Exploring the Mechanism and Future Development of Lybra Finance: Analyzing the Controversies and Challenges of the Stablecoin eUSD

TechFlow Selected TechFlow Selected

Exploring the Mechanism and Future Development of Lybra Finance: Analyzing the Controversies and Challenges of the Stablecoin eUSD

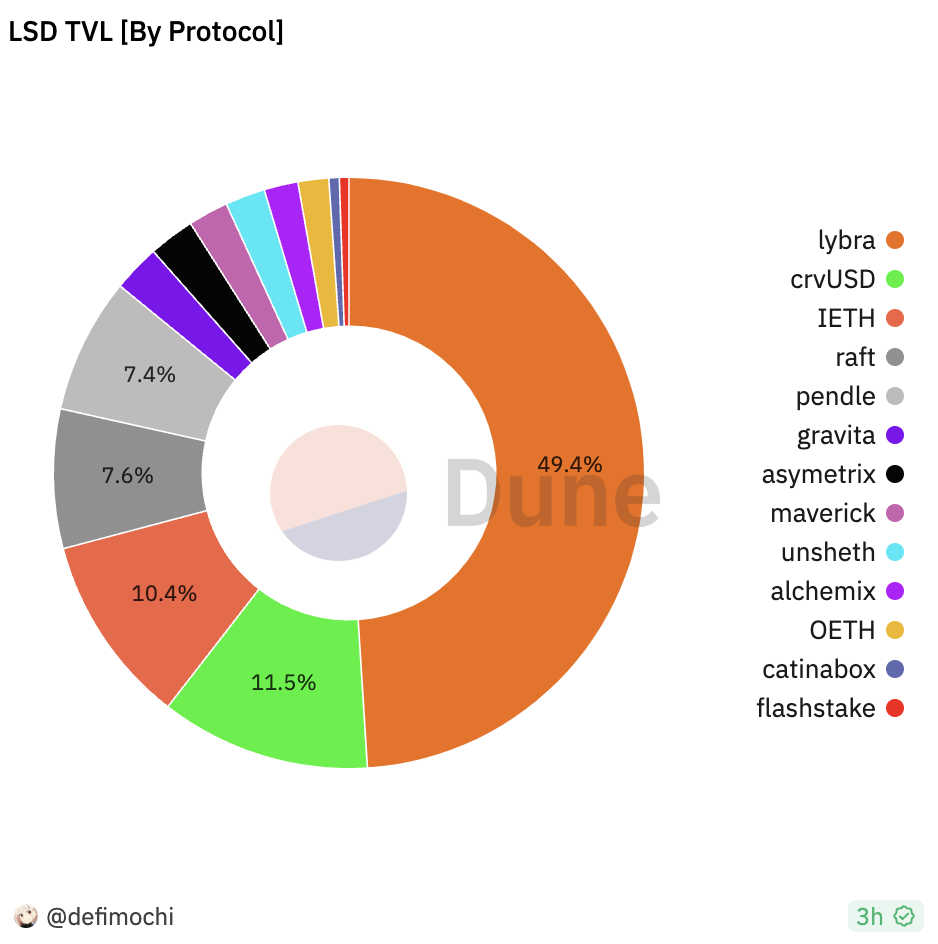

Lybra's TVL has already taken up half of the so-called LSDFi summer.

Author: Lawrence Lee

Lybra Finance is a new LSDFi project launched in April this year. Since its inception, it has been embroiled in controversy—questions over the source of IDO funds, smart contract issues, and implications of its relationship with Lido on social media have all made Lybra Finance a focal point of debate. Additionally, its stablecoin design has drawn criticism from DeFi users for lacking proper price anchoring.

Despite these controversies, however, Lybra has captured nearly half of the total value locked (TVL) during what some call the "LSDFi summer."

Source: https://dune.com/defimochi/LSDFi-summer

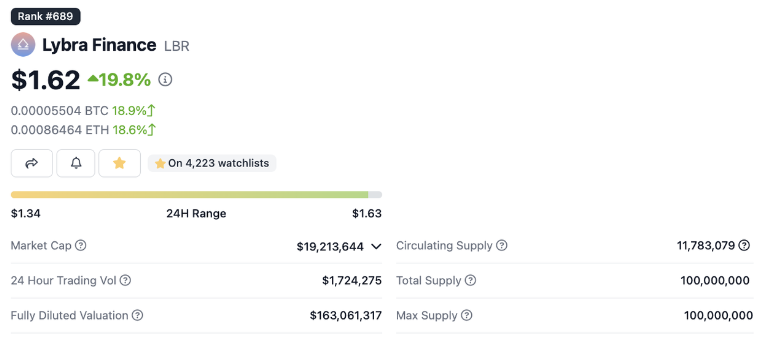

Its governance token, LBR, surged nearly 20-fold within just over 20 days in May and currently maintains a fully diluted market cap exceeding $150 million.

Source: https://www.coingecko.com/en/coins/lybra-finance

In this article, we analyze the mechanisms behind Lybra Finance to answer several key questions:

-

How did Lybra achieve such results?

-

What challenges is Lybra currently facing?

-

How will Lybra’s V2 address these issues?

Our goal is to provide readers with a more comprehensive understanding of Lybra Finance and its stablecoin eUSD.

The views expressed below represent the author's opinions at the time of publication and may contain factual inaccuracies or biases. They are intended solely for discussion purposes and should not be taken as investment advice. Feedback from fellow researchers and analysts is welcome.

1. Basic Information and Business Metrics

Lybra Finance is a stablecoin protocol whose native stablecoin is eUSD and governance token is LBR.

Lybra Finance has a short history—it launched its testnet on April 11 and went live on April 24, meaning it has only been operational for about three months.

The team behind Lybra is anonymous and did not conduct private fundraising. Its only funding round was a public IDO held on April 20, 2023, where 5,000,000 LBR tokens (5% of the total supply) were sold at a valuation of 1 ETH = 20,000 LBR, raising 5,000 ETH. At an ETH price of $2,000, this valued Lybra at $10 million, with a total raise of $500,000.

Since launch, Lybra’s TVL has grown rapidly, reaching $100 million within one month and now approaching $400 million. It ranks as the 18th-largest protocol on Ethereum by TVL.

Source: https://defillama.com/protocol/lybra-finance

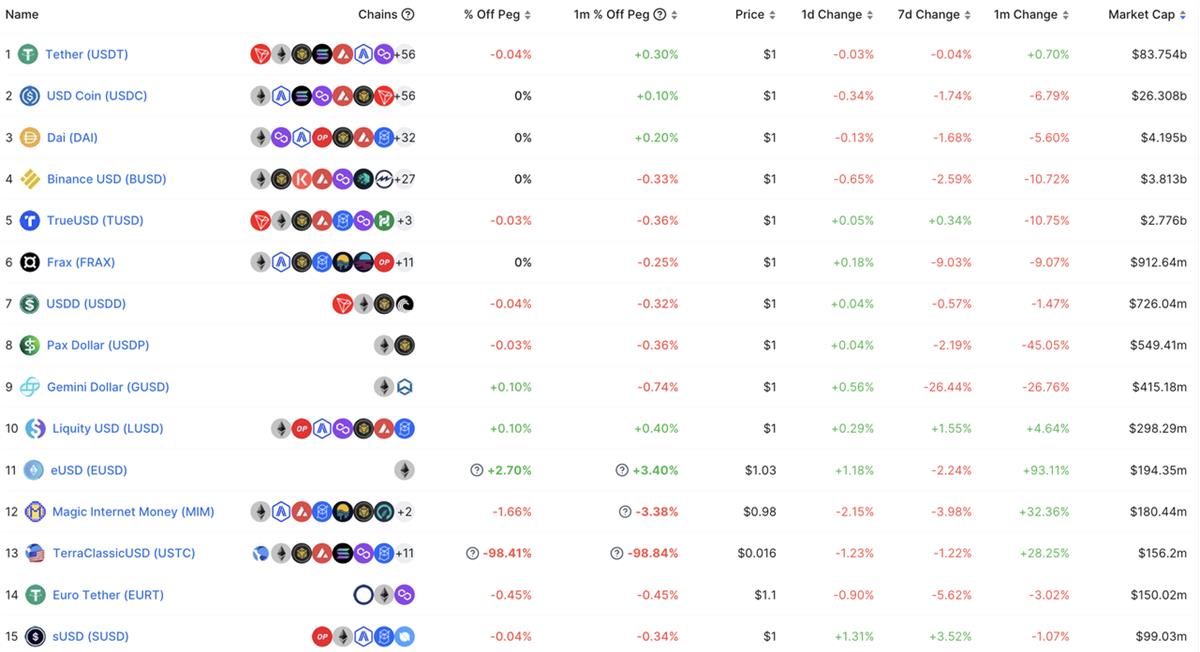

By stablecoin issuance volume, eUSD, with a circulating supply close to $200 million, ranks as the 11th-largest stablecoin overall. Among decentralized stablecoins, eUSD trails only DAI, FRAX, and LUSD, surpassing established names like MIM and alUSD. eUSD has thus emerged as a significant new force in the decentralized stablecoin landscape.

Source: https://defillama.com/stablecoins

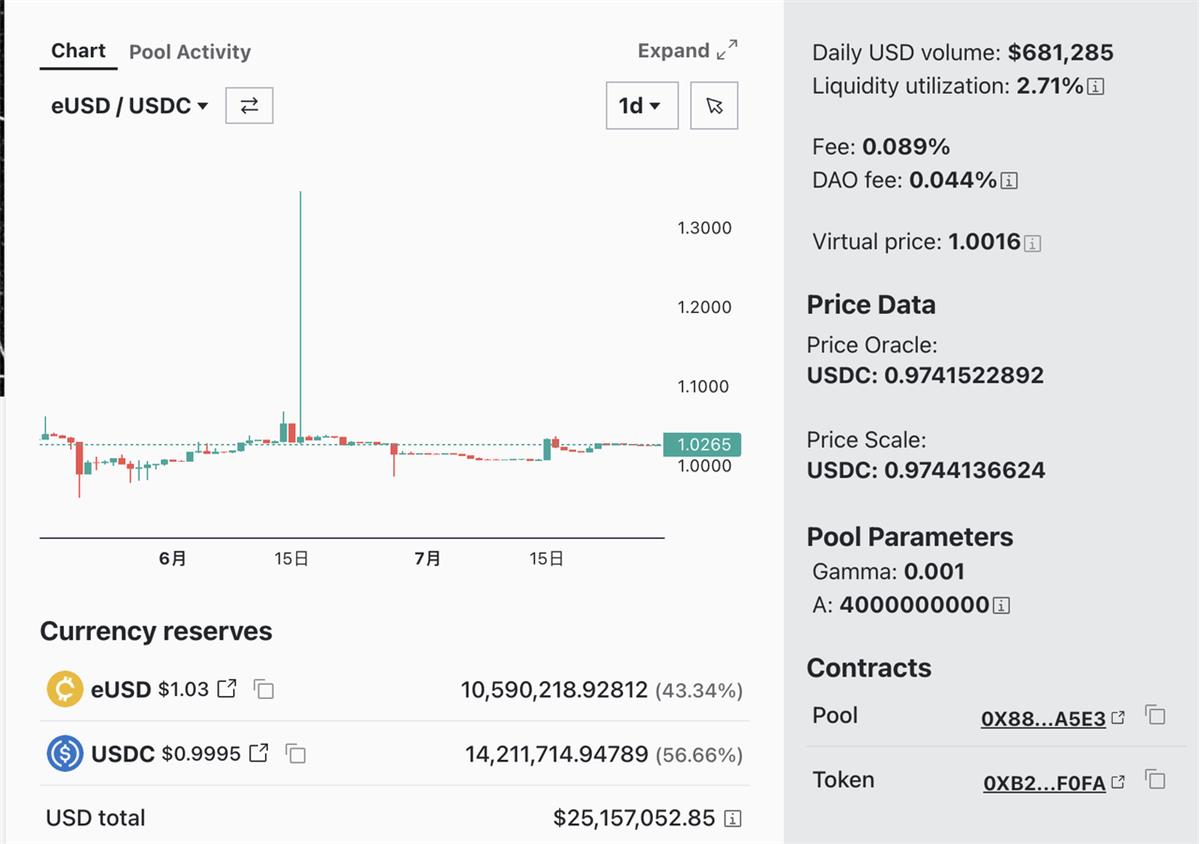

Currently, eUSD has $25.5 million in liquidity on Curve. However, eUSD’s price stability remains problematic, consistently trading at a positive premium. On June 16, a single whale purchase of $900,000 worth of eUSD pushed its price up to $1.36. Although arbitrageurs quickly brought the price back toward $1, the persistent positive premium remains a major issue for eUSD, which we will discuss further below.

Source: https://curve.fi/#/ethereum/pools/factory-crypto-246/deposit

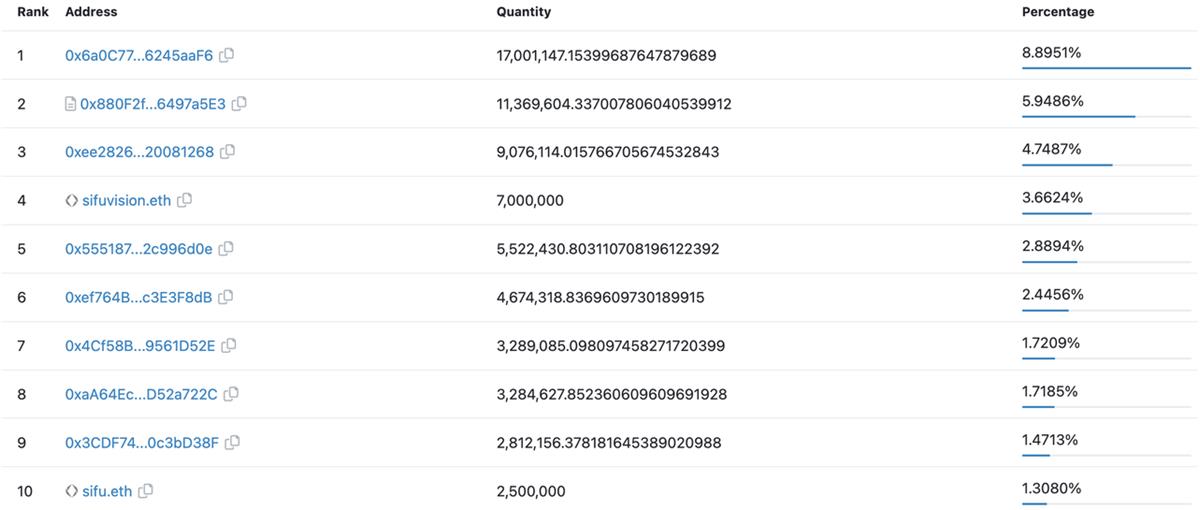

However, eUSD’s holder count remains low at only 829 addresses. Excluding Curve liquidity pools, the top ten holders are individual wallets, indicating relatively dispersed holdings. On-chain use cases for eUSD are scarce—most holders keep eUSD in their wallets to earn yield. This limited utility is partly due to eUSD’s poor composability under its current design (discussed in detail later).

Top 10 eUSD Holders – Source: Etherscan

2. Core Stablecoin Mechanism

In its current V1 version, eUSD can only be minted through over-collateralization of stETH. (Lybra also accepts ETH deposits, but in practice, it immediately stakes them via Lido to obtain stETH before proceeding. Upon full repayment, users can only withdraw stETH.) Thus, effectively, eUSD is backed exclusively by stETH. The minimum collateral ratio required is 150%, meaning each eUSD minted must be backed by at least $1.50 worth of stETH.

For price stability, Lybra relies primarily on a “Rigid Redemption” mechanism. This allows any user to redeem 1 eUSD for stETH worth exactly $1 at any time, paying a 0.5% fee (adjustable by Lybra DAO). Because the system is over-collateralized, as long as the mechanism functions correctly, the combination of over-collateralization and rigid redemption establishes a hard floor of $0.995 for eUSD. Previous stablecoins using similar designs (e.g., Liquity) have generally maintained this lower bound effectively, forming the cornerstone of eUSD’s current price stability.

On the upper bound, however, Lybra V1 lacks effective mechanisms to bring eUSD back to parity when it trades above $1—an important flaw in its current design, discussed in detail later.

For over-collateralized stablecoins, liquidation design is critical to protocol security. A robust price stabilization mechanism requires a reliable liquidation module.

Lybra introduces two roles in liquidations: Liquidators, who provide eUSD capital, and Keepers, who trigger liquidations. They receive 9% and 1% rewards respectively. To better protect collateral, Lybra uses partial forced liquidation: up to 50% of a borrower’s position can be liquidated at once.

Additionally, if the system-wide collateral ratio drops below 150%, all users with a collateral ratio under 125% become eligible for full liquidation, helping to rapidly restore the overall health of the system.

We observe that Lybra Finance draws heavily from the stablecoin protocol Liquity in core mechanisms (minting/redemption, liquidation, price stability)—readers can refer to our prior articles: Liquity: A Rising Star in the Stablecoin Market and An Overview of Liquity, the Leading Decentralized Stablecoin. However, Lybra is not a direct clone. It retains Liquity’s redemption and recovery models but removes the Stability Pool (thus avoiding certain token incentives), instead relying on Liquidators to fund liquidations.

Liquity’s core mechanisms have proven stable over more than two years, evidenced by how other major LSDFi projects like Raft, Gravita, and Prisma have adopted elements of its design. Lybra Finance, built on this foundation, has operated smoothly for over three months. Whether it can maintain this performance remains to be seen.

3. Stablecoin Yield Mechanism

Offering around 8% APR simply for holding eUSD is a major selling point for Lybra Finance and, in my view, a rare innovation in recent stablecoin design. Let’s examine how eUSD’s yield mechanism works.

Source: Lybra Finance Official Website

As we know, Lido Finance’s LSD token stETH aims to maintain a 1:1 peg with ETH, while generating staking rewards from validators on the Ethereum consensus layer. This is achieved via rebase: Lido takes daily snapshots of all stETH holders and distributes newly accrued stETH proportionally. From a user perspective, their stETH balance increases daily, reflecting earned yield. Typically, holding stETH earns users Lido’s staking rewards. Most DeFi protocols integrating stETH pass on rebase rewards to users.

Lybra, however, adopts a fundamentally different approach. When users deposit stETH into Lybra, rebase-generated stETH is not distributed to depositors. Instead, the protocol sells this stETH on secondary markets to buy eUSD, then distributes the eUSD yield pro-rata to all eUSD holders. During this process, Lybra deducts 1.5% annualized eUSD issuance as protocol revenue, distributed to esLBR holders (escrowed LBR obtained by locking LBR or mining).

This creates a model of “yield distribution based on liabilities.” To illustrate:

Assume Day 1: ETH price = 2000 eUSD, stETH APR = 5%:

-

Adam deposits 10 stETH and mints 7,000 eUSD (CR = 285.7%)

-

Bob deposits 10 stETH and mints 10,000 eUSD (CR = 200%)

-

Charlie deposits 10 stETH and mints 13,000 eUSD (CR = 153.8%, just 3.8% above liquidation threshold)

-

Adam sells his 7,000 eUSD to David for ETH; David now holds 7,000 eUSD

-

Eric holds 10 stETH but does not deposit into Lybra

Total system: 30 stETH backing 30,000 eUSD, system CR = 200%.

On Day 2, 30 stETH generate 0.0041 stETH at 5% APR. Lybra sells this for 8.219 eUSD and distributes it to Bob, Charlie, and David based on their eUSD holdings:

-

Adam minted eUSD but no longer holds any—receives zero new eUSD, Day 1 APR = 0%

-

Bob holds 10,000 eUSD (~1/3 share), receives 2.74 eUSD → Day 1 APR = 2.74×365/(10×2000) = 5%. After accounting for Lybra’s 1.5% cut, annual return ≈ 3.5%

-

Charlie holds 13,000 eUSD (13/30), receives 3.56 eUSD → APR = 3.56×365/(10×2000) = 6.5%

-

David holds 7,000 eUSD (7/30), receives 1.92 eUSD → APR = 1.92×365 / 7000 ≈ 10% (note denominator differs from Bob/Charlie)

-

Eric earns standard 5% stETH yield directly

From this example, we see:

-

Ignoring Lybra’s cut, a minter’s eUSD-denominated APR = (stETH APR / personal CR) × system CR. If stETH APR and system CR are constant short-term, increasing APR means lowering personal CR—lower CR yields higher returns but increases liquidation risk. Currently, minters also receive esLBR incentives (~20% APR based on eUSD minted), a primary driver of participation.

-

David, who didn’t mint eUSD (CR = 100%), achieves the highest possible yield: stETH APR × system CR. This matches the ~8.54% yield advertised on Lybra’s website. Unlike most stablecoin protocols, maximizing yield here requires minimizing minting and maximizing eUSD holding. Minters cannot have CR below 150%, so their theoretical max yield = stETH APR × system CR / 150%.

-

Comparing Bob and Eric shows that when personal CR equals system CR, minting + holding eUSD underperforms simply holding stETH due to Lybra’s fee and liquidation risk.

The benefits of this design are clear: it creates a powerful use case for eUSD—earning yield on a stablecoin. In today’s DeFi landscape, decentralized stablecoins are mainly used as yield-generating tools rather than mediums of exchange or units of account. Even MakerDAO, despite its first-mover advantage and network effects, now focuses on offering an 8% APR interest-bearing sDAI to reverse declining TVL and stablecoin adoption. With eUSD delivering ~7.5–8% APR in stablecoin terms, it successfully fulfills its role as a yield-generation instrument.

In fact, reallocating yield from deposited collateral is not uncommon among over-collateralized stablecoin protocols. From a protocol standpoint, over-collateralization ensures safety, but idle high-quality collateral represents wasted resources. Safely generating and redistributing yield benefits both users (who earn extra income) and the protocol (which takes a reasonable cut).

For instance, Alchemix Finance, supported by DeFi figure Andre Cronje in early 2021, issued alUSD with “auto-repaying loans.” Its core idea: deposit stablecoins into Yearn, use generated yield to repay debts, with Alchemix taking a 10% cut. The later alETH followed a similar logic, using yield-bearing assets to auto-repay debt while meeting users’ liquidity needs (e.g., DAI, wstETH).

MakerDAO similarly uses USDC accumulated in its PSM (Peg Stability Module) to invest in various RWA products. Returns fund protocol operations, distribute to sDAI holders, and provide MKR liquidity (effectively half-funded buybacks).

Lybra Finance’s approach differs from both Alchemix and MakerDAO. It targets users’ existing yield-bearing assets, redirecting their yield. Critics argue that eUSD’s entire yield comes from stETH depositors who gain nothing extra—they even bear Lybra’s 1.5% fee—making minters engage in a zero-sum game. Without additional incentives, this would hold true. Yet, as observed in today’s decentralized stablecoin market, circulation volumes are inherently sustained by yield farming opportunities, typically funded by the project’s own governance token (except leading players like DAI, which may also farm third-party tokens for promotional reasons). Once protocol token incentives are layered in, the system can function well—as demonstrated by Lybra’s current success.

For pure eUSD holders (not minters), this design offers a more organic yield experience: earnings come directly in eUSD, with no lockups or complex token management—just hold eUSD daily and receive automatic payouts.

Lybra’s philosophy might be: first stimulate demand for the stablecoin by offering superior yield mechanics (rather than relying solely on incentives), then use targeted supply-side incentives to encourage stETH holders to mint, creating a self-sustaining loop.

That said, this design brings drawbacks. eUSD’s rebase-like behavior makes integration into other DeFi protocols difficult and cross-chain expansion cumbersome, severely limiting its composability.

Moreover, Lybra places all eUSD minters in a kind of “prisoner’s dilemma.”

Since APR = (stETH APR / personal CR) × system CR, and stETH APR is externally determined, users can boost APR only by: 1) lowering personal CR, or 2) increasing system CR.

In the earlier example, Charlie earns average system yield at 200% CR. With a liquidation threshold of 150%, he risks losing stETH if prices drop more than 25%. But if system CR were 300%, Charlie could match base yield at 300% CR, tolerating up to 50% price drops—clearly preferable.

Macroscopically, if all minters maintain high CRs, everyone enjoys consistent returns with greater risk tolerance. Microscopically, each minter has incentive to lower their own CR to increase personal yield. This collective race to lower CR reduces overall system resilience despite unchanged aggregate returns.

Beyond these structural concerns, eUSD’s persistent positive premium poses a more immediate threat. In V1, daily stETH yield is sold on secondary markets to buy eUSD, which is then distributed to holders—creating a fixed daily buy pressure on eUSD. While rigid redemption prevents downside depeg, the protocol lacks tools to correct upside deviations, resulting in chronic slight overvaluation. Though the premium is small, buying a 7.5% yield asset at a 3% premium offers poor risk-return—mechanically constraining eUSD’s growth potential.

eUSD Historical Price – Source: Geckoterminal

4. Token Model

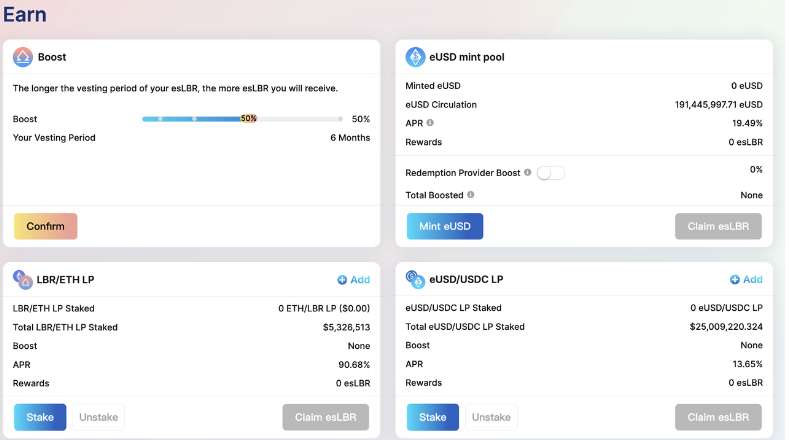

Lybra Finance’s governance token is LBR, with a total supply of 100 million:

-

60% allocated to mining, incentivizing various activities: eUSD minting, eUSD-USDC LP, and LBR-ETH LP

LBR Incentive Allocation – Source: https://lybra.finance/earn

-

8.5% to team, linearly released over 2 years starting 6 months after TGE

-

5% to advisors, linearly released over 1 year starting 1 month after TGE

-

10% for ecosystem incentives, 2% unlocked at TGE, remainder over 2 years

-

10% reserved for treasury, released linearly over 2 years

-

5% for IDO, raising $500,000

-

0.5% for IDO whitelist bonuses

According to Coingecko, current LBR circulation is 11.78 million (11.78% of total supply).

Source: https://www.coingecko.com/en/coins/lybra-finance

LBR utility is primarily realized through esLBR (escrowed LBR), with mining rewards also distributed in esLBR form.

esLBR cannot be traded or transferred but entitles holders to protocol revenue (the 1.5% annual eUSD issuance cut). Users can unlock esLBR to LBR over 30 days or lock LBR to obtain esLBR for faster mining and revenue sharing. esLBR also grants governance rights.

V2 includes significant changes to reward distribution, detailed next.

5. Lybra V2

Lybra V2 has already launched on testnet, with documentation published and undergoing audit by Halborn. Mainnet launch expected no earlier than late August.

Lybra provides a diagram outlining the scope of V2:

Key changes in V2 include:

First, Lybra V2 will introduce a new stablecoin, peUSD, and support additional LSTs (Liquid Staking Tokens).

Current LSTs fall into two categories: rebase types like stETH and sETH (from Stakewise), which we’ve discussed, and value-accumulating types like rETH (Rocket Pool), cbETH (Coinbase), wBETH (Binance), swETH (Swell), and wstETH (Lido). The latter appreciate via increasing ETH exchange rate—not token quantity. For example, rETH balance stays constant, but each rETH redeems for more ETH over time. Lybra’s current eUSD yield mechanism only supports rebase LSTs. To address this, Lybra introduces peUSD (pegged eUSD), mintable directly from value-accumulating LSTs. peUSD shares similar stability, liquidation, and fee mechanics with eUSD, but crucially, peUSD is not a yield-bearing stablecoin—holders don’t automatically earn yield (since underlying asset appreciation remains with the user). However, peUSD can also be wrapped from eUSD, in which case it inherits eUSD’s rebase-derived yield.

peUSD significantly enhances Lybra’s composability: it enables integration with other DeFi protocols and multichain expansion thanks to its stable value. It also broadens collateral to previously unsupported value-accumulating LSTs, achieving full LST coverage. Additionally, peUSD-wrapped eUSD reserves may offer flash loans per Lybra’s plan, generating extra income. However, issuing two distinct stablecoins is unusual and raises user complexity. Despite linkage, peUSD and eUSD differ fundamentally, potentially hindering consumer adoption. Moreover, if peUSD handles all composability while eUSD serves only yield generation (other uses require peUSD), eUSD’s purpose becomes narrow—its yield ultimately dependent on LBR token incentives, risking transformation into a classic Ponzi-like yield scheme.

Second, V2 introduces major adjustments to esLBR reward acquisition, including two bounty programs: Advanced Vesting Bounty and DLP Bounty—inspired by Radiant’s V2 on Arbitrum.

In V2, esLBR unlocking extends from 30 to 90 days, but early unlocking is allowed at escalating penalties (25%–95% depending on timing). Fees paid for early unlocking go to the Advanced Vesting Bounty pool.

The DLP (Dynamic Liquidity Provisioning) Bounty requires eUSD minters to maintain at least 5% of their minted amount as LBR/ETH liquidity to claim esLBR rewards. Failure results in forfeited esLBR becoming part of the DLP Bounty.

Both bounty pools allow users to purchase esLBR at discount using LBR/eUSD. Collected LBR is burned; eUSD goes to the Stability Fund (explained below).

These bounties aim to align incentive acquisition with long-term protocol growth. However, increased friction may deter participation in Lybra’s mining ecosystem.

Another set of key V2 improvements targets eUSD price stability. As analyzed earlier, V1’s yield mechanism creates continuous buy pressure on eUSD via daily stETH sales. V2 adds two solutions:

-

Premium Suppression Mechanism: When eUSD/USDC exceeds 1.005 (0.5% premium), daily stETH yield is sold for USDC instead and distributed to eUSD holders. This shifts buy pressure from eUSD to USDC, addressing the root cause of persistent premium;

-

Stability Fund: Accumulated from discounted eUSD purchases of esLBR. The fund’s eUSD reserves can be deployed during extreme overvaluation to stabilize price. Combined with premium suppression and rigid redemption, this should effectively anchor eUSD price.

Overall, Lybra V2 addresses key V1 shortcomings: poor composability, inability to support value-accumulating LSTs, and persistent eUSD overvaluation. It also strengthens alignment between LBR incentives and long-term protocol health.

However, these changes increase protocol complexity. Two divergent stablecoin designs may hinder user adoption, and peUSD’s composability advantages may further marginalize eUSD.

Conclusion

Among its LSDFi peers, Lybra stands out with weak funding background (no institutional backing), minimal fundraising ($500k), and ongoing FUD. Yet, it leads in TVL and token market cap, with the fastest development—V1 live and V2 already on testnet. This reflects strong team execution and product-market fit.

Compared to incremental tweaks by other LSDFi stablecoin projects, Lybra innovatively reimagines LSD yield distribution. By offering ~8% APR on eUSD, it creates a solid demand driver, complemented by calibrated supply-side incentives, enabling rapid growth. From a holder’s perspective, this yield appears more sustainable than those purely reliant on token emissions, forming a foundation for long-term viability.

Yet, for a $200M-scale stablecoin aiming for broader adoption, this is insufficient. Use case expansion remains the top priority for all decentralized stablecoins. Compared to FRAX, LUSD, or even smaller ones like alUSD and MIM, eUSD’s utility is extremely limited. If peUSD fails to unlock richer use cases, Lybra remains a sophisticated yield farming game—even if cleverly designed and increasingly complex in V2.

Nevertheless, Lybra Finance has become a central player in the LSDFi space. We watch its evolution with keen interest.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News