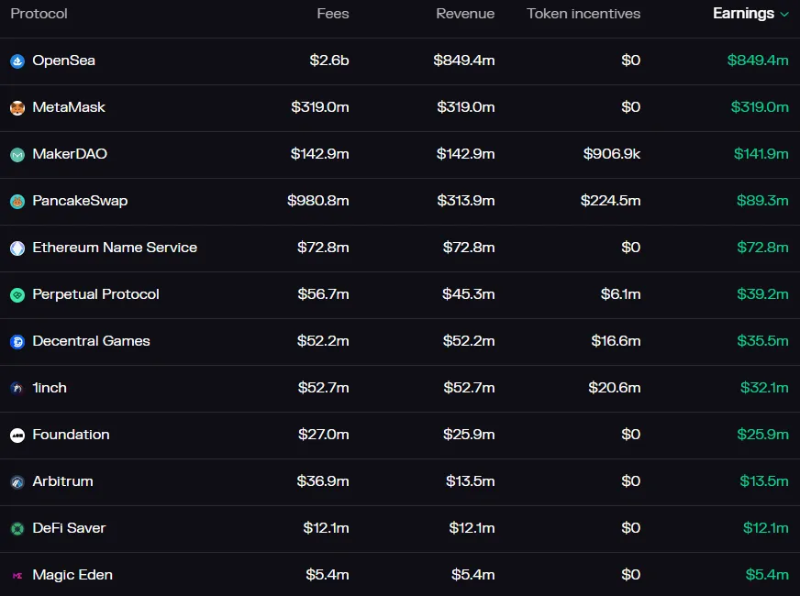

Analysis of 10 Web3 Companies with Gross Profits Exceeding $5 Million: Where Do Their Revenues Come From?

TechFlow Selected TechFlow Selected

Analysis of 10 Web3 Companies with Gross Profits Exceeding $5 Million: Where Do Their Revenues Come From?

Considering salaries and other operating costs, net profit will be significantly reduced.

Author: Marco Manoppo

Compiled by: TechFlow

The snapshot above is dated October 22, 2022. Let's break down their business models.

*Note: These are revenues, not fees or returns. Nor is it "net profit" — net profit would be significantly lower after accounting for salaries and other operating costs.

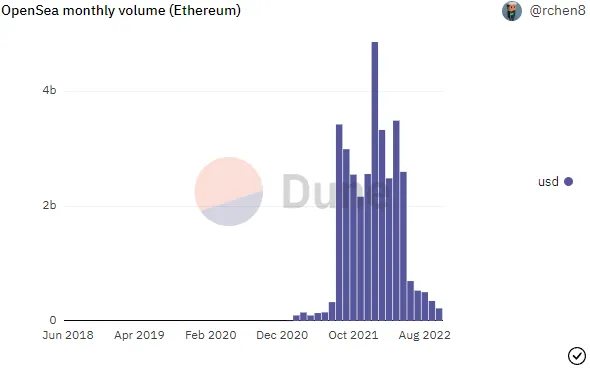

(1) OpenSea — Revenue $850 million

- OS charges a 2.5% fee on each NFT sale.

- Nothing complicated here — this is the oldest game in the book. Any dominant marketplace earns the most money. Higher trading volume → more dollars.

- At its peak, OS consistently had monthly trading volumes exceeding $2 billion.

- This brought OS over $50 million per month in gross profit.

(2) MetaMask — Revenue $320 million

- 0.875% swap fee.

- MetaMask charges a 0.875% fee on every swap transaction conducted within its wallet.

- It routes trades to multiple liquidity sources, including Uniswap, 1inch, etc.

(3) MakerDAO — Revenue $142 million

- Fees generated from stablecoin issuance (varies depending on vault type).

- Stablecoin providers charge fees to $DAI minters (similar to borrowing interest).

- If demand for $DAI increases, Maker earns more dollars.

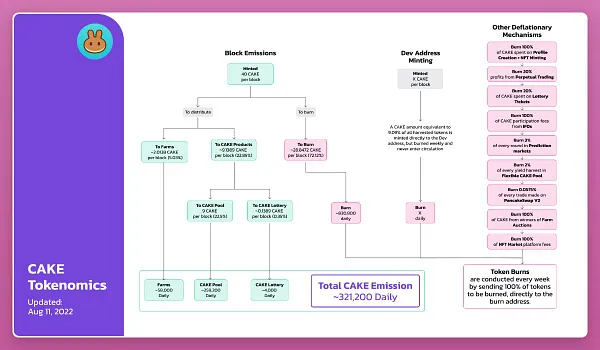

(4) PancakeSwap — Revenue $89 million

- 0.25% swap fee (0.0225% goes to treasury).

- 3% prediction market fee.

- Other product fees.

- Pancake is a platform featuring AMMs, prediction markets, lottery, and an upcoming NFT marketplace. It earns revenue from trading and marketplace fees.

(5) Ethereum Name Service — Revenue $72 million

- .eth domain sales fees.

- $5/year domain renewal fees.

- They sell .eth domains and profit from annual renewals — a very simple recurring revenue stream.

(6) Perp Protocol — Revenue $39 million

- 0.1% transaction fee.

- Derivatives platform charges a 0.1% fee on every trade.

(7) Decentral Games — Revenue $35 million

- $20 million from NFT minting revenue.

- $3.1 million from NFT activation revenue.

- In-game upgrades and secondary sales.

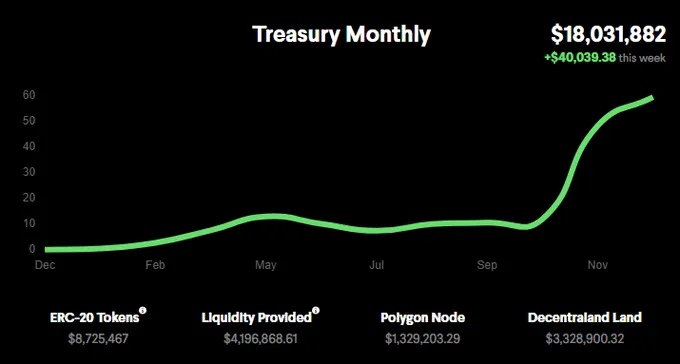

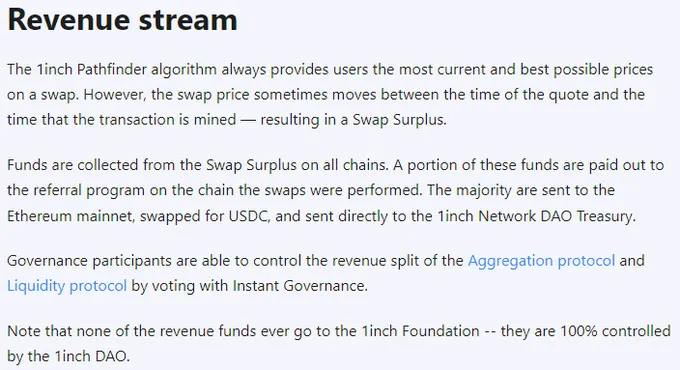

(8) 1inch — Revenue $32 million

1inch is a fee-free aggregator; they profit from swap surplus. Swap surplus refers simply to price movements between quote time and execution time.

(9) Foundation — Revenue $26 million

- 5% marketplace fee.

- Reserves the right to collect up to 15% of total sale price.

- Foundation charges a 5% fee on every NFT sale on its marketplace.

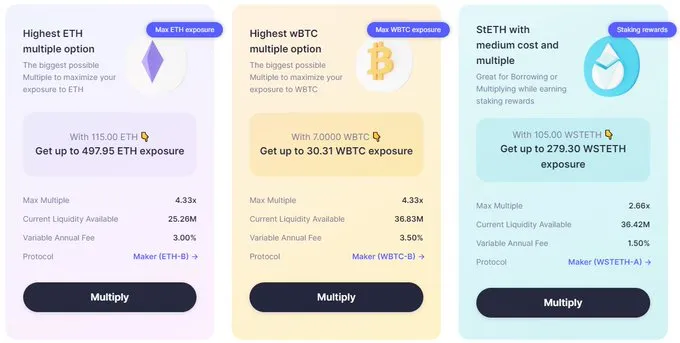

(10) DeFiSaver — Revenue $12 million

- 0.1% equivalent asset swap fee.

- 0.25% swap fee.

- 0.25% premium service fee.

- DeFi management platforms essentially charge fees to simplify users’ operations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News