Pyth Announces Launch of Pyth Pro: Reshaping the Market Data Supply Chain

TechFlow Selected TechFlow Selected

Pyth Announces Launch of Pyth Pro: Reshaping the Market Data Supply Chain

Pyth Pro aims to provide institutions with transparent, comprehensive data insights across asset classes and geographic regions in global markets, eliminating inefficiencies, blind spots, and rising costs in traditional market data supply chains.

Author: Douro Labs

In 2021, only a handful of trading firms and exchanges published their trading data onto blockchain networks. Today, that experiment has rapidly evolved into the world's most comprehensive institutional-grade market data source.

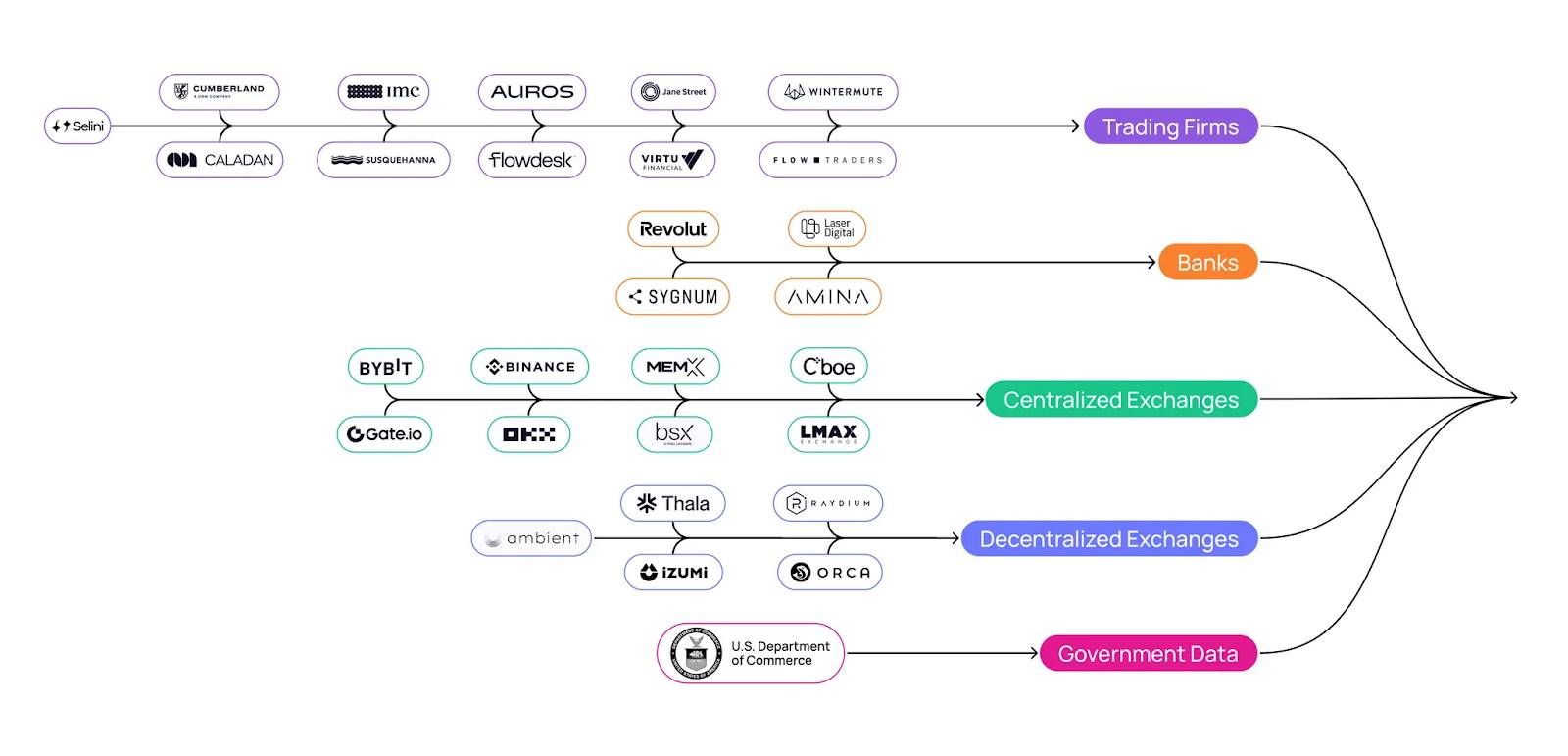

As a universal price layer for the globe, Pyth Network has completely reimagined the market data supply chain: 125 institutions have collectively earned over $50 million by contributing proprietary data to the network, which in turn has powered over 600 applications with $1.7 trillion in trading volume. Pyth also collaborates with industry leaders and government agencies such as Cboe, Jane Street, Revolut, and the U.S. Department of Commerce to establish a new paradigm where market data is more accessible, accurate, and transparent.

Pyth’s mission has always been to create a “single source of truth” for market data—a concept that sounds simple but carries profound implications. Once realized, it will reshape traditional financial systems and expand global market access. Now, after pioneering adoption in DeFi and rapid expansion into traditional finance, Pyth is reimagining the market data economy for global institutions.

Today, with the official launch of Pyth Pro, Pyth takes a major step toward fulfilling its mission—enabling anyone to directly access professional, institutional-grade data from the world’s most advanced trading firms.

Pyth Pro aims to provide institutions with transparent, comprehensive data visibility across asset classes and geographies in global markets, eliminating inefficiencies, blind spots, and rising costs inherent in traditional market data supply chains. Major institutions including Jump Trading Group are participating in Pyth Pro’s early access program, signaling strong demand for this new market data solution.

Problem Analysis: Fragmented, Outdated Systems

Market data is the backbone of modern finance, powering everything from trading and risk management to clearing and reporting. As the internet continues advancing in speed and accessibility, financial systems are more interconnected and data-driven than ever, making market data increasingly critical. Yet, the infrastructure underpinning today’s market data remains deeply entrenched in pre-internet era limitations, with almost no viable alternatives.

Statistics show that institutions spend over $50 billion annually on market data, yet the systems they rely on are ill-suited for today’s global, multi-asset financial environment. With few competitors across regions and asset classes, data costs have surged dramatically—rising over 50% in just the past three years. Institutions pay vastly different prices for the same products, access is restricted by geography, and new entrants still face prohibitively high barriers.

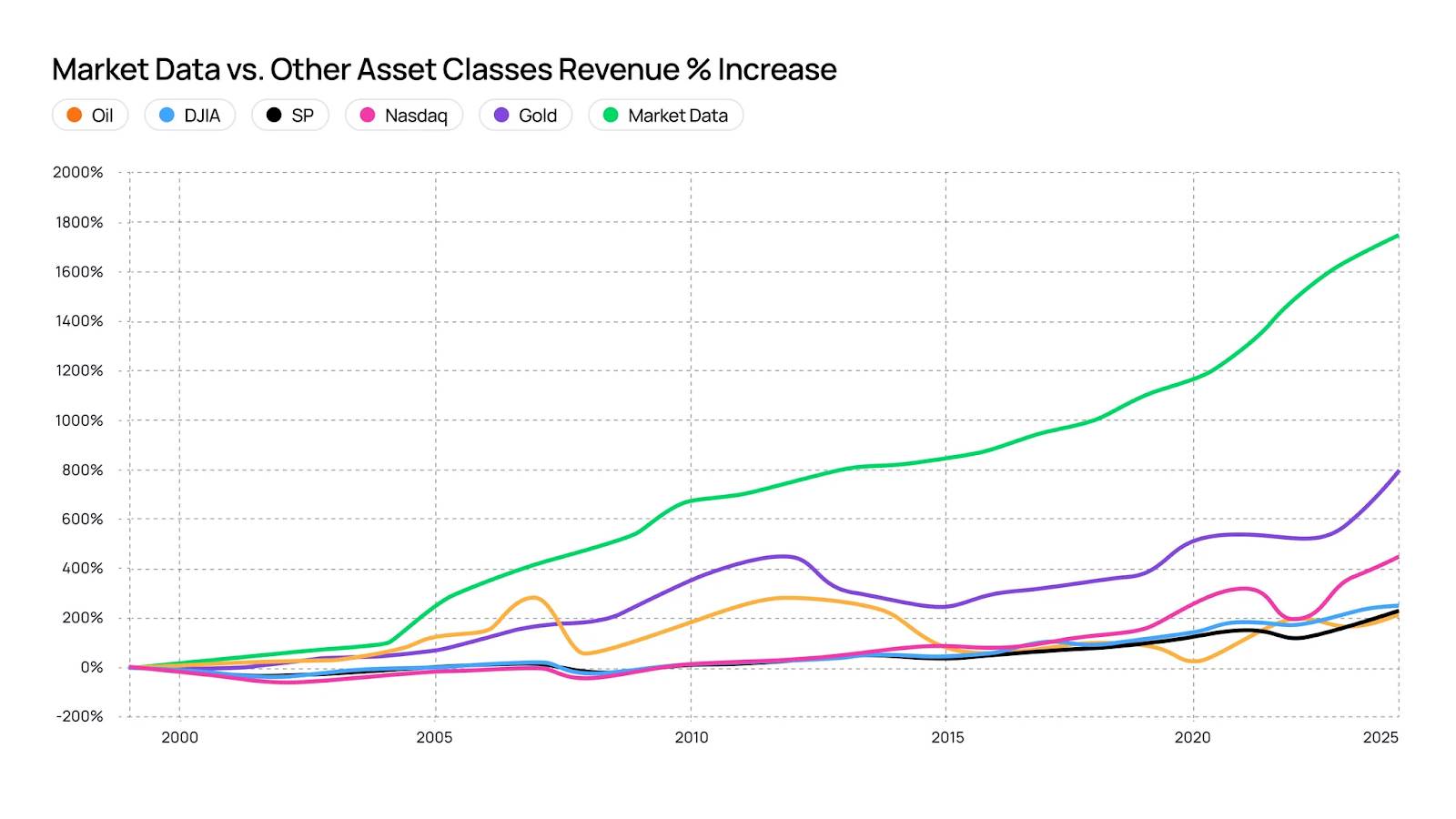

Historical trends highlight this severe imbalance: over the past 25 years, market data costs have outpaced nearly all major asset classes. This upward spiral places growing pressure on institutions that provide liquidity and efficiency to financial markets.

Structurally, the flaws are clear:

-

Exchanges can only see their own order books, which represent just a fraction of global trading activity.

-

Vendors aggregate this limited data, repackage it into large bundles, and sell it at premium prices.

-

Trading firms and banks—the entities generating the most accurate, high-frequency prices—rarely participate directly in the value derived from their data.

This means the most valuable pricing data is created upstream (before reaching exchanges), yet the majority of revenue flows downstream to intermediaries. This outcome isn’t anyone’s fault—market data is constrained by an outdated system that inadvertently entrenches incumbents, suppresses competition, and limits innovation.

Solution: Pyth Pro

Pyth Pro addresses these systemic inefficiencies by rebuilding the market data supply chain from the ground up.

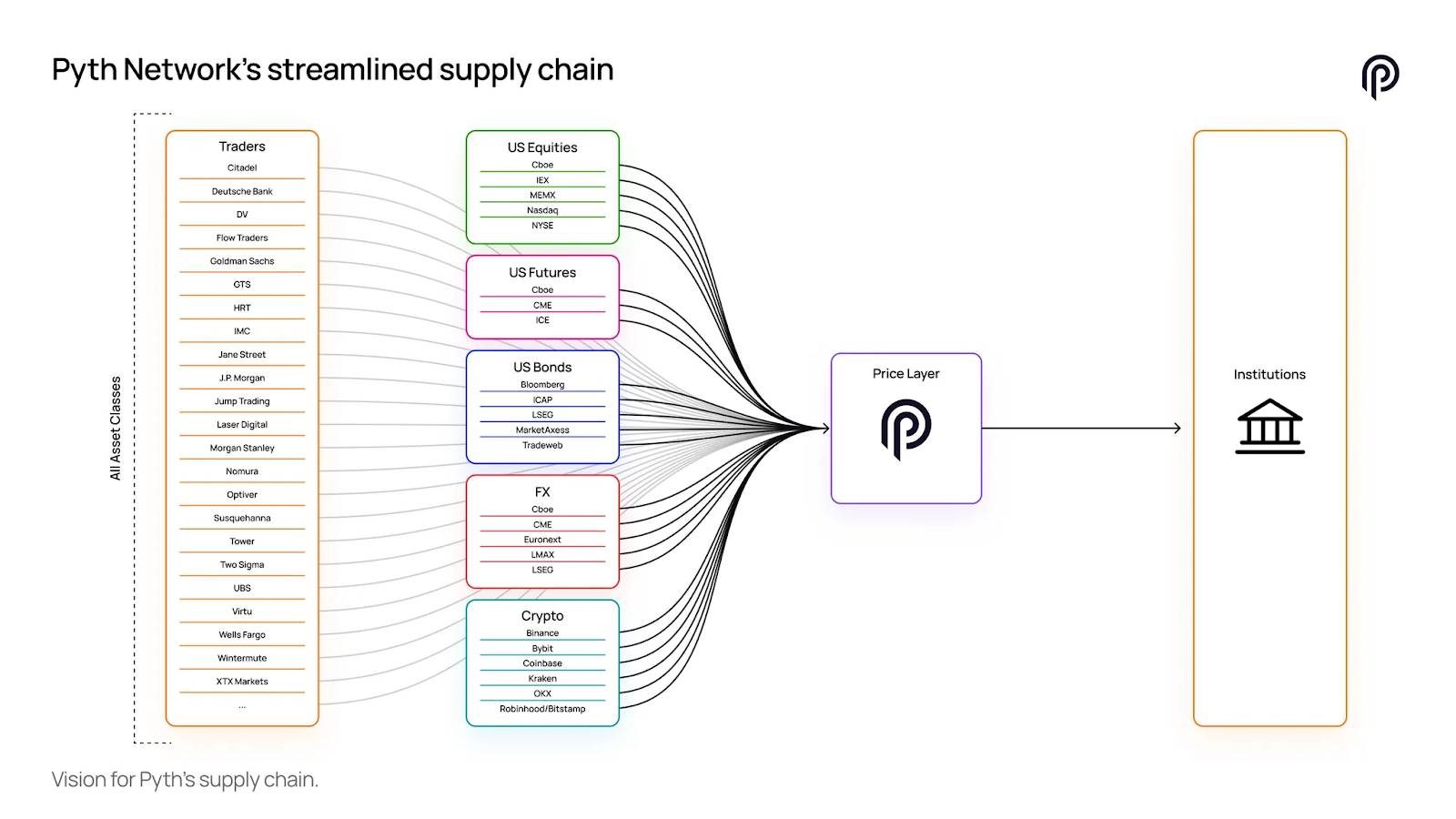

Rather than relying on fragmented, repackaged downstream data, institutions can now access prices directly from the companies that generate them—trading firms, exchanges, and banks—via a single, unified integration platform.

Leading institutions including Jump Trading Group have already partnered with Pyth Pro through its early access version. As a representative from Jump Trading Group stated:

“We’re proud long-time supporters of Pyth, which has developed one of the most comprehensive and valuable sources of market data ever built. Pyth Pro enables broader access to this data—including by traditional financial firms—and brings competition to the market data economy by delivering the purest data directly from the source.”

One Source: Coverage Across All Asset Classes and Regions

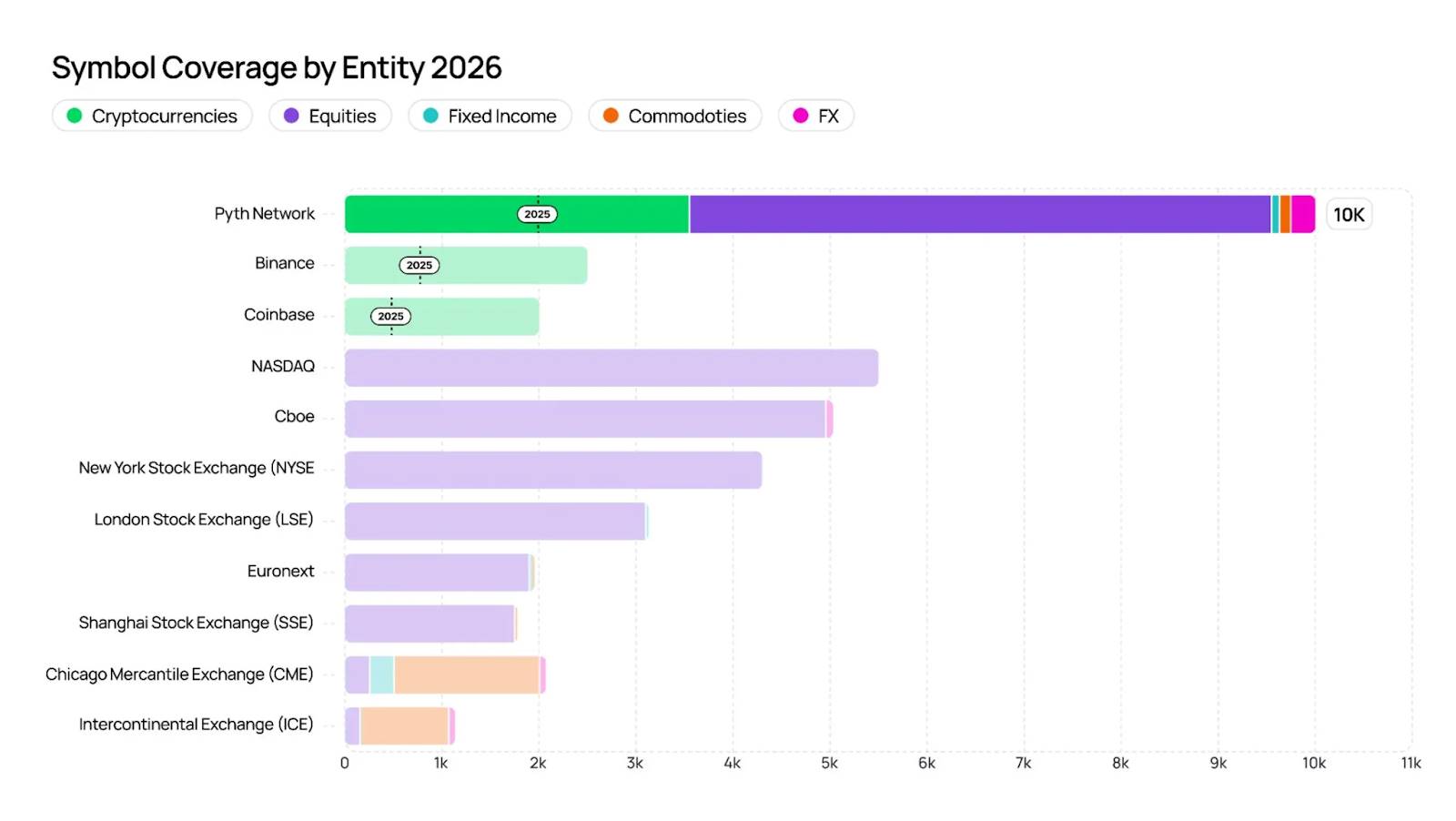

Pyth Pro consolidates global data into a single distribution network: over 2,000 data feeds covering equities, futures, ETFs, commodities, FX, crypto, and fixed income. Data updates at millisecond frequency, achieves over 99.9% uptime, maintains 95% accuracy relative to NBBO, and adds new data categories weekly.

Pyth Pro is designed to deliver comprehensive market insights and serve as the most reliable single source of truth for financial data.

Professional Data: From the Companies That Truly Drive Markets

Over 125 leading institutions have contributed proprietary pricing data to the Pyth Network, including Jane Street, Revolut, Jump, DRW, Optiver, Cboe, and LMAX. These contributions are cryptographically verified, aggregated, and secured through staking and slashing mechanisms to build a system that captures price discovery at its origin while rewarding accuracy and participation.

Streamlined and Cost-Effective Model

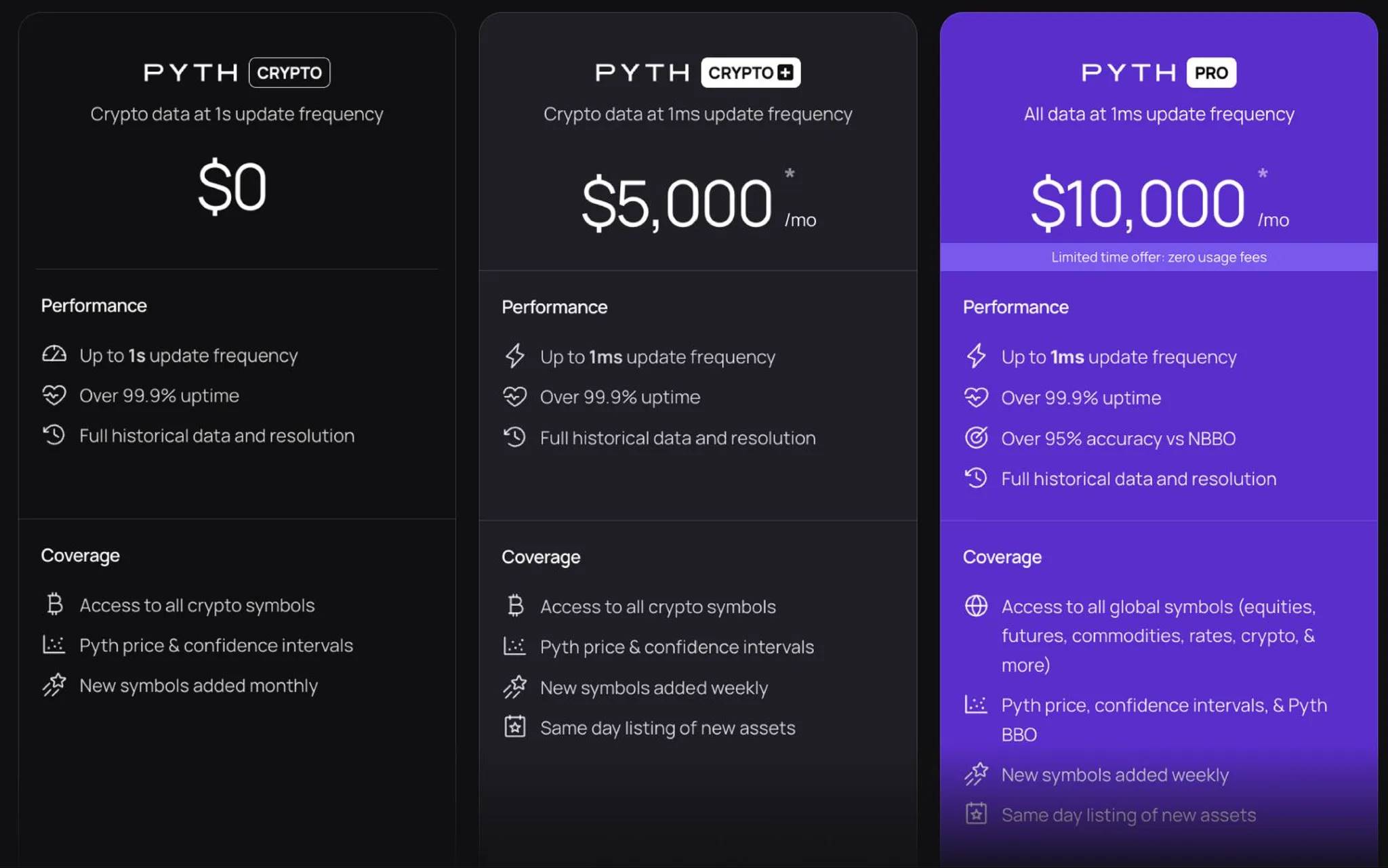

Traditional data vendors often charge up to $250,000 per month, yet offer incomplete coverage, forcing institutions to manage multiple data agreements, duplicate purchases and integrations, and incur unpredictable costs. Pyth Pro resolves this with a transparent subscription model scalable to institutional needs:

-

Pyth Crypto (free): crypto data updated once per second

-

Pyth Crypto+ ($5,000/month): crypto data updated every millisecond

-

Pyth Pro ($10,000/month): global cross-asset coverage, millisecond updates, enterprise support, and redistribution rights

By eliminating discriminatory pricing, siloed access, and opaque contracts, Pyth Pro not only reduces costs but opens the market to broader participation, creating a level playing field for institutions of all sizes and enabling everyone to share in the value. Exchanges, trading firms, and banks can monetize data more directly; institutions gain access to more complete and accurate global market data. The result is a healthier, more competitive ecosystem—where data is more accessible, accurate, and transparent than ever before.

How It Works: Redesigning the Market Data Supply Chain

Pyth delivers capabilities unavailable from traditional vendors thanks to structural innovation. Pyth Network is not another aggregator repackaging downstream data streams—it fundamentally redefines how market data is captured, verified, and distributed globally.

-

Upstream data sources: data is contributed directly by pricing entities such as trading firms, exchanges, and banks—even before fragmentation, averaging, or delays occur.

-

Data quality: over 125 leading institutions contribute proprietary data to Pyth, including Jane Street, Jump, DRW, Optiver, Cboe, LMAX, and the U.S. Department of Commerce.

-

Transparent aggregation: data is aggregated using verifiable methods with confidence intervals, ensuring auditability of data quality.

-

High-performance delivery: data updates are distributed globally with end-to-end latency under 100 milliseconds, supporting co-located low-latency aggregation mechanisms and millisecond precision.

-

Aligned incentives: publishers are rewarded for accuracy via staking, slashing, and Pyth ecosystem incentive models, while bad actors are penalized.

-

Sustainable model: subscription revenue flows back into the Pyth DAO, reinforcing publisher incentives and increasing network value over time.

Pyth Pro aims to replace the fragmented, outdated infrastructure upon which today’s market data relies—but it does not simply displace existing participants. Exchanges, trading firms, and banks remain central: their data is the source of value. By creating a unified, open distribution network, Pyth Pro enables more institutions to access the data they need while allowing data publishers to directly capture the value they create—expanding participation and removing structural bottlenecks.

Pyth Pro’s market data model is more inclusive, accurate, and sustainable than any other existing model. At its core, Pyth Pro aims to grow the pie for everyone: contributors receive fair compensation, institutions gain fuller, lower-cost insight into global markets, and the entire financial system benefits from greater transparency and a healthier cycle of competition.

The next wave of finance has arrived; Pyth Pro is just the beginning.

Under Pyth’s core vision of a “universal price layer for the world,” Pyth Pro empowers builders, innovators, institutions, and leaders to create an open, trusted, and accessible financial system that benefits all participants.

Infrastructure is just the first layer—now everyone has the opportunity to help build the next-generation skyscraper of finance.

Welcome to your Pyth Pro journey, and experience market data that’s more accurate, convenient, and cost-effective.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News