Interpreting Mode Network: An Ethereum-based Full-Stack DeFAI L2 Solution

TechFlow Selected TechFlow Selected

Interpreting Mode Network: An Ethereum-based Full-Stack DeFAI L2 Solution

Mode's core goal is to develop open-source tools for the Superchain ecosystem, supporting native yield, smart vaults, and on-chain AI agents.

Author: Memento Research

Translation: TechFlow

Mode is an Ethereum Layer 2 (L2) solution built on the OP Stack and a key component of the Optimism Superchain. It aims to enhance Ethereum's scalability, particularly within decentralized finance (DeFi).

Mode’s core objective is to develop open-source tools for the Superchain ecosystem, supporting native yield, smart vaults, and on-chain AI agents.

Since its official launch in January 2024, Mode has grown rapidly, attracting over $700 million in cross-chain funds within just a few months.

Currently, Mode is focused on building a future driven by an autonomous on-chain economy through its DeFAI stack.

Report Summary

This report will explore the following topics:

-

The evolution from DeFi to DeFAI and its future potential;

-

Mode’s DeFAI stack and its strategic positioning as a leading DeFAI chain;

-

An overview of Mode’s current ecosystem and its competitive standing in the industry;

-

Mode’s future development plans, including expanding DeFi through on-chain agents and AI-driven financial tools;

From DeFi to DeFAI: The Evolution of Technology and Applications

Limits of DeFi

Decentralized finance (DeFi) has made significant progress in recent years, with total value locked (TVL) now exceeding $120 billion. However, DeFi still faces several critical challenges that hinder broader adoption:

-

Investment Complexity: Users struggle to identify optimal yield opportunities, and the lack of clear investment strategies can lead to inefficient capital allocation.

-

Fund Risk: Impermanent loss (losses liquidity providers may suffer due to price volatility) and smart contract vulnerabilities deter many users, especially on decentralized exchanges (DEXs).

-

Fragmented Cross-Chain Liquidity: Liquidity is scattered across multiple blockchains, making cross-chain transactions inefficient and cumbersome.

-

Poor User Experience: DeFi interfaces and operations remain complex, creating high barriers for new users and limiting mainstream adoption.

Addressing these issues is crucial for advancing DeFi into its next phase and enabling more users to access efficient, secure financial services.

The Rise of DeFAI

As artificial intelligence (AI) technology gradually integrates into the crypto space, DeFi is undergoing a profound transformation. Early projects like Bittensor, Akash, and Render have demonstrated AI’s potential, but market momentum was truly ignited by AI-themed tokens such as GOAT.

GOAT, a memecoin backed by the AI chatbot Truth Terminal, saw its market cap surge past $1 billion within days. This phenomenon sparked widespread interest in AI, accelerating the shift from speculative tokens toward practical AI applications.

The convergence of DeFi and AI, known as DeFAI, is rapidly forming a new frontier in crypto. Projects like Orbit, Griffain, and Mode are leveraging AI to optimize DeFi decision-making, helping users improve yield farming returns, trading strategies, and portfolio management efficiency.

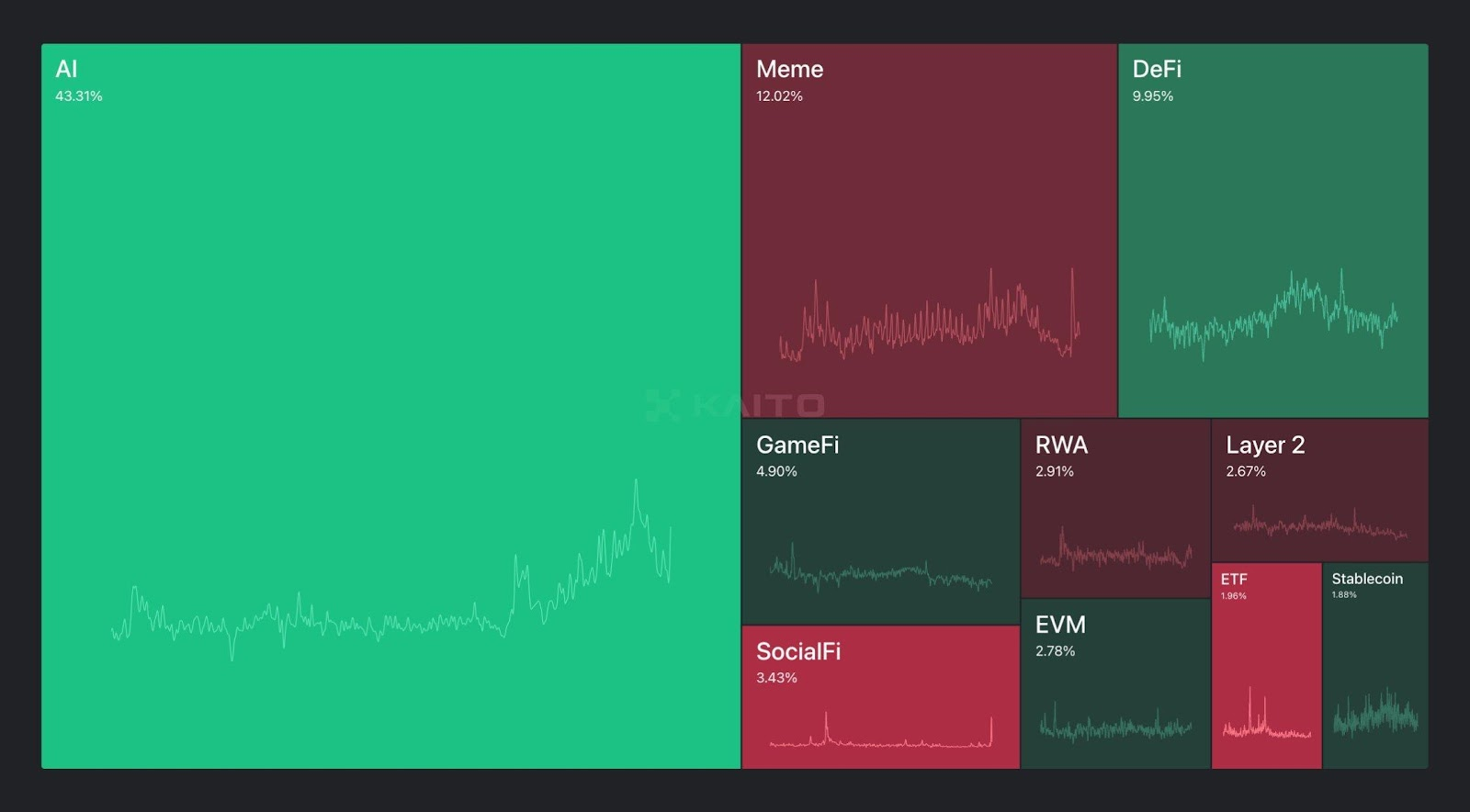

The DeFAI market currently holds a total market cap of $2.11 billion, capturing 53.26% of market attention—surpassing traditional memecoins.

Market Attention by Current Narrative

Source: Kaito

DeFAI Products and Development Potential

Categorization of the Existing DeFAI Ecosystem

The DeFAI ecosystem can be divided into four main areas—a framework first proposed by @poopmandefi:

-

AI Abstraction and User Experience Layer: Frontend GPT technologies can already execute tasks like buying/selling tokens, yield farming, and portfolio management via natural language commands. This abstraction lowers the barrier to entry, enabling broader user accessibility.

-

Market Analysis and Trend Prediction: AI agents (e.g., AIXBT) can aggregate data from social media platforms like Twitter to forecast market trends. While not yet fully automated, future AI agents may directly execute trading strategies.

-

AI Infrastructure and Platforms: Platforms like Virtuals and ai16z provide robust technical support for AI agents. In the future, dedicated DeFAI app stores may emerge, offering customized AI tools for yield optimization and risk management.

-

Yield Optimization and Investment Automation: Integrating AI into DeFi enables automated investment strategies that maximize returns and optimize risk management. This automation-centric approach will also significantly improve capital efficiency in DeFi.

Development Potential of DeFAI

DeFAI brings new possibilities to DeFi, solving long-standing issues such as complex workflows and inefficient capital allocation.

Although DeFAI’s current market cap of $2.1 billion is small compared to DeFi’s $128 billion, its growth potential is substantial.

As technology matures and user adoption grows, DeFAI is poised to become a cornerstone of the crypto economy, seamlessly combining the strengths of artificial intelligence and decentralized finance.

Mode: Leading the Full-Stack DeFAI Chain

About Mode

Mode is an Ethereum Virtual Machine (EVM)-compatible Layer 2 solution built using OP Stack technology. As part of the OP Superchain, Mode benefits from this interoperable blockchain ecosystem. Using optimistic rollups, Mode processes transactions off-chain before batching settlements to Ethereum’s mainnet. This design ensures fast, cost-effective transactions while maintaining Ethereum’s security.

Since its mainnet launch in February 2024, Mode has achieved notable milestones:

-

Over 59 million transactions processed;

-

73 DeFi protocols deployed;

-

More than 400,000 users;

-

Total Value Locked (TVL) reaching $400 million, ranking third among Superchain L2 solutions.

Building on this foundation, Mode is developing full-stack DeFAI infrastructure to meet the demands of this emerging field. As a DeFi-focused L2 chain, Mode aims to scale DeFi to billions of users through on-chain agents and AI-powered financial applications.

To support this vision, Mode has funded five projects and supported nine teams through the AIFI accelerator. Additionally, Mode launched a Synth subnet based on Bittensor and an AI agent app store, and successfully hosted a DeFAI hackathon.

As of January 2025, Mode has deployed over 7,300 AI agents and processed 12,800 AI transactions. With rising demand for DeFAI, Mode is leading the charge toward a fully autonomous on-chain economy.

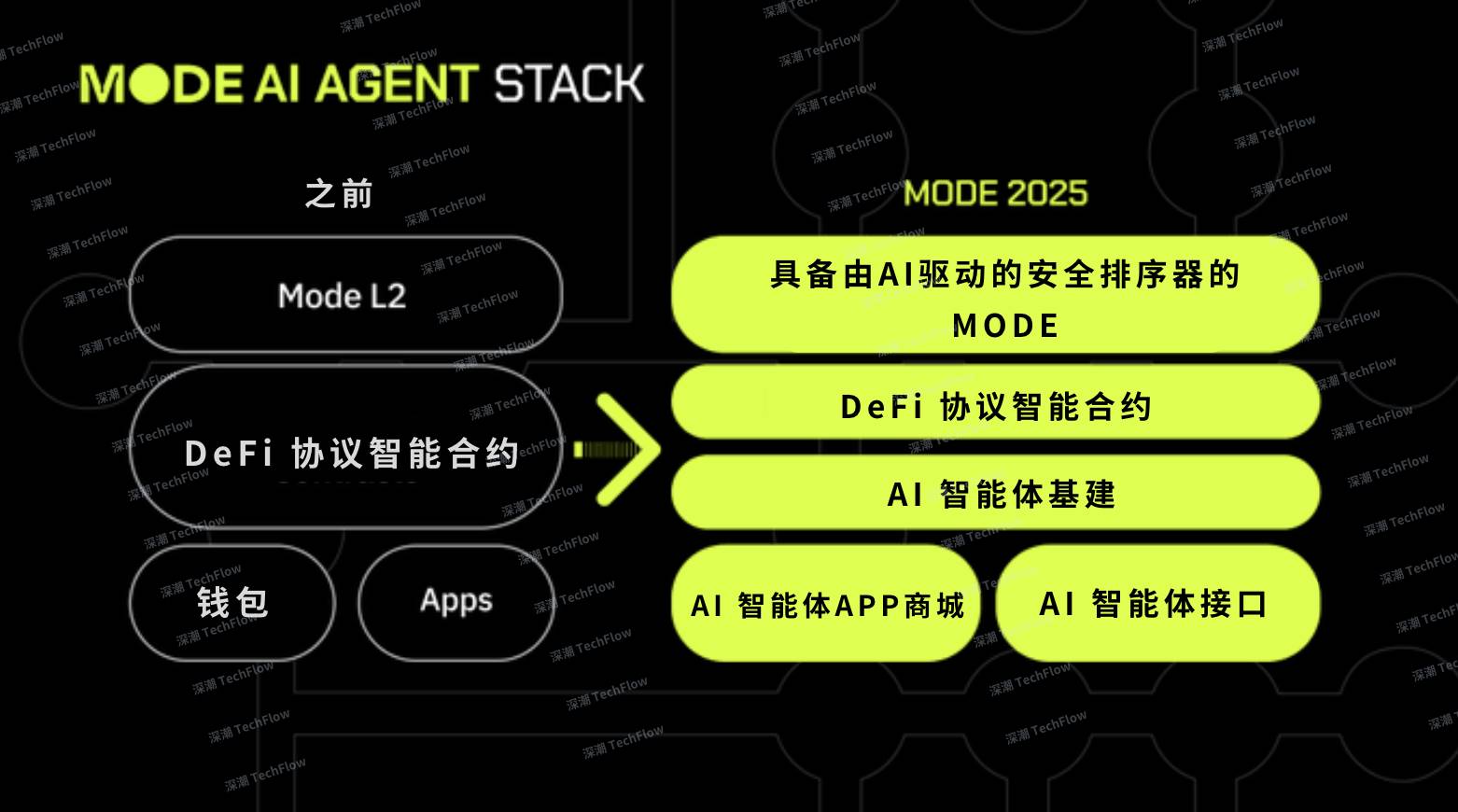

What Is Mode’s DeFAI Stack?

Mode’s DeFAI Stack

Source: Mode (translated by TechFlow)

-

Interface Layer

Mode’s interface layer introduces two innovative solutions: AI Terminal and AI Agent App Store. These tools redefine how users interact with DeFi, enabling AI-powered automation of on-chain transactions, smart contract deployments, and asset management—all without relying on multiple dApp frontends.

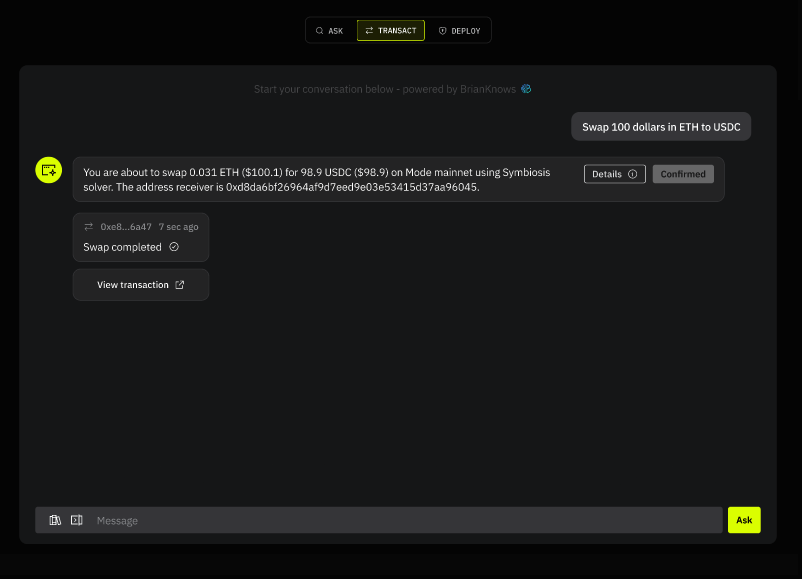

AI Terminal: Your DeFi Smart Assistant (Beta to launch in January 2025 for $MODE stakers)

AI Terminal, Your DeFi Smart Assistant

Source: Mode

AI Terminal is a GPT-powered DeFi interface that helps users easily perform the following tasks:

-

Manage cross-chain portfolios;

-

Deploy smart contracts and distribute tokens;

-

Launch NFT projects and interact with on-chain assets;

-

Execute staking and yield farming strategies with AI assistance.

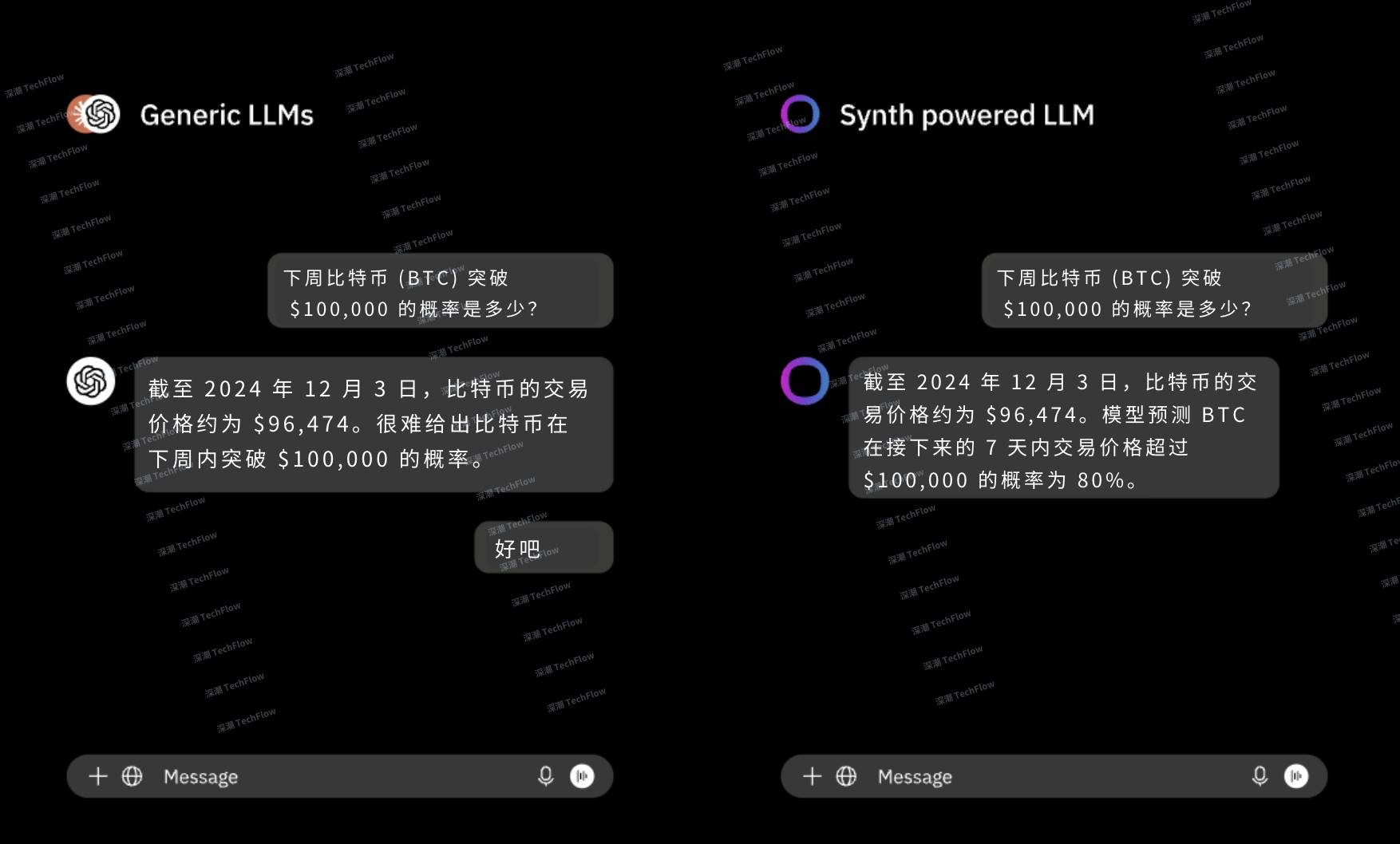

A key feature of AI Terminal is its deep integration with Synth—a synthetic data layer that provides users with high-precision market probability analysis, a capability unmatched by other large language models (LLMs) or AI agents today.

As a DeFi smart assistant, AI Terminal simplifies access to DeFi applications, initially supporting the Mode ecosystem with plans to expand to multi-chain operations in the future.

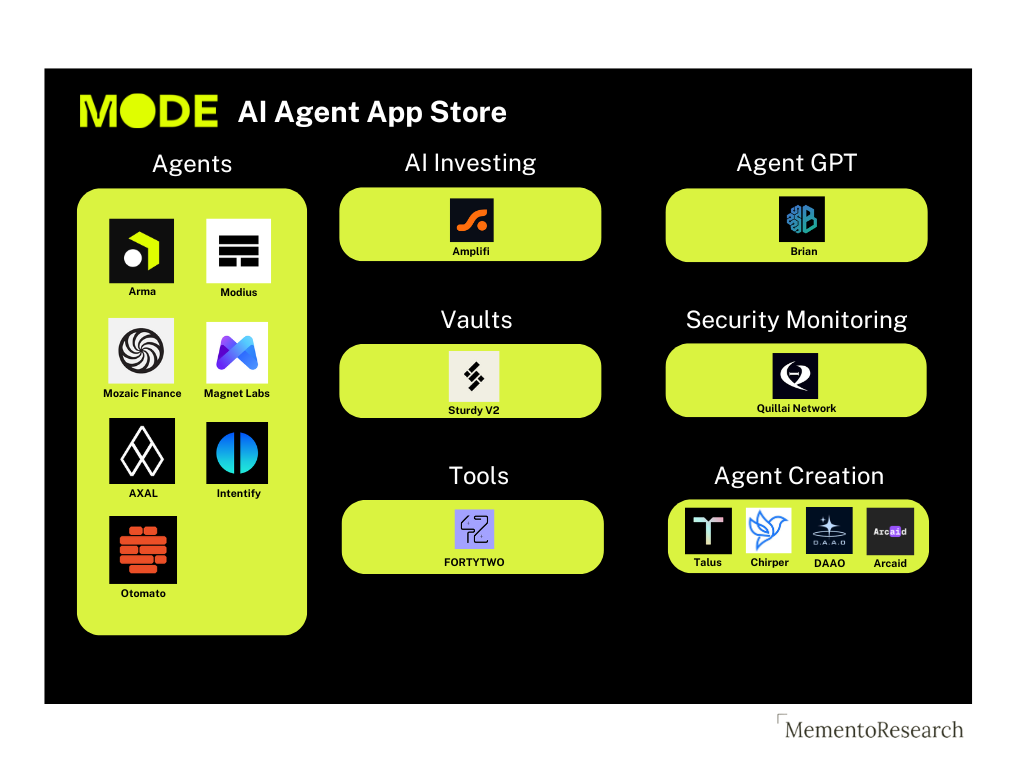

AI Agent App Store: An Integrated Platform for On-Chain AI Strategies

Mode’s AI Agent App Store

Source: Mode

The AI Agent App Store is a dedicated platform offering DeFi strategy AI agents. Since launching in November 2024, it has achieved:

-

Deployment of 7,349+ AI agents (running on Giza and Olas);

-

Management of over $332K in assets.

As a coordination platform, the AI Agent App Store offers various pre-built AI agents to help users complete specific DeFi tasks.

In the future, the platform will introduce additional frameworks and launch tools. New agents planned for release this year will focus on automated governance, cross-chain strategies, and autonomous protocol deployment on Mode.

-

Data Layer

Data and computation are foundational to AI agent development—both are essential.

The intelligence of AI agents depends on the quality of their training data. However, many existing financial AI agents struggle to deliver accurate predictions or probabilistic analysis due to a lack of high-quality synthetic price data.

To address this, Mode created the Synth subnet on Bittensor, specifically designed to provide high-quality synthetic price data to power AI agents and LLMs. This innovation unlocks new DeFi use cases, including:

-

Optimizing liquidity ranges for automated market makers (AMMs);

-

Option pricing based on probabilistic models;

-

AI-driven trading strategies using multi-path simulations.

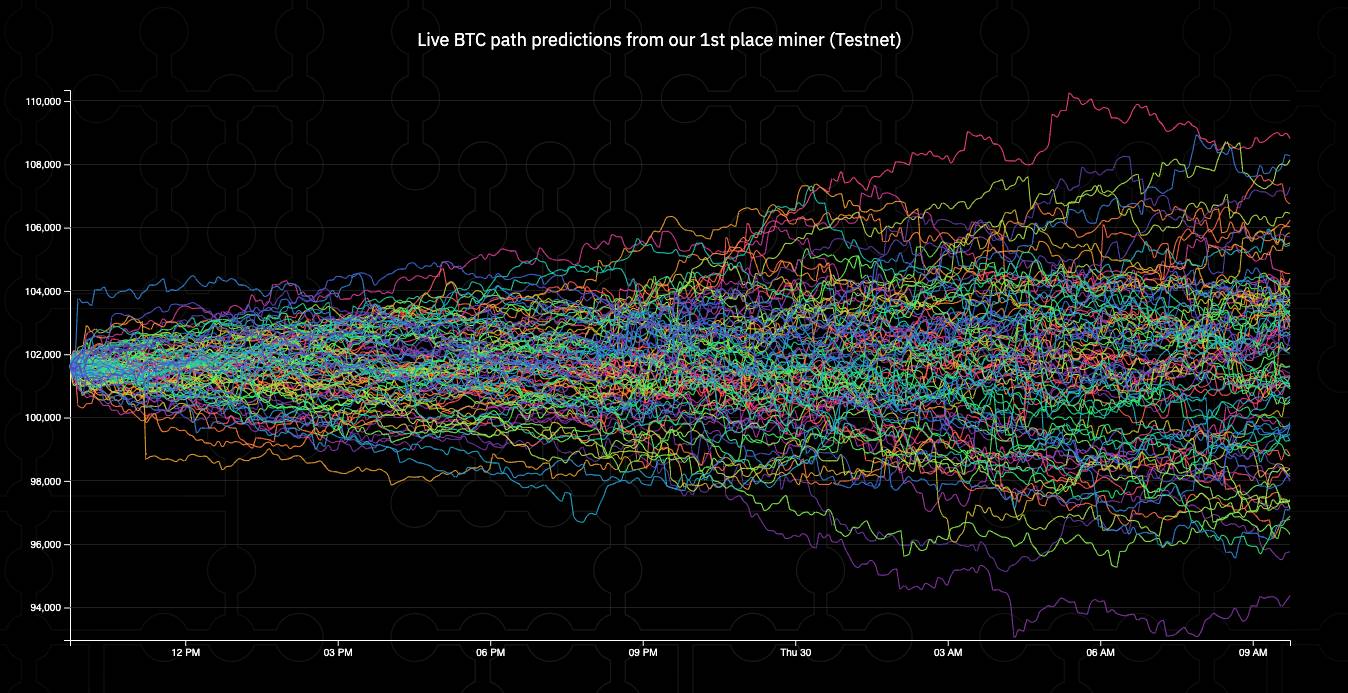

The Art of Prediction? Yes, That’s Exactly What Makes Synth Unique

Source: Mode

Mode focuses on generating full probability distributions of price movements, rather than single-point predictions. This capability opens up entirely new possibilities for risk management and yield optimization in DeFi.

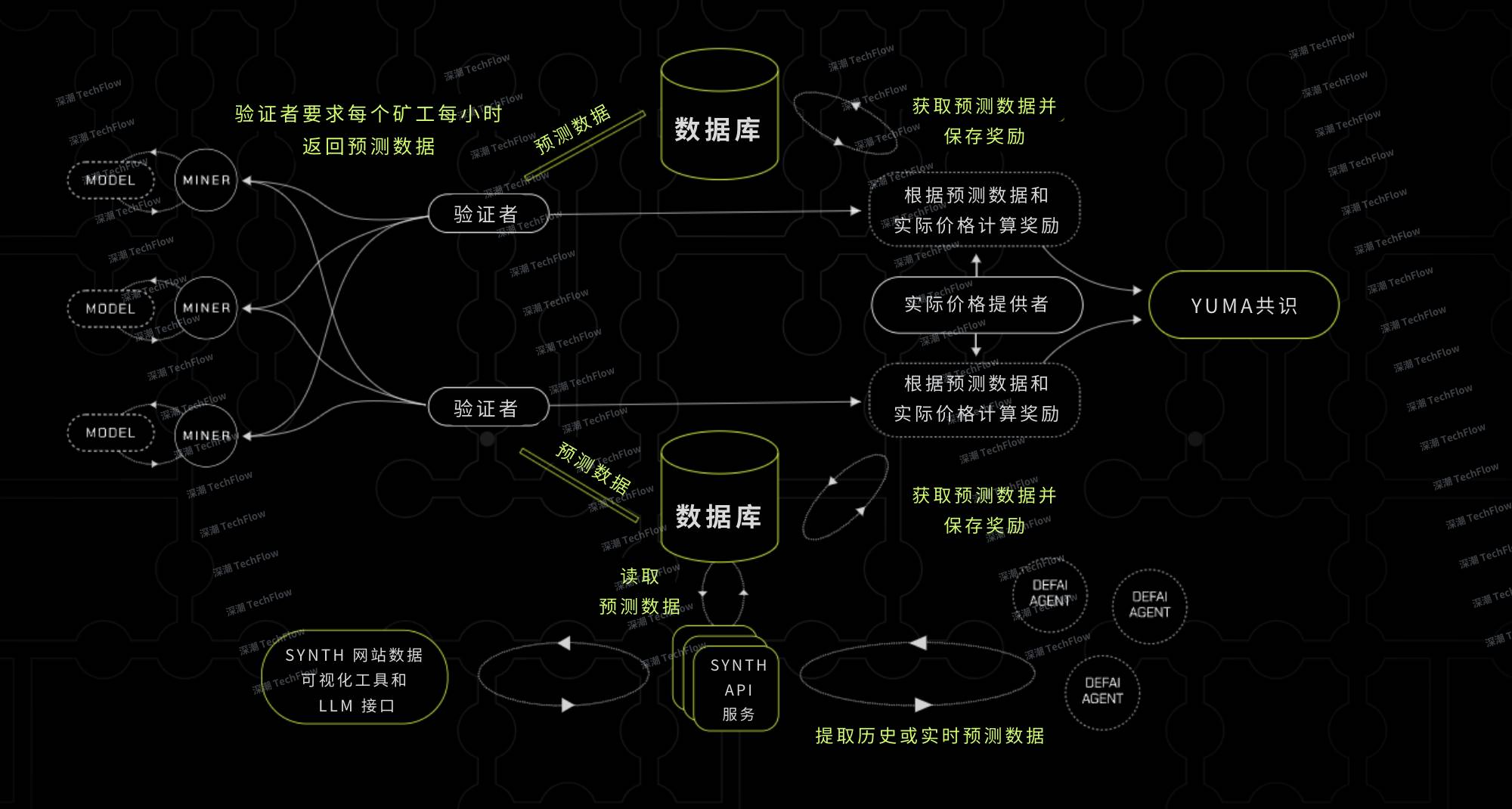

Synth’s Workflow

Source: Mode (translated by TechFlow)

How It Works

Mode’s Synth subnet generates precise probabilistic forecasts by simulating multiple price paths. Unlike traditional models that predict a single price, Synth captures real market dynamics, including extreme volatility and price shifts.

The system uses Continuous Ranked Probability Score (CRPS) to evaluate prediction accuracy, measuring performance in two key aspects:

-

Sharpness: How precisely the model predicts price ranges;

-

Calibration: How well predictions align with actual market changes. This mechanism enables AI agents to make smarter, more adaptive decisions.

With the recent mainnet launch of the Synth subnet (SN50) on Bittensor, Mode’s DeFAI agents now gain real-time access to probabilistic forecasting capabilities.

Synth Subnet’s Forecasting Capabilities

Source: Mode (translated by TechFlow)

-

Infrastructure Layer

Mode’s infrastructure layer further enhances ecosystem security and interoperability.

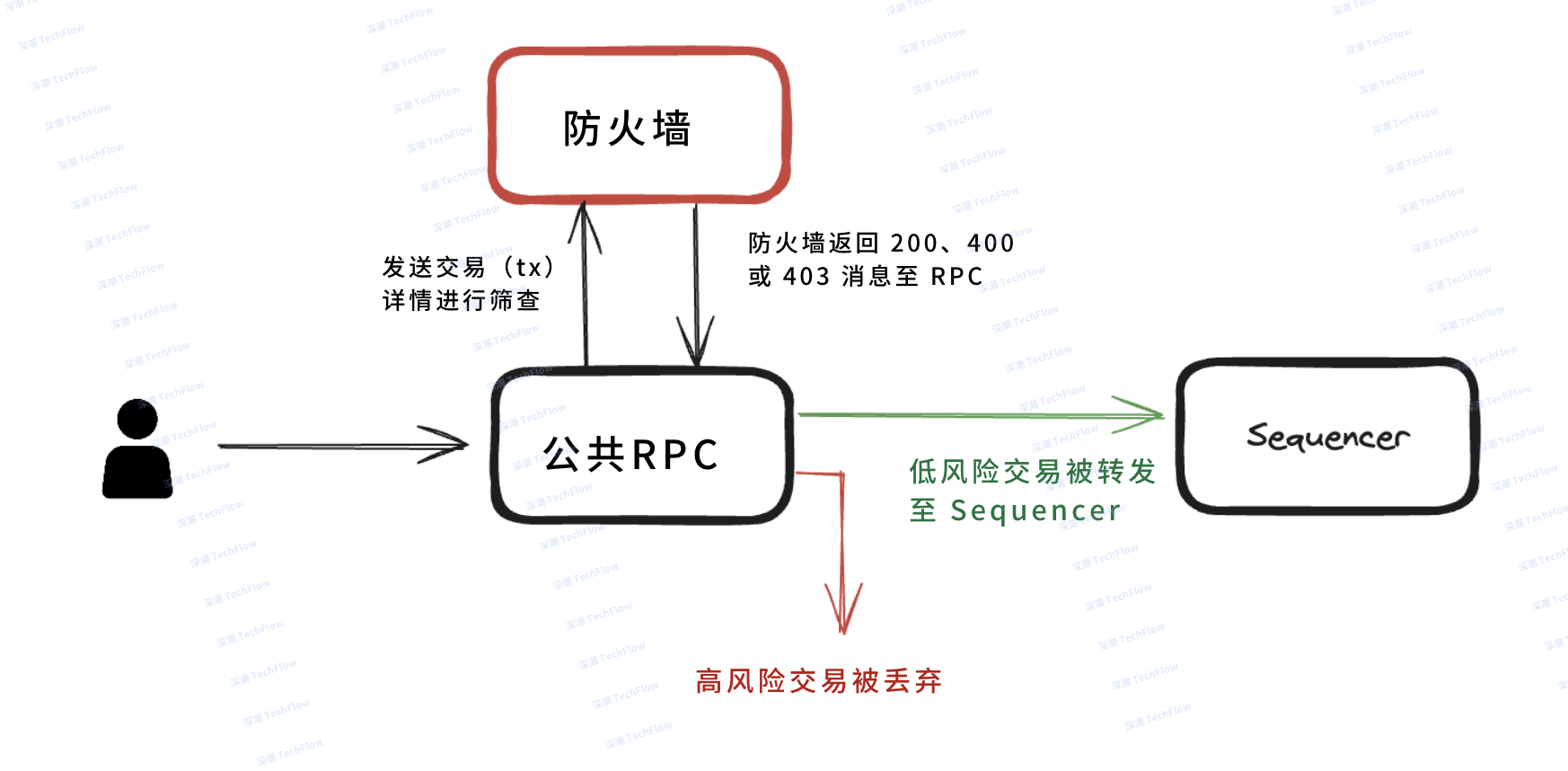

AI Secured Sequencer

Mode is developing an AI Secured Sequencer integrated with Forta Firewall technology to provide enhanced security for L2 transaction processing. Currently in testnet phase, this feature aims to intercept potentially malicious transactions before execution.

Transaction Flow Integrated with Forta Firewall

Source: Forta (translated by TechFlow)

How It Works:

-

Forta’s AI firewall analyzes transactions in real time to detect potential risks;

-

Suspicious transactions are flagged, blocked, or delayed for further review;

-

Malignant activities are stopped at the source, effectively preventing exploits.

Key Advantages:

-

High detection accuracy: Forta detects 99% of vulnerabilities with less than 0.001% false positives and a response time of just 50ms;

-

Enhanced security for developers and users: Applications gain built-in protection, and user assets are safeguarded against malicious transactions.

Superchain Interoperability:

As a core member of the Superchain, Mode gains access to multiple DeFi protocols. Through Mode’s apps and interfaces, users can bridge assets and execute cross-chain strategies. This design simplifies cross-chain deployment while ensuring standardized interoperability across the ecosystem.

Mode’s Ecosystem and Use Cases

Ecosystem Overview: Mode

Mode Ecosystem as of May 2024

Source: Mode

Mode’s DeFi ecosystem is rapidly expanding, with over 250 dApps currently under development on its network. Thanks to Superchain interoperability and growing liquidity, Mode has secured a strong position in the DeFAI space.

AI-driven features like probabilistic forecasting via the Synth subnet offer significant advantages to DeFi protocols, enabling a smooth transition from traditional DeFi to DeFAI.

Though still early, Mode has already attracted over $332K in assets. This number has grown significantly since the launch of the AI Agent App Store, which provides diverse agents and tools catering to different DeFi needs.

Mode’s AI Agent App Store

Source: Memento Research

Ecosystem Expansion Plans

Mode is accelerating DeFAI ecosystem growth through initiatives such as accelerator programs and hackathons, while collaborating with frameworks like a16z, GOAT, and Olas to drive technological innovation.

-

Mode AIFi/DeFAI Accelerator Program

To promote innovation in DeFAI, Mode launched its DeFAI Accelerator Program in October 2024, offering a total prize pool of $100,000 to outstanding teams.

This intensive two-month program admits one cohort per quarter, incentivizing growth across the DeFAI ecosystem.

Participating teams not only receive early-stage funding support of up to $10M through Mode’s angel and VC networks, but also benefit from Optimism audit subsidies—without giving up equity in their tokens.

The first batch of nine teams focuses on key DeFAI areas, including:

-

AI Agent Infrastructure: Talus Network, Intentify;

-

DeFi Agent Training Platform: Almanak;

-

AI Asset Management: Amplifi;

-

Security Agents: QuillAI;

-

AI-Powered Frontend: FortyTwo;

-

Verifiable AI Computation: Inference Labs, Aizel Network;

-

No-Code Model Training (Mobile): Cerbo AI.

-

Mode AI Agent Hackathon

The first round of the Mode AI Agent Hackathon took place from December 17–23, 2024, giving developers the opportunity to build AI agents on the Mode platform using three frameworks:

-

GOAT: An open-source framework providing on-chain tooling for AI agents;

-

Eliza: A multi-agent simulation framework for deploying autonomous AI agents;

-

Olas: A platform integrating tools and a skill marketplace focused on creating efficient AI agents.

The hackathon centered around five themes: DeFi, BTCFi, Social, Gaming, and Wildcard. It attracted 698 registrants in just six days, ultimately selecting five winning projects:

-

Midas: A chat-driven AI agent capable of handling complex DeFi operations such as trading, minting/burning LP positions, and liquidity management;

-

MoDAS: A multi-agent AI system for DeFi automation, enabling task collaboration between agents;

-

Memex: An AI-powered meme coin deployment tool that automatically generates tokens using real-time trends;

-

Mode Mind: An AI agent providing in-depth token analysis for Mode and sharing insights via X (Twitter);

-

Research Idea Generator: An AI tool integrating NFT minting and voice-controlled note management, streamlining workflows via Eliza.

With additional hackathons planned, Mode will continue driving technological innovation in the DeFAI space.

Competitor Analysis

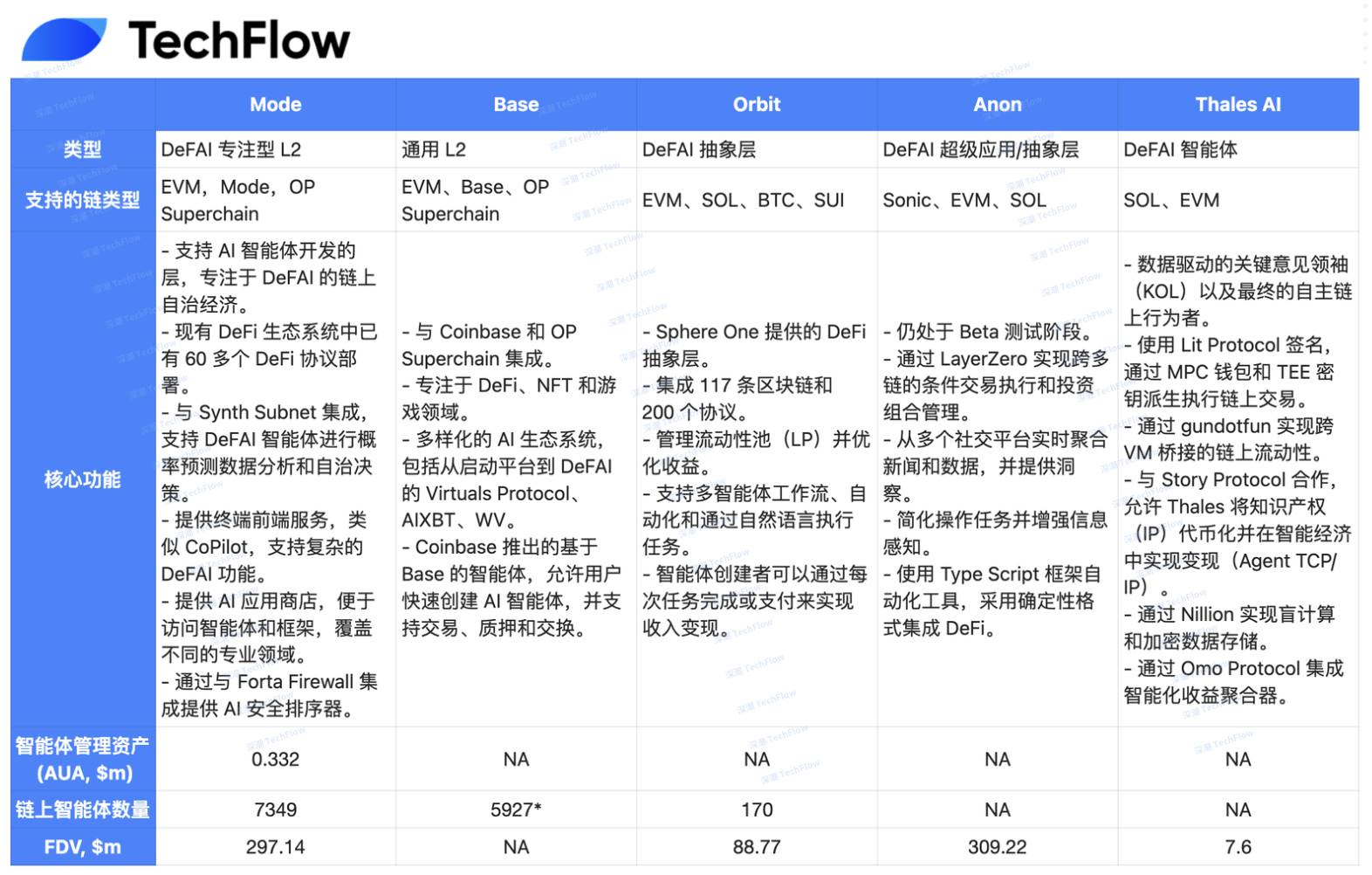

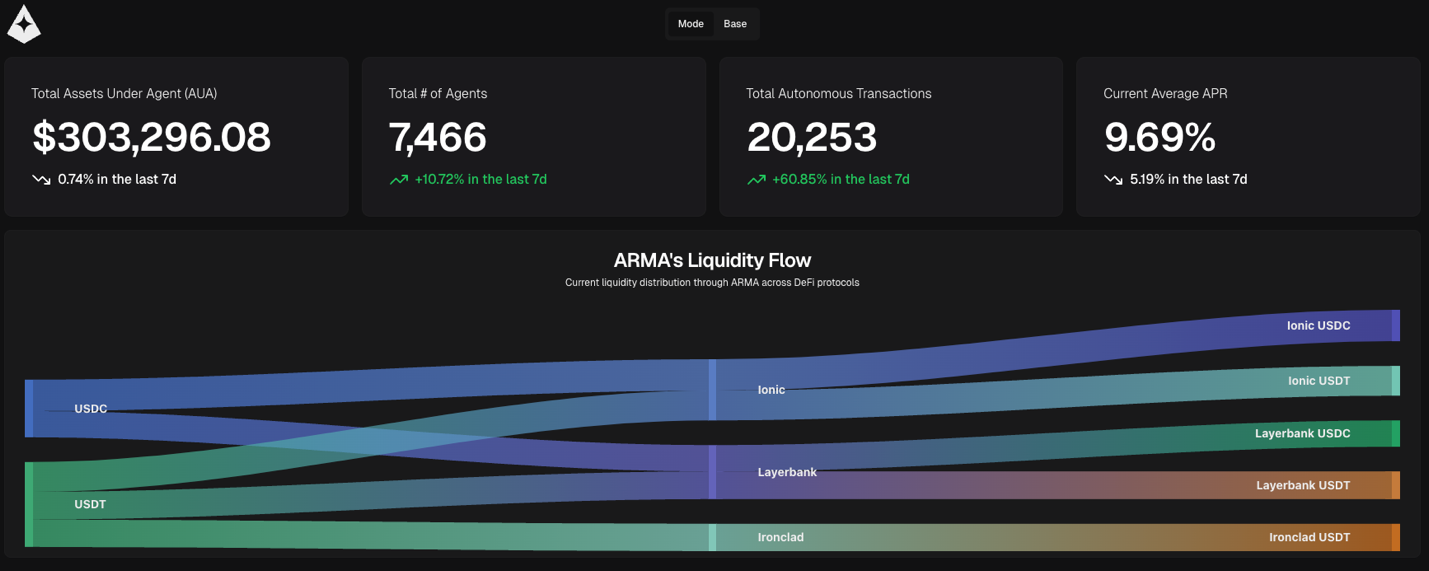

L2 and DeFAI Competitor Analysis

Source: Memento Research (translated by TechFlow)

Compared to other L2 solutions like Base, Mode stands out with its specialized DeFAI infrastructure, offering unique protocol-level features such as the AI Agent App Store, frontend abstraction terminal, and core infrastructure.

This specialization has enabled Mode to deploy over 7,300 AI agents in its app store—surpassing Base’s 5,900.

While Base’s ecosystem spans from launchpads to DeFAI, Mode’s deeper focus on DeFAI gives it an edge at the L2 level. Moreover, Mode is committed to building an autonomously operating on-chain economy, a vision being realized through the Synth subnet. By leveraging high-quality synthetic data, models on Synth can make independent predictions and decisions.

Currently, Mode’s agents manage approximately $332,000 in assets under management (AUA), but its growth potential is vast as community expansion and ecosystem integration progress.

Compared to other DeFAI-focused protocols like Orbit, Anon, and Thales, Mode’s distinction lies in being a complete DeFAI L2 chain, providing core infrastructure that enables seamless interaction of AI agents within the ecosystem.

Case Study: AI Agents in the App Store

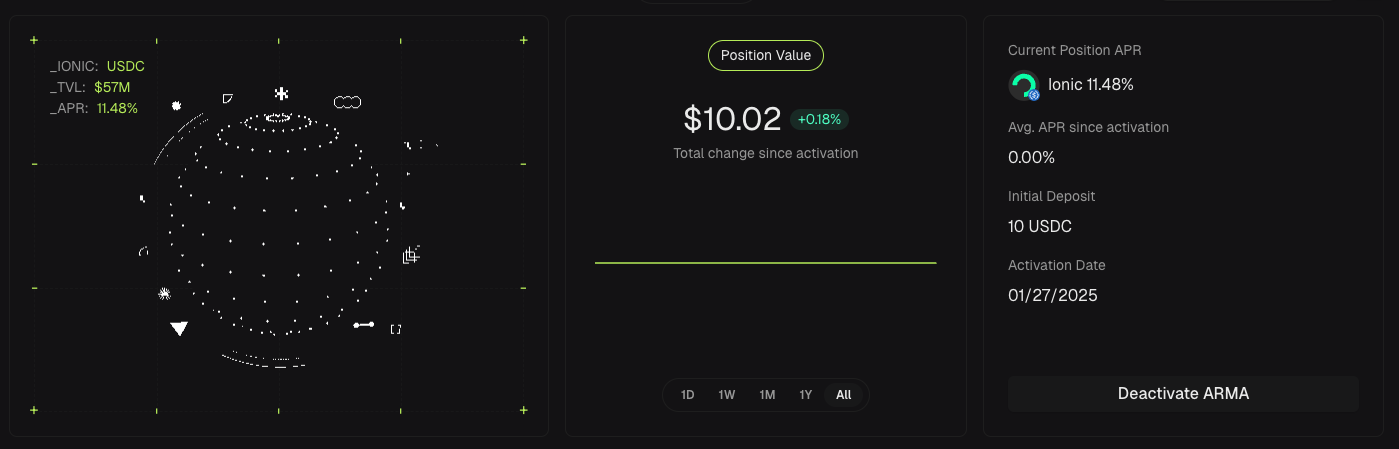

Giza’s ARM

ARMA Dashboard

Source: Arma

ARMA is an autonomous yield optimization agent designed to maximize deposit yields for stablecoins (USDT, USDC). By continuously evaluating lending rates across Mode’s lending protocols (Ionic, LayerBank, and Ironclad), ARMA dynamically allocates funds to the highest-yielding pools. By reducing transaction costs and boosting returns, ARMA ensures users retain full control over their capital. Key features:

-

Self-custodial smart accounts: Account abstraction ensures users maintain full control over their funds.

-

Automatic rebalancing: Dynamically adjusts assets to the most profitable lending pools.

-

Automatic compounding: Reinvests earnings to maximize long-term returns. ARMA has managed over $300,000 in assets, deployed over 7,400 agents, executed over 20,000 autonomous transactions, and achieved an annual percentage rate (APR) of 9.69%.

ARMA Overview

Source: Giza

Amplifi

Amplifi, a participant in Mode’s AI Accelerator Program, focuses on delivering AI-driven yield strategies for BTC and stablecoins. Through its “one-click vault,” Amplifi eliminates gas fees, swaps, and cross-chain operations, making DeFi simpler and more efficient. Amplifi leverages cross-chain liquidity to achieve optimal yields while keeping assets fully self-custodied. Its AI engine dynamically reallocates funds between liquidity pools to prevent yield decay.

Example of Amplifi’s BTC Strategy

Source: Amplifi

Key Features:

-

Dynamic Asset Management: Automatically optimizes assets into pools with the highest APY, applicable to both BTC and stablecoin strategies.

-

Seamless Cross-Chain Functionality: Uses Polyhedra’s zkBridge technology to optimize cross-chain strategies, eliminating manual bridging and gas fees.

-

Account Abstraction: Enables gas-free transactions and Web2-style social logins to improve user experience.

-

Stable APY Management: AI-driven mechanisms ensure consistent yields and prevent decay. Amplifi is currently in closed beta, with public testing planned for Q1 2025. Future integrations include Superchain (BOB and Base), Cardano, Bitlayer, and SVM/Move, with a full v1 release expected by Q4 2025.

Modius by Autonolas

BabyDegen Overview

Source: Olas (translated by TechFlow)

BabyDegen, developed by Autonolas, is an automated portfolio management tool that uses AI models and real-time market data to autonomously execute trades on the Mode platform. By integrating external data sources like CoinGecko, BabyDegen analyzes price trends and selects optimal trading strategies based on market dynamics, making real-time buy, sell, or hold decisions.

Key Features:

-

Personalized Portfolio Management: Dynamically adjusts trading strategies based on market conditions.

-

Protocol and Asset Support: Compatible with USDC and ETH, operating on Balancer and Sturdy.

-

Fully Autonomous with User Control: Operates independently while ensuring users retain full control.

BabyDegen’s alpha version is open to developers on GitHub, with a consumer-facing release expected soon.

$MODE: Season Breakdown and Tokenomics

Token Distribution

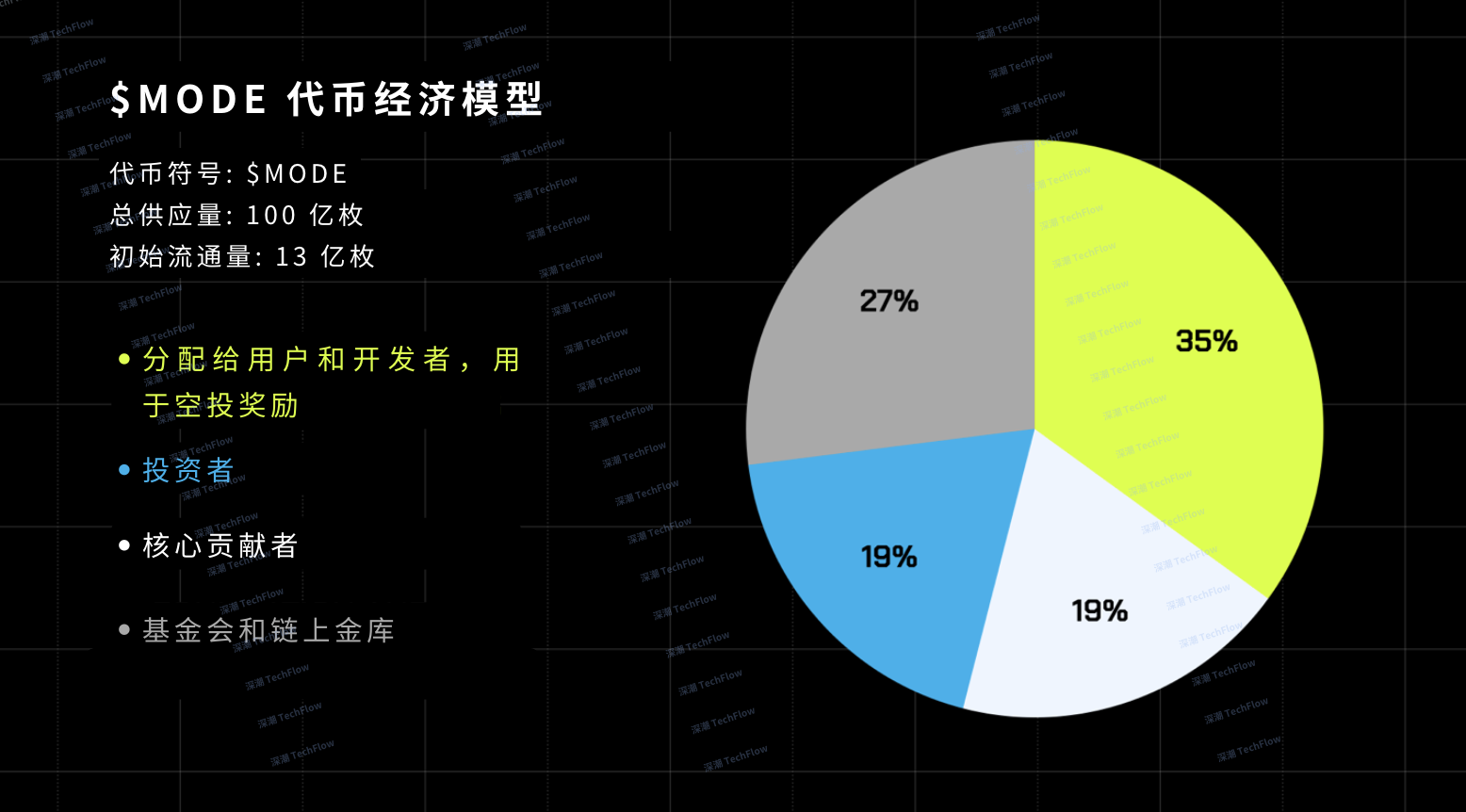

Tokenomics Breakdown

Source: Mode (translated by TechFlow)

$MODE officially launched in May 2024 with an initial supply of 1.3 billion tokens, 35% of which were allocated to users and developers to accelerate ecosystem growth. Distribution to date includes:

-

Season 1: 5.5% of total supply distributed.

-

Season 2: 5% of total supply distributed.

-

Season 3: Marked the end of point-based seasons, shifting focus to the veMODE model.

-

Remaining distribution: 24.5% of total supply. Tokens for core contributors (19%) and investors (19%) follow these rules:

-

12-month lock-up period starting from TGE (Token Generation Event);

-

Linear unlocking over 24 months.

27% of tokens are allocated to the Foundation and on-chain treasury to support ecosystem programs and incentivize application users.

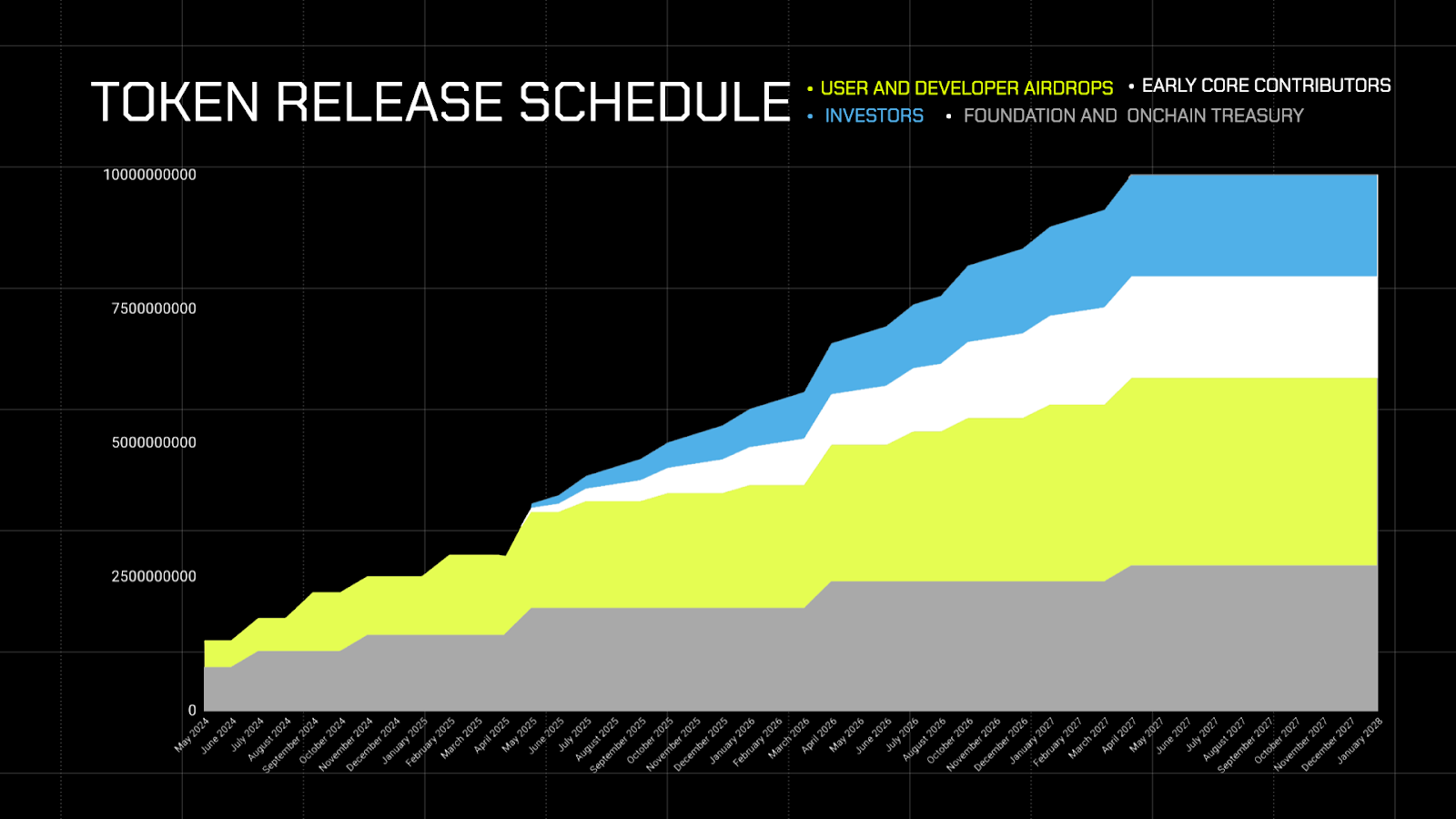

Unlock Schedule

Source: Mode

MODE: Seasons 1–3

Mode is currently in Season 4. The previous three seasons had clear objectives:

-

Season 1 (ended May 2024): Distributed 5.5% of total supply to early participants via airdrop.

-

Season 2 (May–October 2024): Distributed 5% of $MODE and 1,000,000 $OP tokens through incentive campaigns.

-

Season 3 (October 2024–January 2025): Introduced veMODE and veBPT tokens, adopting Curve Finance’s vote-locking system to advance decentralized governance and incentive distribution.

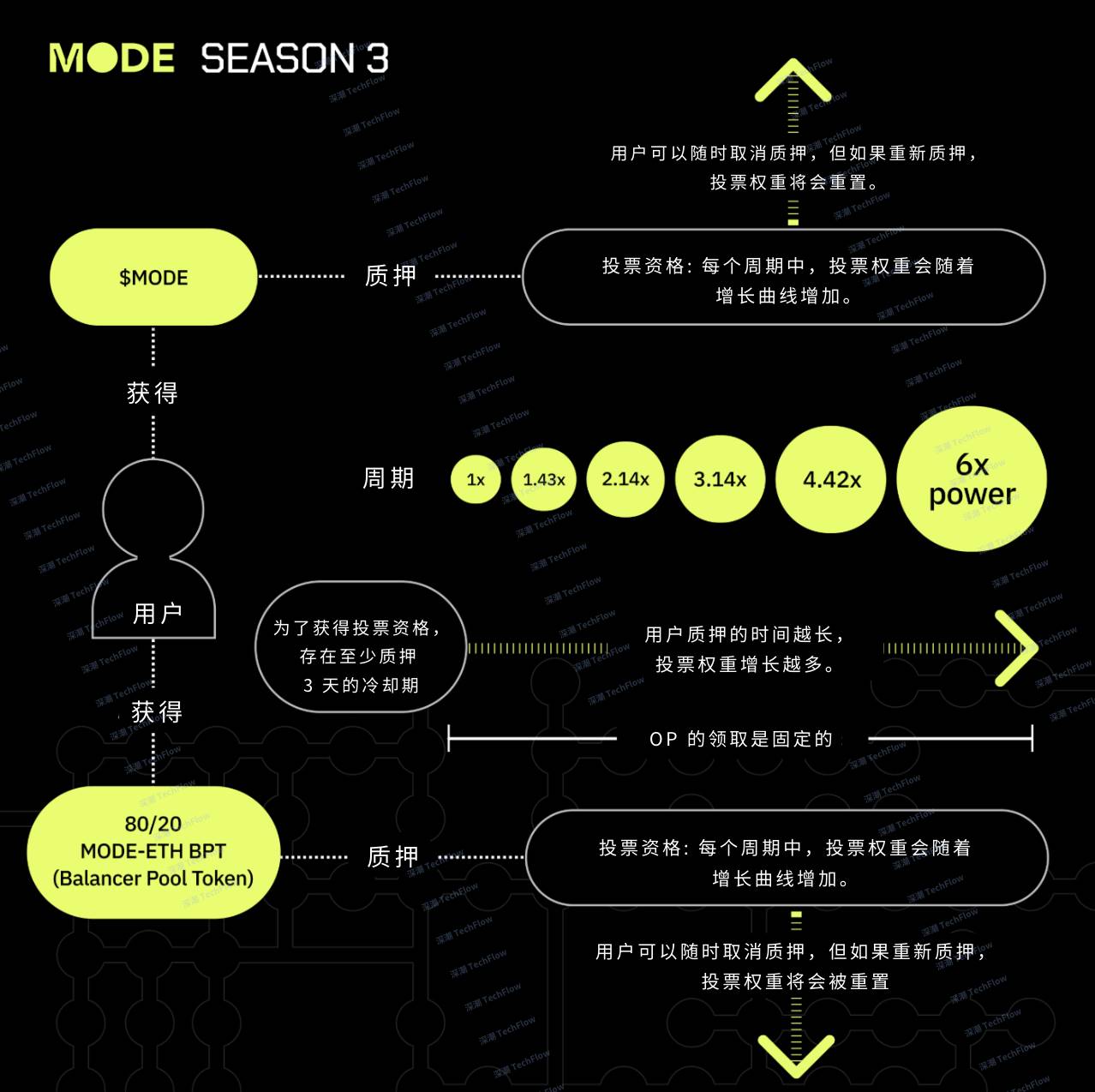

Season 3 veToken Model

Source: Mode (translated by TechFlow)

Season 3: Introduction of the veToken Model

Season 3 introduced two tokens—veMODE and veBPT—granting users governance rights and incentive allocations through staking.

-

veMODE: Obtained by staking $MODE, with voting power increasing over time.

-

veBPT: Earned by staking 80/20 MODE/ETH LP tokens on Balancer, with dynamic voting rules similar to veMODE. Incentives are distributed in a 10:1 ratio between veMODE and veBPT. Holders claim OP rewards based on stake size and voting participation. Unstaking triggers a 3–6 day cooldown period, during which voting power and accumulated rewards are forfeited. Voting occurs biweekly over six cycles, allowing users to vote for protocols competing for community incentives. Protocols receiving more votes earn larger reward shares. Initially supported by OP grants, incentives will gradually transition to $MODE-backed airdrops. In the future, Mode plans to introduce a smart treasury similar to Olympus to sustain protocol operations and provide long-term funding for veToken holders.

Mode: Season 4 (Currently Ongoing)

Season 4 officially began on January 20, 2025, introducing a Bribe Marketplace and Agentic Staking/Voting governance model, enhancing interaction between protocols and voters through bribes.

In Season 3, bribes were offered as isolated airdrops. In Season 4, Mode integrates with Hidden Hand to create a centralized marketplace. Protocols can deposit bribes with specific payout conditions, and voters can easily track and claim rewards—making it easier for voters to support preferred protocols.

$OP remains the primary incentive, primarily used for real on-chain use cases such as yield and liquidity incentives. Meanwhile, the bribe mechanism boosts community engagement by rewarding governance participants.

Additionally, Season 4 introduces staking and voting for AI agent applications, leveraging Crossmint’s GOAT framework to unlock new opportunities for AI-driven governance—a breakthrough enabled by Mode’s recent AI agent hackathon.

Functions of $MODE

$MODE serves as the ecosystem’s core token with multiple utilities, primarily accessed through staking into the veMODE club. Stakers unlock the following benefits:

-

Whitelist eligibility for AI agent projects during Mode Launchpad events.

-

Participation in AI agent project fundraising using $MODE.

-

Liquidity pools for AI agent projects will run on Velodrome, exclusively paired with $MODE.

-

Voting rights in grant applications and incentive distribution governance.

-

Earning incentives through governance voting and participation in the bribe marketplace (initially $OP, later transitioning to on-chain treasury support), fostering collaboration between users and protocols.

-

Early access to DeFAI tools such as Mode AI Terminal.

-

Airdrop eligibility for AI agent projects. These functions effectively regulate token issuance, reduce inflationary pressure, and enhance long-term holder value through veToken governance, laying a solid foundation for the prosperity of the DeFAI ecosystem.

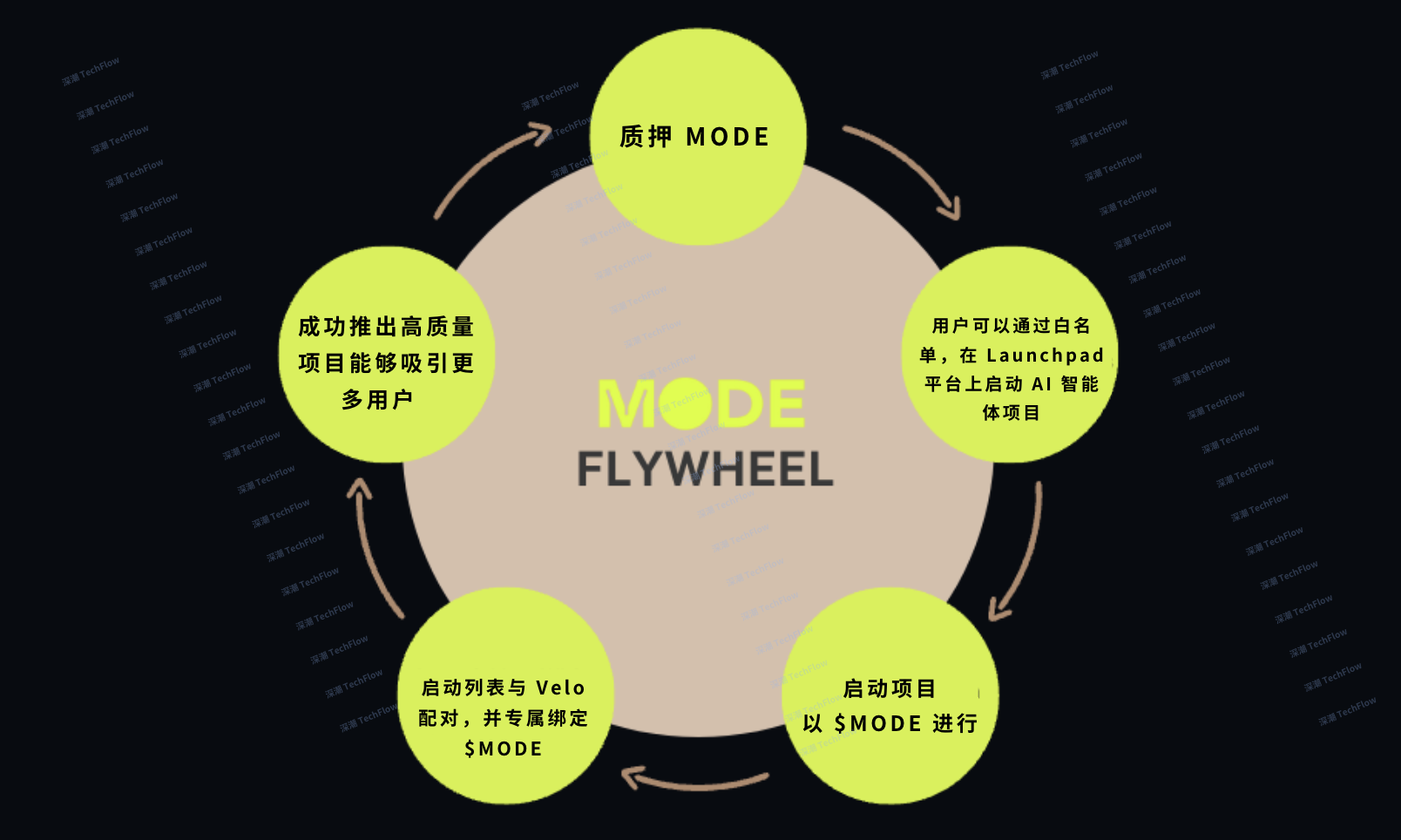

$MODE’s Ecosystem Growth Cycle

With the launch of Season 4, maturation of full-stack DeFAI infrastructure, and increasing releases of AI agent projects, Mode is establishing a powerful ecosystem growth cycle:

Original image from Memento Research, translated by TechFlow

-

Users purchase and stake $MODE to obtain veMODE.

-

After staking, users gain priority access to project launches on AI agent launchpads (e.g., Chirper, DAAO, Arcaid).

-

On these launchpads, AI agent projects raise funds in $MODE.

-

New AI agent projects establish liquidity pools on Velodrome, exclusively paired with $MODE.

-

High-quality AI agent project launches further increase demand for $MODE, attracting more users to stake. This ecosystem loop accelerates Mode’s expansion. To sustain this momentum, attracting high-quality AI agent projects built on Mode’s infrastructure is key to driving broad adoption and growth of the DeFAI ecosystem.

Impact of the veToken Model

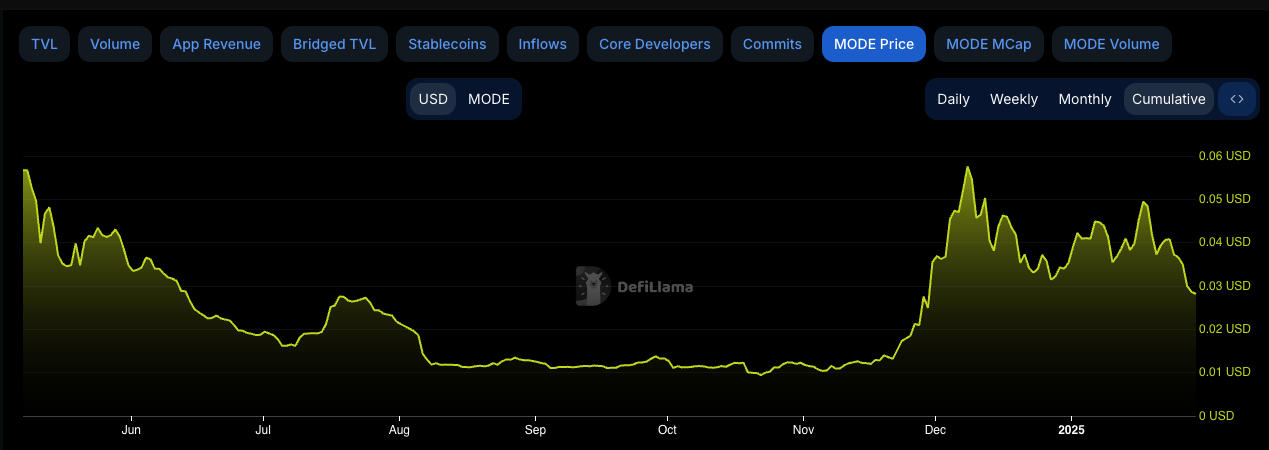

As of January 2025, approximately 432 million $MODE tokens have been staked, representing 17.28% of circulating supply. Since the launch of veMODE in October 2024, the vote-escrow model has proven effective in locking tokens, reducing market supply, and positively impacting $MODE’s price.

Price Movement of $MODE

Data Source: DefiLlama

Despite being live for only three months, veMODE staking remains highly attractive, especially with upcoming autonomous on-chain economy projects. As more high-quality projects launch on Mode, this ecosystem loop will gain even stronger momentum.

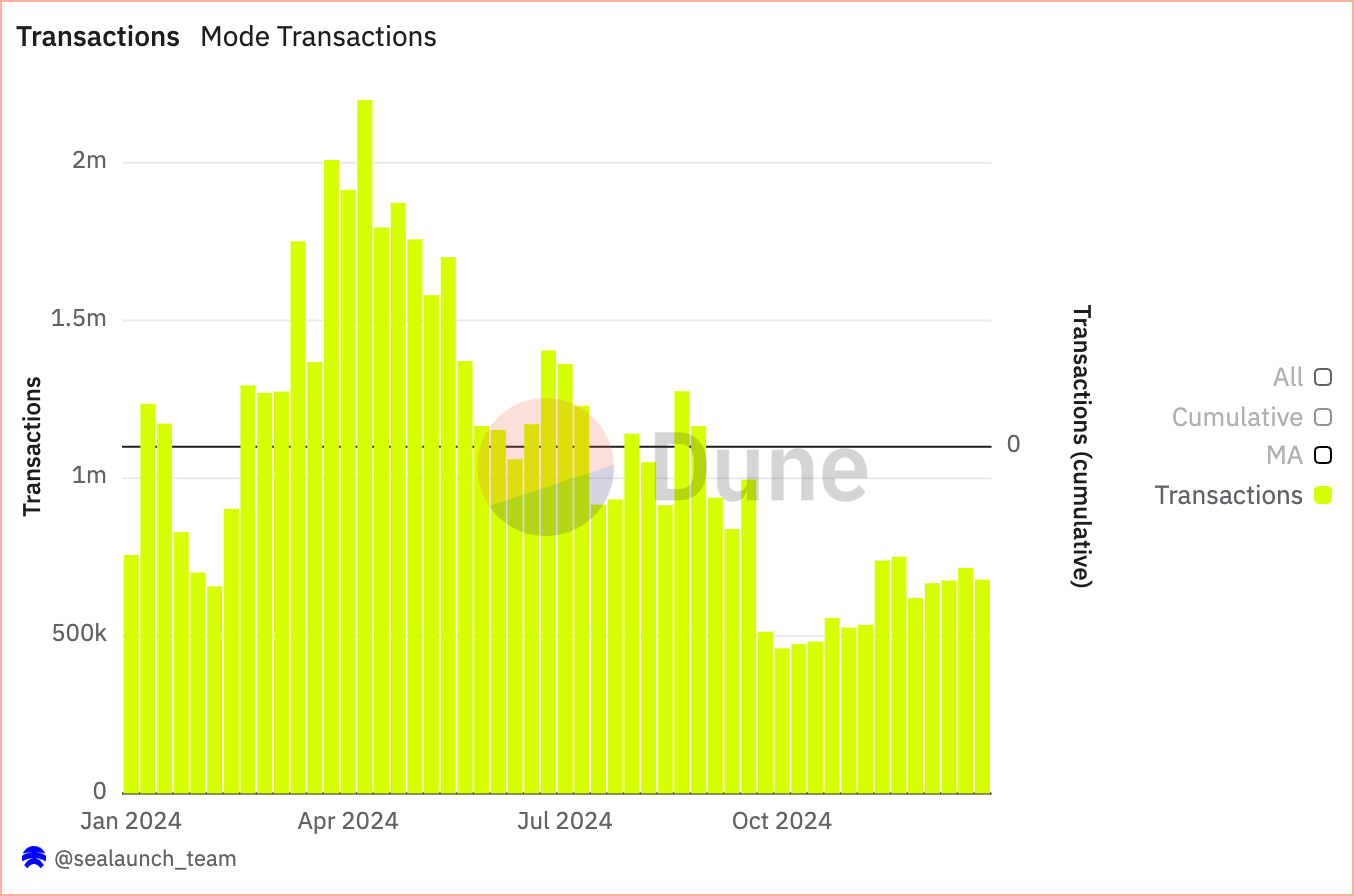

Additionally, Mode’s Total Value Locked (TVL) continues to grow steadily, and on-chain transaction activity shows positive trends, with daily transaction volume consistently rising since the introduction of veToken governance.

Daily Transaction Volume Growth Trend on Mode

Data Source: sealaunch_team (Dune)

Future Directions for MODE

In 2024, Mode focused on building a DeFi ecosystem for yield-bearing assets, integrating over 70 DeFi protocols and bridging over $700 million into the Mode network within months.

Looking ahead to 2025, Mode will further solidify its position as a full-stack DeFAI chain by strengthening its DeFi ecosystem through key releases. Major development directions include:

-

AI Terminal – Providing DeFi users with easier access and automation features.

-

Synth Subnet Data Layer – Enhancing predictive capabilities and on-chain decision-making efficiency.

-

Infrastructure Layer – Strengthening AI-driven security and Superchain interoperability.

-

The recently launched Synth subnet marks a major milestone for Mode, providing an efficient source of synthetic price data. This enables agents and large language models (LLMs) to improve prediction accuracy and support probabilistic reasoning, unlocking novel probabilistic DeFi models and advancing autonomous on-chain economies.

-

Simultaneously, Mode is expanding its ecosystem through partnerships with AI-focused launchpads like Chirper AI, simplifying the deployment process for Tier-3 DeFAI agents.

-

To accelerate DeFAI innovation, Mode launched new initiatives in 2025 such as the “AI Agent Founder School,” aimed at streamlining the development and deployment of AI agents on the Mode network.

Final Thoughts

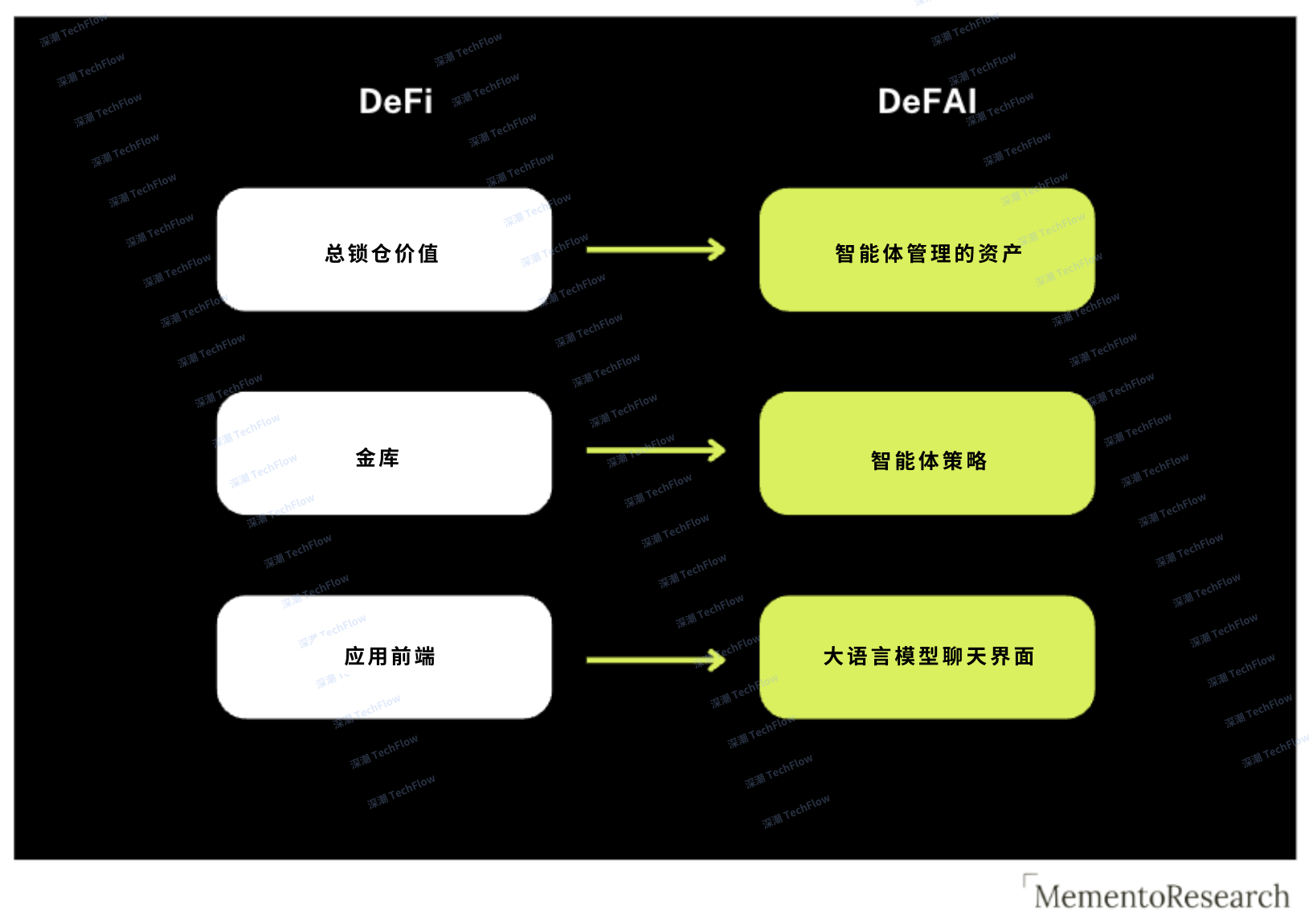

The rise of DeFAI is fundamentally reshaping the DeFi landscape, injecting fresh innovation and unlocking synergies between AI and DeFi. As this field rapidly evolves, we are moving closer to autonomous and intelligent financial systems.

In the future, we can expect:

-

Total Value Locked (TVL) to gradually shift toward Agent-Managed Assets (AUA), where assets are dynamically managed by intelligent agents.

-

Vaults to evolve into Agentic Strategies, enabling intelligent yield optimization.

-

Traditional DeFi frontends to be replaced by LLM-powered chat interfaces, offering users more intuitive and automated experiences.

Transition to DeFAI

Data Source: Memento Research (translated by TechFlow)

AI-driven interaction patterns are already emerging—users accustomed to the Google era are increasingly turning to intelligent conversational tools like ChatGPT for answers.

2025 is seen as the breakout year for utility-driven AI agents. These autonomous agents can act on behalf of users to execute trades, provide liquidity, lend, and borrow. With comprehensive full-stack infrastructure, robust ecosystem-building initiatives, and sustained investment in simplifying AI agent development, Mode occupies a unique advantage in the wave of autonomous on-chain agent economies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News