The next dark horse in the DeFAI sector: How SynFutures is using AI to disrupt DeFi?

TechFlow Selected TechFlow Selected

The next dark horse in the DeFAI sector: How SynFutures is using AI to disrupt DeFi?

This article will delve into SynFutures' DeFAI roadmap.

Author: Viee, Core Contributor of Biteye

With the surge in popularity of AI Agents, the integration of DeFi and AI has gradually become a hot topic in the crypto industry. In the past, although DeFi brought financial freedom, high learning costs, cumbersome interaction methods, and security risks have always been the biggest obstacles to its widespread adoption. Now, the introduction of artificial intelligence promises to completely transform this situation, making on-chain interactions as simple as having a conversation, intelligently optimizing trading logic, and even enabling "AI earning money for you."

In this trend, SynFutures, an experienced player in the DeFi space, plans to build a more intelligent DeFi ecosystem through AI Agents. From automated trading to strategy optimization and AI-driven autonomous decision-making, SynFutures aims to make the DeFi experience smoother.

So how does SynFutures plan to advance DeFAI? This article will delve into SynFutures' DeFAI roadmap and explore why it could secure a significant position in this emerging field.

01 DeFAI: The Game-Changing Tool to Restructure DeFi

Smart contracts made code the rule, eliminated intermediaries, and improved efficiency. But if we look back at developments over recent years, we must admit: DeFi is still some distance away from true intelligence.

Why? Because most DeFi protocols still rely on fixed rules and rigid strategies. Markets evolve quickly, yet capital flows on-chain often lag behind—sometimes only a small number of advanced users can truly navigate this ecosystem. Not to mention that complex operational barriers deter many ordinary users. The integration of AI aims precisely to break through this impasse.

What is the essence of DeFAI? In one sentence: Let AI lead decision-making in DeFi, enabling faster, more efficient, and more precise capital flows.

In the past, DeFi decisions were mostly based on predefined rules. The introduction of AI means more dynamic fund management. For example, interest rates in lending markets no longer remain static, liquidity distribution isn't one-size-fits-all, and even trading strategies can automatically adjust according to on-chain data. This is why projects like Griffain and Aixbt have recently started attracting market attention.

Let’s consider an example: In traditional DeFi, users must manually select assets and configure weights. In contrast, DeFAI algorithms can generate optimal strategies by analyzing market conditions, user risk preferences, and on-chain/off-chain data. In other words, ordinary users only need to set their goals—the rest is handled by AI.

AI can do far more than this—it can enhance risk control, provide early warnings during market volatility, and even automatically rebalance assets; it enables automatic arbitrage and strategy execution, keeping users’ assets in optimal configurations. This is the potential of DeFAI: making liquidity management smarter while lowering the barrier to DeFi usage.

The current DeFAI ecosystem is still in its early stages. Many projects have limited AI capabilities—some use little more than simple automation scripts rather than genuine AI optimization algorithms. But this doesn’t mean the sector lacks future potential. Once AI achieves breakthroughs in on-chain data analysis, smart governance, and automated trading, DeFAI will become a key component of the DeFi market.

02 How Can AI Transform DeFi? Starting with SynFutures' Trading Framework

SynFutures is a decentralized derivatives trading platform backed by top-tier investors including Pantera Capital, Polychain Capital, and Dragonfly Capital. It aims to fully decentralize on-chain futures and perpetual contracts, lower trading barriers, and enable any user to create and participate in derivative markets. Currently, CEXs dominate the market, while most on-chain protocols remain stuck at low capital efficiency and subpar user experiences. Since its founding in 2021, SynFutures has undergone three product iterations, continuously optimizing on-chain derivatives' liquidity mechanisms, gradually building an open derivatives market system that supports permissionless market creation.

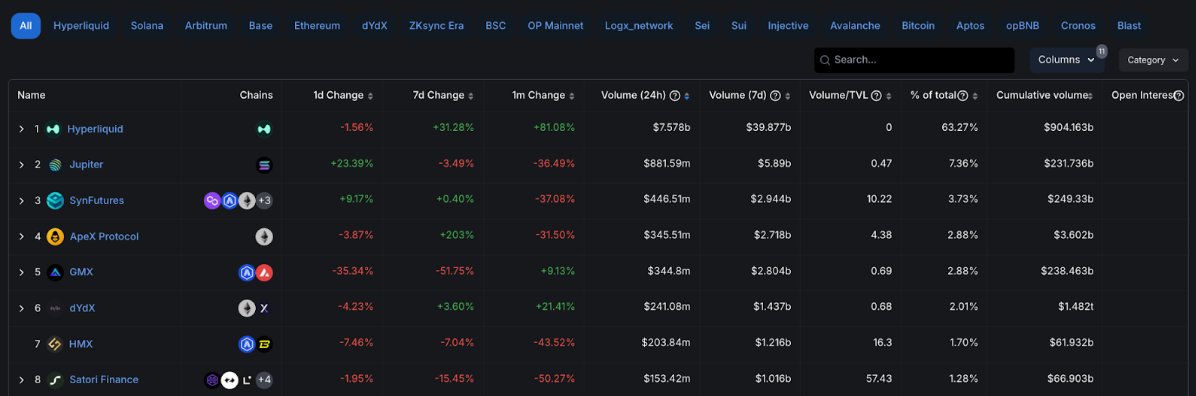

According to Defillama data, SynFutures has achieved nearly $25 billion in cumulative trading volume to date, ranking among the top three in the on-chain perpetual contract DEX category. Platform fee revenue has exceeded $58.48 million. This stable cash flow strongly boosts confidence among developers, users, and partners, providing ample funding for continued investment in AI development.

However, compared to CEXs, decentralized trading still faces many hurdles. Newcomers struggle to grasp trading logic, professional traders spend significant time analyzing markets, and complex cross-chain interactions deter many users. AI integration may reshape the DeFi experience in several ways:

-

Automated transaction execution — AI directly handles on-chain operations for users, including tedious processes like cross-chain transfers.

-

Intelligent market analysis — AI monitors market dynamics and delivers real-time alerts on optimal trading opportunities.

-

Strategy optimization and personalized recommendations — AI provides customized investment advice based on user preferences and trading habits, with one-click execution.

-

Cross-chain intelligent interaction — AI Agents manage assets across different chains, optimize liquidity, and improve yields.

Recognizing this trend, SynFutures has proposed a comprehensive AI-powered DeFi interaction solution—a Web3 AI framework driven by AI Agents.

03 SynFutures' AI Framework: Making DeFi Interaction as Natural as Conversation

From standalone AI Agent trading tools, expanding to an open AI Agent ecosystem, and ultimately evolving into self-learning and self-creating Meta Agents—SynFutures plans to revolutionize DeFi interaction in three major phases:

Phase One: Standalone AI Agents, similar to Aixbt with automated trading

The core value of combining AI technology with DeFi lies in lowering trading barriers and improving execution efficiency. Therefore, SynFutures initially focuses on developing standalone AI Agents dedicated to key DeFi scenarios such as trading, yield farming, and cross-chain transfers.

These standalone AI Agents not only automate transactions but also help users identify optimal trading opportunities and optimize investment strategies, significantly reducing the entry barrier to DeFi. Specific features include:

-

Trading AI Agent (Synthia): Capable of executing on-chain transactions including Swap, Bridge, and Transfer. Users simply input their goals, and the AI completes all operations. Integrated with SynFutures' Spot Aggregator, it supports cross-protocol trading to improve asset management efficiency.

-

Alpha Hunter Agent: Monitors on-chain transaction activity to identify high-value opportunities such as high-yield liquidity pools, arbitrage possibilities, and price anomalies. Combines AI algorithms to automatically deliver trading signals with one-click execution for enhanced efficiency.

-

AI Social Trading Assistant: Allows users to interact with AI directly on social media platforms (Twitter, Discord), issue trading commands, and achieve "one-sentence trading." The AI can automatically generate market analysis and adjust trading strategies.

Phase Two: Open AI Agent Ecosystem, inspired by Virtuals and ElizaOS

After standalone AI Agent tools mature, SynFutures’ second phase will focus on advancing its Web3 AI Framework—enabling more users and developers to create and customize their own AI Agents. This framework will act as an open "AI Agent factory," featuring several key upgrades:

-

Open developer framework: Provides APIs/SDKs for developers to customize on-chain interactions, risk management, and other functions with AI Agents.

-

Visual no-code builder interface: Enables users to create AI Agents via drag-and-drop design without programming, lowering development barriers.

-

Multiple scenario templates: Helps users quickly launch trading and asset management functions.

-

Built-in monetization mechanisms: Supports token issuance, staking, airdrops, and other business models, creating additional profit opportunities.

-

AI Agent marketplace: Allows users to trade agent templates, plugins, and data APIs, further promoting ecosystem growth and innovation.

Phase Three: Meta Agents – Self-Generating AI Agents

With the arrival of the Meta Agents ecosystem, SynFutures will lead the third phase by enabling AI Agents to self-generate and evolve. Meta Agents will autonomously create and manage AI Agents based on task requirements, fundamentally transforming how users interact with DeFi. Instead of manually selecting or configuring AI Agents, users simply define their goals—Meta Agents will analyze and automatically generate the most suitable agents for execution.

Moreover, multiple AI Agents will collaborate on complex tasks such as automatically optimizing returns or portfolio strategies, continuously improving through reinforcement learning and feedback loops. The emergence of Meta Agents will drastically reduce DeFi operation complexity, laying a solid foundation for broader DeFi adoption and mass user onboarding.

04 Competitive Landscape Analysis of the DeFAI Sector: What Unique Advantages Does SynFutures Have?

Several projects are already exploring AI integration in DeFi, such as Griffain and Grift. In this race, different projects take distinct approaches. Some focus on trading functionality, others aim to build AI-driven DeFi applications, while some attempt to turn AI into personal DeFi assistants. Each type serves different purposes and advances the intelligence of DeFi:

Assistant-type DeFAI primarily simplifies DeFi operations—users express intent, and the AI Agent executes trades and manages assets. These products typically offer automated transaction execution, wallet management, and even Meme issuance. For instance, certain AI Agents specialize in automating DCA (dollar-cost averaging), staking, and yield optimization, while others focus on cross-chain interactions, searching hundreds of DeFi protocols for optimal strategies so users don’t need to switch platforms manually.

Trading-focused DeFAI automates trading decisions—for example, using historical market data to optimize DeFi portfolios. Some advanced AI Agents can even execute delta-neutral strategies, generating steady returns while mitigating risk. Other market-analysis AI Agents function as intelligent alpha-hunting tools, monitoring on-chain capital flows and trading trends, leveraging AI to predict market movements and help users precisely capture investment opportunities.

Another category consists of AI-driven dApps—these are not single-function AI Agents but full decentralized applications where AI Agents form a core architectural component. For example, such AI dApps can help users automatically find the best deposit rates in lending markets and maximize yield.

Compared to these existing DeFAI projects, SynFutures holds several distinct advantages that enhance its market competitiveness:

1. Strong DeFi ecosystem support: SynFutures has achieved outstanding results in the Base ecosystem and derivatives markets. Its market share and technical expertise in DeFi far exceed those of most AI+DeFi startups. Compared to new entrants, SynFutures understands DeFi better and deeply grasps the real pain points of traders.

2. Open AI Agent framework: SynFutures plans to open its AI Agent development framework, allowing users to customize their own AI Agents and personalize DeFi trading. AI Agents are not just auxiliary tools—they are adaptable, learnable, personalized assistants.

3. Severely undervalued with high growth potential: Currently, SynFutures has an FDV of only $320 million, significantly lower than Virtuals’ $1.32 billion FDV. As market recognition of DeFAI grows, SynFutures holds substantial potential for valuation re-rating.

4. Professional AI team backing: Beyond deep expertise in DeFi, SynFutures has successfully recruited top AI talent over the past six months, forming a powerful AI team that has published research in leading academic journals. This interdisciplinary, cutting-edge tech team creates additional technical moats, giving SynFutures a competitive edge in the DeFAI landscape.

05 Conclusion: Can AI Agents Become Standard in DeFi Trading?

When AI-powered trading can resolve the complexity of DeFi interactions and demonstrate sufficiently advanced intelligent trading capabilities, it is highly likely to become standard in future DeFi trading. SynFutures currently stands at the forefront of this trend, possessing solid technical advantages in DeFi and steadily progressing in DeFAI implementation.

The DeFAI era may be quietly arriving. The future of DeFi trading is expected to become increasingly intelligent and automated. Leveraging the momentum of DeFAI and its own strengths, SynFutures is well-positioned to expand its market share and emerge as the next dark horse in the AI+DeFi ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News