Hunting Ethereum Bulls: “Whales” Suffer $7 Billion in Losses Amid Collective Scrutiny

TechFlow Selected TechFlow Selected

Hunting Ethereum Bulls: “Whales” Suffer $7 Billion in Losses Amid Collective Scrutiny

All collapses begin with excessive arrogance toward long-term certainty.

By Frank, Maitong MSX

Tom Lee and Jack Yi probably haven’t had a good night’s sleep these past two days.

After all, if one were to pick the most dramatically compelling protagonist of the crypto market in early 2026, it would likely be neither Bitcoin nor some suddenly emergent new narrative—but rather these two ETH “whales,” Tom Lee and Jack Yi, now publicly roasted over an open flame.

Spectators have never minded when funerals get rowdy.

Right now, global investors are collectively holding their breath, watching—live—as the largest and most transparent long ETH positions in Ethereum’s history struggle to survive amid mounting unrealized losses.

I. ETH “Whales” Are Now Sitting on Over $10 Billion in Unrealized Losses

Same story, different year—same whales, different names.

In Web3 parlance, the term “whale” typically refers to institutions or individuals possessing substantial capital sufficient to influence market direction.

Yet over recent years, the positive connotation of this term has been steadily diluted by reality—evolving from merely denoting heavyweight players into something more like the most conspicuous—and easiest-to-spectate—target during periods of extreme market volatility.

Over the past few days, the two ETH “whales” attracting the most market attention have been BitMine (BMNR.M), led by Tom Lee, and Trend Research, helmed by Jack Yi. Though both are bullish on Ethereum (ETH), they represent two fundamentally divergent strategies: the former is the largest ETH treasury company, while the latter is an investment firm openly leveraging on-chain positions to go long ETH.

First, let’s examine BitMine.

As one of the most representative Ethereum reserve companies, BitMine once boldly announced its goal to acquire roughly 5% of Ethereum’s total supply over the long term. As of publication, the company holds 4,285,125 ETH—valued at nearly $10 billion.

According to Ultra Sound Money data, Ethereum’s current total supply stands at approximately 121.4 million ETH, meaning BitMine has already locked up roughly 3.52% of ETH’s circulating supply—a remarkably aggressive pace of execution.

Recall that BitMine only launched its “Ethereum treasury transformation” in July 2025, following a $250 million private placement. In less than six months, BitMine completed a leap—from a Bitcoin mining company to the world’s largest ETH holder.

Source: Ultra Sound Money

Even more noteworthy is that BitMine continued accumulating ETH逆势 during last week’s darkest hours—when ETH plunged below $3,000 and the market accelerated its collapse—buying another 41,787 ETH (≈$108 million) at ~$2,601 per coin, demonstrating unwavering conviction.

But problems soon followed—cost basis. Conviction comes at a price: BitMine’s average ETH acquisition cost stands at ~$3,837, meaning its unrealized loss has ballooned to ~$6.4 billion as ETH fell to ~$2,350.

This extremely aggressive “crypto-native” transformation has also triggered a wild valuation tug-of-war in U.S. public markets.

Back in July 2025, when BitMine first disclosed its Ethereum purchasing strategy, its stock (BMNR.M) was trading around $4. Within half a year, its share price surged from floor to ceiling—peaking at $161—making it the brightest “Ethereum shadow stock” across global capital markets.

Yet what made BitMine soared—Ethereum—also brought it down. As ETH prices sharply retreated, BitMine’s valuation premium rapidly unraveled, with its share price now plummeting to $22.80.

If BitMine represents the long-term spot strategy—trading time for space—then Jack Yi’s Trend Research has opted for a markedly riskier path.

Since November 2025, Trend Research has openly gone long ETH on-chain, employing a classic “stake-borrow-buy-re-stake” loop:

- Stake owned ETH into the on-chain lending protocol Aave;

- Borrow stablecoins (USDT);

- Use USDT to buy more ETH;

- Repeat continuously to amplify long exposure;

The underlying logic is straightforward: use existing ETH as collateral to borrow funds and purchase additional ETH—betting on leveraged gains as prices rise.

Undoubtedly potent in bull markets, this strategy carries commensurate risk: should ETH’s price decline, the value of the collateral shrinks, triggering margin calls from lending protocols—and ultimately, forced liquidations, where ETH is sold at market price to repay debt.

So when ETH crashed from ~$3,000 to a low near $2,150 within just five days, this mechanism entered “emergency mode”—giving rise to a highly theatrical spectacle of “small-knife scalping” on-chain:

To avoid forced liquidation, Trend Research repeatedly transferred ETH to exchanges, sold it for USDT, then deposited the USDT back into Aave to repay loans—barely pushing down its liquidation threshold and buying itself breathing room.

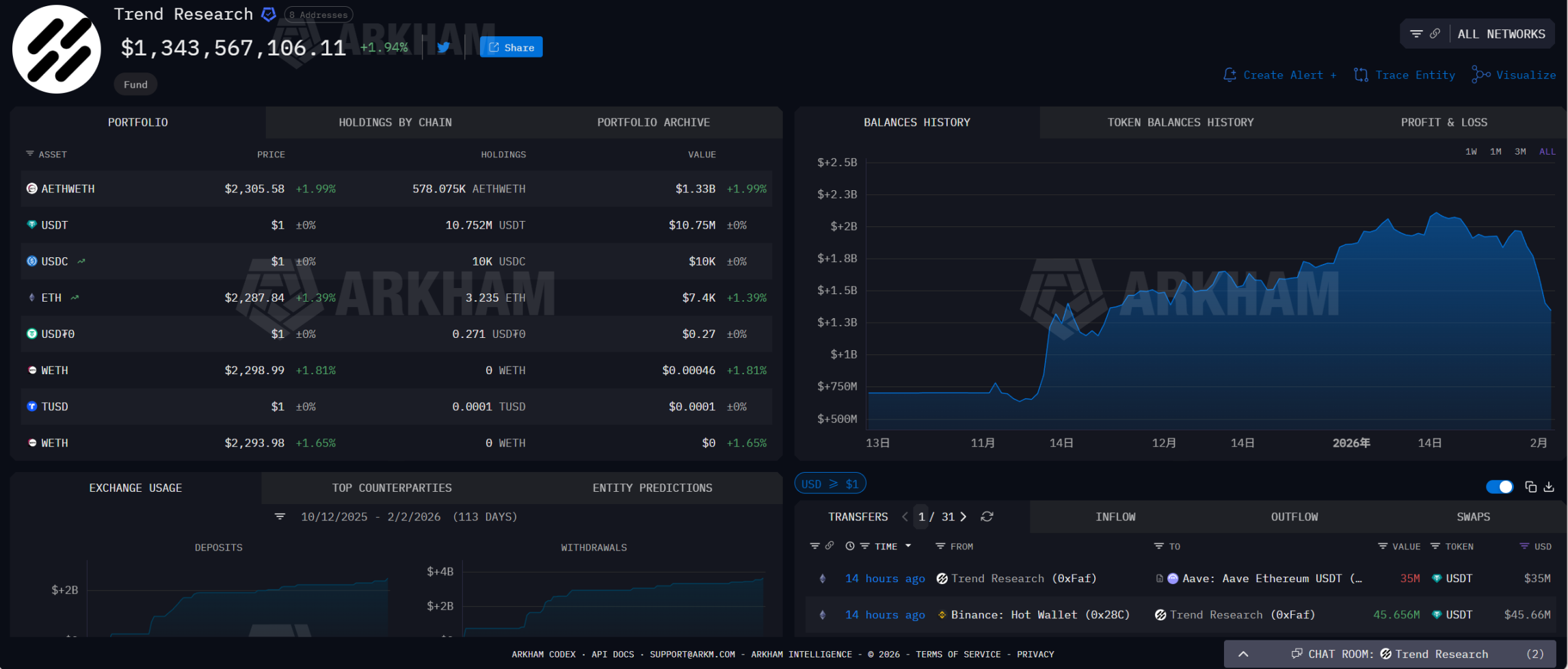

As of February 2, Trend Research had deposited 73,588 ETH (worth ~$169 million) into Binance in multiple batches for sale and loan repayment. Its total ETH lending position loss reached $613 million—including $47.4 million in realized losses and $565 million in unrealized losses—while still carrying ~$897 million in stablecoin leverage debt.

Especially during ETH’s rapid descent through the $2,300–$2,150 range, the entire network watched this “stop-loss survival drama” unfold in real time: each ETH sold by Trend Research bought itself more runway—but simultaneously added fresh sell pressure to the market, further tightening the noose around its own neck.

In other words, Trend Research nearly killed itself.

Source: Arkham

II. On-Chain vs. Off-Chain: “Ice and Fire”

Paradoxically, if we step back from the whales’ multi-billion-dollar unrealized losses and instead examine Ethereum’s on-chain fundamentals—not price alone—we find a reality almost diametrically opposed to secondary-market sentiment: ETH activity on-chain continues heating up.

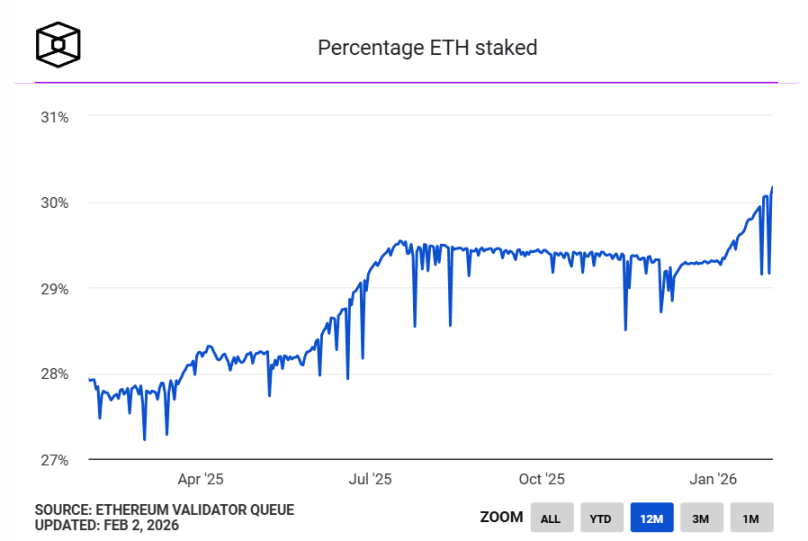

Per The Block’s data, roughly 36.6 million ETH are now staked on Ethereum’s Beacon Chain—exceeding 30% of the network’s circulating supply and setting a new all-time high.

The previous record was 29.54%, set in July 2025. This marks the first time Ethereum’s staking ratio has substantively crossed the 30% threshold since transitioning to Proof-of-Stake.

Source: The Block

From a financial supply-demand perspective, this shift carries profound implications.

Mass staking of ETH means those tokens voluntarily exit free circulation—transforming from a “speculative currency” used for high-frequency trading and speculation into a “yield-bearing bond” with productive utility. In short, ETH is no longer just gas, a medium of exchange, or a speculative instrument—it increasingly functions as “productive capital”: staked to participate in network operations and generate ongoing returns.

Naturally, heavyweight actors like BitMine play a pivotal role here: BitMine has already staked nearly 70% of its ETH holdings (~2,897,459 ETH) and continues adding more.

Meanwhile, validator queues show subtle but telling shifts: the unstaking queue is nearly empty, whereas the queue to stake new ETH keeps lengthening—over 4.08 million ETH currently wait to enter. In brief: “Exiting is smooth; entering requires a seven-day wait.”

This waiting queue has hit a new all-time high since Ethereum’s PoS staking mechanism launched—and its sharp upward inflection began precisely in December 2025.

That’s also when Trend Research began its overt, aggressive ETH long positioning.

Source: Ethereum Validator Queue

Crucially, unlike trading, staking is a low-liquidity, long-duration strategy emphasizing stable returns. Once funds enter the staking queue, flexibility to rebalance or engage in short-term tactical maneuvers is forfeited for a significant period.

Thus, as ever more ETH flows back into staking, it sends a clear signal: at this stage, growing numbers of participants willingly accept opportunity costs—locking up assets long-term—in exchange for assured on-chain yield.

A powerfully contradictory structural picture thus emerges: On one side, nearly one-third of all ETH is being continuously “cellared,” with even more ETH queued up off-chain awaiting lock-up; on the other, secondary-market liquidity tightens, prices remain under sustained pressure, and whales are forced into stop-losses with positions constantly exposed.

This stark divergence between on-chain and off-chain dynamics constitutes the most vivid “ice-and-fire” tableau in today’s Ethereum ecosystem.

III. Are “Whales” Who Play Open-Book Already on the Menu?

In traditional finance, cards are rarely laid face-up: positions, cost bases, leverage ratios—all can be concealed behind information asymmetries embedded in derivatives, OTC agreements, and other instruments.

But on-chain, every whale’s transfer, every pledge, every liquidation threshold is exposed 24/7 to the entire market. Choosing to go long openly thus easily devolves into an exhausting “self-fulfilling Murphy’s Law” battle of attrition.

From a game-theoretic standpoint, though Tom Lee and Jack Yi are both long ETH—and both playing openly—they occupy opposite ends of the risk curve.

Tom Lee may sit on $6.4 billion in unrealized losses, but BitMine pursues a “low-leverage, high-staking, zero-debt” spot strategy. Absent structural risk, he can simply hold and let staking yields gradually offset volatility.

Indeed, contrary to widespread market assumptions, BitMine’s structure isn’t particularly aggressive. As Tom Lee emphasized in a February 2 social media post: the company holds $586 million in cash reserves, with 67% of its ETH staked—generating over $1 million in daily cash flow. For him, price declines represent mere paper losses—not existential threats.

Jack Yi, meanwhile, amplified his exposure via Aave’s circular lending—plunging himself into a negative feedback loop: “price drop → nearing liquidation → selling ETH → topping up margin → further price drop.” It’s like a live-streamed performance art piece watched by the entire network.

Bears don’t need to blow you up outright—they only need to push price down → force deleveraging → generate passive sell pressure → trigger follow-on selling—to complete a structural hunt.

That’s why each repayment and transfer by Trend Research gets magnified as signals of Jack Yi’s shifting confidence—or imminent surrender. As of writing, Trend Research has stopped out 73,588 ETH (worth ~$169 million), and its lending position’s liquidation price has dropped below $1,800.

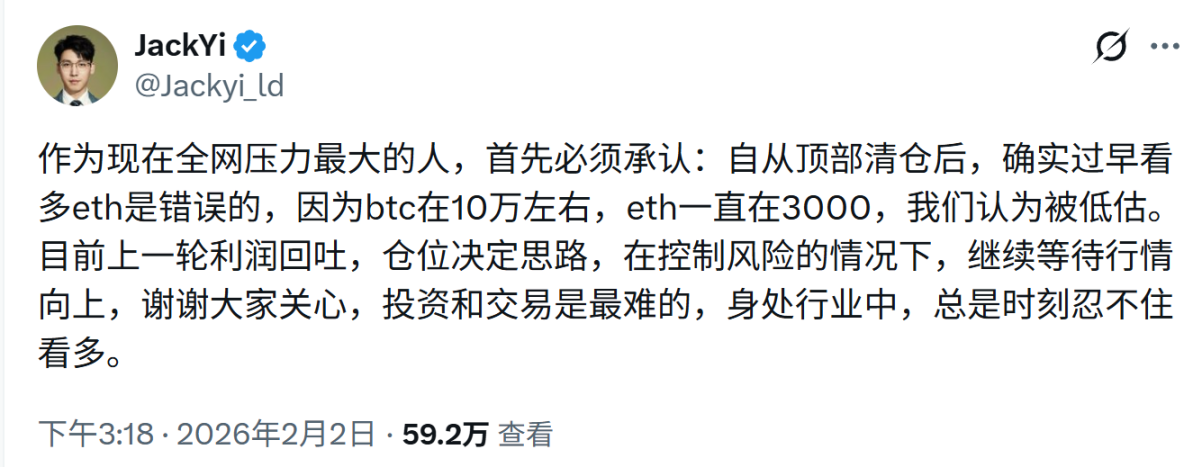

On the same day Tom Lee posted, Jack Yi also publicly reflected: “As the person under the most pressure across the entire network, I must first admit that going long ETH too early was a mistake… Having given back prior profits, I’ll continue waiting for an upward move—while managing risk.”

Ultimately, going long ETH via on-chain circular lending is tantamount to laying your hand face-up on the table. Whether or not any coordinated entity is targeting you specifically, once your position size, cost basis, leverage ratio, and liquidation threshold are all published on-chain, you’ve already landed on every market participant’s shared kill list.

Of course, to some extent, this reflects path dependency: back in April 2025, Jack Yi had publicly called the bottom at $1,450, kept buying, and rode the rebound to profit—earning brief status as ETH’s “bullish spiritual standard-bearer.”

This time, however, the story’s ending remains unwritten—and Tom Lee clearly holds the stronger hand.

Final Thoughts

From Three Arrows Capital to FTX—and now BitMine, under public scrutiny—the script never changes: every collapse begins with excessive arrogance toward long-term certainty.

As Keynes famously (and oft-quoted) observed: “In the long run, we are all dead.” Jack Yi’s error wasn’t being bullish on Ethereum long-term—it was underestimating how brutally irrational markets can behave in the short term. From the moment he chose to go long with open-book leverage, he sacrificed himself to this transparent algorithmic world.

Yet viewed differently, this may be Ethereum’s necessary “great cleansing.” Every cycle demands such a “whale fall”: whales get scrutinized, leverage gets squeezed out, path dependencies get shattered, and chips get redistributed.

Only after the stop-losses are done and the survivors endure the pain can the ecosystem truly move forward unburdened.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News