A New Race: Cosmos' Dual Champions in Full-Chain LSD

TechFlow Selected TechFlow Selected

A New Race: Cosmos' Dual Champions in Full-Chain LSD

For Cosmos, the strongest response to "Cosmos is dead" would be the emergence of a breakout Cosmos chain. The full-chain LSD sector appears poised to become that breakthrough.

1. Introduction

"Cosmos is dead" — negative sentiment around Cosmos has been spreading recently, filled with disappointment, bitterness, and frustration from early supporters. Indeed, Cosmos' recent performance has been underwhelming, with its ecosystem appearing stagnant. So when will the next breakout Cosmos chain emerge?

While the Cosmos ecosystem appears silent, it has never lacked innovation.

Even amid the aftermath of Terra's collapse, projects like Evmos and Canto emerged as popular chains within the ecosystem. Since then, however, the Cosmos ecosystem has largely remained quiet, without producing any new breakout public chains.

Yet developers within the Cosmos ecosystem have not stopped innovating. The project we'll discuss in this article is built on an entirely new frontier—omnichain LSD.

LSD stands for "Liquid Staking Derivatives," a highly trending sector in crypto this year. The core idea behind LSD is to unlock liquidity for staked PoS assets, enabling users to earn both staking rewards and additional DeFi yield simultaneously;

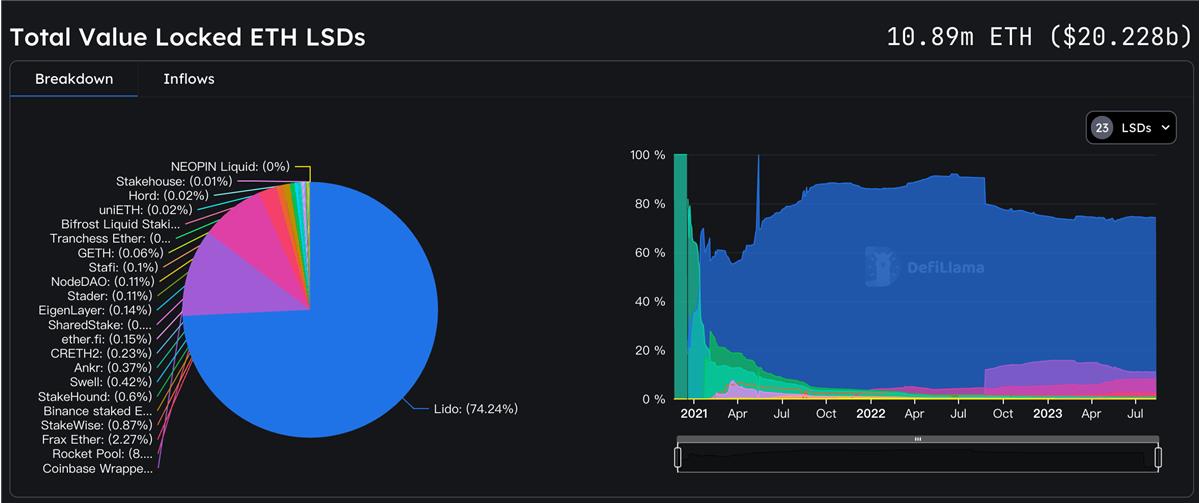

According to DefiLlama data, the market cap of liquid-staked ETH has surpassed $20 billion

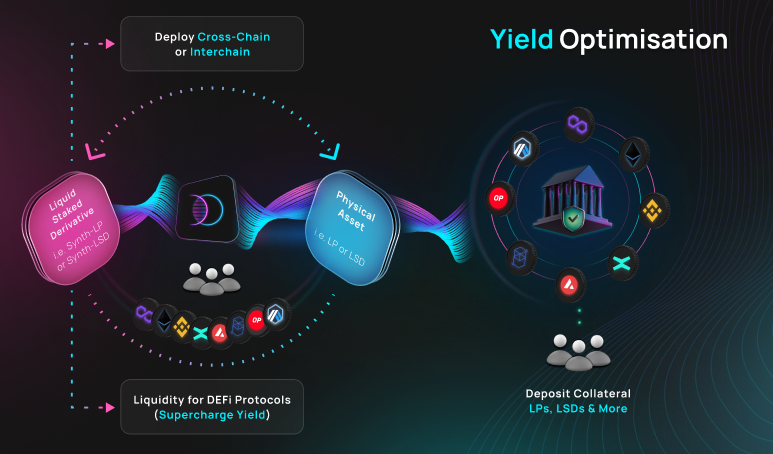

Omnichain LSD extends asset utility across multiple blockchains, aiming to further unlock the liquidity of staked assets and accumulate greater value. It can be simply understood as adding another layer of utility on top of traditional LSD.

2. The Twin Leaders of Omnichain LSD

Interestingly, two omnichain LSD protocols—Entangle Protocol and Tenet Protocol—both originate from the Cosmos ecosystem, making them twin pioneers of omnichain LSD in Cosmos. Both Entangle and Tenet are application-specific chains built using the Cosmos SDK, focusing specifically on omnichain LSD use cases. While their赛道 (track) positioning is similar, their technical approaches differ significantly.

2.1 Entangle Protocol

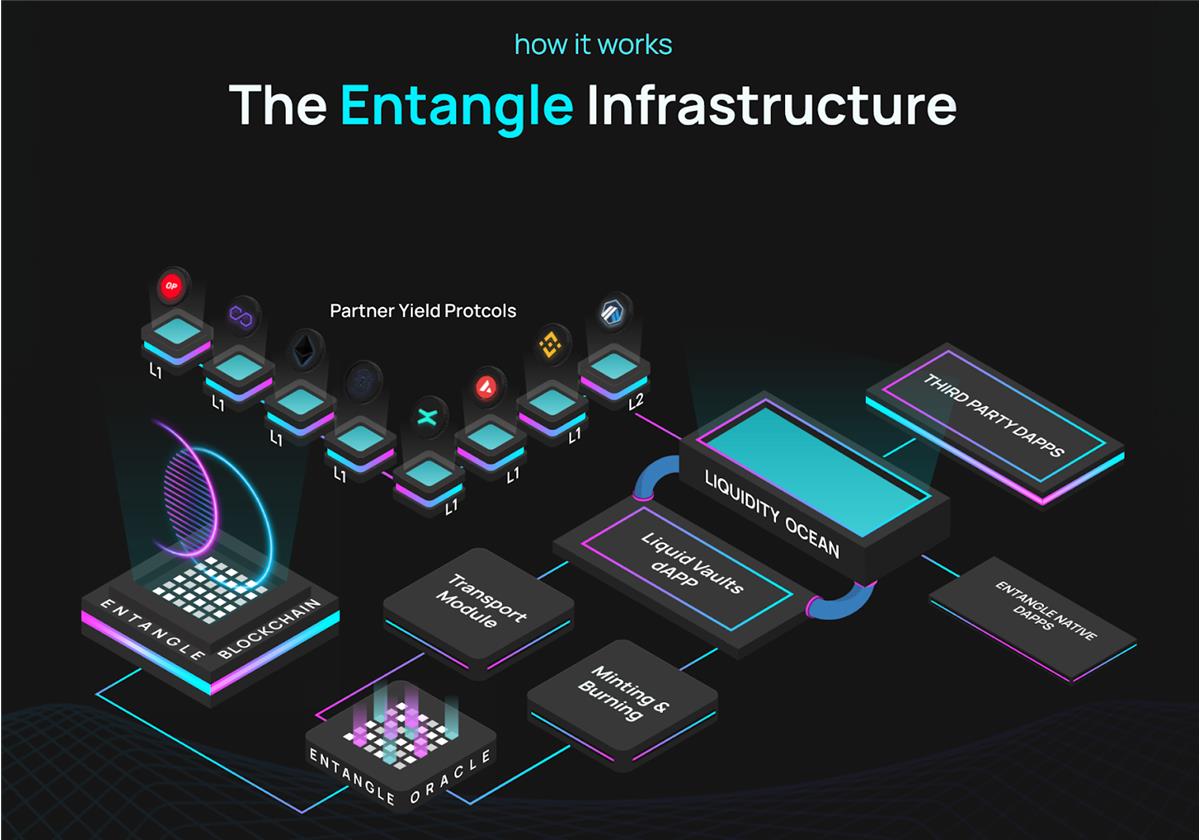

Entangle is a native-oracle-centered, EVM-compatible omnichain LSD application chain. Its "omnichain" nature allows users to create cross-chain LSDs for LP tokens supported across any chain, thereby generating multi-chain yields. For example: a user holding 1 unit of AVAX/USDC LP tokens on TraderJoe (an Avalanche-based DEX) can use Entangle to mint 1 unit of AVAX/USDC LP liquid staked derivative (LSD) on Ethereum.

Core architecture of Entangle

Before diving into technical implementation, let’s first understand why such a design exists. Put differently, why would LP holders go through the trouble of re-staking their liquidity? As mentioned above, the reason is clear: Entangle enables an extra layer of yield—the return generated by LP-LSDs.

Let’s look at two concrete examples:

Example 1:

1) Alice provides liquidity for stETH/ETH on Curve Finance and receives corresponding LP tokens;

2) Alice stakes her LP tokens via Entangle;

3) Entangle automatically deposits the LP tokens into Convex to earn compounding rewards;

4) Entangle issues Alice an LP-LSD receipt;

5) Alice deposits the LP-LSD as collateral into Curvance to earn lending yield.

Example 2:

1) Bob provides AVAX-USDC liquidity on TraderJoe and receives LP tokens;

2) Bob stakes his LP tokens via Entangle;

3) Entangle automatically deposits the LP into TraderJoe’s yield farm for compounding;

4) Entangle issues Bob LP-LSD on Polygon;

5) Bob deposits the LP-LSD as collateral into AAVE to earn lending yield (hypothetical example; AAVE does not currently support Entangle’s LP-LSD).

By stacking LSD assets across multiple DeFi protocols in this Lego-like fashion, capital efficiency and asset liquidity are greatly enhanced, while also bringing sticky liquidity to the protocol (discussed later).

2.1.1 Implementation Mechanism

The above scenarios are easy to grasp conceptually, but technically challenging to implement due to complex issues like cross-chain price feeds and asset anchoring. How does Entangle achieve these omnichain LSD use cases?

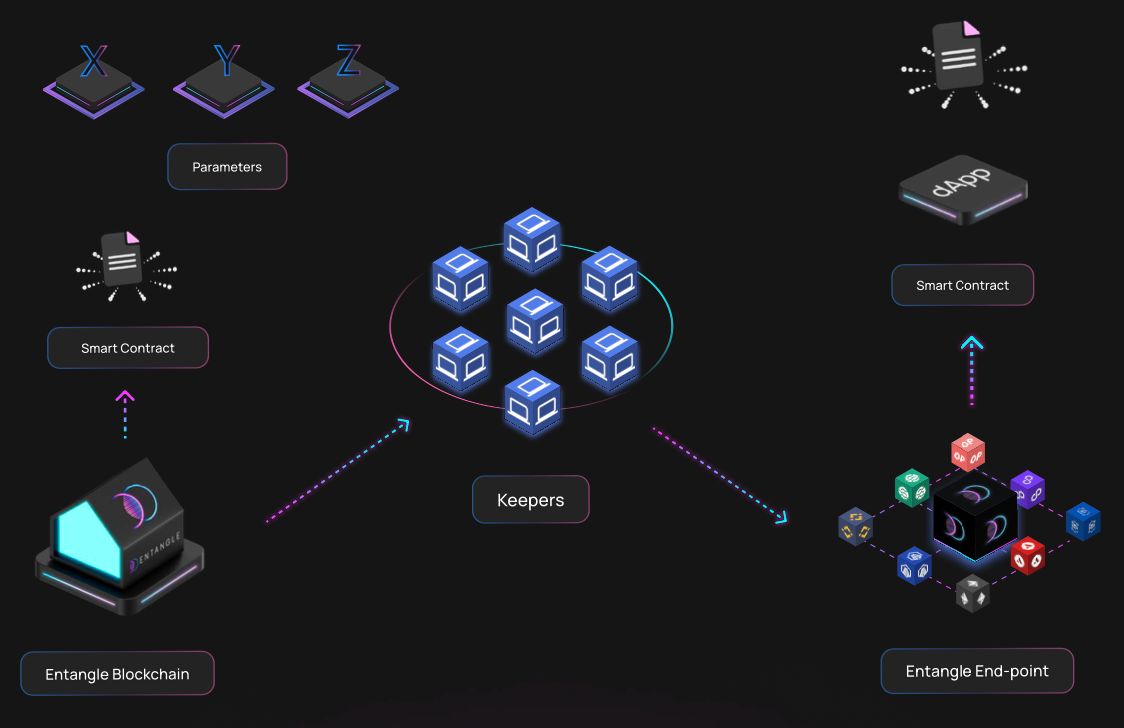

The core of Entangle’s technical mechanism lies in Liquid Vaults (LVs). Using a native oracle network and internally deployed DEXs across multiple chains, Entangle deploys LVs on various supported chains.

Entangle supports minting LSDs on Chain B’s LV at a 1:1 ratio using liquidity from Chain A’s LV. Supported base assets fall into three categories: LP tokens from major DEXs (e.g., AVAX/USDC LP on TraderJoe), lending assets (e.g., USDC pool on AAVE), and liquid staking tokens (e.g., stETH). At its core, a Liquid Vault wraps LP positions and maps them across chains.

Operation flow of Entangle’s Liquid Vaults

By leveraging its native distributed oracle solution, E-DOS (Entangle Distributed Oracle Solution), Entangle provides low-cost, omnichain price feeds for dApps, eliminating reliance on third-party oracles.

Architecture of Entangle’s native oracle E-DOS

2.1.2 Sticky Liquidity

The realization of LP-LSD use cases brings users higher capital returns. From the protocol’s perspective, it also generates “sticky liquidity.”

Many DeFi projects, in their early stages, rely on aggressive tokenomics (high inflation rates, fast release schedules) to attract liquidity providers. However, such incentives are unsustainable—they rapidly dilute tokens and reduce protocol revenue. Once LP returns fail to meet expectations, users withdraw liquidity. This kind of liquidity is not “sticky.”

Entangle’s omnichain LSD infrastructure empowers cross-chain LPs, enhancing liquidity incentives and increasing the “stickiness” of liquidity to some extent.

2.2 Tenet Protocol

While Entangle enables omnichain applications for LP-LSDs, Tenet provides specific use cases (staking on the Tenet chain) for omnichain LSDs. The former resembles a meshed structure, while the latter is more centralized or hub-like.

Like Entangle, Tenet is an EVM-compatible application chain built on the Cosmos SDK. It deeply integrates LayerZero’s omnichain interoperability infrastructure, enabling chain-level utility for LSD assets.

The core innovation of Tenet’s omnichain LSD implementation is its novel consensus mechanism—DiPoS (Diversified Proof of Stake). In simple terms, users are no longer limited to securing the network by staking the native $TENET token as validators or delegators. Instead, a wide range of omnichain LSD assets can now participate in consensus.

2.2.1 Supported LSD Asset Categories

Tenet supports a basket of assets as staking collateral under its DiPoS consensus, including stETH and rETH issued by liquid staking protocols like Lido and RocketPool, as well as exchange-issued LSDs such as cbETH and wBETH from Coinbase and Binance.

Additionally, users can directly stake PoS assets through Tenet’s native liquid staking module without paying management fees (note: Lido charges a 10% fee). Initially supported PoS tokens include ETH, ATOM, BNB, MATIC, ADA, and DOT, with plans to gradually add more PoS assets in the future.

Through this model, PoS stakers earn both native network consensus rewards and Tenet’s block rewards and transaction fee shares. This cross-chain staking approach strengthens inter-chain connections and creates a positive-sum effect—LSD stakers gain higher yields, while Tenet gains enhanced network security via DiPoS.

3. Dream Collaboration

Although Entangle and Tenet are both omnichain LSD application chains rooted in the Cosmos ecosystem, their relationship appears more collaborative than competitive.

Entangle focuses primarily on LP-LSD, offering cross-chain LSD services for LP assets; Tenet centers on DiPoS, enabling diverse LSD assets to participate in consensus staking. Imagine if, in the future, Tenet could accept Entangle’s LP-LSD as valid DiPoS staking collateral—LP-LSD holders would earn additional rewards from Tenet, while Tenet gains enhanced security from the added staked value. That would be a true dream collaboration.

4. Afterword

The LSD summer brought several waves of excitement to DeFi, yet omnichain LSD has received relatively little market attention. As a nascent sector, whether omnichain LSD will explode or quietly fade away remains to be seen.

For Cosmos, the strongest rebuttal to “Cosmos is dead” would be the emergence of a breakout Cosmos chain. And the omnichain LSD space might just be the breakthrough point.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News