniFi integrates directly at the Ethereum node level, aggregating validators to provide decentralized sequencing and pre-confirmation services (UniFi AVS). This delivers ultra-fast confirmation times (in milliseconds)—see extended reading: Understanding Puffer UniFi AVS: From Preconfs to Ethereum’s Next Decade?—while eliminating risks associated with centralized sequencers such as single points of failure or censorship, aligning well with Ethereum’s ongoing decentralization goals.

From this perspective, the launch of Puffer UniFi is not a random experiment into a new direction, but rather a natural narrative extension built upon the mature architecture of Puffer LRT:

Leveraging Puffer’s restaking-enabled validator set, ETH used in restaking can directly serve as collateral for pre-confirmations—requiring no additional deposits. This allows near-zero-cost scaling to tens of thousands of decentralized sequencers. Restaking validators = pre-confirmation service nodes—improving capital efficiency while rapidly assembling a massive, highly decentralized validator set for pre-confirmation, forming the foundational layer for Based Rollups.

Interestingly, from a market demand standpoint, Puffer UniFi also creates diversified revenue streams for Solo Stakers and additional income for validators—enabling “one fish, multiple meals”:

Since Ethereum PoS validators directly expand into L1 sequencing roles, node operators earn not only PoS validation rewards (via Puffer LRT) but also income from pre-confirmation validation (UniFi AVS) and Rollup transaction sequencing fees. Additionally, congestion fees and contention fees generated from transactions contribute to increased returns for pufETH holders.

This further strengthens economic incentives, attracting more operators to participate and driving greater decentralization across Ethereum.

The Vision of a UniFi Appchain Universe

Viewed this way, the emergence of Puffer UniFi represents an effort to utilize Ethereum’s mainnet validator nodes as a decentralized sequencer set, combining Puffer’s own UniFi AVS fast confirmation advantages to offer Rollups a more secure and efficient decentralized solution based on the Based Rollup paradigm.

Through this model, Puffer UniFi effectively activates the validator set, allowing validators to earn extra income while providing pre-confirmation and transaction sequencing services. This consolidates multiple economic benefits from across the ecosystem back to L1, reinforcing Ethereum’s economic incentive structure—and closely aligning with Ethereum’s long-term development trajectory.

The broader vision lies in the fact that Puffer UniFi allows developers to use its infrastructure to build and deploy their own Based Rollup applications. In other words, every DApp on UniFi in the future could function as an appchain, directly capturing part of the value generated from transaction fees.

This could give rise to a visionary “appchain universe” built on Based Rollups:

-

Developers face significantly reduced operational burdens and technical overhead without needing centralized sequencers, lowering the entry barrier for new developers and simplifying the management complexity of appchains;

-

Transactions across multiple appchains can be included in a single block—as long as they share the same decentralized sequencer set (Ethereum’s validator set)—they can share users and liquidity. Users experience seamless composability regardless of which appchain they use, creating tight integration between Rollups and Ethereum L1. For instance, withdrawals from Based Rollups to L1 could settle in seconds, enabling seamless fusion between Rollups and L1 and greatly enhancing user experience and overall ecosystem efficiency;

-

Additionally, developers/projects can capture fees generated by their appchains, directly linking ecosystem success to individual developer success;

In short, UniFi grants project teams control over sequencer fee distribution—an additional economic lever. Whether used for subsidies, user acquisition, marketing within their own appchain ecosystem, or retained as profit, this opens up entirely new incentive models for Rollups and appchains.

Overall, Puffer UniFi fundamentally leverages its优势 in staking/restaking validator sets to enter the new frontier of Based Rollups. Through a combination of Based Rollup-based appchain architecture and its own sequencer-set-driven economic mechanisms, it unlocks the potential for a comprehensive infrastructure serving a future universe of泛-Based Rollup appchains.

Conclusion

If we clearly recognize the “origin point” role played by Puffer LRT within its entire service matrix, we see that the progression from LRT services to the launch of Puffer UniFi and UniFi AVS is not merely a linear product expansion—but rather an inevitable evolution rooted in the resources and technological advantages accumulated through restaking.

By leveraging the staking/restaking validator set from LRT, Puffer fulfills the demand for a decentralized sequencer set required by Puffer UniFi as a Based Rollup. Meanwhile, UniFi AVS, as a pre-confirmation technology solution, provides reliable transaction guarantees—reflecting our conviction and strategic alignment with the future direction of the Ethereum ecosystem.

In brief, Puffer nLRT, Puffer UniFi, and UniFi AVS operate synergistically. Through a logically coherent narrative expansion, they collectively form a complete suite of decentralized infrastructure services for Ethereum. At the heart of this system lies Puffer’s Validator mechanism—the permissionless nature brings significant openness and scalability to the Ethereum ecosystem, meaning any Ethereum node has the opportunity to participate.

Over time, as more new Ethereum nodes emerge and join this network, not only will node resources be vastly enriched and network decentralization enhanced, but since both Rollups and L1 rely on the same shared validator set, the synergy between Based Rollups built on these nodes and L1 will grow stronger. Their technical implementation and ecosystem operations will become increasingly intertwined, gradually merging into a unified, self-reinforcing positive feedback loop—a thriving, holistic Ethereum ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News