How is DeFAI faring after the hype? A look at the current status of six popular projects

TechFlow Selected TechFlow Selected

How is DeFAI faring after the hype? A look at the current status of six popular projects

These projects are leveraging the most innovative AI technologies to transform complex on-chain operations into accessible financial tools for everyone.

Author: Blockchain Knight

A report released earlier this year by CoinMarketCap sparked widespread industry discussion, introducing the concept of the "Agentic Web"—a decentralized network led by AI agents—bringing projects like ai16z and Virtuals into the spotlight. At the same time, a new term quickly entered public consciousness: DeFAI, or Decentralized Finance + Artificial Intelligence.

In simple terms, DeFAI represents an innovative attempt to integrate AI technology into the DeFi ecosystem. By leveraging intelligent agents (AI Agents), it automates complex financial operations such as trade execution, risk management, and yield optimization—improving efficiency while lowering the barrier for ordinary users to access DeFi. As widely echoed on the X platform: "DeFi was the past, AI is now, DeFAI is the future." This trend is rapidly gaining momentum.

The surge in DeFAI is not without cause. From late 2024 to early 2025, multiple projects launched in quick succession, showcasing diverse possibilities for combining AI with DeFi. To better understand this emerging sector, this article reviews recent developments from several representative DeFAI projects. Despite a generally weak market, these teams continue building, demonstrating how technological innovation drives the industry forward.

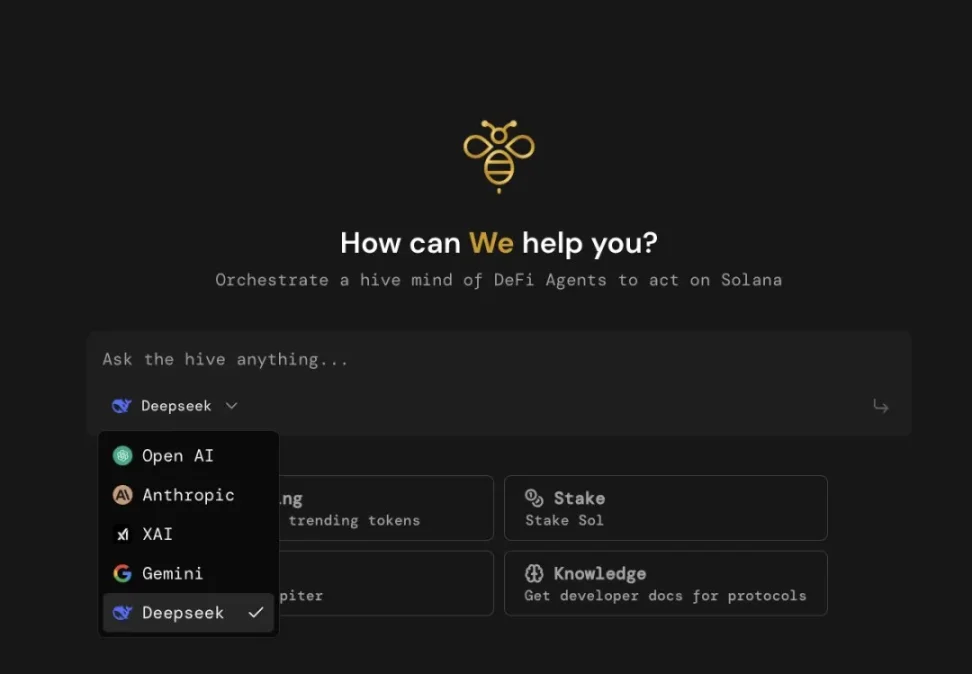

1. The Hive

Project Overview:

The Hive is a decentralized platform built on the Solana blockchain that simplifies and enhances DeFi operations through a coordinated network of interoperable AI agents. It offers token analytics, liquidity management, staking, and trading tools—all powered by AI to deliver real-time insights and automation. Prioritizing user-friendliness, The Hive combines social media data (e.g., X posts) with on-chain analysis and continuously optimizes its technical infrastructure for scalability.

Latest Developments:

-

Token Analysis Agent Upgrade: In January, The Hive launched an upgraded token analysis agent focused on optimizing token liquidity pool (LP) management, including charting tools for visualizing token data, updated UI for token data, enhanced search APIs, and more.

-

Community-Driven UI/UX Improvements: Mid-January saw updates such as automatic USD conversion, interactive transfer tools, and collapsible sidebars, significantly improving usability.

-

Comprehensive Platform Enhancements: Throughout February, a broad range of updates were rolled out across multiple aspects of The Hive ecosystem, including integration of token dashboards, enhancements to liquidity and trading agents, improved staking pool UX, query/input upgrades, and increased API rate limits.

Future Outlook:

-

While currently focused on Solana, growing demand for cross-chain interoperability in DeFi may lead The Hive to explore cross-chain integrations, expanding its market reach. Additionally, The Hive could further develop its AI agents beyond current functionalities. Given its "modular network" positioning, it may introduce more customizable agents tailored to different user needs.

2. griffain

Project Overview:

Griffain is a Solana-based AI-driven platform offering automated trading, liquid staking, and data analytics via autonomous agents. It has built a modular AI agent ecosystem designed to leverage both AI capabilities and Solana’s performance advantages, enabling users to manage crypto assets more intelligently and efficiently.

Latest Developments:

-

Agent DeepSeek: At the end of January, Griffain introduced "Agent DeepSeek," part of its "Agent Engine" suite, aligning with its broader AI-driven strategy by extending agent functionality from trading to data-driven insights.

-

Agent Sniper Launch and Upgrade: In mid-to-late February, Griffain launched "Agent Sniper," a tool designed for trading newly launched tokens on Pump.fun (a popular token launch platform on Solana). Its automation and precision appeal to traders aiming to capitalize on early token trends.

-

Griffain Virtual Validator & Collaboration with Marinade Finance: In early March, Griffain launched a "virtual validator" service for staking Solana (SOL), powered by Marinade Finance—one of Solana's leading liquid staking protocols. The term "virtual" indicates that the staking process is abstracted and managed through the Griffain platform interface, eliminating the need for users to interact directly with native Solana validators. Integration with Marinade enables users to receive liquid staking tokens (e.g., mSOL), which can be used across DeFi while earning staking rewards.

Future Outlook:

The "virtual validator" may mark the beginning of Griffain's expansion into broader DeFi territory. Future plans could include deeper integrations with other major Solana protocols such as Jupiter and Raydium, offering one-stop DeFi solutions—for example, automated strategies combining staking and trading. By enhancing API capacity (such as optimizing the Agent Engine) and potentially launching developer programs, Griffain may attract more developers to build third-party applications on its platform.

3. Cod3x

Project Overview:

Cod3x is a DeFAI platform dedicated to lowering the barrier for users to participate in blockchain finance by integrating DeFi and AI technologies. It enables ordinary users—without specialized programming skills—to easily deploy AI agents for efficient, intelligent on-chain fund management and trading. The platform aims to provide a convenient, secure, and feature-rich environment where users can create personalized AI agents tailored to various financial scenarios such as degen trading, tax management, and DCA (Dollar-Cost Averaging) investment strategies, promoting broader adoption and deeper integration of AI within DeFi.

Latest Developments:

-

Collaboration with Hyperlane: On February 18, Cod3x partnered with Hyperlane to launch $TONY on Solana. Matching the market cap of versions on other chains, $TONY achieved $5 million in trading volume within the first five minutes due to Solana's volatility.

-

Cod3x Create V0.5: Released on February 21, this update featured a new backend architecture, prompt-free interface, scheduling system, and plugin framework—laying the foundation for dynamic AI agents capable of responding in real time to market trends.

-

Participation in Growth Programs: Cod3x has officially joined the Cookie3 Growth Partner Program and will take part in Cookie DAO’s multi-airdrop farming initiative. Cod3x’s trading agents now have access to richer data resources, including market attention metrics and sentiment indicators from the CookieDAO platform, enabling deeper market trend analysis and precise execution of trading strategies—giving them a competitive edge in volatile markets.

Future Outlook:

-

As the DeFAI space continues to grow, Cod3x is poised for breakthroughs in several key areas. Technically, it plans to release Big Tony V2, further refining the functionality and performance of its AI agents. In ecosystem development, Cod3x will collaborate with Sophon Intelligence Agency (S.I.A.) in March to launch Sophon Spark—a flagship project valued at $1.5 million—aimed at advancing DeFi through AI-driven systems that allow users to build custom AI agents without coding, capital, or technical expertise. Additionally, collaboration with the Sophon blockchain network, combined with ongoing innovation and expanding partnerships, positions Cod3x to attract more developers and users to actively engage in its ecosystem.

4. Hey Anon

Project Overview:

Founded by renowned DeFi developer Daniele Sesta, Hey Anon is a project focused on AI-powered DeFi automation tools. Built using TypeScript, it enables DeFi operations via conversational language on Telegram, combining AI-powered market insights with automated agent services for DeFi protocols. The project aims to dramatically improve trading efficiency and reduce operational complexity, supporting a wide range of DeFi actions across multiple blockchains, delivering convenient and efficient services in the complex DeFi landscape.

Latest Developments:

-

Hey Anon Build 0.3: Launched on March 1 on Solana, this version allows users to create or connect existing Solana wallets within the HeyAnon app and execute swaps directly on the Solana network.

-

Public Beta v0.1: Announced on February 1, Public Beta v0.1 simplifies DeFi operations such as executing swaps, cross-chain bridging, and managing DeFi strategies. Users issue commands and specify preferred protocols; the platform handles the rest. Accessible via heyanon.ai, this early version will see frequent updates adding features and protocol support.

-

Integration with Bubblemaps: On March 1, Hey Anon integrated Bubblemaps, a blockchain data visualization platform, bringing direct access to token distribution, holder analysis, and decentralization metrics within Hey Anon.

-

Launch on CowSwap: The decentralized exchange protocol CowSwap is now live on Hey Anon, offering MEV-protected swaps and limit orders on Base, Arbitrum, Gnosis, and Ethereum mainnet.

Future Outlook:

Though only 11 weeks old and still in testing, Hey Anon’s v0.3 already supports multi-chain functionality with more features than any other DeFAI project. With Solana now supported, Hey Anon plans to deepen collaborations with additional blockchains and DeFi projects, continuously expanding the range of supported public chains and use cases.

5. Orbit

Project Overview:

Orbit is an AI-driven DeFi assistant platform that simplifies user operations on blockchain through automation tools and smart contract management. Its capabilities span cross-chain betting and asset bridging, staking, yield strategy optimization, lending protocol access, and comprehensive portfolio management. Supporting over 100 blockchains and more than 200 DeFi protocols, Orbit delivers seamless asset management and trading experiences, lowering entry barriers and enhancing usability.

Latest Developments:

-

On-Chain Automation: In July last year, Orbit launched on-chain automation, allowing users to set conditions for automatic trade execution—further enhancing trading experience and strengthening data-driven decision-making capabilities.

-

Feature Expansion and Integrations: On February 11, Orbit integrated KyberSwap’s liquidity protocol, providing fast and efficient swap experiences. In May last year, it partnered with DEX Screener, enabling its AI agents to detect emerging tokens in real time, allocate funds, and optimize portfolios—delivering smarter investment tools. The platform also integrates market sentiment data from X to provide real-time trend insights.

-

ORBIT V2.0: The most anticipated upcoming release is ORBIT V2.0, though the exact launch date remains unannounced. V2.0 will adopt a hybrid interface, allowing continued on-chain execution while introducing a new paradigm where AI agents construct on-chain activities. Users can initiate multi-agent workflows via agent buttons to achieve more complex goals. Furthermore, ORBIT V2.0 will combine AI agent wallets with delegated actions, granting agents greater autonomy when executing transactions.

Future Outlook:

Compared to other solutions, Orbit stands out through its powerful integration capabilities. Emphasizing cross-chain functionality, Orbit already connects seamlessly with over 117 chains and 200 protocols. Going forward, it will continue expanding support for additional public chains. The release of ORBIT V2.0 is highly anticipated, expected to enable users to build complex on-chain applications and further elevate platform efficiency and user experience.

6. Neur

Project Overview:

Neur is an AI assistant tailored for the Solana ecosystem—an open-source, full-stack application. Through an AI-powered conversational interface, it enables users to interact naturally with DeFi protocols, NFTs, and other Solana services using plain language. Leveraging advanced AI models such as Claude 3.5-Sonnet and GPT-4, Neur offers features including smart wallet functions, NFT management, and market trend tracking.

Latest Developments:

Early Access Program (EAP): On January 1, Neur reported reaching 5,587 non-paying users and 389 EAP participants in its first week on Solana. EAP costs 1 SOL, and participants will receive lifetime access upon official launch.

Privy Wallet Integration: On January 22, Neur enabled Privy’s embedded wallet, allowing users to send assets with just a few clicks—significantly improving asset interaction experience.

Neur v0.3.4 Live: Released on February 14, the update added prompt management, enhanced UI, integration with Cookie.fun, and fixed several data bugs.

Future Outlook:

Currently in early testing, Neur is focused on developing core infrastructure and agent capabilities while continuously refining platform features. Its roadmap outlines ambitions to build scalable infrastructure and AI-driven automation for crypto management—including more user-friendly login pages, chat interfaces, and streaming components for real-time blockchain interactions.

Additionally, Neur’s next phase includes building open-source tools for parsing on-chain events, aiming to attract more contributors—especially developers interested in building and integrating. By enabling parsing of transaction data from various protocols, Neur lays the groundwork for creating automated tools. Ultimately, Neur aims not just to deliver a useful product but to foster a collaborative ecosystem where developers can co-build, share, and enhance on-chain automation.

Conclusion

The six DeFAI projects highlighted in this article—from cross-chain intelligent management and automated strategies to natural language interaction—each demonstrate the transformative potential of merging AI with DeFi. These initiatives are leveraging cutting-edge AI technologies to turn complex on-chain operations into accessible financial tools for everyone.

From these pioneering projects, we can identify several key transitions likely shaping the future of the DeFAI ecosystem. First, from automation to autonomy: while current AI agents mostly rely on predefined rules, next-generation models may incorporate reinforcement learning for adaptive strategy evolution—such as The Hive’s proposed “adaptive liquidity management.” Second, from single-chain to fully interconnected AI agent networks: a future may emerge where AI agents freely operate across multiple chains, automatically selecting optimal execution paths so users no longer need to worry about underlying protocols. Third, from tools to infrastructure: as seen with Neur’s open-sourcing of on-chain parsing tools, AI projects are shifting from closed services to foundational platforms, inviting more developers to contribute and co-create the ecosystem.

DeFAI is reshaping DeFi by making it smarter, simpler, and more accessible. Although the overall DeFAI sector currently operates in a market downturn, continuous expansion of AI-powered dApps into new application scenarios suggests a significant transformation in DeFi’s intelligent evolution may arrive this summer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News