What opportunities on Berachain are worth watching as the Cosmos ecosystem rises?

TechFlow Selected TechFlow Selected

What opportunities on Berachain are worth watching as the Cosmos ecosystem rises?

This article provides a brief overview of Berachain and its ecosystem projects.

Written by: 2Lambroz.eth

Translated by: TechFlow

With the rise of the Cosmos ecosystem, Berachain has gradually attracted attention.

Recently, Berachain's co-founder hinted on Twitter that a major event is imminent. This article provides a brief overview of Berachain and its ecosystem projects.

Content Overview

-

Background of Bera

-

What is Berachain

-

Berachain NFTs and Airdrop Opportunities

-

Berachain Ecosystem Projects

Why should we pay attention to Berachain now? Because Berachain’s co-founder recently tweeted hints about an upcoming major event.

Bera is a meme smoking bear NFT project that originated from viral discussions in the OlympusDAO Discord channel and raised $42 million for Berachain—an EVM-compatible chain built on the Cosmos SDK featuring a "proof of liquidity" concept.

The project hasn't launched yet, but the team has been teasing an imminent release, fueling FOMO within the community.

Background of Bera

Dev Bear and Smokey The Bera, two OHM investors, launched an NFT series that attracted many veteran OGs and investors from OlympusDAO.

This is important because you need to understand their culture financially supports Ponzi-like schemes.

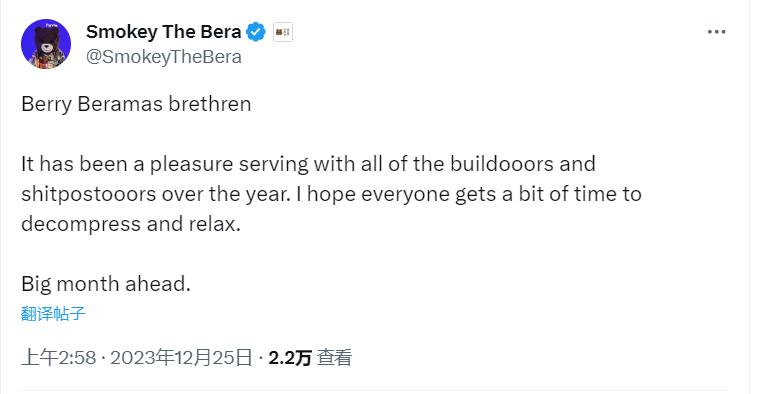

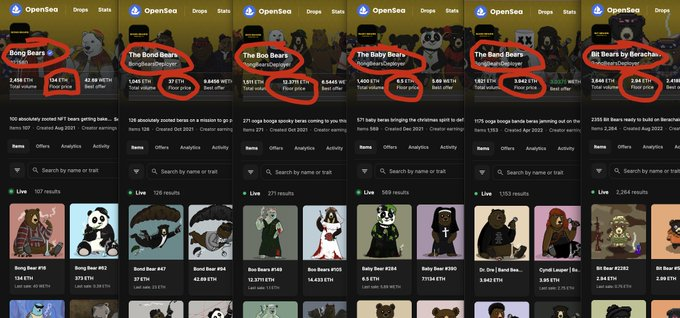

These NFTs then evolved into more NFT collections. Although I don't fully understand the mechanics, there are currently six NFT series in total, summarized as follows:

-

Bong bears, floor price at 134 ETH

-

Bond bears, floor price at 37 ETH

-

Boo bears, floor price at 12.3 ETH

-

Baby bears, floor price at 6.5 ETH

-

Band bears, floor price at 3.9 ETH

-

Bit bears, floor price at 2.9 ETH

Bear NFT prices skyrocketed (remember, this happened during a bear market)

On April 20, they announced raising $42 million from top-tier institutions and investors.

What is Berachain

It is an EVM-compatible L1 built using the Cosmos SDK, featuring a virtual machine called Polaris VM and a proof-of-liquidity consensus mechanism.

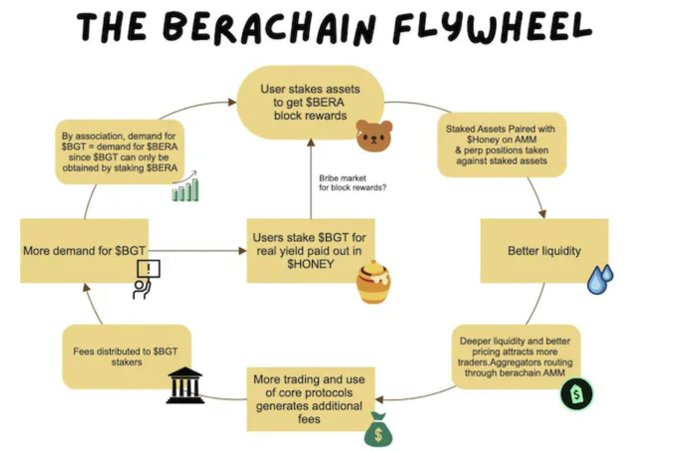

The core idea is to incentivize users to deposit mainstream tokens like BTC and ETH to provide liquidity to the chain. These assets are paired with Honey (Bera's stablecoin) and deposited into LPs to earn trading fees and releases of $Bera.

Essentially, the goal is to retain blue-chip assets within their ecosystem in hopes of:

-

Providing ample liquidity

-

Promoting trading activity

-

Increasing TVL

-

Improving key data metrics

Ultimately aiming to achieve a positive flywheel effect.

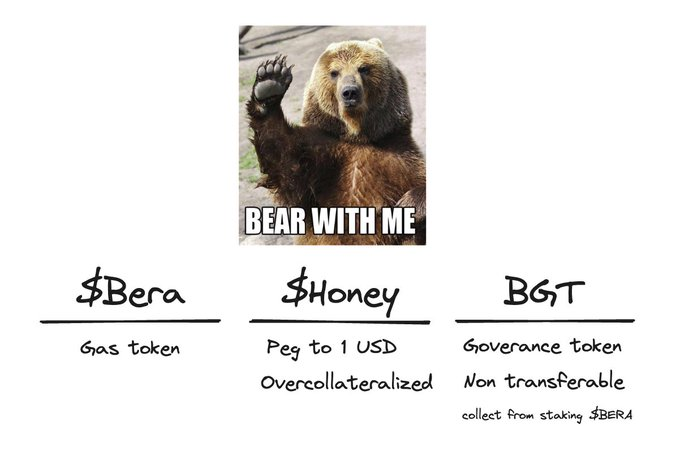

Looking deeper into the details, the ecosystem mainly features three tokens:

-

$Bera - Gas token

-

$Honey - Over-collateralized stablecoin

-

BGT - Non-transferable governance token earned through staking $Bera

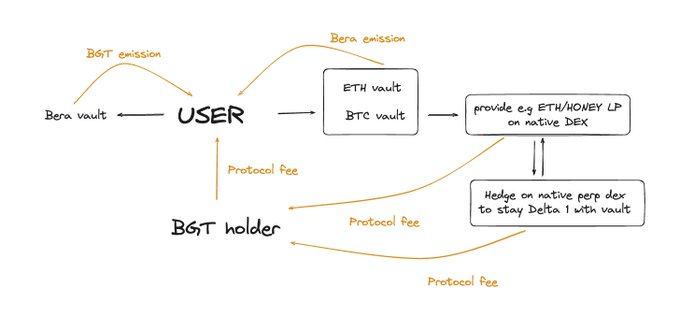

The user staking logic works as follows:

-

Deposit BTC and ETH or future voting assets into vaults, earning protocol fees and released Bera

-

Stake Bera in vaults to earn BGT

-

Fees are distributed to BGT stakers

There is also a positive flywheel effect—for example, more TVL leads to higher trading volume, which generates more fees, increases BGT yields, attracts more Bera stakers, and ultimately creates a self-reinforcing cycle.

I know this sounds like a typical DEX loop combined with some PoS yield. But in crypto, how much does pure technology really affect token price?

Crypto is about price consensus—whether short-term or long-term?

Most high-return crypto investments tend to evolve in the following stages:

-

Stage One: Price rises, so I buy

-

Stage Two: It's a Ponzi scheme, I won't buy

-

Stage Three: It's a Ponzi scheme, but I'm buying anyway

Berachain NFTs and Airdrop Opportunities

From the above introduction, you now have an understanding of what Berachain is. Below are some speculations regarding NFT airdrops. Click here for detailed reading.

Berachain Ecosystem Projects

Below is a list of projects on Berachain. Note that the list below is definitely incomplete—there are too many early-stage projects, so I've filtered out most of them after screening.

-

Ramen Finance: A combination of a DEX and launchpad providing liquidity for Berachain

-

Beradrome: Staking and liquidity market on Berachain

-

Stacking Salmon: Lending market + leveraged yield farming

-

honeypotfinance: Swap and Farm on Berachain

-

beradoge: A meme token on Bera

-

Beramonium: NFT-based role-playing game

In addition, keep an eye on two key ecosystems/followers within the Berachain space:

-

BeraLand: A community hub covering everything on Berachain

-

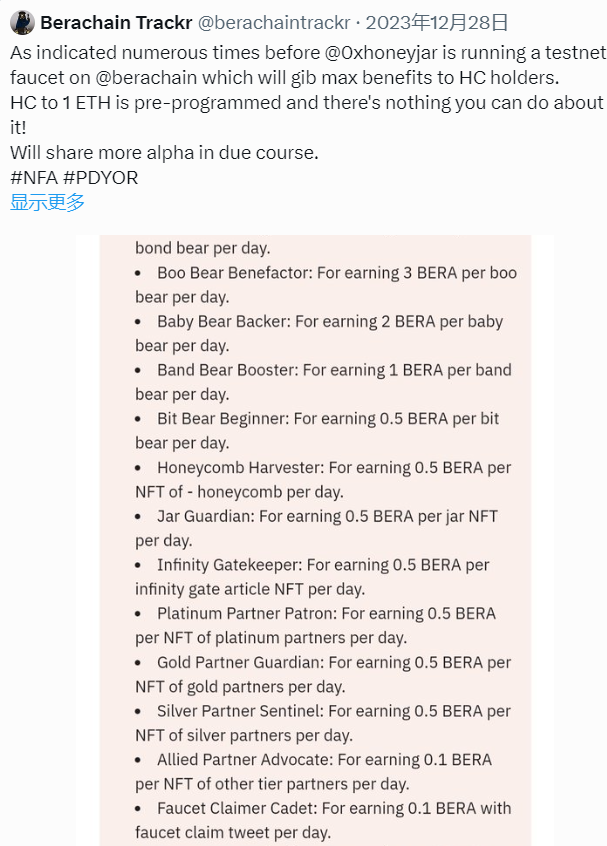

The Honey Jar: Contains all information about Berachain + NFTs—must-read if you're entering the Berachain ecosystem

-

Ursadom Labs: Investors and builders behind Berachain

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News