MetaMask's growth flywheel is failing, and broad-user applications are becoming the new "entry point" at the center

TechFlow Selected TechFlow Selected

MetaMask's growth flywheel is failing, and broad-user applications are becoming the new "entry point" at the center

This article will analyze the activation and operation of MetaMask's growth flywheel, as well as why it may be failing.

Author: Pengyu, Co-founder of Particle Network

MetaMask is the most well-known wallet product in the industry, whose influence has extended beyond wallets and created an almost unshakable impression. The core reason lies in its first-mover advantage among developers and its co-evolution with the dApp ecosystem to form a growth flywheel. This article analyzes how MetaMask's growth flywheel started and operated—and why it may now be failing.

A Brief Review of MetaMask’s Development History

Let’s briefly review MetaMask’s development history:

MetaMask was created by Kumavis (also known as Aaron Davis) and several other core team members. Its goal was to simplify user interactions with dApps via a browser extension. Before 2016, interacting with Ethereum-based dApps typically required running a full Ethereum node—an overly complex process for many users.

Contrary to common perception, MetaMask was initially positioned more as a developer tool—aimed at providing developers with a friendly and easy-to-use interface for user onboarding.

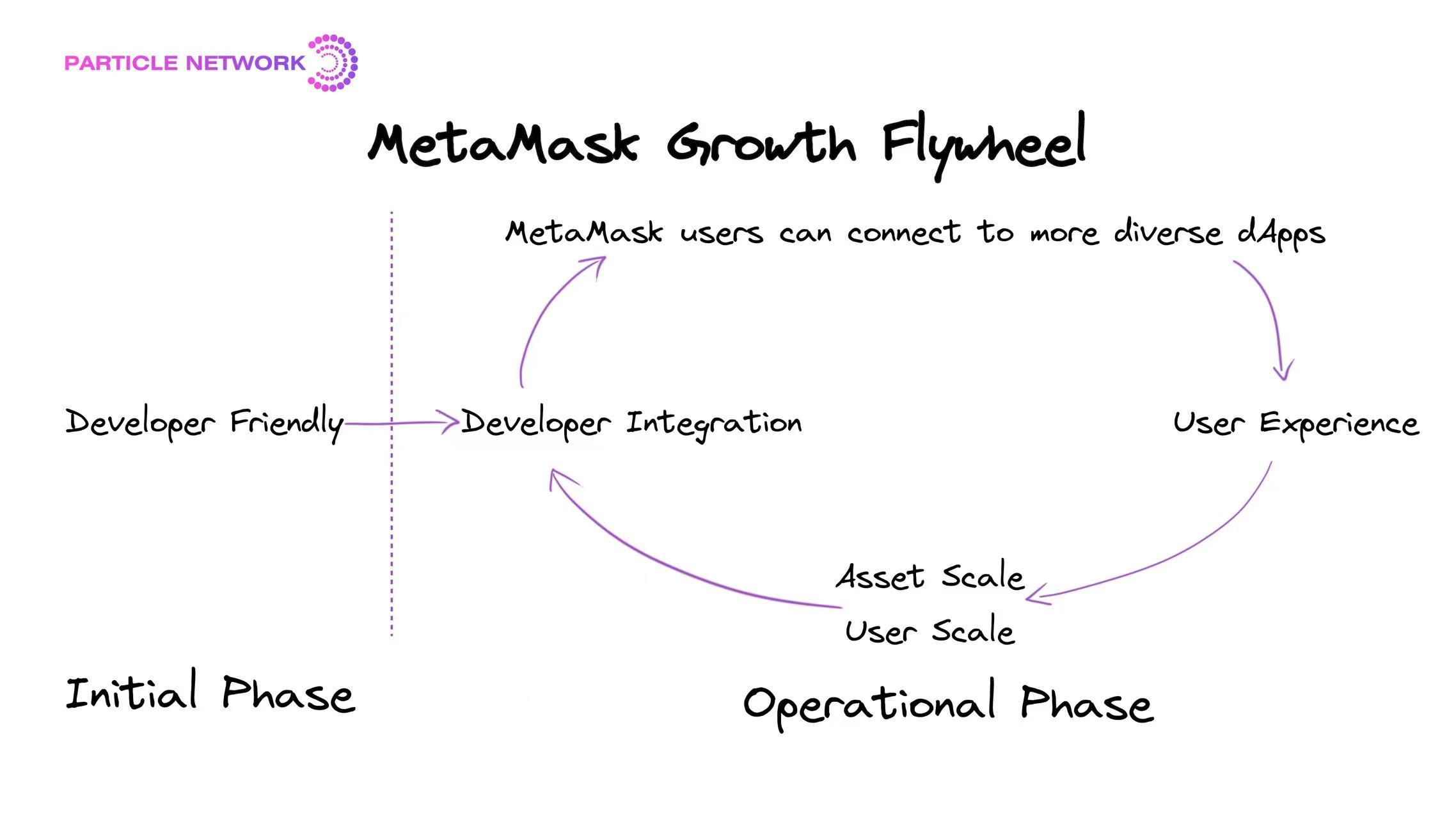

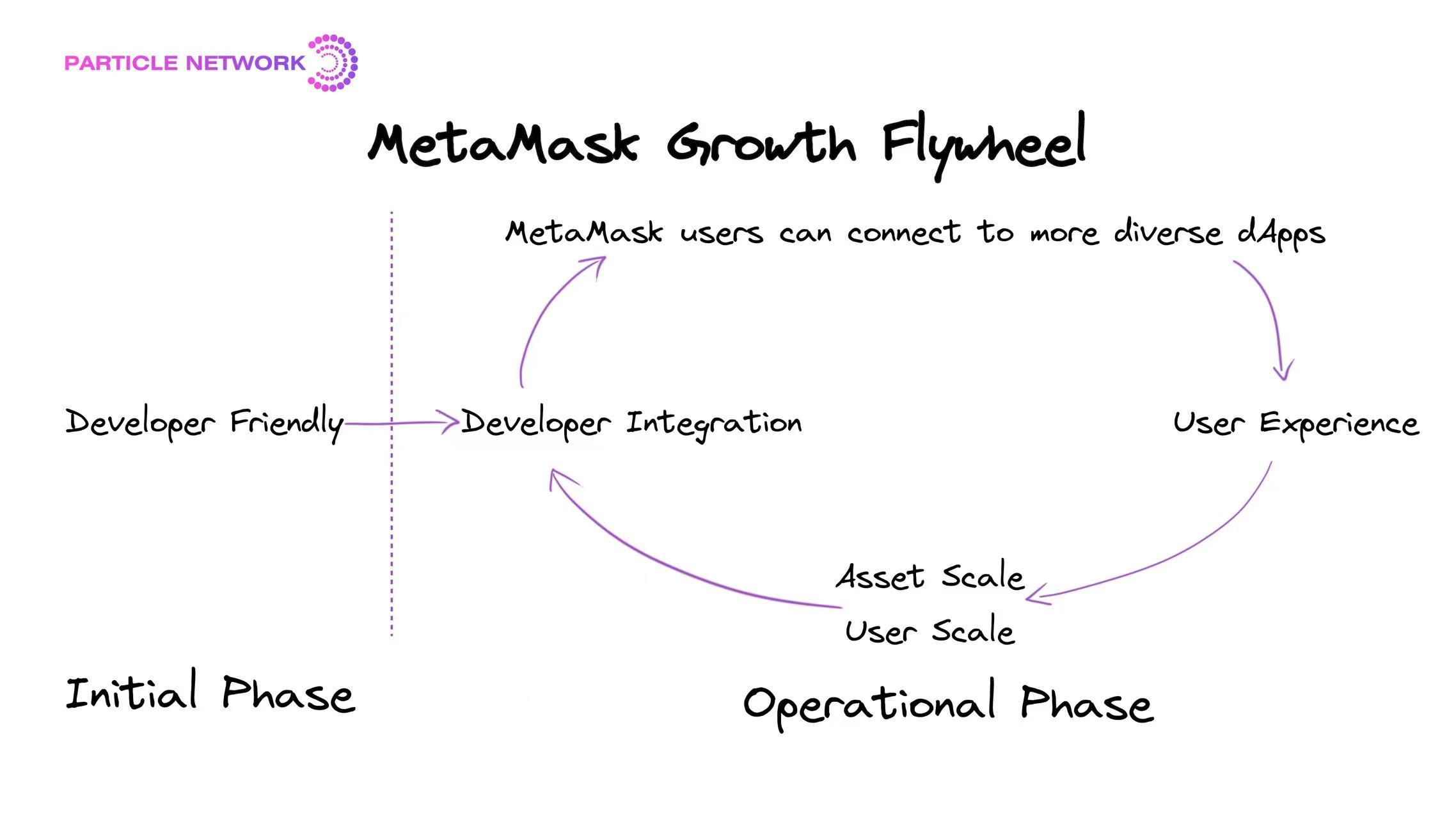

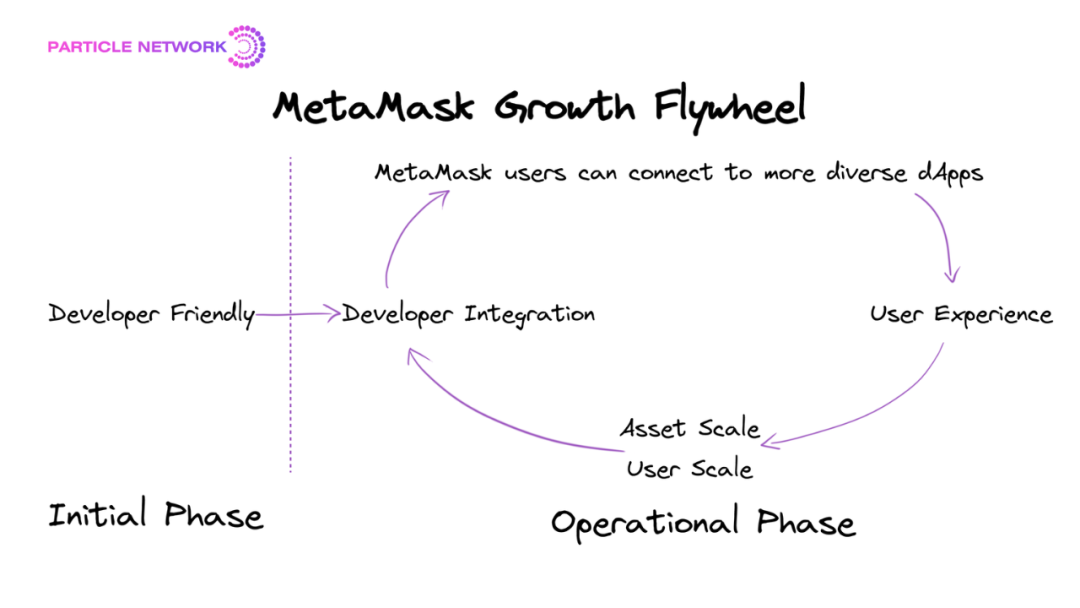

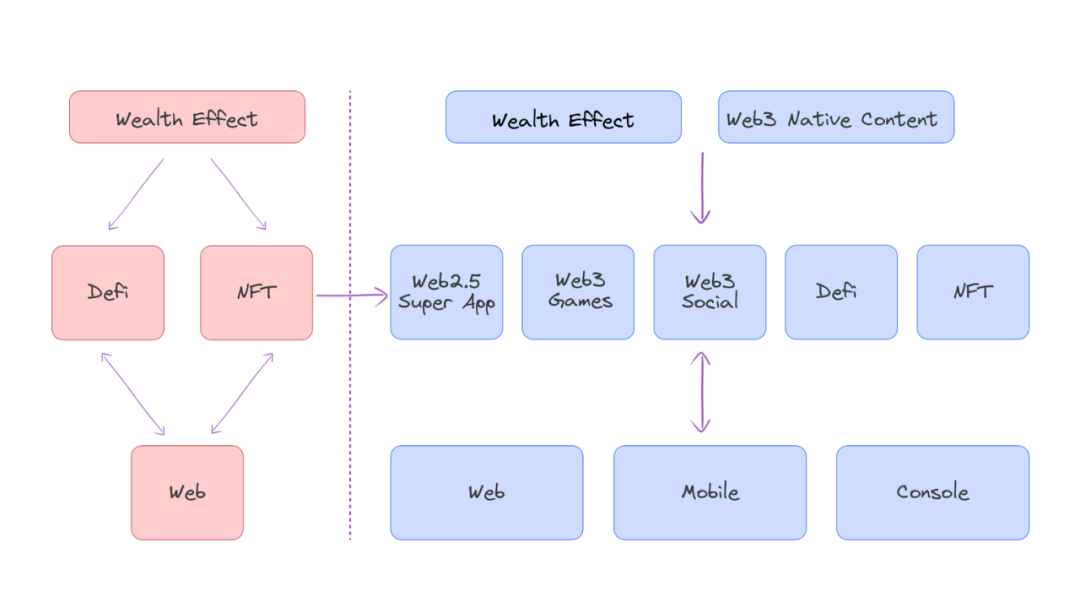

Figure 1 – MetaMask’s Growth Flywheel

From its development history, we can summarize the starting and operating phases of MetaMask’s growth flywheel

During the rapid rise of DeFi and NFTs, thanks to MetaMask’s advantages in asset and user scale, more and more dApps chose MetaMask as their default connection method to blockchain services—further strengthening MetaMask’s scale in both users and assets.

Summarizing MetaMask’s development journey, we can clearly identify the initiation, launch, and operation stages of its growth flywheel:

-

Initial Phase: Focused on developer-friendliness, becoming the default onboarding tool for early dApps.

-

Launch Phase: Achieved early lead in user and asset scale.

-

Operating Phase: Industry “wealth effect” → new users enter on-chain products (mainly DeFi, primarily via web interfaces) → default connection via MetaMask → increased MetaMask user and asset scale → transition from a simple access tool into a full user ecosystem → further attracts developers to adopt MetaMask.

Why Is It Failing?

I believe MetaMask’s growth flywheel is now failing, due to several key reasons:

1. It failed to become an "entry point," which would have stabilized the flywheel.

Throughout the user journey, MetaMask isn’t the primary driver bringing in new users—it merely serves as one of the destinations where new users land, driven by the wealth effect. In terms of traffic dynamics, MetaMask acts only as a one-way absorber, lacking distribution or feedback mechanisms. Another characteristic: very few users treat MetaMask as the starting point for active needs beyond transfers.

I define an entry point as the origin of aggregation and distribution of active demand—not just a traffic sink. For example, Google is an entry point, but Lu.ma, a Web3 event platform frequently used, is not. In fact, MetaMask hopes that Snaps will take over the role of shifting from traffic absorption to traffic distribution.

2. Core on-chain use cases are shifting: non-DeFi, broad-user application-layer projects are rapidly rising.

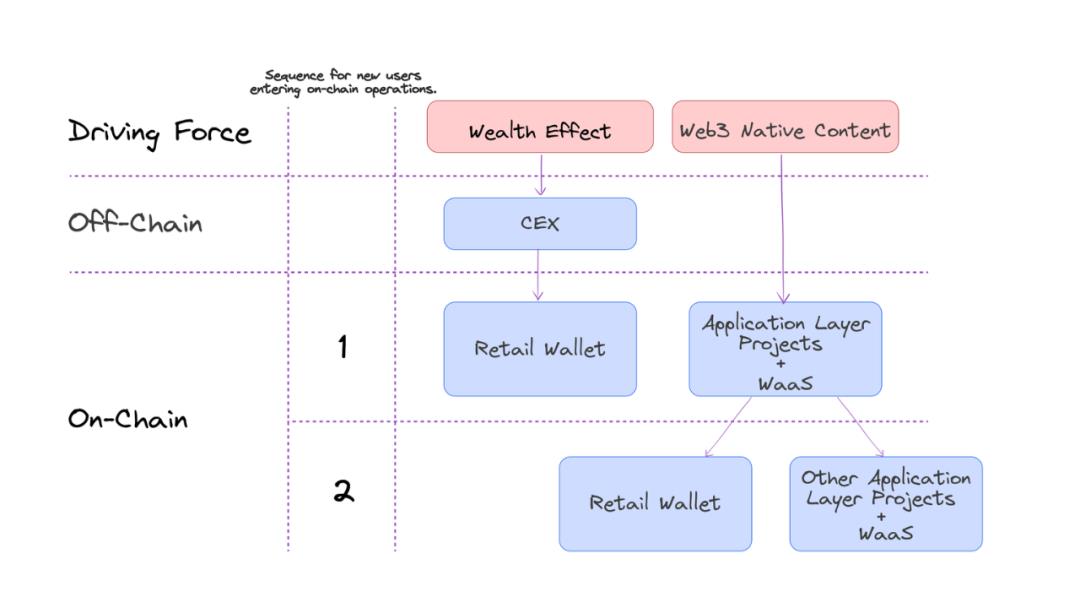

This shift in core use cases changes the fundamental drivers behind new on-chain users. Previously, nearly all new users were driven by the wealth effect of top-tier assets like Bitcoin and Ethereum. But with the rise of application-layer projects, this driver is evolving into a dual force: wealth effects plus native Web3 content. As a result, the onboarding paths for new users have clearly changed.

In these broad-user application scenarios, user interactions with the chain are characterized by cross-platform usage, low value, and high frequency—distinct from DeFi’s web-based, high-value, medium-to-low-frequency interactions. The standard setup for such applications will prioritize mobile and adopt a cross-platform product matrix.

On mobile, using MetaMask as the access tool creates noticeable friction. In product metrics, new user registration conversion rates are low, and signature completion rates within mobile dApp contexts are also poor. Under these conditions, the damage to end-user experience becomes significantly amplified—MetaMask’s scale advantages in users and assets can no longer compensate.

3. Hesitation in Account Abstraction.

Some application-layer projects leverage account abstraction to enable more sophisticated smart interactions, but MetaMask does not strengthen synergy with these use cases—it only plays the role of a Signer.

The essence of account abstraction is generalizing account types, ultimately aiming to eliminate EOA accounts. However, as a leader in the EOA account system, MetaMask has inherent misalignment with this ultimate goal, resulting in a lack of aggressive strategic moves in the account abstraction space.

4. Misalignment between iteration mindset and product essence: Despite being the largest C-end Web3 on-chain product, its design philosophy remains developer-first.

MetaMask’s overall strategy centers on developers—a sound approach in the early days when virtually all users were developers themselves.

It worked during the DeFi boom, but as broad-user application-layer projects surge, the crypto industry is transitioning from a crypto-punk-friendly niche to a mass consumer market. A developer-first mindset increasingly disconnects from end users.

Figure 2 – Shift in Core On-Chain Use Cases

Based on the two core reasons behind the failure of the growth flywheel, how might the "entry point" landscape change?

We can analyze potential shifts in the "entry point" landscape based on these two core reasons.

1. MetaMask has not yet become an entry point and has lost the flywheel effect of mutually reinforcing user and asset scale with dApps on mobile.

Does this mean there will be more opportunities for retail wallets?

This brings competition back to a product-level battle—but doesn’t necessarily lower the barrier for other retail wallets to become entry points.

On mobile, pressure on other retail wallets decreases. Unlike in the web era, they no longer compete against the ecosystem formed by MetaMask, DeFi products, and web-first dApps. Instead, they compete more directly with MetaMask as a standalone wallet product already established on mobile. Retail wallets have shifted from competing as independent products within ecosystems (web era) to competing as standalone products against other standalone products (mobile era).

However, this doesn’t mean other retail wallets have greater chances of becoming "entry points." As previously analyzed, retail wallets must both absorb traffic and actively distribute demand to qualify as entry points. On mobile, this challenge hasn’t eased for others. Meanwhile, even though MetaMask lacks unique growth strategies on mobile, this merely levels the playing field—MetaMask still holds a clear first-mover advantage.

Even under these conditions, opportunities will belong only to certain retail wallets, likely possessing these traits:

-

Mobile-first retail wallets with deep understanding of and ability to meet native end-user needs in mobile scenarios.

-

Mobile retail wallets capable of operating with a positive economic model across the user lifecycle. As standalone products, they achieve commercialization closure internally—for example, combining wallet functions with on-chain contract trading, potentially enabling monetization at certain user scales. They enhance the entire ecosystem’s ability to generate revenue. Such ecosystems are currently concentrated in exchange products capable of generating high LTV through strong operations, including leading decentralized and centralized exchanges. Examples: Uniswap’s mobile wallet, OKX’s OKX Wallet.

-

Products that transcend the traditional wallet UI, tapping into底层 optimization opportunities in every on-chain transaction. These products may not even be classified as wallets today—such as companies optimizing Mempool, MEV, or authorization management.

2. However, I believe the migration of core on-chain use cases is the more critical reason behind the failure of MetaMask’s growth flywheel.

Next, let’s discuss how this factor reshapes the "entry point" landscape.

The most lasting impact of the shift in core on-chain use cases isn’t just the breakdown of MetaMask’s flywheel—it’s the transformation of the primary drivers behind new on-chain users.

Before the rise of application-layer projects, the main driver for new on-chain users was the wealth effect of top-tier assets. But with the emergence of app-based projects, this driver has evolved into a dual force: wealth effect plus native Web3 content.

Therefore, to better understand possible changes in the "entry point" landscape, we should focus on how broad-user application-layer projects handle new user interactions with the chain—including public key generation, private key management, initiating signatures, completing signatures, and post-signature feedback.

Broad-user application-layer projects have three options for handling new user on-chain interactions:

1. Integrate with high-market-share retail wallets like MetaMask or Coinbase Wallet.

2. Build their own wallet.

3. Integrate with WaaS (Wallet-as-a-Service).

Building their own wallet includes four specific approaches:

1. Self-built custodial in-app wallet.

2. Self-built mnemonic-based, non-custodial in-app wallet.

3. Self-built social-login-based, non-custodial in-app wallet.

4. Self-built standalone retail wallet.

Based on user experience (new user registration conversion rate, in-dApp signature completion efficiency) and asset responsibility, combined with the interaction characteristics of broad-user application-layer projects—broad audience, cross-platform, low value, high frequency—we can make the following comparison:

Option 1: Integration with high-market-share retail wallets like MetaMask / Coinbase Wallet.

Under the dual drive of wealth effect and native Web3 content, this option is impractical. Imagine a new user downloads a Web3 game’s mobile app because of compelling content or gameplay, only to be immediately asked to download a second app (Coinbase Wallet or MetaMask mobile) from the app store.

Option 2: Self-build a wallet.

Building a standalone retail wallet is relatively suboptimal—it neither solves the experience fragmentation issue nor reduces asset liability compared to integrating with established retail wallets.

A self-built mnemonic wallet avoids requiring a second app download, but fails to address the low new-user registration conversion caused by mnemonics. Typically, for broad users (with little Web3 experience), the mnemonic step (understanding and memorizing) causes over 60% user drop-off.

A self-built custodial in-app wallet is a short-term viable solution that improves UX. But it prevents tracking of individual on-chain behaviors, and as the business grows, the project’s asset liability increases.

A self-built social-login-based, non-custodial in-app wallet is relatively optimal, but for most teams, the cost of building and maintaining it makes it uneconomical.

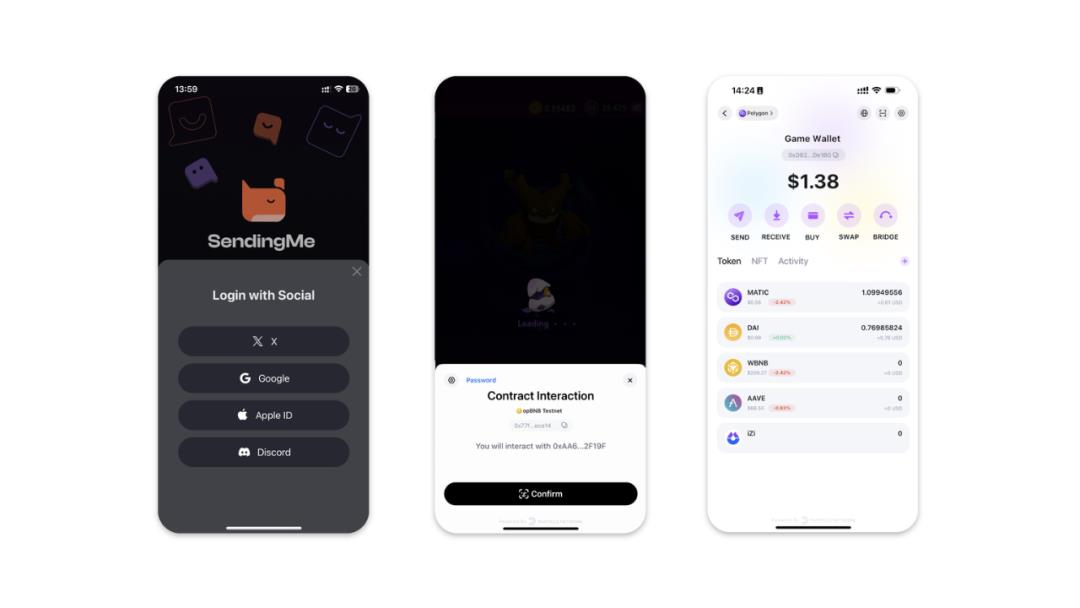

Option 3: Integrate with WaaS (Wallet-as-a-Service).

WaaS products fundamentally offer two services: first, providing dApps with social login solutions to dramatically improve new user registration conversion; second, generating a fully functional in-app wallet so that on-chain signing related to the business can be completed within the dApp without switching apps.

This differs fundamentally from retail wallet SDKs: first, onboarding must be non-mnemonic, otherwise it contradicts the goal of solving low registration conversion; second, no separate wallet app is required as a prerequisite for signing. Additionally, WaaS products differ from retail wallets in business models and product evolution paths.

Figure 3 – Wallet-as-a-Service Product (Entry → In-App Signing → Full On-Chain Operations)

This approach resolves both asset liability and user experience issues. The risk lies in reliance on the WaaS provider’s operational capabilities. However, I believe the core risk isn't the service itself, but making the right partner choice.

Considering cost and efficiency, in the current landscape where broad-user application-layer projects are rising, the standard configuration for handling new user on-chain interactions will be WaaS. Therefore, after the core scenario shift, a large portion of new users will interact on-chain directly through application-layer projects integrated with WaaS, only later分流ing to other dApps or standalone retail wallets after engaging in multiple use cases.

Based on this outlook, we can sketch the likely evolution of the "entry point" landscape.

Figure 4: Traffic Paths Under Dual Drivers

Who Will Be the New "Entry Point"?

Under this trend, will broad-user application-layer projects become the new entry points?

Let’s return to the definition of an entry point: An entry point is the origin of aggregation and distribution of active demand—not merely a traffic sink.

Under this trend, broad-user application-layer projects effectively replace MetaMask’s role as traffic sink—and have the added advantage of themselves being one of the fundamental drivers attracting new users into the industry.

Yet, even individual application-layer projects with strong user acquisition power won’t automatically become entry points—they still need to solve two challenges:

1. Top-tier effect;

2. Redistributive capability.

In the dual-driver traffic path diagram, the top-tier effect determines the scale at which broad-user application-layer projects can absorb users, while redistributive capability determines whether they can establish a healthy bidirectional relationship with traffic beyond being a mere landing zone.

Assessing top-tier effect seems straightforward but is actually highly uncertain—only one category is widely recognized: Web2 super apps making sustained investments in Web3 with clear goals. For example, Telegram. Will the next generation of Web3-native top-tier broad applications emerge from the further evolution of centralized exchanges, or from Web3 social communication protocols or gaming platforms?

Redistributive capability is one of the essential characteristics of an "entry point." But in the Web3 context, I believe redistribution encompasses more than traffic—it includes capability redistribution and consensus redistribution. Traffic redistribution is straightforward: actively guiding end users’ attention to upstream and downstream products. Capability redistribution includes on-chain asset management and community operations. Narrative and consensus redistribution are essentially about distributing influence among top users.

Top-tier effect and redistributive capability together determine whether a sustainable "entry point" can form.

Additionally, two roles cannot be overlooked:

1. Centralized Exchanges: Leading centralized exchanges will continue to play a role in redirecting traffic to on-chain services. Mobile retail wallets, WaaS (wallet-as-a-service), and on-chain contract trading will become standard offerings for top-tier exchanges.

2. Purely Web3-born Innovations: Unlike Web2’s data silos and restricted user rights, Web3 transactions and authorizations are fully controlled by end users. With the rise of application-layer projects, users may need a unified platform to manage authorizations and signatures across different use cases. New "entry point" opportunities may emerge around management of users’ on-chain assets, authorizations, and transaction states.

Overall, MetaMask’s growth flywheel may be failing. The core reason is the rise of broad-user application-layer projects, shifting core on-chain use cases from web-based interactions to mobile-first, cross-platform experiences. The Web3 industry is transforming from a crypto-punk-friendly financial sector into a mass-market consumer industry. In this shift, broad-user application-layer projects with top-tier effect and redistributive capability become the main driving forces. And the Web3 "entry point" we envision may not be something deliberately engineered—but rather the reward earned by the player contributing most during this evolution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News