Analyzing the Current Three Popular Ethereum Standards: EIP-6969, ERC-721C, and ERC-6551

TechFlow Selected TechFlow Selected

Analyzing the Current Three Popular Ethereum Standards: EIP-6969, ERC-721C, and ERC-6551

Every standard has the potential to create or transform an industry.

Producer: TechFlow Research

Author: David

Over the past week, we’ve seen at least three Ethereum-related standards being intensively discussed across various channels. These are EIP-6969, ERC-721C, and ERC-6551—each serving distinct purposes and carrying unique potential implications.

Each of these standards could potentially shape or reshape an entire industry segment, underscoring their significance. Getting ahead of the curve helps identify emerging trends and new developments early on.

However, a defining characteristic of the crypto world is that information tends to be fragmented and sporadic. Combined with limited time and attention, it’s likely impossible for you to deeply understand the technical details and potential impact of each standard. That’s why TechFlow aims to consolidate, interpret, and compare these standards, guiding you through a clear and accessible overview.

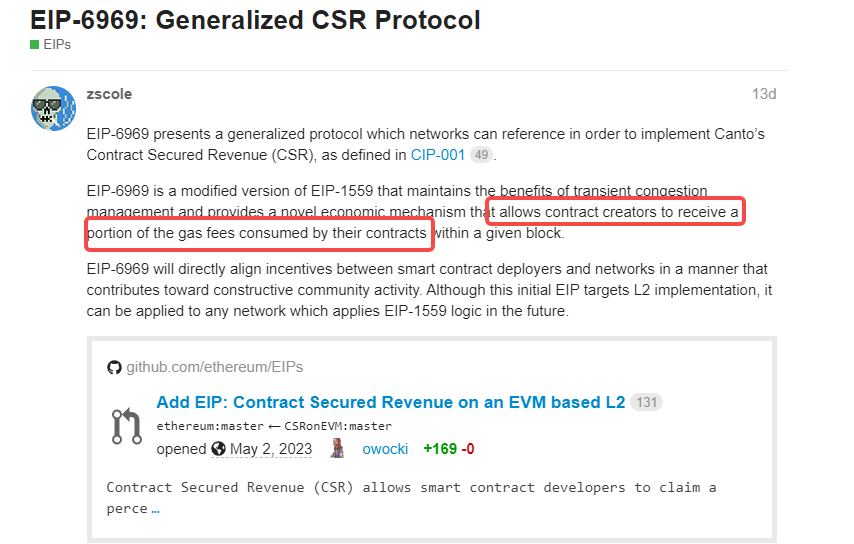

1. EIP-6969: A Boon for Smart Contract Creators and L2 Ecosystems?

EIP-6969 is a proposal first introduced around May 8th. It proposes a universal protocol designed to enable Contract Source Revenue (CSR), which can be viewed as an evolution of the earlier EIP-1559.

In plain terms: this protocol aims to allow creators of smart contracts to earn a share of the Gas fees generated when users interact with their contracts.

Co-author of the proposal @owocki has stated that the goal is to incentivize smart contract developers and thereby promote the growth of Ethereum's Layer 2 (L2) ecosystem, while explicitly not implementing such a mechanism on Ethereum’s Layer 1 (L1), in order to preserve L1’s neutrality.

In our view, if this incentive mechanism were implemented on Ethereum L1, it could lead to a surge of low-quality contracts aimed solely at maximizing fee extraction, resulting in network congestion—ultimately doing more harm than good. Therefore, deploying it on L2 may be a better approach.

To fully grasp EIP-6969, one must understand how gas fees currently work on Ethereum—including their structure and distribution. This brings us back to EIP-1559.

EIP-1559 took effect during Ethereum’s London hard fork in August 2021, introducing a revised transaction fee mechanism with multiple destinations:

-

Burn: A portion of transaction fees from each block is permanently destroyed (burned), reducing the total supply of ETH over time.

-

Base Fee: Part of the base transaction fee paid by users is allocated as part of the block reward to validators (formerly miners). This incentivizes them to continue creating blocks and processing transactions.

-

Max Priority Fee: The optional tip set by users goes directly to validators as an additional incentive to prioritize their transactions.

Clearly, EIP-1559 did not significantly consider the interests of smart contract developers. In reality, Ethereum’s supply side consists of two key components:

Validators (ex-miners) + Contract Developers. The former provide a trustworthy ledger; the latter offer diverse applications. So, in theory, rewarding the latter makes perfect sense.

If EIP-6969 is implemented, gas fees could be broken down into: Burn + Base Fee + Priority Fee + Payment to Contract Creator.

In summary, EIP-6969 builds upon EIP-1559. While EIP-1559 improved transaction fee predictability and congestion management, EIP-6969 retains those benefits while adding a revenue-sharing mechanism for contract creators—better aligning incentives between developers and the network, encouraging greater participation and innovation.

The table below clearly illustrates the functions and impacts of EIP-6969, along with its relationship to EIP-1559:

Notably, a major risk associated with this new protocol is whether allowing developers to collect gas fees might encourage the creation of spam or malicious contracts. This introduces real concerns around contract security and the potential misuse of public blockchain resources.

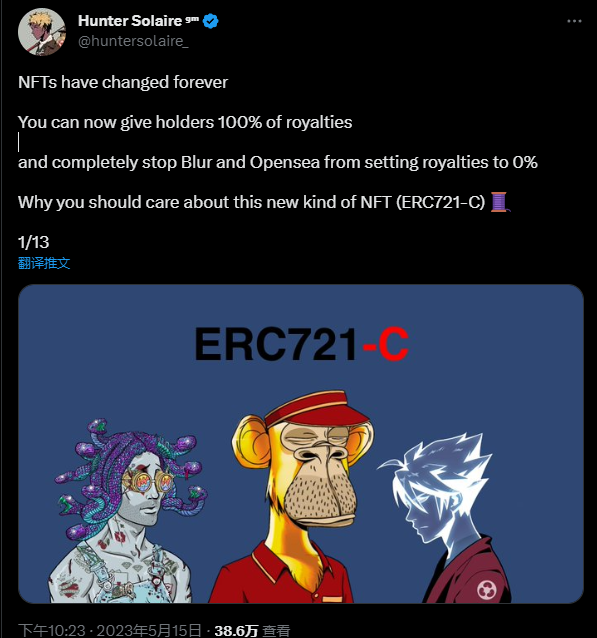

2. ERC-721C: On-Chain Enforcement of NFT Royalties

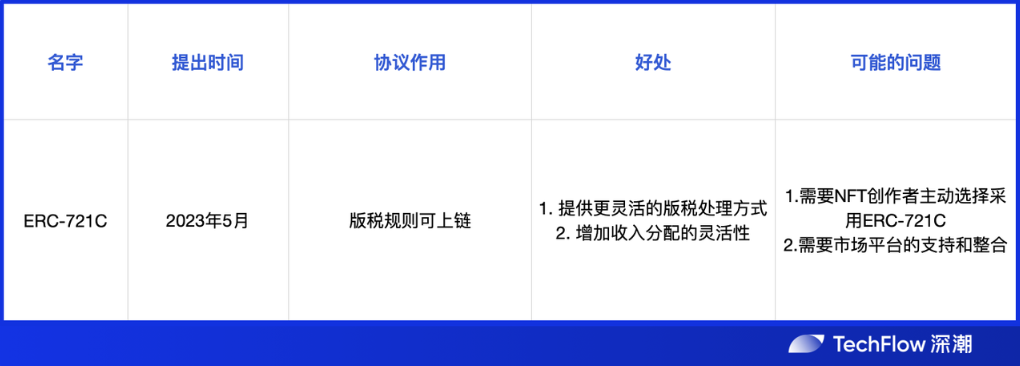

ERC-721C is an enhancement to the Ethereum ERC-721 non-fungible token (NFT) standard, proposed by Limit Break. Its primary goal is to give NFT creators greater control and customization over their collections and royalty mechanisms.

TechFlow Note:

Limit Break is a free-to-play game development studio that introduced the concept of “Creator Tokens” in January 2021. Version 1.1 of the ERC-721C standard launched in May 2023, incorporating many of these creator token concepts. @huntersolaire_ also detailed the standard in a series of tweets.

Limit Break’s official “Creator Token Transfer” library indicates that ERC-721C is currently operational on both Ethereum and Polygon. It is also supported on Ethereum’s Sepolia testnet and Polygon’s Mumbai testnet.

Given the name "Creator Token," ERC-721C clearly prioritizes creators, focusing heavily on protecting royalty rights.

In simple terms: under the current ERC-721 standard, royalties are merely commercial agreements—not enforceable on-chain. ERC-721C aims to solve this by making royalties programmable rules enforced via smart contracts on the blockchain.

With ERC-721C, several new use cases become possible:

-

Shared Royalties: Instead of all royalty income going solely to the NFT creator, it can be shared with holders—rewarding early adopters.

-

Royalties Only for Minter: The minter of the NFT becomes the sole recipient of royalty income, rather than the original creator.

-

Conditional Royalty Payments: Royalties can be configured to apply only under certain conditions. For example, payments could be triggered only when resale prices exceed the original mint price.

-

Transferable Royalties: Creators can issue a separate NFT granting someone else the right to receive royalty income. For instance, minting "NFT X" could simultaneously generate "NFT Y", which entitles its holder to all future royalties from "NFT X".

The introduction of ERC-721C will have significant implications for the NFT industry:

-

Greater Creator Control: ERC-721C enhances creators’ design autonomy, turning royalties into on-chain enforceable rules and offering stronger rights protection.

-

Fairer Royalty Distribution: Programmable royalties allow creators to implement flexible distribution models, such as those mentioned above.

-

Reduced Marketplace Influence: With royalty logic embedded directly in smart contracts, creators gain direct control over royalty settings, reducing reliance on and interference from marketplaces.

A summary table for ERC-721C:

3. ERC-6551: When NFTs Become Wallets

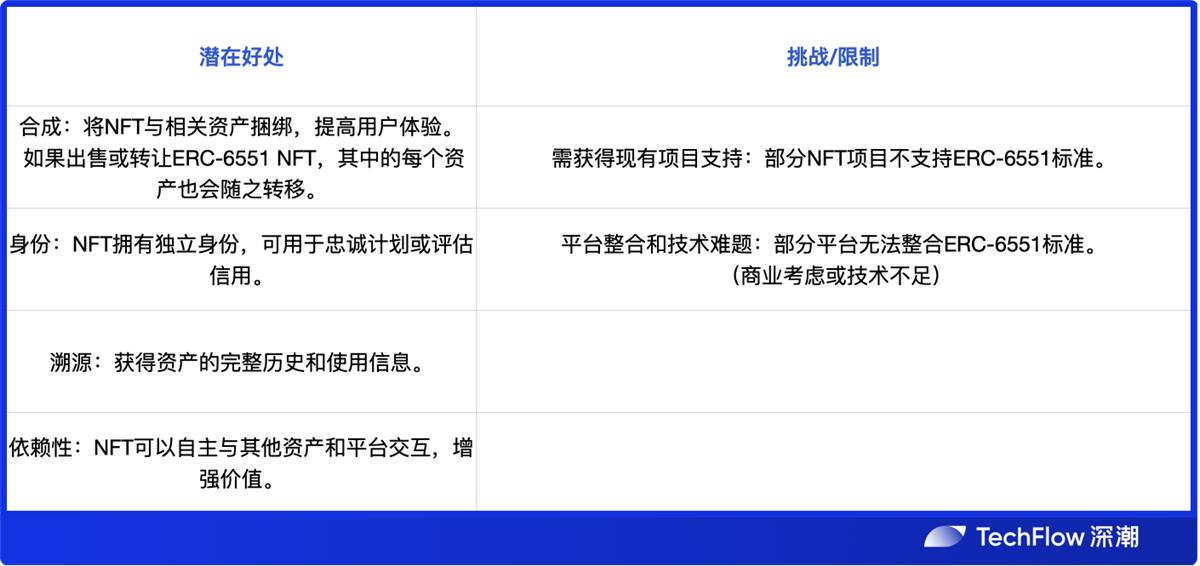

ERC-6551 enhances the functionality and value of NFTs by enabling them to function like smart contract wallets.

The co-author of this proposal is @BennyGiang, a founding member of Dapper Labs, whose team previously worked on the ERC-721 token standard and early projects like CryptoKitties.

The limitation of standard ERC-721 NFTs lies in their narrow scope—they can only be owned and transferred. They cannot own other assets like tokens or NFTs themselves, nor can they interact with other smart contracts or evolve based on external inputs or user actions.

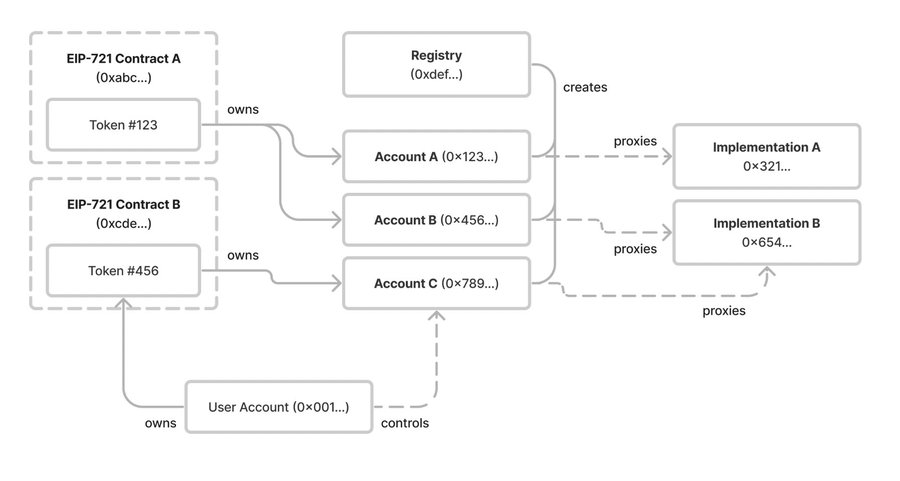

ERC-6551 addresses these limitations by introducing the concept of a smart contract wallet for NFTs. Through a combination of a registry and proxy contracts, it enables NFTs to hold other assets and interact with smart contracts and accounts, unlocking richer functionalities and interactivity.

Put simply, an NFT compliant with ERC-6551 operates as a smart contract wallet. This means it can hold tokens and other NFTs, conduct transactions, and interact with decentralized exchanges (DEXs), lending platforms, gaming environments, and more—just like any regular smart contract wallet.

This model creates what’s known as “Token-Bound Accounts” (TBAs)—managed via a permissionless registry compatible with existing ERC-721 NFTs.

In short, here are some potential benefits and challenges brought by ERC-6551:

EIP vs. ERC—What’s the Difference?

At this point, a common question arises: What exactly is the difference between EIP and ERC?

EIP (Ethereum Improvement Proposal) and ERC (Ethereum Request for Comments) are both standards within the Ethereum ecosystem, but they serve different purposes.

An EIP is a formal proposal for improving the Ethereum protocol itself. Once accepted, EIPs become part of the core Ethereum protocol and are implemented across the network. EIPs describe changes at the protocol level—such as modifications to consensus mechanisms, virtual machine rules, or blockchain architecture.

In contrast, ERCs define standards specifically for smart contract interfaces—particularly for tokens. ERCs ensure interoperability among different token contracts on Ethereum by specifying functions like token transfers, balance checks, and metadata retrieval.

Therefore, although both EIPs and ERCs are part of Ethereum’s standardization process, they focus on different layers. EIPs deal with protocol-level upgrades, while ERCs standardize token contract behavior. As such, an EIP does not automatically become an ERC—they are independent frameworks serving distinct roles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News