Metis LSD Ecosystem Mining: The First Collision Between Layer 2 and LSD

TechFlow Selected TechFlow Selected

Metis LSD Ecosystem Mining: The First Collision Between Layer 2 and LSD

As a Layer2, Metis innovatively introduced the POS mechanism into the sequencer pool, creating a staking demand for $METIS.

Written by: @auggest_crypto

TL;DR

-

As the first Layer 2 to focus on developing the LSD sector, Metis has broken through limitations unreachable by other Layer 2 networks. Its unique decentralized sequencer pool design creates staking demand, making LSD the most convenient and high-yield channel for community participation in decentralization.

-

LSD, as a key component of PoS-based networks like Ethereum, significantly lowers network staking barriers, enhances security, supports token value, boosts liquidity, and drives the growth of derivative DeFi ecosystems.

-

To aggressively grow its liquid staking sector, Metis launched multiple ecosystem incentive programs such as MetisLSB, offering LSD protocols an annual mining yield of 20%, far surpassing Ethereum's 4.25% and other networks.

-

Emerging protocols like ENKI and Artemis have initiated community proposals, with their tokenomics and upcoming ecosystem activities set to become key criteria for early airdrops—worth close attention.

1. Metis LSD

1.1 Why LSD?

1) Lowering High Barriers of Traditional Staking

LSD stands for Liquid Staking Derivatives. Since Ethereum’s Paris upgrade transitioned the blockchain from PoW to PoS, validators must stake a certain amount of tokens to participate in block production and earn rewards. However, this remains difficult for ordinary users.

Typically, public chains require large amounts of capital—for example, Ethereum requires at least 32 $ETH per validator node, raising entry barriers. Long lock-up periods reduce capital efficiency for retail investors, and technical and hardware requirements make staking unfriendly for average users.

Ethereum's Shanghai (Shapella) upgrade enabled staking withdrawals, marking the beginning of the LSDfi era. LSD not only opens new revenue channels for retail users and unlocks liquidity for staked assets but also enables diverse protocols such as LSDfi and restaking, accelerating DeFi ecosystem growth and broadening participation.

Metis, as a Layer 2, innovatively introduces PoS mechanisms into its sequencer pool, creating demand for $METIS staking. By shifting network consensus security from traditional node validation to decentralized sequencers, advancing LSD becomes the most crucial step toward achieving full decentralization.

Metis is a truly decentralized Ethereum Layer 2 network, pioneering focus on decentralized sequencers and redistributing gray-area revenues like MEV back to the community, thereby building a transparent and user-friendly network. We detailed Metis’ decentralization technology in a previous article, with the most critical aspect being its decentralized sequencer pool secured via node staking.

Metis employs a pool of multiple sequencers, where any staked participant can view the transaction pool and process transactions, preventing manipulation by a single sequencer. Nodes must stake the network token $METIS to join, with at least 20,000 $METIS (~$2.4M) required to become a sequencer node. Once involved in block production, sequencers earn both gas fees from transaction processing and additional $METIS staking rewards. Blocks are broadcast based on random selection weighted by staked share.

Moreover, becoming a Metis sequencer offers not just network and staking rewards, but also access to the EDF program, which allocates 3 million of its 4.6 million $METIS fund specifically to achieve sequencer decentralization. This highlights Metis' strong commitment to decentralization. However, the $2.4 million staking threshold makes direct participation unattainable for most individuals.

LSD provides a solution by allowing users to participate with minimal investment, drastically lowering the barrier to entry.

2) Enhancing Network Security and Supporting Token Value

Why open staking to the broader community? For PoS blockchains, network security heavily depends on the distribution of staked assets.

If staked tokens are concentrated among a few nodes, those entities gain excessive control, increasing centralization risks. Conversely, when staking participants are numerous and widely distributed, no single node holds significant influence. This raises the cost of malicious attacks, as compromising the network would require controlling many more nodes.

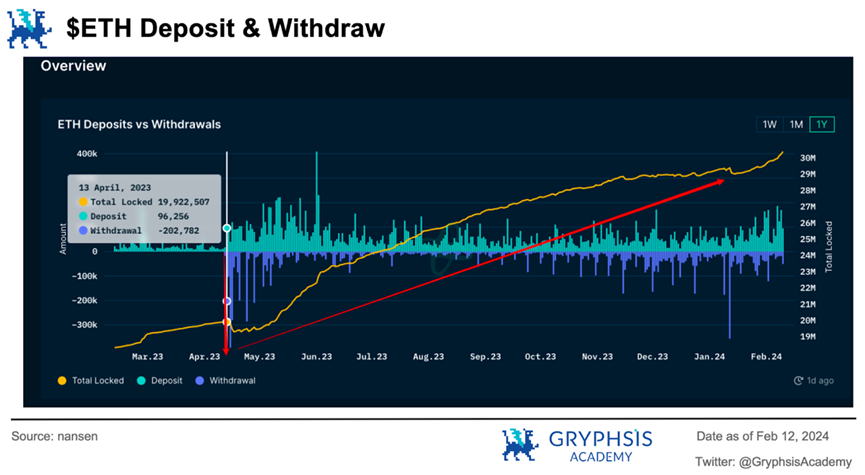

Although there was a short-term withdrawal spike in $ETH staking after Ethereum’s Shanghai upgrade, long-term total staked ETH has grown substantially. Users often reallocate withdrawn funds into LSD protocols, maintaining staking exposure while gaining liquidity and flexibility—thus continuing to support Ethereum’s staking rate, consensus stability, and overall network security.

Clearly, LSD has expanded Ethereum staking access to retail investors, enhancing network security as more tokens participate. At the same time, staking reduces circulating supply, helping maintain or increase token value.

3) Improving Capital Efficiency & Promoting DeFi Ecosystem Growth

As a core part of Ethereum, LSD currently holds a TVL of $37.96B, accounting for 35% of Ethereum’s total TVL. Leading protocols like Lido and Rocket Pool offer robust liquid staking solutions, driving innovation across sub-sectors including LSDFi, restaking, and DVT.

A mature liquid staking ecosystem allows $ETH assets to be easily subdivided and traded, enabling new DeFi use cases. For instance, users can leverage staking-derived tokens in lending, market-making, and yield farming, significantly improving capital efficiency for otherwise locked assets.

By providing liquidity and innovative financial products, LSD attracts more users and capital into the DeFi ecosystem, stimulating economic growth across the board.

Therefore, LSD development is vital for PoS networks—it strengthens consensus and promotes capital circulation within the ecosystem. Metis further supports this vision with rich and comprehensive incentive programs for its own liquid staking sector.

1.2 Ecosystem Incentive Programs

1.2.1 MetisLSB

On February 8, Metis launched the LSB (Liquid Staking Blitz) program, aimed at establishing Metis as the first rollup with a decentralized sequencer, sharing sequencer revenue with the community.

From its 4.6 million $METIS Ecosystem Development Fund (MetisEDF), 3 million $METIS will be allocated to accelerate the deployment and growth of LSD protocols. Selected protocols will gain pairing rights with sequencer nodes and receive a 20% MRR (Mining Reward Rate) yield incentive during their first year.

As previously noted, Metis sequencers earn both gas fees and $METIS staking rewards upon participating in block production. Now, LSD protocols serving the community can act as individual entities paired with sequencer nodes, earning a 20% mining reward rate.

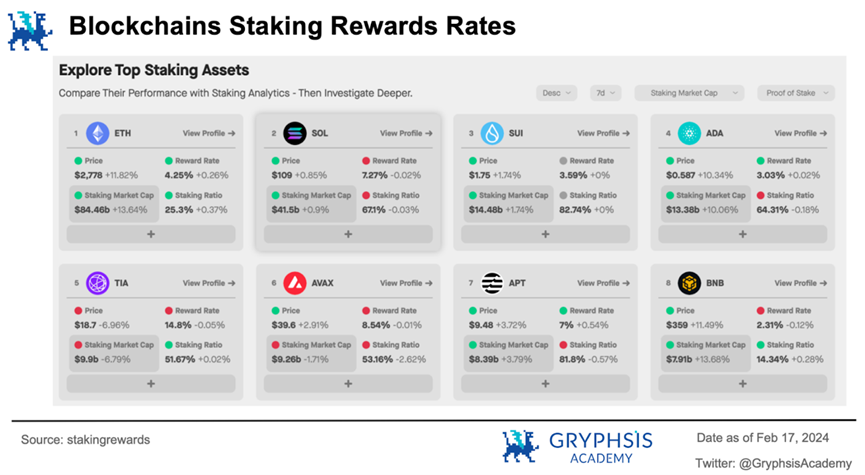

Compared to staking yields on other PoS networks—Ethereum at 4.25%, Solana at 7.25%, Celestia at 14.8%—Metis offers the highest rate among Ethereum-native projects, exceeding even the recently popular API3, with others generally below 10%.

Metis LSB combines sequencer mining incentives with ecosystem funding to boost returns for LSD products, amplifying liquid staking yields. This not only attracts more users to contribute to decentralization but also encourages expansion into derivative sectors like restaking, expanding the network while activating asset circulation.

1.2.2 MetisEDF & Journey

On December 6, Metis announced a $5 million incentive program, #MetisJourney, targeting DeFi applications to attract and incentivize more dApps to deploy.

On December 18, Metis launched the #MetisEDF (Ecosystem Development Fund), allocating 4.6 million $METIS (valued at $550 million) to support decentralized sequencer implementation, dApp grants, dApp-building mining incentives, liquidity programs, and other ecosystem initiatives.

Specifically, 3 million $METIS from EDF is dedicated to sequencer mining to ensure functionality and decentralization, while the remaining 1.6 million $METIS aims to attract more LSD protocol deployments, including lending, stablecoins, CDPs, and other ecosystem developments.

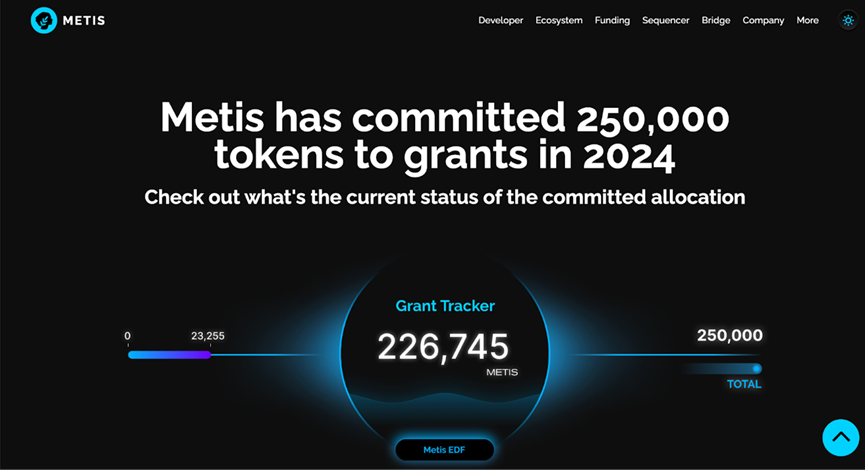

On February 16, it was confirmed that 250,000 $METIS would be drawn from EDF as the 2024 Grant Pool, with 23K already claimed.

Source: https://www.metis.io/grants

To date, Metis has committed hundreds of millions of dollars in incentives, fueling innovation in new assets, products, and platforms, strongly supporting network decentralization and asset liquidity.

Community proposals for LSD protocols are now open. Combined with the LSB program, participating in selected protocols promises high mining yields. So what are these protocols?

2. Alpha Protocols

2.1 ENKI

2.1.1 Overview

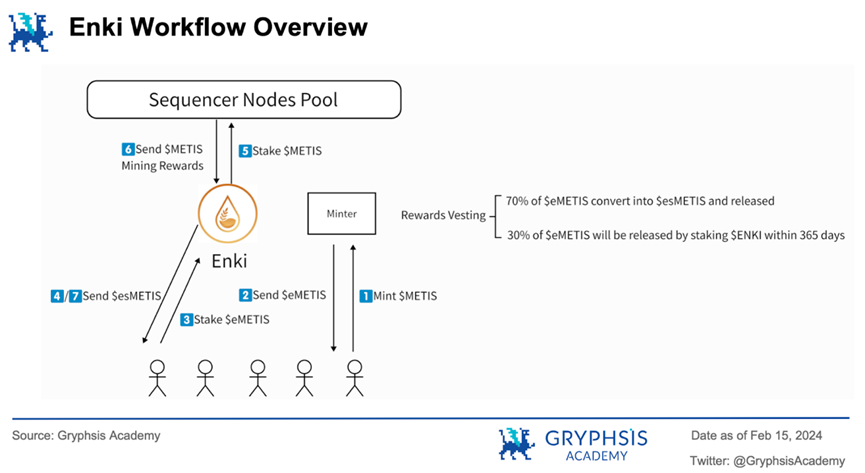

ENKI is the first LSD project deployed on Metis, designed to simplify participation in Metis Sequencer Node Staking. It enables users to earn rewards without needing to run a full sequencer node, acting as a bridge connecting retail users to Metis Sequencer Nodes and enabling multi-layered yield generation.

Here’s how it works:

-

Step 1: Convert to $eMETIS — Users convert their $METIS into $eMETIS via ENKI’s Minter.

-

Step 2: Stake $eMETIS to receive $seMETIS, serving as proof of active participation and eligibility for yield accrual.

-

Step 3: Accumulate earnings — The $seMETIS balance grows over time, reflecting performance within the Metis Sequencer Node ecosystem.

-

Step 4: Claim rewards — Rewards are distributed weekly. 70% of $eMETIS rewards are converted directly into $seMETIS and immediately released, while the remaining 30% enters a vesting period requiring $ENKI staking to unlock over 365 days.

-

Step 5: Withdraw rewards — Users can convert $seMETIS back into $eMETIS via ENKI, then trade $eMETIS for $METIS on secondary markets like Netswap.

Even users holding small amounts of $METIS can now participate in staking, eliminating the need for technical expertise or large initial investments, opening staking opportunities to a much wider audience.

2.1.2 Tokenomics

1) Distribution Mechanism

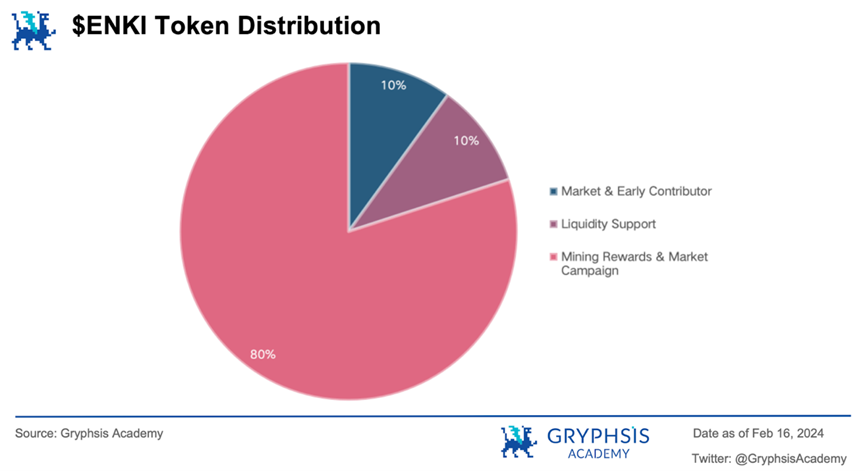

The native token of the ENKI protocol is $ENKI, with a total supply of 10 million. Holding $ENKI enables participation in staking, potential governance rights, and other ecosystem benefits.

Initial $ENKI allocation is as follows:

-

Market, partners & early community supporters: 10% (1M $ENKI).

-

Protocol liquidity support: 10% (1M $ENKI), added in tranches based on market demand and protocol revenue.

-

Future mining incentives & marketing campaigns: 80% (8M $ENKI), gradually released through various mechanisms.

The ENKI team holds no allocation, conducts no fundraising, and adopts a Fair Launch model for all token releases.

2) Dual-Token Model

-

$eMETIS: A stablecoin-like token pegged 1:1 to $METIS, minted via ENKI’s Minter. It simplifies user entry into the ENKI system and serves as the gateway to Metis Sequencer Node staking.

-

$seMETIS: Represents staked $eMETIS, proving effective collateralization while earning additional staking rewards. It remains liquid and compatible with other DeFi integrations.

3) Value Capture

-

Governance Rights: Holders play a key role in decentralized governance. Most $ENKI tokens are distributed as mining rewards, enabling holders to vote on incentive structures, fee models, protocol upgrades, and ecosystem direction.

-

Unlocking Rights: As mentioned, 30% of ENKI’s mining rewards require users to stake $ENKI to unlock over 365 days.

$ENKI is essential for unlocking rewards. Staking $ENKI is mandatory to claim a portion of the $eMETIS rewards earned by $seMETIS holders. This locking mechanism ties user incentives directly to the long-term success of the ENKI ecosystem.

2.1.3 Recent Developments

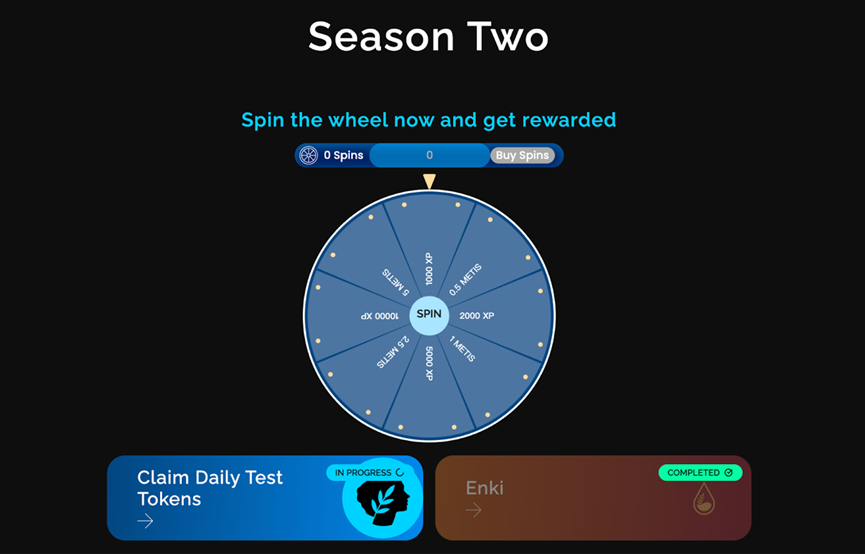

ENKI is currently deployed on the Metis Sepolia Testnet and is participating in the second phase of Metis’ Decentralized Sequencer Community Testing.

On January 16, Metis launched Community Testing on the Sepolia testnet, inviting users to explore various dApps to test the PoS Sequencer pool and earn Testing Points. Each dApp has its own points pool with different point ratios per action. Participants can obtain testnet $METIS via faucet to join at zero cost and accumulate points.

In Season 1, participating projects included Hummus Exchange, League.Tech, Tethys Finance, Midas Games, and Netswap. Only ENKI is featured in Season 2.

Source: https://decentralize.metis.io/#szn2

Users can claim test $METIS, perform Mint & Stake actions on ENKI’s site to earn points, or stake test $ENKI tokens to receive rewards.

Source: Medium

On February 8, ENKI officially launched the Fantasy Genesis Plan, releasing 10% (1M) of $ENKI tokens in stages as incentives.

The event consists of two phases:

Phase 1 - Pre-launch (Early Market & Testnet Activities)

-

Community engagement & trivia tasks: 25,000 $ENKI (0.25%).

-

Testnet participation: 25,000 $ENKI (0.25%).

-

Testnet Bug Bounty & marketing partnerships: 100,000 $ENKI (1%).

-

Ecosystem partner airdrop: 100,000 $ENKI (1%), rewarding loyal users from Metis’ ecosystem partners.

All participants in the above activities will qualify to mint an Early Supporter NFT on the Metis mainnet after Phase 1 ends. This NFT will serve as proof for claiming future airdrops.

Phase 2 - Post-launch (After Mainnet Deployment)

-

Metis staking airdrop: 200,000 $ENKI (2%), distributed proportionally to users staking METIS via ENKI.

-

Invite-to-stake campaign: 400,000 $ENKI (4%).

-

Holders of $eMETIS or $seMETIS are eligible. They can mint a special Inviter NFT and receive a unique referral code. Users who stake via this code will add “airdrop points” to the inviter’s NFT, provided each invitee contributes at least 0.1 $METIS to the staking pool.

-

Point calculation: Points = 100 × number of invitees + 200 × total staked amount by invitees. After the event, tokens will be distributed based on point share. The Inviter NFT will serve as the redemption credential.

-

ENKI liquidity incentives: 150,000 $ENKI (1.5%).

ENKI marks a pivotal step toward Metis’ decentralized sequencer vision, lowering staking barriers to reach everyday users and individual investors, enabling full community participation in network development and reward-sharing.

2.2 Artemis

2.2.1 Overview

Artemis Finance is a liquid staking protocol designed specifically for the Metis decentralized sequencer pool. Users can stake their $METIS tokens on Artemis and receive $artMETIS, which automatically accrues yield while remaining usable for interactions across the Metis ecosystem.

2.2.2 Tokenomics

1) Distribution Mechanism

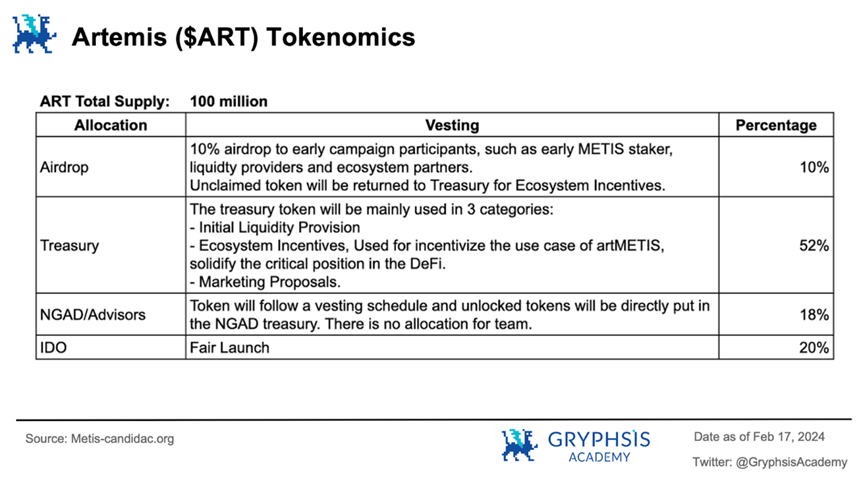

The native token of Artemis is $ART, with a total supply of 100 million. Initial allocation is as follows:

-

Airdrop (10%, 10M): Early participants such as $METIS stakers, liquidity providers, and ecosystem partners.

-

Treasury (52%, 52M): Used for initial liquidity, $artMETIS usage incentives, and partnership proposals.

-

NGDAO / Advisors (18%, 18M): Locked in DAO; team holds no allocation.

-

IDO (20%, 20M): Launched via Fair Launch.

2) Value Capture

By allocating 10% of tokens to early participants such as $METIS stakers, Artemis enables multi-layered yield generation—similar to a “golden shovel”—granting access to ecosystem-wide incentives and further boosting staking motivation. Additionally, portions of the allocation aim to expand $artMETIS use cases, increasing asset utility and adoption.

Details on $ART holder benefits have not yet been disclosed.

2.2.3 Recent Developments

Artemis plans to launch a series of initiatives in collaboration with DeFi projects, liquidity providers, and yield optimization platforms to boost liquidity and expand $artMETIS use cases:

-

Launch $artMETIS/$METIS pools on DEXs with liquidity mining incentives;

-

List $artMETIS on Pendle to enable yield trading;

-

Integrate $artMETIS as eligible collateral in lending protocols;

These efforts aim to encourage more users to stake $METIS while enabling them to use $artMETIS across diverse DeFi applications and generate yield. Like ENKI, Artemis offers $METIS holders a simplified path to participate in decentralized sequencer operations and profit from it.

3. Summary

We can foresee a positive cycle driven by Metis’ aggressive development of LSD protocols: LSD lowers staking barriers and allows ordinary users to enjoy multi-layered yields, encouraging greater participation. Higher $METIS staking rates promote network decentralization, redistribute traditional Layer 2 MEV income to the community, lower user costs, and protect user returns—creating a unique network identity that attracts more users.

As $METIS is consumed for network usage, rising adoption increases demand, potentially driving token appreciation. Meanwhile, LSD remains the fastest and highest-yielding investment option for $METIS holders, attracting even more participation. A growing user base fuels innovation in derivative sectors like LSDfi and restaking, enabling users to earn yield while retaining liquidity—ultimately energizing the entire DeFi ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News