Deep Dive into the Opportunities and Concerns Behind the MetaMask Token

TechFlow Selected TechFlow Selected

Deep Dive into the Opportunities and Concerns Behind the MetaMask Token

$MASK could reach a 12 billion USD FDV and bring the largest airdrop in history.

Author: The Smart Ape

Translated by: Tim, PANews

I think a piece of news has been overlooked on crypto Twitter — the CEO of ConsenSys recently announced that a MetaMask token is coming soon. His exact words were: "The MASK token is coming, possibly sooner than you expect."

MetaMask Adoption

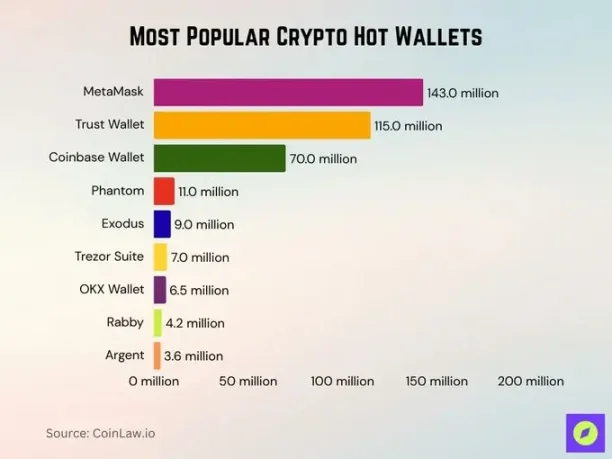

I personally stopped using MetaMask a long time ago because I prefer Rabby's interface and features, but MetaMask still holds a first-mover advantage. It remains the most popular wallet with 143 million users.

MetaMask Revenue Analysis

MetaMask has multiple revenue streams:

-

MetaMask Swap: Built-in DEX aggregator charging around 0.9% per swap

-

Fiat on-ramps: Buying crypto with bank cards

-

Cross-chain bridges: Token transfers across chains

-

Staking: Direct ETH staking via MetaMask Portfolio

-

Institutional version: MetaMask solutions for funds and enterprises.

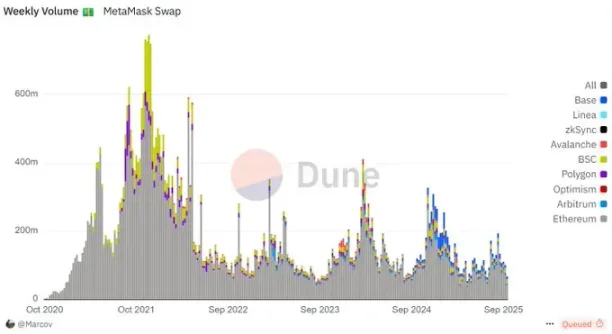

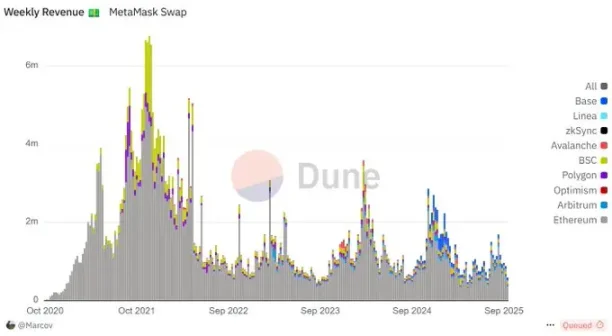

Over the past three months, MetaMask’s weekly trading volume ranged between $60 million and $200 million.

This translates to an average weekly revenue of $1.5 million, or about $72 million annually. Last year was even higher, with weekly revenue averaging $2.5 million and annual revenue reaching $120 million.

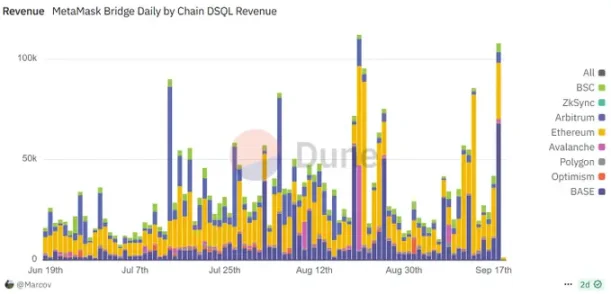

Cross-chain bridge revenue can reach up to $100,000 per day, adding another $36 million annually.

Other revenues contribute approximately $10 million per year, bringing MetaMask’s total annual revenue to around $120 million.

FDV Estimation

We don’t yet know the economic model or actual utility of the MetaMask token, but it wouldn’t be surprising if there were some form of revenue sharing or buyback mechanism. If so, earnings would drive its valuation.

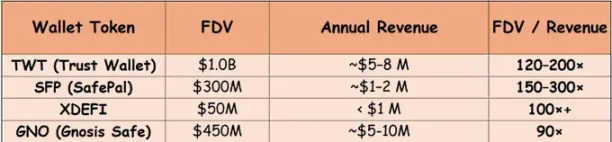

To gauge a reasonable fully diluted valuation (FDV) to revenue multiple, we can look at other wallet tokens such as TWT, SFP, XDEFI, and GNO.

In a conservative scenario, the FDV-to-revenue ratio could reach 100x.

With current annual revenue of about $120 million, this implies a potential FDV close to $12 billion.

In comparison, Trust Wallet, the second most-used wallet, has a token (TWT) FDV of $1.32 billion, making it hard to imagine MetaMask launching below a $5 billion FDV.

Potentially the Largest Airdrop in History

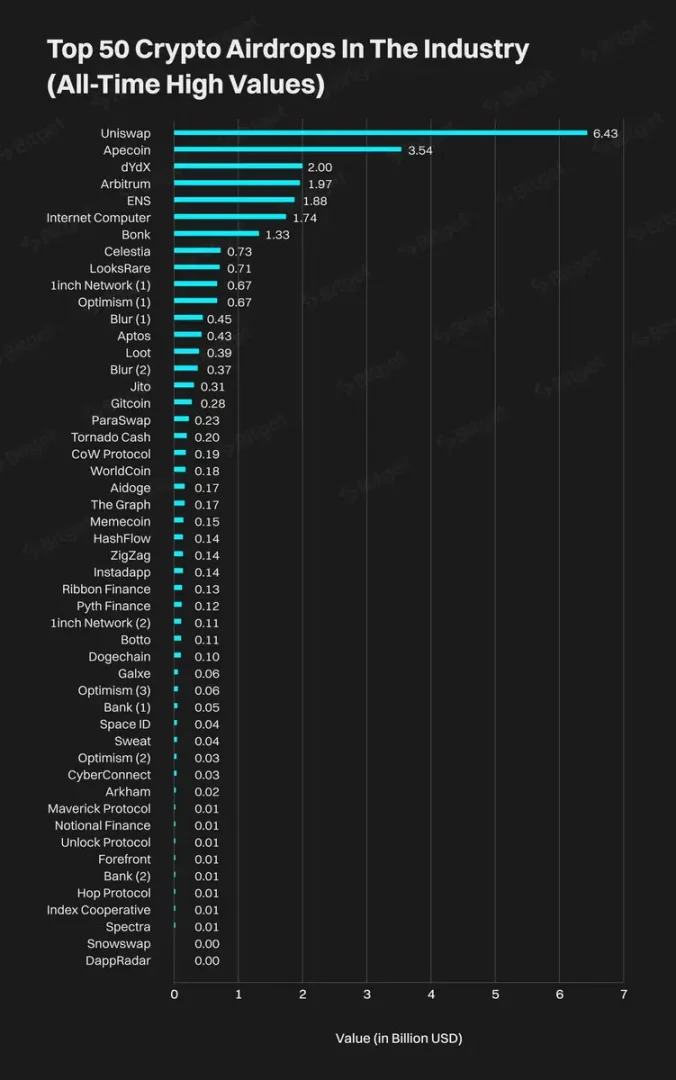

The largest airdrops in history include Uniswap, ApeCoin, dYdX, and Arbitrum, and the MetaMask airdrop could very well reshape this leaderboard — possibly joining or even surpassing them.

If we assume a $12 billion FDV and a 20% airdrop to MetaMask users, the distributed value could reach $2.4 billion, easily placing it among the top three.

Despite the massive total amount, it will be spread across over 143 million users. The uniqueness of this airdrop lies in its enormous eligible user base, which amplifies both total value and reach.

A vast user base, consistent revenue, clear utility, and quadrennial market hype could make this a historic airdrop.

How to Play the MetaMask Token Launch?

I’d normally say maximize your airdrop eligibility, but if you haven’t started actively engaging yet, it might already be too late — especially given the ConsenSys CEO’s hint that mainnet is imminent.

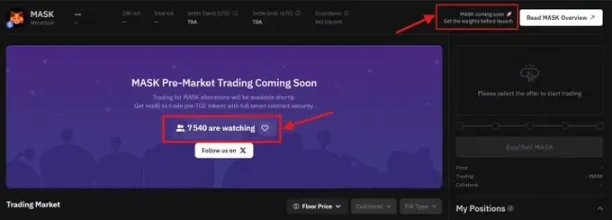

A current strategy is pre-purchasing, as the MetaMask token is expected to soon launch on Whales Market. Clearly, I’m not the only one waiting for this listing.

I’ll be closely watching the pre-listing FDV: if the initial valuation is below $5 billion, early buying could be attractive, though volatility is expected to be extreme.

MetaMask may also introduce token incentive programs, such as mUSD liquidity pools, staking opportunities, or trading rewards — potentially a great way to early-mine MetaMask tokens with high APRs.

Given the massive number of potential token recipients, the first 24 hours post-airdrop will likely see extreme market volatility, creating significant arbitrage opportunities between centralized and decentralized exchanges.

Concerns After LINEA Missteps

ConsenSys launched LINEA several weeks ago but made several major mistakes.

Technical issues occurred during TGE, including distribution delays and network congestion.

The token’s actual utility remains unclear, and large whales dumped immediately after the airdrop.

Many complained that Binance Alpha users received faster and more favorable access than most of the community.

I just hope ConsenSys learns from these past mistakes and avoids repeating them with MetaMask — especially ensuring that Binance Alpha or insiders don’t get earlier token access or listing news than the core MetaMask user base.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News