Web3.0's Failure, Challenges for Emerging Stablecoins, and RWA Opportunities in the Middle East

TechFlow Selected TechFlow Selected

Web3.0's Failure, Challenges for Emerging Stablecoins, and RWA Opportunities in the Middle East

The ledger must be decentralized, while the assets must be centralized.

By Nathan Ma, Co-Founder & Chairman of DMZ Finance

Key Takeaways:

-

Stablecoins are experiencing explosive growth—2025 is the "Skype moment" for blockchain finance

-

The vision of Web3.0 has failed; what we've built instead is Finance3.0

-

RWA tokenization: ledgers must be decentralized, while assets must be centralized

-

Hong Kong’s “Hundred Stablecoin Battle”: challenges facing emerging stablecoins

-

The Middle East opportunity in RWA: building a world-class digital asset hub

-

RWA synergy between Mainland China/Hong Kong and the Middle East

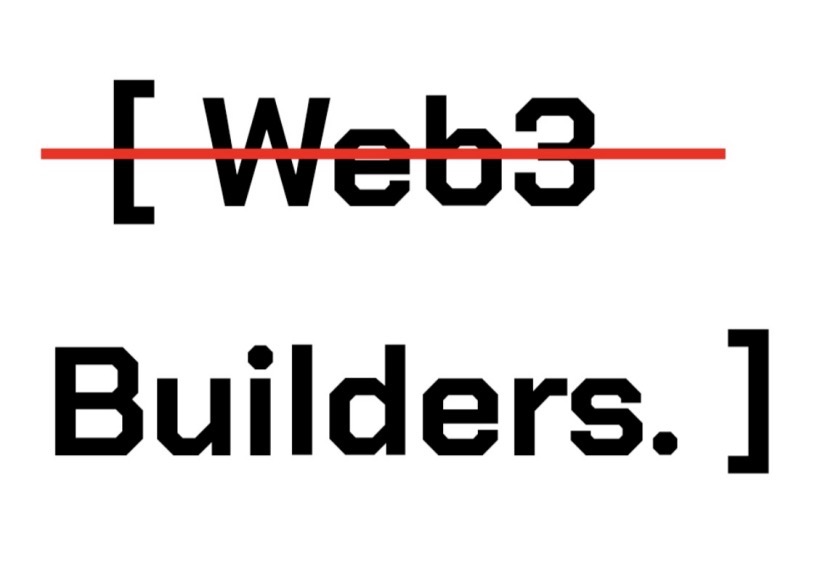

As one of the most pivotal applications in blockchain finance, stablecoins are witnessing explosive growth in 2025.

According to data from RWA.xyz, by July 2025, the global stablecoin market has surpassed $250 billion. Over the past 12 months, stablecoins have seen over 240 million active addresses, 1.4 billion payment transactions, and a total transaction volume reaching $6.7 trillion. In 2024, annual transaction value of stablecoins exceeded the combined volumes of Visa and MasterCard, making them one of the most significant payment vehicles globally.

The U.S. Treasury Borrowing Advisory Committee (TBAC) projects that the base market cap of stablecoins could reach $2 trillion by 2028. If interest-bearing stablecoins are included, the total market size could range between $3.5 and $4 trillion.

2025: The Skype Moment for Blockchain Finance

Before Skype emerged in 2003, international phone calls were expensive and inconvenient. Skype disrupted traditional telephony by enabling nearly free real-time voice and text communication worldwide—and this was only the beginning.

In 2009 WhatsApp launched, followed by WeChat in 2011. The rise of WeChat Pay and Alipay then ushered in the era of internet finance.

Stablecoins, one of the most representative innovations in blockchain finance, were initially designed as on-chain transaction media. However, amid geopolitical sanctions, global inflation, and rising international tensions, they have evolved into strong challengers to the traditional SWIFT payment system.

This challenge stems from inherent technological advantages in efficiency and cost: traditional SWIFT cross-border transfers take an average of five business days and incur fees of about 2–3%. In contrast, blockchain-based stablecoin payments enable 7×24 global real-time settlement. On networks like Solana, the average transaction fee can be as low as $0.00025 per transfer—highlighting a dramatic cost advantage.

Just as internet communication replaced telephone networks in 2003, today blockchain networks are replacing traditional interbank payment systems—an irreversible trend marking the dawn of a new financial revolution.

The Failed Pursuit of Web3.0: What We Built Was Finance3.0

The true dividing line between Web1.0 and Web2.0 wasn’t just improved user interaction, but the explosion of application-layer innovation. Search engines, video platforms, payments, e-commerce, gaming, and social media—all the internet experiences we now take for granted—emerged en masse during the Web2.0 era. The driving force behind this wasn't abstract ideals, but breakthroughs in chip performance and network bandwidth, which ignited an unprecedented app revolution.

If we define generational shifts by application adoption, then so-called "Web3.0" has yet to experience such a breakout. Instead, progress has been limited to foundational infrastructure innovations—such as distributed ledgers and cryptocurrency protocols. Defining generations solely by "centralized vs. decentralized" functionality lacks persuasive power.

From this perspective, the construction of Web3.0 has failed. What we’ve actually built is "Finance3.0": leveraging decentralized networks and cryptocurrencies to migrate traditional financial functions—exchanges, derivatives, leverage, lending—onto the blockchain.

-

Finance 1.0——Traditional Financial System

-

Finance 2.0——Internet Finance

-

Finance 3.0——Blockchain Finance

The most critical application within Finance3.0 is the stablecoin built on decentralized networks, which is fundamentally reshaping global payment and clearing infrastructures. This innovation rivals the shift from horse-drawn carriages to trains—a qualitative leap in efficiency and cost reduction.

RWA Tokenization: Ledgers Must Be Decentralized, Assets Must Be Centralized

Unlike Finance2.0, blockchain networks were designed from inception as asset-trading platforms, initially supporting crypto-native assets like Bitcoin (BTC) and Ethereum (ETH). Now, the tokenization of real-world assets (RWA) is accelerating rapidly. Tokenized U.S. stocks, Treasuries, gold, and real estate are all moving on-chain. This not only enables instant asset transfers but also allows these tokens to serve as collateral in lending and DeFi services, significantly enhancing liquidity and yield potential. Boston Consulting Group (BCG) forecasts that the RWA tokenization market could reach $16 trillion by 2030.

In the process of RWA tokenization, two core questions arise: first, ledger choice—public chain or consortium chain, and how decentralized should it be? Second, which types of assets should be prioritized for tokenization? These decisions directly impact the success and scalability of asset tokenization.

My view: ledgers must be decentralized, while assets must be centralized.

1. Ledger Choice: RWA Should Prioritize Decentralized Public Chains

In RWA tokenization practice, I recommend using decentralized public blockchains—such as Ethereum, Solana, or exchange-backed chains like BNB Chain and Base. For example, three leading tokenized U.S. Treasury products—BUIDL (BlackRock + Securitize), BENJI (Franklin Templeton), and QCDT (QNB + DMZ Finance)—are all issued on public chains.

The rationale lies in their two primary use cases:

1) Reserve Assets for Stablecoins

BUIDL has become a key underlying asset for yield-bearing stablecoin USDtb (Ethena), at one point accounting for over 70% of USDtb’s holdings.

Circle has partnered with BlackRock to replace 90% of USDC’s short-term Treasury reserves with BUIDL, improving on-chain transparency and yield.

2) Exchange Margin Collateral

This mirrors traditional finance: at CME, over 50% of margin deposits are U.S. Treasuries.

The blockchain world is replicating this model: In April 2025, OKX and Standard Chartered launched a “Collateral Mirroring” pilot program, allowing institutional clients to use crypto assets and tokenized money market funds (e.g., Franklin Templeton’s BENJI) as trading collateral. Binance, Bybit, and others are expected to follow soon.

If a tokenized Treasury bond is issued on a consortium or private chain today, it would struggle to integrate into these two critical applications, severely undermining its utility and value. Yet current financial institutions often still prefer consortium or private chains initially, primarily due to concerns around security and control. The long-term effectiveness of this approach remains to be seen.

2. Asset Selection: Must Be Centralized

The higher the level of centralization, the more mature the standardization, rating systems, and secondary market liquidity. Ranked by degree of centralization:

Treasuries / Gold > Stocks > Large Bank Deposits > Private Debt > Real Estate > EV Chargers > Malu Grapes

Centralized assets offset the decentralization of blockchain networks. Only when both are combined can true global liquidity be unlocked. Tokenizing EV chargers doesn’t solve their illiquidity; putting grapes on-chain is little more than hype, unlikely to form deep markets.

Hong Kong’s Hundred Stablecoin Battle: Opportunities and Challenges for Emerging Stablecoins

Recently, with clearer regulations emerging in jurisdictions like the U.S. and Hong Kong, stablecoin market enthusiasm has reached unprecedented levels.

Functionally, stablecoins fall into three main categories: trading-focused, payment-focused, and yield-bearing stablecoins. While overlapping, each emphasizes different priorities.

Success for trading-focused stablecoins heavily depends on support from top-tier exchanges, often requiring substantial profit-sharing—e.g., Coinbase and USDC—or direct backing by exchanges themselves, such as Binance's deep integration and control over FDUSD.

After USDT/UADC, the next wave of large-scale stablecoins has largely been yield-bearing stablecoins, such as Ethena’s USDe and USDtb. Their core mechanism involves sharing protocol-generated income (e.g., funding rates) with users to boost holding incentives.

New “compliant stablecoins” focus primarily on payment use cases, typically issued by payment giants (PayPal, Visa) or e-commerce platforms (Amazon, JD.com). These stablecoins are embedded within existing global payment operations and often adopt a “B2B first, then B2C” rollout strategy.

During recent research trips to Hong Kong, I engaged deeply with multiple institutions and learned that over 100 companies are applying or preparing to apply for Hong Kong stablecoin licenses—the “Hundred Stablecoin Battle” has officially begun. Yet this competition faces several major challenges:

1. No Yield, Hard to Hold: Under regulatory frameworks in the U.S. and Hong Kong, compliant stablecoins cannot pay direct interest to holders. This removes incentives beyond payments, limiting capital retention.

2. Difficult Entry into Trading: High Exchange Barriers: Even established compliant stablecoin issuers face tough negotiations with major exchanges, where listing opportunities are scarce and actual deployment challenging.

3. Payment Ecosystems Are Walled Gardens: Hard to Break Out: Most e-commerce-issued stablecoins serve only their own ecosystems. It’s hard to imagine Amazon adopting JD’s stablecoin, or vice versa.

To address these pain points, innovative firms are emerging around settlement and yield aggregation across stablecoins. Infrastructure players backed by major banks enjoy structural advantages, including:

- Partior: incubated by the Monetary Authority of Singapore (MAS), focused on cross-border stablecoin payments, supported by DBS, J.P. Morgan, and ENBD;

- Taurus: backed by Credit Suisse and Deutsche Bank, focused on European tokenization;

- DMZ Finance: an RWA infrastructure provider supported by QNB and Standard Chartered.

All three have been selected for the Qatar Central Bank-led QFC Digital Asset Lab and are seen as key builders of next-generation stablecoin infrastructure.

The Middle East Opportunity in RWA: A World-Class Digital Asset Hub

A region’s RWA potential can be assessed through three dimensions: regulation, ecosystem, and market.

Regulatory Dimension: As early as 2018, Abu Dhabi Global Market (ADGM)’s Financial Services Regulatory Authority (FSRA) introduced one of the world’s first comprehensive crypto regulatory frameworks, covering exchanges, custodians, and issuance mechanisms. In 2022, VARA was established as Dubai’s virtual asset regulator outside DIFC, and in 2024 signed cooperation agreements with SCA, providing cross-emirate regulatory pathways. Today, Binance, OKX, and Deribit hold full VARA licenses in Dubai, while Bybit has obtained a temporary license.

In July 2025, Dubai’s DFSA formally approved the first tokenized money market fund—QCDT. Registered in DIFC and launched by QNB and DMZ Finance, both the fund and its tokens are custodied by Standard Chartered (Dubai). QCDT combines the strengths of two major Middle Eastern financial centers—Dubai and Doha—to serve global markets.

Ecosystem Dimension: Data shows UAE sovereign wealth funds now hold over $40 billion in crypto assets. In March this year, MGX, a subsidiary of Abu Dhabi’s sovereign fund, invested $2 billion in Binance—the first sovereign fund to invest in a top-tier crypto exchange. Meanwhile, the region is investing hundreds of billions in building the largest AI computing cluster outside the U.S. In Dubai, elite wealth managers, hedge funds, quant firms, private equity funds, and family offices are actively entering the crypto space.

Dubai is known as the world’s third-largest financial center. The Dubai International Financial Centre (DIFC) hosts over 2,600 financial institutions and corporations. As of end-2024, these include:

- Over 260 banks and capital market institutions;

- Over 410 wealth and asset management firms, including 75 hedge funds;

- Over 125 insurance and reinsurance companies;

- Over 800 family businesses.

On the Chinese side, DIFC is the only cluster of Chinese financial enterprises in the UAE. China’s Big Five Banks account for over 30% of banking and capital market assets in DIFC, with about 30% of Chinese firms in DIFC being Fortune 500 companies.

Market Dimension: Projections indicate that around 9,800 millionaires will relocate to the UAE by 2025, making it the top destination for high-net-worth individuals globally, surpassing the U.S. and UK. Crypto asset penetration in the UAE is expected to reach 39% in 2025, far above the global average of 6.8%.

Dubai, Abu Dhabi, and Doha offer distinct advantages:

- Zero personal income tax and capital gains tax, with very low corporate tax rates;

- Global market connectivity: Dubai’s “10-year Golden Visa” has low thresholds and is only 4 hours apart from Hong Kong, Singapore, and mainland China, and 3 and 2 hours from London and Switzerland respectively—making it an ideal global financial nexus.

Therefore, the Middle East’s RWA opportunity goes far beyond a mere “wealthy market.” It is a compliant gateway for global institutions and HNWIs. RWA projects from the region will gain strong credibility in global capital markets.

These three pillars—regulation, ecosystem, and market—are collectively transforming the Middle East into a global epicenter for crypto assets.

RWA Synergy Between the Middle East and Mainland China/Hong Kong

The Middle East is the ideal market for offshore RMB stablecoins. Annual trade between Mainland China/Hong Kong and the UAE exceeds $110 billion, and over $30 billion with Qatar. If part of this trade volume could be settled via offshore RMB stablecoins issued in Hong Kong, it would significantly energize both the RWA and Chinese stablecoin markets.

Moreover, high-quality domestic assets could leverage the Middle East’s robust compliance framework to showcase and raise capital on this world-class digital asset stage—bringing tangible benefits to both business operations and brand value.

While the ideal of Web3.0 falters in practice, Finance3.0 has already achieved concrete breakthroughs through stablecoins and asset tokenization in core financial areas such as payments, clearing, and collateral. Its logic is clear: ledgers must be decentralized to earn global trust; assets must be centralized to connect with real-world value.

As global regulation clarifies and traditional financial institutions accelerate their entry, the Middle East is rapidly becoming a pivotal hub linking new financial infrastructure with global capital flows. With forward-looking regulatory frameworks, strong global liquidity, and resource allocation capabilities—combined with deep economic ties to Mainland China and Hong Kong—it offers fertile ground for scalable adoption of stablecoins and RWA.

We stand at the starting point of a global financial transformation. The new era of stablecoins and RWA has already begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News