Consensys: Network activity data grows against the trend, Ethereum is poised for takeoff

TechFlow Selected TechFlow Selected

Consensys: Network activity data grows against the trend, Ethereum is poised for takeoff

How does the Ethereum ecosystem build for the long term and ensure it is prepared for network growth?

Written by: David Shuttleworth, Simran Jagdev

Translated by: TechFlow

Ethereum is the world's largest programmable blockchain. It serves as the foundation for the future of the internet (Web3) and the future of finance (DeFi).

Currently, more than half of the entire DeFi ecosystem resides on Ethereum. Despite market volatility and macroeconomic uncertainty, participation in Ethereum remains high.

This article will guide you through how the Ethereum ecosystem continues long-term development and prepares itself for network growth.

Like any efficient technology, Ethereum’s roadmap is filled with infrastructure upgrades designed to make it more future-ready.

The first major upgrade, known as “The Merge,” will occur around mid-September 2022.

For the nascent cryptocurrency industry, this will be a historic moment—The Merge will lay the groundwork for greater security, sustainability, and scalability on Ethereum.

Currently, the Ethereum network runs two parallel blockchain layers—the Proof-of-Work (PoW) layer, known as the execution layer (carrying Ethereum’s historical state and block production), and the Proof-of-Stake (PoS) layer, known as the consensus layer.

The Merge refers to the event that unifies these two layers, effectively ending PoW and fully transitioning the Ethereum mainnet to PoS.

Why Does Ethereum Dominate in DeFi?

Today’s DeFi ecosystem is valued at $62.6 billion, with Ethereum accounting for the majority—holding $36.7 billion in total value locked (TVL).

Reasons for Ethereum’s dominance in DeFi include:

- Most popular DeFi applications are built on Ethereum, including MakerDAO, Aave, Uniswap, and Curve.

- Ethereum benefits from a strong developer and user community, particularly the Ethereum CoreDevs, who continuously improve the network by creating documentation and rolling out regular updates.

These resources help maintain a robust, decentralized network and drive further adoption.

Both adoption and utilization rates have surged, signaling strong network maturity.

To understand how Ethereum’s user adoption has grown, let’s examine some statistics.

Network Activity

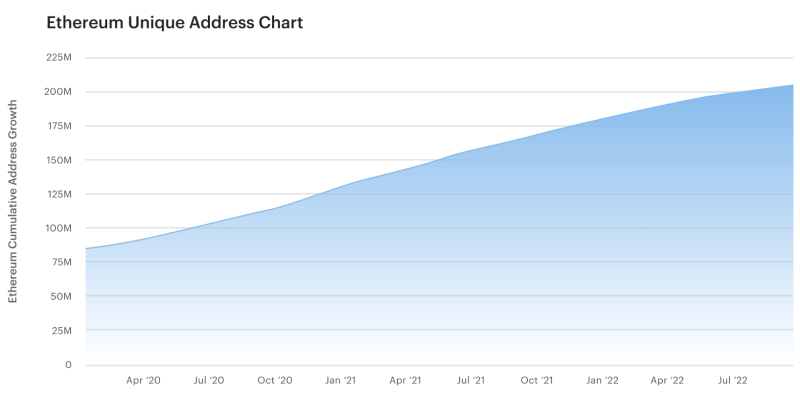

Since January 2020, the total number of unique addresses on the Ethereum network has more than doubled, surpassing 200 million—an indicator of Ethereum’s popularity among Web3 users.

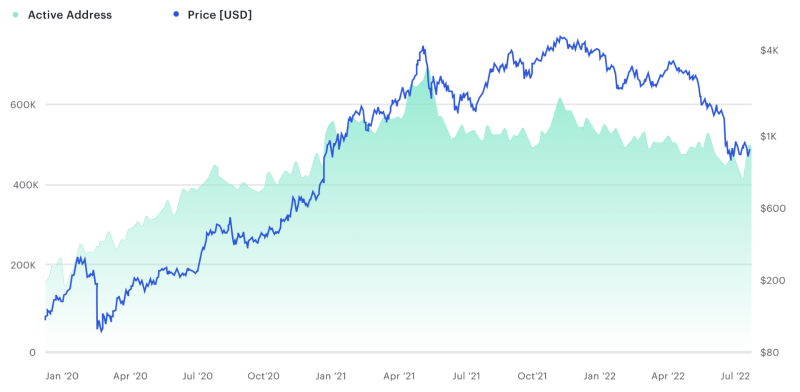

Active Ethereum address counts have also been on an upward trend since January 2020. Despite recent market downturns, active addresses remain above 504K.

Ongoing user engagement despite market volatility indicates that Ethereum’s use cases extend beyond price speculation.

In contrast, Fantom’s growth declined by 70% following the market crash in May.

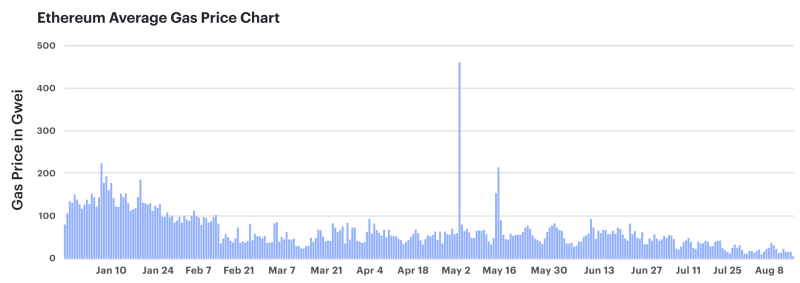

A sign of Ethereum’s network maturity is that gas fees have steadily declined since January this year.

Even as network activity increases, fees have become more predictable.

Lower gas fees make Ethereum transactions cost-effective and less sensitive to network congestion.

As a result, users no longer need to worry about paying $100 to complete a transaction during peak congestion times.

Daily transaction volume on Ethereum has shown an upward trend since January 2020 and has now stabilized.

Over the past 12 months, over one million transactions have been completed on Ethereum each day on average.

Thus, users continue to use the network despite fluctuations in Web3 and global macro markets.

This is also a signal that meaningful applications with real-world use cases are being built on Ethereum.

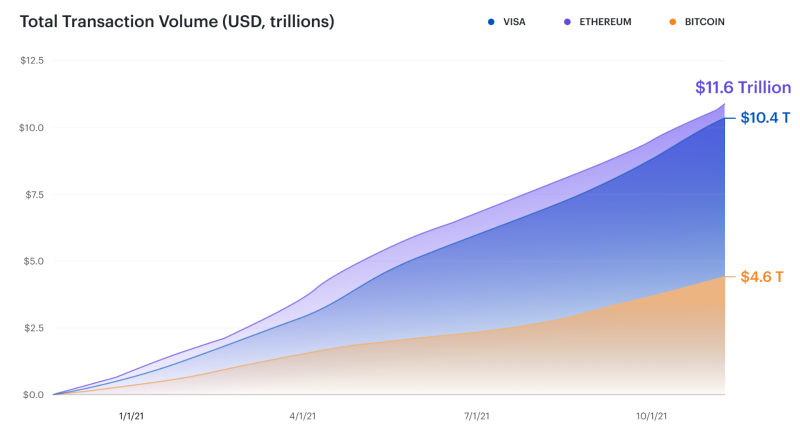

To illustrate the scale of transaction volume on Ethereum, consider this: in 2021, Ethereum processed more transactions than Visa, the world’s largest payment processor.

Ethereum handled $11.6 trillion in transaction volume, compared to Visa’s $10.4 trillion.

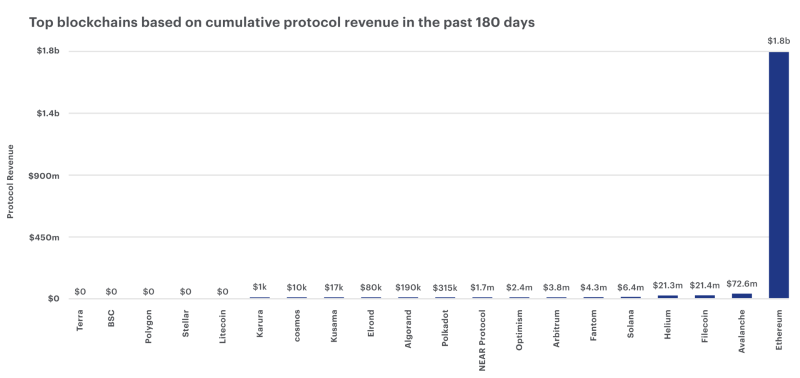

A strong indicator of demand for a blockchain network is protocol revenue—the amount users are willing to pay to conduct transactions on the blockchain.

Blockchains earn revenue by selling block space, which miners (or validators in the consensus layer) purchase to process transactions.

On the other hand, a blockchain’s primary expenditure revolves around resources spent securing network integrity and maintaining safety.

Currently, nearly every blockchain spends more on securing its network than it earns from selling block space.

Therefore, revenue provides a better sense of network demand than simply counting transactions.

While using Tron or Solana may be cheaper than Ethereum, users may be willing to pay a premium for Ethereum due to its superior security and reliability.

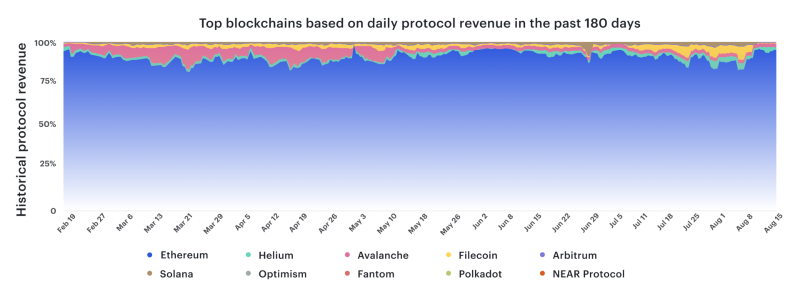

Since mid-March this year, ETH has generated $1.8 billion in protocol revenue—the highest among 20 top blockchains including Avalanche, Solana, Polkadot, and Polygon.

For comparison, Avalanche—the second-highest earner during the same period—generated only $72.6 million.

During the same period, Ethereum accounted for over 90% of total protocol revenue compared to other Layer 1 (L1) networks.

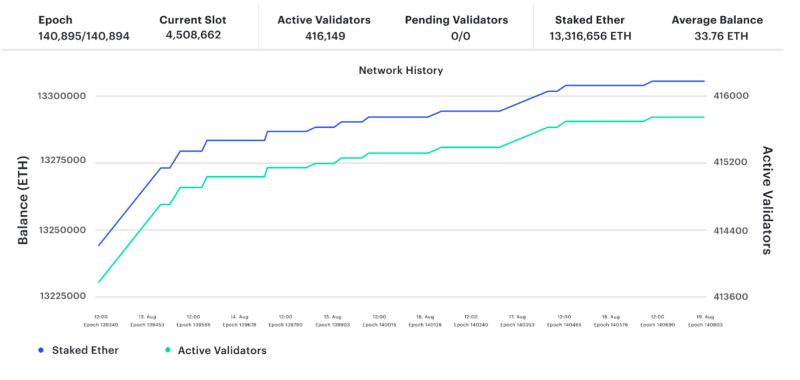

Since December 2020, staking on Ethereum has gained massive traction.

As of August 19, 2022, over 13.3 million ETH have been staked—nearly 11% of all ETH supply.

Conclusion

As we’ve seen above, the volume of users and liquidity coming to Ethereum is unmatched by any other L1 network.

Due to this high liquidity and large user base, Ethereum becomes highly attractive to developers deciding where to build across different blockchains.

This popularity helps create a moat of liquidity around Ethereum.

Most decentralized applications (dApps) with high TVL and strong Web3 usage are natively built on Ethereum.

As a result, substantial value flows through the network, offering institutional participants opportunities to tap into and benefit from this ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News