MakerDAO Analysis: DAI's Growth Momentum and Future Challenges

TechFlow Selected TechFlow Selected

MakerDAO Analysis: DAI's Growth Momentum and Future Challenges

MakerDAO has increased its exposure to real-world assets (RWAs).

Author: Kunal

Translation: TechFlow

In this article, I will examine MakerDAO and its stablecoin DAI. Since July 2023, the MKR token has surged nearly 90%. Here's why:

-

MakerDAO has increased its exposure to real-world assets (RWAs). It currently holds $1.14 billion in U.S. Treasuries and $500 million in USDC, which earns yield through Coinbase Prime, helping boost its revenue.

-

The DAO voted to reduce the surplus buffer cap from 200 million DAI to 50 million DAI. Any DAI exceeding this threshold will automatically be used for periodic buybacks of MKR tokens, which will then be provided to the Uniswap V2 DAI/MKR pool to gradually increase MKR’s on-chain liquidity.

-

The DAI Savings Rate (DSR) has reached 5%. This is the yield users can earn by depositing DAI into Spark Protocol, funded by income generated from RWAs and stability fees (a fee charged proportionally when debt is repaid by returning DAI, known as the stability fee). Since this change, the amount of DAI locked in DSR has surged, accounting for approximately 27% of DAI’s total supply.

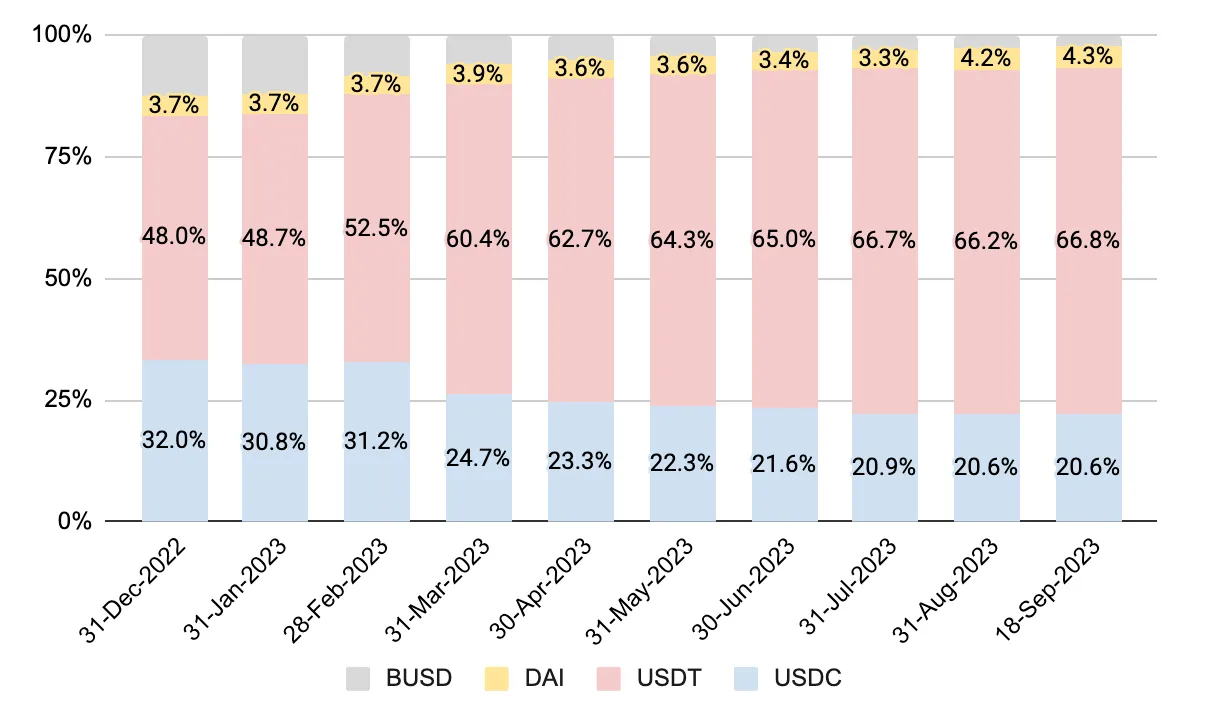

1. DAI Performance Year-to-Date

Looking at stablecoin market capitalization over the past year, USDT has clearly emerged as the winner, capturing market share from USDC and BUSD. Amid FUD surrounding these two stablecoins, investors have shifted toward USDT. The recent initiatives mentioned above have reignited interest in DAI, whose market share is slowly approaching its historical highs from 2021.

2. Maker’s Use of RWAs

Currently, about 60% of Maker’s interest income comes from RWAs. So how does this work?

Let me use Clydesdale as an example. Essentially, Clydesdale sets up an SPV and borrows DAI from Maker. This DAI is then converted into USDC via the PSM (Peg Stability Module), and subsequently exchanged into USD cash. These USD funds are used to purchase U.S. Treasury bonds, which are held by the SPV as collateral for the borrowed DAI. Clydesdale earns a small management fee for running the SPV, while the residual interest from the Treasuries goes to Maker.

3. Revenue and Cost Analysis of DAI Collateral

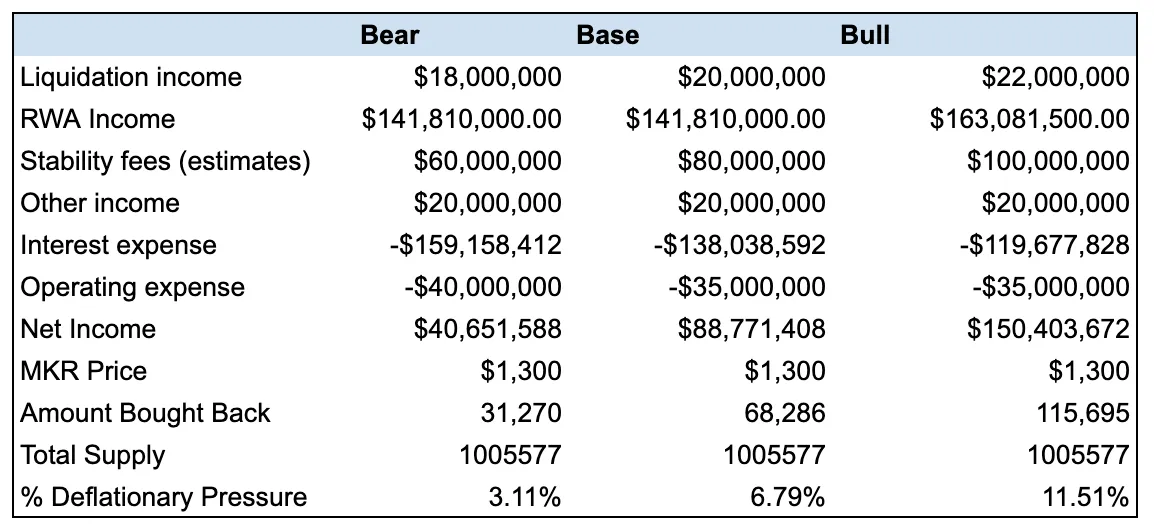

I’ve created a high-level forecast of MakerDAO’s revenues and expenses over the next 12 months, outlining bull, base, and bear scenarios. This is important because MakerDAO’s net earnings flow into the surplus buffer, and any amount exceeding 50 million will be periodically used to buy back MKR tokens.

While most of the revenue growth stems from RWAs, this growth may plateau given that various vaults are nearing their debt ceilings. Further expansion would require Maker to launch new vaults dedicated to purchasing RWAs.

Most of the remaining income will come from stability fees on newly minted DAI and from lending DAI to Spark Protocol (Maker’s DeFi sub-DAO) via D3M. Over recent months, the D3M vault’s ceiling has been raised from 20 million to 220 million. This vault serves as a direct lending platform to Spark Protocol, allowing users to borrow DAI against other assets as collateral at an annual rate of approximately 5.53%. Of this 5.53%, 10% goes to Aave, since Spark Protocol uses Aave’s codebase.

For operating expenses, projections for 2023 are similar to 2022 levels, around $24 million. However, I believe this could rise to approximately $30 million over the next 12 months. MakerDAO now supports more RWA-backed vaults and plans to launch Maker as an independent chain separate from Ethereum. These developments will increase spending on technology, development, oracles, and ecosystem expansion, which constitute the bulk of operational costs.

Over the coming year, most of the revenue will go toward paying the 5% interest rate on DSR. The volume of DAI locked in DSR has grown significantly over the past three months. I expect this growth to slow to a more sustainable pace and have adjusted my estimates accordingly. Even so, I project related expenses to range between $120 million and $160 million. This will be a key factor to monitor month after month to assess the protocol’s health.

Taking all the above into account, supply-side deflationary pressure over the next 12 months is estimated at around 3–12%.

4. DAI Supply Breakdown

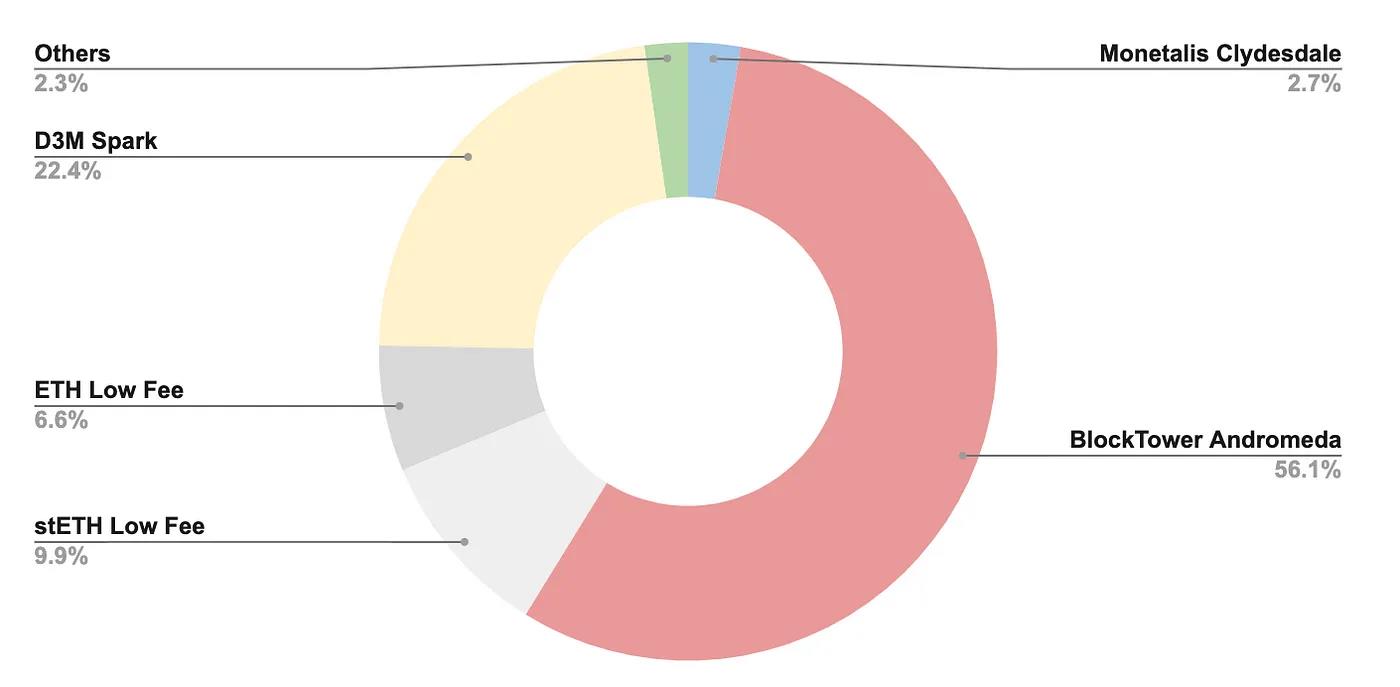

To remain profitable, Maker must continue increasing the amount of newly minted DAI. I analyzed changes in DAI across different vaults over the past three months. 56% of the DAI increase came from BlockTower Andromeda, 22.4% from increases in the D3M vault debt ceiling, and about 15% from ETH/stETH-collateralized vaults. The BlockTower Andromeda vault is nearing its debt ceiling, so growth here will slow down.

Looking ahead, the D3M vault’s debt ceiling serves as a good proxy for user demand for DAI. Looking at numbers on Spark, many users appear to be depositing wstETH as collateral to borrow DAI. These DAI may then flow into DSR, where users hope the 5% yield and a potential 24 million SPK airdrop will offset the 5.53% borrowing cost.

The most costly scenario for Maker is if growth in DSR comes from existing DAI rather than newly minted DAI.

5. Conclusion

Currently, I am optimistic about Maker. The use of RWAs acts as a buffer to help cover interest payments on DAI in DSR. Recent Federal Reserve guidance suggests rates will remain elevated for longer, which benefits Maker over the next two years. Below are the key metrics I will monitor to evaluate the protocol’s health:

-

Growth rate of DAI in DSR (if growth in DSR exceeds growth in newly minted DAI, this could be a concern);

-

D3M debt ceiling and DAI utilization on Spark Protocol (indicative of demand for newly minted DAI—particularly interesting post-SPK airdrop);

-

Launch of any new RWA vaults (additional revenue streams).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News