Why I'm not optimistic about Ethereum right now?

TechFlow Selected TechFlow Selected

Why I'm not optimistic about Ethereum right now?

Our investment decisions should be based on rationality rather than belief.

Author: Alex Xu

I'm bearish—not because I lack confidence in Ethereum's business development (in terms of long-term user growth and settlement transaction volume, which I believe will still grow), but because I wouldn't want to buy at the current price, as it's too expensive relative to its fundamentals.

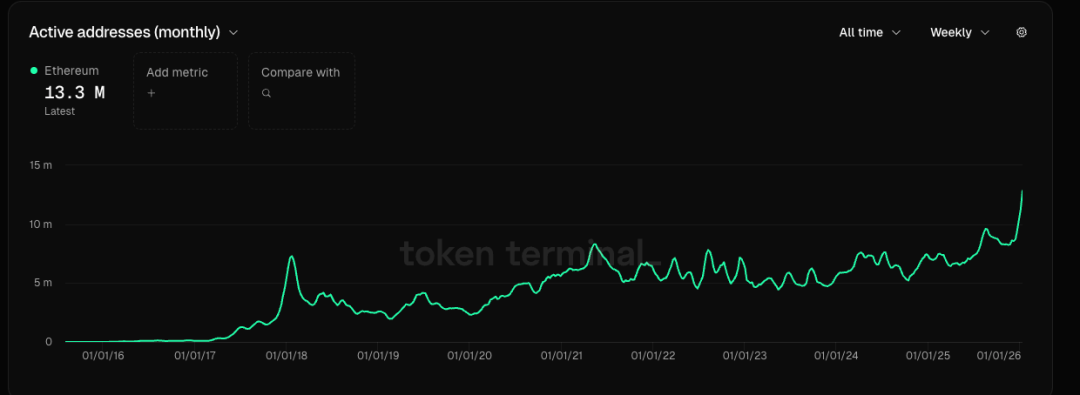

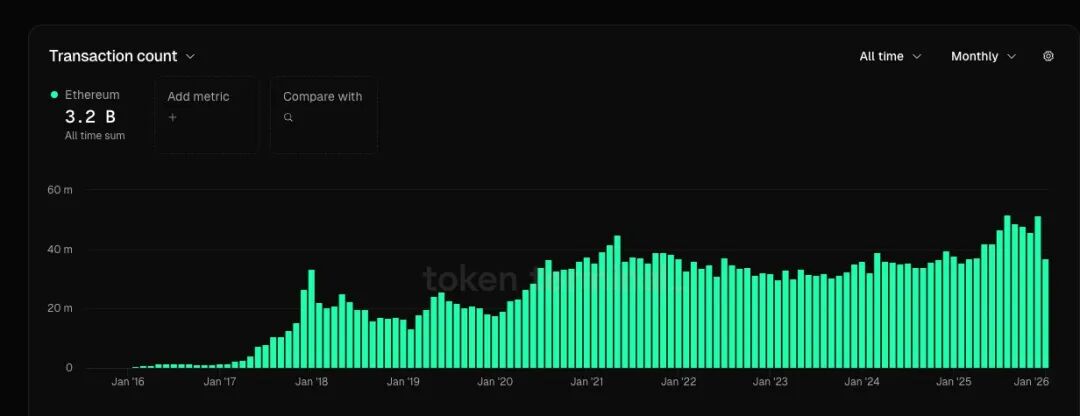

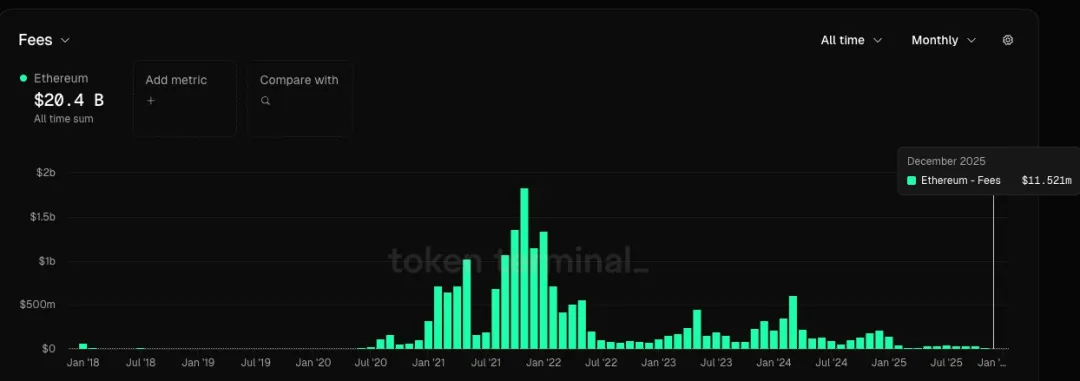

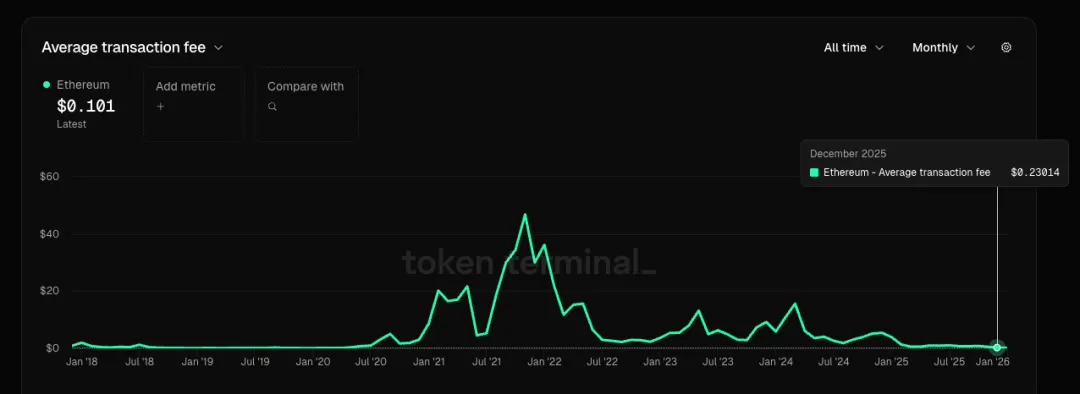

A few charts can help paint a picture of Ethereum today:

1. Active user scale has risen in a wave-like pattern to a new high (44% higher than the previous cycle peak), and transfer transaction count has also hit a record high (13% higher than the last cycle peak). However, the growth rate of these two metrics lags behind GMV growth rates seen at some leading e-commerce platforms.

2. Current monthly fees are only 0.6% of the previous cycle’s peak, and average per-transaction fees are just 0.5% of the prior high. This slow growth in users and transactions has come at the cost of a severe drop in service pricing. For any company in any industry, such growth driven by aggressive price cuts is not a healthy sign.

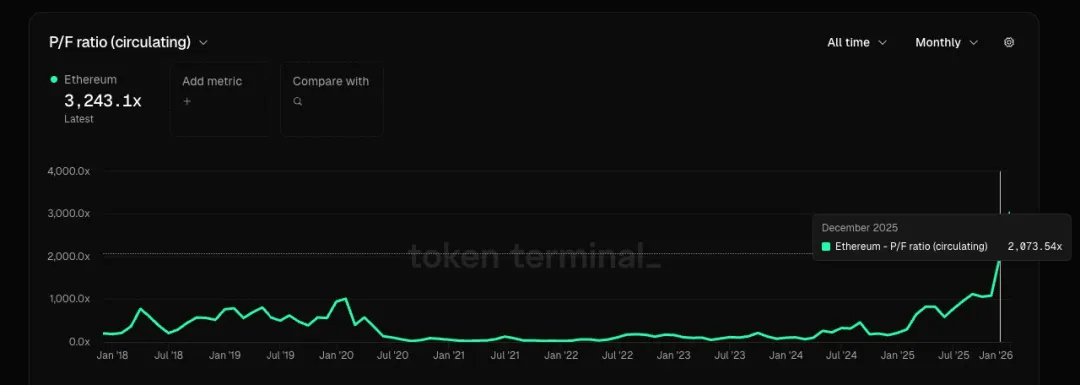

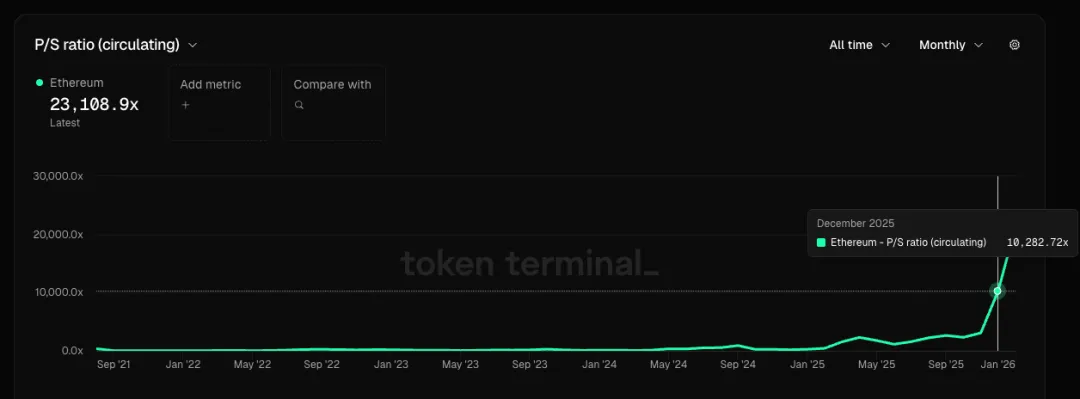

3. If we view Ethereum as a company providing block space services, based on December data, its Price-to-Fee ratio (PF) exceeds 2,000x, and its Price-to-Sales ratio (PS) exceeds 10,000x. Its net profit is negative, so there is no meaningful P/E ratio. In contrast, typical cloud service companies trade at P/E ratios of around 20–30x, with PS ratios in the single digits.

4. If instead we treat Ethereum as a commodity (akin to digital crude oil), the challenge lies in the fact that other public chains and rollups can offer similar block space services (like substitute crude sources). Some may argue Ethereum’s stronger decentralization and censorship resistance justify a premium valuation. But does it really warrant such a massive premium? The earlier narrative that ETH could rival BTC as a store of value has now nearly disappeared, as consensus has formed that unlike BTC’s “digital gold” status, ETH resembles more of a tech company plus a specialized cloud provider—making its commodity positioning quite replaceable.

5. There has been a near-generation gap in crypto-native applications with strong product-market fit. This cycle has seen almost no breakout-value applications. Insufficient demand combined with increasing supply (growing number of rollups and public chains) has led to severe oversupply in block space, causing the entire public chain sector to stagnate or even shrink.

6. The grand vision painted by Tom Lee and certain domestic VCs—that "Ethereum is Wall Street on-chain, and everything will eventually be built on Ethereum"—currently lacks supporting data or solid evidence. There’s no clear logical progression behind it; it feels more like a pump-and-dump narrative. Our investment decisions should be based on rationality, not faith. I’m not interested in eating their pie right now. If, in the future, real data and facts begin to substantiate this story, then there will still be time to partake later.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News