From LRT Protocol to Decentralized Infrastructure Provider: How Puffer Aligns with the Ethereum Ecosystem?

TechFlow Selected TechFlow Selected

From LRT Protocol to Decentralized Infrastructure Provider: How Puffer Aligns with the Ethereum Ecosystem?

Puffer has consistently adhered to Ethereum-aligned principles in its design and product evolution, demonstrating strong support for Ethereum's long-term vision.

By LINDABELL

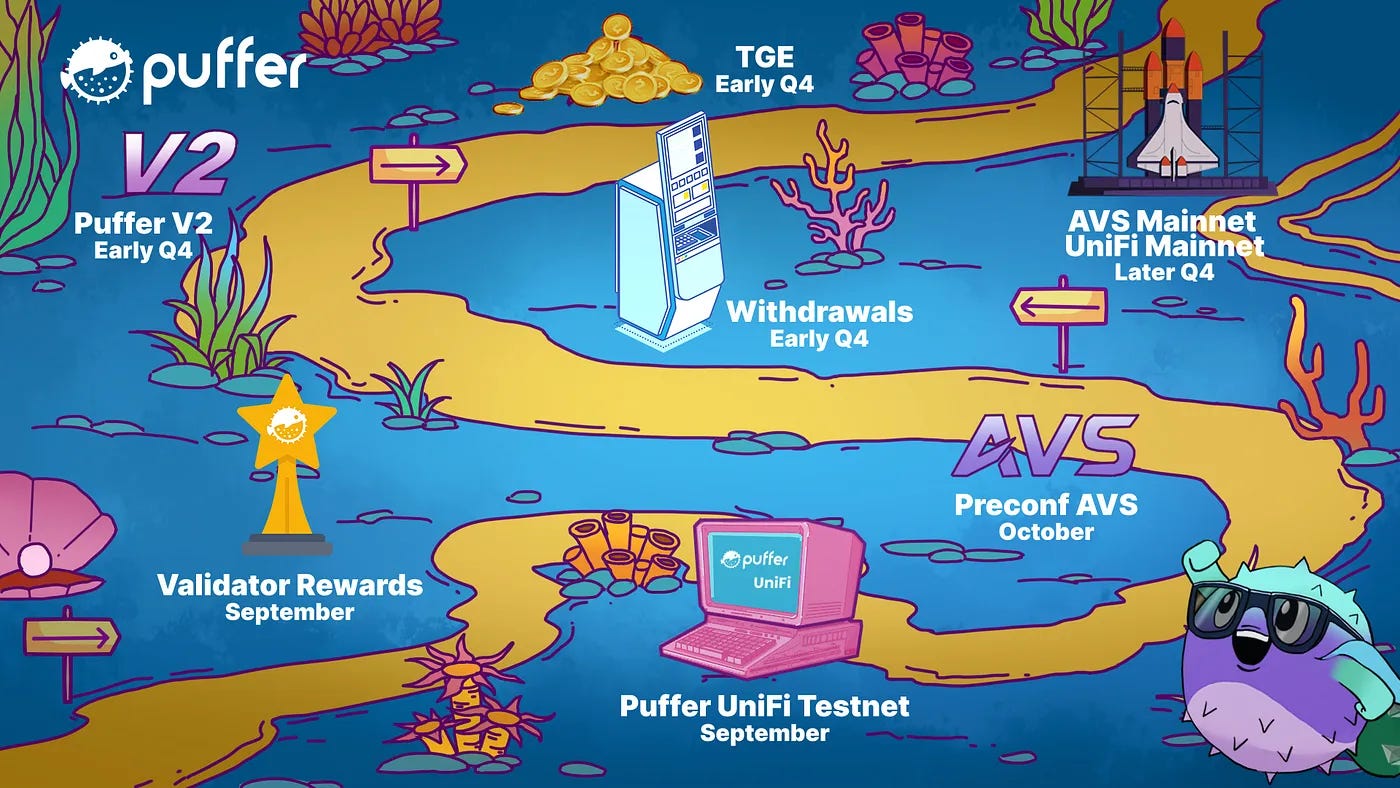

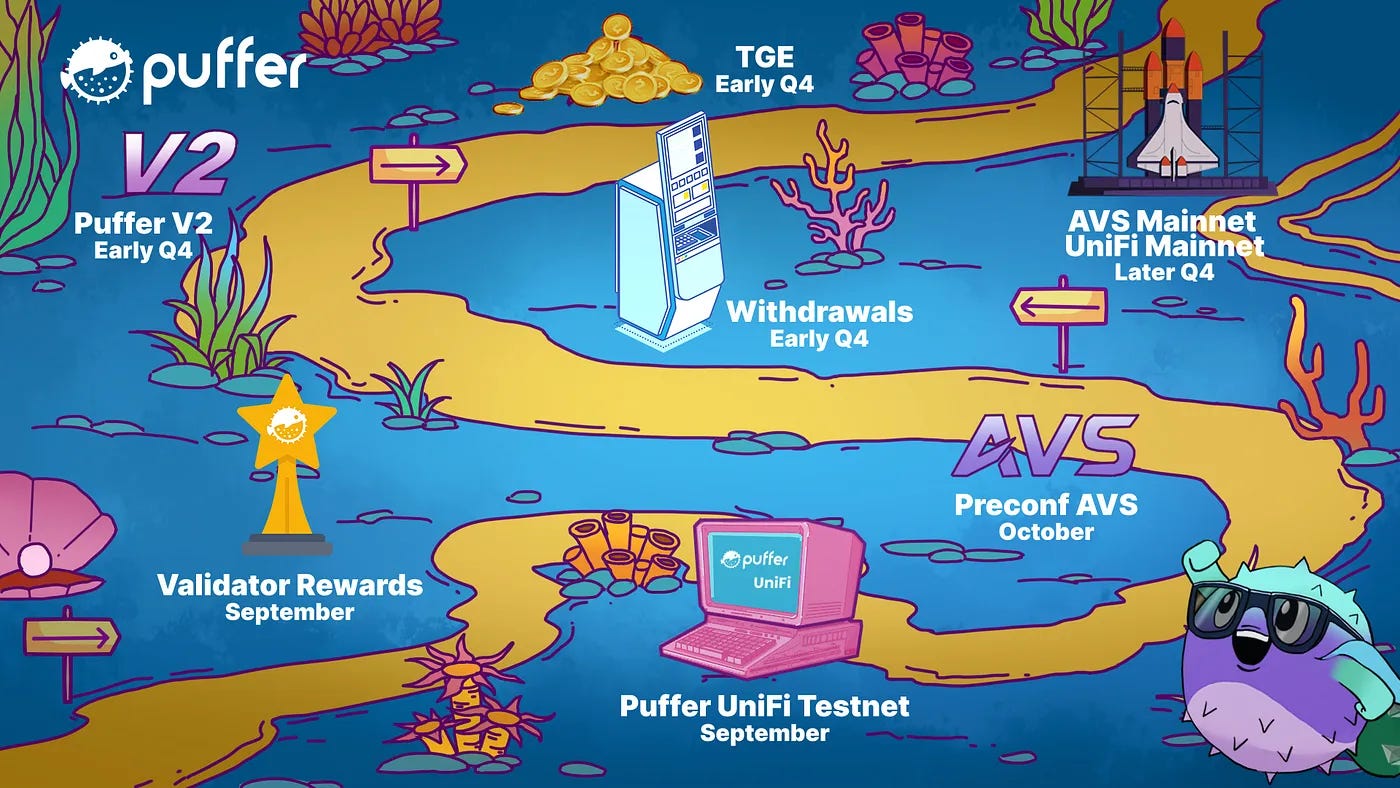

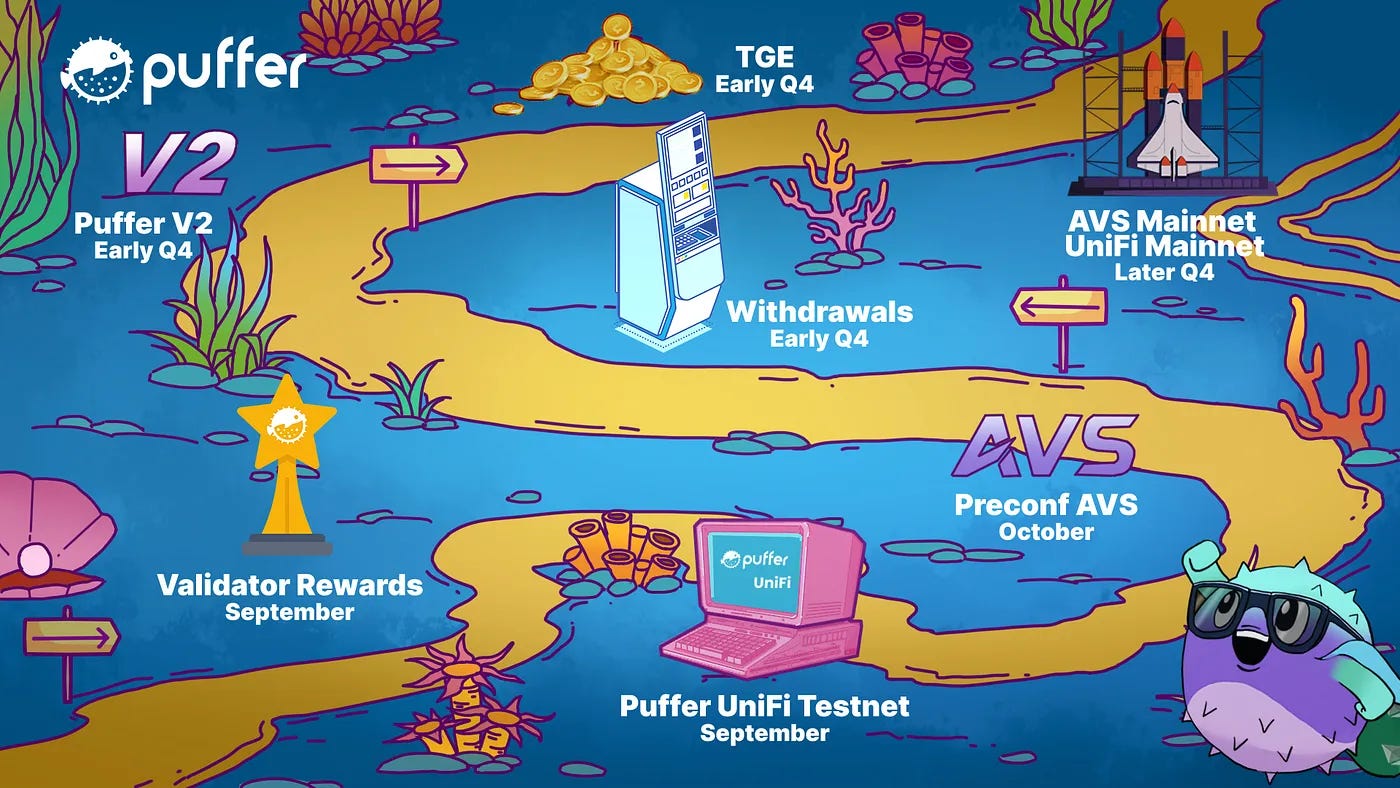

According to Puffer Finance's recently released strategic roadmap, the platform has evolved from a native liquid restaking protocol into a decentralized infrastructure provider for Ethereum. Its product architecture has also been updated—beyond Puffer LRT, it now includes Based Rollup Puffer UniFi and the pre-confirmation solution UniFi AVS. Regarding these changes, Puffer stated: "Puffer’s strategic roadmap reflects our team’s commitment to building the infrastructure necessary to support Ethereum’s growth and resilience. Every element—from UniFi AVS to the PUFI token generation event (TGE)—has been carefully designed to align with Ethereum’s core principles."

The Birth of Puffer

On November 29, 2023, Jason Vranek, co-founder of Puffer, presented a demo of Puffer at EigenLayer’s “Restaking Summit: Istanbul Devconnect.” Puffer is a native liquid restaking protocol aiming to design a permissionless, slash-risk-minimized liquidity restaking solution, addressing centralization and high entry barriers in today’s staking market.

The founding team initially sought to use verifiable technology to reduce slashing risks in liquid staking protocols. Inspired by Justin Drake, an Ethereum Foundation researcher, who in 2022 proposed using hardware to mitigate slashing risks for solo validators in his paper “Liquid solo validating,” Puffer developed Secure Signer—a secure signing technology—in late 2022. This technology leverages Intel SGX to store validator private keys within an enclave, protecting against slashing due to key leaks or operational errors. The development of Secure Signer was supported by a grant from the Ethereum Foundation in Q4 2022.

Additionally, Puffer has attracted significant attention from investment firms and angel investors. To date, Puffer Finance has completed four funding rounds, raising a total of $24.15 million. In June 2022, Puffer secured a $650,000 Pre-Seed round led by Jump Crypto. Then, in August 2023, it raised $5.5 million in a seed round co-led by Lemniscap and Lightspeed Faction, with participation from Brevan Howard Digital and Bankless Ventures. These funds were used to further develop Secure-Signer. In April this year, Puffer closed an $18 million Series A round led by Brevan Howard Digital and Electric Capital, with Coinbase Ventures, Kraken Ventures, Consensys, Animoca, and GSR among the participants. This round primarily funded mainnet launch efforts.

Puffer LRT Protocol: A Native Liquid Restaking Protocol

Liquid Restaking Tokens (LRTs) are an asset class emerging around the EigenLayer ecosystem, designed to enhance capital efficiency of staked Ethereum assets through restaking. The mechanism works by restaking ETH already staked on Ethereum’s PoS network—or liquid staking tokens (LSTs)—via EigenLayer onto other networks, thereby earning additional yield beyond standard Ethereum staking rewards.

Since Ethereum’s transition to PoS, numerous staking products have emerged, driving market growth. However, platforms like Lido have captured large shares of the market, raising concerns about network centralization. In September 2023, Lido held approximately 33% of the liquid staking market. As liquid restaking protocols gained traction, Lido’s share began to decline and now stands around 28%. Ethereum contributor Anthony Sasson noted that the vampire attack initiated by Puffer significantly impacted Lido, involving over $1 billion in capital movement.

As a permissionless, decentralized native liquid restaking protocol, Puffer combines both liquid staking and liquid restaking strategies. Using technologies such as Secure Signer and Validator Tickets (VT), Puffer enables independent validators to effectively participate in Ethereum staking and restaking processes, increasing yields while preserving the decentralization of the Ethereum network.

Moreover, to prevent excessive centralization within the network, Puffer strictly limits its validator node count, ensuring it never exceeds 22% of Ethereum’s total validator set, thus safeguarding its trust-minimized neutrality toward Ethereum.

Lowering Staking Entry Threshold from 32 ETH to as Low as 1 ETH

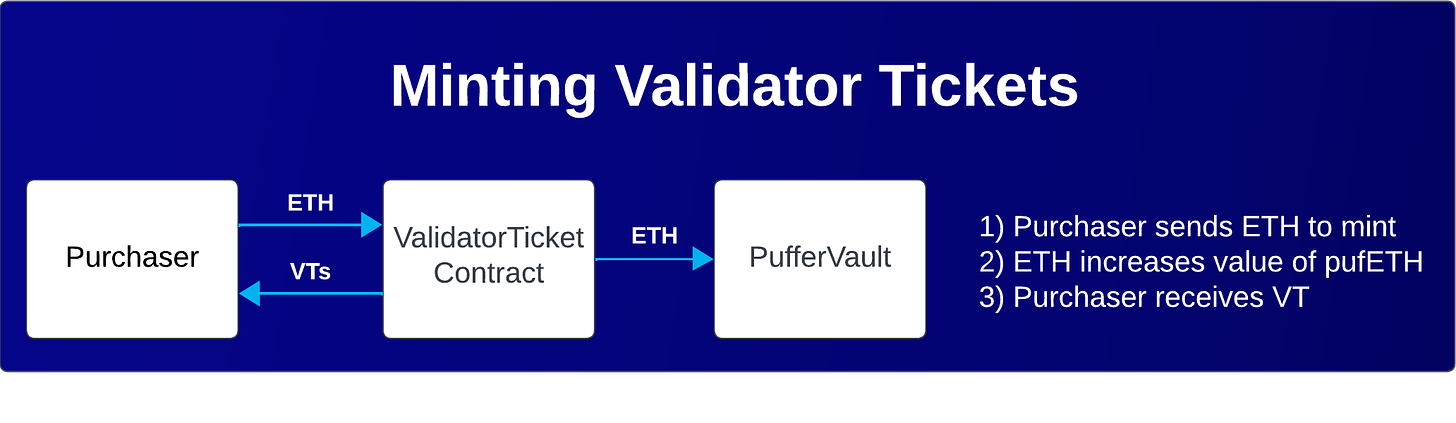

Becoming a node on Ethereum requires 32 ETH—an undoubtedly high barrier for individual users. Puffer reduces this threshold via a mechanism called Validator Tickets (VT), enabling node operators to run a validator with just 2 ETH in collateral (or only 1 ETH if using SGX). VT is an ERC20 token representing one day of rights to operate an Ethereum validator. The price of VT is based on the expected daily return from running a validator. Node operators must lock up a certain amount of VT to stake, which is gradually released back to liquidity providers during the staking period, while validators receive full PoS rewards.

To illustrate simply, it's akin to franchising a restaurant—users can either pay monthly revenues or make a one-time upfront payment covering projected annual earnings to gain operating rights. Puffer’s VT mechanism follows the latter model. Additionally, node operators earn 100% of PoS rewards, avoiding the “lazy node” phenomenon common in traditional staking models, where underperforming returns lead to passive participation or withdrawal from consensus. Furthermore, as an equity instrument, VT not only supplements staking capital but also offers liquidity, tradable on secondary markets.

Dual Yield via EigenLayer Integration

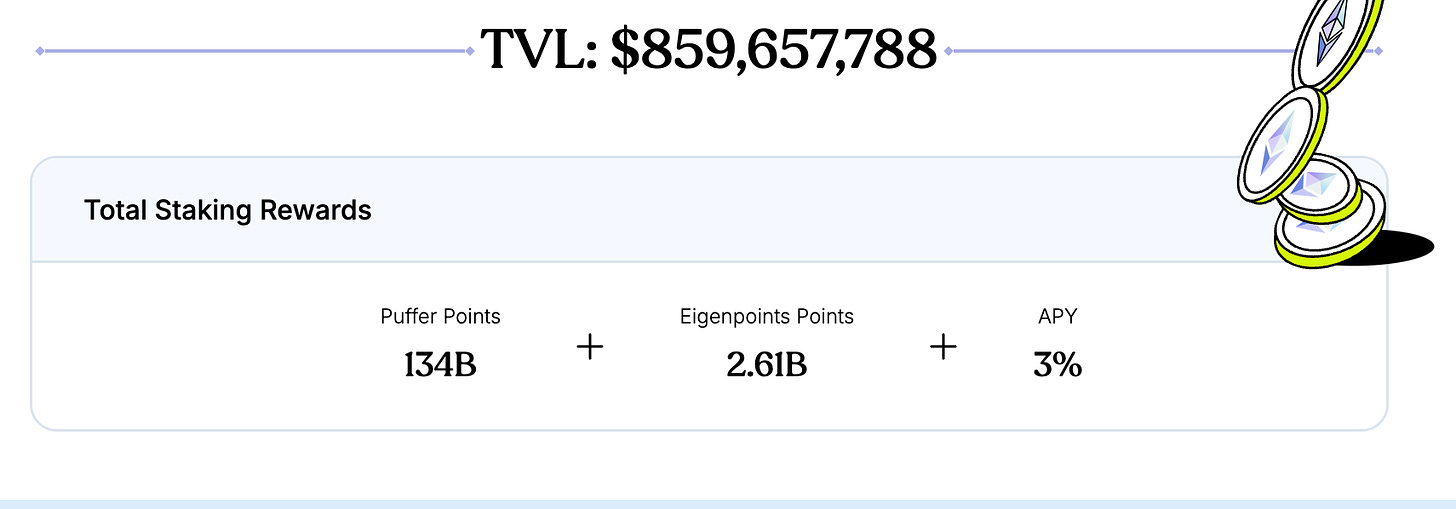

Puffer is a native liquid restaking protocol. The term “native” here means that users, besides participating in Ethereum’s PoS consensus, can directly re-stake their ETH. This allows stakers to earn both validator rewards from Ethereum PoS and additional yield through restaking, achieving dual returns. Unlike traditional liquid restaking products, Puffer does not rely on third-party liquidity providers; instead, it uses native validators’ ETH directly for restaking, avoiding centralization risks posed by dominance from a few large staking entities. In doing so, Puffer enhances both yield and network decentralization. Currently, Puffer’s total value locked (TVL) stands at $859.6 million, with an annualized yield of 3%.

Mitigating Slash Risk with Secure-Signer and RAVe

Puffer employs Secure-Signer and RAVe (Remote Attestation Verification) to effectively prevent slashing penalties caused by validator operational errors. Secure-Signer is a remote signing tool built on Intel SGX hardware security technology, capable of generating, storing, and executing signatures within an enclave, thereby preventing slashing due to double-signing or other signature faults. RAVe verifies the authenticity of remote attestation reports generated by Intel SGX, ensuring nodes are indeed running the authenticated Secure-Signer program. Upon verification, the system records the validator key status on-chain, preventing malicious nodes from running unverified code or altering critical logic.

Notably, Secure Signer is open-sourced as a public good and is currently available for review on GitHub.

Puffer launched its mainnet on May 9, 2024. To further enhance Ethereum’s decentralization, Puffer plans to release version V2 in Q4 this year. This upgrade focuses on improving user experience and introduces several key features:

-

Fast Path Rewards (FPR): Allows users to directly withdraw consensus layer rewards from L2, avoiding high gas costs associated with withdrawals via EigenPod.

-

Global Forced Anti-Slashing: Puffer V2 will implement a protocol-wide anti-slashing mechanism, further enhancing network security and decentralization.

-

Reduced Collateral Requirements: Puffer V2 lowers collateral requirements for NoOps (non-operational nodes), requiring only a small amount of pufETH to cover potential slashing from inactivity.

Puffer UniFi: Achieving 100ms Transaction Confirmation via UniFi AVS

On July 6, 2024, Puffer released the Litepaper for its Based Rollup solution, Puffer UniFi. As a Based Rollup, UniFi leverages Ethereum validators for transaction ordering and returns transaction value to L1, thereby strengthening Ethereum’s security and decentralization.

Since Ethereum adopted its “Rollup-centric” roadmap, numerous L2 solutions have emerged. According to L2Beat data, there are now over 100 Rollups in the market. While these scaling solutions improve Ethereum’s scalability and user experience, they also introduce issues such as liquidity fragmentation and centralized sequencers. First, liquidity fragmentation: due to poor interoperability between different Rollups, liquidity and users are scattered across isolated L2 networks, hindering effective synergy across the ecosystem. Moreover, transferring assets between Rollups relies on cross-chain bridges, increasing operational costs and introducing security risks. Additionally, most current Rollups use centralized sequencers that extract MEV rents from user transactions, negatively impacting user experience.

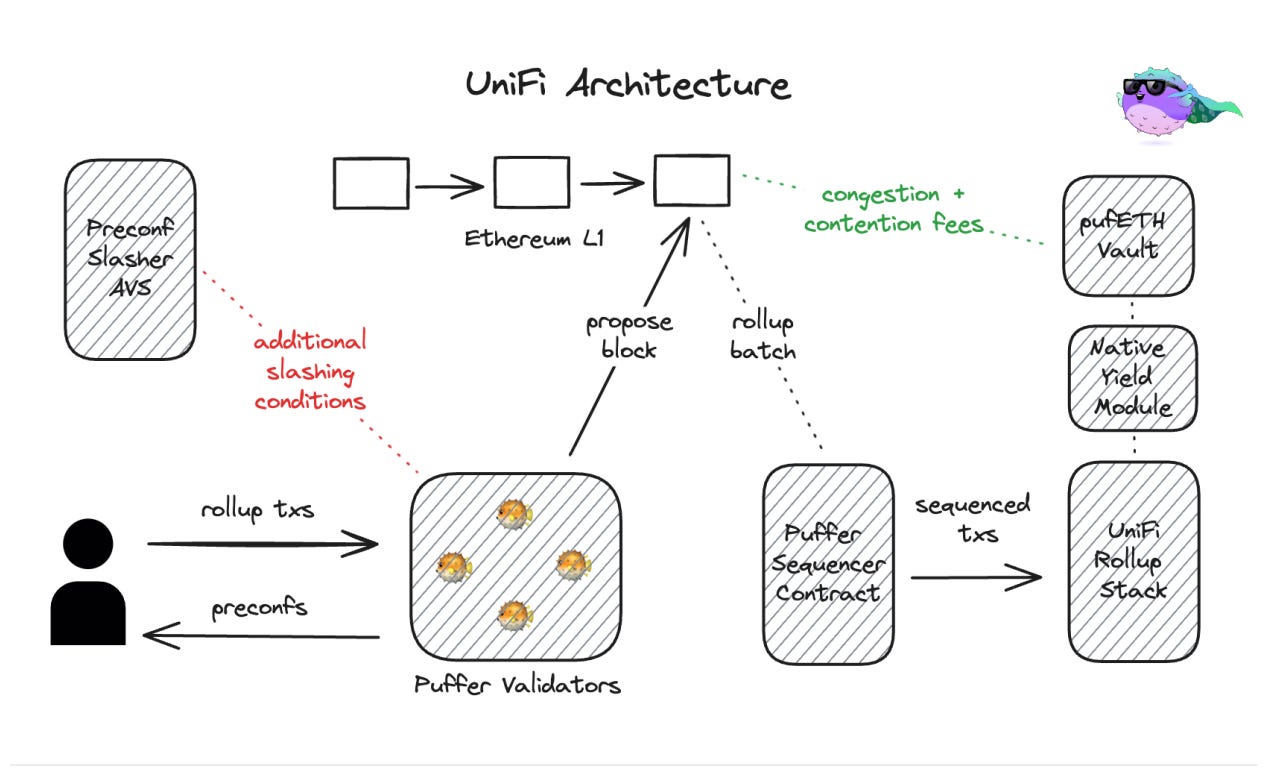

Puffer’s UniFi aims to address these challenges through validator-based decentralized transaction ordering. Unlike traditional centralized sequencing, although transactions in UniFi are processed by Puffer nodes, these nodes are themselves native Ethereum stakers. Thus, UniFi distributes transaction ordering rights among decentralized validators, fully leveraging Ethereum’s security and decentralization.

Further Reading: What Is a Based Rollup That Inherits Ethereum Liveness?

In addition, UniFi tackles liquidity fragmentation through synchronous composability and atomic composability. Applications built on UniFi can leverage its ordering and pre-confirmation mechanisms to achieve seamless interoperability with other L1-ordered Rollups or app chains. By utilizing Puffer’s TEE-multiprover technology, UniFi achieves atomic-level composability with L1—enabling instant L1 settlement and direct access to L1 liquidity, enhancing cross-layer transaction and application efficiency, and empowering developers to build more efficient applications.

However, while Based Rollups eliminate risks from centralized sequencers by delegating transaction ordering to L1 validators, their confirmation speed remains constrained by L1 block times (~12 seconds), making fast finality impossible. To solve this, Puffer introduced an AVS service based on EigenLayer, providing a pre-confirmation mechanism that achieves 100ms transaction confirmation.

Further Reading: Why Do Based Rollups Need Pre-Confirmation (Preconfs) Technology?

Within Puffer UniFi AVS, validators can use their ETH staked on Ethereum’s mainnet to provide pre-confirmation validation services for UniFi via EigenLayer’s restaking mechanism—without needing to deposit new capital. This improves capital efficiency and lowers participation barriers. Moreover, UniFi AVS inherits Ethereum’s economic security. If a validator violates its pre-confirmation commitment, it risks losing its staked ETH on the mainnet, eliminating the need for Puffer to design separate slashing mechanisms.

To participate in Puffer UniFi AVS, validators must own an EigenPod to ensure that the UniFi AVS service can enforce slashing penalties, constraining behavior of validators violating pre-confirmation commitments. Additionally, node operators must run Commit-Boost on the server or environment hosting their validator client, handling communication between validators and the pre-confirmation supply chain.

Within just two weeks of launch, UniFi AVS has attracted 1.05 million ETH in staked value, with over 32,000 validators participating. Looking ahead, Puffer plans to integrate with the Ethereum Foundation’s neutral registration contract mechanism, allowing any L1 proposer to voluntarily register as a pre-confirmation validator. This would enable every Ethereum validator to opt-in as a pre-confirmation validator, further expanding system decentralization.

Conclusion

As the Ethereum ecosystem continues to grow, ensuring alignment among projects and participants toward shared goals has become a central concern for the community. This concept of alignment is widely regarded as key to Ethereum’s long-term success. Early discussions framed alignment in terms of “cultural,” “technical,” and “economic” dimensions. More recently, Vitalik Buterin proposed a refined framework in his article “Making Ethereum Alignment Legible,” emphasizing openness (open-source, open standards), decentralization and security, and positive-sum dynamics. Regardless of the framework used, the ultimate goal remains ensuring that protocols, communities, and projects evolve in harmony with Ethereum’s overarching vision, contributing positively to sustainable ecosystem development.

It is commendable that Puffer has consistently adhered to Ethereum-alignment principles throughout its design and product evolution, demonstrating strong support for Ethereum’s long-term vision. By integrating with EigenLayer, Puffer enables broader participation of independent validators in the staking network, enhancing Ethereum’s decentralization. Meanwhile, Puffer’s UniFi returns transaction ordering power to native Ethereum stakers, aligning with Ethereum in terms of security and decentralization.

Currently, Puffer Finance has published its tokenomics, allocating 75 million PUFFER tokens (7.5% of total supply) for the first season of the Crunchy Carrot Quest airdrop. The eligibility snapshot for Season One was completed on October 5, 2024, and users can claim their tokens via the token claims portal between October 14, 2024, and January 14, 2025. With the official rollout of the PUFFER token, it remains to be seen whether Puffer can continue advancing its mission of Ethereum alignment while achieving greater decentralization and user growth—an evolution worth closely watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News