Who Killed the King of Cross-Chain, Cosmos?

TechFlow Selected TechFlow Selected

Who Killed the King of Cross-Chain, Cosmos?

Cosmos ecosystem is at a critical historical moment.

Author: Yanz, TechFlow

From late 2024 to early 2025, the Cosmos ecosystem drew significant attention—but not for good news.

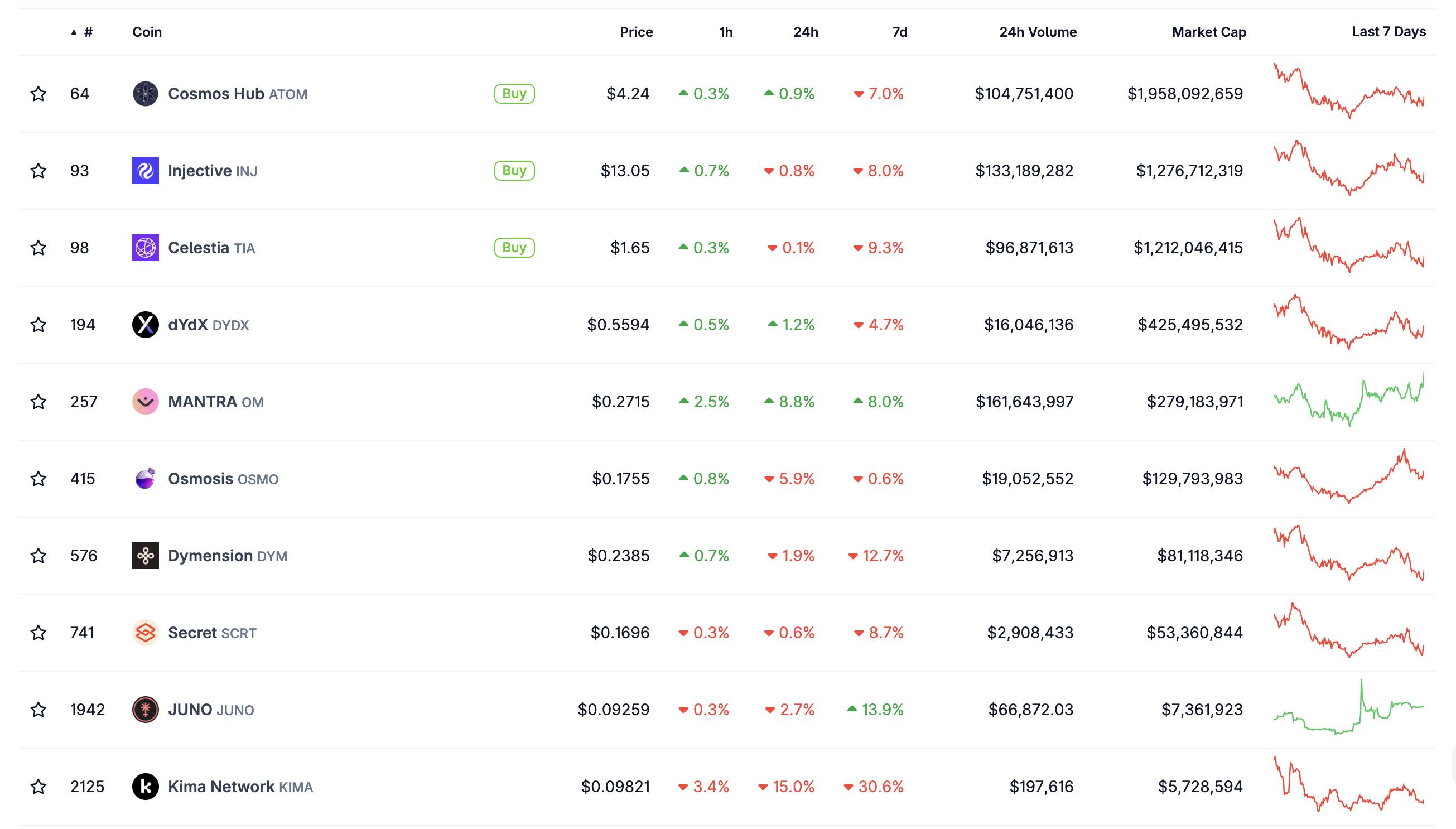

As of August 5, 2025, Cosmos’ core token ATOM had dropped to $4.20, down 90% from its all-time high. Meanwhile, compared to the end of 2024, major projects such as Osmosis (OSMO) fell 79%, JUNO lost 82% of its value and nearly hit zero, and even relatively strong performers like Injective (INJ) retreated from $34 to around $12. Not to mention Kava, Evmos, Cronos, and Fetch.AI—all saw widespread declines...

Cosmos, once a standout during the 2022 bear market with TVL ranking second, is now facing collective value destruction. What exactly happened to the ecosystem once hailed as the internet of blockchains? How did it go from being a DeFi star in 2021 to such market underperformance today?

A closer look reveals deeper forces behind this crash—far beyond simple market volatility.

Airdrop Frenzy, Death Spiral

In early 2024, when news of the Celestia (TIA) airdrop spread across the crypto community, no one anticipated that this free wealth giveaway would mark the beginning of a nightmare for the entire Cosmos ecosystem.

Celestia, a modular data availability network built on the Cosmos SDK, is deeply integrated into the Cosmos ecosystem via the IBC (Inter-Blockchain Communication) protocol.

A year ago, in spring, TIA surged to an all-time high of $20.17, with social media flooded by rags-to-riches stories. Yet this euphoria lasted only two months before a massive sell-off hit, sending TIA plunging 91.9% in freefall, now hovering around $1.60.

And it wasn’t isolated—collapse rippled across the entire Cosmos ecosystem.

The Celestia airdrop perfectly illustrated the vicious cycle of "hype–dump" within Cosmos. When airdrop rumors emerged, speculative capital rushed in, driving rapid price increases and creating an illusion of prosperity.

However, growth based on speculation rather than intrinsic value is inherently unsustainable. Once early holders began selling to lock in profits, prices started falling, panic spread quickly, triggering broader sell-offs, ultimately leading to price collapse.

Osmosis experienced a similar pattern during the 2022 liquidity mining boom, dropping from a peak of $11 to its current $0.17.

Each such cycle erodes trust and drains capital from the ecosystem. Short-term speculation drives out genuine long-term builders, fostering a restless, shallow environment.

Puppet Emperor and Fragmented Kingdoms

As ecosystem projects remain trapped in this death spiral, ATOM—the core asset of Cosmos—faces its own bottleneck in price performance.

Under its multi-chain architecture, ATOM’s role as a network fuel lacks a closed-loop mechanism. Most zones have their own native tokens and do not directly depend on ATOM, preventing value and traffic from flowing back to the central chain.

The inflationary model with no hard cap incentivizes staking and governance participation but creates persistent downward pressure on ATOM’s price due to continuous dilution. More critically, while Cosmos’ open chain-building philosophy encourages innovation and competition, it fragments user traffic and isolates projects—sharply contrasting Ethereum’s model where most value accrues to ETH.

ATOM has become the puppet emperor of Cosmos, with governance challenges spreading further while the federation gains nothing.

JUNO is the most prominent example: In April 2022, the JUNO community discovered a whale who bypassed airdrop rules using multiple wallets, acquiring approximately $35 million worth of JUNO tokens.

After heated community debate, the JUNO DAO officially passed Proposal #20 on April 29, 2022, deciding to confiscate these tokens—a decision enacted on May 4.

This controversial move severely split the community and drastically undermined investor confidence in JUNO’s governance. Governance failure not only failed to address technical and market challenges but accelerated its decline, with JUNO crashing from $43 to $0.09—a 99% drop.

Yet these are not the only problems facing Cosmos, nor are they unique to it.

The “Midlife Crisis” of Multi-Chain Ecosystems

When discussing Cosmos’ struggles, we’re actually analyzing a shared anxiety across all multi-chain ecosystems—the profound disconnect between technological innovation and real-world adoption.

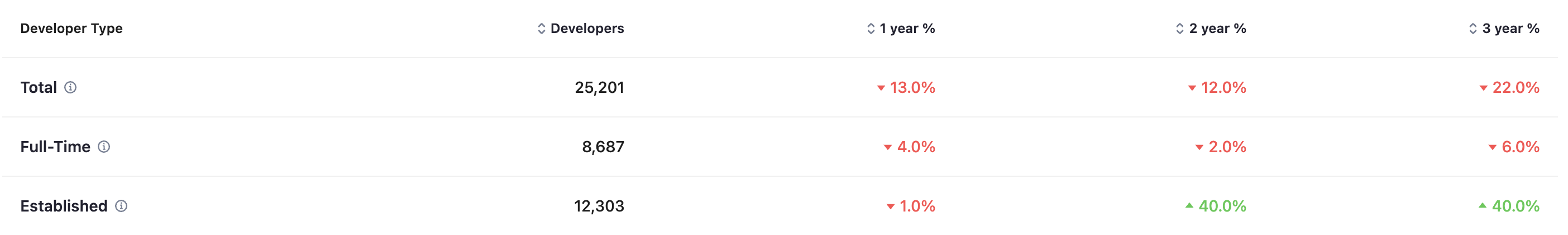

In April 2025, Cosmos ranked first among blockchain projects in development activity. Despite this apparent lead, it masks a weakening trend: declining active crypto developers.

Source: developer report

Other multi-chain ecosystems are similarly sluggish: Ethereum saw a 2.54% decline in developer count, BNB Chain dropped 9.45% in development metrics, while Polygon, Arbitrum, Optimism, and Avalanche fell by 10.35%, 7.62%, 6.82%, and 12.08% respectively.

Polkadot ranked tenth with 3.4K developer activities, contributors down 0.91% to 325. Amid slow responses to the JAM upgrade and market competition, the community even raised urgent calls of "React or die."

All multi-chain ecosystems face similar structural challenges:

-

Lack of network effects: Compared to Ethereum, they lack sufficient user base and use cases to create self-reinforcing ecosystem loops

-

Inadequate developer incentives: Despite advanced tech, they lack strong economic incentives to attract and retain top development talent

-

Unclear market positioning: In competing with Ethereum, these projects often fall into the trap of superior tech but poor application adoption

These internal weaknesses are further amplified by current market shifts.

In Q2 2025, the total crypto market cap surpassed $3.5 trillion—but this rally was driven primarily by institutional capital, which operates under a completely different logic: controllable risk, ample liquidity, regulatory compliance.

For institutions seeking stable returns, Bitcoin and Ethereum are clearly more attractive than technically innovative multi-chain projects. This shift in capital flow has directly marginalized multi-chain projects in fundraising and liquidity.

Even more damaging, institutionalization has brought an unexpected side effect—the accelerating "Matthew Effect" in infrastructure development.

Stablecoins are becoming the core infrastructure linking traditional finance and crypto. But this infrastructure development centers on mature networks. As stablecoins become the utilities of the new financial system, multi-chain ecosystems find themselves pushed to the periphery.

This crisis forces these ecosystems to reevaluate their value propositions, shifting from pure technological competition toward practical, user-centric approaches focused on real-world applications.

This transformation isn't just about survival—it could also mark the beginning of the next innovation cycle.

Crossroads: Rebirth or Decline

At this point in 2025, the Cosmos ecosystem stands at a historic crossroads.

From the grand vision of an "internet of blockchains" at its mainnet launch in 2019, to ATOM reaching its all-time high of $44.70 in 2021 amid market frenzy over interoperability, to deep introspection during the 2022–2024 bear market when prices plunged near $3.50, Cosmos has followed a classic yet unique trajectory of blockchain project evolution.

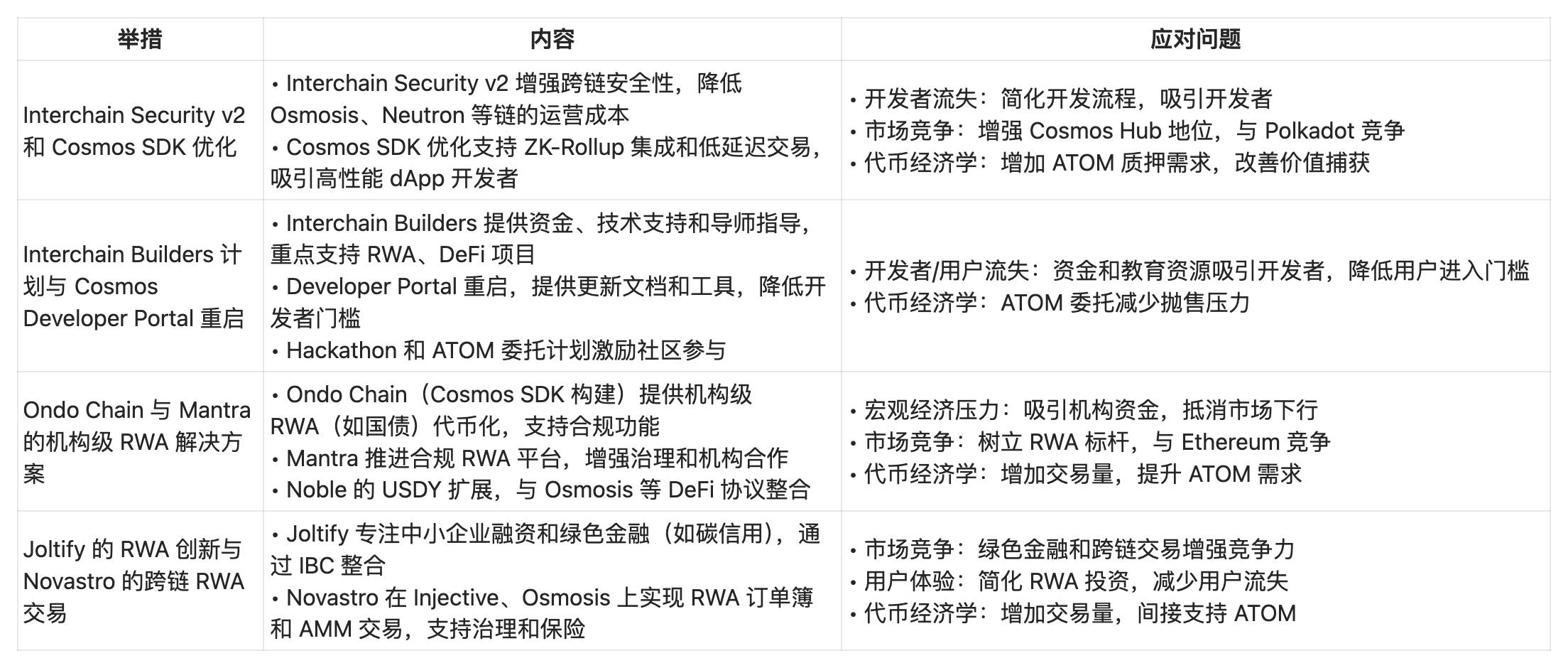

At this darkest hour, despite bleak data, Cosmos is indeed undergoing a profound self-revolution.

Different institutions offer divergent forecasts for the Cosmos (ATOM) ecosystem and price trends. Short-term predictions vary widely: CCN and Changelly are pessimistic, emphasizing bearish technical indicators (like RSI and moving averages), while CoinLore and CryptoNewsZ are more optimistic, expecting a bull run pushing prices above $20–$40.

Regarding Cosmos’ uncertain future, ecosystem expansion, technical upgrades, market sentiment, regulatory environment, and competitive pressures are frequently cited factors.

It's undeniable that the real impact of technical upgrades and governance reforms will take time to verify.

Competition from Layer-2 solutions and other interoperability platforms persists. The influence of Federal Reserve policies and geopolitical risks on the broader crypto market cannot be ignored. More importantly, the transition from idealism to realism itself is painful—requiring a delicate balance between innovation and market realities.

History shows that truly transformative technologies and ecosystems often emerge from the darkest times. Cosmos too needs time—to find out whether the future awaits, or only deeper darkness.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News