Technology VS Sovereignty: Cosmos Quietly Adopted by Central Bank Digital Currencies

TechFlow Selected TechFlow Selected

Technology VS Sovereignty: Cosmos Quietly Adopted by Central Bank Digital Currencies

Could Cosmos's modular blockchain architecture become the technological foundation for central bank digital currencies?

Author: Sanqing

Introduction

On May 22, 2025, Magnus Mareneck, co-CEO of Interchain Labs, revealed that the Colombian government is collaborating with a banking consortium to test a CBDC for cross-border payments on the Cosmos network, opting for a private, permissioned node model and the IBC Eureka technology stack. [Source: news.bitcoin.com]

No DAO, no on-chain governance—just permissioned nodes and a distributed ledger. Who would have thought that Cosmos, known as the "Lego of decentralization," would become the ideal partner for central bank digital currencies?

Cosmos: A Blockchain Toolkit, the Perfect-Fitting Power Suit

Cosmos is not a single blockchain but an entire toolkit for "building chains + connecting chains," designed specifically for multi-chain architectures. Compared to Ethereum's standardized and open nature, Cosmos offers flexibility and controllability, providing central banks with an ideal template for "custom sovereign ledgers."

Cosmos SDK: Assembling Sovereign Chains Like Lego

The Cosmos SDK is a modular development framework allowing central banks to assemble components as needed:

-

Add account permissions and KYC modules

-

Disable smart contract virtual machines to prevent deployment of "uncontrollable" contracts

-

Incorporate regulatory plugins such as audit trails and targeted payments

Tendermint BFT: Rotating the Role of "Central Bank"

Cosmos uses the Tendermint consensus mechanism, which does not rely on mining power but instead has authorized validators take turns producing blocks. With controlled validator membership, extremely low latency, and strong block finality, it naturally fits real-time payment scenarios required by CBDCs.

IBC: The "TCP/IP" Between Blockchains

IBC is Cosmos' inter-blockchain communication protocol:

-

Supports state proofs and cross-chain asset transfers

-

Zones remain independent while exchanging authenticated data packets when necessary

-

Enables chain-level whitelisting and packet inspection—“controlled interoperability” rather than chaotic connectivity

Leveraging this protocol and the ICS-20 standard, tokens like ATOM and OSMO can freely circulate across multiple Zones in the Cosmos ecosystem without bridges.

Hub-and-Zone: Avoiding Reinventing L2 Wheels

Cosmos' architecture is based on the "Hub and Zone" model:

-

The Cosmos Hub is the earliest chain in the ecosystem but not the "central commander"

-

Zones refer to individual chains such as Osmosis and Juno, each with its own independent ledger and validators

-

They communicate via IBC without requiring routing through the Hub

Each Zone is a "plug-and-play, independently operated" sovereign chain—interconnected yet autonomous.

Colombia’s Path: Sovereignty Calculations Behind Technology Choices

Colombia's CBDC chain is essentially a Zone built using Cosmos technology.

-

Does not rely on the Cosmos Hub

-

Not directly interoperable with other DeFi ecosystems

-

It is a closed, permissioned chain utilizing only three core components from Cosmos: SDK, Tendermint, and IBC

For the Central Bank of Colombia, this is not "idealism" rooted in decentralization, but a pragmatic, tool-oriented choice.

The Divergence Between Cosmos and mBridge: Balancing Cost, Efficiency, and Control

In infrastructure selection for central bank digital currencies, Cosmos may not have expected itself to become one of the options.

The current dominant path remains mBridge, led by the Bank for International Settlements (BIS), involving numerous cooperating nations—an alliance chain network connecting various national CBDC networks (including five members comprising central banks and international organizations, plus over 32 observer members). Participating central banks set up Operator Nodes within mBridge, creating a sense of joint central banking, allowing permitted commercial banks or clearing institutions from member countries to run nodes for currency exchange.

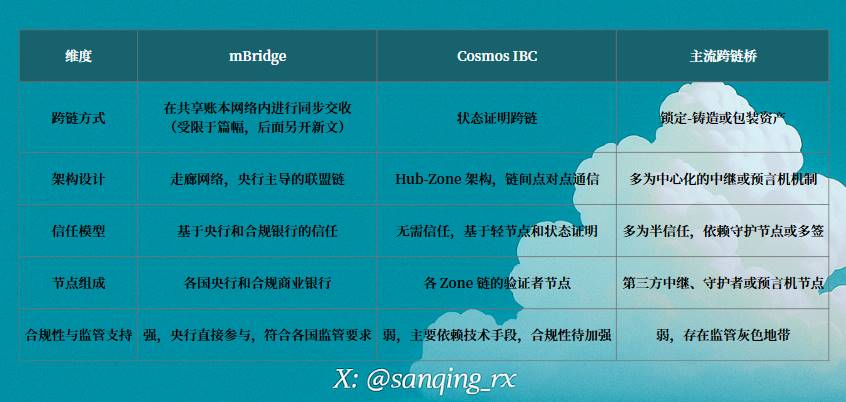

The author compares mBridge, Cosmos, and mainstream cross-chain bridges below:

Why Did Colombia Choose Cosmos Over mBridge?

On one hand, mBridge is a product of great-power competition, with slow technological iteration and high entry barriers. On the other, Cosmos provides "out-of-the-box" technical components, enabling rapid construction of a local permissioned chain without complex negotiations or diplomatic coordination, while preserving future interoperability possibilities via IBC.

This better aligns with the current practical needs of Latin American economies:

-

Limited budgets require fast deployment

-

Unwillingness to fully depend on alliances dominated by specific major powers

-

A desire to balance compliance control with blockchain innovation

If Colombia's pilot succeeds, Cosmos might emerge as a new pathway for small and medium-sized economies to build sovereign digital currencies—a controllable, cost-effective, and technically independent route potentially replicated across South America, Africa, and Southeast Asia. This marks a classic victory of "technological pragmatism."

Conclusion

What Cosmos offers is a kind of technical "neutrality" and "customizability": it does not presuppose governance models nor reject centralized deployment.

Colombia isn't joining Web3; it's merely borrowing Cosmos. Without open nodes, on-chain governance, or connections to public chain ecosystems, this Cosmos-based CBDC chain resembles more of a streamlined and customized "sovereign money machine."

Yet this measured, context-sensitive adaptation of Web3 technology into real-world applications also represents a form of recognition of its engineering value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News