Consensys Report: The Mechanisms, Importance, and Risks of Cross-Chain Interoperability

TechFlow Selected TechFlow Selected

Consensys Report: The Mechanisms, Importance, and Risks of Cross-Chain Interoperability

Cross-chain interoperability allows users to freely choose how they want to interact with DeFi, without being restricted by any single blockchain network.

Written by: Simran Jagdev

Compiled by: TechFlow

One of the key factors currently hindering widespread adoption of blockchain technology and Web3 is their siloed nature. While users on a single blockchain—such as Ethereum—can seamlessly interact with decentralized applications built on that specific chain, communicating with other blockchains like Polkadot or Avalanche remains difficult. As a result, users are forced to fragment their liquidity across different chains, while developers inefficiently spend time and resources building on isolated networks.

Currently, one way users interact across different blockchains is by swapping tokens through centralized exchanges (CEXs). CEXs operate much like traditional stock exchanges, facilitating buy and sell orders between different users. Suppose a user holding Polygon’s native token MATIC wants to participate in DeFi on Ethereum. They must go through a CEX and exchange their MATIC for ETH. This process is time-consuming and cumbersome, and users lose money due to gas fees.

CEXs act as third-party custodians of user funds, which contradicts the principle of decentralization—a core tenet of Web3 and blockchain. The recent collapse of FTX, the world's second-largest cryptocurrency exchange, and the resulting losses faced by customers, clearly illustrate the dangers of entrusting control of your crypto deposits to a centralized entity.

Cross-chain interoperability allows users and developers the freedom to choose how they engage with DeFi without being constrained by any single network’s rules or associated assets. Let’s dive into what it means, why it matters for DeFi, and its current applications.

What Is Cross-Chain Interoperability?

To understand cross-chain interoperability, we first need to understand why two blockchains cannot interact with each other.

A blockchain is essentially a shared ledger that immutably tracks transactions posted by its users. For two independent blockchains to share data, they must agree on a single state of the blockchain and maintain an immutable record of every subsequent transaction on the other chain. The volume of data that needs to be exchanged and stored between the two chains makes scalability challenging.

Cross-chain interoperability solves this problem by enabling different blockchains to exchange data and value. It essentially acts as a bridge between two blockchains, eliminating the need for third-party intermediaries like CEXs.

Why Is Cross-Chain Interoperability Important for DeFi?

Today’s DeFi ecosystem is valued at $40.82 billion, with Ethereum accounting for nearly 58%. However, in a world without blockchain interoperability, users on non-Ethereum blockchains such as Polygon and Avalanche cannot access the value created within the largest DeFi ecosystems. Think of each DeFi ecosystem as an independent economy—without the ability to communicate with one another, these economies cannot scale significantly.

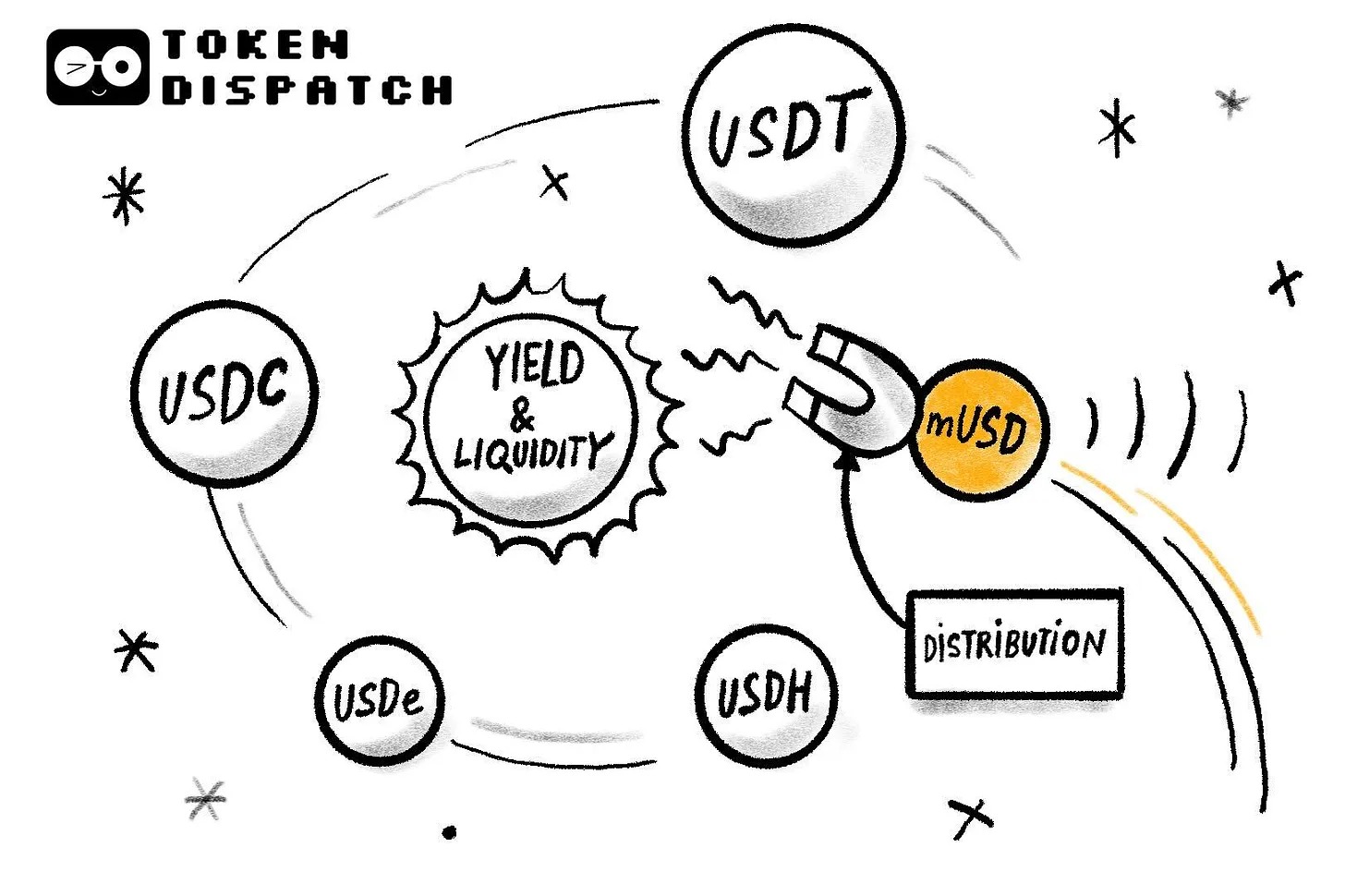

Cross-chain interoperability can drive broader adoption of DeFi: By allowing users to freely access DeFi protocols across blockchain networks, it creates more value for users to engage with DeFi. This convenience in access can in turn attract more users to Web3 and DeFi. More users will lead to increased liquidity flowing into the DeFi ecosystem, enabling larger-scale staking, yield farming, and lending operations.

Cross-chain interoperability also allows users to overcome various limitations of individual blockchains: They are no longer restricted by Ethereum’s high gas fees or the lower user base and liquidity on other networks. Developers can also create primitives that enable digital assets to be transferred across multiple chains.

Interoperability Mechanisms

Cross-Chain Bridges

As the name suggests, cross-chain bridges serve as gateways for exchanging data and assets between two different blockchains. They achieve this by locking an asset on one network and minting a synthetic version of that asset on the destination blockchain.

For example, if a user wants to swap ETH for Polygon’s MATIC, a wrapped version of ETH compatible with the Polygon network is created and sent to the user’s wallet. This ETH is locked in a smart contract on the Ethereum network and will always equal the amount of wrapped MATIC created. When bridging back, the wrapped MATIC is burned, and the locked ETH is released back into circulation.

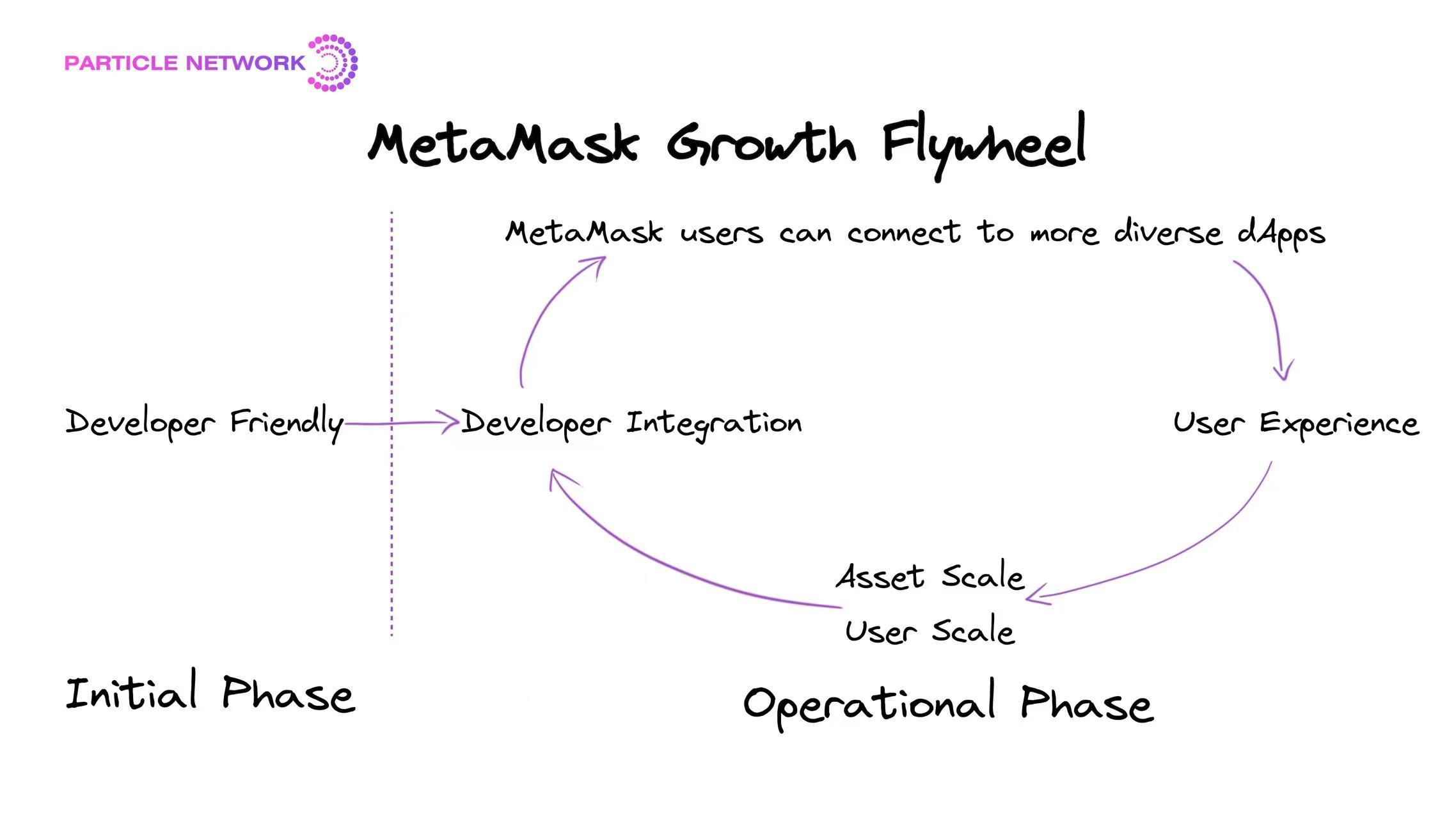

MetaMask, the most popular cryptocurrency wallet, recently launched a test version of its cross-chain bridge aggregation service, called MetaMask Bridges. It helps users find the best way to transfer their assets from one chain to another. Currently, it supports transfers of up to $10,000 across four EVM networks: Ethereum, Binance Smart Chain, Polygon, and Avalanche. MetaMask Bridges vets third-party bridges it integrates with to ensure the process does not compromise security or decentralization.

Cross-Chain Swaps via DEXs

Users can also swap tokens using a mechanism known as atomic swaps through decentralized exchanges (DEXs).

Atomic swaps are trustless peer-to-peer exchange methods facilitated by smart contracts between two separate wallets.

Atomic swaps utilize Hash Time-Locked Contracts (HTLCs), which set a deadline for completing the transaction. For the swap to succeed, both parties must provide cryptographic proof that they own the assets they wish to exchange. The HTLC smart contract ensures that if either party fails to provide proof within the predetermined timeframe, the digital assets are returned to their original wallets.

Blockchain Interoperability Protocols

The third and potentially most effective method of achieving cross-chain interoperability is through the Inter-Blockchain Communication (IBC) protocol.

IBC enables independent blockchains to directly exchange data and assets using smart contracts deployed on each blockchain.

-

Currently, IBC is primarily used among blockchains in the Cosmos ecosystem, which aims to build an internet of blockchains.

-

Another protocol leveraging IBC is LayerZero, designed to serve as a foundational layer for all blockchains—whether Layer1 or Layer2—to allow different blockchains to communicate with each other.

Risks of Cross-Chain Interoperability

Although progress has been made in enabling the flow of value across independent blockchains, there are still limitations.

For instance, cross-chain bridges are complex mechanisms because they navigate two entirely separate blockchain ecosystems built using different programming languages. This complexity creates opportunities for hackers to exploit vulnerabilities. Vitalik Buterin has also expressed reservations about cross-chain bridges due to their inherent security constraints.

Another vulnerability in the bridging process is that it creates large pools of assets locked within a single contract on one chain. This concentration creates a centralized point of failure that hackers may subsequently target. According to data analytics firm Chainalysis, cross-chain bridge hacks accounted for 69% of all stolen cryptocurrency funds in 2022. On the other hand, atomic swaps can be cumbersome, requiring users to go through multiple steps during the process.

Conclusion

Despite the risks associated with today’s available cross-chain interoperability mechanisms, they remain popular because they allow users to access the promises of DeFi and Web3 at lower costs and higher speeds.

One way organizations can access DeFi and cross-chain bridges is through MetaMask Institutional (MMI), MetaMask’s institutional-grade version. MMI provides organizations with the broadest access across EVM-compatible protocols. While MMI offers access to all EVM blockchains and Layer2 solutions, an organization’s access to these blockchains depends on the EVM chains supported by their chosen custodian.

MMI also offers reporting features such as snapshots and transaction histories across 13 EVM chains. Only MMI delivers unparalleled DeFi access without compromising institutional requirements for security, operational efficiency, or compliance.

The collapse of centralized cryptocurrency exchange FTX has heightened user awareness of the importance of DeFi. According to data analytics firm Nansen, in the week prior to November 15, many DeFi protocols saw “double-digit percentage growth in users and transactions.” As more users flock to DeFi, cross-chain interoperability becomes a natural focal point for ensuring they derive maximum value from their digital assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News