Perp's Game-Changer: How SynFutures Is Leading the Next Wave of DeFi Innovation?

TechFlow Selected TechFlow Selected

Perp's Game-Changer: How SynFutures Is Leading the Next Wave of DeFi Innovation?

"Believe that in the near future, with further improvements in underlying public chain performance, the popularization of AA wallets, and the improvement of infrastructure."

Author: SHA

I. Introduction

Currently, there are two widely adopted solutions in the derivatives space: one is GMX's Vault model, where LPs act as counterparty to traders and prices are determined by oracles; the other is dYdX’s order book model, which uses off-chain matching with on-chain settlement, as seen in platforms like AEVO, Vertex, and dYdX V3/V4. The former carries counterparty risk and oracle attack vulnerabilities, while the latter suffers from opacity and potential exchange malfeasance.

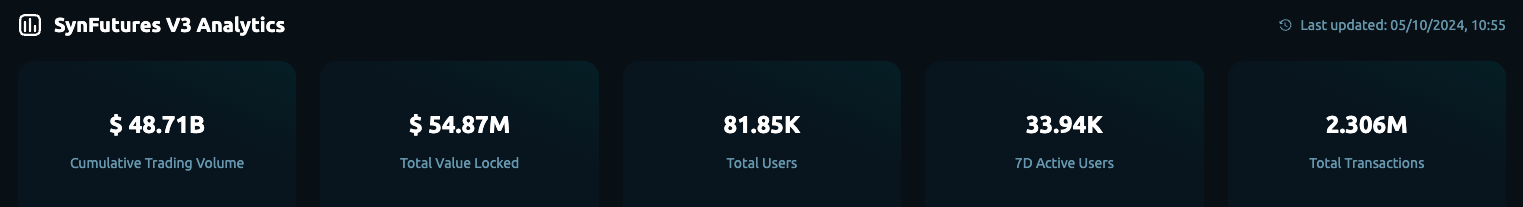

Unlike semi-decentralized solutions such as dYdX and AEVO, SynFutures has consistently focused on building a fully decentralized and high-performance perpetual futures exchange. Founded in 2021, SynFutures has raised a total of $38 million from leading industry investors including Pantera, Polychain, Dragonfly, Standard Crypto, and Framework. According to DeFillama data, since its V3 launch on Blast on February 29 this year, it has achieved a cumulative trading volume exceeding $48 billion, ranking among the top three in daily trading volume globally.

SynFutures V1 and V2 used an xyk AMM model similar to UniSwapV2, suffering from low capital efficiency and poor liquidity depth. Therefore, SynFutures V3 introduced oAMM — a specialized AMM for derivatives trading based on Uniswap V3’s concentrated liquidity model — allowing LPs to concentrate liquidity within specific price ranges, maximizing capital efficiency and liquidity depth. While maintaining full decentralization, it provides traders with excellent execution experience and minimizes slippage costs.

-

A key innovation of oAMM is its implementation of a fully on-chain order book, enabling market makers to place limit orders and directly receive one-third of trading fees as rebates. This may be the highest fee-sharing ratio in the entire industry, making it highly attractive for centralized exchange market makers to participate in on-chain market making, thus achieving order book depth comparable to centralized exchanges.

-

Another major innovation of oAMM lies in its permissionless nature — just like Uniswap V3 — and enables "three allowances": anyone can create a perpetual contract using any token as collateral at any time, with the entire listing process completed within 30 seconds. This means any project team can launch derivative trading pairs for their own tokens on SynFutures. Imagine if half of all projects began creating contracts backed by their own tokens on SynFutures — what a massive market that could become...

-

Meanwhile, as a purely on-chain smart contract, oAMM naturally integrates and grows together with the underlying blockchain ecosystem — something many semi-decentralized exchanges lack today. After all, composability — the ability to stack protocols like LEGO blocks — is one of DeFi’s most compelling features. Furthermore, all data is stored on-chain and verifiable by anyone, so users never need to worry about risks such as "exchange downtime, pulled cables, or stolen funds" inherent to centralized systems.

II. Understanding the oAMM Mechanism

If Uniswap V2 were compared to a stream, Uniswap V3 would be like building two dams across it to form a large reservoir. A small stream supports only minnows and shrimp, but a big reservoir allows whales and sharks to swim freely, fostering a more complex ecosystem. SynFutures V3 operates similarly.

2.1 Concentrated Liquidity — Enhancing Capital Efficiency

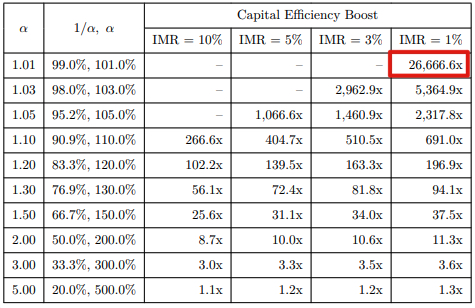

By allowing LPs to allocate liquidity within specified price ranges, oAMM significantly improves AMM liquidity depth and capital utilization efficiency. It supports larger and more frequent trades while generating higher fee income for LPs. According to documentation, its capital efficiency can reach up to 26,666.6x that of traditional models.

2.2 Fully On-Chain Order Book — High Efficiency with Full Transparency

Liquidity in oAMM is distributed across designated price intervals, each consisting of multiple discrete price points. For example, if an LP provides liquidity in the ETH-USDB-PERP pool between [3000, 4000], this range can be divided into several price points, with equal liquidity allocated to each. You might already realize — isn’t this essentially an order book? Exactly!

oAMM implements on-chain limit orders by allowing users to provide liquidity at specific price points, simulating order book behavior and further improving capital efficiency.

Compared to traditional AMM market-making methods, centralized exchange market makers are far more familiar and comfortable with limit-order-based strategies, increasing their willingness to participate. Thus, supporting limit orders enables oAMM to attract active market makers, enhancing trading efficiency and depth to deliver a user experience rivaling centralized exchanges.

In contrast to off-chain order books like dYdX, oAMM runs entirely on-chain as a smart contract, with all data permanently recorded and publicly verifiable. There is no central authority, eliminating concerns about opaque operations or fabricated trading activity.

2.3 Limit Orders Earn Trading Fee Rebates — Highest in the Industry

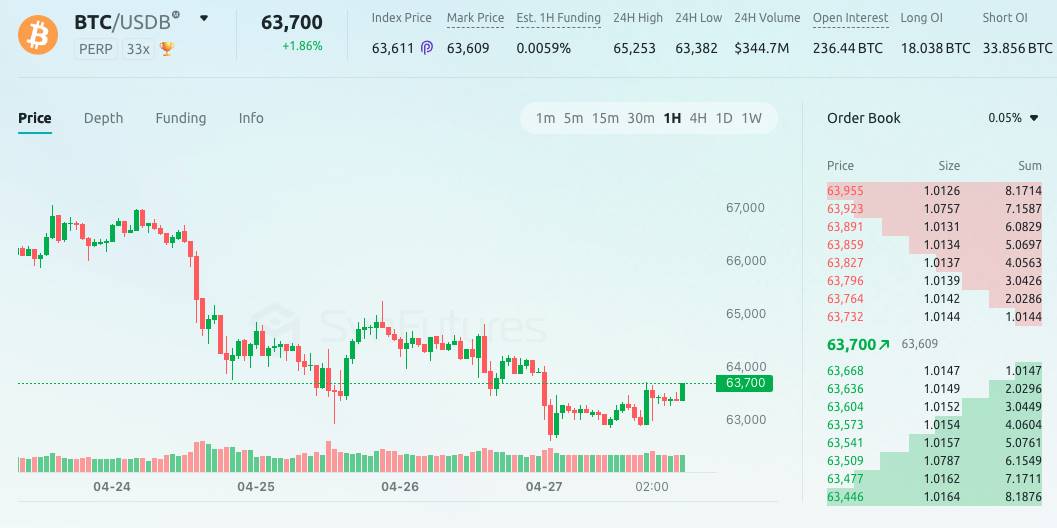

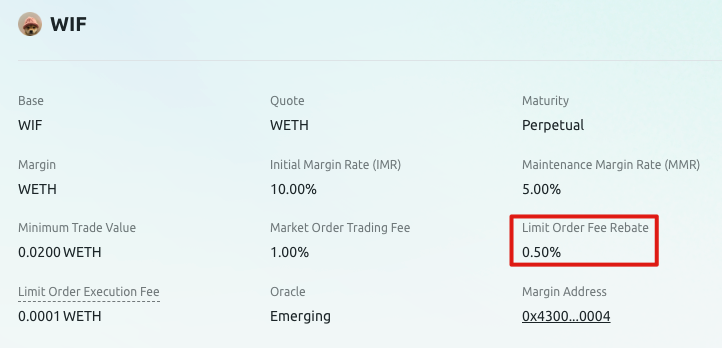

Since placing a limit order effectively provides liquidity to oAMM, users earn a share of trading fees. In centralized exchanges, fee sharing is typically reserved for institutional clients or VIPs and paid out after certain settlement cycles. In oAMM, however, fee rebates are instantly credited to the user’s margin account when their order is filled. For example, in the BTC-USDB-PERP market, the current rebate rate is 0.01% of trade value; for higher-risk meme coins like WIF-WETH-PERP, it reaches up to 0.5%. This is likely the highest rebate rate in the derivatives industry today.

2.4 Permissionless Listing — Rapid Access to New Opportunities

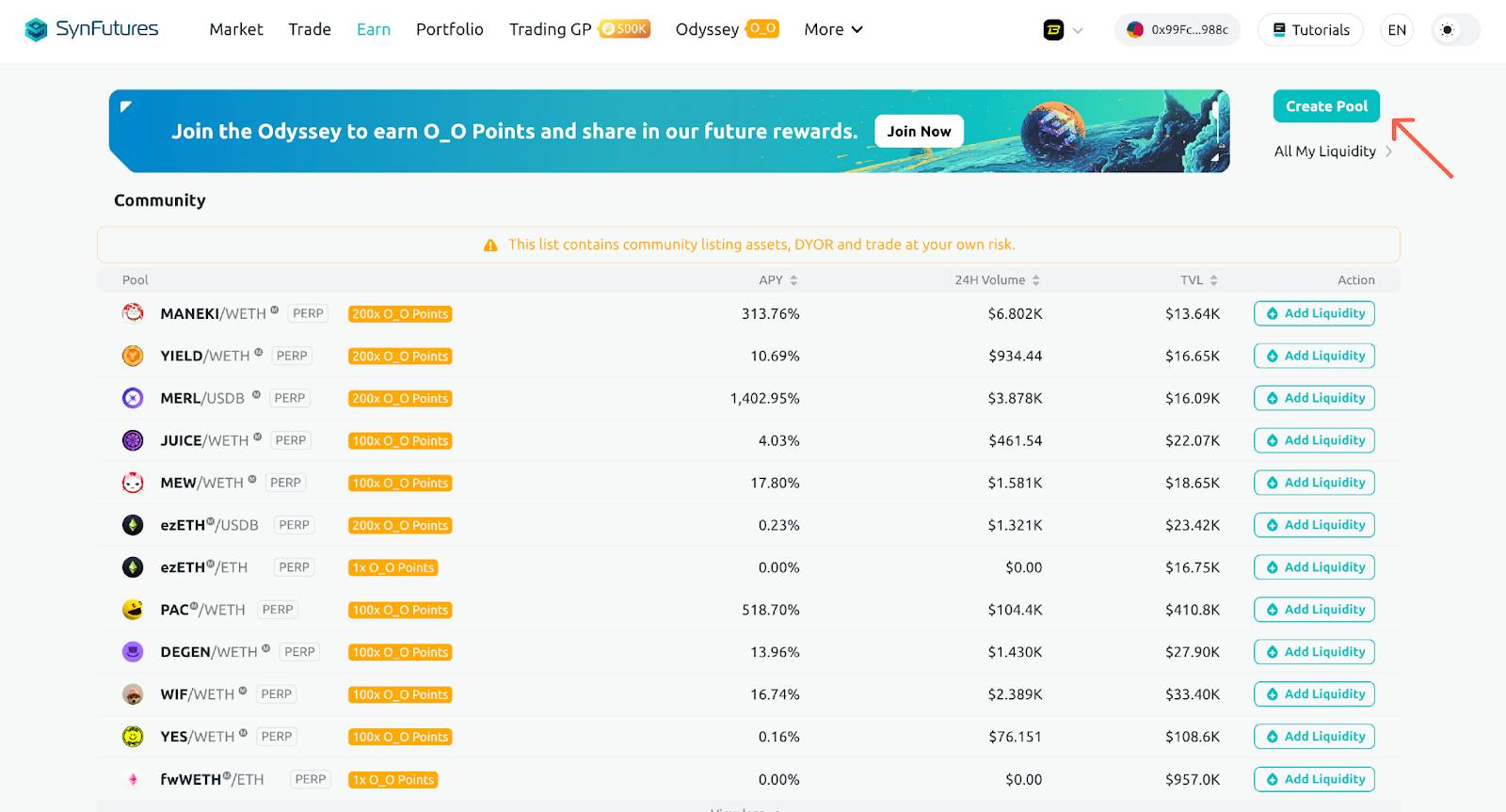

Currently, all decentralized derivative exchanges require either the project team or community governance to approve new token listings, making it difficult for ordinary users to profit from early launches. However, oAMM is fundamentally a permissionless on-chain smart contract — just like most spot AMMs — allowing anyone to freely create perpetual or expiry contracts at any time.

In other words, if you believe a certain token will gain popularity and providing liquidity could be profitable, you can create a corresponding futures market on SynFutures. For instance, a newly launched meme coin gaining traction without exchange support yet — you could list it first on SynFutures, leveraging both the meme hype and SynFutures’ traffic and community, achieving dual benefits.

2.5 Support for Any ERC20 Token as Collateral — Pioneering a New Derivatives Paradigm

Each oAMM pool operates independently without cross-pool risk exposure. This design theoretically allows any ERC20 token in circulation to be used as collateral without increasing systemic risk — something unimaginable in systems like Hyperliquid or dYdX.

Imagine if half of the top 500 altcoins by market cap created pools on SynFutures, each with even just $1 million in liquidity — the aggregate scale would be substantial. Projects can also empower their own tokens by enabling holders to use them as collateral or earn rewards through liquidity provision, including SynFutures points and trading fees — a true win-win scenario.

2.6 Risk Management System — Comprehensive Protection of User Funds

Derivatives are inherently more complex than spot trading. Spot platforms like Uniswap involve immediate swap-and-go interactions, whereas derivatives involve open positions requiring robust safety mechanisms. To address this, SynFutures employs four key measures: smoothed price curves, dynamic penalty fees, emergency response protocols, and large-profit withdrawal checks — collectively safeguarding user assets.

2.6.1 Smoothed Price Curve

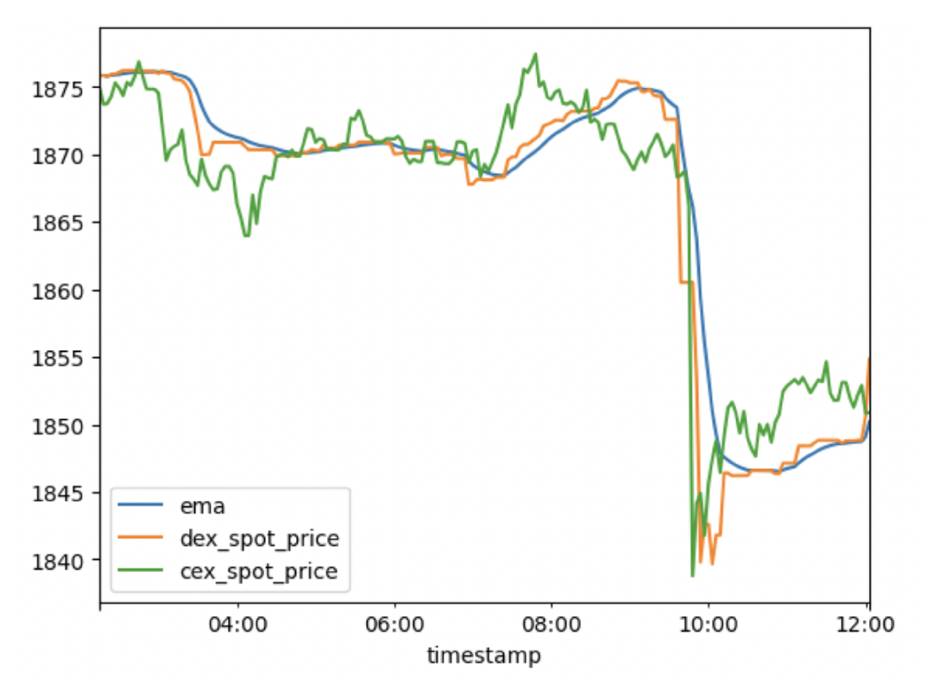

Historically, both GMX and dYdX have suffered losses due to oracle manipulation attacks. To mitigate this, SynFutures does not use raw oracle prices directly. Instead, it applies EMA (Exponential Moving Average) smoothing before incorporating prices into the system. As shown below, the EMA-smoothed price curve is significantly smoother than raw oracle feeds, reducing the impact of oracle fluctuations on mark prices and lowering oracle attack risks.

2.6.2 Dynamic Penalty Fees

What if someone attempts to manipulate prices maliciously for profit? SynFutures counters this via dynamic penalty fees. If a user significantly distorts the price, they incur additional transaction fees as punishment. Under these conditions, attackers cannot profit and therefore lack incentive. The collected penalties are redistributed to LPs in that market.

2.6.3 Emergency Response Mechanism

We often say blockchain is a dark forest — you never know what threats lurk. What happens if, despite the above safeguards, an unforeseen event threatens user funds? SynFutures activates an emergency protocol: markets triggering risk controls (e.g., significant deviation between market and mark price) are temporarily frozen, risks are assessed, mitigation plans developed, and every effort made to protect user assets.

2.6.4 Large-Profit Withdrawal Verification

For large-profit withdrawals, SynFutures sets a threshold beyond which withdrawals may face a maximum 24-hour waiting period — meaning funds arrive within 24 hours, though users can contact the community to expedite processing. This check ensures profits were earned legitimately, helping safeguard overall fund security.

III. Project Development Status

3.1 Performance Metrics

Since launching SynFutures V3 on the Blast mainnet on February 29:

- Cumulative trading volume exceeds $48 billion

- Daily trading volume approaches $1 billion

- TVL exceeds $54 million

- 7-day active addresses exceed 33,000

Currently the largest decentralized derivatives exchange on Blast, and expected to soon match or surpass projects like GMX, dYdX V4, and Hyperliquid in key metrics as it continues growing.

3.2 Growth Potential

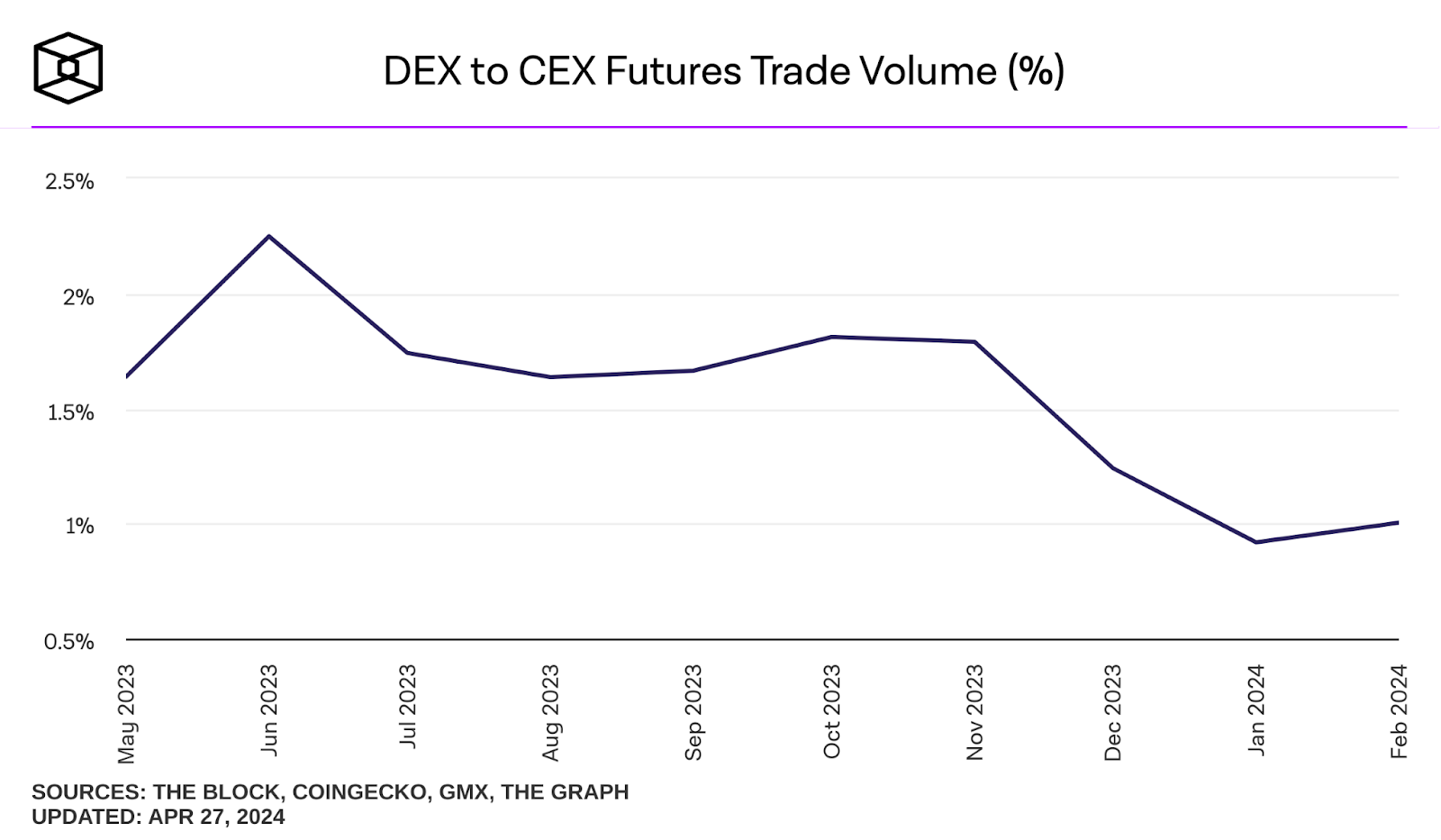

According to The Block, decentralized derivatives currently account for less than 3% of centralized exchange volumes — indicating enormous room for growth. Two clear trends are emerging in DeFi: users increasingly trust established brands, favoring longer-standing projects perceived as safer; and top-tier protocols continue accumulating disproportionate TVL. In this environment, unoriginal clones or copycats stand little chance of overtaking incumbents, let alone challenging centralized exchanges.

The sector demands continuous innovation and iteration to improve trading experience and capital efficiency. Only truly innovative projects can emerge as challengers and disruptors, expanding the market share of decentralized derivatives.

SynFutures V3 exemplifies such innovation: it creatively implements an on-chain order book via oAMM, allowing users to provide liquidity at precise price points; enables market makers to earn direct fee rebates through limit orders, attracting professional participation to enhance capital efficiency and trading quality. Merging active and passive market making into a single, fully on-chain system represents one of the most significant innovations in the derivatives space today.

While Vertex, Bluefin, and RabbitX use Exilier to add passive liquidity to their order books, SynFutures natively achieves passive liquidity provision directly through AMM mechanics — no third-party dependencies, reduced LP risk, and better user experience.

Moreover, SynFutures V3’s permissionless design and “three allowances” — allowing anyone to list any token as collateral at any time, completing the entire process within 30 seconds — establish a new paradigm for decentralized derivatives trading, potentially capturing a meaningful share of the centralized exchange market, much like Uniswap did in spot trading.

3.3 Challenges and Analysis

The main drawback of xyk AMMs is impermanent loss, which is difficult for average users to hedge or manage. Like Uniswap V3, SynFutures’ oAMM also exposes LPs to impermanent loss. Based on public information and AMAs, SynFutures plans to introduce Strategy Vaults in the future — offering proven passive market-making strategies to users, somewhat akin to copy-trading — enabling more risk-averse participants to join safely.

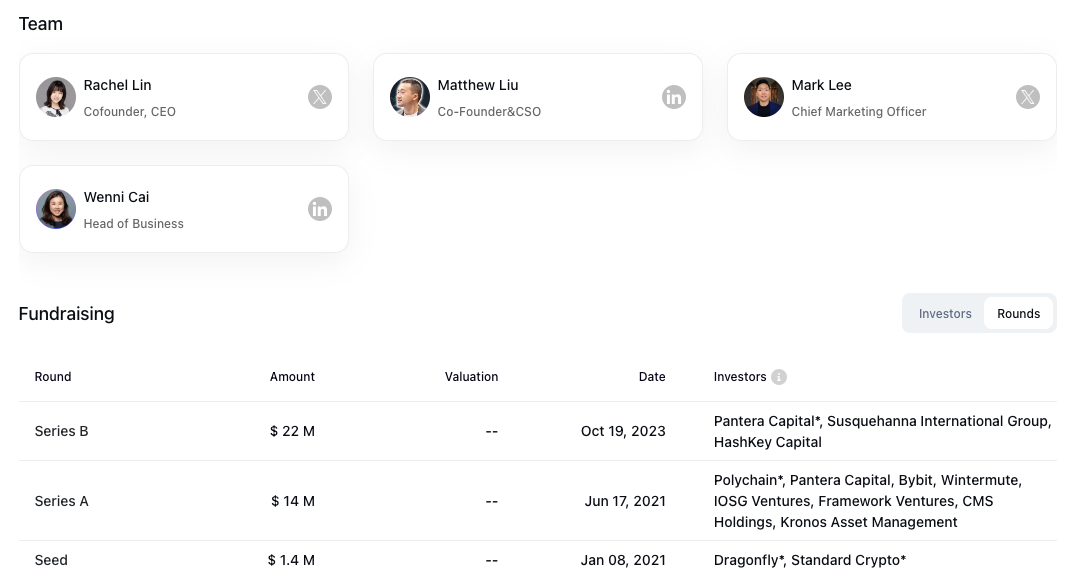

IV. Team Background

SynFutures’ founding team includes professionals with backgrounds from top-tier international investment banks, tech companies, and crypto OGs. The project has attracted investments from Pantera, Polychain, Standard Crypto, Dragonfly, Framework, SIG, Hashkey, IOSG, Bybit, Wintermute, CMS, and Woo, raising over $38 million to date.

V. Conclusion

After the explosive DeFi Summer and DeFi 2.0 eras, DeFi appears to have entered a quiet phase — disruptive innovations are rare, with most efforts limited to minor improvements over existing protocols or novel marketing tactics. SynFutures V3 stands out by creatively merging the two dominant models — AMM and Order Book — and bridging the final gap for centralized-exchange-style market making on-chain. It delivers performance and usability without sacrificing security, transparency, or decentralization. Its permissionless framework and “three allowances” establish a new paradigm in derivatives trading, positioning it as a breakthrough innovator in the decentralized derivatives space.

Decentralization is the elephant in the room — seemingly invisible until it matters. When it does, its importance becomes undeniable. FTX serves as the clearest cautionary tale. Therefore, I strongly support and understand SynFutures’ unwavering commitment to a fully decentralized path. Although current blockchain infrastructure limitations result in a slightly inferior user experience compared to centralized exchanges, I believe that with continued improvements in base-layer scalability, widespread adoption of AA wallets, and maturing infrastructure, decentralized exchanges like SynFutures will soon match — and eventually challenge — centralized giants, securing a significant place in the global derivatives landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News