Crypto Morning News: US initial jobless claims post largest increase in three months, Kanye West launches meme coin YZY

TechFlow Selected TechFlow Selected

Crypto Morning News: US initial jobless claims post largest increase in three months, Kanye West launches meme coin YZY

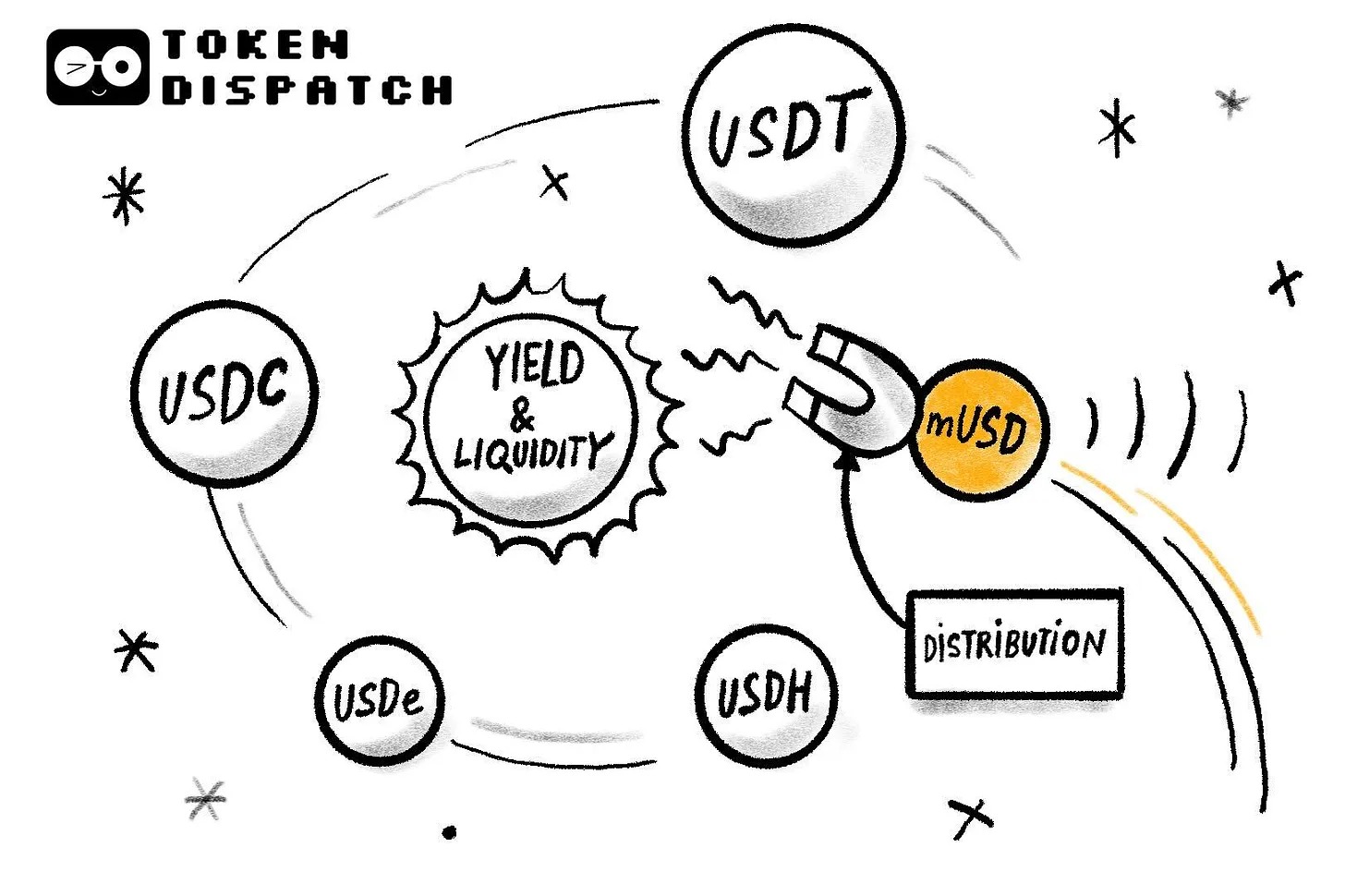

MetaMask will launch the mUSD stablecoin, issued by Bridge, a subsidiary of Stripe.

Author: TechFlow

Yesterday's Market Dynamics

U.S. jobless claims post largest increase in three months, continuing claims rise to highest since 2021

According to Jinshi Data, initial U.S. jobless claims rose by the most in nearly three months, signaling potential increases in layoffs and further weakening labor market conditions. The Labor Department reported on Thursday that seasonally adjusted initial claims increased by 11,000 to 235,000 for the week ending August 16—the largest gain since late May. As businesses navigate Trump’s protectionist trade policies, the labor market has entered a phase of "low layoffs, weak hiring." Earlier this month, government data showed an average monthly addition of just 35,000 jobs over the past three months. Domestic demand growth in Q2 slowed to its weakest pace since Q4 2022. Meanwhile, continuing claims rose by 30,000 to 1.972 million for the week ending August 9—the highest level since November 2021.

CFTC Acting Chair announces new crypto regulatory sprint initiative

According to an official announcement from the U.S. Commodity Futures Trading Commission (CFTC), CFTC Acting Chair Caroline D. Pham has launched a new crypto regulatory sprint initiative to implement recommendations from the President’s Working Group Report on Digital Asset Markets. The initiative will begin engaging stakeholders immediately.

Pham stated that enabling instant digital asset transactions at the federal level is a key priority under the Trump administration. CFTC’s spot crypto listing program aligns with SEC’s Project Crypto, responding directly to President Trump’s call to action.

The CFTC invites all relevant parties to provide feedback on the report’s CFTC-related recommendations by October 20; submissions will be published on the CFTC website.

U.S. defense bill to include anti-central bank digital currency provisions

According to The Block, the U.S. House of Representatives has added anti-central bank digital currency (CBDC) regulatory provisions to the must-pass defense bill.

The provision, titled the “Anti-CBDC Surveillance State Act,” was previously introduced as standalone legislation by House Majority Whip Tom Emmer. This summer, the full House passed the bill by a vote of 219–210, aiming to prohibit the Federal Reserve from issuing CBDCs directly to individuals.

MetaMask to launch mUSD stablecoin issued via Stripe’sBridge

According to The Block, MetaMask has officially announced the launch of its first native stablecoin, MetaMask USD (mUSD), planned for release on Ethereum and Consensys’ Linea network later in 2025. The stablecoin will be issued through Bridge, a platform under Stripe, and minted using M0’s decentralized infrastructure. mUSD will be fully backed 1:1 by U.S. cash and short-term Treasury securities, offering real-time transparency and cross-chain compatibility.

Ajay Mittal, MetaMask’s Vice President of Product Strategy, said this marks the first stablecoin launched by a self-custodial crypto wallet and will serve as the default digital dollar unit within the MetaMask ecosystem. Users will be able to deposit, hold, swap, transfer, and bridge mUSD within MetaMask, with plans to enable spending at Mastercard-accepting merchants via the MetaMask Card before year-end.

Earlier reports indicated that MetaMask might announce its mUSD stablecoin plans this week.

Kanye West’s X account announces launch of meme coin YZY

Kanye West’s (aka Ye) X account tweeted the launch of a meme coin named “YZY,” though it remains unconfirmed whether the account was compromised.

The website indicates that alongside YZY MONEY, Kanye West also launched two associated projects: Ye Pay and YZY Card.

Aave deploys on non-EVM blockchain Aptos for the first time, advancing multi-chain strategy

According to The Block, decentralized finance lending provider Aave has officially launched on the Aptos blockchain—its first deployment on a non-EVM chain. Initially, the platform will support native USDC, USDT, APT, and sUSDe as core assets. The Aptos Foundation will offer user rewards and liquidity incentives to drive adoption, while integrating Chainlink price feeds to ensure oracle-secured markets. Aave founder Stani Kulechov said this marks a significant step in Aave’s multi-chain strategy, emphasizing that operating across diverse blockchains is central to building a global open financial system.

Camp Network launches airdrop eligibility checker

According to an official announcement from the Camp Network Foundation, the CAMP token airdrop eligibility checking tool is now live. Users must register by 23:59 ET on August 25 to verify eligibility for Season One airdrop qualifications.

Tether and Circle executives to meet CEOs of major South Korean banks

According to Decrypt, executives from Tether and Circle will meet this week with CEOs of several top financial groups in South Korea, including Shinhan Financial Group CEO Kim Ok-dong and Hana Financial Group CEO Ham Young-joon. Discussions will focus on the potential distribution and use of dollar-backed stablecoins in South Korea, as well as the issuance of won-backed stablecoins.

The meetings come as South Korea prepares to roll out a legal framework for stablecoins in October, amid differing regulatory views between ruling and opposition parties.

Cactus Custody helps OnChain tokenize Chiyu International money market fund RWA

OnChain, in collaboration with Cactus Custody, has tokenized Chiyu International’s U.S. dollar money market fund as a real-world asset (RWA), offering investors auditable on-chain investment options. Launched on February 2, 2024, the fund ranked first among Bloomberg’s Asia-Pacific peers as of July 31, 2025, leading the market with transparency, low volatility, and verifiable net asset value.

This partnership directly addresses four key pain points in on-chain wealth management: lack of custodiable, audit-ready cash equivalents on-chain; inefficient switching between bank and on-chain funds; difficulty in unifying risk control and auditing across multiple jurisdictions; and fragmented liquidity across chains. OnChain provides RWA tokenization technology, with off-chain NAV calculation periodically posted on-chain. Token holdings and transfers are controlled via whitelists and limits, while proprietary liquidity mechanisms and contracts optimize redemption experience. Cactus Custody delivers institutional-grade custody services, employing multi-approval workflows, multi-signature mechanisms, cold-hot storage separation, daily reconciliations, and periodic audits to ensure accurate accounting, strict segregation of on-chain assets from operational funds, and protection against hacking or internal errors—providing bank-level investment security for OnChain users and maximum protection against on-chain volatility and external threats.

More importantly, this represents not just a single fund going on-chain but a replicable RWA template. By validating the full process through a money market fund, the model can be extended to pools of bills, short-term bonds, and passive products, building a sustainable RWA product line and enriching the on-chain wealth management ecosystem.

Insider: Claude parent Anthropic in talks to raise up to $10 billion in new funding

According to Jinshi Data, sources reveal that Anthropic, parent company of Claude, is nearing an agreement to raise up to $10 billion in fresh funding—a figure exceeding earlier expectations and one of the largest financings ever for an AI startup.

Sources note that negotiations are ongoing and the final amount may change. Earlier reports indicated Anthropic was in advanced discussions to raise $5 billion in this round at a $170 billion valuation. However, strong investor demand has significantly increased the target amount.

Iconiq Capital is expected to lead the round, with other anticipated participants including TPG Inc., Lightspeed Venture Partners, Spark Capital, and Menlo Ventures. Anthropic has also held discussions with Qatar Investment Authority and Singapore’s sovereign wealth fund GIC about joining the round.

Market Movements

Suggested Reading

This Time, Kanye West Brings $YZY to the Forefront of Crypto

This article discusses Kanye West’s launch of the YZY token, which sparked heated debate and controversy in the crypto market. The YZY token quickly attracted a large number of holders, but faced skepticism due to allegations of insider trading and manipulation. The YZY Money website unveiled related projects in crypto payments and debit cards, aiming to challenge centralized authority. However, the token’s price plummeted shortly after launch, shifting market sentiment from admiration to ridicule. This event is seen as a move by Kanye, in collaboration with a crypto team, to leverage his influence for financial gain.

Gbirb: Moonbirds Rises from the Ashes

This article recounts the rollercoaster journey of the Moonbirds NFT project—from glory to decline and now revival. After enduring leadership controversies, community trust crises, and market downturns, the project has regained momentum under new stewardship by Orange Cap Games and the efforts of founder Spencer, demonstrating long-term building potential.

Warning Tale of Crypto Treasury Companies: From "Financial Alchemy" to Countdown to Liquidation

This article analyzes the risks behind digital asset treasuries (DAT), particularly Michael Saylor’s MicroStrategy “financial alchemy” model. It explores how DATs drive market growth through premium trading while examining the collapse risks when premiums turn into discounts. The article forecasts future DAT trends, including regulatory intervention, investor lawsuits, and potential bear markets in crypto.

This article examines whether the traditional four-year crypto cycle might be redefined by institutional participation, analyzing arguments for and against, and proposing a scenario where the bull market could extend into 2026, along with detailed insights into changing market structures, macroeconomic dynamics, and potential risks.

Decoding Flipr: Bringing Prediction Markets to the Masses on X, Where Every Trade Is a Tweet

This article discusses the unique design and growth potential of prediction market platform Flipr, highlighting its innovations in social integration and user experience. Flipr leverages the X platform (formerly Twitter) as its front end, merging prediction markets with social interaction to attract more users and lower entry barriers. The article also covers Flipr’s Mindshare Mining campaign and its integration strategies with Kalshi and Polymarket, showcasing its innovative edge in the prediction market space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News